|

Automatic Stabilizer

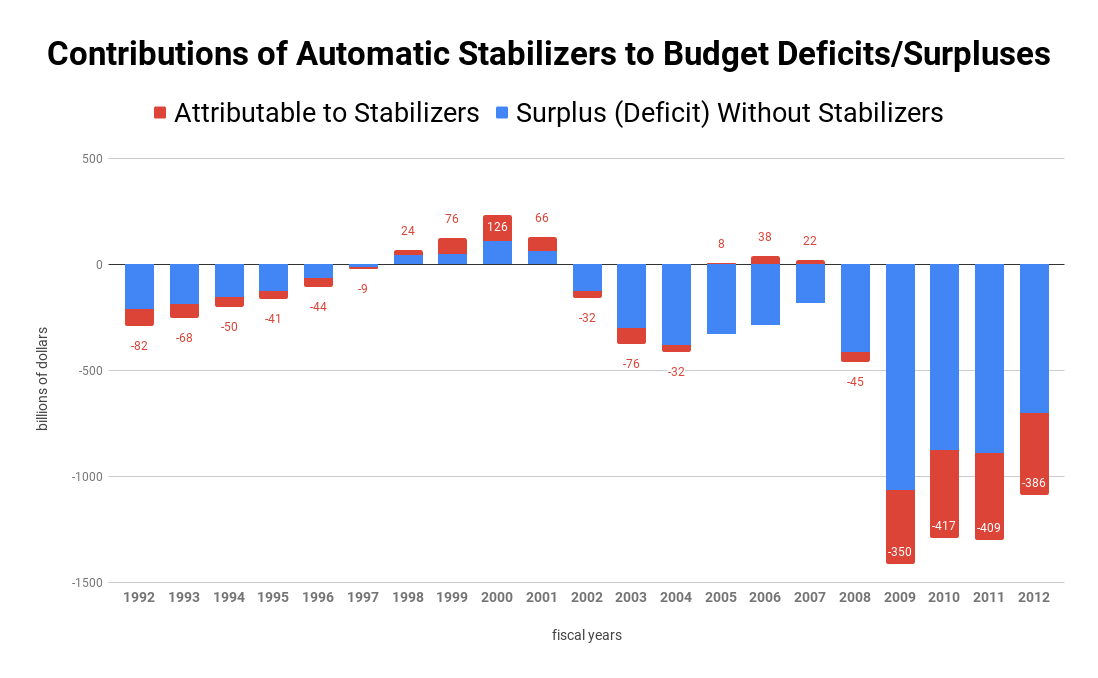

In macroeconomics, automatic stabilizers are features of the structure of modern government budgets, particularly income taxes and Welfare (financial aid), welfare spending, that act to damp out fluctuations in real GDP. The size of the government budget deficit tends to increase when a country enters a recession, which tends to keep national income higher by maintaining aggregate demand. There may also be a multiplier (economics), multiplier effect. This effect happens automatically depending on GDP and household income, without any explicit policy action by the government, and acts to reduce the severity of recessions. Similarly, the budget deficit tends to decrease during booms, which pulls back on aggregate demand. Therefore, automatic stabilizers tend to reduce the size of the fluctuations in a country's GDP. Induced taxes Tax revenues generally depend on household income and the pace of economic activity. Household incomes fall and the economy slows down during a recession, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Macroeconomics

Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study topics such as output (economics), output/Gross domestic product, GDP (gross domestic product) and national income, unemployment (including Unemployment#Measurement, unemployment rates), price index, price indices and inflation, Consumption (economics), consumption, saving, investment (macroeconomics), investment, Energy economics, energy, international trade, and international finance. Macroeconomics and microeconomics are the two most general fields in economics. The focus of macroeconomics is often on a country (or larger entities like the whole world) and how its markets interact to produce large-scale phenomena that economists refer to as aggregate variables. In microeconomics the focus of analysis is often a single market, such as whether changes in supply or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Per Head

A poll tax, also known as head tax or capitation, is a lump-sum tax, tax levied as a fixed sum on every liable individual (typically every adult), without reference to income or resources. ''Poll'' is an archaic term for "head" or "top of the head". The sense of "counting heads" is found in phrases like polling place and opinion poll. Head taxes were important sources of revenue for many governments from ancient times until the 19th century. In the United Kingdom, poll taxes were levied by the governments of John of Gaunt in the 14th century, Charles II of England, Charles II in the 17th and Margaret Thatcher in the 20th century. In the United States, voting poll taxes (whose payment was a precondition to voting in an election) have been used to Disenfranchisement after the Reconstruction Era, disenfranchise impoverished and minority voters (especially after Reconstruction Era, Reconstruction). Poll taxes are Regressive tax, regressive, meaning the higher someone's income is, t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Negative Feedback

Negative feedback (or balancing feedback) occurs when some function (Mathematics), function of the output of a system, process, or mechanism is feedback, fed back in a manner that tends to reduce the fluctuations in the output, whether caused by changes in the input or by other disturbances. Whereas positive feedback tends to instability via exponential growth, oscillation or chaos theory, chaotic behavior, negative feedback generally promotes stability. Negative feedback tends to promote a settling to List of types of equilibrium, equilibrium, and reduces the effects of perturbations. Negative feedback loops in which just the right amount of correction is applied with optimum timing, can be very stable, accurate, and responsive. Negative feedback is widely used in Mechanical engineering, mechanical and electronic engineering, and it is observed in many other fields including biology, chemistry and economics. General negative feedback systems are studied in Control engin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Recession

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009.“US Business Cycle Expansions and Contractions” United States NBER, or National Bureau of Economic Research, updated March 14, 2023. This government agency dates the Great Recession as starting in December 2007 and bottoming-out in June 2009. The scale and timing of the recession varied from country to country (see map). At the time, the International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression. The causes of the Great Recession include a combination of vulnerabilities that developed in the financial system ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Congressional Budget Office

The Congressional Budget Office (CBO) is a List of United States federal agencies, federal agency within the United States Congress, legislative branch of the United States government that provides budget and economic information to Congress. Inspired by California's California Legislative Analyst's Office, Legislative Analyst's Office that manages the state budget in a strictly nonpartisan fashion, the CBO was created as a nonpartisan agency by the Congressional Budget and Impoundment Control Act of 1974. Whereas politicians on both sides of the aisle have criticized the CBO when its estimates have been politically inconvenient, economists and other academics overwhelmingly reject that the CBO is partisan or that it fails to produce credible forecasts. There is a consensus among economists that "adjusting for legal restrictions on what the CBO can assume about future legislation and events, the CBO has historically issued credible forecasts of the effects of both Democratic and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Contributions Of Automatic Stabilizers To Budget Deficits Surpluses

Contribution may refer to: Music * ''Contribution'' (album), by Mica Paris (1990) ** "Contribution" (song), title song from the album *''Contribution'', a 1976 album by Shawn Phillips * A contribution concert is where a band plays in the songs of or in the style of a separate band Finance and law *Contribution (law), an agreement between defendants in a suit to apportion liability *Contributions, a vital goal of fundraising *Contribution margin, the selling price per unit minus the variable cost per unit * Contribution, a principle of insurance Sport * Goal contribution In association football, an assist is a contribution leading to the scoring of a goal, where the contribution is made by someone on the scoring team other than the scorer. Statistics for assists made by players may be kept officially by the organ ..., a player statistic in association football See also * Adobe Contribute, former web-editing software {{Disambiguation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Imports

An importer is the receiving country in an export from the sending country. Importation and exportation are the defining financial transactions of international trade. Import is part of the International Trade which involves buying and receiving of goods or services produced in another country. The seller of such goods and services is called an exporter, while the foreign buyer is known as an importer. In international trade, the importation and exportation of goods are limited by import quotas and mandates from the customs authority. The importing and exporting jurisdictions may impose a tariff A tariff or import tax is a duty (tax), duty imposed by a national Government, government, customs territory, or supranational union on imports of goods and is paid by the importer. Exceptionally, an export tax may be levied on exports of goods ... (tax) on the goods. In addition, the importation and exportation of goods are subject to trade agreements between the importing and exp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ceteris Paribus

' (also spelled ') (Classical ) is a Latin phrase, meaning "other things equal"; some other English translations of the phrase are "all other things being equal", "other things held constant", "all else unchanged", and "all else being equal". A statement about a causal, empirical, moral, or logical relation between two states of affairs is ''ceteris paribus'' if it is acknowledged that the statement, although usually accurate in expected conditions, can fail because of, or the relation can be abolished by, intervening factors. chapter 2 A ''ceteris paribus'' assumption is often key to scientific inquiry, because scientists seek to eliminate factors that perturb a relation of interest. Thus epidemiologists, for example, may seek to control independent variables as factors that may influence dependent variables—the outcomes of interest. Likewise, in scientific modeling, simplifying assumptions permit illustration of concepts considered relevant to the inquiry. An example ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

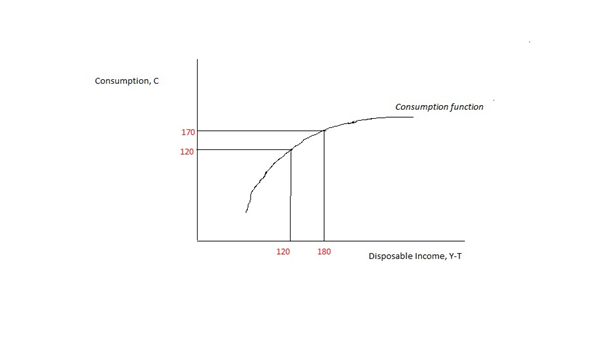

Marginal Propensity To Consume

In economics, the marginal propensity to consume (MPC) is a metric that quantifies induced consumption, the concept that the increase in personal consumer spending ( consumption) occurs with an increase in disposable income (income after taxes and transfers). The proportion of disposable income which individuals spend on consumption is known as propensity to consume. MPC is the proportion of additional income that an individual consumes. For example, if a household earns one extra dollar of disposable income, and the marginal propensity to consume is 0.65, then of that dollar, the household will spend 65 cents and save 35 cents. Obviously, the household cannot spend ''more'' than the extra dollar (without borrowing or using savings). If the extra money accessed by the individual gives more economic confidence, then the MPC of the individual may well exceed 1, as they may borrow or utilise savings. According to John Maynard Keynes, marginal propensity to consume is less than one. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Multiplier (economics)

In macroeconomics, a multiplier is a factor of proportionality that measures how much an endogenous variable changes in response to a change in some exogenous variable. For example, suppose variable ''x'' changes by ''k'' units, which causes another variable ''y'' to change by ''M'' × ''k'' units. Then the multiplier is ''M''. Common uses Two multipliers are commonly discussed in introductory macroeconomics. Commercial banks create money, especially under the fractional-reserve banking system used throughout the world. In this system, money is created whenever a bank gives out a new loan. This is because the loan, when drawn on and spent, mostly finishes up as a deposit back in the banking system and is counted as part of money supply. After putting aside a part of these deposits as mandated bank reserves, the balance is available for the making of further loans by the bank. This process continues multiple times, and is called the multiplier effect. The multiplier m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Keynesian

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. It is influenced by a host of factors that sometimes behave erratically and impact production, employment, and inflation. Keynesian economists generally argue that aggregate demand is volatile and unstable and that, consequently, a market economy often experiences inefficient macroeconomic outcomes, including recessions when demand is too low and inflation when demand is too high. Further, they argue that these economic fluctuations can be mitigated by economic policy responses coordinated between a government and their central bank. In particular, fiscal policy actions taken by the government and monetary policy action ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unemployment

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is the proportion of people above a specified age (usually 15) not being in paid employment or self-employment but currently available for work during the reference period. Unemployment is measured by the unemployment rate, which is the number of people who are unemployed as a percentage of the labour force (the total number of people employed added to those unemployed). Unemployment can have many sources, such as the following: * the status of the economy, which can be influenced by a recession * competition caused by globalization and international trade * new technologies and inventions * policies of the government * regulation and market * war, civil disorder, and natural disasters Unemployment and the status of the economy can be influenced by a country through, for example, fiscal policy. Furthermore, the monetary authority of a country, such as the central bank, can in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |