|

Recession Of 2001

The early 2000s recession was a major decline in economic activity which mainly occurred in developed countries. The recession affected the European Union during 2000 and 2001 and the United States from March to November 2001. The United Kingdom, Canada and Australia avoided the recession, while Russia, a nation that did not experience prosperity during the 1990s, began to recover from it. Japan's 1990s recession continued. A combination of the Dot Com Bubble collapse and the September 11 attacks lengthed and worsened the recession. This recession was predicted by economists because the boom of the 1990s, accompanied by both low inflation and low unemployment, slowed in some parts of East Asia during the 1997 Asian financial crisis. The recession in industrialized countries was not as significant as either of the two previous worldwide recessions. Some economists in the United States object to characterizing it as a recession since there were no two consecutive quarters of n ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Recession

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009.“US Business Cycle Expansions and Contractions” United States NBER, or National Bureau of Economic Research, updated March 14, 2023. This government agency dates the Great Recession as starting in December 2007 and bottoming-out in June 2009. The scale and timing of the recession varied from country to country (see map). At the time, the International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression. The causes of the Great Recession include a combination of vulnerabilities that developed in the financial system ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Recession2001

In economics, a recession is a business cycle contraction that occurs when there is a period of broad decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale anthropogenic or natural disaster (e.g. a pandemic). There is no official definition of a recession, according to the IMF. In the United States, a recession is defined as "a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales." The European Union has adopted a similar definition. In the United Kingdom and Canada, a recession is defined as negative economic growth for two consecutive quarters. Governments usually respond to recessions ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Market Downturn Of 2002

In 2001, stock prices took a sharp downturn (some say "stock market crash" or " the Internet bubble bursting") in stock markets across the United States, Canada, Asia, and Europe. After recovering from lows reached following the September 11 attacks, indices slid steadily starting in March 2002, with dramatic declines in July and September leading to lows last reached in 1997 and 1998. The U.S. dollar increased in value relative to the euro, reaching a 1-to-1 valuation not seen since the euro's introduction. Background This downturn can be viewed as part of a larger bear market or correction that began in 2000 after a decade-long bull market had led to unusually high stock valuations, according to a report by the Cleveland Federal Reserve. The collapse of Enron is a prime example. Many internet companies ( Webvan, Exodus Communications, and Pets.com) went bankrupt. Others (Amazon.com, eBay, and Yahoo!) went down dramatically in value, but remain in business to this day and hav ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow (), is a stock market index of 30 prominent companies listed on stock exchanges in the United States. The DJIA is one of the oldest and most commonly followed equity indices. It is Price-weighted index, price-weighted, unlike other common indexes such as the Nasdaq Composite or S&P 500, which use Capitalization-weighted index, market capitalization. The DJIA also contains fewer stocks, which could exhibit higher risk; however, it could be less volatile when the market is rapidly rising or falling due to its components being well-established large-cap companies. The value of the index can also be calculated as the sum of the stock prices of the companies included in the index, divided by a factor, which is approximately 0.163 . The factor is changed whenever a constituent company undergoes a stock split so that the value of the index is unaffected by the stock split. First calculated on May 26, 1896, the ind ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Irrational Exuberance

"Irrational exuberance" is the phrase used by the then- Federal Reserve Board chairman, Alan Greenspan, in a December 1996 speech given at the American Enterprise Institute during the dot-com bubble of the 1990s. The phrase was interpreted as a warning that the stock market might be overvalued. Origin Greenspan's comment was made during a televised speech on December 5, 1996 (emphasis added in excerpt): The Tokyo market was open during the speech and immediately moved down sharply after this comment, closing off 3%. Markets around the world followed. Greenspan wrote in his 2008 book that the phrase occurred to him in the bathtub while he was writing a speech. The irony of the phrase and its aftermath lies in Greenspan's widely held reputation as the most artful practitioner of Fedspeak, often known as Greenspeak, in the modern televised era. The speech coincided with the rise of dedicated financial TV channels around the world that would broadcast his comments live, such as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revised Data

Official statistics are statistics published by Government, government agencies or other Statutory corporation, public bodies such as International organization, international organizations as a Public good (economics), public good. They provide quantitative or qualitative information on all major areas of citizens' lives, such as economic and social development, living conditions, health, education, and the environment. During the 15th and 16th centuries, statistics were a method for counting and listing populations and State resources. The term ''statistics'' comes from the Neo-Latin ''statisticum collegium'' (council of state) and refers to ''science of the state''. According to the Organisation for Economic Co-operation and Development (OECD), official statistics are statistics disseminated by the national statistical system, excepting those that are explicitly not to be official". Governmental agencies at all levels, including municipal, county, and state administrations, may ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bill Clinton

William Jefferson Clinton (né Blythe III; born August 19, 1946) is an American politician and lawyer who was the 42nd president of the United States from 1993 to 2001. A member of the Democratic Party (United States), Democratic Party, he previously served as the attorney general of Arkansas from 1977 to 1979 and as the governor of Arkansas from 1979 to 1981, and again from 1983 to 1992. Clinton, whose policies reflected a centrist "Third Way" political philosophy, became known as a New Democrats (United States), New Democrat. Born and raised in Arkansas, Clinton graduated from Georgetown University in 1968, and later from Yale Law School, where he met his future wife, Hillary Clinton, Hillary Rodham. After graduating from law school, Clinton returned to Arkansas and won election as state attorney general, followed by Governorships of Bill Clinton, two non-consecutive tenures as Arkansas governor. As governor, he overhauled the state's education system and served as Chai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gross Domestic Product

Gross domestic product (GDP) is a monetary measure of the total market value of all the final goods and services produced and rendered in a specific time period by a country or countries. GDP is often used to measure the economic performance of a country or region. Several national and international economic organizations maintain definitions of GDP, such as the OECD and the International Monetary Fund. GDP is often used as a metric for international comparisons as well as a broad measure of economic progress. It is often considered to be the world's most powerful statistical indicator of national development and progress. The GDP can be divided by the total population to obtain the average GDP per capita. Total GDP can also be broken down into the contribution of each industry or sector of the economy. Nominal GDP is useful when comparing national economies on the international market according to the exchange rate. To compare economies over time inflation can be adjus ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

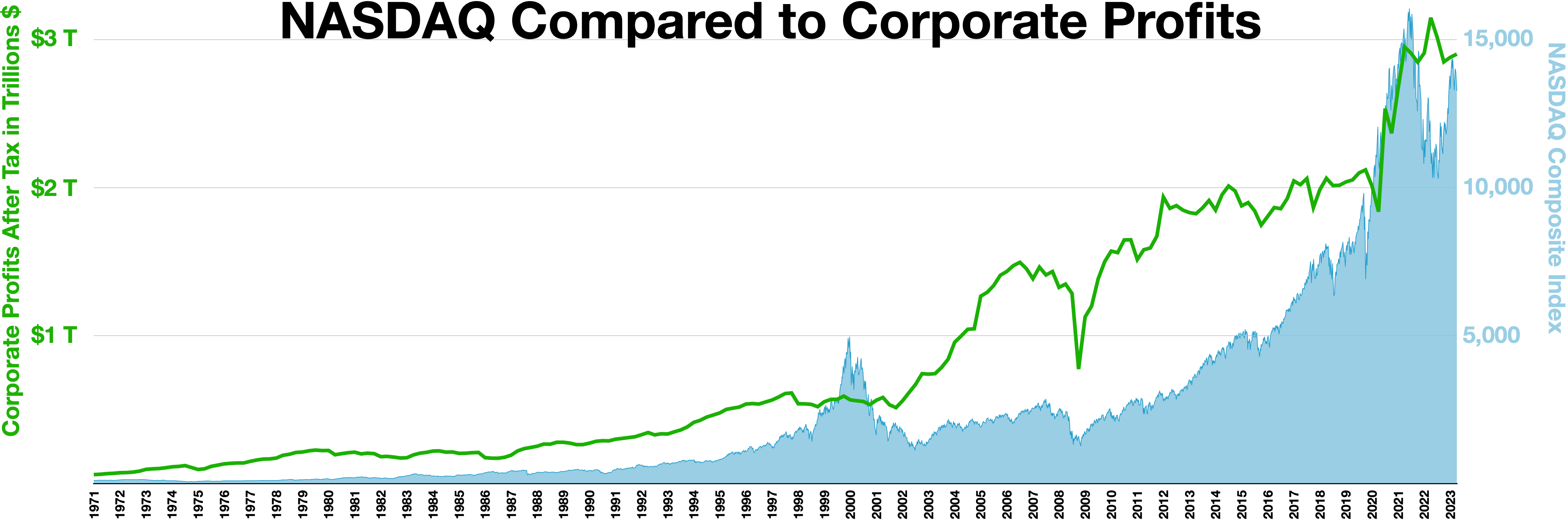

NASDAQ

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc. (which the exchange also lists; ticker symbol NDAQ), which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. Although it trades stock of healthcare, financial, media, entertainment, retail, hospitality, and food businesses, it focuses more on technology stocks. The exchange is made up of both American and foreign firms, with China and Israel being the largest foreign sources. History 1972–2000 Nasdaq, Inc. was founded in 1971 by the National Association of Securities Dealers (NASD), which is now known as the Financial Industry Regulatory A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Soft Landing (economics)

A soft landing in the business cycle is the process of an economy shifting from growth to slow-growth to potentially flat, as it approaches but avoids a recession. It is usually caused by government attempts to slow down inflation. The criteria for distinguishing between a '' hard'' and ''soft'' landing are numerous and subjective. The term was adapted to economics from its origins in the early days of flight, when it historically was the method of the landing of hot air balloons, by gradually reducing their buoyancy. It later also applied to aviation, gliders and spacecraft, as in the Lunar lander. In the United States, modern recessions and hard and soft landings follow from Federal Reserve tightening cycles, in which the Federal funds rate is increased over several consecutive moves. In modern times, the most notable, and possibly the only true soft landing in the most recent 16 business cycles occurred in the soft landing of 1994, engineered by Federal Reserve Chairman Alan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics (particularly the panic of 1907) led to the desire for central control of the monetary system in order to alleviate financial crises. Although an instrument of the U.S. government, the Federal Reserve System considers itself "an independent central bank because its monetary policy decisions do not have to be approved by the president or by anyone else in the executive or legislative branches of government, it does not receive funding appropriated by Congress, and the terms of the members of the board of governors span multiple presidential and congressional terms." Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

October 27, 1997 Mini-crash

On October 27, 1997, a global stock market crash was caused by an Asian financial crisis, economic crisis in Asia, the "Asian contagion", or ''Tom Yam, Tom Yum Goong crisis'' (). The point loss that the Dow Jones Industrial Average suffered on this day currently List of largest daily changes in the Dow Jones Industrial Average, ranks as the 18th biggest percentage loss since the Dow's creation in 1896. This crash is considered a "mini-crash" because the percentage loss was relatively small compared to some other notable crashes. After the crash, the markets still remained positive for 1997, but the "mini-crash" may be considered as the beginning of the end of the 1990s economic boom in the United States and Canada, as both consumer confidence and economic growth were mildly reduced during the winter of 1997–1998 (with neither being strongly affected, compared to the rest of the world), and when both returned to pre-October levels, they began to grow at an even slower pace than b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |