The Bank of New York Mellon on:

[Wikipedia]

[Google]

[Amazon]

The Bank of New York Mellon Corporation, commonly known as BNY, is an American international

The bank had a monopoly on banking services in the city until the Bank of the Manhattan Company was founded by Aaron Burr in 1799; the Bank of New York and Hamilton vigorously opposed its founding.

During the 19th century, the bank was known for its conservative lending practices that allowed it to weather financial crises. It was involved in the funding of the Morris and Erie canals, and

The bank had a monopoly on banking services in the city until the Bank of the Manhattan Company was founded by Aaron Burr in 1799; the Bank of New York and Hamilton vigorously opposed its founding.

During the 19th century, the bank was known for its conservative lending practices that allowed it to weather financial crises. It was involved in the funding of the Morris and Erie canals, and

Mellon Financial was founded as T. Mellon & Sons' Bank in

Mellon Financial was founded as T. Mellon & Sons' Bank in

In October 2008, the U.S. Treasury named BNY Mellon the master custodian of the

In October 2008, the U.S. Treasury named BNY Mellon the master custodian of the

financial services

Financial services are service (economics), economic services tied to finance provided by financial institutions. Financial services encompass a broad range of tertiary sector of the economy, service sector activities, especially as concerns finan ...

company headquartered in New York City

New York, often called New York City (NYC), is the most populous city in the United States, located at the southern tip of New York State on one of the world's largest natural harbors. The city comprises five boroughs, each coextensive w ...

. It was established in its current form in July 2007 by the merger of the Bank of New York and Mellon Financial Corporation. Through the lineage of Bank of New York, which was founded in 1784 by a group that included Alexander Hamilton

Alexander Hamilton (January 11, 1755 or 1757July 12, 1804) was an American military officer, statesman, and Founding Fathers of the United States, Founding Father who served as the first U.S. secretary of the treasury from 1789 to 1795 dur ...

, BNY is regarded as one of the three oldest banks in the United States and among the oldest in the world. It was the first company listed on the New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District, Manhattan, Financial District of Lower Manhattan in New York City. It is the List of stock exchanges, largest stock excha ...

. In 2024, it was ranked 130th on the ''Fortune'' 500 list of the largest U.S. corporations by total revenue. As of 2024, it is the 13th-largest bank in the United States by total assets and the 83rd-largest in the world. BNY is considered a systemically important financial institution by the Financial Stability Board.

BNY provides a wide range of financial services, including asset management, custody and securities services, government finance services, and pension plan management. The company serves diverse clients, including corporations, institutions, and individuals, offering financial expertise and technological platforms to support their objectives. The company's key subsidiaries include BNY Investments, BNY Pershing, and BNY Wealth. It is the world's largest custodian bank and securities services company; as of September 2024, it has $2.1trillion in assets under management

In finance, assets under management (AUM), sometimes called fund under management, refers to the total market value of all financial assets that a financial institution—such as a mutual fund, venture capital firm, or depository institutio ...

and $52.1trillion in assets under custody and administration, making it the first bank to surpass $50trillion. BNY has been named among '' Fortune''s World's Most Admired Companies.

History

Bank of New York

The first bank in the U.S. was the Bank of North America in Philadelphia, which was chartered by the Continental Congress in 1781;Alexander Hamilton

Alexander Hamilton (January 11, 1755 or 1757July 12, 1804) was an American military officer, statesman, and Founding Fathers of the United States, Founding Father who served as the first U.S. secretary of the treasury from 1789 to 1795 dur ...

, Thomas Jefferson and Benjamin Franklin were among its founding shareholders. In February 1784, The Massachusetts Bank in Boston was chartered.

The shipping industry in New York City

New York, often called New York City (NYC), is the most populous city in the United States, located at the southern tip of New York State on one of the world's largest natural harbors. The city comprises five boroughs, each coextensive w ...

chafed under the lack of a bank, and investors envied the 14% dividends that Bank of North America paid, and months of local discussion culminated in a June 1784 meeting at a coffee house on St. George's Square which led to the formation of the Bank of New York company. The bank operated without a charter for seven years. The initial plan was to capitalize the company with $750,000, a third in cash and the rest in mortgages, but after this was disputed the first offering was to capitalize it with $500,000 in gold or silver. When the bank opened on June 9, 1784, the full $500,000 had not been raised; 723 shares had been sold, held by 192 people. Aaron Burr had three of them, and Hamilton had one and a half shares. The first president was Alexander McDougall and the Cashier was William Seton.

Its first offices were in the old Walton Mansion in New York City. In 1787, it moved to a site on Hanover Square that the New York Cotton Exchange later moved into.

The bank provided the United States government its first loan in 1789. The loan was orchestrated by Hamilton, then Secretary of the Treasury

The United States secretary of the treasury is the head of the United States Department of the Treasury, and is the chief financial officer of the federal government of the United States. The secretary of the treasury serves as the principal a ...

, and it paid the salaries of United States Congress

The United States Congress is the legislature, legislative branch of the federal government of the United States. It is a Bicameralism, bicameral legislature, including a Lower house, lower body, the United States House of Representatives, ...

members and President George Washington

George Washington (, 1799) was a Founding Fathers of the United States, Founding Father and the first president of the United States, serving from 1789 to 1797. As commander of the Continental Army, Washington led Patriot (American Revoluti ...

.

The Bank of New York was the first company to be traded on the New York Stock Exchange when it first opened in 1792. In 1796, the bank moved to a location at the corner of Wall Street and William Street, which would later become 48 Wall Street.

The bank had a monopoly on banking services in the city until the Bank of the Manhattan Company was founded by Aaron Burr in 1799; the Bank of New York and Hamilton vigorously opposed its founding.

During the 19th century, the bank was known for its conservative lending practices that allowed it to weather financial crises. It was involved in the funding of the Morris and Erie canals, and

The bank had a monopoly on banking services in the city until the Bank of the Manhattan Company was founded by Aaron Burr in 1799; the Bank of New York and Hamilton vigorously opposed its founding.

During the 19th century, the bank was known for its conservative lending practices that allowed it to weather financial crises. It was involved in the funding of the Morris and Erie canals, and steamboat

A steamboat is a boat that is marine propulsion, propelled primarily by marine steam engine, steam power, typically driving propellers or Paddle steamer, paddlewheels. The term ''steamboat'' is used to refer to small steam-powered vessels worki ...

companies. The bank helped finance both the War of 1812 and the Union Army during the American Civil War

The American Civil War (April 12, 1861May 26, 1865; also known by Names of the American Civil War, other names) was a civil war in the United States between the Union (American Civil War), Union ("the North") and the Confederate States of A ...

. Following the Civil War, the bank loaned money to many major infrastructure projects, including utilities, railroads, and the New York City Subway.

Through the early 20th century, the Bank of New York continued to expand and prosper. In July 1922, the bank merged with the New York Life Insurance and Trust Company. The bank continued to profit and pay dividends throughout the Great Depression

The Great Depression was a severe global economic downturn from 1929 to 1939. The period was characterized by high rates of unemployment and poverty, drastic reductions in industrial production and international trade, and widespread bank and ...

, and its total deposits increased during the decade. In 1948, the bank again merged, this time with the Fifth Avenue Bank, which was followed by a merger in 1966 with the Empire Trust Company. The bank's holding company

A holding company is a company whose primary business is holding a controlling interest in the Security (finance), securities of other companies. A holding company usually does not produce goods or services itself. Its purpose is to own Share ...

was created in 1969.

In 1988, the Bank of New York merged with Irving Bank Corporation after a year-long takeover bid by Bank of New York. Irving had been headquartered at 1 Wall Street and after the merger, this became the headquarters of the Bank of New York on July 20, 1988.

From 1993 to 1998, the bank made 33 acquisitions, including acquiring JP Morgan's Global Custody Business in 1995. Ivy Asset Management was acquired in 2000.

In the 1990s, or "Mickey" Galitzine established and headed the Eastern European Department at the Bank of New York until 1992 and hired many Russians. He mentored many new bankers in Hungary

Hungary is a landlocked country in Central Europe. Spanning much of the Pannonian Basin, Carpathian Basin, it is bordered by Slovakia to the north, Ukraine to the northeast, Romania to the east and southeast, Serbia to the south, Croatia and ...

, the former East Germany

East Germany, officially known as the German Democratic Republic (GDR), was a country in Central Europe from Foundation of East Germany, its formation on 7 October 1949 until German reunification, its reunification with West Germany (FRG) on ...

, Poland

Poland, officially the Republic of Poland, is a country in Central Europe. It extends from the Baltic Sea in the north to the Sudetes and Carpathian Mountains in the south, bordered by Lithuania and Russia to the northeast, Belarus and Ukrai ...

, Romania

Romania is a country located at the crossroads of Central Europe, Central, Eastern Europe, Eastern and Southeast Europe. It borders Ukraine to the north and east, Hungary to the west, Serbia to the southwest, Bulgaria to the south, Moldova to ...

, and Bulgaria

Bulgaria, officially the Republic of Bulgaria, is a country in Southeast Europe. It is situated on the eastern portion of the Balkans directly south of the Danube river and west of the Black Sea. Bulgaria is bordered by Greece and Turkey t ...

and travelled extensively to capital cities in the former Soviet Union or the CIS to assist new bankers especially in Russia

Russia, or the Russian Federation, is a country spanning Eastern Europe and North Asia. It is the list of countries and dependencies by area, largest country in the world, and extends across Time in Russia, eleven time zones, sharing Borders ...

to where he travelled for his first time in 1990, Ukraine

Ukraine is a country in Eastern Europe. It is the List of European countries by area, second-largest country in Europe after Russia, which Russia–Ukraine border, borders it to the east and northeast. Ukraine also borders Belarus to the nor ...

, Latvia

Latvia, officially the Republic of Latvia, is a country in the Baltic region of Northern Europe. It is one of the three Baltic states, along with Estonia to the north and Lithuania to the south. It borders Russia to the east and Belarus to t ...

, Georgia, Armenia

Armenia, officially the Republic of Armenia, is a landlocked country in the Armenian Highlands of West Asia. It is a part of the Caucasus region and is bordered by Turkey to the west, Georgia (country), Georgia to the north and Azerbaijan to ...

, Turkmenistan, and Kazakhstan

Kazakhstan, officially the Republic of Kazakhstan, is a landlocked country primarily in Central Asia, with a European Kazakhstan, small portion in Eastern Europe. It borders Russia to the Kazakhstan–Russia border, north and west, China to th ...

. Bank of New York had correspondent accounts for several Russian banks including Inkombank (), Menatep (), Tokobank (), Tveruniversalbank (), Alfa-Bank (), (), Moscow International Bank () and others.

In October 2002, Bank of New York entered into an alliance with ING to gain a stronger footing in Eastern European markets.

In 2003, Bank of New York acquired Pershing LLC, the stock clearing unit of Credit Suisse First Boston for $2 billion. The Pershing acquisition made BNY the nation’s largest clearing firm for stock trades. EMAT and the wealth management firm Lockwood Financial Partners, which was originally formed as Lockwood Advisors in 1995 and was based in Malvern, Pennsylvania, specialised in providing independent financial investment advisory services to brokers of high-net-worth individuals; it went on to become one of the largest independent advisory companies in the United States before both firms were sold to the Bank of New York in 2002, while Gerald L Hassell was president of Bank of New York. Lockwood and Pershing LLC were folded into the BNY Securities Group under the Pershing umbrella in October 2003, with Joseph M. Velli heading the BNY Securities Group. It allowed Bank of New York to compete against U.S. Trust, J.P. Morgan Chase, as well as those more brokerage-oriented organizations for private banking clients.

In 2005, the bank paid a $14 million settlement to the Russian government concerning the money laundering activities of a rogue employee in the 1990s. This scandal has been sometimes called Russiagate.

In 2006, the Bank of New York traded its retail banking and regional middle-market businesses for J.P. Morgan Chase's corporate trust assets. The deal signaled the bank's exit from retail banking.

Mellon Financial

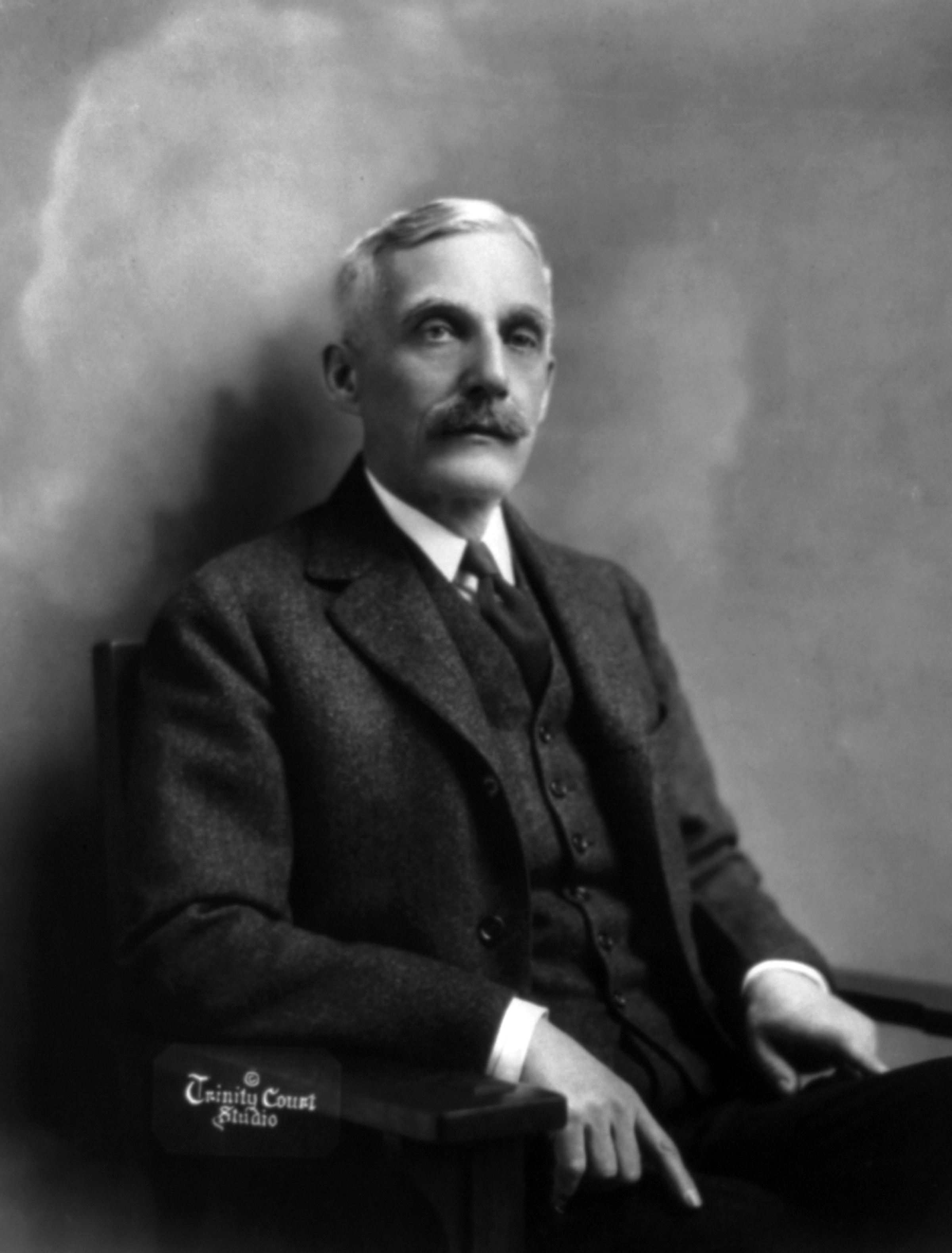

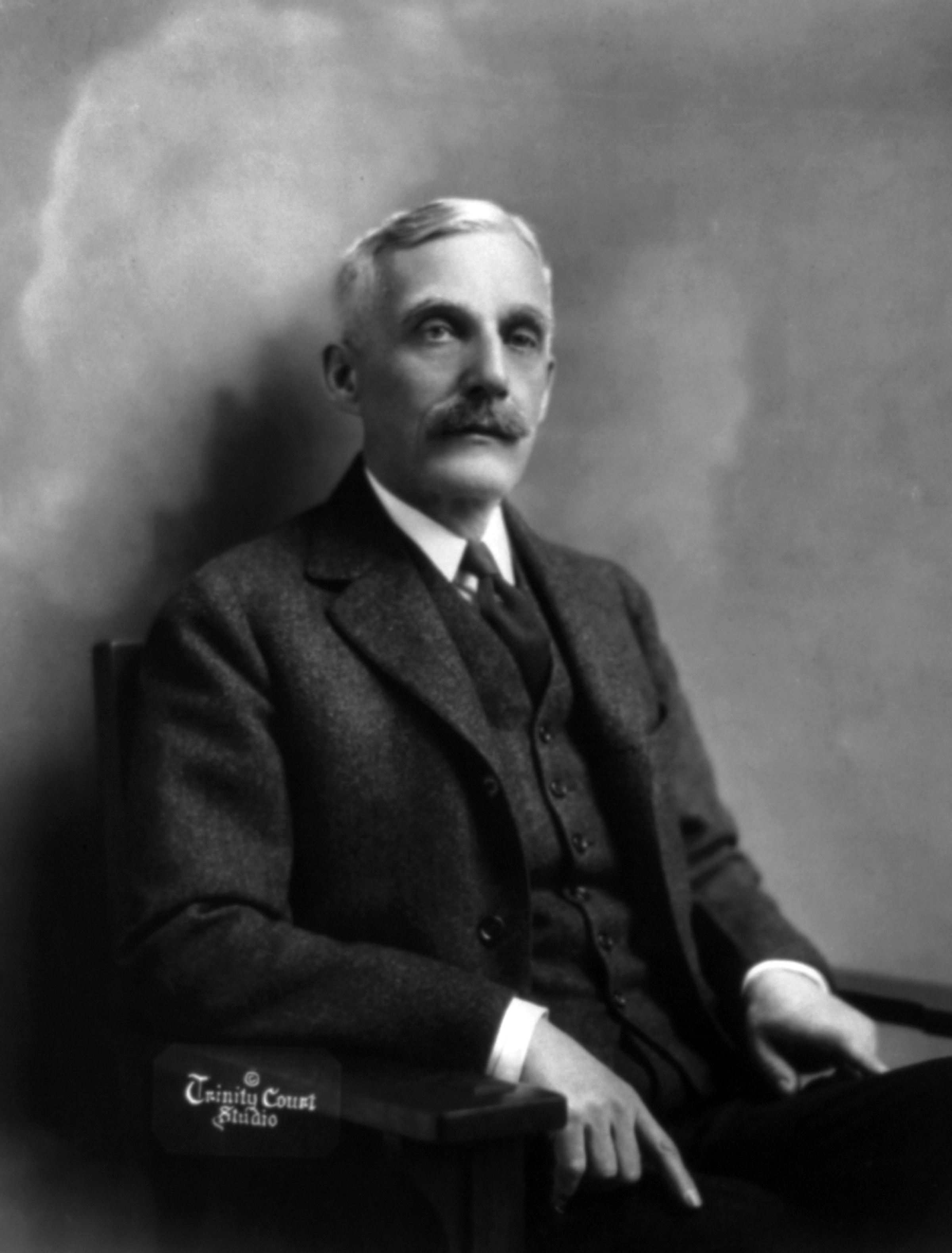

Mellon Financial was founded as T. Mellon & Sons' Bank in

Mellon Financial was founded as T. Mellon & Sons' Bank in Pittsburgh

Pittsburgh ( ) is a city in Allegheny County, Pennsylvania, United States, and its county seat. It is the List of municipalities in Pennsylvania#Municipalities, second-most populous city in Pennsylvania (after Philadelphia) and the List of Un ...

, Pennsylvania, in 1869 by retired judge Thomas Mellon and his sons Andrew W. Mellon and Richard B. Mellon. The bank invested in and helped found numerous industrial firms in the late 1800s and early 1900s including Alcoa, Westinghouse, Gulf Oil, General Motors

General Motors Company (GM) is an American Multinational corporation, multinational Automotive industry, automotive manufacturing company headquartered in Detroit, Michigan, United States. The company is most known for owning and manufacturing f ...

and Bethlehem Steel. Both Gulf Oil and Alcoa are, according to the financial media, considered to be T. Mellon & Sons' most successful financial investments.

In 1902, T. Mellon & Sons' name was changed to the Mellon National Bank. In 1946, the firm merged with the Union Trust Company, a business founded by Andrew Mellon in 1899, and other affiliated financial firms. The newly formed organization was named the Mellon National Bank and Trust Company, and was Pittsburgh's first US$1 billion bank.

The bank formed the first dedicated family office in the United States in 1971. A reorganization in 1972 led to the bank's name changing to Mellon Bank, N.A. and the formation of a holding company, Mellon National Corporation.

Mellon Bank acquired multiple banks and financial institutions in Pennsylvania during the 1980s and 1990s. In 1992, Mellon acquired 54 branch offices of Philadelphia Savings Fund Society, the first savings bank in the United States, founded in 1819.

In 1993, Mellon acquired The Boston Company from American Express and AFCO Credit Corporation from The Continental Corporation. The following year, Mellon merged with the Dreyfus Corporation, bringing its mutual funds under its umbrella. In 1999, Mellon Bank Corporation became Mellon Financial Corporation. Two years later, it exited the retail banking business by selling its assets and retail bank branches to Citizens Financial Group.

Merger

On December 4, 2006, the Bank of New York and Mellon Financial Corporation announced they would merge. The merger created the world's largest securities servicing company and one of the largest asset management firms by combining Mellon's wealth-management business and the Bank of New York's asset-servicing and short-term-lending specialties. The companies anticipated saving about $700 million in costs and cutting around 3,900 jobs, mostly by attrition. The deal was valued at $16.5 billion and under its terms, the Bank of New York's shareholders received 0.9434 shares in the new company for each share of the Bank of New York that they owned, while Mellon Financial shareholders received 1 share in the new company for each Mellon share they owned. The Bank of New York and Mellon Financial entered into mutual stock option agreements for 19.9 percent of the issuer's outstanding common stock. The merger was finalized on July 1, 2007. The company's principal office of business was located at the One Wall Street office previously held by the Bank of New York. The full name of the company became The Bank of New York Mellon Corp., with the BNY Mellon brand name being used for most lines of business.Post-merger history

Troubled Asset Relief Program

The Troubled Asset Relief Program (TARP) is a program of the United States government to purchase toxic assets and equity from financial institutions to strengthen its financial sector that was passed by Congress and signed into law by U.S. Presi ...

(TARP) bailout fund during the 2008 financial crisis. BNY Mellon won the assignment, which included handling accounting and record-keeping for the program, through a bidding process. In November 2008, the company announced that it would lay-off 1,800 employees, or 4% of its global workforce, due to the 2008 financial crisis. According to the results of a February 2009 stress test conducted by federal regulators, BNY Mellon was one of only three banks that could withstand a worsening economic situation. The company received $3 billion from TARP, which it paid back in full in June 2009, along with US$136 million to buy back warrants from the Treasury in August 2009.

In August 2009, BNY Mellon purchased Insight Investment, a management business, from Lloyds Banking Group. The company acquired PNC Financial Services' Global Investment Servicing Inc. in July 2010 and Talon Asset Management's wealth management business in 2011.

By 2013, the company's capital had steadily recovered from the 2008 financial crisis. In the results of the Federal Reserve's Dodd-Frank stress test in 2013, the bank was least affected by hypothetical extreme economic scenarios among banks tested. It was also a top performer on the same test in 2014.

BNY Mellon began a marketing campaign in 2013 to increase awareness of the company that included a new slogan and logo.

In 2013, the bank started building a new IT system called NEXEN. NEXEN uses open source technology and includes components such as an API store, data analytics, and a cloud computing environment.

In May 2014, BNY Mellon moved its global headquarters from 1 Wall Street to Brookfield Place, following the sale of the former building. In June 2014, the company combined its global markets, global collateral services and prime services to create the new Markets Group, also known as BNY Markets Mellon. The company expanded its Hong Kong

Hong Kong)., Legally Hong Kong, China in international treaties and organizations. is a special administrative region of China. With 7.5 million residents in a territory, Hong Kong is the fourth most densely populated region in the wor ...

office in October 2014 as part of the company's plans to grow its wealth management business.

Between 2014 and 2016, BNY Mellon opened innovation centers focused on emerging technologies, big data, digital and cloud-based projects, with the first opening in Silicon Valley.

In September 2017, BNY Mellon announced that it agreed to sell CenterSquare Investment Management to its management team and the private equity firm Lovell Minnick Partners. The transaction is subject to standard regulatory approvals and is expected to be completed by the end of 2017.

In November 2017, BNY Mellon performed the United States banking industry's first real-time payment transaction using a system set up by The Clearing House. The transaction moved a nominal amount between accounts at BNY Mellon and U.S. Bancorp in three seconds, inaugurating the first new payment clearance and settlement system for the US in over 40 years.

In January 2018, BNY Mellon announced that it was again moving its headquarters location, less than four years after its prior move. The headquarters location was announced as 240 Greenwich Street, a renaming of the already BNY Mellon-owned 101 Barclay Street office building in Tribeca, New York City

New York, often called New York City (NYC), is the most populous city in the United States, located at the southern tip of New York State on one of the world's largest natural harbors. The city comprises five boroughs, each coextensive w ...

. BNY Mellon had owned the office building for over 30 years, with control of the location obtained via 99-year ground lease. The same year, the company purchased the location from the city for $352 million.

In February 2020, Mellon announced that it has successfully onboarded Liontrust Asset Management to its new Investment Operations platform.

In early 2023, BNY Mellon’s Pershing unit announced the addition of real-time payments to its investor portal. In June 2023, BNY Mellon's Pershing X launched wealth management platform Wove. In July 2023, BNY Mellon became an early adopter of Federal Reserve’s instant payment rail, FedNow. That same year, BNY made history by selecting minority-, veteran-, and woman-owned firms as bookrunners for a $500 million debt offering. Additionally, the company increased its minimum wage for U.S.-based employees by 12.5%, raising the hourly rate from $20.00 to $22.50, and expanded its mental health resources.

In June 2024, BNY Mellon announced an update to its logo and a simplification of its corporate brand to BNY. As part of this rebranding, BNY Mellon Investment Management was renamed BNY Investments, BNY Mellon Wealth Management became BNY Wealth, and BNY Mellon Pershing was shortened to BNY Pershing.

Operations

BNY offers technology, services and expertise across its platforms to support clients on a global scale, helping them create, administer, manage, transact, distribute and optimize their assets. BNY’s businesses include BNY Investments, BNY Wealth and BNY Pershing. BNY operates in 35 countries in theAmericas

The Americas, sometimes collectively called America, are a landmass comprising the totality of North America and South America.''Webster's New World College Dictionary'', 2010 by Wiley Publishing, Inc., Cleveland, Ohio. When viewed as a sing ...

, Europe, the Middle East and Africa (EMEA), and Asia-Pacific. The company employed 53,400 people . In October 2015, the group's American and global headquarters relocated to 225 Liberty Street, as the former 1 Wall Street building was sold in 2014. In July 2018, the company changed its headquarters again, this time to its existing 240 Greenwich Street location in New York (previously addressed 101 Barclay St). The group's EMEA headquarters are located in London and its Asia-Pacific headquarters are located in Hong Kong

Hong Kong)., Legally Hong Kong, China in international treaties and organizations. is a special administrative region of China. With 7.5 million residents in a territory, Hong Kong is the fourth most densely populated region in the wor ...

.

Business

BNY is an international financial services company that helps clients manage, move and safekeep their assets across the entire financial lifecycle. Today BNY helps over 90% of Fortune 100 companies and nearly all the top 100 banks globally access the money they need. BNY also supports governments in funding local projects and works with over 90% of the top 100 pension plans to safeguard assets for individuals. BNY had $45.7 trillion in assets under custody and $1.8 trillion in assets under management as of September 2023. Those figures rose to $49.5 trillion in assets under custody and/or $2.0 trillion in assets under management by June 2024. Thefinancial services

Financial services are service (economics), economic services tied to finance provided by financial institutions. Financial services encompass a broad range of tertiary sector of the economy, service sector activities, especially as concerns finan ...

offered by the business include asset servicing, alternative investment services, broker-dealer services, corporate trust services and treasury services. Other offerings include global collateral services, foreign exchange, securities lending, middle and back office outsourcing, and depository receipts. The bank's clients include a significant portion of Fortune 500 companies, top endowments, pension and employee benefit funds, life and health insurance companies, and leading universities.

In 2014, the company established the Markets Group, providing services in collateral management, securities finance, foreign exchange and capital markets. This group is now known as BNY Markets.

BNY Investments

BNY Investments is an asset management group that manages nearly $2 trillion in assets. It provides investment solutions through its specialist firms, which include ARX Investimentos, Dreyfus, Insight Investment, Mellon Investments Corporation, Newton Investment Management, Siguler Guff & Company, and Walter Scott & Partners. Each firm operates with its distinct approach to investment management across various asset classes.BNY Pershing

BNY Pershing provides clearing and custody, trading and settlement services, a variety of investment solutions, middle and back office support, data insights and business consulting to clients in the wealth and institutional segments.BNY Wealth

BNY’s Wealth business handles the private banking, estate planning, family office services, and investment servicing and management of high-net-worth individuals and families. Starting in 2013, the unit began expansion efforts, including opening eight new banking offices, increasing salespeople, bankers, and portfolio managers on staff, and launching an awareness campaign for wealth management services through television ads. As of 2014, it ranks 7th among wealth management businesses in the United States.Leadership

Charles W. Scharf was appointed CEO in July 2017 and became Chairman after former CEO and chairman Gerald Hassell retired at the end of 2017. Hassell had been Chairman and CEO since 2011, after serving as BNY Mellon's president from 2007 to 2012 and as the president of the Bank of New York from 1998 until its merger. Scharf stepped down in 2019 to become the new CEO of Wells Fargo. Thomas "Todd" Gibbons served as BNY Mellon's CEO from 2020 to 2022. Robin A. Vince was appointed president and CEO in August 2022, succeeding Gibbons. Upon his appointment, Robin Vince also became a member of the company’s board of directors. Karen Peetz served as president (the bank's first female president) from 2013 to 2016, when she retired; the company did not appoint a new president when she retired. Thomas Gibbons served as CFO between 2008 and 2017, when he also served as vice chairman. In 2017, Gibbons was replaced as CFO by Michael P. Santomassimo. BNY Mellon's Investment Management business is run by CEO Mitchell Harris, and the company's Investment Services business was led by Brian Shea until his retirement in December 2017. In 2020, Hanneke Smits became CEO of BNY Mellon Investment Management. In July 2024, BNY announced that Hanneke Smits would retire at the end of 2024, with Jose Minaya to become the next head of BNY Investments and BNY Wealth. As of 2024, the company's board members were Linda Z. Cook, Joseph J. Echevarria, M. Amy Gilliland, Jeffrey A. Goldstein, K. Guru Gowrappan, Ralph Izzo, Sandie O’Connor, Elizabeth E. Robinson, Robin Vince, and Alfred W. “Al” Zollar.Company culture

In 2008, BNY Mellon formed a Board of Directors corporate social responsibility committee to set sustainability goals. The company's corporate social responsibility activities include philanthropy, social finance in the communities the bank is located in, and protecting financial markets globally. The bank's philanthropic activities include financial donations and volunteerism. The company matches employee volunteer hours and donations with financial contributions through its Giving at BNY program. Between 2010 and 2012, the company and its employees donated approximately $100 million to charity. In 2014, the company worked with theForbes

''Forbes'' () is an American business magazine founded by B. C. Forbes in 1917. It has been owned by the Hong Kong–based investment group Integrated Whale Media Investments since 2014. Its chairman and editor-in-chief is Steve Forbes. The co ...

Fund to create a platform that connects nonprofit organization

A nonprofit organization (NPO), also known as a nonbusiness entity, nonprofit institution, not-for-profit organization, or simply a nonprofit, is a non-governmental (private) legal entity organized and operated for a collective, public, or so ...

s with private businesses to solve social challenges.

The CDP, which measures corporate greenhouse gas emissions and disclosures, gave the company A ratings between 2013 and 2021. As of 2014, the company has saved $48 million due to building efficiency; five of its buildings have achieved Leadership in Energy and Environmental Design (LEED-EB) certification and 23 have interiors that are LEED certified.

The company has business resource groups for employees that are focused on diversity and inclusion. In 2009, Karen Peetz co-founded the BNY Mellon Women's Initiative Network (WIN), a resource group for female employees' professional development. As of 2013, WIN had 50 chapters. Other groups include PRISM for LGBT employees, IMPACT, which serves multicultural employees, HEART for employees with disabilities, GENEDGE, intergenerational resource group, and VETNET for veterans, military spouses, family members and their colleagues. The bank has services for returning military, including a tool to help veterans align military skills and training with jobs at the company. In 2014, it was recognized for its diversity practices by the National Business Inclusion Consortium, which named it Financial Services Diversity Corporation of the Year.

In 2009, the company began an innovation program for employees to suggest ideas for large-scale projects and company improvement. Ideas from the initial pilot program generated approximately $165 million in pretax profit. The program results in an annual contest called "ACE" in which teams pitch their ideas.

In 2022, BNY Mellon released ''The Pathway to Inclusive Investment'', a report focused on the gender-investment gap. The research surveyed 8,000 respondents across 16 markets globally with combined assets of $60T. The report identified barriers to investment and ways that the industry could overcome them, indicating that if were women to invest at the same rate as men, this would unlock an estimated $3.2T of additional capital.

In 2023, BNY hired Meaghan Muldoon, the firm’s first Chief Sustainability Officer.

As of 2024, BNY has been included in the Dow Jones Sustainability Indices, recognized by the Human Rights Campaign Foundation’s Corporate Equality Index, and listed on the FTSE4Good Global Benchmark Index, Bloomberg

Bloomberg may refer to:

People

* Daniel J. Bloomberg (1905–1984), audio engineer

* Georgina Bloomberg (born 1983), professional equestrian

* Michael Bloomberg (born 1942), American businessman and founder of Bloomberg L.P.; politician a ...

’s Gender-Equality Index, and the JUST Capital's JUST 100 list.

Controversies and legal issues

Foreign currency exchange issues

In October 2011, the U.S. Justice Department and New York's attorney general filed civil lawsuits against the Bank of New York, alleging foreign currency fraud. The suits held that the bank deceived pension-fund clients by manipulating the prices assigned to them for foreign currency transactions. Allegedly, the bank selected the day's lowest rates for currency sales and highest rates for purchases, appropriating the difference as corporate profit. The scheme was said to have generated $2 billion for the bank, at the expense of millions of Americans' retirement funds, and to have transpired over more than a decade. Purportedly, the bank would offer secret pricing deals to clients who raised concerns, in order to avoid discovery. Bank of New York defended itself vigorously, maintaining the fraud accusations were "flat out wrong" and warning that as the bank employed 8,700 employees in New York, any damage to the bank would have negative repercussions for the state of New York. Finally, in March 2015, the company admitted to facts concerning the misrepresentation of foreign exchange pricing and execution. BNY Mellon's alleged misconduct in this area includes representing pricing as best rates to its clients, when in fact they were providing clients with bad prices while retaining larger margins. In addition to dismissing key executives, the company agreed to pay a total of US$714 million to settle related lawsuits. In May 2015, BNY Mellon agreed to pay $180 million to settle a foreign exchange-related lawsuit. In May 2016, multiple plaintiffs filed suit against the bank, alleging that the company had breached its fiduciary duty to ERISA plans that held American Depositary Receipts by overcharging retirement plans that invested in foreign securities. In March 2017, the presiding judge declined to dismiss the suit. In December 2017, another lawsuit alleged that BNY Mellon manipulated foreign exchange rates was filed by Sheet Metal Workers' National Pension Fund. BNY Mellon agreed to pay $12.5 million to settle the 2016 lawsuit in December 2018.Personal data breach

In February 2008, BNY Mellon suffered a security breach resulting in the loss of personal information when backup tapes containing the personal records of 4.5 million individuals went missing. Social security numbers and bank account information were included in the records. The breach was not reported to the authorities until May 2008, and letters were sent to those affects on May 22, 2008. In August 2008, the number of affected individuals was raised to 12.5 million, 8 million more than originally thought.IT system outages

On Saturday, August 22, 2015, BNY Mellon's SunGard accounting system broke down during a software change. This led to the bank being unable to calculate net asset value (NAV) for 1,200 mutual funds via automated computer system. Between the breakdown and the eventual fix, the bank calculated the values using alternative means, such as manual operation staff. By Wednesday, August 26, the system was still not fully operational. The system was finally operational to regular capacity the following week. As a result of a Massachusetts Securities Division investigation into the company's failure and lack of a backup plan, the company paid $3 million. In December 2016, another major technology issue caused BNY Mellon to be unable to process payments related to the SWIFT network. As of the time of the issue, the bank processed about 160,000 global payments daily, an average of $1.6 trillion. The company was unable to process payments for a 19 hours, which led to a backlog of payments and an extension of Fedwire payment services.Privately owned public space agreement violation

According to a New York City Comptroller audit in April 2017, BNY Mellon was in violation of a privately owned public space (POPS) agreement for at least 15 years. In constructing the 101 Barclay Street building inLower Manhattan

Lower Manhattan, also known as Downtown Manhattan or Downtown New York City, is the southernmost part of the Boroughs of New York City, New York City borough of Manhattan. The neighborhood is History of New York City, the historical birthplace o ...

, BNY Mellon had received a permit allowing modification of height and setback regulations in exchange for providing a lobby accessible to the general public 24 hours a day. Auditors and members of the public had been unable to access or assess the lobby for many years, and were actively prevented from doing so by BNY Mellon security.

In September 2018, the company began to permit public access to a portion of the lobby. However, BNY Mellon remains in violation of its agreement, as the lobby must be accessible to the public 24 hours a day. As of early 2021 the city Comptroller reported that company security personnel prevented auditors from entering or photographing the lobby and was seeking to have the "public lobby" designation removed.

Employment legal issues

BNY Mellon settled foreign bribery charges with the U.S. Securities and Exchange Commission (SEC) in August 2015 regarding its practice of providing internships to relatives of officials at a Middle Eastern investment fund. The U.S. SEC found the firm in violation of the Foreign Corrupt Practices Act. The case was settled for $14.8 million. In March 2019, BNY Mellon staff considered legal options after the company banned employees from working from home. In particular, staff cited concerns regarding the impact on childcare, mental health, and diversity. The company reverted the ban as a result of employee outcry.Other legal issues

In September 2009, BNY Mellon settled a lawsuit that had been filed against the Bank of New York by the Russian government in May 2007 for money laundering; the original suit claimed $22.5 billion in damages and was settled for $14 million. In 2011,South Carolina

South Carolina ( ) is a U.S. state, state in the Southeastern United States, Southeastern region of the United States. It borders North Carolina to the north and northeast, the Atlantic Ocean to the southeast, and Georgia (U.S. state), Georg ...

sued BNY Mellon for allegedly failing to adhere to the investment guidelines relating to the state's pension fund. The company settled with the state in June 2013 for $34 million.

In July 2012, BNY Mellon settled a class action lawsuit relating to the collapse of Sigma Finance Corp. The suit alleged that the bank invested and lost cash collateral in medium-term notes. The company settled the lawsuit for $280 million.

In December 2018, BNY Mellon agreed to pay nearly $54 million to settle charges of improper handling of "pre-released" American depositary receipt, American depositary receipts (ADRs) under investigation of the U.S. Securities and Exchange Commission, U.S. Securities and Exchange Commission (SEC). BNY Mellon did not admit or deny the investigation findings but agreed to pay disgorgement of more than $29.3 million, $4.2 million in prejudgment interest and a penalty of $20.5 million.

Recognition and rankings

As of 2024, BNY is the world's largest custody bank, the sixth-largest investment management firm in the world, and the seventh-largest wealth management firm in the United States. In 2018, BNY ranked 175 on the ''Fortune'' 500 and 250 on the Financial Times Global 500. By 2024, it ranked 130th on the ''Fortune'' 500 list. It was named one of world's 50 Safest Banks by ''Global Finance (magazine), Global Finance'' in 2013 and 2014, and one of the 20 Most Valuable Banking Brands in 2014 by ''The Banker''. BNY was named on the Dow Jones Sustainability Index, Dow Jones Sustainability North America Index in 2013, 2014 and 2015, and the World Index in 2014, 2015 and 2016. BNY has also been named among the World's Most Admired Companies by ''Fortune''. The bank claims to be the longest-running bank in the United States, though this distinction is sometimes disputed by rivals and historians. The Bank of North America, chartered in 1781, was eventually acquired by Wells Fargo after a series of mergers. Similarly, The Massachusetts Bank became part of Bank of America through a series of acquisitions. The Bank of New York remained independent, acquiring other companies, until its merger with Mellon. BNY is generally recognized as one of the three oldest banks in the U.S.Sponsorships

Since 2012, BNY has expanded its number of sponsorships. BNY was the title sponsor of the Oxford University Boat Club, Oxford and Cambridge University Boat Club, Cambridge Boat Race from 2012 to 2015. The company also sponsors the Head of the Charles Regatta in Boston. In 2013, the company became a 10-year sponsor of the San Francisco 49ers and a founding partner of Levi's Stadium. The company is a regular sponsor of the Royal Academy of Arts in London, the Pittsburgh Symphony Orchestra, and is a founding sponsor of the Perelman Performing Arts Center (PAC) in Lower Manhattan.See also

* List of presidents of the Bank of New York * 1 Wall Street * BNY Mellon Center (disambiguation) * CIBC Mellon * Eagle Investment SystemsNotes

References

Books

* *External links

* {{DEFAULTSORT:Bank Of New York Mellon BNY Mellon, Alexander Hamilton Companies listed on the New York Stock Exchange 2007 establishments in New York City Banks based in New York City Systemically important financial institutions Companies based in Manhattan American companies established in 2007 Banks established in 2007 Multinational companies based in New York City Publicly traded companies based in New York City Asset management companies 2007 mergers and acquisitions