|

Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics (particularly the panic of 1907) led to the desire for central control of the monetary system in order to alleviate financial crises. Although an instrument of the U.S. government, the Federal Reserve System considers itself "an independent central bank because its monetary policy decisions do not have to be approved by the president or by anyone else in the executive or legislative branches of government, it does not receive funding appropriated by Congress, and the terms of the members of the board of governors span multiple presidential and congressional terms." Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Vice Chair Of The Federal Reserve

The vice chair of the Board of Governors of the Federal Reserve System is the second-highest officer of the Federal Reserve, after the chair of the Federal Reserve. In the absence of the chair, the vice chair presides over the meetings Board of Governors of the Federal Reserve System. The vice chair and the vice chair for supervision each serve a four-year term after being nominated by the president of the United States and confirmed by the United States Senate, and they serve concurrently as members of the Board of Governors. Both vice chairs may serve multiple terms, pending a new nomination and confirmation at the end of each term, with Ronald Ransom as the longest serving vice chair from 1936 to 1947. They cannot be dismissed by the president before the end of their term. The position of vice chair is currently held by Philip Jefferson who was sworn in on September 13, 2023. The position of vice chair for supervision is currently held by Michelle Bowman after Michael Barr (T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve Board Of Governors

The Board of Governors of the Federal Reserve System, commonly known as the Federal Reserve Board, is the main governing body of the Federal Reserve System. It is charged with overseeing the Federal Reserve Banks and with helping implement the monetary policy of the United States. Governors are appointed by the president of the United States and confirmed by the Senate for staggered 14-year terms.See It is headquartered in the Eccles Building on Constitution Avenue, N.W. in Washington, D.C. Statutory description By law, the appointments must yield a "fair representation of the financial, agricultural, industrial, and commercial interests and geographical divisions of the country". As stipulated in the Banking Act of 1935, the chair and vice chair of the Board are two of seven members of the Board of Governors who are appointed by the president from among the sitting governors of the Federal Reserve Banks. The terms of the seven members of the Board span multiple presidential ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chair Of The Federal Reserve

The chair of the Board of Governors of the Federal Reserve System is the head of the Federal Reserve, and is the active executive officer of the Federal Reserve Board of Governors, Board of Governors of the Federal Reserve System. The chairman presides at meetings of the Board. The chairman serves a four-year term after being nominated by the president of the United States and confirmed by the United States Senate; the officeholder serves concurrently as a member of the Board of Governors. The chairman may serve multiple terms, subject to re-nomination and confirmation each time; William McChesney Martin (1951–1970) was the longest serving chair, with Alan Greenspan (1987–2006) a close second. neither the president nor congress of the US can dismiss a chairman before the end of a term. Jerome Powell was sworn in as chairman on February 5, 2018. He had been first nominated to the position by President Donald Trump on November 2, 2017, and confirmed by the Senate. He was nomi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Seal Of The United States Federal Reserve System

Seal may refer to any of the following: Common uses * Pinniped, a diverse group of semi-aquatic marine mammals, many of which are commonly called seals, particularly: ** Earless seal, also called "true seal" ** Fur seal ** Eared seal * Seal (emblem), a device to impress an emblem, used as a means of authentication, on paper, wax, clay or another medium (the impression is also called a seal) * Seal (mechanical), a device which helps prevent leakage, contain pressure, or exclude contamination where two systems join ** Hermetic seal, an airtight mechanical seal * Security seals such as labels, tapes, bands, or ties affixed onto a container in order to prevent and detect tampering Arts, entertainment and media * Seal (1991 album), ''Seal'' (1991 album), by Seal * Seal (1994 album), ''Seal'' (1994 album), sometimes referred to as ''Seal II'', by Seal * ''Seal IV'', a 2003 album by Seal * ''Seal Online'', a 2003 massively multiplayer online role-playing game Law * Seal (contract la ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

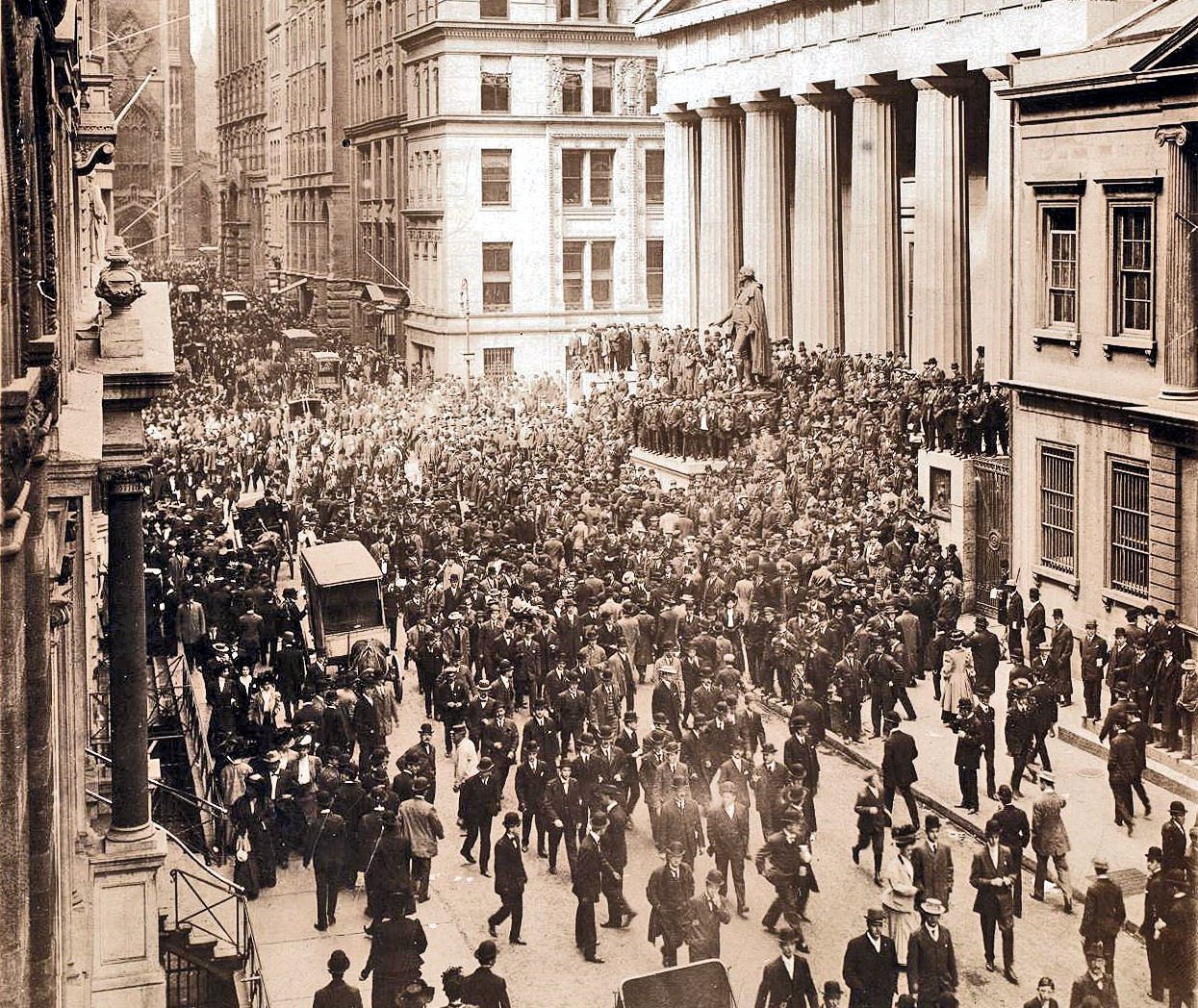

Panic Of 1907

The Panic of 1907, also known as the 1907 Bankers' Panic or Knickerbocker Crisis, was a financial crisis that took place in the United States over a three-week period starting in mid-October, when the New York Stock Exchange suddenly fell almost 50% from its peak the previous year. The panic occurred during a time of economic recession, and there were numerous bank run, runs affecting banks and trust company, trust companies. The 1907 panic eventually spread throughout the nation when many state and local banks and businesses entered bankruptcy. The primary causes of the run included a retraction of market liquidity by a number of New York City banks and a loss of confidence among depositors, exacerbated by unregulated side bets at bucket shop (stock market), bucket shops. The panic was triggered by the failed attempt in October 1907 to cornering the market, corner the market on stock of the United Copper, United Copper Company. When the bid failed, banks that had lent money to t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Depression

The Great Depression was a severe global economic downturn from 1929 to 1939. The period was characterized by high rates of unemployment and poverty, drastic reductions in industrial production and international trade, and widespread bank and business failures around the world. The economic contagion began in 1929 in the United States, the largest economy in the world, with the devastating Wall Street stock market crash of October 1929 often considered the beginning of the Depression. Among the countries with the most unemployed were the U.S., the United Kingdom, and Weimar Republic, Germany. The Depression was preceded by a period of industrial growth and social development known as the "Roaring Twenties". Much of the profit generated by the boom was invested in speculation, such as on the stock market, contributing to growing Wealth inequality in the United States, wealth inequality. Banks were subject to laissez-faire, minimal regulation, resulting in loose lending and wides ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Recession

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009.“US Business Cycle Expansions and Contractions” United States NBER, or National Bureau of Economic Research, updated March 14, 2023. This government agency dates the Great Recession as starting in December 2007 and bottoming-out in June 2009. The scale and timing of the recession varied from country to country (see map). At the time, the International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression. The causes of the Great Recession include a combination of vulnerabilities that developed in the financial system ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Policy

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability (normally interpreted as a low and stable rate of inflation). Further purposes of a monetary policy may be to contribute to economic stability or to maintain predictable exchange rates with other currencies. Today most central banks in developed countries conduct their monetary policy within an inflation targeting framework, whereas the monetary policies of most developing countries' central banks target some kind of a fixed exchange rate system. A third monetary policy strategy, targeting the money supply, was widely followed during the 1980s, but has diminished in popularity since then, though it is still the official strategy in a number of emerging economies. The tools of monetary policy vary from central bank to central bank, depending on the country's stage of development, inst ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Regulation

Banking regulation and supervision refers to a form of financial regulation which subjects banks to certain requirements, restrictions and guidelines, enforced by a financial regulatory authority generally referred to as banking supervisor, with semantic variations across jurisdictions. By and large, banking regulation and supervision aims at ensuring that banks are safe and sound and at fostering market transparency between banks and the individuals and corporations with whom they conduct business. Its main component is prudential regulation and supervision whose aim is to ensure that banks are viable and resilient ("safe and sound") so as to reduce the likelihood and impact of bank failures that may trigger systemic risk. Prudential regulation and supervision requires banks to control risks and hold adequate capital as defined by capital requirements, liquidity requirements, the imposition of concentration risk (or large exposures) limits, and related reporting and public di ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Beige Book

The Beige Book, more formally called the Summary of Commentary on Current Economic Conditions, is a report published by the United States Federal Reserve Board eight times a year. The report is published in advance of meetings of the Federal Open Market Committee. Each report is a gathering of " anecdotal information on current economic conditions" by each Federal Reserve Bank in its district from "Bank and Branch directors and interviews with key business contacts, economists, market experts, and other sources." It is called the ''Beige Book'' because its cover is colored beige. History The ''Beige Book'' (at that time called the ''Redbook'') was first collected under the direction of Arthur Burns in 1970, seeking to formalize the process of collecting qualitative understandings of the various districts under the Federal Reserve. The ''Redbook'' became public in 1983 at the request of U.S. House of Representatives delegate Walter E. Fauntroy. In order to minimize the appe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Depository Institution

Colloquially, a depository institution is a financial institution in the United States (such as a savings bank, commercial bank, savings and loan associations, or credit unions) that is legally allowed to accept monetary deposits from consumer A consumer is a person or a group who intends to order, or use purchased goods, products, or services primarily for personal, social, family, household and similar needs, who is not directly related to entrepreneurial or business activities. ...s. Under federal law, however, a "depository institution" is limited to banks and savings associations - credit unions are not included (debatable). An example of a non-depository institution might be a mortgage bank. While licensed to lend, they cannot accept deposits. See also * Authorised deposit-taking institution References * Ruben D Cohen (2004) �The Optimal Capital Structure of Depository Institutions��, ''Wilmott Magazine'', March issue. Financial services in the United St ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Bank

A central bank, reserve bank, national bank, or monetary authority is an institution that manages the monetary policy of a country or monetary union. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monetary base. Many central banks also have supervisory or regulatory powers to ensure the stability of commercial banks in their jurisdiction, to prevent bank runs, and, in some cases, to enforce policies on financial consumer protection, and against bank fraud, money laundering, or terrorism financing. Central banks play a crucial role in macroeconomic forecasting, which is essential for guiding monetary policy decisions, especially during times of economic turbulence. Central banks in most developed nations are usually set up to be institutionally independent from political interference, even though governments typically have governance rights over them, legislative bodies exercise scrutiny, and central banks frequently do show resp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |