|

Profit And Loss Sharing

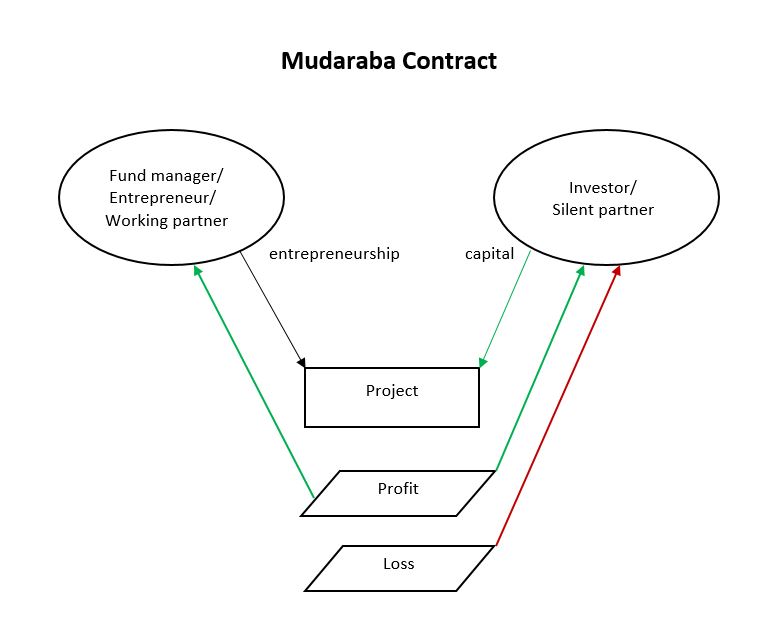

Profit and Loss Sharing (also called PLS or participatory banking) refers to Sharia-compliant forms of equity financing such as mudarabah and musharakah. These mechanisms comply with the religious prohibition on interest on loans that most Muslims subscribe to. ''Mudarabah'' (مضاربة) refers to "trustee finance" or passive partnership contract, while ''Musharakah'' (مشاركة or مشركة) refers to equity participation contract. Other sources include sukuk (also called "Islamic bonds") and direct equity investment (such as purchase of common shares of stock) as types of PLS. Khan, ''Islamic Banking in Pakistan'', 2015: p.91 The profits and losses shared in PLS are those of a business enterprise or person which/who has obtained capital from the Islamic bank/financial institution (the terms "debt", "borrow", "loan" and "lender" are not used). As financing is repaid, the provider of capital collects some agreed upon percentage of the profits (or deducts if there are losses ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Banking

Islamic banking, Islamic finance ( ''masrifiyya 'islamia''), or Sharia-compliant finance is banking or financing activity that complies with Sharia (Islamic law) and its practical application through the development of Islamic economics. Some of the modes of Islamic finance include '' mudarabah'' (profit-sharing and loss-bearing), '' wadiah'' (safekeeping), '' musharaka'' (joint venture), '' murabahah'' (cost-plus), and '' ijarah'' (leasing). Sharia prohibits ''riba'', or usury, generally defined as interest paid on all loans of money (although some Muslims dispute whether there is a consensus that interest is equivalent to ''riba''). Investment in businesses that provide goods or services considered contrary to Islamic principles (e.g. pork or alcohol) is also ''haram'' ("sinful and prohibited"). These prohibitions have been applied historically in varying degrees in Muslim countries/communities to prevent un-Islamic practices. In the late 20th century, as part of the revi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Muhammad

Muhammad (8 June 632 CE) was an Arab religious and political leader and the founder of Islam. Muhammad in Islam, According to Islam, he was a prophet who was divinely inspired to preach and confirm the tawhid, monotheistic teachings of Adam in Islam, Adam, Noah in Islam, Noah, Abraham in Islam, Abraham, Moses in Islam, Moses, Jesus in Islam, Jesus, and other Prophets and messengers in Islam, prophets. He is believed to be the Seal of the Prophets in Islam, and along with the Quran, his teachings and Sunnah, normative examples form the basis for Islamic religious belief. Muhammad was born in Mecca to the aristocratic Banu Hashim clan of the Quraysh. He was the son of Abdullah ibn Abd al-Muttalib and Amina bint Wahb. His father, Abdullah, the son of tribal leader Abd al-Muttalib ibn Hashim, died around the time Muhammad was born. His mother Amina died when he was six, leaving Muhammad an orphan. He was raised under the care of his grandfather, Abd al-Muttalib, and paternal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Khurshid Ahmad (scholar)

Khurshīd Ahmad (; 23 March 1932 – 13 April 2025) was a Pakistani economist, philosopher, politician and an Islamic activist who helped to develop Islamic economic jurisprudence as an academic discipline and one of the co-founders (along with Khurram Murad) of The Islamic Foundation in Leicester, UK. A senior conservative figure, he was a long-standing party worker of the Islamist Jamaat-e-Islami (JeI) party, where he successfully ran for Senate in the general elections held in 2002 on a platform of Muttahida Majlis-e-Amal (MMA). He served in the Senate until 2012. He played his role as a policy adviser in Zia administration when he chaired the Planning Commission, focusing on the role of Islamising the country's national economy in the 1980s. Early life and education Ahmad was born into an Urdu-speaking family in Delhi, British India, on 23 March 1932. He entered in the Anglo-Arabic College in Delhi. After the partition of India in 1947, the family moved to Pakista ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Umer Chapra

Muhammad Umer Chapra (born 1 February 1933) is a Pakistani-Saudi economist. he serves as Advisor at the Islamic Research and Training Institute (IRTI) of the Islamic Development Bank (IDB) in Jeddah, Saudi Arabia. Prior to this position, he worked at the Saudi Arabian Monetary Agency (SAMA), Riyadh, for nearly 35 years, as Economic Advisor and then Senior Economic Advisor. Personal life Chapra was born in Bombay, British India on 1 February 1933 to Abdul Karim Chapra, and grew up in Karachi, Pakistan. He completed undergraduate studies from the University of Sindh in 1950, followed by undergraduate and postgraduate degrees in commerce at the University of Karachi in 1954 and 1956 respectively. He then moved to the United States, where he pursued a PhD in economics and sociology from the University of Minnesota in 1961, and worked as an academic for six years. In 1965, at a time when there was high demand for skilled Pakistani migrants, he moved to Saudi Arabia after being offer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fractional-reserve Banking

Fractional-reserve banking is the system of banking in all countries worldwide, under which banks that take deposits from the public keep only part of their deposit liabilities in liquid assets as a reserve, typically lending the remainder to borrowers. Bank reserves are held as cash in the bank or as balances in the bank's account at the central bank. Fractional-reserve banking differs from the hypothetical alternative model, full-reserve banking, in which banks would keep all depositor funds on hand as reserves. The country's central bank may determine a minimum amount that banks must hold in reserves, called the "reserve requirement" or "reserve ratio". Most commercial banks hold more than this minimum amount as excess reserves. Some countries, e.g. the core Anglosphere countries of the United States, the United Kingdom, Canada, Australia, and New Zealand, and the three Scandinavian countries, do not impose reserve requirements at all. Bank deposits are usually of a rel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taqi Usmani

Muhammad Taqi Usmani (born 3 October 1943) SI, OI, is a Pakistani Islamic jurist and leading scholar in the fields of Qur'an, Hadith, Islamic law, Islamic economics, and comparative religion. He was a member of the Council of Islamic Ideology from 1977 to 1981, a judge of the Federal Shariat Court from 1981 to 1982, and a judge in the Shariat Appellate Bench of the Supreme Court of Pakistan from 1982 to 2002. In 2020, he was selected as the most influential Muslim personality in the world. He is considered a leading intellectual of the contemporary Deobandi movement, and his opinions and fatwas are widely accepted by Deobandi scholars and institutions worldwide, including the Darul Uloom Deoband in India. Since 2021, he has been serving as the Chairman of Wifaq ul Madaris Al-Arabia. His father, Shafi Usmani, was the Grand Mufti of Darul Uloom Deoband and Taqi Usmani migrated to Pakistan with his family after the partition of India in 1948. Usmani studied at Darul Uloom Karac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rate Of Profit

In economics and finance, the profit rate is the relative profitability of an investment project, a capitalist enterprise or a whole capitalist economy. It is similar to the concept of rate of return on investment. Historical cost ''vs.'' market value The rate of profit depends on the definition of ''capital invested''. Two measurements of the value of capital exist: capital at historical cost and capital at market value. Historical cost is the original cost of an asset at the time of purchase or payment. Market value is the re-sale value, replacement value, or value in present or alternative use. To compute the rate of profit, replacement cost of capital assets must be used to define the capital cost. Assets such as machinery cannot be replaced at their historical cost, but must be purchased at the current market value. When inflation occurs, historical cost would not take account of rising prices of equipment. The rate of profit would be overestimated, using lower historic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Libor

The London Inter-Bank Offered Rate (Libor ) was an interest rate average calculated from estimates submitted by the leading Bank, banks in London. Each bank estimated what it would be charged were it to borrow from other banks. It was the primary benchmark, along with the Euribor, for short-term interest rates around the world. Libor was phased out at the end of 2021, with market participants encouraged to transition to risk-free interest rates such as SOFR and SARON. LIBOR was discontinued in the summer of 2023. The last rates were published on 30 June 2023 before 12:00 pm UK time. The 1 month, 3 month, 6 month, and 12 month Secured Overnight Financing Rate (SOFR) is its replacement. In July 2023, the International Organization of Securities Commissions (IOSCO) said four unnamed United States dollar, dollar-denominated alternatives to LIBOR, known as "credit-sensitive rates", had "varying degrees of vulnerability" that might appear during times of market stress. Libor rates w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Imputed Rent

Imputed rent is the rental price an individual would pay for an asset they own. The concept applies to any capital good, but it is most commonly used in housing markets to measure the rent homeowners would pay for a housing unit equivalent to the one they own. Imputing housing rent is necessary to measure economic activity in national accounts. Because asset owners do not pay rent, owners' imputed rent must be measured indirectly. Imputed housing rent is the economic theory of imputation applied to real estate: that the value is more a matter of what the buyer is willing to pay than the cost the seller incurs to create it. In this case, market rents are used to estimate the value to the property owner. Thus, imputed rent offers a way to compare homeowners' and tenants' economic decisions. More formally, in owner-occupancy, the landlord– tenant relationship is short-circuited. Consider a model: two people, A and B, each of whom owns property. If A lives in B's property, and B ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mecelle

The Mecelle-i Ahkâm-ı Adliye (), or the Mecelle in short, was the civil code of the Ottoman Empire in the late 19th and early 20th century. It is the first Codification (law), codification of Sharia law by an Islamic nation. Name The Ottoman Turkish name of the code is ''Mecelle-ʾi Aḥkām-ı ʿAdlīye'', which derives from the Arabic ''مجلة الأحكام العدلية'', ''Majallah el-Ahkam-i-Adliya''. Majalla can mean a law code or a bound text in general. It has also been transliterated in European languages as ''Mejelle'', ''Majalla'', ''Medjelle'', or ''Meğelle''. In French, it is known as ''Medjéllé'' or the ''Code Civil Ottoman''. History Enactment The code was prepared by a commission headed by Ahmed Cevdet Pasha, including a large team of scholars, issued in sixteen volumes (containing 1,851 articles) from 1869 to 1876 and entered into force in the year 1877. In its structure and approach it was clearly influenced by the earlier European codifications. Fa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |