|

Country-by-Country Reporting

Country-by-Country Reporting (or CbCR, sometimes referred to as Country-by-Country Report or CbC report) is an international initiative pioneered by the OECD. It establishes a reporting standard for multinational enterprises (MNEs) with total consolidated group revenues > EUR 750 million, containing key tax related information, including financial information and information on employees and non-cash tangible assets. Under the OECD rules, the information is to be exchanged between tax authorities of different countries. However, the EU adopted legislation to make the Country-by-Country Reporting publicly available, starting the year after 2024. History Country-by-Country Reporting was initially proposed in 2003 as an accounting standard. The proposal emanated originally from the Tax Justice Network. The key component was information that would allow reconciliation of financial statements across different national jurisdictions. The initiative was initially considered as utopian ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OECD

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate economic progress and world trade. It is a forum whose member countries describe themselves as committed to democracy and the market economy, providing a platform to compare policy experiences, seek answers to common problems, identify good practices, and coordinate domestic and international policies of its members. The majority of OECD members are high-income economies with a very high Human Development Index (HDI), and are regarded as developed countries. Their collective population is 1.38 billion. , the OECD member countries collectively comprised 62.2% of global nominal GDP (US$49.6 trillion) and 42.8% of global GDP (Int$54.2 trillion) at purchasing power parity. The OECD is an official United Nations observer. In April 1948, th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Multinational Corporation

A multinational company (MNC), also referred to as a multinational enterprise (MNE), a transnational enterprise (TNE), a transnational corporation (TNC), an international corporation or a stateless corporation with subtle but contrasting senses, is a corporate organization that owns and controls the production of goods or services in at least one country other than its home country. Control is considered an important aspect of an MNC, to distinguish it from international portfolio investment organizations, such as some international mutual funds that invest in corporations abroad simply to diversify financial risks. Black's Law Dictionary suggests that a company or group should be considered a multinational corporation "if it derives 25% or more of its revenue from out-of-home-country operations". Most of the largest and most influential companies of the modern age are publicly traded multinational corporations, including '' Forbes Global 2000'' companies. History Colonialism T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Country By Country Reporting Requirements

A country is a distinct part of the world, such as a state, nation, or other political entity. When referring to a specific polity, the term "country" may refer to a sovereign state, states with limited recognition, constituent country, or a dependent territory. Most sovereign states, but not all countries, are members of the United Nations. There is no universal agreement on the number of "countries" in the world since several states have disputed sovereignty status, limited recognition and a number of non-sovereign entities are commonly considered countries. The definition and usage of the word "country" are flexible and have changed over time. ''The Economist'' wrote in 2010 that "any attempt to find a clear definition of a country soon runs into a thicket of exceptions and anomalies." Areas much smaller than a political entity may be referred to as a "country", such as the West Country in England, "big sky country" (used in various contexts of the American West), "coa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Justice Network

The Tax Justice Network (or TJN) is an advocacy group consisting of a coalition of researchers and activists with a shared concern about tax avoidance, tax competition, and tax havens. Empirical results The TJN has reported on the OECD Base erosion and profit shifting (BEPS) projects and conducted their own research that the scale of corporate taxes being avoided by multinationals is an estimated $660bn in 2012 (a quarter of US multinationals’ gross profits), which is equivalent to 0.9% of World GDP. In July 2012, following a study into wealthy individuals with offshore accounts, the Tax Justice Network published claims regarding deposits worth at least $21 trillion (£13 trillion), potentially even $32 trillion, in secretive tax havens. As a result, governments suffer a lack of income taxes of up to $280 billion. In November 2020, the TJN published "The State of Tax Justice 2020" report. It claims $427 billion is lost every year to tax abuse. Focus Financial Secrecy Index ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Base Erosion And Profit Shifting (OECD Project)

The OECD G20 Base Erosion and Profit Shifting Project (or BEPS Project) is an OECD/G20 project to set up an international framework to combat tax avoidance by multinational enterprises ("MNEs") using '' base erosion and profit shifting'' tools. The project, led by the OECD's Committee on Fiscal Affairs, began in 2013 with OECD and G20 countries, in a context of financial crisis and tax affairs (e.g. Offshore Leaks). Currently, after the BEPS report has been delivered in 2015, the project is now in its implementation phase, 116 countries are involved including a majority of developing countries. During two years, the package was developed by participating members on an equal footing, as well as widespread consultations with jurisdictions and stakeholders, including business, academics and civil society. And since 2016, the OECD/G20 Inclusive Framework on BEPS provides for its 140 members a platform to work on an equal footing to tackle BEPS, including through peer review of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Avoidance

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable by means that are within the law. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not be confused with tax evasion, which is illegal. Forms of tax avoidance that use legal tax laws in ways not necessarily intended by the government are often criticized in the court of public opinion and by journalists. Many corporations and businesses that take part in the practice experience a backlash from their active customers or online. Conversely, benefiting from tax laws in ways that were intended by governments is sometimes referred to as tax planning. The World Bank's World Development Report 2019 on the future of work supports increased government efforts to curb tax avoidance as part of a new social contract focused on human capital investments and expanded so ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rishi Sunak

Rishi Sunak (; born 12 May 1980) is a British politician who has served as Prime Minister of the United Kingdom and Leader of the Conservative Party since October 2022. He previously held two cabinet positions under Boris Johnson, lastly as Chancellor of the Exchequer from 2020 to 2022. Sunak has been Member of Parliament (MP) for Richmond (Yorks) since 2015. Ideologically, Sunak has been described as belonging to the centre-ground of the Conservative Party. Sunak was born in Southampton to parents of Indian descent who migrated to Britain from East Africa in the 1960s. He was educated at Winchester College, studied philosophy, politics and economics at Lincoln College, Oxford, and earned an MBA from Stanford University in California as a Fulbright Scholar. During his time at Oxford University, Sunak undertook an internship at Conservative Campaign Headquarters and joined the Conservative Party. After graduating, Sunak worked for Goldman Sachs and later as a partner at th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Oxfam

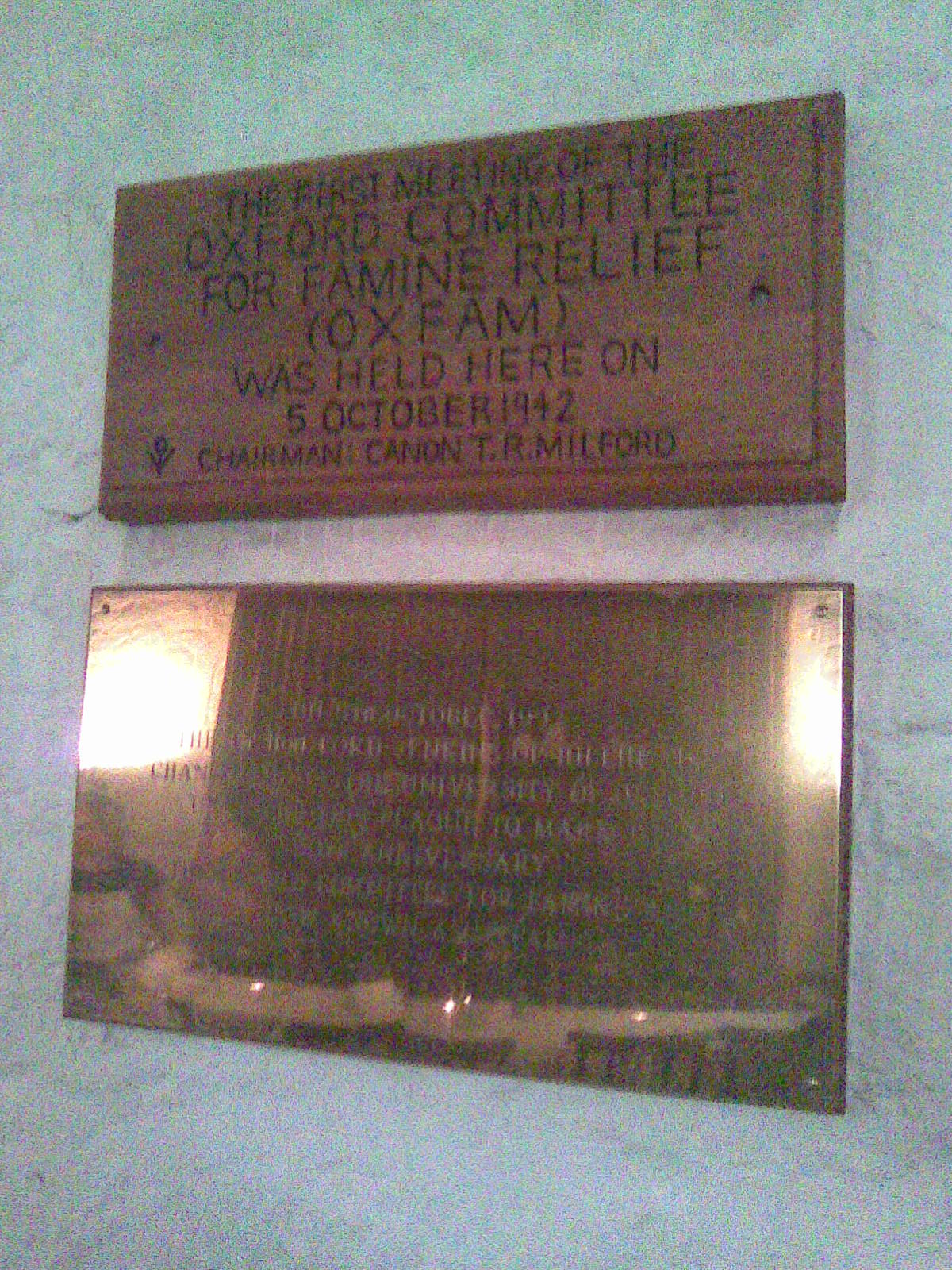

Oxfam is a British-founded confederation of 21 independent charitable organizations focusing on the alleviation of global poverty, founded in 1942 and led by Oxfam International. History Founded at 17 Broad Street, Oxford, as the Oxford Committee for Famine Relief by a group of Quakers, social activists, and Oxford academics in 1942 and registered in accordance with UK law in 1943, the original committee was a group of concerned citizens, including Henry Gillett (a prominent local Quaker), Theodore Richard Milford, Gilbert Murray and his wife Mary, Cecil Jackson-Cole, and Alan Pim. The committee met in the Old Library of University Church of St Mary the Virgin, Oxford, for the first time in 1942, and its aim was to help starving citizens of occupied Greece, a famine caused by the Axis occupation of Greece and Allied naval blockades and to persuade the British government to allow food relief through the blockade. The Oxford committee was one of several local committees ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Double Irish Arrangement

The Double Irish arrangement was a base erosion and profit shifting (BEPS) corporate tax avoidance tool used mostly by United States multinationals since the late 1980s to avoid corporate taxation on non-U.S. profits. It was the largest tax avoidance tool in history and by 2010 was shielding US$100 billion annually in US multinational foreign profits from taxation, and was the main tool by which US multinationals built up untaxed offshore reserves of US$1 trillion from 2004 to 2018. Traditionally, it was also used with the Dutch Sandwich BEPS tool; however, 2010 changes to tax laws in Ireland dispensed with this requirement. Despite US knowledge of the Double Irish for a decade, it was the European Commission that in October 2014 forced Ireland to close the scheme, starting in January 2015. However, users of existing schemes, such as Apple, Google, Facebook and Pfizer, were given until January 2020 to close them. At the announcement of the closure it was known that multi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ireland V Commission

On 29 August 2016, after a two-year investigation, Margrethe Vestager of the European Commission announced: "Ireland granted illegal tax benefits to Apple". The Commission ordered Apple to pay €13 billion, plus interest, in unpaid Irish taxes from 2004–14 to the Irish state. It was the largest corporate tax "fine" (in fact a recovery order, technically not a fine) in history. On 7 September 2016, the Irish State secured a majority in Dáil Éireann to reject payment of the back-taxes, which including penalties could reach €20 billion, or 10% of 2014 Irish GDP. In November 2016, the Irish government formally appealed the ruling, claiming there was no violation of Irish tax law, and that the commission's action was "an intrusion into Irish sovereignty", as national tax policy is excluded from EU treaties. In November 2016, Apple CEO Tim Cook, announced Apple would appeal, and in September 2018, Apple lodged €13 billion to an escrow account, pending appeal. I ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Taxation

International taxation is the study or determination of tax on a person or business subject to the tax laws of different countries, or the international aspects of an individual country's tax laws as the case may be. Governments usually limit the scope of their income taxation in some manner territorially or provide for offsets to taxation relating to extraterritorial income. The manner of limitation generally takes the form of a territorial, residence-based, or exclusionary system. Some governments have attempted to mitigate the differing limitations of each of these three broad systems by enacting a hybrid system with characteristics of two or more. Many governments tax individuals and/or enterprises on income. Such systems of taxation vary widely, and there are no broad general rules. These variations create the potential for double taxation (where the same income is taxed by different countries) and no taxation (where income is not taxed by any country). Income tax syste ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax Avoidance

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable by means that are within the law. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not be confused with tax evasion, which is illegal. Forms of tax avoidance that use legal tax laws in ways not necessarily intended by the government are often criticized in the court of public opinion and by journalists. Many corporations and businesses that take part in the practice experience a backlash from their active customers or online. Conversely, benefiting from tax laws in ways that were intended by governments is sometimes referred to as tax planning. The World Bank's World Development Report 2019 on the future of work supports increased government efforts to curb tax avoidance as part of a new social contract focused on human capital investments and expanded social pro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |