|

Dot-com Companies

A dot-com company, or simply a dot-com (alternatively rendered dot.com, dot com, dotcom or .com), is a company that conducts most of its businesses on the Internet, usually through a website on the World Wide Web that uses the popular top-level domain " .com". As of 2021, .com is by far the most used TLD, with almost half of all registrations. The suffix .com in a URL usually (but not always) refers to a commercial or for-profit entity, as opposed to a non-commercial entity or non-profit organization, which usually use .org. The name for the domain came from the word ''commercial'', as that is the main intended use. Since the .com companies are web-based, often their products or services are delivered via web-based mechanisms, even when physical products are involved. On the other hand, some .com companies do not offer any physical products. History Origin of the .com domain (1985–1991) The .com top-level domain (TLD) was one of the first seven created when the Internet was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internet

The Internet (or internet) is the Global network, global system of interconnected computer networks that uses the Internet protocol suite (TCP/IP) to communicate between networks and devices. It is a internetworking, network of networks that consists of Private network, private, public, academic, business, and government networks of local to global scope, linked by a broad array of electronic, Wireless network, wireless, and optical networking technologies. The Internet carries a vast range of information resources and services, such as the interlinked hypertext documents and Web application, applications of the World Wide Web (WWW), email, electronic mail, internet telephony, streaming media and file sharing. The origins of the Internet date back to research that enabled the time-sharing of computer resources, the development of packet switching in the 1960s and the design of computer networks for data communication. The set of rules (communication protocols) to enable i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Japanese Asset Price Bubble

The was an economic bubble in Japan from 1986 to 1991 in which real estate and stock market prices were greatly inflated. In early 1992, this price bubble burst and the country's economy stagnated. The bubble was characterized by rapid acceleration of asset prices and overheated economic activity, as well as an uncontrolled money supply and credit expansion.Kunio Okina, Masaaki Shirakawa, and Shigenori Shiratsuka (February 2001):The Asset Price Bubble and Monetary Policy: Japan's Experience in the Late 1980s and the Lessons More specifically, over-confidence and speculation regarding asset and stock prices were closely associated with excessive monetary easing policy at the time.Edgardo Demaestri, Pietro Masci (2003): Financial Crises in Japan and Latin America, Inter-American Development Bank Through the creation of economic policies that cultivated the marketability of assets, eased the access to credit, and encouraged speculation, the Japanese government started a prolon ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dot-com Bubble

The dot-com bubble (or dot-com boom) was a stock market bubble that ballooned during the late-1990s and peaked on Friday, March 10, 2000. This period of market growth coincided with the widespread adoption of the World Wide Web and the Internet, resulting in a dispensation of available venture capital and the rapid growth of valuations in new dot-com Startup company, startups. Between 1995 and its peak in March 2000, investments in the NASDAQ composite stock market index rose by 80%, only to fall 78% from its peak by October 2002, giving up all its gains during the bubble. During the dot-com crash, many online shopping companies, notably Pets.com, Webvan, and Boo.com, as well as several communication companies, such as Worldcom, NorthPoint Communications, and Global Crossing, failed and shut down. Others, like Lastminute.com, MP3.com and PeopleSound were bought out. Larger companies like Amazon (company), Amazon and Cisco Systems lost large portions of their market capitalizati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Market Crash

A stock market crash is a sudden dramatic decline of stock prices across a major cross-section of a stock market, resulting in a significant loss of paper wealth. Crashes are driven by panic selling and underlying economic factors. They often follow speculation and economic bubbles. A stock market crash is a social phenomenon where external economic events combine with crowd psychology in a positive feedback loop where selling by some market participants drives more market participants to sell. Generally speaking, crashes usually occur under the following conditions: a prolonged period of rising stock prices (a bull market) and excessive economic optimism, a market where price–earnings ratios exceed long-term averages, and extensive use of margin debt and leverage by market participants. Other aspects such as wars, large corporate hacks, changes in federal laws and regulations, and natural disasters within economically productive areas may also influence a significant decline i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Initial Public Offering

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges. Through this process, colloquially known as ''floating'', or ''going public'', a privately held company is transformed into a public company. Initial public offerings can be used to raise new equity capital for companies, to monetize the investments of private shareholders such as company founders or private equity investors, and to enable easy trading of existing holdings or future capital raising by becoming publicly traded. After the IPO, shares are traded freely in the open market at what is known as the free float. Stock exchanges stipulate a minimum free float both in absolute terms (the total value as determined by the share price multiplied ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exit Strategy

An exit strategy is a means of leaving one's current situation, either after a predetermined objective has been achieved, or as a strategy to mitigate failure. An organisation or individual without an exit strategy may be in a quagmire. At worst, an exit strategy will save face; at best, an exit strategy will deliver an objective worth more than the cost of continuing the execution of a previous plan considered "deemed to fail" by weight of the present situation. In warfare In military strategy, an exit strategy is understood to minimise losses of what military jargon called "blood and treasure" (lives and materiel). The term was used technically in internal Pentagon critiques of the Vietnam War (cf. President Richard Nixon's promise of Peace With Honor), but remained obscure to the general public until the Battle of Mogadishu, Somalia when the U.S. military involvement in that U.N. peacekeeping operation cost the lives of U.S. troops without a clear objective. Republican cr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Share

Market share is the percentage of the total revenue or sales in a Market (economics), market that a company's business makes up. For example, if there are 50,000 units sold per year in a given industry, a company whose sales were 5,000 of those units would have a 10percent share in that market. "Marketers need to be able to translate sales targets into market share because this will demonstrate whether forecasts are to be attained by growing with the market or by capturing share from competitors. The latter will almost always be more difficult to achieve. Market share is closely monitored for signs of change in the competitive landscape, and it frequently drives strategic or tactical action."Farris, Paul W.; Neil T. Bendle; Phillip E. Pfeifer; David J. Reibstein (2010). ''Marketing Metrics: The Definitive Guide to Measuring Marketing Performance.'' Upper Saddle River, New Jersey: Pearson Education, Inc. . The Marketing Accountability Standards Board (MASB) endorses the definitio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Get Big Fast

In marketing strategy, first-mover advantage (FMA) is the competitive advantage gained by the initial ("first-moving") significant occupant of a market segment. First-mover advantage enables a company or firm to establish strong brand recognition, customer loyalty, and early purchase of resources before other competitors enter the market segment. First movers in a specific industry are almost always followed by competitors that attempt to capitalise on the first movers' success. These followers are also aiming to gain market share; however, most of the time the first-movers will already have an established market share, with a loyal customer base that allows them to maintain their market share. Mechanisms leading to first-mover advantages The three primary sources of a first-mover advantage are technology leadership, control of resources, and buyer switching costs. Technology leadership First movers can make their technology/product/services harder for later entrants to replicat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Plan

A business plan is a formal written document containing the goals of a business, the methods for attaining those goals, and the time-frame for the achievement of the goals. It also describes the nature of the business, background information on the organization, the organization's financial projections, and the strategies it intends to implement to achieve the stated targets. In its entirety, this document serves as a road-map (a plan) that provides direction to the business. Written business plans are often required to obtain a bank loan or other kind of financing. Templates and guides, such as the ones offered in the United States by the Small Business Administration can be used to facilitate producing a business plan. Audience Business plans may be internally or externally focused. Externally-focused plans draft goals that are important to outside stakeholders, particularly financial stakeholders. These plans typically have detailed information about the organization or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Venture Capital

Venture capital (VC) is a form of private equity financing provided by firms or funds to start-up company, startup, early-stage, and emerging companies, that have been deemed to have high growth potential or that have demonstrated high growth in terms of number of employees, annual revenue, scale of operations, etc. Venture capital firms or funds invest in these early-stage companies in exchange for Equity (finance), equity, or an ownership stake. Venture capitalists take on the risk of financing start-ups in the hopes that some of the companies they support will become successful. Because Startup company, startups face high uncertainty, VC investments have high rates of failure. Start-ups are usually based on an innovation, innovative technology or business model and often come from high technology industries such as information technology (IT) or biotechnology. Pre-seed and seed money, seed rounds are the initial stages of funding for a startup company, typically occurring earl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

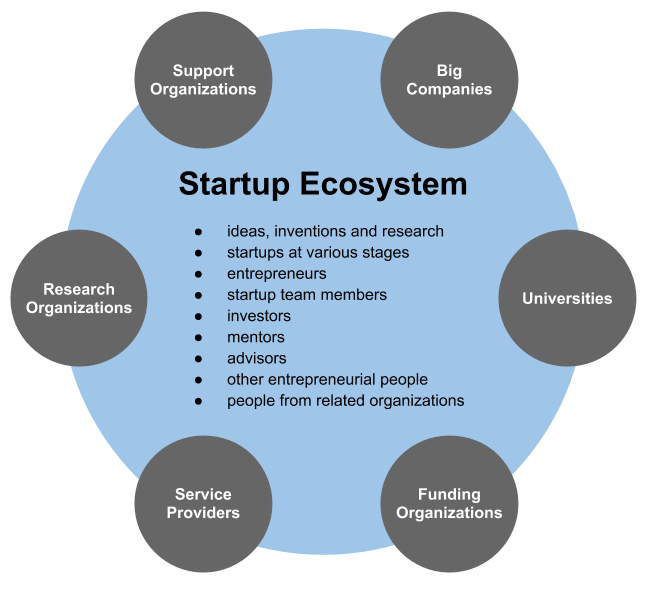

Startup Company

A startup or start-up is a company or project undertaken by an Entrepreneurship, entrepreneur to seek, develop, and validate a scalable business model. While entrepreneurship includes all new businesses including self-employment and businesses that do not intend to Initial public offering, go public, startups are new businesses that intend to grow large beyond the solo-founder. During the beginning, startups face high uncertainty and have high rates of failure, but a minority of them do go on to become successful and influential, such as unicorn (finance), unicorns.Erin Griffith (2014)Why startups fail, according to their founders, Fortune.com, 25 September 2014; accessed 27 October 2017 Actions Startups typically begin by a founder (solo-founder) or co-founders who have a way to solve a problem. The founder of a startup will do the market validation by problem interview, solution interview, and building a minimum viable product (MVP), i.e. a prototype, to develop and validate thei ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Weekend America

''Weekend America'' was a weekly public radio program dealing with news, popular culture, the arts and more. The program was produced for American Public Media and hosted by John Moe in Saint Paul, Minnesota Saint Paul (often abbreviated St. Paul) is the List of capitals in the United States, capital city of the U.S. state of Minnesota and the county seat of Ramsey County, Minnesota, Ramsey County. As of the 2020 United States census, 2020 census, .... ''Weekend America'' launched Saturday, May 1, 2004, as a pilot aired by the show's developmental stations, then known as ''Public Radio Weekend''. The show went national under the ''Weekend America'' branding Saturday, October 9, 2004. Public radio veterans Bill Radke and Barbara Bogaev, based in Los Angeles, served as hosts during the pilot stage and early national phase. Bogaev left the program on December 9, 2006. Detroit native Desiree Cooper was selected to replace Bogaev, beginning in August 2007. Cooper's arrival si ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |