|

2000s Commodities Boom

The 2000s commodities boom, commodities super cycle or China boom was the rise of many physical commodity prices (such as those of food, oil, metals, chemicals and fuels) during the early 21st century (2000–2014), following the Great Commodities Depression of the 1980s and 1990s. The boom was largely due to the rising demand from emerging markets such as the BRIC (economics term), BRIC countries, particularly China during the period from 1992 to 2013, as well as the result of concerns over long-term supply availability. There was a sharp down-turn in prices during 2008 and early 2009 due to the 2008 financial crisis and European debt crisis, but prices began to rise as demand recovered from late 2009 to mid-2010. Oil began to slip downwards after mid-2010, but peaked at $101.80 on 30 and 31 January 2011, as the Egyptian revolution of 2011 broke out, leading to concerns over both the safe use of the Suez Canal and overall security in Arabia itself. On 3 March, Libya's National Oi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commodity Prices

In economics, a commodity is an economic good, usually a resource, that specifically has full or substantial fungibility: that is, the market treats instances of the good as equivalent or nearly so with no regard to who produced them. The price of a commodity good is typically determined as a function of its market as a whole: well-established physical commodities have actively traded spot and derivative markets. The wide availability of commodities typically leads to smaller profit margins and diminishes the importance of factors (such as brand name) other than price. Most commodities are raw materials, basic resources, agricultural, or mining products, such as iron ore, sugar, or grains like rice and wheat. Commodities can also be mass-produced unspecialized products such as chemicals and computer memory. Popular commodities include crude oil, corn, and gold. Other definitions of commodity include something useful or valued and an alternative term for an economic good or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

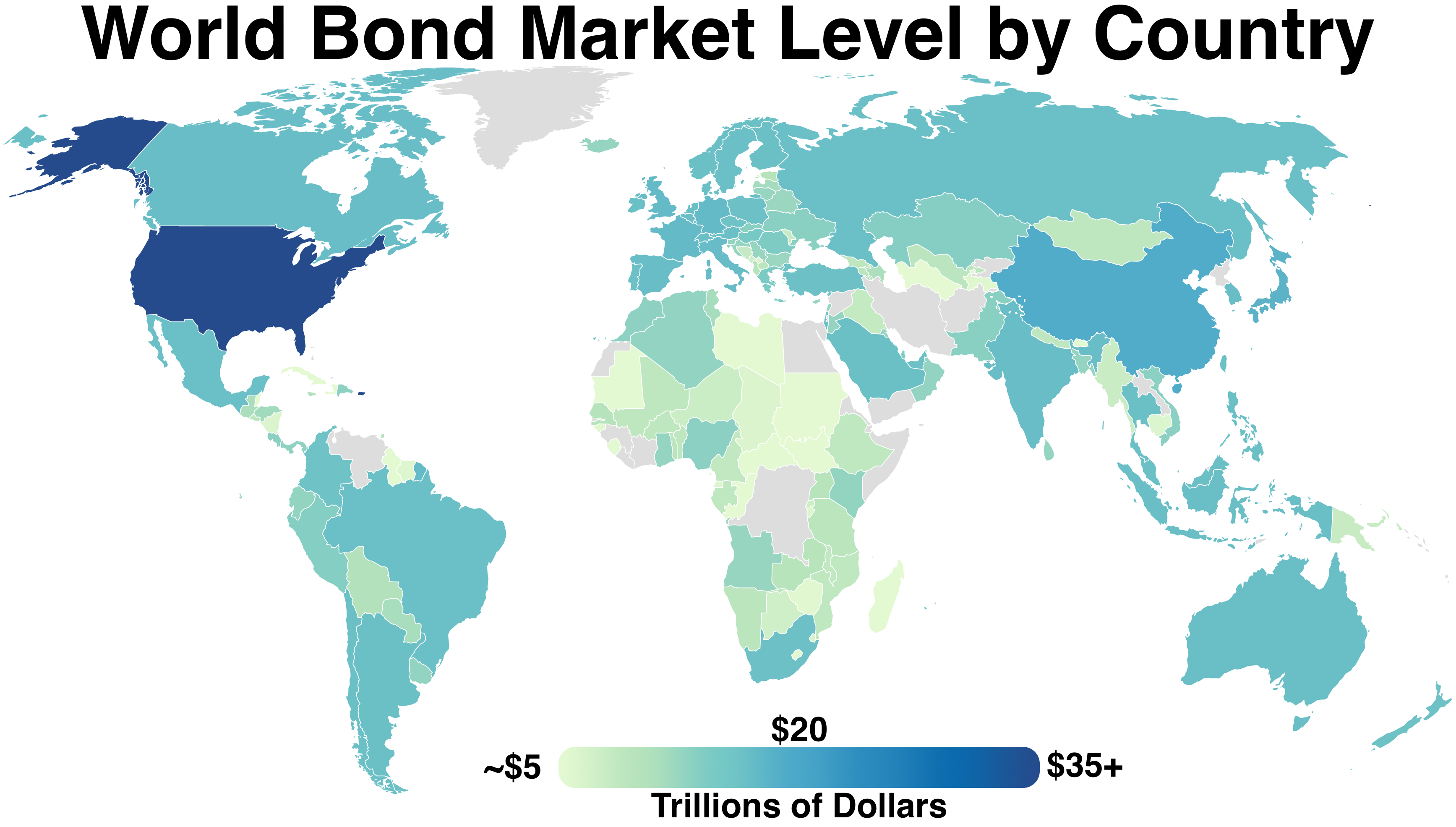

Bond Market

The bond market (also debt market or credit market) is a financial market in which participants can issue new debt, known as the primary market, or buy and sell debt security (finance), securities, known as the secondary market. This is usually in the form of bond (finance), bonds, but it may include notes, bills, and so on for public and private expenditures. The bond market has largely been dominated by the United States, which accounts for about 39% of the market. In 2021, the size of the bond market (total debt outstanding) was estimated to be $119 Trillion (short scale), trillion worldwide and $46 trillion for the US market, according to the Securities Industry and Financial Markets Association (SIFMA). Bonds and bank loans form what is known as the ''credit market''. The global credit market in aggregate is about three times the size of the global equity market. Bank loans are not securities under the U.S. Securities and Exchange Act, but bonds typically are and are therefore ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Housing Bubble

The 2000s United States housing bubble or house price boom or 2000s housing cycle was a sharp run up and subsequent collapse of house asset prices affecting over half of the U.S. states. In many regions a Real-estate bubble, real estate bubble, it was the impetus for the subprime mortgage crisis. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2011. On December 30, 2008, the Case–Shiller index, Case–Shiller home price index reported the largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is an important cause of the Great Recession in the United States. Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a Subprime mortgage crisis, crisis in August 2008 for the Subprime mortgage, subprime, Alt-A, collateralized debt obligation (CDO), mortgage loan, mortgage, Fixed income, credit, hedge fund, and foreign bank markets. In October 2007, Henry Paulson, the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mundell–Fleming Model

The Mundell–Fleming model, also known as the IS-LM-BoP model (or IS-LM-BP model), is an economic model first set forth (independently) by Robert Mundell and Marcus Fleming. Reprinted in Reprinted in The model is an extension of the IS–LM model. Whereas the traditional IS-LM model deals with economy under autarky (or a closed economy), the Mundell–Fleming model describes a small open economy. The Mundell–Fleming model portrays the short-run relationship between an economy's nominal exchange rate, interest rate, and output (in contrast to the closed-economy IS-LM model, which focuses only on the relationship between the interest rate and output). The Mundell–Fleming model has been used to argue that an economy cannot simultaneously maintain a fixed exchange rate, free capital movement, and an independent monetary policy. An economy can only maintain two of the three at the same time. This principle is frequently called the " impossible trinity," "unholy trinity," "ir ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Macroeconomic

Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study topics such as output/ GDP (gross domestic product) and national income, unemployment (including unemployment rates), price indices and inflation, consumption, saving, investment, energy, international trade, and international finance. Macroeconomics and microeconomics are the two most general fields in economics. The focus of macroeconomics is often on a country (or larger entities like the whole world) and how its markets interact to produce large-scale phenomena that economists refer to as aggregate variables. In microeconomics the focus of analysis is often a single market, such as whether changes in supply or demand are to blame for price increases in the oil and automotive sectors. From introductory classes in "principles of economics" through doctora ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Robert Solow

Robert Merton Solow, GCIH (; August 23, 1924 – December 21, 2023) was an American economist who received the 1987 Nobel Memorial Prize in Economic Sciences, and whose work on the theory of economic growth culminated in the exogenous growth model named after him. He was Institute Professor Emeritus of Economics at the Massachusetts Institute of Technology, where he was a professor from 1949 on. He was awarded the John Bates Clark Medal in 1961, the Nobel Memorial Prize in Economic Sciences in 1987, and the Presidential Medal of Freedom in 2014. Four of his PhD students, George Akerlof, Joseph Stiglitz, Peter Diamond, and William Nordhaus, later received Nobel Memorial Prizes in Economic Sciences in their own right. Biography Robert Solow was born in Brooklyn, New York, into a Jewish family on August 23, 1924, the oldest of three children. He attended local public school and excelled academically early in life. In September 1940, Solow went to Harvard College with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New York Mercantile Exchange

The New York Mercantile Exchange (NYMEX) is a commodity futures exchange owned and operated by CME Group of Chicago. NYMEX is located at One North End Avenue in Brookfield Place in the Battery Park City section of Manhattan, New York City. The company's two principal divisions are the New York Mercantile Exchange and Commodity Exchange, Inc (COMEX), once separately owned exchanges. NYMEX traces its history to 1882 and for most of its history, as was common of exchanges, it was owned by the members who traded there. Later, NYMEX Holdings, Inc., the former parent company of the New York Mercantile Exchange and COMEX, went public and became listed on the New York Stock Exchange on November 17, 2006, under the ticker symbol NMX. On March 17, 2008, Chicago based CME Group signed a definitive agreement to acquire NYMEX Holdings, Inc. for $11.2 billion in cash and stock and the takeover was completed in August 2008. Both NYMEX and COMEX now operate as designated contract marke ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Crude Oil

Petroleum, also known as crude oil or simply oil, is a naturally occurring, yellowish-black liquid chemical mixture found in geological formations, consisting mainly of hydrocarbons. The term ''petroleum'' refers both to naturally occurring unprocessed crude oil, as well as to petroleum products that consist of refined crude oil. Petroleum is a fossil fuel formed over millions of years from anaerobic decay of organic materials from buried prehistoric organisms, particularly planktons and algae, and 70% of the world's oil deposits were formed during the Mesozoic. Conventional reserves of petroleum are primarily recovered by drilling, which is done after a study of the relevant structural geology, analysis of the sedimentary basin, and characterization of the petroleum reservoir. There are also unconventional reserves such as oil sands and oil shale which are recovered by other means such as fracking. Once extracted, oil is refined and separated, most easily by disti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Barrel (unit)

A barrel is one of several units of volume applied in various contexts; there are dry barrels, fluid barrels (such as the U.K. beer barrel and U.S. beer barrel), oil barrels, and so forth. For historical reasons, the volumes of some barrel units are roughly double the volumes of others; volumes in common use range approximately from . In many connections, the term is used almost interchangeably with ''barrel''. Since medieval times, the term as a unit of measure has had various meanings throughout Europe, ranging from about 100 litres to about 1,000 litres. The name was derived in medieval times from the French , of unknown origin, but still in use, both in French and as derivations in many other languages, such as Italian, Polish, and Spanish. In most countries, such usage is obsolescent, having been superseded by SI units. As a result, the meaning of corresponding words and related concepts (vat, cask, keg etc.) in other languages often refers to a physical co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation Adjustment

In economics, nominal value refers to value measured in terms of absolute money amounts, whereas real value is considered and measured against the actual goods or services for which it can be exchanged at a given time. Real value takes into account inflation and the value of an asset in relation to its purchasing power. In macroeconomics, the real gross domestic product compensates for inflation so economists can exclude inflation from growth figures, and see how much an economy actually grows. Nominal GDP would include inflation, and thus be higher. Commodity bundles, price indices and inflation A commodity bundle is a sample of goods, which is used to represent the sum total of goods across the economy to which the goods belong, for the purpose of comparison across different times (or locations). At a single point of time, a commodity bundle consists of a list of goods, and each good in the list has a market price and a quantity. The market value of the good is the market ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

PPI Commodities

PPI may refer to: Science and technology Biochemistry * PPi, the anion P2O74−, a pyrophosphate * Polyproline I helix * Protein–protein interaction Medicine * Patient and public involvement * Prepulse inhibition, of a later pulse * Proton-pump inhibitor, a class of medications * Psychopathic Personality Inventory, a personality test * Psychophysiological Interaction, fMRI analysis technique Computing * Parallel Peripheral Interface, of the Blackfin processor * Programmable Peripheral Interface, Intel 8255 chip * Programmable Peripheral Interconnect, in Nordic nRF microcontrollers * Pixels per inch, of a display * Productivity Products International, commercializer of the Objective-C language Other science and technology * Gabarit passe-partout international, in railways * Picks per inch, a unit of textile measurement * Plan position indicator, radar display * Polymethylene polyphenylene isocyanate Business and organizations * Italian People's Party (1919) (Partito P ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |