|

Public Spending

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual or collective needs of the community, is classed as government final consumption expenditure. Government acquisition of goods and services intended to create future benefits, such as infrastructure investment or research spending, is classed as government investment (government gross capital formation). These two types of government spending, on final consumption and on gross capital formation, together constitute one of the major components of gross domestic product. Spending by a government that issues its own currency is nominally self-financing. However, under a full employment assumption, to acquire resources produced by its population without potential inflationary pressures, removal of purchasing power must occur via government bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Income Accounting

A variety of measures of national income and output are used in economics to estimate total economic activity in a country or region, including gross domestic product (GDP), Gross national income (GNI), net national income (NNI), and adjusted national income (NNI adjusted for natural resource depletion – also called as NNI at factor cost). All are specially concerned with counting the total amount of goods and services produced within the economy and by various sectors. The boundary is usually defined by geography or citizenship, and it is also defined as the total income of the nation and also restrict the goods and services that are counted. For instance, some measures count only goods & services that are exchanged for money, excluding bartered goods, while other measures may attempt to include bartered goods by ''imputing'' monetary values to them. National accounts Arriving at a figure for the total production of goods and services in a large region like a country entails a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

MSS And MSB

The Ministry of State Security (MSS) is the principal civilian intelligence and security service of the People's Republic of China, responsible for foreign intelligence, counterintelligence, and defense of the political security and honor of the Chinese Communist Party (CCP). One of the largest and most secretive intelligence organizations in the world, it maintains powerful semi-autonomous branches at the provincial, city, municipality and township levels throughout China. The ministry's headquarters, Yidongyuan, is a large compound in Beijing's Haidian district. The origins of the MSS begin with the CCP's Central Special Branch, better known as the ''Teke'', which was replaced by the Central Social Affairs Department from 1936 through the proclamation of the People's Republic in 1949. In 1955, the department was replaced with the Central Investigation Department, which existed in various configurations through the Cultural Revolution to 1983, when it was merged with counte ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Keynesian Economics

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomics, macroeconomic theories and Economic model, models of how aggregate demand (total spending in the economy) strongly influences Output (economics), economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the aggregate supply, productive capacity of the economy. It is influenced by a host of factors that sometimes behave erratically and impact production, employment, and inflation. Keynesian economists generally argue that aggregate demand is volatile and unstable and that, consequently, a market economy often experiences inefficient macroeconomic outcomes, including economic recession, recessions when demand is too low and inflation when demand is too high. Further, they argue that these economic fluctuations can be mitigated by economic policy responses coordinated between a government and their central bank. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deficit Spending

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit, the opposite of budget surplus. The term may be applied to the budget of a government, private company, or individual. A central point of controversy in economics, government deficit spending was first identified as a necessary economic tool by John Maynard Keynes in the wake of the Great Depression. Controversy Government deficit spending is a central point of controversy in economics, with prominent economists holding differing views. The mainstream economics position is that deficit spending is desirable and necessary as part of countercyclical fiscal policy, but that there should not be a structural deficit (i.e., permanent deficit): The government should run deficits during recessions to compensate for the shortfall in aggregate demand, but should run surpluses in boom times so that there is no ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unemployment Insurance

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is the proportion of people above a specified age (usually 15) not being in paid employment or self-employment but currently available for work during the reference period. Unemployment is measured by the unemployment rate, which is the number of people who are unemployed as a percentage of the labour force (the total number of people employed added to those unemployed). Unemployment can have many sources, such as the following: * the status of the economy, which can be influenced by a recession * competition caused by globalization and international trade * new technologies and inventions * policies of the government * regulation and market * war, civil disorder, and natural disasters Unemployment and the status of the economy can be influenced by a country through, for example, fiscal policy. Furthermore, the monetary authority of a country, such as the central bank, can in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

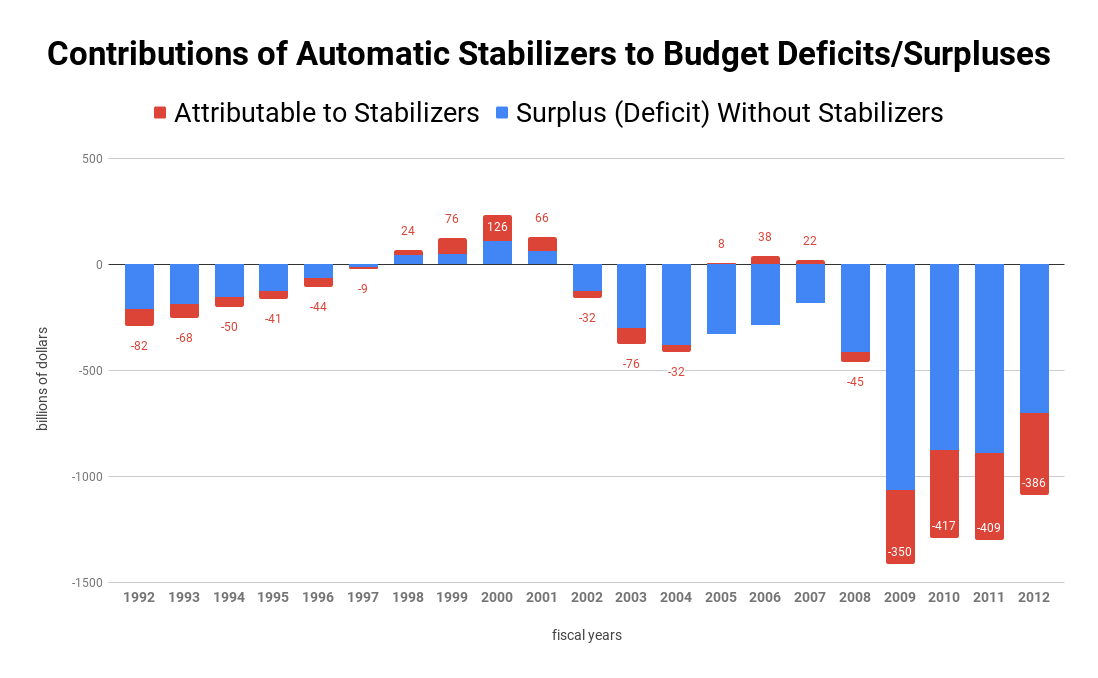

Automatic Stabilizer

In macroeconomics, automatic stabilizers are features of the structure of modern government budgets, particularly income taxes and Welfare (financial aid), welfare spending, that act to damp out fluctuations in real GDP. The size of the government budget deficit tends to increase when a country enters a recession, which tends to keep national income higher by maintaining aggregate demand. There may also be a multiplier (economics), multiplier effect. This effect happens automatically depending on GDP and household income, without any explicit policy action by the government, and acts to reduce the severity of recessions. Similarly, the budget deficit tends to decrease during booms, which pulls back on aggregate demand. Therefore, automatic stabilizers tend to reduce the size of the fluctuations in a country's GDP. Induced taxes Tax revenues generally depend on household income and the pace of economic activity. Household incomes fall and the economy slows down during a recession, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Output (economics)

In economics, output is the quantity and quality of goods or services produced in a given time period, within a given economic network, whether consumed or used for further production. The economic network may be a firm, industry, or nation. The concept of national output is essential in the field of macroeconomics Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study topics such as output (econ .... It is national output that makes a country rich, not large amounts of money. H.L Ahuja (1978). '' Macro-development economics: an analytical approach''. Definition Output is the result of an economic process that has used inputs to produce a product or service that is available for sale or use somewhere else. ''Net output'', sometimes called ''netput'' is a quantity, in the context of production, that is posi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Recession

In economics, a recession is a business cycle contraction that occurs when there is a period of broad decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale Anthropogenic hazard, anthropogenic or natural disaster (e.g. a pandemic). There is no official definition of a recession, according to the International Monetary Fund, IMF. In the United States, a recession is defined as "a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales." The European Union has adopted a similar definition. In the United Kingdom and Canada, a recession is defined as negative economic growth for two consecutive qu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Policy

In economics and political science, fiscal policy is the use of government revenue collection ( taxes or tax cuts) and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables developed in reaction to the Great Depression of the 1930s, when the previous laissez-faire approach to economic management became unworkable. Fiscal policy is based on the theories of the British economist John Maynard Keynes, whose Keynesian economics theorised that government changes in the levels of taxation and government spending influence aggregate demand and the level of economic activity. Fiscal and monetary policy are the key strategies used by a country's government and central bank to advance its economic objectives. The combination of these policies enables these authorities to target inflation and to increase employment. In modern economies, inflation is conventionally considered "healthy" in the range of 2%–3%. Add ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Figure A - Crowding Out

Figure may refer to: General *A shape, drawing, depiction, or geometric configuration *Figure (wood), wood appearance *Figure (music), distinguished from musical motif *Noise figure, in telecommunication *Dance figure, an elementary dance pattern *A person's figure, human physical appearance *Figure–ground (perception), the distinction between a visually perceived object and its surroundings Arts *Figurine, a miniature statuette representation of a creature *Action figure, a posable jointed solid plastic character figurine *Figure painting, realistic representation, especially of the human form *Figure drawing *Model figure, a scale model of a creature Writing *figure, in writing, a type of floating block (text, table, or graphic separate from the main text) *Figure of speech, also called a rhetorical figure *Christ figure, a type of character * in typesetting, text figures and lining figures Accounting *Figure, a synonym for number *Significant figures in a decimal numbe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lindahl Tax

A Lindahl tax is a form of taxation conceived by Erik Lindahl in which individuals pay for Public good (economics), public goods according to their marginal benefits. In other words, they pay according to the amount of satisfaction or utility they derive from the consumption of an additional unit of the public good. Lindahl taxation is designed to maximize Economic efficiency, efficiency for each individual and provide the optimal level of a public good. Lindahl taxes can be seen as an individual's share of the collective Tax incidence, tax burden of an economy. The optimal level of a public good is that quantity at which the willingness to pay for one more unit of the good, taken in totality for all the individuals is equal to the marginal cost of supplying that good. Lindahl tax is the optimal quantity times the willingness to pay for one more unit of that good at this quantity.0 . Existence Duncan K. Foley, Foley proved that, If the utility functions have continuous derivati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |