|

Murabaha

''Murabaḥah'', ''murabaḥa'', or ''murâbaḥah'' (, derived from ''ribh'' , meaning profit) was originally a term of ''fiqh'' (Islamic jurisprudence) for a sales contract where the buyer and seller agree on the Markup (business), markup (profit) or "Cost-plus pricing, cost-plus" price for the item(s) being sold. In recent decades it has become a term for a very common form of Islamic (i.e., "shariah compliant") Islamic banking and finance, financing, where the price is marked up in exchange for allowing the buyer to pay over time—for example with monthly payments (a contract with deferred payment being known as ''bai-muajjal''). ''Murabaha'' financing is basically the same as a rent-to-own arrangement in the non-Muslim world, with the intermediary (e.g., the lending bank) retaining ownership of the item being sold until the loan is paid in full. There are also Islamic investment funds and ''sukuk'' (Islamic bonds) that use ''murabahah'' contracts.Sukuk#FJIFD2012, Jamaldeen, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Banking

Islamic banking, Islamic finance ( ''masrifiyya 'islamia''), or Sharia-compliant finance is banking or financing activity that complies with Sharia (Islamic law) and its practical application through the development of Islamic economics. Some of the modes of Islamic finance include '' mudarabah'' (profit-sharing and loss-bearing), '' wadiah'' (safekeeping), '' musharaka'' (joint venture), '' murabahah'' (cost-plus), and '' ijarah'' (leasing). Sharia prohibits ''riba'', or usury, generally defined as interest paid on all loans of money (although some Muslims dispute whether there is a consensus that interest is equivalent to ''riba''). Investment in businesses that provide goods or services considered contrary to Islamic principles (e.g. pork or alcohol) is also ''haram'' ("sinful and prohibited"). These prohibitions have been applied historically in varying degrees in Muslim countries/communities to prevent un-Islamic practices. In the late 20th century, as part of the revi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Banking And Finance

Islamic banking, Islamic finance ( ''masrifiyya 'islamia''), or Sharia-compliant finance is banking or Finance, financing activity that complies with Sharia (Islamic law) and its practical application through the development of Islamic economics. Some of the modes of Islamic finance include ''Profit and loss sharing#Mudarabah, mudarabah'' (profit-sharing and loss-bearing), ''wadiah'' (safekeeping), ''musharaka'' (joint venture), ''murabahah'' (cost-plus), and ''ijarah'' (leasing). Sharia prohibits ''riba'', or usury, generally defined as interest paid on all loans of money (although some Muslims dispute whether there is a consensus that interest is equivalent to ''riba''). Investment in businesses that provide goods or services considered contrary to Islamic Value (personal and cultural), principles (e.g. pork or alcohol) is also ''haram'' ("sinful and prohibited"). These prohibitions have been applied historically in varying degrees in Muslim countries/communities to prevent ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Riba

''Riba'' (, or , ) is an Arabic word used in Islamic law and roughly translated as " usury": unjust, exploitative gains made in trade or business. ''Riba'' is mentioned and condemned in several different verses in the Qur'an3:130 and most commonl 2:275-2:280 . It is also mentioned in many '''' (reports of the life of [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Profit And Loss Sharing

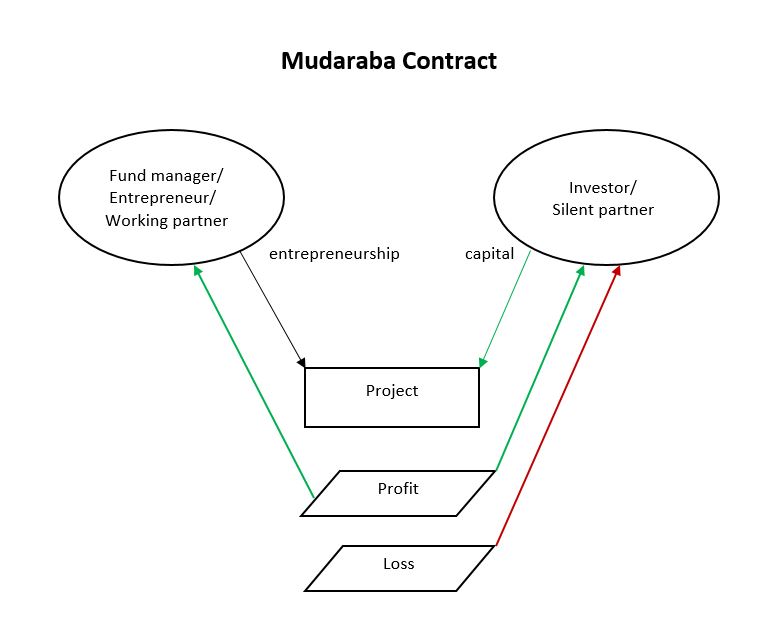

Profit and Loss Sharing (also called PLS or participatory banking) refers to Sharia-compliant forms of equity financing such as mudarabah and musharakah. These mechanisms comply with the religious prohibition on interest on loans that most Muslims subscribe to. ''Mudarabah'' (مضاربة) refers to "trustee finance" or passive partnership contract, while ''Musharakah'' (مشاركة or مشركة) refers to equity participation contract. Other sources include sukuk (also called "Islamic bonds") and direct equity investment (such as purchase of common shares of stock) as types of PLS. Khan, ''Islamic Banking in Pakistan'', 2015: p.91 The profits and losses shared in PLS are those of a business enterprise or person which/who has obtained capital from the Islamic bank/financial institution (the terms "debt", "borrow", "loan" and "lender" are not used). As financing is repaid, the provider of capital collects some agreed upon percentage of the profits (or deducts if there are losses ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sukuk

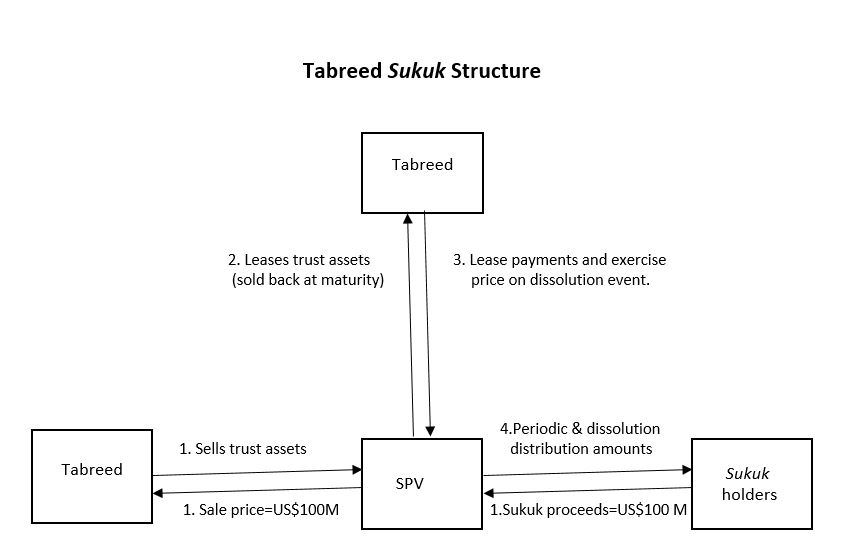

Sukuk (; plural of ) is the Arabic name for financial certificates, also commonly referred to as "sharia compliant" bonds. Sukuk are defined by the AAOIFI ( Accounting and Auditing Organization for Islamic Financial Institutions) as "securities of equal denomination representing individual ownership interests in a portfolio of eligible existing or future assets." The Fiqh academy of the OIC legitimized the use of sukuk in February 1988.Visser, Hans. 2009. ''Islamic finance: Principles and practice.'' Cheltenham, UK and Northampton MA, Edward Elgar. p.63 Khan, ''What Is Wrong with Islamic Economics?'', 2013: p.251 Sukuk were developed as an alternative to conventional bonds which are not considered permissible by many Muslims as they pay interest (prohibited or discouraged as Riba, or usury), and also may finance businesses involved in activities not permitted under Sharia (gambling, alcohol, pork, etc.). Sukuk securities are structured to comply with Sharia by paying profit, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reverse Murabaha Or Tawarruq And Conventional Loan In Landscape

Reverse or reversing may refer to: Arts and media * ''Reverse'' (Eldritch album), 2001 * ''Reverse'' (2009 film), a Polish comedy-drama film * ''Reverse'' (2019 film), an Iranian crime-drama film * ''Reverse'' (Morandi album), 2005 * ''Reverse'' (TV series), a 2017–2018 South Korean television series *"Reverse", a 2014 song by SomeKindaWonderful * REVERSE art gallery, in Brooklyn, NY, US *Reverse tape effects including backmasking, the recording of sound in reverse * '' Reversing: Secrets of Reverse Engineering'', a book by Eldad Eilam *''Tegami Bachi: REVERSE'', the second season of the '' Tegami Bachi'' anime series, 2010 Driving * Reverse gear, in a motor or mechanical transmission * Reversing (vehicle maneuver), reversing the direction of a vehicle * Turning a vehicle through 180 degrees Sports and games *Reverse (American football), a trick play in American football *Reverse swing, a cricket delivery * Reverse (bridge), a type of bid in contract bridge Technology *Rever ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by 191 member countries, with headquarters in Washington, D.C. It is regarded as the global lender of last resort to national governments, and a leading supporter of exchange-rate economic stability, stability. Its stated mission is "working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and poverty reduction, reduce poverty around the world." Established in July 1944 at the Bretton Woods Conference, primarily according to the ideas of Harry Dexter White and John Maynard Keynes, it started with 29 member countries and the goal of reconstructing the international monetary systems, international monetary system after World War II. In its early years, the IMF primarily focused on facilitating fixed exchange rates across the developed worl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Microfinance

Microfinance consists of financial services targeting individuals and small businesses (SMEs) who lack access to conventional banking and related services. Microfinance includes microcredit, the provision of small loans to poor clients; savings account, savings and checking accounts; microinsurance; and payment systems, among other services. Microfinance product and services in MFI include: # Savings # Microcredit # Microinsurance # Microleasing and # Fund transfer/remittance. Microfinance services are designed to reach excluded customers, usually low income population segments, possibly socially marginalized, or geographically more isolated, and to help them become self-sufficient.Peck Christen, Robert; Rosenberg, Richard; Jayadeva, Veena. ''Financial institutions with a double-bottom line: Implications for the future of microfinance''. CGAP, Occasional Papers series, July 2004, pp. 2–3. ID Ghana is an example of a microfinance institution. Microfinance initially had a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |