2000s Commodities Boom on:

[Wikipedia]

[Google]

[Amazon]

The 2000s commodities boom, commodities super cycle or China boom was the rise of many physical

The 2000s commodities boom, commodities super cycle or China boom was the rise of many physical

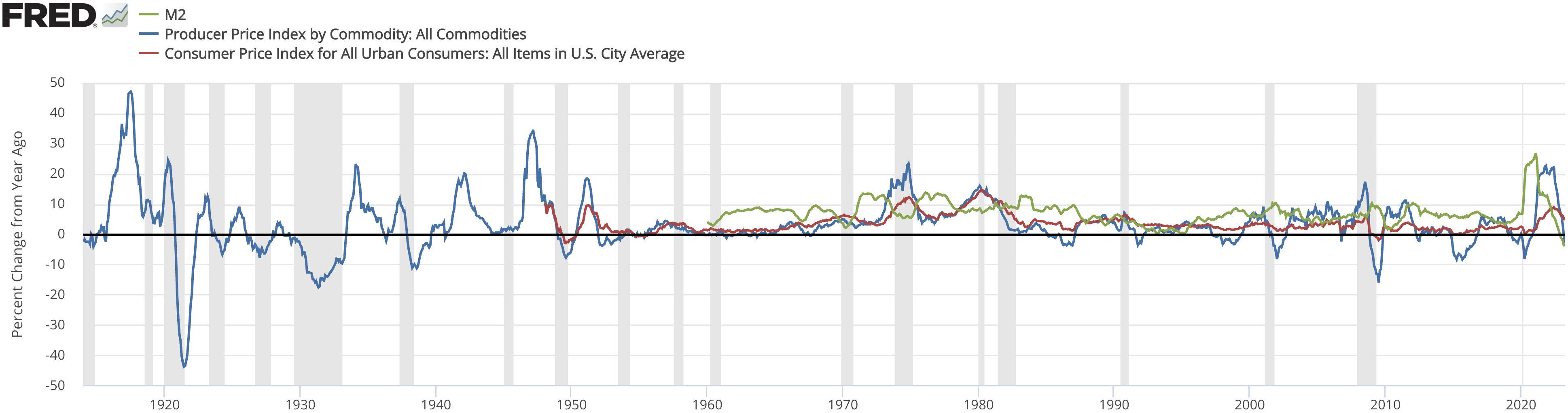

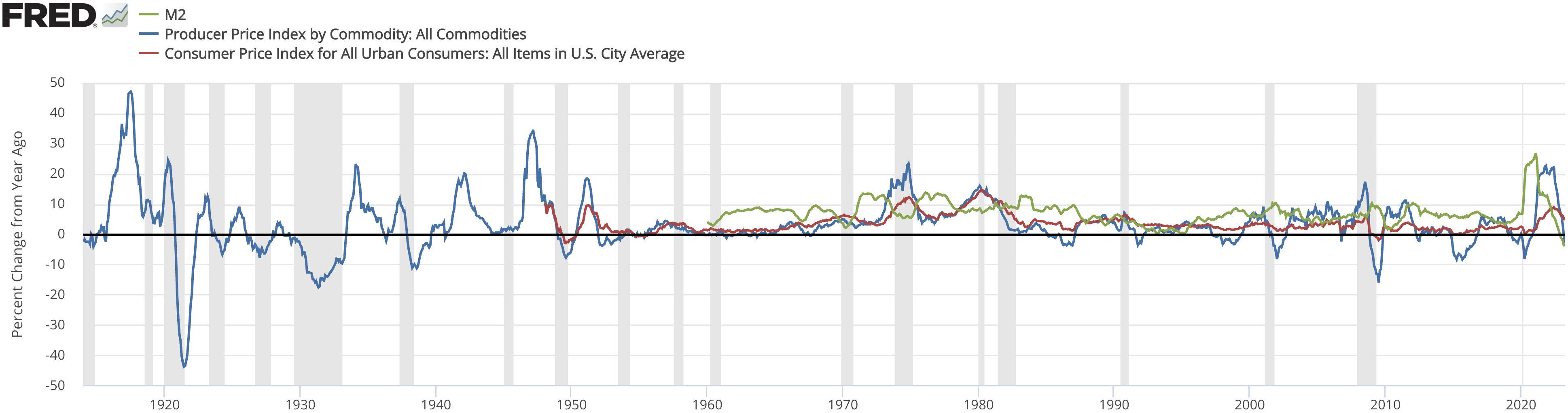

The prices of raw materials were depressed and declining from, roughly, 1982 until 1998. From the mid-1980s to September 2003, the inflation-adjusted price of a

The prices of raw materials were depressed and declining from, roughly, 1982 until 1998. From the mid-1980s to September 2003, the inflation-adjusted price of a

A commodity price bubble, known as the 2000s commodities boom, was created following the collapse of the mid-2000s housing bubble. Commodities were seen as a safe bet after the bubble economy surrounding

A commodity price bubble, known as the 2000s commodities boom, was created following the collapse of the mid-2000s housing bubble. Commodities were seen as a safe bet after the bubble economy surrounding

Both a rising global population and a sharp decline in food crop production in favour of a sharp rise in

Both a rising global population and a sharp decline in food crop production in favour of a sharp rise in

There was in increase in the demand for

There was in increase in the demand for

Prices rose modestly and briefly because of

Prices rose modestly and briefly because of

Recycle.cc (10 March 2011). Retrieved 28 March 2011.

. Wild About Britain. Retrieved 28 March 2011. The German price of €100/£49 per tonne was typical for the year 2003 and it steadily rose over the years. By September 2008 saw American price of $235 per ton had fallen to just $120 per ton, The slump was probably due to the economic down turn in East Asia causing the market for waste paper drying up in China. 2010 prices averaged $120.32 at the start of the year, but saw a rapid rise in global prices in May 2010, reaching $217.11 per ton in the US in June 2010 as China's paper market began to reopen.

Coal prices rose to A$73 per tonne in September

Coal prices rose to A$73 per tonne in September

www.commodityonline.com (20 October 2009). Retrieved 28 March 2011. and then up to A$84 per tonne in the October 2009 due to renewed interest by China's and

During 2003, the price rose above $30, reached $60 by 11 August 2005, and peaked at $147.30 in July 2008. Commentators attributed the heavy price increases to many factors, including reports from the

During 2003, the price rose above $30, reached $60 by 11 August 2005, and peaked at $147.30 in July 2008. Commentators attributed the heavy price increases to many factors, including reports from the

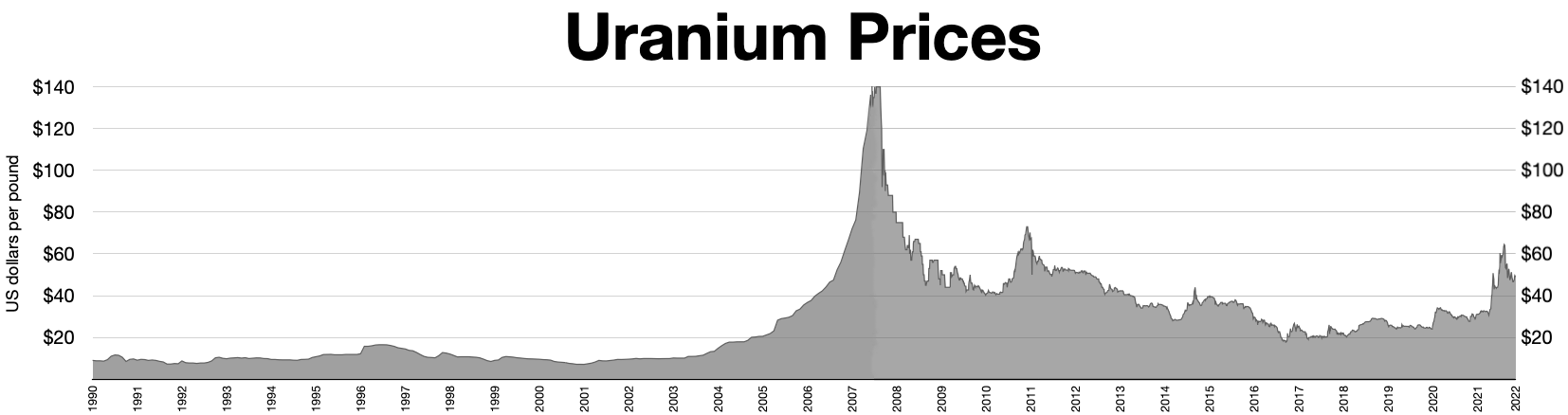

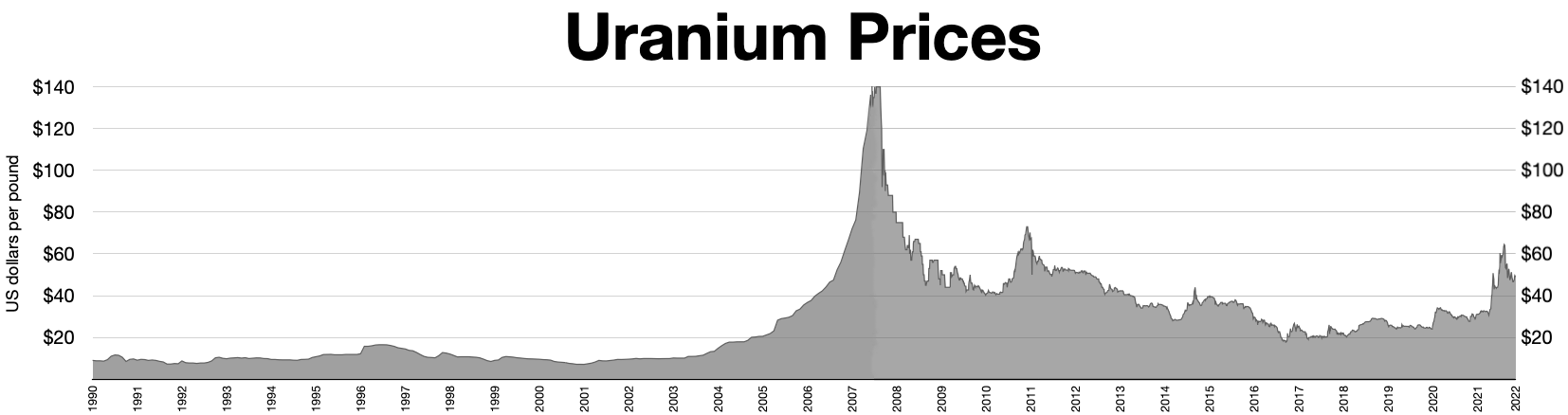

News.goldseek.com. Retrieved 28 March 2011. and began to accelerate badly with the 2006 flooding of the Cigar Lake Mine in Saskatchewan.Uranium Has Bottomed: Two Uranium Bulls to Jump on Now

UraniumSeek.com (22 August 2008). Retrieved 28 March 2011.

. Uranium.info. Retrieved 28 March 2011.

There was a sharp shift in the prices of gold and, to a lesser extent, both silver and

There was a sharp shift in the prices of gold and, to a lesser extent, both silver and

Silver cost $4 per troy ounce in 1992, started to rise rapidly in early 2004, reached $18 per troy oz by late 2007, slipped badly to $10 per troy oz during the Credit Crunch of 2008, but was selling in late 2009 and again in early 2010 at just under $18 per troy oz of metal. A year later, the Feb 2011 average was over $30 per oz of silver. On 29 April 2011, silver price reached $47.94 but fell by 12% on 2 May 2011.

Prices range around $20–$25 in 2013-2014.

Silver cost $4 per troy ounce in 1992, started to rise rapidly in early 2004, reached $18 per troy oz by late 2007, slipped badly to $10 per troy oz during the Credit Crunch of 2008, but was selling in late 2009 and again in early 2010 at just under $18 per troy oz of metal. A year later, the Feb 2011 average was over $30 per oz of silver. On 29 April 2011, silver price reached $47.94 but fell by 12% on 2 May 2011.

Prices range around $20–$25 in 2013-2014.

Platinum first sold at about $350 per troy oz in 1992 and stayed rather flat save for a small dip to about $325 per troy oz in the mid-1990s and an equally small rise to about $375 per troy ounce in the Millennium period. It started to gain value in mid-2002 and grew on an Experience curve effects, experiential curve model as the prices then began to move sharply upwards. The high point was when it was trading for $2,200 per troy oz in early 2007. Prices declined to $800 per troy oz in January 2008, but the price had increased $1,600 per troy oz by early 2010.

Platinum first sold at about $350 per troy oz in 1992 and stayed rather flat save for a small dip to about $325 per troy oz in the mid-1990s and an equally small rise to about $375 per troy ounce in the Millennium period. It started to gain value in mid-2002 and grew on an Experience curve effects, experiential curve model as the prices then began to move sharply upwards. The high point was when it was trading for $2,200 per troy oz in early 2007. Prices declined to $800 per troy oz in January 2008, but the price had increased $1,600 per troy oz by early 2010.

Rhodium prices rose briefly during the millennium period due to increased demand, then collapsed to nearly their original 1995-7 starting price of $500/oz between 2002 and 2004.

Later on, the mysterious and unexpected Rhodium price bubble of 2008 suddenly increased prices from just over $500/oz in late 2006 to $9,000/oz-$9,500/oz in July 2008, only for the price then to tumble down only $1,000/oz in January 2009. Both an increase in demand in the Automotive industry in the United States, American automotive industry, a herd instinct among investors, a then bullish market in rare metals and a rogue speculator or rogue speculators on Wall Street were all at least partly to blame for the sudden rise and fall in the Metal prices, rare metal's price.

Rhodium is mainly mined as a by-product of other metals such as platinum, so the production is based on production of other metals and therefore on demand of them, and less on the demand of rhodium.

Rhodium rose in price extremely sharply in January 2021 and by mid February 2021 it had reached an all time high of $21,400 per Troy ounce making it the most valuable metal ever sold.

Rhodium prices rose briefly during the millennium period due to increased demand, then collapsed to nearly their original 1995-7 starting price of $500/oz between 2002 and 2004.

Later on, the mysterious and unexpected Rhodium price bubble of 2008 suddenly increased prices from just over $500/oz in late 2006 to $9,000/oz-$9,500/oz in July 2008, only for the price then to tumble down only $1,000/oz in January 2009. Both an increase in demand in the Automotive industry in the United States, American automotive industry, a herd instinct among investors, a then bullish market in rare metals and a rogue speculator or rogue speculators on Wall Street were all at least partly to blame for the sudden rise and fall in the Metal prices, rare metal's price.

Rhodium is mainly mined as a by-product of other metals such as platinum, so the production is based on production of other metals and therefore on demand of them, and less on the demand of rhodium.

Rhodium rose in price extremely sharply in January 2021 and by mid February 2021 it had reached an all time high of $21,400 per Troy ounce making it the most valuable metal ever sold.

Most palladium is used for catalytic converters in the automobile industry. It is also used for some medical, high grade steel, industrial, dental and electronic purposes.

Palladium prices rose sharply during the millennium period due to increased demand, then collapsed to nearly their original starting price by the end 2002, only to start to rise less dramatically in the year 2006. Palladium prices in 1992 and 2002–04 was about $200/oz. It rapidly shot up to approximately $1,000/oz between 1999 and 2001 and collapsed to only $200/oz by late 2002, but is now just under $500/oz per of Palladium in 2010.

In the run up to 2000, Russian supply of palladium to the global market was repeatedly delayed and disrupted because the export quota was not granted on time, for political reasons. The ensuing market panic drove the palladium price to an all-time high of $1,100 per troy ounce in January 2001. Around this time, the Ford Motor Company, fearing auto vehicle production disruption due to a possible palladium shortage, stockpiled large amounts of the metal purchased near the price high. When prices fell in early 2001, Ford lost nearly US$1 billion. World demand for palladium increased from 100 tons in 1990 to nearly 300 tons in 2000. The global production of palladium from mines was 222 tonnes in 2006 according to the USGS.

Most palladium is used for catalytic converters in the automobile industry. It is also used for some medical, high grade steel, industrial, dental and electronic purposes.

Palladium prices rose sharply during the millennium period due to increased demand, then collapsed to nearly their original starting price by the end 2002, only to start to rise less dramatically in the year 2006. Palladium prices in 1992 and 2002–04 was about $200/oz. It rapidly shot up to approximately $1,000/oz between 1999 and 2001 and collapsed to only $200/oz by late 2002, but is now just under $500/oz per of Palladium in 2010.

In the run up to 2000, Russian supply of palladium to the global market was repeatedly delayed and disrupted because the export quota was not granted on time, for political reasons. The ensuing market panic drove the palladium price to an all-time high of $1,100 per troy ounce in January 2001. Around this time, the Ford Motor Company, fearing auto vehicle production disruption due to a possible palladium shortage, stockpiled large amounts of the metal purchased near the price high. When prices fell in early 2001, Ford lost nearly US$1 billion. World demand for palladium increased from 100 tons in 1990 to nearly 300 tons in 2000. The global production of palladium from mines was 222 tonnes in 2006 according to the USGS.

Aluminium is a widely used, mined, refined and trusted metal. The fortunes of this metal are linked to the rise and fall of the aircraft, electrical and automotive industries.

The price of aluminium was 80 US cents per lb in 1995 and 45 cents per lb in 1998 and hovered around this until the January 2003, when it started to rise to $1.50 per pound and in 2006 and $1.40 per lb in the December 2007.Dynamic Charting Tool , InvestmentMine

Aluminium is a widely used, mined, refined and trusted metal. The fortunes of this metal are linked to the rise and fall of the aircraft, electrical and automotive industries.

The price of aluminium was 80 US cents per lb in 1995 and 45 cents per lb in 1998 and hovered around this until the January 2003, when it started to rise to $1.50 per pound and in 2006 and $1.40 per lb in the December 2007.Dynamic Charting Tool , InvestmentMine

Infomine.com. Retrieved 28 March 2011.Dynamic Charting Tool , InvestmentMine

Infomine.com. Retrieved 28 March 2011. It collapsed down to a mere 60 cents per lb in the November 2008, but is now hovering at about $1.00 per lb, with a new April peak of $1.10 per pound of aluminium.

The price of nickel boomed in the late 1990s, then imploded from around $51,000 /£36,700 per tonne in May 2007 to about $11,550/£8,300 per tonne in January 2009. Prices were only just starting to recover as of January 2010, but most of Australia's nickel mines had gone bankrupt by then. As the price for high grade nickel sulphate ore recovered in 2010, so did the Australian mining industry.

The price of nickel boomed in the late 1990s, then imploded from around $51,000 /£36,700 per tonne in May 2007 to about $11,550/£8,300 per tonne in January 2009. Prices were only just starting to recover as of January 2010, but most of Australia's nickel mines had gone bankrupt by then. As the price for high grade nickel sulphate ore recovered in 2010, so did the Australian mining industry.

In the years prior to the rise of copper prices in late 2003 as part of the boom various copper mining companies exibited cartel-like behaviour. This consisted of announcements made in late 2001 for production cuts for 2002 which were carried out, and a repetition of similar announcements for 2003 in late 2002.

It was also noticed that a copper price bubble was occurring at the same time as the oil bubble. Copper traded at about $2,500 per tonne from 1990 until 1999, when it fell to about $1,600. The price slump lasted until 2004 which saw a price surge that had copper reaching $9,000 per tonne in the May 2006, but it eventually fell down to $7,040 per tonne in early 2008. When the slump came, it hit some copper mining countries like the Democratic Republic of the Congo (D.R.C.) very hard. Mining authorities announced on 10 December 2009, that the Dikulushi mine, which is situated in the D.R.C.'s Katanga Province, would close due to poor copper prices. It reopened in July 2010. The price rose again to over $10,000 in early 2011 but soon fell to below $8,000, around where it was fairly stable during 2012. The high prices have caused a heavy increase in theft of copper cables, causing interruptions in electrical supply. During 2013-2014 there has been a slow decline to below $7,000.

Chilean state-owned copper giant Codelco made large gains during the boom. Artisan miners known as pirquineros also made considerable profits albeit some found it difficult to Retraining, reskill to gold mining in Chile, gold mining after copper prices fell in 2008.

In the years prior to the rise of copper prices in late 2003 as part of the boom various copper mining companies exibited cartel-like behaviour. This consisted of announcements made in late 2001 for production cuts for 2002 which were carried out, and a repetition of similar announcements for 2003 in late 2002.

It was also noticed that a copper price bubble was occurring at the same time as the oil bubble. Copper traded at about $2,500 per tonne from 1990 until 1999, when it fell to about $1,600. The price slump lasted until 2004 which saw a price surge that had copper reaching $9,000 per tonne in the May 2006, but it eventually fell down to $7,040 per tonne in early 2008. When the slump came, it hit some copper mining countries like the Democratic Republic of the Congo (D.R.C.) very hard. Mining authorities announced on 10 December 2009, that the Dikulushi mine, which is situated in the D.R.C.'s Katanga Province, would close due to poor copper prices. It reopened in July 2010. The price rose again to over $10,000 in early 2011 but soon fell to below $8,000, around where it was fairly stable during 2012. The high prices have caused a heavy increase in theft of copper cables, causing interruptions in electrical supply. During 2013-2014 there has been a slow decline to below $7,000.

Chilean state-owned copper giant Codelco made large gains during the boom. Artisan miners known as pirquineros also made considerable profits albeit some found it difficult to Retraining, reskill to gold mining in Chile, gold mining after copper prices fell in 2008.

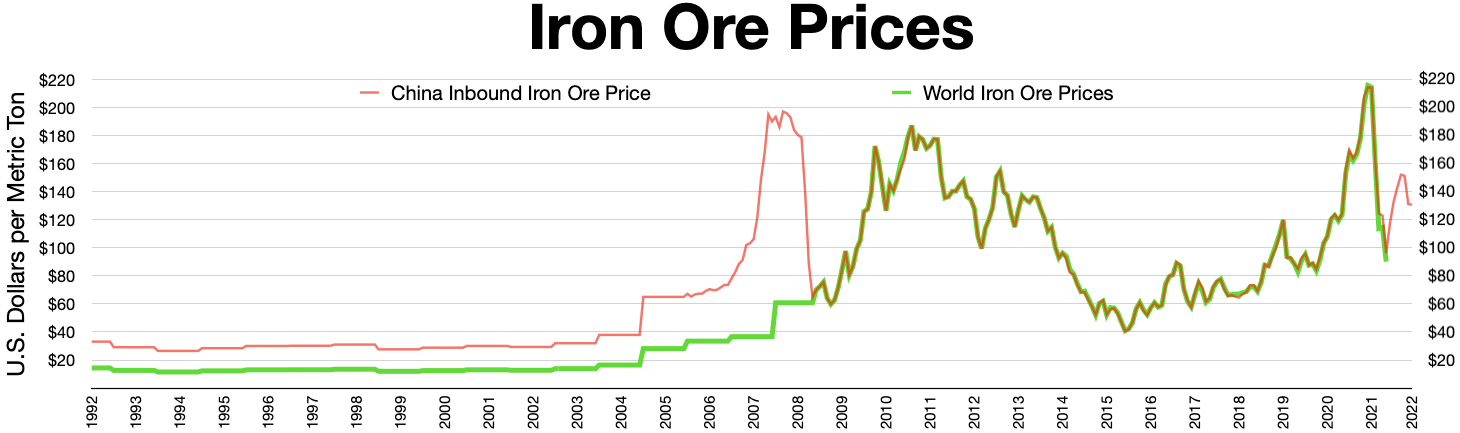

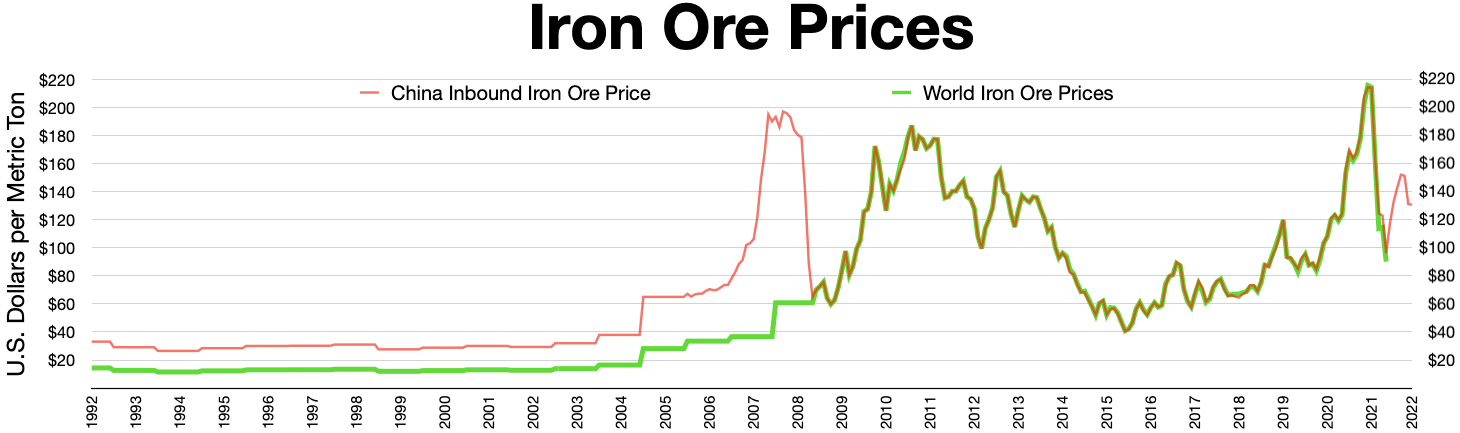

The prices of iron ore rose sharply from around $10 per tonne in 2003 to around $170 in April 2009 (transported to China). After that (written September 2013) the price was between $100 and $150; in September 2014 it started dropping precipitously, and was below $70 per ton in December 2014. The price of steel (at steel plants in Japan) has risen from around $300 per tonne in 2003 to $1,000 in late 2008, stabilizing at $800 in 2012.

The rise in prices made abandoned mines to reopen and new ones to open. It took some years to open mines, so some got a scaled up production around the time the prices dropped (drop partly caused by such production). Furthermore, started construction projects had to be finished so demand only reacted slowly to the rising prices.

The prices of iron ore rose sharply from around $10 per tonne in 2003 to around $170 in April 2009 (transported to China). After that (written September 2013) the price was between $100 and $150; in September 2014 it started dropping precipitously, and was below $70 per ton in December 2014. The price of steel (at steel plants in Japan) has risen from around $300 per tonne in 2003 to $1,000 in late 2008, stabilizing at $800 in 2012.

The rise in prices made abandoned mines to reopen and new ones to open. It took some years to open mines, so some got a scaled up production around the time the prices dropped (drop partly caused by such production). Furthermore, started construction projects had to be finished so demand only reacted slowly to the rising prices.

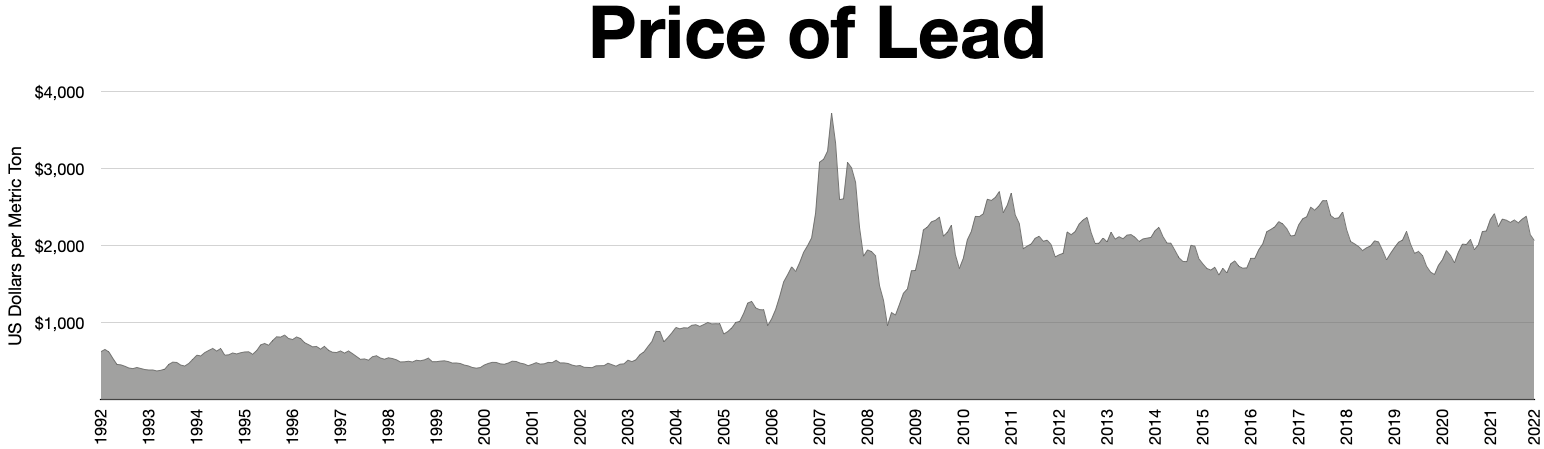

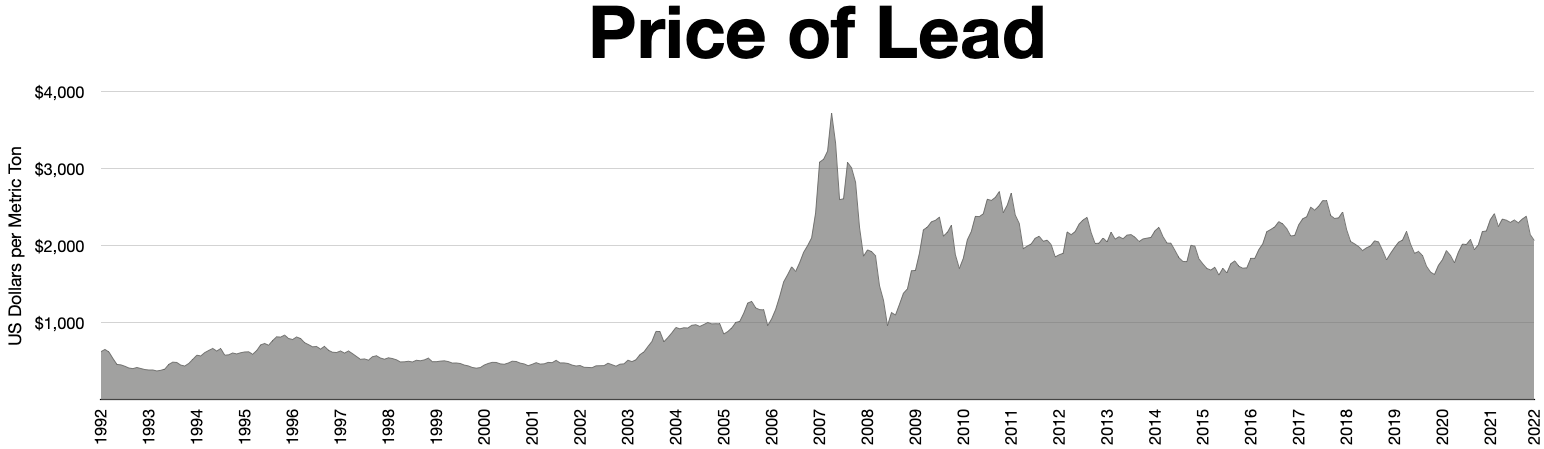

The price of lead rose sharply in early 2007, then collapsed to nearly their original starting price by the end of the next year. Lead prices began to rise in early 2007 due to increased worldwide demand. Prices were about $1,200 per tonne of lead in the July, then rose to $2,220 per tonne by September and collapsed back down to $1,200 per tonne in the October of that year. Despite the bullish market condition, the price had collapsed by the July 2009 and was only worth about $1,400 per tonne of lead. The lead and zinc markets became rather Bear market, bearish for several months afterwards. Prices were hovering at between $1,770 and $2,175 per tonneLead prices plunge as LME stocks rise relentlessly , 19 February 2010

The price of lead rose sharply in early 2007, then collapsed to nearly their original starting price by the end of the next year. Lead prices began to rise in early 2007 due to increased worldwide demand. Prices were about $1,200 per tonne of lead in the July, then rose to $2,220 per tonne by September and collapsed back down to $1,200 per tonne in the October of that year. Despite the bullish market condition, the price had collapsed by the July 2009 and was only worth about $1,400 per tonne of lead. The lead and zinc markets became rather Bear market, bearish for several months afterwards. Prices were hovering at between $1,770 and $2,175 per tonneLead prices plunge as LME stocks rise relentlessly , 19 February 2010

www.commodityonline.com (19 February 2010). Retrieved 28 March 2011. as the markets became more bullish and increased prices after China's car scrapping scheme had caused a general upturn in lead, zinc, cadmium and aluminium production. By the June 2010, prices stood at only $870 per tonne, and were back to about $2,200 in the July 2010.

The price of zinc rose sharply in early 2007 after a five-year secular bear market, then collapsed to nearly their original starting price by the end of the next year.Current Primary and Scrap Metal Prices – LME (London Metal Exchange)

The price of zinc rose sharply in early 2007 after a five-year secular bear market, then collapsed to nearly their original starting price by the end of the next year.Current Primary and Scrap Metal Prices – LME (London Metal Exchange)

. Metalprices.com. Retrieved 28 March 2011. Zinc also exhibited similar bullish trading patterns as most metals did since 2004, but with a different overall price.

. Proactiveinvestors (18 June 2010). Retrieved 28 March 2011. Zinc sale prices were 80 cents per pound in July 2008, which was typical of its 2004–2008 pricing levels. By January 2009 it had bottomed out and was worth 45 cents per lb. A spectacular bull market and increased Chinese interest in galvanised construction steel caused prices to top off at $1.20 per pound of metal by January 2010. It then quickly fell back to a routine 80 cents by July 2010. Zinc is popular in manufacturing and building; its ability to create corrosion-resistant galvanization, zinc plating of steel (hot-dip galvanizing) is the major application for zinc. Other applications are in batteries and alloys, such as brass. A variety of zinc compounds are commonly used, such as zinc carbonate and zinc gluconate (as dietary supplements), zinc chloride (in deodorants), zinc pyrithione (anti-dandruff shampoos), zinc sulfide (in luminescent paints), and zinc methyl or zinc diethyl in the organic laboratory.

The Baltic Dry Index is a measure of the cost of shipping dry bulk goods around the world. It increased during the mid 2000s because of global demand for manufactured goods initially and in 2008 the price of oil drove the index higher to an all time high of 11,440 points in May 2008. Because of the Great Recession the index dropped to 715 points in late 2008.

The Baltic Dry Index is a measure of the cost of shipping dry bulk goods around the world. It increased during the mid 2000s because of global demand for manufactured goods initially and in 2008 the price of oil drove the index higher to an all time high of 11,440 points in May 2008. Because of the Great Recession the index dropped to 715 points in late 2008.

AllBusiness.com (1 May 2005). Retrieved 28 March 2011. the increased use of chlorine-based chemicals for the aquatics industry. The price of chlorine caustic was $350 per ton, dry short ton, up from $100 last March. Chlorine was priced at $330 per dry short ton, up $130 on 2008's price of $200. The gas's price steadily increased throughout 2007 and early 2008 as demand for PVC, P.V.C. and some metals like copper, Neodymium and Tantalum rose due to the increased growth of the BRIC countries demand for electrical goods. United States, America's chlorine prices rose suddenly from about $125–$150 per ton fob between June and August 2009 months on a sharp rise in chlor-alkali production and capacity cuts after a year in which production quotes largely stay flat.Chlorine Prices Surge Amid Chlor-alkali Production Cuts :: Chemical Week

Chemweek.com (7 August 2009). Retrieved 28 March 2011. The spot price surged more than 300% to about $475–$525 ton fob in August 2009. Both

. Icis.com. Retrieved 28 March 2011. As the European chlorine production spiked in November to a daily output of 26,971 tonnes, before falling to 23,667 short ton in December due to the Christmas and New Year holidays. Production was about European production was 25.8% higher than December 2008 levels.

The price of cotton was rising in 2010 and peaked in early 2011. India the worlds second largest exporter restricted shipments to help its domestic textiles industry

The price of cotton was rising in 2010 and peaked in early 2011. India the worlds second largest exporter restricted shipments to help its domestic textiles industry

The Impact of Index and Swap Funds on Commodity Futures Markets

OECD Working Paper. In February 2008, analyst Gary Dorsch wrote: Economist James D. Hamilton has argued that the increase in oil prices in the period of 2007 to 2008 was a significant cause of the recession. He evaluated several different approaches to estimating the impact of oil price shocks on the economy, including some methods that had previously shown a decline in the relationship between oil price shocks and the overall economy. All of these methods "support a common conclusion; had there been no increase in oil prices between 2007:Q3 and 2008:Q2, the US economy would not have been in a recession over the period 2007:Q4 through 2008:Q3". Hamilton's own model, a time-series econometric forecast based on data up to 2003, showed that the decline in GDP could have been successfully predicted to almost its full extent given knowledge of the price of oil. The results imply that oil prices were entirely responsible for the recession; however, Hamilton himself acknowledged that this was probably not the case but maintained that it showed that oil price increases made a significant contribution to the downturn in economic growth.

Lehman Brothers warns of resources collapse

(20 May 2008)

Askar Akayev's research group predicts the burst of the "Gold Bubble" in April – June 2011

Latin American Growth in the 21st Century: The 'Commodities Boom' That Wasn't

, from the Center for Economic and Policy Research, May 2014 * {{DEFAULTSORT:2000s Commodities Boom Commodity booms Open economy macroeconomics 1980s in economic history 2000s in economic history 20th century in economic history 21st century in economic history

The 2000s commodities boom, commodities super cycle or China boom was the rise of many physical

The 2000s commodities boom, commodities super cycle or China boom was the rise of many physical commodity

In economics, a commodity is an economic goods, good, usually a resource, that specifically has full or substantial fungibility: that is, the Market (economics), market treats instances of the good as equivalent or nearly so with no regard to w ...

prices (such as those of food, oil, metals, chemicals

A chemical substance is a unique form of matter with constant chemical composition and characteristic properties. Chemical substances may take the form of a single element or chemical compounds. If two or more chemical substances can be combin ...

and fuel

A fuel is any material that can be made to react with other substances so that it releases energy as thermal energy or to be used for work (physics), work. The concept was originally applied solely to those materials capable of releasing chem ...

s) during the early 21st century (2000–2014), following the Great Commodities Depression of the 1980s and 1990s. The boom was largely due to the rising demand from emerging markets

An emerging market (or an emerging country or an emerging economy) is a market that has some characteristics of a developed market, but does not fully meet its standards. This includes markets that may become developed markets in the future or we ...

such as the BRIC countries, particularly China during the period from 1992 to 2013, as well as the result of concerns over long-term supply availability. There was a sharp down-turn in prices during 2008 and early 2009 due to the 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

and European debt crisis

The euro area crisis, often also referred to as the eurozone crisis, European debt crisis, or European sovereign debt crisis, was a multi-year debt crisis and financial crisis in the European Union (EU) from 2009 until, in Greece, 2018. The e ...

, but prices began to rise as demand recovered from late 2009 to mid-2010.

Oil began to slip downwards after mid-2010, but peaked at $101.80 on 30 and 31 January 2011, as the Egyptian revolution of 2011

The 2011 Egyptian revolution, also known as the 25 January Revolution (;), began on 25 January 2011 and spread across Egypt. The date was set by various youth groups to coincide with the annual Egyptian "Police holiday" as a statement against ...

broke out, leading to concerns over both the safe use of the Suez Canal

The Suez Canal (; , ') is an artificial sea-level waterway in Egypt, Indo-Mediterranean, connecting the Mediterranean Sea to the Red Sea through the Isthmus of Suez and dividing Africa and Asia (and by extension, the Sinai Peninsula from the rest ...

and overall security in Arabia

The Arabian Peninsula (, , or , , ) or Arabia, is a peninsula in West Asia, situated north-east of Africa on the Arabian plate. At , comparable in size to India, the Arabian Peninsula is the largest peninsula in the world.

Geographically, the ...

itself. On 3 March, Libya's National Oil Corp said that output had halved due to the departure of foreign workers. As this happened, Brent Crude

Brent Crude may refer to any or all of the components of the Brent Complex, a physically and financially traded oil market based around the North Sea of Northwest Europe; colloquially, Brent Crude usually refers to the price of the ICE (Intercon ...

surged to a new high of above $116.00 a barrel as supply disruptions and potential for more unrest in the Middle East and North Africa continued to worry investors. Thus the price of oil

The price of oil, or the oil price, generally refers to the spot price of a barrel () of benchmark crude oil—a reference price for buyers and sellers of crude oil such as West Texas Intermediate (WTI), Brent Crude, Dubai Crude, OPEC ...

kept rising into the 2010s. The commodities supercycle peaked in 2011, "driven by a combination of strong demand from emerging nations and low supply growth". Prior to 2002, only 5 to 10 per cent of trading in the commodities market was attributable to investors. Since 2002 "30 per cent of trading is attributable to investors in the commodities market" which "has caused higher price volatility".

The 2000s commodities boom is comparable to the commodity supercycles which accompanied post–World War II economic expansion

The post–World War II economic expansion, also known as the postwar economic boom or the Golden Age of Capitalism, was a broad period of worldwide economic expansion beginning with the aftermath of World War II and ending with the 1973–1975 r ...

and the Second Industrial Revolution

The Second Industrial Revolution, also known as the Technological Revolution, was a phase of rapid Discovery (observation), scientific discovery, standardisation, mass production and industrialisation from the late 19th century into the early ...

in the second half of the 19th century and early 20th century.

Background of depressed prices

The prices of raw materials were depressed and declining from, roughly, 1982 until 1998. From the mid-1980s to September 2003, the inflation-adjusted price of a

The prices of raw materials were depressed and declining from, roughly, 1982 until 1998. From the mid-1980s to September 2003, the inflation-adjusted price of a barrel

A barrel or cask is a hollow cylindrical container with a bulging center, longer than it is wide. They are traditionally made of wooden stave (wood), staves and bound by wooden or metal hoops. The word vat is often used for large containers ...

of crude oil

Petroleum, also known as crude oil or simply oil, is a naturally occurring, yellowish-black liquid chemical mixture found in geological formations, consisting mainly of hydrocarbons. The term ''petroleum'' refers both to naturally occurring u ...

on NYMEX

The New York Mercantile Exchange (NYMEX) is a commodity futures exchange owned and operated by CME Group of Chicago. NYMEX is located at One North End Avenue in Brookfield Place in the Battery Park City section of Manhattan, New York City.

...

was generally under $25/barrel. Since 1968 the price of gold has ranged widely, from a high of $850/oz ($27,300/kg) on 21 January 1980, to a low of $252.90/oz ($8,131/kg) on 21 June 1999 (London Gold Fixing).

The analysis of this period is based on the work of Robert Solow

Robert Merton Solow, GCIH (; August 23, 1924 – December 21, 2023) was an American economist who received the 1987 Nobel Memorial Prize in Economic Sciences, and whose work on the theory of economic growth culminated in the exogenous growth ...

and is rooted in macroeconomic

Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study topics such as output/ GDP ...

theories of trade including the Mundell–Fleming model

The Mundell–Fleming model, also known as the IS-LM-BoP model (or IS-LM-BP model), is an economic model first set forth (independently) by Robert Mundell and Marcus Fleming. Reprinted in Reprinted in The model is an extension of the IS–LM ...

. One opinion stated that

"The volatility and interest rates found its way into commodity inputs and all sectors of the world economy."Hence, in the case of an economic crisis commodities prices follow the trends in exchange rate (coupled) and its prices decrease in case there are downward trends of diminishing money supply. Foreign exchange impacts commodities prices and so does money supply: the advent of a crisis will pull commodities prices down.

Boom

A commodity price bubble, known as the 2000s commodities boom, was created following the collapse of the mid-2000s housing bubble. Commodities were seen as a safe bet after the bubble economy surrounding

A commodity price bubble, known as the 2000s commodities boom, was created following the collapse of the mid-2000s housing bubble. Commodities were seen as a safe bet after the bubble economy surrounding housing

Housing refers to a property containing one or more Shelter (building), shelter as a living space. Housing spaces are inhabited either by individuals or a collective group of people. Housing is also referred to as a human need and right to ...

prices had gone from boom to bust in several western nations, including the USA, UK, Ireland, Greece

Greece, officially the Hellenic Republic, is a country in Southeast Europe. Located on the southern tip of the Balkan peninsula, it shares land borders with Albania to the northwest, North Macedonia and Bulgaria to the north, and Turkey to th ...

and Spain. Advisers claimed that commodity prices could be predicted better than stocks, since they are traded for actual usage and the price is based on supply and demand, while stocks are bought for speculation and news immediately influence prices. Still commodity prices have fluctuated outside predictions.

The renewed interest in coal by China

China, officially the People's Republic of China (PRC), is a country in East Asia. With population of China, a population exceeding 1.4 billion, it is the list of countries by population (United Nations), second-most populous country after ...

's and Taiwan

Taiwan, officially the Republic of China (ROC), is a country in East Asia. The main geography of Taiwan, island of Taiwan, also known as ''Formosa'', lies between the East China Sea, East and South China Seas in the northwestern Pacific Ocea ...

's energy companies and the rise of alternative power sources like wind farms helped modify coal prices over the 2000s.

Chlorine price steadily increased throughout 2007 and early 2008 as demand for PVC and some metals like copper, neodymium and tantalum rose due to the increased growth of the BRIC countries' demand for electrical goods. Russia

Russia, or the Russian Federation, is a country spanning Eastern Europe and North Asia. It is the list of countries and dependencies by area, largest country in the world, and extends across Time in Russia, eleven time zones, sharing Borders ...

increased production, but the US offset this with production cuts in the late 1990s and mid-2000s.

Phosphorus

Phosphorus is a chemical element; it has Chemical symbol, symbol P and atomic number 15. All elemental forms of phosphorus are highly Reactivity (chemistry), reactive and are therefore never found in nature. They can nevertheless be prepared ar ...

, rhodium

Rhodium is a chemical element; it has symbol Rh and atomic number 45. It is a very rare, silvery-white, hard, corrosion-resistant transition metal. It is a noble metal and a member of the platinum group. It has only one naturally occurring isot ...

, molybdenum

Molybdenum is a chemical element; it has Symbol (chemistry), symbol Mo (from Neo-Latin ''molybdaenum'') and atomic number 42. The name derived from Ancient Greek ', meaning lead, since its ores were confused with lead ores. Molybdenum minerals hav ...

, manganese

Manganese is a chemical element; it has Symbol (chemistry), symbol Mn and atomic number 25. It is a hard, brittle, silvery metal, often found in minerals in combination with iron. Manganese was first isolated in the 1770s. It is a transition m ...

, vanadium

Vanadium is a chemical element; it has Symbol (chemistry), symbol V and atomic number 23. It is a hard, silvery-grey, malleable transition metal. The elemental metal is rarely found in nature, but once isolated artificially, the formation of an ...

and palladium

Palladium is a chemical element; it has symbol Pd and atomic number 46. It is a rare and lustrous silvery-white metal discovered in 1802 by the English chemist William Hyde Wollaston. He named it after the asteroid Pallas (formally 2 Pallas), ...

are used in high grade steels, oil based lubricants, automotive catalytic converters, chemical plants' catalysts, electronics, TV screens and in radio isotopes. Demand for these metals appeared to be increasing as computers and mobile phones became more popular in the mid to late 2000s. Thulium

Thulium is a chemical element; it has symbol Tm and atomic number 69. It is the thirteenth element in the lanthanide series of metals. It is the second-least abundant lanthanide in the Earth's crust, after radioactively unstable promethium. It i ...

is used in x-ray

An X-ray (also known in many languages as Röntgen radiation) is a form of high-energy electromagnetic radiation with a wavelength shorter than those of ultraviolet rays and longer than those of gamma rays. Roughly, X-rays have a wavelength ran ...

tubes and neodymium

Neodymium is a chemical element; it has Symbol (chemistry), symbol Nd and atomic number 60. It is the fourth member of the lanthanide series and is considered to be one of the rare-earth element, rare-earth metals. It is a hard (physics), hard, sli ...

is used in high strength/high grade magnets.

Molybdenum

Molybdenum is a chemical element; it has Symbol (chemistry), symbol Mo (from Neo-Latin ''molybdaenum'') and atomic number 42. The name derived from Ancient Greek ', meaning lead, since its ores were confused with lead ores. Molybdenum minerals hav ...

, rhodium

Rhodium is a chemical element; it has symbol Rh and atomic number 45. It is a very rare, silvery-white, hard, corrosion-resistant transition metal. It is a noble metal and a member of the platinum group. It has only one naturally occurring isot ...

, neodymium

Neodymium is a chemical element; it has Symbol (chemistry), symbol Nd and atomic number 60. It is the fourth member of the lanthanide series and is considered to be one of the rare-earth element, rare-earth metals. It is a hard (physics), hard, sli ...

and palladium

Palladium is a chemical element; it has symbol Pd and atomic number 46. It is a rare and lustrous silvery-white metal discovered in 1802 by the English chemist William Hyde Wollaston. He named it after the asteroid Pallas (formally 2 Pallas), ...

are relatively scarce metals, while manganese

Manganese is a chemical element; it has Symbol (chemistry), symbol Mn and atomic number 25. It is a hard, brittle, silvery metal, often found in minerals in combination with iron. Manganese was first isolated in the 1770s. It is a transition m ...

and vanadium

Vanadium is a chemical element; it has Symbol (chemistry), symbol V and atomic number 23. It is a hard, silvery-grey, malleable transition metal. The elemental metal is rarely found in nature, but once isolated artificially, the formation of an ...

are, like phosphorus

Phosphorus is a chemical element; it has Chemical symbol, symbol P and atomic number 15. All elemental forms of phosphorus are highly Reactivity (chemistry), reactive and are therefore never found in nature. They can nevertheless be prepared ar ...

and sulfur

Sulfur ( American spelling and the preferred IUPAC name) or sulphur ( Commonwealth spelling) is a chemical element; it has symbol S and atomic number 16. It is abundant, multivalent and nonmetallic. Under normal conditions, sulfur atoms ...

, fairly abundant for minor minerals. The major metals such as iron, lead and tin are commonplace.

Recycling of the aluminum, ferrous

In chemistry, iron(II) refers to the chemical element, element iron in its +2 oxidation number, oxidation state. The adjective ''ferrous'' or the prefix ''ferro-'' is often used to specify such compounds, as in ''ferrous chloride'' for iron(II ...

metals, copper fractions, gold, palladium

Palladium is a chemical element; it has symbol Pd and atomic number 46. It is a rare and lustrous silvery-white metal discovered in 1802 by the English chemist William Hyde Wollaston. He named it after the asteroid Pallas (formally 2 Pallas), ...

and platinum

Platinum is a chemical element; it has Symbol (chemistry), symbol Pt and atomic number 78. It is a density, dense, malleable, ductility, ductile, highly unreactive, precious metal, precious, silverish-white transition metal. Its name origina ...

in mobile phones and computers had got under way by the mid-2000s. Battery recycling

Battery recycling is a recycling activity that aims to reduce the number of batteries being disposed as municipal solid waste. Batteries contain a number of heavy metals and toxic chemicals and disposing of them by the same process as regula ...

has helped bring down both the nickel and cadmium

Cadmium is a chemical element; it has chemical symbol, symbol Cd and atomic number 48. This soft, silvery-white metal is chemically similar to the two other stable metals in group 12 element, group 12, zinc and mercury (element), mercury. Like z ...

prices.

Sulfuric acid

Sulfuric acid (American spelling and the preferred IUPAC name) or sulphuric acid (English in the Commonwealth of Nations, Commonwealth spelling), known in antiquity as oil of vitriol, is a mineral acid composed of the elements sulfur, oxygen, ...

(an important chemical commodity used in processes such as steel processing, copper production and bioethanol production) increased in price 3.5-fold in less than 1 year while producers of sodium hydroxide

Sodium hydroxide, also known as lye and caustic soda, is an inorganic compound with the formula . It is a white solid ionic compound consisting of sodium cations and hydroxide anions .

Sodium hydroxide is a highly corrosive base (chemistry), ...

have declared force majeure due to flooding, precipitating similarly steep price increases.

Food

Corn, wheat, rice, cocoa and Soya beans

biofuel

Biofuel is a fuel that is produced over a short time span from Biomass (energy), biomass, rather than by the very slow natural processes involved in the formation of fossil fuels such as oil. Biofuel can be produced from plants or from agricu ...

crops helped cause a sharp rise in basic food stock prices. Ethiopia

Ethiopia, officially the Federal Democratic Republic of Ethiopia, is a landlocked country located in the Horn of Africa region of East Africa. It shares borders with Eritrea to the north, Djibouti to the northeast, Somalia to the east, Ken ...

also saw a drought threaten its already frail farm lands in 2007. Cocoa was also affected by a bad crop in 2008, due to disease and unusually heavy rain in parts of West Africa.

Rising demand in both India

India, officially the Republic of India, is a country in South Asia. It is the List of countries and dependencies by area, seventh-largest country by area; the List of countries by population (United Nations), most populous country since ...

and Egypt

Egypt ( , ), officially the Arab Republic of Egypt, is a country spanning the Northeast Africa, northeast corner of Africa and Western Asia, southwest corner of Asia via the Sinai Peninsula. It is bordered by the Mediterranean Sea to northe ...

helped to ramp up demand for American wheat during the bull market during August 2007. Discounted wheat sold at about £11–£15/t. August 2007, with non-discounted wheat at slightly higher price. The November 2007 wheat futures market was trading at nearly £165/t, with November 2008 contracts at £128.50. The market became rather bearish as non-futures prices froze and stagnated in December 2007. The price of wheat reached record highs after Kazakhstan

Kazakhstan, officially the Republic of Kazakhstan, is a landlocked country primarily in Central Asia, with a European Kazakhstan, small portion in Eastern Europe. It borders Russia to the Kazakhstan–Russia border, north and west, China to th ...

began to limit supplies being sold overseas in early 2008, but had slowed down by late 2008. Food riot

A food riot is a riot in protest of a shortage and/or unequal distribution of food. Historical causes have included rises in food prices, harvest failures, inept food storage, transport problems, food speculation, hoarding, poisoning of food, ...

s hit Egypt on 12 April 2008, as national bread prices rose rapidly in March and April 2008.

In late April 2008 rice prices hit 24 cents (U.S.) per U.S. pound, more than doubling the price in just seven months. The price of wheat had risen from an already high £88 per tonne to £91 from January to March 2010, due to the bullish market and currency concerns. This led to food riots in places such as Haiti

Haiti, officially the Republic of Haiti, is a country on the island of Hispaniola in the Caribbean Sea, east of Cuba and Jamaica, and south of the Bahamas. It occupies the western three-eighths of the island, which it shares with the Dominican ...

, Indonesia, Côte d'Ivoire

Ivory Coast, also known as Côte d'Ivoire and officially the Republic of Côte d'Ivoire, is a country on the southern coast of West Africa. Its capital city of Yamoussoukro is located in the centre of the country, while its largest city and ...

, Uzbekistan, Egypt and Ethiopia

Ethiopia, officially the Federal Democratic Republic of Ethiopia, is a landlocked country located in the Horn of Africa region of East Africa. It shares borders with Eritrea to the north, Djibouti to the northeast, Somalia to the east, Ken ...

.

On 31 July, leading economists predicted that food prices, especially wheat would rise in Chad

Chad, officially the Republic of Chad, is a landlocked country at the crossroads of North Africa, North and Central Africa. It is bordered by Libya to Chad–Libya border, the north, Sudan to Chad–Sudan border, the east, the Central Afric ...

as Russia

Russia, or the Russian Federation, is a country spanning Eastern Europe and North Asia. It is the list of countries and dependencies by area, largest country in the world, and extends across Time in Russia, eleven time zones, sharing Borders ...

ended exports due to a domestic drought destroying their wheat and barley harvests. By 3 August, wheat prices stood at $7.11 per bushel due to the Russian export ban.

Fertilizer

There was in increase in the demand for

There was in increase in the demand for fertilizer

A fertilizer or fertiliser is any material of natural or synthetic origin that is applied to soil or to plant tissues to supply plant nutrients. Fertilizers may be distinct from liming materials or other non-nutrient soil amendments. Man ...

from China

China, officially the People's Republic of China (PRC), is a country in East Asia. With population of China, a population exceeding 1.4 billion, it is the list of countries by population (United Nations), second-most populous country after ...

and India

India, officially the Republic of India, is a country in South Asia. It is the List of countries and dependencies by area, seventh-largest country by area; the List of countries by population (United Nations), most populous country since ...

. Also an increase in demand for fertilizer to create biofuels like Ethanol as a Fuel from corn in the United States, Brazil, and Europe. Increased livestock

Livestock are the Domestication, domesticated animals that are raised in an Agriculture, agricultural setting to provide labour and produce diversified products for consumption such as meat, Egg as food, eggs, milk, fur, leather, and wool. The t ...

grew demand for more grain

A grain is a small, hard, dry fruit (caryopsis) – with or without an attached husk, hull layer – harvested for human or animal consumption. A grain crop is a grain-producing plant. The two main types of commercial grain crops are cereals and ...

and fertilizer causing grain reserves to plunge to a historic low. China put export controls on their fertilizer. Natural gas prices increased a lot during this period and that is used in the process of making some fertilizers (Haber process

The Haber process, also called the Haber–Bosch process, is the main industrial procedure for the ammonia production, production of ammonia. It converts atmospheric nitrogen (N2) to ammonia (NH3) by a reaction with hydrogen (H2) using finely di ...

). Phosphate prices went up because of an increase in price of sulfur

Sulfur ( American spelling and the preferred IUPAC name) or sulphur ( Commonwealth spelling) is a chemical element; it has symbol S and atomic number 16. It is abundant, multivalent and nonmetallic. Under normal conditions, sulfur atoms ...

which is and input to phosphate fertilizer.

Sugar

Prices rose modestly and briefly because of

Prices rose modestly and briefly because of Hurricane Katrina

Hurricane Katrina was a powerful, devastating and historic tropical cyclone that caused 1,392 fatalities and damages estimated at $125 billion in late August 2005, particularly in the city of New Orleans and its surrounding area. ...

in 2005 and 2006 but a bigger price climb came later from supply disruptions in India

India, officially the Republic of India, is a country in South Asia. It is the List of countries and dependencies by area, seventh-largest country by area; the List of countries by population (United Nations), most populous country since ...

, Brazil

Brazil, officially the Federative Republic of Brazil, is the largest country in South America. It is the world's List of countries and dependencies by area, fifth-largest country by area and the List of countries and dependencies by population ...

, and other places around the world.

Paper

Recycled paper

The price ofrecycled paper

The recycling of paper is the process by which waste paper is turned into new paper products. It has several important benefits: It saves waste paper from occupying the homes of people and producing methane as it breaks down. Because paper fibr ...

has varied greatly over the last 30 or so years.

Recycling and Composting OnlineRecycle.cc (10 March 2011). Retrieved 28 March 2011.

. Wild About Britain. Retrieved 28 March 2011. The German price of €100/£49 per tonne was typical for the year 2003 and it steadily rose over the years. By September 2008 saw American price of $235 per ton had fallen to just $120 per ton, The slump was probably due to the economic down turn in East Asia causing the market for waste paper drying up in China. 2010 prices averaged $120.32 at the start of the year, but saw a rapid rise in global prices in May 2010, reaching $217.11 per ton in the US in June 2010 as China's paper market began to reopen.

Fuel

Coal

Coal prices rose to A$73 per tonne in September

Coal prices rose to A$73 per tonne in Septemberwww.commodityonline.com (20 October 2009). Retrieved 28 March 2011. and then up to A$84 per tonne in the October 2009 due to renewed interest by China's and

Taiwan

Taiwan, officially the Republic of China (ROC), is a country in East Asia. The main geography of Taiwan, island of Taiwan, also known as ''Formosa'', lies between the East China Sea, East and South China Seas in the northwestern Pacific Ocea ...

's energy companies.

Oil

During 2003, the price rose above $30, reached $60 by 11 August 2005, and peaked at $147.30 in July 2008. Commentators attributed the heavy price increases to many factors, including reports from the

During 2003, the price rose above $30, reached $60 by 11 August 2005, and peaked at $147.30 in July 2008. Commentators attributed the heavy price increases to many factors, including reports from the United States Department of Energy

The United States Department of Energy (DOE) is an executive department of the U.S. federal government that oversees U.S. national energy policy and energy production, the research and development of nuclear power, the military's nuclear w ...

and others showing a decline in petroleum reserves, worries over peak oil

Peak oil is the point when global oil production reaches its maximum rate, after which it will begin to decline irreversibly. The main concern is that global transportation relies heavily on gasoline and diesel. Adoption of electric vehicles ...

, Middle East tension, and oil price speculation.

For a time, geo-political events and natural disasters indirectly related to the global oil market had strong short-term effects on oil prices, such as North Korean missile tests

North Korea has tested numerous missiles since 1984. North Korea has tested short-range ballistic missile (SRBMs), intermediate-range ballistic missile (IRBMs), intercontinental ballistic missiles (ICBMs), maneuverable reentry vehicles (MaRV) ba ...

, the 2006 conflict between Israel and Lebanon, worries over Iranian nuclear plans in 2006, Hurricane Katrina

Hurricane Katrina was a powerful, devastating and historic tropical cyclone that caused 1,392 fatalities and damages estimated at $125 billion in late August 2005, particularly in the city of New Orleans and its surrounding area. ...

, and various other factors.

By 2008, such pressures appeared to have an insignificant impact on oil prices given the onset of the global recession

A global recession is a recession that affects many countries around the world—that is, a period of global economic slowdown or declining economic output.

Definitions

The International Monetary Fund defines a global recession as "a decline ...

. The recession caused demand for energy to shrink in late 2008, with oil prices falling from the July 2008 high of $147 to a December 2008 low of $32.

Oil prices stabilized by October 2009 and established a trading range between $60 and $80.

The price of oil nearly tripled from $50 to $147 from early 2007 to 2008, before plunging during the 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

. Experts debate the causes, which include the flow of money from housing and other investments into commodities to speculation and monetary policy or the increasing feeling of raw materials scarcity in a fast-growing world economy and thus positions taken on those markets, such as Chinese increasing presence in Africa. An increase in oil prices tends to divert a larger share of consumer spending

Consumer spending is the total money spent on final goods and services by individuals and households.

There are two components of consumer spending: induced consumption (which is affected by the level of income) and autonomous consumption (which ...

into gasoline, which creates downward pressure on economic growth in oil importing countries, as wealth flows to oil-producing states.

In January 2008, oil prices surpassed $100 a barrel for the first time, the first of many price milestones to be passed in the course of the year. In July 2008, oil peaked at $147.30 a barrel and a gallon of gasoline was more than $4 across most of the US. The high of 2008 may have been part of broader pattern of spiking instability in the price of oil over the preceding decade. This pattern of instability in oil price may be a product of peak oil. There is concern that if the economy was to improve, oil prices might return to pre-recession levels.

In testimony before the Senate Committee on Commerce, Science, and Transportation on 3 June 2008, former director of the CFTC Division of Trading & Markets (responsible for enforcement) Michael Greenberger specifically named the Atlanta-based IntercontinentalExchange

Intercontinental Exchange, Inc. (ICE) is an American multinational financial services company formed in 2000 that operates global financial exchanges and clearing houses and provides mortgage technology, data and listing services. Listed on the ...

, founded by Goldman Sachs

The Goldman Sachs Group, Inc. ( ) is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered in Lower Manhattan in New York City, with regional headquarters in many internationa ...

, Morgan Stanley

Morgan Stanley is an American multinational investment bank and financial services company headquartered at 1585 Broadway in Midtown Manhattan, New York City. With offices in 42 countries and more than 80,000 employees, the firm's clients in ...

and BP as playing a key role in the speculative run-up of oil futures prices traded off the regulated futures exchanges in London and New York.

The price of oil rose to $77 per barrel on 24 June 2010 as a cyclone

In meteorology, a cyclone () is a large air mass that rotates around a strong center of low atmospheric pressure, counterclockwise in the Northern Hemisphere and clockwise in the Southern Hemisphere as viewed from above (opposite to an ant ...

begins to form in the south western Caribbean

The Caribbean ( , ; ; ; ) is a region in the middle of the Americas centered around the Caribbean Sea in the Atlantic Ocean, North Atlantic Ocean, mostly overlapping with the West Indies. Bordered by North America to the north, Central America ...

. The price for July 2010 was about $84–$90 per barrel of crude oil

Petroleum, also known as crude oil or simply oil, is a naturally occurring, yellowish-black liquid chemical mixture found in geological formations, consisting mainly of hydrocarbons. The term ''petroleum'' refers both to naturally occurring u ...

.

Oil prices ended the year at $101.80, falling to $100.01 per barrel on 30 and 31 January 2011., then the Egypt

Egypt ( , ), officially the Arab Republic of Egypt, is a country spanning the Northeast Africa, northeast corner of Africa and Western Asia, southwest corner of Asia via the Sinai Peninsula. It is bordered by the Mediterranean Sea to northe ...

ian civil war broke out, as it theoretically put the use of Suez Canal at risk. Making matters worse, a gas pipeline

A pipeline is a system of Pipe (fluid conveyance), pipes for long-distance transportation of a liquid or gas, typically to a market area for consumption. The latest data from 2014 gives a total of slightly less than of pipeline in 120 countries ...

to Jordan

Jordan, officially the Hashemite Kingdom of Jordan, is a country in the Southern Levant region of West Asia. Jordan is bordered by Syria to the north, Iraq to the east, Saudi Arabia to the south, and Israel and the occupied Palestinian ter ...

was blown up by saboteurs in the Sinai Peninsula. Prices remained steady until a dramatic drop began the 2010s oil glut

The 2010s oil glut was a significant surplus of Petroleum, crude oil that started in 2014–2015 and accelerated in 2016, with multiple causes. They include general oversupply as Unconventional (oil & gas) reservoir, unconventional US and Canadi ...

.

Jet fuel

Hurricane Katrina

Hurricane Katrina was a powerful, devastating and historic tropical cyclone that caused 1,392 fatalities and damages estimated at $125 billion in late August 2005, particularly in the city of New Orleans and its surrounding area. ...

caused Jet fuel

Jet fuel or aviation turbine fuel (ATF, also abbreviated avtur) is a type of aviation fuel designed for use in aircraft powered by Gas turbine, gas-turbine engines. It is colorless to straw-colored in appearance. The most commonly used fuels for ...

prices to rise in 2005 because of slowed down refining in the Gulf Coast

The Gulf Coast of the United States, also known as the Gulf South or the South Coast, is the coastline along the Southern United States where they meet the Gulf of Mexico. The coastal states that have a shoreline on the Gulf of Mexico are Tex ...

area, those prices dipped and the price of jet fuel went up with the price of oil through 2008.

Uranium

Uranium

Uranium is a chemical element; it has chemical symbol, symbol U and atomic number 92. It is a silvery-grey metal in the actinide series of the periodic table. A uranium atom has 92 protons and 92 electrons, of which 6 are valence electrons. Ura ...

traded at about $15–$20/kg since the late 1980s due to a 10-year secular bear market, with a 2001 low of just over $10/kg. The Uranium bubble of 2007 started in 2005Uranium Bubble & Spec Market OutlookNews.goldseek.com. Retrieved 28 March 2011. and began to accelerate badly with the 2006 flooding of the Cigar Lake Mine in Saskatchewan.Uranium Has Bottomed: Two Uranium Bulls to Jump on Now

UraniumSeek.com (22 August 2008). Retrieved 28 March 2011.

. Uranium.info. Retrieved 28 March 2011.

Uranium

Uranium is a chemical element; it has chemical symbol, symbol U and atomic number 92. It is a silvery-grey metal in the actinide series of the periodic table. A uranium atom has 92 protons and 92 electrons, of which 6 are valence electrons. Ura ...

prices peaked at roughly $300/kg in mid-2007, began to fall in mid-2008 and are now (end 2010) hovering about $100/kg. The stock prices of many uranium mining and exploration companies rose sharply, only to fall later in this boom.

There was also a resurgence of interest in nuclear power by the UK government between 2006 and 2008 due to the apparently insecure nature of Middle Eastern and Russian oil and after the closure of several old and economically/environmentally unviable coal fired power stations at the time. This helped the uranium price to rally at this date.

Precious metals

Gold

There was a sharp shift in the prices of gold and, to a lesser extent, both silver and

There was a sharp shift in the prices of gold and, to a lesser extent, both silver and platinum

Platinum is a chemical element; it has Symbol (chemistry), symbol Pt and atomic number 78. It is a density, dense, malleable, ductility, ductile, highly unreactive, precious metal, precious, silverish-white transition metal. Its name origina ...

. Prices were at or near an all-time high in late 2010 due to people using the precious metals as a Safe-haven currency, safe haven for their money as both the de facto value of cash and the stock market prices became more erratic in the late 2000s.

The period from 1999 to 2001 marked the "Brown Bottom" after a 20-year secular bear market at $252.90 per troy ounce. Prices increased rapidly from 2001, but the 1980 high was not exceeded until 3 January 2008 when a new maximum of $865.35 per troy weight, troy ounce was set (a.m. London Gold Fixing). Another record price was set on 17 March 2008 at $1,023.50/oz ($32,900/kg) (am. London Gold Fixing). In the fall of 2009, gold markets experience renewed momentum upwards due to increased demand and a weakening US dollar. On 2 December 2009, gold passed the important barrier of US$1,200 per ounce to close at $1,215. Gold further rallied hitting new highs in May 2010 after the European Union debt crisis prompted further purchase of gold as a safe asset.

Since April 2001, the price of gold has more than tripled in value against the US dollar, prompting speculation that the long secular bear market had ended and a bull market has returned. Gold's price finally stood at $1,350 per troy oz on 1 July 2010.

On 7 October 2010, it cost $1,364.60 per troy ounce, by 7 December reached the all time nominal historic high of $1,429.05 per troy ounce.

Silver

Silver cost $4 per troy ounce in 1992, started to rise rapidly in early 2004, reached $18 per troy oz by late 2007, slipped badly to $10 per troy oz during the Credit Crunch of 2008, but was selling in late 2009 and again in early 2010 at just under $18 per troy oz of metal. A year later, the Feb 2011 average was over $30 per oz of silver. On 29 April 2011, silver price reached $47.94 but fell by 12% on 2 May 2011.

Prices range around $20–$25 in 2013-2014.

Silver cost $4 per troy ounce in 1992, started to rise rapidly in early 2004, reached $18 per troy oz by late 2007, slipped badly to $10 per troy oz during the Credit Crunch of 2008, but was selling in late 2009 and again in early 2010 at just under $18 per troy oz of metal. A year later, the Feb 2011 average was over $30 per oz of silver. On 29 April 2011, silver price reached $47.94 but fell by 12% on 2 May 2011.

Prices range around $20–$25 in 2013-2014.

Platinum

Platinum first sold at about $350 per troy oz in 1992 and stayed rather flat save for a small dip to about $325 per troy oz in the mid-1990s and an equally small rise to about $375 per troy ounce in the Millennium period. It started to gain value in mid-2002 and grew on an Experience curve effects, experiential curve model as the prices then began to move sharply upwards. The high point was when it was trading for $2,200 per troy oz in early 2007. Prices declined to $800 per troy oz in January 2008, but the price had increased $1,600 per troy oz by early 2010.

Platinum first sold at about $350 per troy oz in 1992 and stayed rather flat save for a small dip to about $325 per troy oz in the mid-1990s and an equally small rise to about $375 per troy ounce in the Millennium period. It started to gain value in mid-2002 and grew on an Experience curve effects, experiential curve model as the prices then began to move sharply upwards. The high point was when it was trading for $2,200 per troy oz in early 2007. Prices declined to $800 per troy oz in January 2008, but the price had increased $1,600 per troy oz by early 2010.

Titanium

Titanium prices rose to over $16,000 per metric ton in 2006.

Rhodium

Rhodium prices rose briefly during the millennium period due to increased demand, then collapsed to nearly their original 1995-7 starting price of $500/oz between 2002 and 2004.

Later on, the mysterious and unexpected Rhodium price bubble of 2008 suddenly increased prices from just over $500/oz in late 2006 to $9,000/oz-$9,500/oz in July 2008, only for the price then to tumble down only $1,000/oz in January 2009. Both an increase in demand in the Automotive industry in the United States, American automotive industry, a herd instinct among investors, a then bullish market in rare metals and a rogue speculator or rogue speculators on Wall Street were all at least partly to blame for the sudden rise and fall in the Metal prices, rare metal's price.

Rhodium is mainly mined as a by-product of other metals such as platinum, so the production is based on production of other metals and therefore on demand of them, and less on the demand of rhodium.

Rhodium rose in price extremely sharply in January 2021 and by mid February 2021 it had reached an all time high of $21,400 per Troy ounce making it the most valuable metal ever sold.

Rhodium prices rose briefly during the millennium period due to increased demand, then collapsed to nearly their original 1995-7 starting price of $500/oz between 2002 and 2004.

Later on, the mysterious and unexpected Rhodium price bubble of 2008 suddenly increased prices from just over $500/oz in late 2006 to $9,000/oz-$9,500/oz in July 2008, only for the price then to tumble down only $1,000/oz in January 2009. Both an increase in demand in the Automotive industry in the United States, American automotive industry, a herd instinct among investors, a then bullish market in rare metals and a rogue speculator or rogue speculators on Wall Street were all at least partly to blame for the sudden rise and fall in the Metal prices, rare metal's price.

Rhodium is mainly mined as a by-product of other metals such as platinum, so the production is based on production of other metals and therefore on demand of them, and less on the demand of rhodium.

Rhodium rose in price extremely sharply in January 2021 and by mid February 2021 it had reached an all time high of $21,400 per Troy ounce making it the most valuable metal ever sold.

Palladium

Most palladium is used for catalytic converters in the automobile industry. It is also used for some medical, high grade steel, industrial, dental and electronic purposes.

Palladium prices rose sharply during the millennium period due to increased demand, then collapsed to nearly their original starting price by the end 2002, only to start to rise less dramatically in the year 2006. Palladium prices in 1992 and 2002–04 was about $200/oz. It rapidly shot up to approximately $1,000/oz between 1999 and 2001 and collapsed to only $200/oz by late 2002, but is now just under $500/oz per of Palladium in 2010.

In the run up to 2000, Russian supply of palladium to the global market was repeatedly delayed and disrupted because the export quota was not granted on time, for political reasons. The ensuing market panic drove the palladium price to an all-time high of $1,100 per troy ounce in January 2001. Around this time, the Ford Motor Company, fearing auto vehicle production disruption due to a possible palladium shortage, stockpiled large amounts of the metal purchased near the price high. When prices fell in early 2001, Ford lost nearly US$1 billion. World demand for palladium increased from 100 tons in 1990 to nearly 300 tons in 2000. The global production of palladium from mines was 222 tonnes in 2006 according to the USGS.

Most palladium is used for catalytic converters in the automobile industry. It is also used for some medical, high grade steel, industrial, dental and electronic purposes.

Palladium prices rose sharply during the millennium period due to increased demand, then collapsed to nearly their original starting price by the end 2002, only to start to rise less dramatically in the year 2006. Palladium prices in 1992 and 2002–04 was about $200/oz. It rapidly shot up to approximately $1,000/oz between 1999 and 2001 and collapsed to only $200/oz by late 2002, but is now just under $500/oz per of Palladium in 2010.

In the run up to 2000, Russian supply of palladium to the global market was repeatedly delayed and disrupted because the export quota was not granted on time, for political reasons. The ensuing market panic drove the palladium price to an all-time high of $1,100 per troy ounce in January 2001. Around this time, the Ford Motor Company, fearing auto vehicle production disruption due to a possible palladium shortage, stockpiled large amounts of the metal purchased near the price high. When prices fell in early 2001, Ford lost nearly US$1 billion. World demand for palladium increased from 100 tons in 1990 to nearly 300 tons in 2000. The global production of palladium from mines was 222 tonnes in 2006 according to the USGS.

Rhenium

Because of the low availability relative to demand, rhenium is among the most expensive industrial metals, with an average price exceeding US$6,000 per kilogram, as of mid-2009. It first traded in 1928 at US$10,000 per kilogram of metal, but traded at US$250 per Troy ounce in mid-2010. It traded in July 2010, at about US$4,000–4,500/kg.Other industrial metals

Aluminium

Aluminium is a widely used, mined, refined and trusted metal. The fortunes of this metal are linked to the rise and fall of the aircraft, electrical and automotive industries.

The price of aluminium was 80 US cents per lb in 1995 and 45 cents per lb in 1998 and hovered around this until the January 2003, when it started to rise to $1.50 per pound and in 2006 and $1.40 per lb in the December 2007.Dynamic Charting Tool , InvestmentMine

Aluminium is a widely used, mined, refined and trusted metal. The fortunes of this metal are linked to the rise and fall of the aircraft, electrical and automotive industries.

The price of aluminium was 80 US cents per lb in 1995 and 45 cents per lb in 1998 and hovered around this until the January 2003, when it started to rise to $1.50 per pound and in 2006 and $1.40 per lb in the December 2007.Dynamic Charting Tool , InvestmentMineInfomine.com. Retrieved 28 March 2011.Dynamic Charting Tool , InvestmentMine

Infomine.com. Retrieved 28 March 2011. It collapsed down to a mere 60 cents per lb in the November 2008, but is now hovering at about $1.00 per lb, with a new April peak of $1.10 per pound of aluminium.

Nickel

The price of nickel boomed in the late 1990s, then imploded from around $51,000 /£36,700 per tonne in May 2007 to about $11,550/£8,300 per tonne in January 2009. Prices were only just starting to recover as of January 2010, but most of Australia's nickel mines had gone bankrupt by then. As the price for high grade nickel sulphate ore recovered in 2010, so did the Australian mining industry.

The price of nickel boomed in the late 1990s, then imploded from around $51,000 /£36,700 per tonne in May 2007 to about $11,550/£8,300 per tonne in January 2009. Prices were only just starting to recover as of January 2010, but most of Australia's nickel mines had gone bankrupt by then. As the price for high grade nickel sulphate ore recovered in 2010, so did the Australian mining industry. Battery recycling

Battery recycling is a recycling activity that aims to reduce the number of batteries being disposed as municipal solid waste. Batteries contain a number of heavy metals and toxic chemicals and disposing of them by the same process as regula ...

has helped bring down both the nickel and cadmium prices.

Copper

In the years prior to the rise of copper prices in late 2003 as part of the boom various copper mining companies exibited cartel-like behaviour. This consisted of announcements made in late 2001 for production cuts for 2002 which were carried out, and a repetition of similar announcements for 2003 in late 2002.

It was also noticed that a copper price bubble was occurring at the same time as the oil bubble. Copper traded at about $2,500 per tonne from 1990 until 1999, when it fell to about $1,600. The price slump lasted until 2004 which saw a price surge that had copper reaching $9,000 per tonne in the May 2006, but it eventually fell down to $7,040 per tonne in early 2008. When the slump came, it hit some copper mining countries like the Democratic Republic of the Congo (D.R.C.) very hard. Mining authorities announced on 10 December 2009, that the Dikulushi mine, which is situated in the D.R.C.'s Katanga Province, would close due to poor copper prices. It reopened in July 2010. The price rose again to over $10,000 in early 2011 but soon fell to below $8,000, around where it was fairly stable during 2012. The high prices have caused a heavy increase in theft of copper cables, causing interruptions in electrical supply. During 2013-2014 there has been a slow decline to below $7,000.

Chilean state-owned copper giant Codelco made large gains during the boom. Artisan miners known as pirquineros also made considerable profits albeit some found it difficult to Retraining, reskill to gold mining in Chile, gold mining after copper prices fell in 2008.

In the years prior to the rise of copper prices in late 2003 as part of the boom various copper mining companies exibited cartel-like behaviour. This consisted of announcements made in late 2001 for production cuts for 2002 which were carried out, and a repetition of similar announcements for 2003 in late 2002.

It was also noticed that a copper price bubble was occurring at the same time as the oil bubble. Copper traded at about $2,500 per tonne from 1990 until 1999, when it fell to about $1,600. The price slump lasted until 2004 which saw a price surge that had copper reaching $9,000 per tonne in the May 2006, but it eventually fell down to $7,040 per tonne in early 2008. When the slump came, it hit some copper mining countries like the Democratic Republic of the Congo (D.R.C.) very hard. Mining authorities announced on 10 December 2009, that the Dikulushi mine, which is situated in the D.R.C.'s Katanga Province, would close due to poor copper prices. It reopened in July 2010. The price rose again to over $10,000 in early 2011 but soon fell to below $8,000, around where it was fairly stable during 2012. The high prices have caused a heavy increase in theft of copper cables, causing interruptions in electrical supply. During 2013-2014 there has been a slow decline to below $7,000.

Chilean state-owned copper giant Codelco made large gains during the boom. Artisan miners known as pirquineros also made considerable profits albeit some found it difficult to Retraining, reskill to gold mining in Chile, gold mining after copper prices fell in 2008.

Iron

The prices of iron ore rose sharply from around $10 per tonne in 2003 to around $170 in April 2009 (transported to China). After that (written September 2013) the price was between $100 and $150; in September 2014 it started dropping precipitously, and was below $70 per ton in December 2014. The price of steel (at steel plants in Japan) has risen from around $300 per tonne in 2003 to $1,000 in late 2008, stabilizing at $800 in 2012.

The rise in prices made abandoned mines to reopen and new ones to open. It took some years to open mines, so some got a scaled up production around the time the prices dropped (drop partly caused by such production). Furthermore, started construction projects had to be finished so demand only reacted slowly to the rising prices.

The prices of iron ore rose sharply from around $10 per tonne in 2003 to around $170 in April 2009 (transported to China). After that (written September 2013) the price was between $100 and $150; in September 2014 it started dropping precipitously, and was below $70 per ton in December 2014. The price of steel (at steel plants in Japan) has risen from around $300 per tonne in 2003 to $1,000 in late 2008, stabilizing at $800 in 2012.

The rise in prices made abandoned mines to reopen and new ones to open. It took some years to open mines, so some got a scaled up production around the time the prices dropped (drop partly caused by such production). Furthermore, started construction projects had to be finished so demand only reacted slowly to the rising prices.

Lead