|

Tax Justice Network

The Tax Justice Network (TJN) is a British advocacy group consisting of a coalition of researchers and activists with a shared concern about tax avoidance, tax competition, and tax havens. Activity Research The TJN has reported on the OECD Base erosion and profit shifting (BEPS) projects and conducted their own research that the scale of corporate taxes being avoided by multinationals is an estimated $660 billion in 2012 (a quarter of US multinationals’ gross profits), which is equivalent to 0.9% of World GDP. In July 2012, following a study into wealthy individuals with offshore accounts, the Tax Justice Network published claims regarding deposits worth at least $21 trillion (£13 trillion), potentially even $32 trillion, in secretive tax havens. As a result, governments suffer a lack of income taxes of up to $280 billion. In November 2020, the TJN published "The State of Tax Justice 2020" report. It claims $427 billion is lost every year to tax abuse. Financial Secre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

London

London is the Capital city, capital and List of urban areas in the United Kingdom, largest city of both England and the United Kingdom, with a population of in . London metropolitan area, Its wider metropolitan area is the largest in Western Europe, with a population of 14.9 million. London stands on the River Thames in southeast England, at the head of a tidal estuary down to the North Sea, and has been a major settlement for nearly 2,000 years. Its ancient core and financial centre, the City of London, was founded by the Roman Empire, Romans as Londinium and has retained its medieval boundaries. The City of Westminster, to the west of the City of London, has been the centuries-long host of Government of the United Kingdom, the national government and Parliament of the United Kingdom, parliament. London grew rapidly 19th-century London, in the 19th century, becoming the world's List of largest cities throughout history, largest city at the time. Since the 19th cen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Richard Murphy (tax Campaigner)

Richard Murphy (born 21 March 1958) is a British former chartered accountant and political economist who campaigns on issues of tax avoidance and tax evasion. He advises the Trades Union Congress on economics and taxation, and founded the Tax Justice Network. He is a Professor of Accounting Practice at University of Sheffield Management School. Early life Richard Murphy was born in 1958 and brought up in Ipswich. His undergraduate degree was in Accountancy at the University of Southampton, and he trained further at KPMG becoming a Chartered Accountant. Career For much of his early career he was an accountant in Downham Market, Norfolk. In 1985 he co-founded an accountancy firm which became Murphy Deeks Nolan. The company was sold in 2000. Murphy was also the founder of a company that became the European distributor for the game ''Trivial Pursuit''. Murphy has since admitted that the manufacturing operation he set up in Ireland to manufacture ''Trivial Pursuit'' was there t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Taxation

International taxation is the study or determination of tax on a person or business subject to the tax laws of different countries, or the international aspects of an individual country's tax laws as the case may be. Governments usually limit the scope of their income taxation in some manner territorially or provide for offsets to taxation relating to extraterritorial income. The manner of limitation generally takes the form of a territorial, residence-based, or exclusionary system. Some governments have attempted to mitigate the differing limitations of each of these three broad systems by enacting a hybrid system with characteristics of two or more. Many governments tax individuals and/or enterprises on income. Such systems of taxation vary widely, and there are no broad general rules. These variations create the potential for double taxation (where the same income is taxed by different countries) and no taxation (where income is not taxed by any country). Income tax systems ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Ethics Organizations

Business is the practice of making one's living or making money by producing or Trade, buying and selling Product (business), products (such as goods and Service (economics), services). It is also "any activity or enterprise entered into for profit." A business entity is not necessarily separate from the owner and the creditors can hold the owner liable for debts the business has acquired except for limited liability company. The taxation system for businesses is different from that of the corporates. A business structure does not allow for corporate tax rates. The proprietor is personally taxed on all income from the business. A distinction is made in law and public offices between the term business and a company (such as a corporation or cooperative). Colloquially, the terms are used interchangeably. Corporations are distinct from Sole proprietorship, sole proprietors and partnerships. Corporations are separate and unique Legal person, legal entities from their shareholde ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Avoidance

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not be confused with tax evasion, which is illegal. Forms of tax avoidance that use legal tax laws in ways not necessarily intended by the government are often criticized in the court of public opinion and by journalists. Many businesses pay little or no tax, and some experience a backlash (sociology), backlash when their tax avoidance becomes known to the public. Conversely, benefiting from tax laws in ways that were intended by governments is sometimes referred to as tax planning. The World Bank's World Development Report 2019 on the future of work supports increased government efforts to curb tax avoidance as part of a new social contract focused on human capital investments and expanded social protection. "T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Haven

A tax haven is a term, often used pejoratively, to describe a place with very low tax rates for Domicile (law), non-domiciled investors, even if the official rates may be higher. In some older definitions, a tax haven also offers Bank secrecy, financial secrecy. However, while countries with high levels of secrecy but also high rates of taxation, most notably the United States and Germany in the Financial Secrecy Index (FSI) rankings, can be featured in some tax haven lists, they are often omitted from lists for political reasons or through lack of subject matter knowledge. In contrast, countries with lower levels of secrecy but also low "effective" rates of taxation, most notably Ireland in the FSI rankings, appear in most . The consensus on ''effective tax rates'' has led academics to note that the term "tax haven" and "offshore financial centre" are almost synonymous. In reality, many offshore financial centers do not have harmful tax practices and are at the forefront among ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

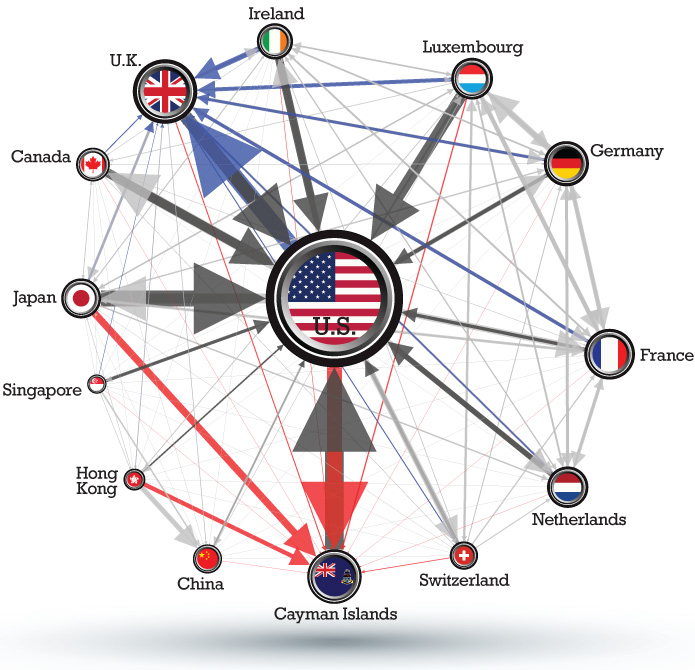

Corporate Haven

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or Incorporation (business), incorporation of regional or main company headquarters, mostly due to favourable tax regimes (not just the headline tax rate), and/or favourable secrecy laws (such as the avoidance of regulations or disclosure of tax schemes), and/or favourable regulatory regimes (such as weak data-protection or employment laws). Unlike traditional tax havens, modern corporate tax havens reject they have anything to do with near-zero Corporation tax in the Republic of Ireland#Effective tax rate (ETR), effective tax rates, due to their need to encourage jurisdictions to enter into bilateral Tax treaty, tax treaties that accept the haven's base erosion and profit shifting (BEPS) tools. CORPNET show each corporate tax haven is strongly connected with specific traditional tax havens (via additional ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Foundation

The Tax Foundation is an international research think tank based in Washington, D.C. that collects data and publishes research studies on Taxation in the United States, U.S. tax policies at both the federal and state levels. Its stated mission is to "improve lives through tax policy research and education that leads to greater economic growth and opportunity". The Tax Foundation is organized as a 501(c)(3) Tax exemption, tax-exempt Non-profit organization, non-profit educational and research organization, with three primary areas of research: the Center for Federal Tax Policy, the Center for State Tax Policy, and the Center for Global Tax Policy. The group is known for its annual reports such as the ''State Tax Competitiveness Index'', ''International Tax Competitiveness Index'', and ''Facts & Figures: How Does Your State Compare'', which was first produced in 1941. History The Tax Foundation was organized on December 5, 1937, in New York City by Alfred P. Sloan Jr., Chai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Association For The Taxation Of Financial Transactions And For Citizens' Action

The Association pour la Taxation des Transactions financières et pour l'Action Citoyenne (''Association for the Taxation of financial Transactions and Citizen's Action'', ATTAC) is an activist organisation originally created to promote the establishment of a tax on foreign exchange transactions. Background Originally called "Action for a Tobin Tax to Assist the Citizen", ATTAC was a single-issue movement demanding the introduction of the so-called Tobin tax on currency speculation. n the ATTAC: A new European alternative to globalisation, David Moberg, These Times magazine, May 2001/ref> ATTAC has enlarged its scope to a wide range of issues related to globalisation, and monitoring the decisions of the World Trade Organization (WTO), the Organisation for Economic Co-operation and Development (OECD,) and the International Monetary Fund (IMF). ATTAC representatives attend the meetings of the G8 with the goal of influencing policymakers' decisions. In 2007, ATTAC spokesmen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sol Picciotto

Sol Picciotto (born 1942) is a British academic, emeritus professor of law at Lancaster University. Life Sol Picciotto was born in Aleppo, Syria in 1942, of Jewish parents. His family left Syria in 1947 to 1948, and he was educated at Manchester Grammar School. Picciotto was educated at the University of Oxford (BA) and the University of Chicago (JD). Picciotto has been joint editor of the ''International Journal of the Sociology of Law'', and founding joint editor of ''Social and Legal Studies'' and an editorial consultant on the ''Australian Journal of Law and Society''. He is a senior adviser at the Tax Justice Network The Tax Justice Network (TJN) is a British advocacy group consisting of a coalition of researchers and activists with a shared concern about tax avoidance, tax competition, and tax havens. Activity Research The TJN has reported on the OECD .... Picciotto's students have included Attiya Waris who is also involved with the Tax Justice Network. Publicat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nicholas Shaxson

Nicholas Shaxson (born 1966) is a British author, journalist and investigator. He is best known for his investigative books ''Poisoned Wells'' (2007), '' Treasure Islands'' (2011), and The Finance Curse (2018). He has worked as a part-time writer and researcher for the Tax Justice Network., ''treasureislands.org'', 19 November 2010Shaxson, NicholasThe truth about tax havens ''The Guardian'', 8 January 2011 Biography Shaxson was born in Malawi and educated in Britain. He has lived at various times in India, Brazil, England, Lesotho, Spain, Angola, South Africa, Germany, Switzerland, and the Netherlands. Since 1993, he has written on global business and politics for '' Vanity Fair'', the ''Economist Intelligence Unit'', ''Foreign Affairs'', '' American Interest'', and others. Shaxson first began working for the Tax Justice Network in 2006. His first book was ''Poisoned Wells: The Dirty Politics of African Oil''. In 2011 he wrote ''Treasure Islands: Tax Havens and the Men who Stol ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |