Stock Market Downturn Of 2002 on:

[Wikipedia]

[Google]

[Amazon]

In 2001, stock prices took a sharp downturn (some say "

To put the downturn of 2002 in perspective, here is a look at annual U.S. stock market declines in 2000, 2001, and 2002:

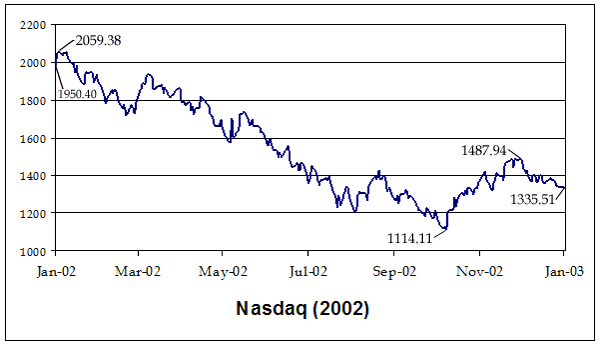

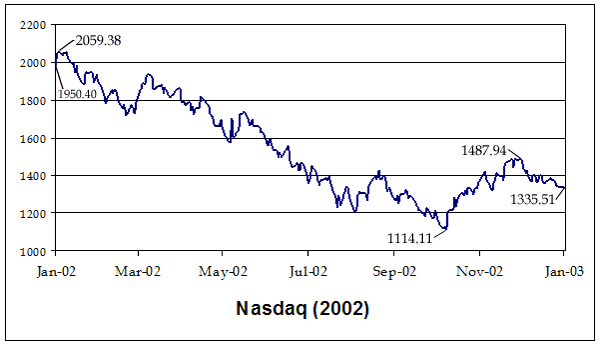

* Nasdaq

** In 2000, the Nasdaq lost 39.28% of its value (4,069.31 to 2,470.52).

** In 2001, the Nasdaq lost 21.05% of its value (2,470.52 to 1,950.40).

** In 2002, the Nasdaq lost 31.53% of its value (1,950.40 to 1,335.51).

* Dow Jones Industrial Average

** In 2000, the Dow lost 6.17% of its value (11,497.10 to 10,788.00)

** In 2001, the Dow lost 5.35% of its value (10,788.00 to 10,021.60)

** In 2002, the Dow lost 16.76% of its value (10,021.60 to 8,341.63)

Here is a historical view of the stock market downturn of 2002 including figures from the stock market bubble of the late 1990s:

:§Values represent percent change from previous date listed in table.

To put the downturn of 2002 in perspective, here is a look at annual U.S. stock market declines in 2000, 2001, and 2002:

* Nasdaq

** In 2000, the Nasdaq lost 39.28% of its value (4,069.31 to 2,470.52).

** In 2001, the Nasdaq lost 21.05% of its value (2,470.52 to 1,950.40).

** In 2002, the Nasdaq lost 31.53% of its value (1,950.40 to 1,335.51).

* Dow Jones Industrial Average

** In 2000, the Dow lost 6.17% of its value (11,497.10 to 10,788.00)

** In 2001, the Dow lost 5.35% of its value (10,788.00 to 10,021.60)

** In 2002, the Dow lost 16.76% of its value (10,021.60 to 8,341.63)

Here is a historical view of the stock market downturn of 2002 including figures from the stock market bubble of the late 1990s:

:§Values represent percent change from previous date listed in table.

"Rally Sends Major Gauges to Gains of More Than 5%"

''The New York Times'', July 30, 2002

''The New York Times'', July 22, 2002

''The New York Times'', July 21, 2002

''The New York Times'', July 20, 2002

''The New York Times'', July 20, 2002

''The New York Times'', July 21, 2002

Bloomberg News, July 19, 2002 {{DEFAULTSORT:Stock Market Downturn Of 2002 2002 in the United States 2002 in Canada 2002 in Europe 2002 in Asia Stock market crashes Economic crises in the United States 2002 in economic history

stock market crash

A stock market crash is a sudden dramatic decline of stock prices across a major cross-section of a stock market, resulting in a significant loss of paper wealth. Crashes are driven by panic selling and underlying economic factors. They often fol ...

" or " the Internet bubble bursting") in stock market

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include ''securities'' listed on a public stock exchange a ...

s across the United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 ...

, Canada

Canada is a country in North America. Its Provinces and territories of Canada, ten provinces and three territories extend from the Atlantic Ocean to the Pacific Ocean and northward into the Arctic Ocean, making it the world's List of coun ...

, Asia

Asia ( , ) is the largest continent in the world by both land area and population. It covers an area of more than 44 million square kilometres, about 30% of Earth's total land area and 8% of Earth's total surface area. The continent, which ...

, and Europe

Europe is a continent located entirely in the Northern Hemisphere and mostly in the Eastern Hemisphere. It is bordered by the Arctic Ocean to the north, the Atlantic Ocean to the west, the Mediterranean Sea to the south, and Asia to the east ...

. After recovering from lows reached following the September 11 attacks

The September 11 attacks, also known as 9/11, were four coordinated Islamist terrorist suicide attacks by al-Qaeda against the United States in 2001. Nineteen terrorists hijacked four commercial airliners, crashing the first two into ...

, indices slid steadily starting in March 2002, with dramatic declines in July and September leading to lows last reached in 1997 and 1998. The U.S. dollar increased in value relative to the euro

The euro (currency symbol, symbol: euro sign, €; ISO 4217, currency code: EUR) is the official currency of 20 of the Member state of the European Union, member states of the European Union. This group of states is officially known as the ...

, reaching a 1-to-1 valuation not seen since the euro's introduction.

Background

This downturn can be viewed as part of a largerbear market

A market trend is a perceived tendency of the financial markets to move in a particular direction over time. Analysts classify these trends as ''secular'' for long time-frames, ''primary'' for medium time-frames, and ''secondary'' for short time ...

or correction that began in 2000 after a decade-long bull market

A market trend is a perceived tendency of the financial markets to move in a particular direction over time. Analysts classify these trends as ''secular'' for long time-frames, ''primary'' for medium time-frames, and ''secondary'' for short time ...

had led to unusually high stock valuations, according to a report by the Cleveland Federal Reserve. The collapse of Enron

Enron Corporation was an American Energy development, energy, Commodity, commodities, and services company based in Houston, Texas. It was led by Kenneth Lay and developed in 1985 via a merger between Houston Natural Gas and InterNorth, both re ...

is a prime example. Many internet companies ( Webvan, Exodus Communications, and Pets.com) went bankrupt

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the de ...

. Others (Amazon.com

Amazon.com, Inc., doing business as Amazon, is an American multinational technology company engaged in e-commerce, cloud computing, online advertising, digital streaming, and artificial intelligence. Founded in 1994 by Jeff Bezos in Bellevu ...

, eBay

eBay Inc. ( , often stylized as ebay) is an American multinational e-commerce company based in San Jose, California, that allows users to buy or view items via retail sales through online marketplaces and websites in 190 markets worldwide. ...

, and Yahoo!

Yahoo (, styled yahoo''!'' in its logo) is an American web portal that provides the search engine Yahoo Search and related services including My Yahoo, Yahoo Mail, Yahoo News, Yahoo Finance, Yahoo Sports, y!entertainment, yahoo!life, and its a ...

) went down dramatically in value, but remain in business to this day and have generally good long-term growth prospects. An outbreak of accounting scandals

Accounting scandals are business scandals that arise from intentional manipulation of financial statements with the disclosure of financial misdeeds by trusted executives of corporations or governments. Such misdeeds typically involve complex ...

, (Arthur Andersen

Arthur Andersen LLP was an American accounting firm based in Chicago that provided auditing, tax advising, consulting and other professional services to large corporations. By 2001, it had become one of the world's largest multinational corpo ...

, Adelphia, Enron

Enron Corporation was an American Energy development, energy, Commodity, commodities, and services company based in Houston, Texas. It was led by Kenneth Lay and developed in 1985 via a merger between Houston Natural Gas and InterNorth, both re ...

, and WorldCom

MCI, Inc. (formerly WorldCom and MCI WorldCom) was a telecommunications company. For a time, it was the second-largest long-distance telephone company in the United States, after AT&T. WorldCom grew largely by acquiring other telecommunicatio ...

) was also a factor in the speed of the fall, as numerous large corporations were forced to restate earnings (or lack thereof) and investor confidence suffered. The September 11 attacks

The September 11 attacks, also known as 9/11, were four coordinated Islamist terrorist suicide attacks by al-Qaeda against the United States in 2001. Nineteen terrorists hijacked four commercial airliners, crashing the first two into ...

also contributed heavily to the stock market downturn, as investors became unsure about the prospect of terrorism

Terrorism, in its broadest sense, is the use of violence against non-combatants to achieve political or ideological aims. The term is used in this regard primarily to refer to intentional violence during peacetime or in the context of war aga ...

affecting the United States economy.

The International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by 191 member countries, with headquarters in Washington, D.C. It is regarded as the global lender of las ...

had expressed concern about instability

In dynamical systems instability means that some of the outputs or internal states increase with time, without bounds. Not all systems that are not stable are unstable; systems can also be marginally stable or exhibit limit cycle behavior.

...

in United States stock markets in the months leading up to the sharp downturn. The technology-heavy NASDAQ

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list ...

stock market peaked on March 10, 2000, hitting an intra-day high of 5,132.52 and closing at 5,048.62. The Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow (), is a stock market index of 30 prominent companies listed on stock exchanges in the United States.

The DJIA is one of the oldest and most commonly followed equity indice ...

, a price-weighted average (adjusted for splits and dividends) of 30 large companies on the New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District, Manhattan, Financial District of Lower Manhattan in New York City. It is the List of stock exchanges, largest stock excha ...

, peaked on January 14, 2000, with an intra-day high of 11,750.28 and a closing price of 11,722.98. In 2001, the DJIA was largely unchanged overall but had reached a secondary peak of 11,337.92 (11,350.05 intra-day) on May 21.

The downturn may be viewed as a reversion to average stock market performance in a longer-term context. From 1987 to 1995, the Dow rose each year by about 10%, but from 1995 to 2000, the Dow rose 15% a year. While the bear market

A market trend is a perceived tendency of the financial markets to move in a particular direction over time. Analysts classify these trends as ''secular'' for long time-frames, ''primary'' for medium time-frames, and ''secondary'' for short time ...

began in 2000, by July and August 2002, the index had only dropped to the same level it would have achieved if the 10% annual growth rate followed during 1987–1995 had continued up to 2002.

Seeking a bottom

After falling for 11 of 12 consecutive days closing below Dow 8000 on July 23, 2002, the market rallied. The Dow rose 13% over the next four trading days, but then fell sharply again in early August. On August 5, theNASDAQ

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list ...

fell below its July 23 low. However, the markets rose sharply over the rest of the week, and eventually surpassed Dow 9000 during several trading sessions in late August. After that, the Dow dropped to a four-year low on September 24, 2002, while the NASDAQ reached a 6-year low. The markets continued their declines, breaking the September low to five-year lows on October 7 and reaching a bottom (below Dow 7200 and just above 1100 on the NASDAQ) on October 9. Stocks recovered slightly from their October lows to year-end, with the Dow remaining in the mid-8000s from November 2002 to mid-January 2003. The markets reached a final low below Dow 7500 in mid-March 2003.

Scale

As of September 24, 2002, the Dow Jones Industrial Average had lost 27% of the value it held on January 1, 2001: a total loss of 5 trillion dollars. The Dow Jones had already lost 9% of its peak value at the start of 2001, while the Nasdaq had lost 44%. At the March 2000 top, the sum in valuation of allNYSE

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District, Manhattan, Financial District of Lower Manhattan in New York City. It is the List of stock exchanges, largest stock excha ...

-listed companies stood at $12.9 trillion, and the valuation sum of all NASDAQ

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list ...

-listed companies stood at $5.4 trillion, for a total market value of $18.3 trillion. The NASDAQ subsequently lost nearly 80% and the S&P 500

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 leading companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and in ...

lost 50% to reach the October 2002 lows. The total market value of NYSE (7.2) and NASDAQ (1.8) companies at that time was only $9 trillion, for an overall market loss of $9.3 trillion.

Index levels

See also

*Economy of the United States

The United States has a highly developed mixed economy. It is the world's largest economy by nominal GDP and second largest by purchasing power parity (PPP). As of 2025, it has the world's seventh highest nominal GDP per capita and ninth ...

References

External links

NB: Registration required for all links"Rally Sends Major Gauges to Gains of More Than 5%"

''The New York Times'', July 30, 2002

''The New York Times'', July 22, 2002

''The New York Times'', July 21, 2002

''The New York Times'', July 20, 2002

''The New York Times'', July 20, 2002

''The New York Times'', July 21, 2002

Bloomberg News, July 19, 2002 {{DEFAULTSORT:Stock Market Downturn Of 2002 2002 in the United States 2002 in Canada 2002 in Europe 2002 in Asia Stock market crashes Economic crises in the United States 2002 in economic history