|

Shariah Board

A Sharia Board (also Sharia Supervisory Board, Advisory Board or Religious Board) certifies Islamic financial products as being Sharia-compliant (i.e. in accordance with Islamic law). Because compliance with Sharia law is the underlying reason for the existence of Islamic finance, Islamic banks (and conventional banking institutions that offer Islamic banking products and services) should establish a Sharia Supervisory Board (SSB) to advise them on whether their products comply, and to ensure that their operations and activities comply with Sharia principles. Jamaldeen, ''Islamic Finance For Dummies'', 2012:265 There are also national Sharia boards in many Muslim majority countries that regulate Islamic financial institutions nationwide. History Some of the first Islamic financial institutions to have a Sharia Boards were the Faisal Islamic Bank of Egypt, (founded in 1976); the Jordan Islamic Bank, (founded in 1978); the Sudanese Faisal Islamic Bank (founded in 1978); the Kuwaiti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islam

Islam is an Abrahamic religions, Abrahamic monotheistic religion based on the Quran, and the teachings of Muhammad. Adherents of Islam are called Muslims, who are estimated to number Islam by country, 2 billion worldwide and are the world's Major religious groups, second-largest religious population after Christians. Muslims believe that Islam is the complete and universal version of a Fitra, primordial faith that was revealed many times through earlier Prophets and messengers in Islam, prophets and messengers, including Adam in Islam, Adam, Noah in Islam, Noah, Abraham in Islam, Abraham, Moses in Islam, Moses, and Jesus in Islam, Jesus. Muslims consider the Quran to be the verbatim word of God in Islam, God and the unaltered, final revelation. Alongside the Quran, Muslims also believe in previous Islamic holy books, revelations, such as the Torah in Islam, Tawrat (the Torah), the Zabur (Psalms), and the Gospel in Islam, Injil (Gospel). They believe that Muhammad in Islam ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Indonesia

Bank Indonesia (BI) is the central bank of the Republic of Indonesia. It replaced in 1953 the Bank of Java (, DJB), which had been created in 1828 to serve the financial needs of the Dutch East Indies. History Bank of Java King William I of the Netherlands granted the right to create a private bank in the Indies in 1826, which was named . It was founded on 24 January 1828 and later became the bank of issue of the Dutch East Indies. The bank regulated and issued the Netherlands Indies gulden. In 1881, an office of the Bank of Java was opened in Amsterdam. Later followed the opening of an office in New York. By 1930 the bank owned sixteen office branches in the Dutch East Indies: Bandung, Cirebon, Semarang, Yogyakarta, Surakarta, Surabaya, Malang, Kediri, Banda Aceh, Medan, Padang, Palembang, Banjarmasin, Pontianak, Makassar, and Manado. The Bank of Java was operated as a private bank and individuals as well as industries etc. could get help in the bank's offices. File ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sharia Investments

Islamic finance products, services and contracts are financial products and services and related contracts that conform with Sharia (Islamic law). Islamic banking and finance has its own products and services that differ from conventional banking. These include ''Mudharabah'' (profit sharing), ''Wadiah'' (safekeeping), ''Musharakah'' (joint venture), ''Murabahah'' (cost plus finance), ''Ijar'' (leasing), ''Hawala'' (an international fund transfer system), ''Takaful'' (Islamic insurance), and ''Sukuk'' (Islamic bonds). Sharia prohibits ''riba'', or usury, defined as interest paid on all loans of money (although some Muslims dispute whether there is a consensus that interest is equivalent to ''riba''). Farooq, ''Riba-Interest Equation and Islam'', 2005: pp. 3–6 Khan, ''What Is Wrong with Islamic Economics?'', 2013: pp. 216–226 Investment in businesses that provide goods or services considered contrary to Islamic principles (e.g. pork or alcohol) is also ''haraam'' ("sinful and p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiqh

''Fiqh'' (; ) is the term for Islamic jurisprudence.Fiqh Encyclopædia Britannica ''Fiqh'' is often described as the style of human understanding, research and practices of the sharia; that is, human understanding of the divine Islamic law as revealed in the Quran and the sunnah (the teachings and practices of the Islamic prophet Muhammad and his companions). Fiqh expands and develops Shariah through interpretation (''ijtihad'') of the Quran and ''Sunnah'' by Islamic jurists (''ulama'') and is implemented by the rulings (''fatwa'') of jurists on questions presented to them. Thus, whereas ''sharia'' is considered immutable and infallible by Muslims, ''fiqh'' is considered fallible and changeable. ''Fiqh'' deals with the observance of rituals, morals and social legislation in Islam as well as econo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ulema

In Islam, the ''ulama'' ( ; also spelled ''ulema''; ; singular ; feminine singular , plural ) are scholars of Islamic doctrine and law. They are considered the guardians, transmitters, and interpreters of religious knowledge in Islam. "Ulama" may refer broadly to the educated class of such religious scholars, including theologians, canon lawyers (muftis), judges ( qadis), professors, and high state religious officials. Alternatively, "ulama" may refer specifically to those holding governmental positions in an Islamic state. By longstanding tradition, ulama are educated in religious institutions (''madrasas''). The Quran and sunnah (authentic hadith) are the scriptural sources of traditional Islamic law. Traditional way of education Students of Islamic doctrine do not seek out a specific educational institution, but rather seek to join renowned teachers. By tradition, a scholar who has completed their studies is approved by their teacher. At the teacher's individual dis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lease

A lease is a contractual arrangement calling for the user (referred to as the ''lessee'') to pay the owner (referred to as the ''lessor'') for the use of an asset. Property, buildings and vehicles are common assets that are leased. Industrial or business equipment are also leased. In essence, a lease agreement is a contract between two parties: the lessor and the lessee. The lessor is the legal owner of the asset, while the lessee obtains the right to use the asset in return for regular rental payments. The lessee also agrees to abide by various conditions regarding their use of the property or equipment. For example, a person leasing a car may agree to the condition that the car will only be used for personal use. The term rental agreement can refer to two kinds of leases: * A lease in which the asset is tangible property. Here, the user '' rents'' the asset (e.g. land or goods) ''let out'' or ''rented out'' by the owner (the verb ''to lease'' is less precise because it c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

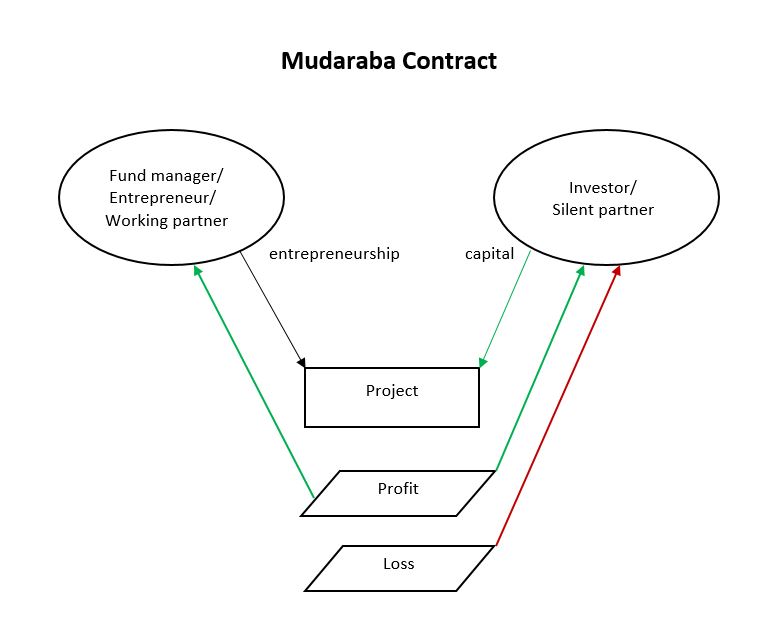

Profit And Loss Sharing

Profit and Loss Sharing (also called PLS or participatory banking) refers to Sharia-compliant forms of equity financing such as mudarabah and musharakah. These mechanisms comply with the religious prohibition on interest on loans that most Muslims subscribe to. ''Mudarabah'' (مضاربة) refers to "trustee finance" or passive partnership contract, while ''Musharakah'' (مشاركة or مشركة) refers to equity participation contract. Other sources include sukuk (also called "Islamic bonds") and direct equity investment (such as purchase of common shares of stock) as types of PLS. Khan, ''Islamic Banking in Pakistan'', 2015: p.91 The profits and losses shared in PLS are those of a business enterprise or person which/who has obtained capital from the Islamic bank/financial institution (the terms "debt", "borrow", "loan" and "lender" are not used). As financing is repaid, the provider of capital collects some agreed upon percentage of the profits (or deducts if there are losses ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage

A mortgage loan or simply mortgage (), in civil law (legal system), civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is "collateral (finance), secured" on the borrower's property through a process known as mortgage origination. This means that a Mortgage law, legal mechanism is put into place which allows the lender to take possession and sell the secured property ("foreclosure" or "repossession") to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word ''mortgage'' is derived from a Law French term used in Legal professions in England and Wales, Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken throu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shari'ah

Sharia, Sharī'ah, Shari'a, or Shariah () is a body of religious law that forms a part of the Islamic tradition based on scriptures of Islam, particularly the Qur'an and hadith. In Islamic terminology ''sharīʿah'' refers to immutable, intangible divine law; contrary to ''fiqh'', which refers to its interpretations by Islamic scholars. Sharia, or fiqh as traditionally known, has always been used alongside customary law from the very beginning in Islamic history; has been elaborated and developed over the centuries by legal opinions issued by qualified jurists – reflecting the tendencies of different schools – and integrated and with various economic, penal and administrative laws issued by Muslim rulers; and implemented for centuries by judges in the courts until recent times, when secularism was widely adopted in Islamic societies. Traditional theory of Islamic jurisprudence recognizes four sources for Ahkam al-sharia: the Qur'an, ''sunnah'' (or authentic ahadith) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fatwa

A fatwa (; ; ; ) is a legal ruling on a point of Islamic law (sharia) given by a qualified Islamic jurist ('' faqih'') in response to a question posed by a private individual, judge or government. A jurist issuing fatwas is called a ''mufti'', and the act of issuing fatwas is called ''ifta. Fatwas have played an important role throughout Islamic history, taking on new forms in the modern era. Resembling ''jus respondendi'' in Roman law and rabbinic ''responsa'', privately issued fatwas historically served to inform Muslim populations about Islam, advise courts on difficult points of Islamic law, and elaborate substantive law. In later times, public and political fatwas were issued to take a stand on doctrinal controversies, legitimize government policies or articulate grievances of the population. During the era of mass European/Christian invasions, fatwas played a part in mobilizing resistance against foreign aggressors. Muftis acted as independent scholars in the classical ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Murabaha

''Murabaḥah'', ''murabaḥa'', or ''murâbaḥah'' (, derived from ''ribh'' , meaning profit) was originally a term of ''fiqh'' (Islamic jurisprudence) for a sales contract where the buyer and seller agree on the Markup (business), markup (profit) or "Cost-plus pricing, cost-plus" price for the item(s) being sold. In recent decades it has become a term for a very common form of Islamic (i.e., "shariah compliant") Islamic banking and finance, financing, where the price is marked up in exchange for allowing the buyer to pay over time—for example with monthly payments (a contract with deferred payment being known as ''bai-muajjal''). ''Murabaha'' financing is basically the same as a rent-to-own arrangement in the non-Muslim world, with the intermediary (e.g., the lending bank) retaining ownership of the item being sold until the loan is paid in full. There are also Islamic investment funds and ''sukuk'' (Islamic bonds) that use ''murabahah'' contracts.Sukuk#FJIFD2012, Jamaldeen, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |