|

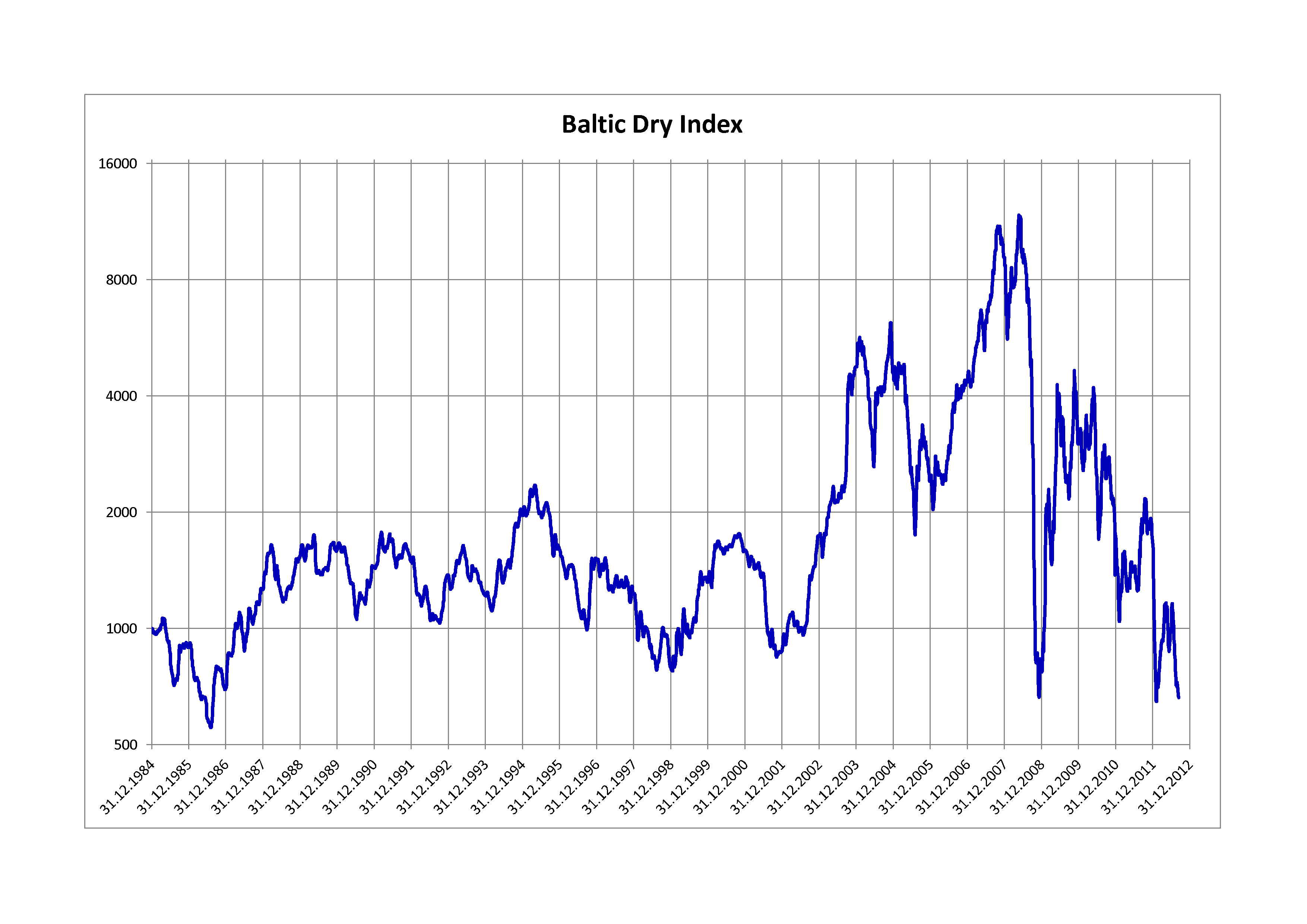

Baltic Dry Index

The Baltic Dry Index (BDI) is a shipping freight-cost index issued daily by the London-based Baltic Exchange. The BDI is a composite of the Capesize, Panamax and Supramax Timecharter Averages. It is reported around the world as a proxy for dry bulk shipping stocks as well as a general shipping market bellwether. The BDI is the successor to the Baltic Freight Index (BFI) and came into operation on 1 November 1999. The BDI continues the established time series of the BFI, however, the voyages and vessels covered by the index have changed over time so caution should be exercised in assuming long term constancy of the data. Historical origin In 1744, the ''Virginia and Maryland'' coffee house in Threadneedle Street, London, changed its name to ''Virginia and Baltick,'' to more accurately describe the business interests of the merchants who gathered there. Today's Baltic Exchange has its roots in a committee of merchants formed in 1823 to regulate trading and formalize the excha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Concrete

Concrete is a composite material composed of fine and coarse aggregate bonded together with a fluid cement (cement paste) that hardens (cures) over time. Concrete is the second-most-used substance in the world after water, and is the most widely used building material. Its usage worldwide, ton for ton, is twice that of steel, wood, plastics, and aluminum combined. Globally, the ready-mix concrete industry, the largest segment of the concrete market, is projected to exceed $600 billion in revenue by 2025. This widespread use results in a number of environmental impacts. Most notably, the production process for cement produces large volumes of greenhouse gas emissions, leading to net 8% of global emissions. Other environmental concerns include widespread illegal sand mining, impacts on the surrounding environment such as increased surface runoff or urban heat island effect, and potential public health implications from toxic ingredients. Significant research and developmen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Slate

Slate is a fine-grained, foliated, homogeneous metamorphic rock derived from an original shale-type sedimentary rock composed of clay or volcanic ash through low-grade regional metamorphism. It is the finest grained foliated metamorphic rock. Foliation may not correspond to the original sedimentary layering, but instead is in planes perpendicular to the direction of metamorphic compression. The foliation in slate is called " slaty cleavage". It is caused by strong compression causing fine grained clay flakes to regrow in planes perpendicular to the compression. When expertly "cut" by striking parallel to the foliation, with a specialized tool in the quarry, many slates will display a property called fissility, forming smooth flat sheets of stone which have long been used for roofing, floor tiles, and other purposes. Slate is frequently grey in color, especially when seen, en masse, covering roofs. However, slate occurs in a variety of colors even from a single locality; f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2000s Commodities Boom

The 2000s commodities boom or the commodities super cycle was the rise of many physical commodity prices (such as those of food, oil, metals, chemicals and fuels) during the early 21st century (2000–2014), following the Great Commodities Depression of the 1980s and 1990s. The boom was largely due to the rising demand from emerging markets such as the BRIC countries, particularly China during the period from 1992 to 2013, as well as the result of concerns over long-term supply availability. There was a sharp down-turn in prices during 2008 and early 2009 as a result of the Financial crisis of 2007–2010, credit crunch and 2010 European sovereign debt crisis, sovereign debt crisis, but prices began to rise as demand recovered from late 2009 to mid-2010. Oil began to slip downwards after mid-2010, but peaked at $101.80 on 30 and 31 January 2011, as the Egyptian revolution of 2011 broke out, leading to concerns over both the safe use of the Suez Canal and overall security in Arabia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Freightos Baltic Index

The Freightos Baltic Index (FBX) (also sometimes known as the Freightos Baltic Daily Index or Freightos Baltic Global Container Index) is a daily freight container index issued by the Baltic Exchange and Freightos. The index measures global container freight rates by calculating spot rates for 40-foot containers on 12 global tradelanes. It is reported around the world as a proxy for shipping stocks, and is a general shipping market bellwether. The FBX is currently one of the most widely used freight rate indices. History The Freightos International Freight Index was first launched as a weekly freight index in early 2017. The Freightos Baltic Index has been in wide use since 2018. It is currently the only freight rate index that is issued daily, and is also the only IOSCO-compliant freight index that is currently regulated by the EU (in particular, the European Securities and Markets Authority). The index is calculated from real-time anonymized data. As of February 2020, 50 to 70 m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2010–2011 Queensland Floods

A series of floods hit Queensland, Australia, beginning in November 2010. The floods forced the evacuation of thousands of people from towns and cities. At least 90 towns and over 200,000 people were affected. Damage initially was estimated at around A$1 billion before it was raised to $2.38 billion. The estimated reduction in Australia's GDP is about A$30 billion. As of March 2012, there were 33 deaths attributed to the floods, with a further three people still missing. Three-quarters of the council areas within the state of Queensland were declared disaster zones. Communities along the Fitzroy and Burnett Rivers were particularly hard hit, while the Condamine, Ballone, and Mary Rivers recorded substantial flooding. An unexpected flash flood caused by a thunderstorm raced through Toowoomba's central business district. Rainfall from the same storm devastated communities in the Lockyer Valley. A few days later, thousands of houses in Ipswich and Brisbane were inundated as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Letter Of Credit

A letter of credit (LC), also known as a documentary credit or bankers commercial credit, or letter of undertaking (LoU), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Letters of credit are used extensively in the financing of international trade, when the reliability of contracting parties cannot be readily and easily determined. Its economic effect is to introduce a bank as an underwriter that assumes the counterparty risk of the buyer paying the seller for goods. History The letter of credit has been used in Europe since ancient times. Letters of credit were traditionally governed by internationally recognized rules and procedures rather than by national law. The International Chamber of Commerce oversaw the preparation of the first Uniform Customs and Practice for Documentary Credits (UCP) in 1933, creating a voluntary framework for commercial banks to apply to transactions wo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

TheStreet

''TheStreet'' is a financial news and financial literacy website. It is a subsidiary of The Arena Group. The company provides both free content and subscription services such as Action Alerts Plus a stock recommendation portfolio co-managed by Bob Lang and Chris Versace. Former notable contributors include Jim Cramer, Bob Powell, Aaron Task, Herb Greenberg, and Brett Arends. History Early years: going public TheStreet, Inc., (formerly, TheStreet.com, Inc.) was co-founded in 1996 by Jim Cramer and Marty Peretz. It became a public company via an initial public offering in May 1999 under the direction of former CEO Kevin English and former CFO Paul Kothari. Dave Kansas became editor-in-chief in April 1997. Kansas also opened a San Francisco bureau and was a member of the board of directors. In 1999, at the peak of the dot-com bubble, the market capitalization of the company was $1.7 billion. In July 2001, David J. Morrow, a former reporter for ''The New York Times'', ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

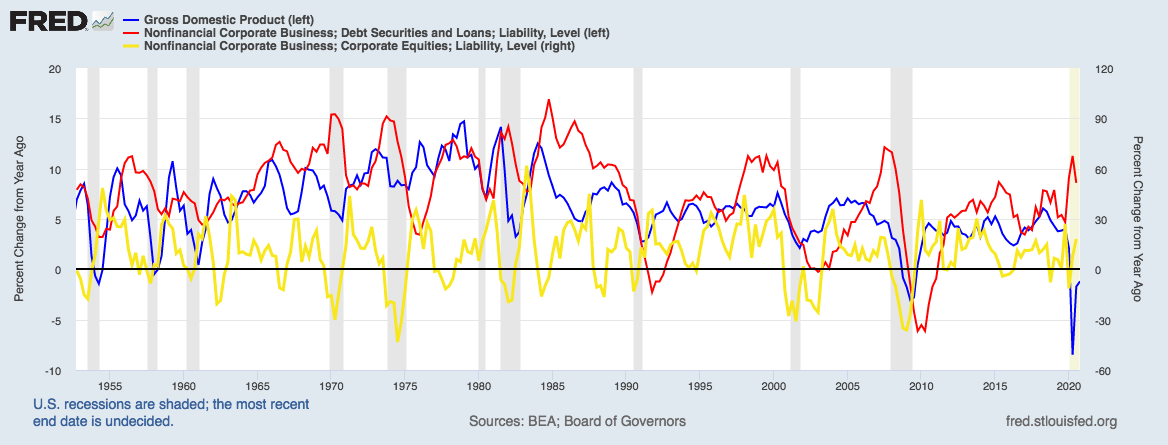

Gross National Product

The gross national income (GNI), previously known as gross national product (GNP), is the total domestic and foreign output claimed by residents of a country, consisting of gross domestic product ( GDP), plus factor incomes earned by foreign residents, minus income earned in the domestic economy by nonresidents. Comparing GNI to GDP shows the degree to which a nation's GDP represents domestic or international activity. GNI has gradually replaced GNP in international statistics. While being conceptually identical, it is calculated differently. GNI is the basis of calculation of the largest part of contributions to the budget of the European Union. In February 2017, Ireland's GDP became so distorted from the base erosion and profit shifting ("BEPS") tax planning tools of U.S. multinationals, that the Central Bank of Ireland replaced Irish GDP with a new metric, Irish Modified GNI (or "GNI*"). In 2017, Irish GDP was 162% of Irish Modified GNI. Comparison of GNI and GDP ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer Confidence

Consumer confidence is an economic indicator that measures the degree of optimism that consumers feel about the overall state of the economy and their personal financial situation. If the consumer has confidence in the immediate and near future economy and his/her personal finance, then the consumer will spend more than save. When consumer confidence is high, consumers make more purchases. When confidence is low, consumers tend to save more and spend less. A month-to-month trend in consumer confidence reflects the outlook of consumers with respect to their ability to find and retain good jobs according to their perception of the current state of the economy and their personal financial situation. Consumer confidence typically increases when the economy expands, and decreases when the economy contracts. In the United States, there is evidence that the measure is a lagging indicator of stock market performance. Usage Investors, manufacturers, retailers, banks, public opinion resea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leading Economic Indicator

An economic indicator is a statistic about an economic activity. Economic indicators allow analysis of economic performance and predictions of future performance. One application of economic indicators is the study of business cycles. Economic indicators include various indices, earnings reports, and economic summaries: for example, the unemployment rate, quits rate (quit rate in American English), housing starts, consumer price index (a measure for inflation), Inverted yield curve, consumer leverage ratio, industrial production, bankruptcies, gross domestic product, broadband internet penetration, retail sales, price index, and money supply changes. The leading business cycle dating committee in the United States of America is the private National Bureau of Economic Research. The Bureau of Labor Statistics is the principal fact-finding agency for the U.S. government in the field of labor economics and statistics. Other producers of economic indicators includes the United Sta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Indicator

An economic indicator is a statistic about an economic activity. Economic indicators allow analysis of economic performance and predictions of future performance. One application of economic indicators is the study of business cycles. Economic indicators include various indices, earnings reports, and economic summaries: for example, the unemployment rate, quits rate (quit rate in American English), housing starts, consumer price index (a measure for inflation), Inverted yield curve, consumer leverage ratio, industrial production, bankruptcies, gross domestic product, broadband internet penetration, retail sales, price index, and money supply changes. The leading business cycle dating committee in the United States of America is the private National Bureau of Economic Research. The Bureau of Labor Statistics is the principal fact-finding agency for the U.S. government in the field of labor economics and statistics. Other producers of economic indicators includes the United ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |