|

WebMethods

webMethods was an enterprise software company focused on application integration, business process integration and B2B partner integration. Founded in 1996, the company sold systems for organizations to use web services to connect software applications over the Internet. In 2000, the company stock shares rose over 500% the first day it was publicly traded. In 2007 webMethods was acquired by Software AG for $546 million and was made a subsidiary. By 2010 the webMethods division accounted for almost half of the parent company's revenues. Software AG retained the webMethods name, and uses it as a brand to identify a software suite encompassing process improvement, service-oriented architecture (SOA), IT modernization and business and partner integration. In July 2024, IBM completed its purchase of webMethods, and related products. History The company was founded in 1996 by married couple Phillip Merrick (who was chief executive) and Caren Merrick (who was vice president for ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Software AG

Software GmbH, trading as Software AG, is a German multinational software corporation that develops enterprise software for business process management, integration, and big data analytics. Founded in 1969, the company is headquartered in Darmstadt, Germany, and has offices worldwide. In 2023, Silver Lake and Bain Capital made separate offers to buy the German company. In June, Software AG had most of its controlling interest acquired by Silver Lake, in a deal valued at 2.4 billion euros. History The company was founded in 1969 by six young employees at the consulting firm AIV (Institut für Angewandte Informationsverarbeitung). One of the founders was the mathematician Peter Schnell, who later became chairman of the board for many years. ADABAS was launched in 1971 as a high-performance transactional database management system. In 1979, Natural, a 4GL application development English-like language, that was mainly developed by Peter Pagé, was launched. The company continued ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reston, Virginia

Reston is a census-designated place in Fairfax County, Virginia, United States, and a principal city of both Northern Virginia and the Washington metropolitan area. As of the 2020 U.S. census, Reston's population was 63,226. Founded in 1964, Reston was influenced by the Garden city movement, Garden City movement that emphasized planned, self-contained communities that intermingled green space, residential neighborhoods, and commercial development. The intent of Reston's founder, Robert E. Simon, was to build a town that would revolutionize Post-war, post–World War II concepts of land use and residential/corporate development in suburban America. History Colonial era In the early days of Colonial history of the United States, Colonial America, the land that is present-day Reston was part of the Northern Neck Proprietary, a vast grant by Charles II of England, King Charles II to Thomas Fairfax, 6th Lord Fairfax of Cameron, Lord Thomas Fairfax that extended from the Potomac Rive ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mayfield Fund

Mayfield, also known as Mayfield Fund, is a US-based venture capital firm that focuses on early-stage to growth-stage investments in enterprise and consumer technology companies. Founded in 1969 and based in Menlo Park, California. History The firm was founded in 1969 by venture capitalist Thomas J. Davis, Jr. and Wally Davis (no relation). Thomas Davis Jr. had earlier founded venture capital firm Davis & Rock with fellow investor Arthur Rock, with funding from several founders of Fairchild Semiconductor. William F. Miller, a former vice president and provost at Stanford University, was an early investor. In 2009 and 2010, Mayfield fully funded marketing automation software company Marketo's series C and D rounds, and benefited when the company went public in 2013. In June 2011, Mayfield invested in field SaaS software startup ServiceMax. In September, Mayfield invested in Zimride's Series A funding round, a predecessor to ride hailing service Lyft. Also in 2011, Navin C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deloitte Fast 500

The Deloitte Technology Fast 500 Awards are organized and overseen by the global professional services firm Deloitte Touche Tohmatsu Limited. These awards recognize the 500 technology companies with the highest growth rates across various regions worldwide. Recipients encompass both publicly traded and privately held companies. The awards were established in 1997 amid the dotcom boom to showcase the achievements of burgeoning U.S. technology firms. Over time, the Fast 500 initiative has broadened its scope to encompass North America, Asia Pacific, and Europe, the Middle East, and Africa (EMEA). The Fast 500 examines companies' relative growth in revenue In accounting, revenue is the total amount of income generated by the sale of product (business), goods and services related to the primary operations of a business. Commercial revenue may also be referred to as sales or as turnover. Some compan ... over a three-year period. A company that grows by $1 million from a revenue ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deloitte

Deloitte is a multinational professional services network based in London, United Kingdom. It is the largest professional services network in the world by revenue and number of employees, and is one of the Big Four accounting firms, along with EY, KPMG, and PwC. The Deloitte network is composed of member firms of Deloitte Touche Tohmatsu Limited ( ) a private company limited by guarantee incorporated in England and Wales. The firm was founded by accountant William Welch Deloitte in London, England in 1845 and expanded into the United States in 1890. It merged with Haskins & Sells to form Deloitte Haskins & Sells in 1972 and with Touche Ross in the US to form Deloitte & Touche in 1989. In 1993, the international firm was renamed Deloitte Touche Tohmatsu, later abbreviated to Deloitte. In 2002, Arthur Andersen's practice in the UK as well as several of that firm's practices in Europe and North and South America agreed to merge with Deloitte. Subsequent acquisitions have inc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Activity Monitoring

Business activity monitoring (BAM) is a category of software intended for use in monitoring and tracking business activities. BAM is a term introduced by Gartner, Inc., referring to the collection, analysis, and presentation of real-time information about activities within organizations, including those involving customers and partners. BAM tracks individual business processes and sequences of activities across multiple systems and applications and provides information about them in real time. Description BAM software is used to monitor the status and outcomes of operations, processes, and transactions. BAM systems typically display data on computer dashboards, but they differ from business intelligence (BI) dashboards. In BAM systems, events are processed in real time or near real time and displayed immediately, whereas BI dashboards typically update at scheduled intervals by querying databases. Related fields * Business service management * Business intelligence * Business ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Early 2000s Recession

The early 2000s recession was a major decline in economic activity which mainly occurred in developed countries. The recession affected the European Union during 2000 and 2001 and the United States from March to November 2001. The United Kingdom, Canada and Australia avoided the recession, while Russia, a nation that did not experience prosperity during the 1990s, began to recover from it. Japan's Lost Decade (Japan), 1990s recession continued. A combination of the Dot Com Bubble collapse and the September 11 attacks, September 11 attacks lengthed and worsened the recession. This recession was predicted by economists because the boom of the 1990s, accompanied by both low inflation and low unemployment, slowed in some parts of East Asia during the 1997 Asian financial crisis. The recession in industrialized countries was not as significant as either of the two previous worldwide recessions. Some economists in the United States object to characterizing it as a recession since t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Santa Clara, California

Santa Clara ( ; Spanish language, Spanish for "Clare of Assisi, Saint Clare") is a city in Santa Clara County, California. The city's population was 127,647 at the 2020 United States census, 2020 census, making it the List of cities and towns in the San Francisco Bay Area, eighth-most populous city in the Bay Area. Located in the southern San Francisco Bay Area, Bay Area, the city was founded by the Spanish in 1777 with the establishment of Mission Santa Clara de Asís under the leadership of Junípero Serra. Santa Clara is located in the center of Silicon Valley and is home to the headquarters of companies such as Intel, Advanced Micro Devices (AMD), and Nvidia. It is also home to Santa Clara University, the oldest university in California, and Levi's Stadium, the home of the National Football League's San Francisco 49ers, and California's Great America Park. Santa Clara is bordered by San Jose, California, San Jose on almost every side, except for Sunnyvale, California, Sunnyv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dot-com Bubble

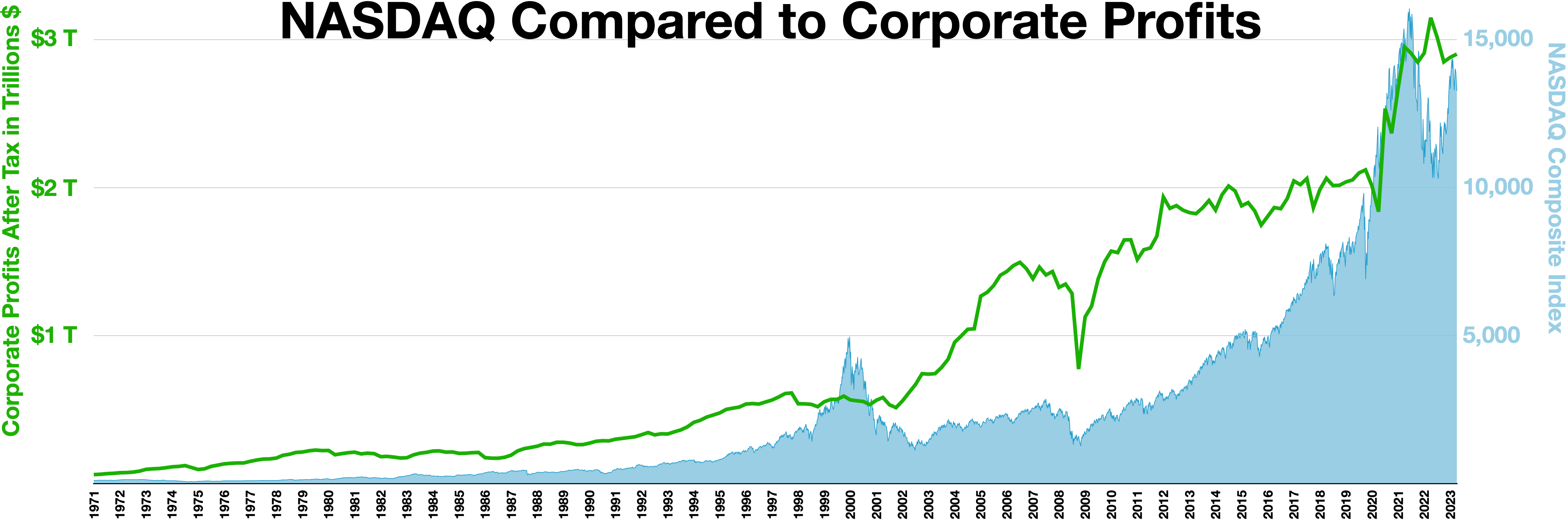

The dot-com bubble (or dot-com boom) was a stock market bubble that ballooned during the late-1990s and peaked on Friday, March 10, 2000. This period of market growth coincided with the widespread adoption of the World Wide Web and the Internet, resulting in a dispensation of available venture capital and the rapid growth of valuations in new dot-com Startup company, startups. Between 1995 and its peak in March 2000, investments in the NASDAQ composite stock market index rose by 80%, only to fall 78% from its peak by October 2002, giving up all its gains during the bubble. During the dot-com crash, many online shopping companies, notably Pets.com, Webvan, and Boo.com, as well as several communication companies, such as Worldcom, NorthPoint Communications, and Global Crossing, failed and shut down. Others, like Lastminute.com, MP3.com and PeopleSound were bought out. Larger companies like Amazon (company), Amazon and Cisco Systems lost large portions of their market capitalizati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unicorn (finance)

In business, a unicorn is a startup company Valuation (finance), valued at over US$1 billion which is privately owned and not listed on a share market. The term was first published in 2013, coined by venture capitalist Aileen Lee, choosing the unicorn, mythical animal to represent the statistical rarity of such successful ventures. Many unicorns saw their valuations fall in 2022 as a result of an economic slowdown caused by the COVID-19 pandemic, an increase in interest rates causing the cost of borrowing to grow, increased market volatility (finance), volatility, stricter regulatory scrutiny and underperformance. CB Insights identified 1,248 unicorns worldwide . Unicorns with over $10 billion in valuation have been designated as "decacorn" companies. For private companies valued over $100 billion, the terms "centicorn" and "hectocorn" have been used. History Aileen Lee originated the term "unicorn" in a 2013 ''TechCrunch'' article, "Welcome To The Unicorn Club: Learn ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NASDAQ

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc. (which the exchange also lists; ticker symbol NDAQ), which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. Although it trades stock of healthcare, financial, media, entertainment, retail, hospitality, and food businesses, it focuses more on technology stocks. The exchange is made up of both American and foreign firms, with China and Israel being the largest foreign sources. History 1972–2000 Nasdaq, Inc. was founded in 1971 by the National Association of Securities Dealers (NASD), which is now known as the Financial Industry Regulatory A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |