Reagan Recession on:

[Wikipedia]

[Google]

[Amazon]

The early 1980s recession was a severe economic recession that affected much of the world between approximately the start of 1980 and 1983. It is widely considered to have been the most severe recession since World War II. A key event leading to the recession was the

Like Canada, the early 1980s recession in the United States technically consisted of two separate downturns, one commencing in January 1980 which yielded to modest growth in July 1980 with a deeper downturn from July 1981 to November 1982. Paul Krugman

Like Canada, the early 1980s recession in the United States technically consisted of two separate downturns, one commencing in January 1980 which yielded to modest growth in July 1980 with a deeper downturn from July 1981 to November 1982. Paul Krugman

"Did the Federal Reserve Cause the Recession?"

''The New York Times'', April 1, 1991; One cause was the Federal Reserve's contractionary monetary policy, which sought to rein in the high inflation. In the wake of the

Unemployment had risen from 5.1% in January 1974 to a high of 9.0% in May 1975. Although it had gradually declined to 5.6% by May 1979, unemployment began rising again. It jumped sharply to 6.9% in April 1980 and to 7.5% in May 1980. A mild recession from January to July 1980 kept unemployment high, but despite economic recovery, it remained at historically high levels (about 7.5%) until the end of 1981.Table 34, U.S. Federal Reserve Board, ''Monetary Policy Report to the Congress'', February 14, 2007. In mid-1982,

Unemployment had risen from 5.1% in January 1974 to a high of 9.0% in May 1975. Although it had gradually declined to 5.6% by May 1979, unemployment began rising again. It jumped sharply to 6.9% in April 1980 and to 7.5% in May 1980. A mild recession from January to July 1980 kept unemployment high, but despite economic recovery, it remained at historically high levels (about 7.5%) until the end of 1981.Table 34, U.S. Federal Reserve Board, ''Monetary Policy Report to the Congress'', February 14, 2007. In mid-1982,

"Rockford Unemployment: better off now or in the 1980s?"

/ref> In September 1982, Michigan led the nation with 14.5%, Alabama was second with 14.3%, and West Virginia was third with 14.0%. The Youngstown–Warren Metropolitan Area had an 18.7% rate, the highest of all metro areas, and

Federal Reserve Bank of St. Louis Determined to wring inflation out of the economy, Federal Reserve chairman Paul Volcker slowed the rate of growth of the money supply and raised

''History of the Eighties: Lessons for the Future''

Vol. 1. Division of Research and Statistics, December 1997. Banks rushed into real estate lending, speculative lending, and other ventures as the economy soured. By mid-1982, the number of bank failures was rising steadily. Bank failures reached 42, the highest since the depression, as both the recession and high interest rates took their toll. By the end of the year, the Federal Deposit Insurance Corporation (FDIC) had spent $870 million to purchase bad loans in an effort to keep various banks afloat.

In July 1982, the US Congress enacted the Garn–St. Germain Depository Institutions Act of 1982, which further deregulated banks and deregulated savings and loans. The Act authorized banks to begin offering

By mid-1982, the number of bank failures was rising steadily. Bank failures reached 42, the highest since the depression, as both the recession and high interest rates took their toll. By the end of the year, the Federal Deposit Insurance Corporation (FDIC) had spent $870 million to purchase bad loans in an effort to keep various banks afloat.

In July 1982, the US Congress enacted the Garn–St. Germain Depository Institutions Act of 1982, which further deregulated banks and deregulated savings and loans. The Act authorized banks to begin offering

Congressional deregulation exacerbated the S&L crisis. The Economic Recovery Tax Act of 1981 led to a boom in commercial real estate. The passage of the Depository Institutions Deregulation and Monetary Control Act and the Garn–St. Germain Act expanded the authority of federally chartered S&Ls to make acquisition, development, and construction real estate loans, and the statutory limit on loan-to-value ratios was eliminated. The changes allowed S&Ls to make high-risk loans to developers. Beginning in 1982, many S&Ls rapidly shifted away from traditional home mortgage financing and into new, high-risk investment activities like casinos, fast-food franchises, ski resorts, junk bonds,

Congressional deregulation exacerbated the S&L crisis. The Economic Recovery Tax Act of 1981 led to a boom in commercial real estate. The passage of the Depository Institutions Deregulation and Monetary Control Act and the Garn–St. Germain Act expanded the authority of federally chartered S&Ls to make acquisition, development, and construction real estate loans, and the statutory limit on loan-to-value ratios was eliminated. The changes allowed S&Ls to make high-risk loans to developers. Beginning in 1982, many S&Ls rapidly shifted away from traditional home mortgage financing and into new, high-risk investment activities like casinos, fast-food franchises, ski resorts, junk bonds,

"Origin and Causes of the S&L Debacle: A Blueprint for Reform: A Report to the President and Congress of the United States"

Washington, D.C.: U.S. Government Printing Office, 1993. As the risk exposure of S&Ls expanded, the economy slid into the recession. Soon, hundreds of S&Ls were insolvent. Between 1980 and 1983, 118 S&Ls with $43 billion in assets failed. The Federal Savings and Loan Insurance Corporation, the federal agency which insured the deposits of S&Ls, spent $3.5 billion to make depositors whole again (in comparison, only 143 S&Ls with $4.5 billion in assets had failed in the previous 45 years, costing the FSLIC $306 million). The FSLIC pushed mergers as a way to avoid insolvency. From 1980 to 1982, there were 493 voluntary mergers and 259 forced mergers of savings and loans overseen by the agency. Despite the failures and mergers, there were still 415 S&Ls at the end of 1982 that were insolvent. Federal action initially caused the problem by allowing institutions to get involved in creating wealth by unhealthy fractional reserve practices, lending out much more money than they could ever afford to pay back out to customers if they came to withdraw their money. That ultimately led to S&Ls' failure. Later, the government's inaction worsened the industry's problems. Responsibility for handling the S&L crisis lay with the

The recession was nearly a year old before President

The recession was nearly a year old before President

The midterm elections were the low point of Reagan's presidency.

According to

The midterm elections were the low point of Reagan's presidency.

According to

As with most of the rest of the developed world, recession hit the United Kingdom at the beginning of the 1980s. That followed a string of crises that had plagued the British economy for most of the 1970s. Consequently, unemployment had gradually increased since the mid-1960s.

When the Conservative Party, led by Margaret Thatcher won the general election of May 1979, and swept

As with most of the rest of the developed world, recession hit the United Kingdom at the beginning of the 1980s. That followed a string of crises that had plagued the British economy for most of the 1970s. Consequently, unemployment had gradually increased since the mid-1960s.

When the Conservative Party, led by Margaret Thatcher won the general election of May 1979, and swept

''Issues in Economics Today''

New York: McGraw Hill Professional, 2004. * *

Accessed May 5, 2007. {{DEFAULTSORT:Early 1980s Recession Recessions 1982 elections in the United States 1981 in the United States 1982 in the United States 1980s economic history

1979 energy crisis

The 1979 oil crisis, also known as the 1979 Oil Shock or Second Oil Crisis, was an energy crisis caused by a drop in oil production in the wake of the Iranian Revolution. Although the global oil supply only decreased by approximately four per ...

, mostly caused by the Iranian Revolution

The Iranian Revolution ( fa, انقلاب ایران, Enqelâb-e Irân, ), also known as the Islamic Revolution ( fa, انقلاب اسلامی, Enqelâb-e Eslâmī), was a series of events that culminated in the overthrow of the Pahlavi dynas ...

which caused a disruption to the global oil supply, which saw oil prices rising sharply in 1979 and early 1980. The sharp rise in oil prices pushed the already high rates of inflation in several major advanced countries to new double-digit highs, with countries such as the United States, Canada, West Germany, Italy, the United Kingdom and Japan

Japan ( ja, 日本, or , and formally , ''Nihonkoku'') is an island country in East Asia. It is situated in the northwest Pacific Ocean, and is bordered on the west by the Sea of Japan, while extending from the Sea of Okhotsk in the north ...

tightening their monetary policies by increasing interest rates in order to control the inflation. These G7 countries each, in fact, had "double-dip

Double dip or double dipping may refer to:

Food

* , biting a chip and then re-dipping it into a dip

* Double Dip (confectionery), flavored powders with an edible stick to dip into them

* Originally it means taking twice the portion of everyone e ...

" recessions involving short declines in economic output in parts of 1980 followed by a short period of expansion, in turn, followed by a steeper, longer period of economic contraction starting sometime in 1981 and ending in the last half of 1982 or in early 1983. Most of these countries experienced stagflation, a situation of both high inflation rates and high unemployment rates.

Globally, while some countries experienced downturns in economic output in 1980 and/or 1981, the broadest and sharpest worldwide decline of economic activity and the largest increase in unemployment was in 1982, with the World Bank naming the recession the "global recession of 1982". Even after major economies, such as the United States and Japan exited the recession relatively early, many countries were in recession into 1983 and high unemployment would continue to affect most OECD nations until at least 1985. Long-term effects of the early 1980s recession contributed to the Latin American debt crisis

The Latin American debt crisis ( es, Crisis de la deuda latinoamericana; pt, Crise da dívida latino-americana) was a financial crisis that originated in the early 1980s (and for some countries starting in the 1970s), often known as ''La Décad ...

, long-lasting slowdowns in the Caribbean and Sub-Saharan African countries, the US savings and loans crisis, and a general adoption of neoliberal

Neoliberalism (also neo-liberalism) is a term used to signify the late 20th century political reappearance of 19th-century ideas associated with free-market capitalism after it fell into decline following the Second World War. A prominent fa ...

economic policies throughout the 1990s.

North America

Canada

The Canadian economy experienced overall weakness from the start of 1980 to the end of 1983, with low yearly real GDP growth rates of 2.1% and 2.6% in 1980 and 1983, respectively, and a steep 3.2% decline in real GDP for 1982., title=Canada GDP Growth Rate 1961-2020, url=https://www.macrotrends.net/countries/CAN/canada/gdp-growth-rate As with other G7 countries, Canada had two separate economic contractions in the early 1980s. These were a shallow drop in GDP and a slowing in employment growth for five months between February and June 1980, and a deeper 17-month contraction in both GDP and employment between July 1981 and October 1982,Bonham, Mark S., work=The Canadian Encyclopedia , title=Recession in Canada/ref> although both contractions were driven by the same desire of governments to reduce inflation by increasing interest rates.Cross, Philip, and Bergevin, Philippe Real Canadian GDP declined by 5% during the 17-month 1981-82 recession with the unemployment rate peaking at 12%. In-between the two downturns, Canada had 12 months of economic growth, with growth between October 1980 and June 1981 being relatively robust with the total GDP and employment in June 1981 actually surpassing their pre-recession peaks and 1981 having a yearly increase in real GDP of 3.5%. Canada had higher inflation, interest rates, and unemployment than the United States during the early 1980s recession. While inflation accelerated across North America in the late 1970s, it was higher in Canada because of the US decision to switch to afloating exchange rate

In macroeconomics and economic policy, a floating exchange rate (also known as a fluctuating or flexible exchange rate) is a type of exchange rate regime in which a currency's value is allowed to fluctuate in response to foreign exchange mar ...

, which lowered the value of the Canadian dollar to US$0.85 by 1979, which made US imports more expensive for Canadians to purchase. Canada's inflation rate was 10.2% for 1980 overall, rising to 12.5% for 1981 and 10.8% for 1982 before dropping to 5.8% for 1983.

To control its inflation, the US introduced credit controls producing a slump in demand for Canada's housing and auto industry exports in early 1980 thereby triggering the 1980 portion of the larger early 1980s recession in Canada. Most Canadians were also hit hard financially by a steady rise in oil and gas prices during the 1970s, especially their acceleration in 1979 when the worldwide oil supply was disrupted by the Iranian revolution, with the price of oil reaching almost $40 a barrel compared to $3 a barrel at the start of the decade.

The Bank of Canada

The Bank of Canada (BoC; french: Banque du Canada) is a Crown corporation and Canada's central bank. Chartered in 1934 under the ''Bank of Canada Act'', it is responsible for formulating Canada's monetary policy,OECD. OECD Economic Surveys: Ca ...

raised its prime interest rate throughout 1980 and early 1981 in an attempt to rein in inflation, with the deeper second portion of the early 1980s recession beginning in July 1981. The Bank of Canada's interest rate peaked at 21% in August 1981 and was kept at high levels until spring 1982, but the inflation rate still averaged more than 12% in 1981-82. Jobs were also lost to mechanization in industry and to workforce downsizing by many Canadian firms in order to stay efficient and compete internationally in the increasingly globalized economy Alberta, the prime location of Canada's oil industry at the time, experienced a boom in the late 1970s, 1980 and early 1981, with rapid employment growth, attaining, at 76%, the highest percentage of persons aged 15–64 being employed (defined as the "employment ratio") of all the provinces in early 1981.Kneeboen, Ronald, and Gres, Margarita By the start of 1982, however, Alberta's oil boom had ended due to over-expansion and the deep global recession of that year, which caused oil prices to plummet, with Alberta then suffering the steepest drop (7.2 percentage points) in its employment ratio of all the provinces by mid-1983. Yukon's mining industry was also particularly hard hit and more than 70,000 of 115,000 miners across the country were out of work by the end of 1982.

Canada's GDP increased markedly in November 1982 officially ending the recession, although employment growth did not resume until December 1982 before faltering again in 1983. The average unemployment rates for 1982 and 1983 averaged 11.1% and 12%, respectively, steep rises from 7.6% in 1981. A slowdown in productivity in Canada also emerged during the recession as average output per worker slowed by 1%. The lingering effects of the recession combined with mechanization and companies downsizing to complete internationally, kept Canada's unemployment rates above 10% until 1986. Despite this, Canada's GDP growth rate was among the highest of the OECD countries from 1984–86, although growth was by far strongest in Ontario and Quebec.

Liberal Prime Minister Pierre Trudeau

Joseph Philippe Pierre Yves Elliott Trudeau ( , ; October 18, 1919 – September 28, 2000), also referred to by his initials PET, was a Canadian lawyer and politician who served as the 15th prime minister of Canada

The prime mini ...

, who was in power from the start of the recession in early 1980, was very low in the public opinion polls in early 1984 and on February 29, 1984, decided to resign as Liberal Party leader. His successor as Prime Minister was John Turner, who, although leading in the opinion polls when he called an election for September, ended up being resoundingly defeated by the Progressive Conservatives under Brian Mulroney

Martin Brian Mulroney ( ; born March 20, 1939) is a Canadian lawyer, businessman, and politician who served as the 18th prime minister of Canada from 1984 to 1993.

Born in the eastern Quebec city of Baie-Comeau, Mulroney studied political sci ...

.

United States

Like Canada, the early 1980s recession in the United States technically consisted of two separate downturns, one commencing in January 1980 which yielded to modest growth in July 1980 with a deeper downturn from July 1981 to November 1982. Paul Krugman

Like Canada, the early 1980s recession in the United States technically consisted of two separate downturns, one commencing in January 1980 which yielded to modest growth in July 1980 with a deeper downturn from July 1981 to November 1982. Paul Krugman"Did the Federal Reserve Cause the Recession?"

''The New York Times'', April 1, 1991; One cause was the Federal Reserve's contractionary monetary policy, which sought to rein in the high inflation. In the wake of the

1973 oil crisis

The 1973 oil crisis or first oil crisis began in October 1973 when the members of the Organization of Arab Petroleum Exporting Countries (OAPEC), led by Saudi Arabia, proclaimed an oil embargo. The embargo was targeted at nations that had supp ...

and the 1979 energy crisis

The 1979 oil crisis, also known as the 1979 Oil Shock or Second Oil Crisis, was an energy crisis caused by a drop in oil production in the wake of the Iranian Revolution. Although the global oil supply only decreased by approximately four per ...

, stagflation began to afflict the economy.

Unemployment

Unemployment had risen from 5.1% in January 1974 to a high of 9.0% in May 1975. Although it had gradually declined to 5.6% by May 1979, unemployment began rising again. It jumped sharply to 6.9% in April 1980 and to 7.5% in May 1980. A mild recession from January to July 1980 kept unemployment high, but despite economic recovery, it remained at historically high levels (about 7.5%) until the end of 1981.Table 34, U.S. Federal Reserve Board, ''Monetary Policy Report to the Congress'', February 14, 2007. In mid-1982,

Unemployment had risen from 5.1% in January 1974 to a high of 9.0% in May 1975. Although it had gradually declined to 5.6% by May 1979, unemployment began rising again. It jumped sharply to 6.9% in April 1980 and to 7.5% in May 1980. A mild recession from January to July 1980 kept unemployment high, but despite economic recovery, it remained at historically high levels (about 7.5%) until the end of 1981.Table 34, U.S. Federal Reserve Board, ''Monetary Policy Report to the Congress'', February 14, 2007. In mid-1982, Rockford, Illinois

Rockford is a city in Winnebago County, Illinois, located in the far northern part of the state. Situated on the banks of the Rock River, Rockford is the county seat of Winnebago County (a small portion of the city is located in Ogle County). ...

, had the highest unemployment of all metro areas, at 25%.Ptashkin, Samantha"Rockford Unemployment: better off now or in the 1980s?"

/ref> In September 1982, Michigan led the nation with 14.5%, Alabama was second with 14.3%, and West Virginia was third with 14.0%. The Youngstown–Warren Metropolitan Area had an 18.7% rate, the highest of all metro areas, and

Stamford, Connecticut

Stamford () is a city in the U.S. state of Connecticut, outside of Manhattan. It is Connecticut's second-most populous city, behind Bridgeport. With a population of 135,470, Stamford passed Hartford and New Haven in population as of the 2020 ...

, had the lowest unemployment, at 3.5%.

The peak of the recession occurred in November and December 1982, when the nationwide unemployment rate was 10.8%, the highest since the Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagio ...

. In November, West Virginia and Michigan had the highest unemployment with 16.4%, Alabama was in third with 15.3%. South Dakota had the lowest unemployment rate in the nation, with 5.6%. Flint, Michigan

Flint is the largest city and seat of Genesee County, Michigan, United States. Located along the Flint River, northwest of Detroit, it is a principal city within the region known as Mid Michigan. At the 2020 census, Flint had a population of 8 ...

, had the highest unemployment rate of all metro areas, with 23.4%. In March 1983, West Virginia's unemployment rate hit 20.1%. In spring 1983, thirty states had double-digit unemployment. When Reagan was re-elected in 1984, the latest unemployment numbers (August 1984) showed that West Virginia still had the highest rate in the nation (13.6%) followed by Mississippi (11.1%) and Alabama (10.9%).

Inflation

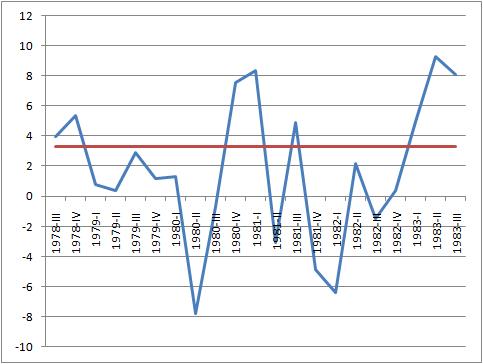

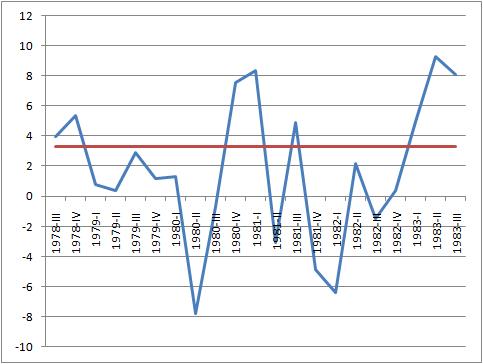

Inflation, which had averaged 3.2% annually since World War II had more than doubled after the 1973 oil shock, to a 7.7% annual rate. Inflation reached 9.1% in 1975, the highest rate since 1947. Inflation declined to 5.8% the following year but then edged higher. By 1979, inflation reached a startling 11.3% and in 1980, it soared to 13.5%. A brief recession occurred in 1980. Several key industries, including housing, steel manufacturing, and automobiles, experienced a downturn from which they did not recover until the end of the next recession. Many of the economic sectors that supplied the basic industries were also hit hard.Michael A. Urquhart, and Marillyn A. Hewson, "Unemployment Continued to Rise in 1982 as Recession Deepened", ''Monthly Labor Report'', 106:2 (February 1983) Each period of high unemployment saw the Federal Reserve increase interest rates to reduce high inflation. Each time, once inflation fell and interest rates were lowered, unemployment slowly fell."Federal Funds Rate, Inflation, Unemployment: 1970–1990"Federal Reserve Bank of St. Louis Determined to wring inflation out of the economy, Federal Reserve chairman Paul Volcker slowed the rate of growth of the money supply and raised

interest rates

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, th ...

. The federal funds rate, which was about 11% in 1979, rose to 20% by June 1981. The prime interest rate, an important economic measure, eventually reached 21.5% in June 1982.

Financial industry crisis

The recession had a severe effect on financial institutions such assavings and loans

A savings and loan association (S&L), or thrift institution, is a financial institution that specializes in accepting savings deposits and making mortgage and other loans. The terms "S&L" or "thrift" are mainly used in the United States; sim ...

and banks.

=Banks

= The recession came at a particularly bad time for banks because of a recent wave ofderegulation

Deregulation is the process of removing or reducing state regulations, typically in the economic sphere. It is the repeal of governmental regulation of the economy. It became common in advanced industrial economies in the 1970s and 1980s, as a ...

. The Depository Institutions Deregulation and Monetary Control Act of 1980 had phased out a number of restrictions on their financial practices, broadened their lending powers, and raised the deposit insurance

Deposit insurance or deposit protection is a measure implemented in many countries to protect bank depositors, in full or in part, from losses caused by a bank's inability to pay its debts when due. Deposit insurance systems are one component of ...

limit from $40,000 to $100,000, which caused moral hazard. Federal Deposit Insurance Corporation''History of the Eighties: Lessons for the Future''

Vol. 1. Division of Research and Statistics, December 1997. Banks rushed into real estate lending, speculative lending, and other ventures as the economy soured.

money market account

A money market account (MMA) or money market deposit account (MMDA) is a deposit account that pays interest based on current interest rates in the money markets. The interest rates paid are generally higher than those of savings accounts and tra ...

s in an attempt to encourage deposit in-flows, and it also removed additional statutory restrictions in real estate lending and relaxed loans-to-one-borrower limits. That encouraged a rapid expansion in real estate lending while the real estate market was collapsing, increased the unhealthy competition between banks and savings and loans, and encouraged too many branches to be started.

The recession affected the banking industry long after the economic downturn had technically ended, in November 1982. In 1983, another 50 banks failed. The FDIC listed another 540 banks as "problem banks", on the verge of failure.

In 1984, the Continental Illinois National Bank and Trust Company, the nation's seventh-largest bank (with $45 billion in assets), failed. The FDIC had long known of its problems. The bank had first approached failure in July 1982, when the Penn Square Bank, which had partnered with Continental Illinois in a number of high- risk lending ventures, collapsed. However, federal regulators were reassured by Continental Illinois executives that steps were being taken to ensure the bank's financial security. After its collapse, federal regulators were willing to let the bank fail to reduce moral hazard and so other banks would rein in some of their more risky lending practices. Members of Congress and the press, however, felt that Continental Illinois was " too big to fail". In May 1984, federal banking regulators finally offered a $4.5 billion rescue package to Continental Illinois.

Continental Illinois itself may not have been too big to fail, but its collapse could have caused the failure of some of the largest banks. The American banking system had been significantly weakened by the severe recession and the effects of deregulation. Had other banks been forced to write off loans to Continental Illinois, institutions like Manufacturer's Hanover Trust Company

Manufacturers Hanover Corporation was the bank holding company formed as parent of Manufacturers Hanover Trust Company, a large New York bank formed by a merger in 1961. After 1969, Manufacturers Hanover Trust became a subsidiary of Manufa ...

, Bank of America, and perhaps Citicorp would have become insolvent.

=Saving and loan crisis

= The recession also significantly exacerbated the savings and loan crisis. In 1980, there were approximately 4590 state and federally chartered savings and loan institutions (S&Ls), with total assets of $616 billion. From 1979, they began losing money because of spiraling interest rates. Net S&L income, which had totaled $781 million in 1980, fell to a loss of $4.6 billion in 1981 and a loss of $4.1 billion in 1982. The tangiblenet worth

Net worth is the value of all the non-financial and financial assets owned by an individual or institution minus the value of all its outstanding liabilities. Since financial assets minus outstanding liabilities equal net financial assets, net ...

for the entire S&L industry was virtually zero.

The Federal Home Loan Bank Board (FHLBB) regulated and inspected S&Ls and administered the Federal Savings and Loan Insurance Corporation (FSLIC), which insured deposits at S&Ls. The FHLBB's enforcement practices were significantly weaker than those of other federal banking agencies. Until the 1980s, savings and loans had limited lending powers and so the FHLBB was a relatively small agency, overseeing a quiet, stable industry. Unsurprisingly, the FHLBB's procedures and staff were inadequate to supervise S&Ls after deregulation. Also, the FHLBB was unable to add to its staff because of stringent limits on the number of personnel that it could hire and the level of compensation it could offer. The limitations were placed on the agency by the Office of Management and Budget and were routinely subject to the political whims of that agency and political appointees in the Executive Office of the President. In financial circles, the FHLBB and FSLIC were called "the doormats of financial regulation".

Because of its weak enforcement powers, the FHLBB and FSLIC rarely forced S&Ls to correct poor financial practices. The FHLBB relied heavily on its persuasive powers and the US states to enforce banking regulations. With only five enforcement lawyers, the FHLBB would have been in a poor position to enforce the law, even if it had wanted to.

One consequence of the FHLBB's lack of enforcement abilities was the promotion of deregulation and of aggressive, expanded lending to forestall insolvency. In November 1980, the FHLBB lowered net worth requirements for federally insured S&Ls from 5% of deposits to 4%. The FHLBB lowered net worth requirements again to 3% in January 1982. Additionally, the agency required S&Ls to meet those requirements only over 20 years. The rule meant that S&Ls less than 20 years old had practically no capital reserve requirements. That encouraged extensive chartering of new S&Ls since a $2 million investment could be leveraged into $1.3 billion in lending.

Congressional deregulation exacerbated the S&L crisis. The Economic Recovery Tax Act of 1981 led to a boom in commercial real estate. The passage of the Depository Institutions Deregulation and Monetary Control Act and the Garn–St. Germain Act expanded the authority of federally chartered S&Ls to make acquisition, development, and construction real estate loans, and the statutory limit on loan-to-value ratios was eliminated. The changes allowed S&Ls to make high-risk loans to developers. Beginning in 1982, many S&Ls rapidly shifted away from traditional home mortgage financing and into new, high-risk investment activities like casinos, fast-food franchises, ski resorts, junk bonds,

Congressional deregulation exacerbated the S&L crisis. The Economic Recovery Tax Act of 1981 led to a boom in commercial real estate. The passage of the Depository Institutions Deregulation and Monetary Control Act and the Garn–St. Germain Act expanded the authority of federally chartered S&Ls to make acquisition, development, and construction real estate loans, and the statutory limit on loan-to-value ratios was eliminated. The changes allowed S&Ls to make high-risk loans to developers. Beginning in 1982, many S&Ls rapidly shifted away from traditional home mortgage financing and into new, high-risk investment activities like casinos, fast-food franchises, ski resorts, junk bonds, arbitrage

In economics and finance, arbitrage (, ) is the practice of taking advantage of a difference in prices in two or more markets; striking a combination of matching deals to capitalise on the difference, the profit being the difference between the ...

schemes, and derivative instruments.

Federal deregulation also encouraged state legislatures to deregulate state-chartered S&Ls. Unfortunately, many of the states that deregulated S&Ls were also soft on supervision and enforcement. In some cases, state-chartered S&Ls had close political ties to elected officials and state regulators, which further weakened oversight.Norman Strunk and Fred Case, ''Where Deregulation Went Wrong: A Look at the Causes behind Savings and Loan Failures in the 1980s''. Washington, D.C.: Savings & Community Bankers of America, 1988. . National Commission on Financial Institution Reform, Recovery and Enforcement"Origin and Causes of the S&L Debacle: A Blueprint for Reform: A Report to the President and Congress of the United States"

Washington, D.C.: U.S. Government Printing Office, 1993. As the risk exposure of S&Ls expanded, the economy slid into the recession. Soon, hundreds of S&Ls were insolvent. Between 1980 and 1983, 118 S&Ls with $43 billion in assets failed. The Federal Savings and Loan Insurance Corporation, the federal agency which insured the deposits of S&Ls, spent $3.5 billion to make depositors whole again (in comparison, only 143 S&Ls with $4.5 billion in assets had failed in the previous 45 years, costing the FSLIC $306 million). The FSLIC pushed mergers as a way to avoid insolvency. From 1980 to 1982, there were 493 voluntary mergers and 259 forced mergers of savings and loans overseen by the agency. Despite the failures and mergers, there were still 415 S&Ls at the end of 1982 that were insolvent. Federal action initially caused the problem by allowing institutions to get involved in creating wealth by unhealthy fractional reserve practices, lending out much more money than they could ever afford to pay back out to customers if they came to withdraw their money. That ultimately led to S&Ls' failure. Later, the government's inaction worsened the industry's problems. Responsibility for handling the S&L crisis lay with the

Cabinet Council on Economic Affairs

Cabinet or The Cabinet may refer to:

Furniture

* Cabinetry, a box-shaped piece of furniture with doors and/or drawers

* Display cabinet, a piece of furniture with one or more transparent glass sheets or transparent polycarbonate sheets

* Filin ...

(CCEA), an intergovernmental council located within the Executive Office of the President. At the time, the CCEA was chaired by Treasury Secretary Donald Regan. The CCEA pushed the FHLBB to refrain from re-regulating the S&L industry and adamantly opposed any governmental expenditures to resolve the S&L problem. Furthermore, the Reagan administration did not want to alarm the public by closing a large number of S&Ls. Such actions significantly worsened the S&L crisis.

The S&L crisis lasted well beyond the end of the economic downturn. The crisis was finally quelled by passage of the Financial Institutions Reform, Recovery and Enforcement Act of 1989. The estimated total cost of resolving the S&L crisis was more than $160 billion.

=Political fallout

= The recession was nearly a year old before President

The recession was nearly a year old before President Ronald Reagan

Ronald Wilson Reagan ( ; February 6, 1911June 5, 2004) was an American politician, actor, and union leader who served as the 40th president of the United States from 1981 to 1989. He also served as the 33rd governor of California from 1967 ...

stated on October 18, 1981 that the economy was in a "slight recession".

The recession, which has been termed the "Reagan recession", coupled with budget cuts, which were enacted in 1981 but began to take effect only in 1982, led many voters to believe that Reagan was insensitive to the needs of average citizens and favored the wealthy. In January 1983, Reagan's popularity rating fell to 35%, approaching levels experienced by Richard Nixon and Jimmy Carter at their most unpopular periods. Although his approval rating did not fall as low as Nixon's during the Watergate scandal, Reagan's re-election seemed unlikely.

Pressured to counteract the increased deficit caused by the recession, Reagan agreed to a corporate tax

A corporate tax, also called corporation tax or company tax, is a direct tax imposed on the income or capital of corporations or analogous legal entities. Many countries impose such taxes at the national level, and a similar tax may be imposed at ...

increase in 1982. However, he refused to raise income tax or to cut defense spending. The Tax Equity and Fiscal Responsibility Act of 1982 instituted a three-year, $100 billion tax hike, the largest tax increase since the Second World War.

The 1982 US midterm elections

Midterm elections in the United States are the Elections in the United States, general elections that are held near the midpoint of a President of the United States, president's four-year term of office, on Election Day (United States), Elec ...

were largely viewed as a referendum on Reagan and his economic policies. The election results proved to be a setback for Reagan and his Republicans

Republican can refer to:

Political ideology

* An advocate of a republic, a type of government that is not a monarchy or dictatorship, and is usually associated with the rule of law.

** Republicanism, the ideology in support of republics or agains ...

. The Democrats gained 26 seats in the US House of Representatives seats, then the most for the party in any election since the " Watergate year" of 1974.Paul R. Abramson, John H. Aldrich and David W. Rhode, ''Change and Continuity in the 1984 Elections''. Rev. ed. Washington, D.C.: Congressional Quarterly Press, 1987. . However, the net balance of power in the US Senate was unchanged.

Recovery

The midterm elections were the low point of Reagan's presidency.

According to

The midterm elections were the low point of Reagan's presidency.

According to Keynesian economists

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output a ...

, a combination of deficit spending and the lowering of interest rates would slowly lead to economic recovery. Many economists also insist that the significantly-lower tax rates significantly contributed to the recovery. From a high of 10.8% in December 1982, unemployment gradually improved until it fell to 7.2% on Election Day in 1984. Nearly two million people left the unemployment rolls. Inflation fell from 10.3% in 1981 to 3.2% in 1983. Corporate income

A corporation is an organization—usually a group of people or a company—authorized by the state to act as a single entity (a legal entity recognized by private and public law "born out of statute"; a legal person in legal context) and re ...

rose by 29% in the July–September quarter of 1983, compared with the same period in 1982. Some of the most dramatic improvements came in industries that were the hardest hit by the recession, such as paper and forest products, rubber, airlines, and the auto industry.

By November 1984, voter anger at the recession had evaporated, and Reagan's re-election was certain. Reagan was subsequently re-elected by a landslide electoral and popular vote margin in the 1984 presidential election. Immediately after the election, Dave Stockman, Reagan's OMB manager admitted that the coming deficits were much higher than the projections that had been released during the campaign.

United Kingdom

Economic impact

As with most of the rest of the developed world, recession hit the United Kingdom at the beginning of the 1980s. That followed a string of crises that had plagued the British economy for most of the 1970s. Consequently, unemployment had gradually increased since the mid-1960s.

When the Conservative Party, led by Margaret Thatcher won the general election of May 1979, and swept

As with most of the rest of the developed world, recession hit the United Kingdom at the beginning of the 1980s. That followed a string of crises that had plagued the British economy for most of the 1970s. Consequently, unemployment had gradually increased since the mid-1960s.

When the Conservative Party, led by Margaret Thatcher won the general election of May 1979, and swept James Callaghan

Leonard James Callaghan, Baron Callaghan of Cardiff, ( ; 27 March 191226 March 2005), commonly known as Jim Callaghan, was Prime Minister of the United Kingdom from 1976 to 1979 and Leader of the Labour Party from 1976 to 1980. Callaghan is ...

's Labour Party from power, the country had just witnessed the Winter of Discontent in which numerous public sector workers had staged strikes. Inflation was about 10% and some 1.5 million people were unemployed, compared to some 1 million in 1974, 580,000 in 1970 and just over 300,000 in 1964. Thatcher set about controlling inflation with monetarist

Monetarism is a school of thought in monetary economics that emphasizes the role of governments in controlling the amount of money in circulation. Monetarist theory asserts that variations in the money supply have major influences on national ...

policies and changing trade union legislation in an attempt to reduce the strikes of public-sector workers.

Thatcher's battle against inflation raised the exchange rate, resulting in the closure of many factories, shipyards and coal pits because imports were cheaper and the strong pound made British products more expensive in export markets. Inflation fell below 10% by the turn of 1982, having peaked at 22% in 1980, and by spring 1983, it had fallen to a 15-year low of 4%. Strikes were also at their lowest level since the early 1950s, and wage growth rose to 3.8% by 1983.

However, unemployment reached 3 million, or 12.5% of the workforce, by January 1982, a level that had not been seen for some 50 years. The unemployment rate would remain similarly high for a number of years afterwards. Northern Ireland was the hardest-hit region, with unemployment standing at nearly 20%. The rate exceeded 15% in much of Scotland and Northern England. By April 1983, Britain, once known globally as the "workshop of the world" became a net importer of goods for the first time in modern times. Areas of Tyneside, Yorkshire, Merseyside, South Wales

South Wales ( cy, De Cymru) is a loosely defined region of Wales bordered by England to the east and mid Wales to the north. Generally considered to include the historic counties of Glamorgan and Monmouthshire, south Wales extends westwards ...

, Western Scotland

Western may refer to:

Places

*Western, Nebraska, a village in the US

*Western, New York, a town in the US

*Western Creek, Tasmania, a locality in Australia

*Western Junction, Tasmania, a locality in Australia

*Western world, countries that id ...

and the West Midlands were particularly hard hit by the loss of industry and subsequent sharp rise in unemployment. Only in Southeast England did unemployment remain below 10%.

Despite the economic recovery that followed the early 1980s recession, unemployment in the United Kingdom barely fell until the second half of the decade. As late as 1986, unemployment exceeded 3 million, but it fell below that figure the following year. By the end of 1989, it had fallen to 1.6 million.

Social impact

The mass unemployment and social discontent resulting from the recession were widely seen as major factors in widespread rioting across Britain in 1981 in parts of towns and cities including Toxteth, Liverpool, as well as a number of districts of London. In 1985, the economy had been out of recession for three years, but unemployment remained stubbornly high. Another wave of rioting occurred across numerous areas of Britain, including several areas across London. Poor employment opportunities, and social discontent were once again seen as factors in the rioting.Political impact

In the first three years of Thatcher's premiership, opinion polls gave the government approval ratings as low as 25%, with the polls initially being led by the Labour opposition and then by the SDP-Liberal Alliance, the latter being formed by the Liberal Party and the Social Democratic Party in 1981. However, an economic recovery, combined with theFalklands War

The Falklands War ( es, link=no, Guerra de las Malvinas) was a ten-week undeclared war between Argentina and the United Kingdom in 1982 over two British dependent territories in the South Atlantic: the Falkland Islands and its territorial de ...

, led to the Thatcher-led Conservative Party winning 42.4% of votes for a parliamentary majority in the general election in 1983

The year 1983 saw both the official beginning of the Internet and the first mobile cellular telephone call.

Events January

* January 1 – The migration of the ARPANET to Internet protocol suite, TCP/IP is officially completed (this is consid ...

.

Recovery

In the UK, economic growth was re-established by the end of 1982, but the era of mass unemployment was far from over. By the summer of 1984, unemployment had hit a new record of 3.3 million although the Great Depression had seen a higher percentage of the workforce unemployed. It remained above the 3 million mark until the spring of 1987, when theLawson Boom

The Lawson Boom was the macroeconomic conditions prevailing in the United Kingdom at the end of the 1980s, which became associated with the policies of Margaret Thatcher's Chancellor of the Exchequer, Nigel Lawson.

The term ''Lawson Boom'' was ...

, seen as the consequence of tax cuts by Chancellor Nigel Lawson, sparked an economic boom that saw unemployment fall dramatically. By early 1988, it was below 2.5 million; by early 1989, it fell below 2 million. By the end of 1989, it was just over 1.6 million, almost half the figure of three years earlier. However, the unemployment figures did not include benefit claimants who were placed on Employment Training schemes, an adult variant of the controversial Youth Training Scheme, who were paid the same rate of benefit for working full-time hours. Other incentives that aided the British economic recovery after the early 1980s recession included the introduction of enterprise zones on deindustrialised land in which traditional industries were replaced by new industries as well as commercial developments. Businesses were given temporary tax breaks, and exemptions as incentives to set up base in such areas.

See also

*Early 1990s recession

The early 1990s recession describes the period of economic downturn affecting much of the Western world in the early 1990s. The impacts of the recession contributed in part to the 1992 U.S. presidential election victory of Bill Clinton over incu ...

* 1982 crisis in Chile

*Supply-side economics

Supply-side economics is a macroeconomic theory that postulates economic growth can be most effectively fostered by lowering taxes, decreasing regulation, and allowing free trade. According to supply-side economics, consumers will benefit fr ...

* Reaganomics

References

Sources

*Brunner, Karl. "The Recession of 1981/1982 in the Context of Postwar Recessions." ''Policy Statement and Position Papers''. Rochester, N.Y.: Bradley Policy Research Center, William E. Simon Graduate School of Business Administration, University of Rochester. March 1983. *Day, Kathleen. ''S&L Hell: How Politics Created a Trillion Dollar Debacle''. New York: W.W. Norton and Co., 1993. * Guell, Robert C.''Issues in Economics Today''

New York: McGraw Hill Professional, 2004. * *

Accessed May 5, 2007. {{DEFAULTSORT:Early 1980s Recession Recessions 1982 elections in the United States 1981 in the United States 1982 in the United States 1980s economic history