|

Economic Recovery Tax Act Of 1981

The Economic Recovery Tax Act of 1981 (ERTA), or Kemp–Roth Tax Cut, was an Act that introduced a major tax cut, which was designed to encourage economic growth. The Act was enacted by the 97th Congress and signed into law by U.S. President Ronald Reagan. The Accelerated Cost Recovery System (ACRS) was a major component of the Act, and was amended in 1986 to become the Modified Accelerated Cost Recovery System (MACRS). Representative Jack Kemp and Senator William Roth, both Republicans, had nearly won passage of a tax cut during the Carter presidency; however, President Jimmy Carter feared an increase in the deficit and so prevented the bill's passage. Reagan made a major tax cut his top priority once he had taken office. Although Democrats maintained a majority in the U.S. House of Representatives during the 97th Congress, Reagan convinced conservative Democrats like Phil Gramm to support the bill. The Act passed the U.S. Congress on August 4, 1981, and it was signed ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States House Of Representatives

The United States House of Representatives is a chamber of the Bicameralism, bicameral United States Congress; it is the lower house, with the U.S. Senate being the upper house. Together, the House and Senate have the authority under Article One of the United States Constitution, Article One of the Constitution of the United States, U.S. Constitution to pass or defeat federal legislation, known as Bill (United States Congress), bills. Those that are also passed by the Senate are sent to President of the United States, the president for signature or veto. The House's exclusive powers include initiating all revenue bills, Impeachment in the United States, impeaching federal officers, and Contingent election, electing the president if no candidate receives a majority of votes in the United States Electoral College, Electoral College. Members of the House serve a Fixed-term election, fixed term of two years, with each seat up for election before the start of the next Congress. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Phil Gramm

William Philip Gramm (born July 8, 1942) is an American economist and politician who represented Texas in both chambers of United States Congress, Congress. Though he began his political career as a Democratic Party (United States), Democrat, Gramm Party switching in the United States, switched to the Republican Party (United States), Republican Party in 1983. Gramm was an unsuccessful candidate in the 1996 Republican Party presidential primaries against eventual nominee Bob Dole. Early life and education Gramm was born on July 8, 1942, in Fort Benning, Georgia, and grew up in nearby Columbus, Georgia, Columbus. Soon after his birth, Gramm's father, Kenneth Marsh Gramm, a career Army sergeant, suffered a stroke and was partially paralyzed. He died when Gramm was 14. Gramm's mother, Florence (née Scroggins), worked double shifts as a nurse to supplement the veterans disability pension. Gramm attended Public school (government funded), public schools, graduated in 1961 from Geo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Department Of The Treasury

The Department of the Treasury (USDT) is the Treasury, national treasury and finance department of the federal government of the United States. It is one of 15 current United States federal executive departments, U.S. government departments. The department oversees the Bureau of Engraving and Printing and the United States Mint, U.S. Mint, two federal agencies responsible for printing all paper currency and minting United States coinage, coins. The treasury executes Currency in circulation, currency circulation in the domestic fiscal system, Tax collector, collects all taxation in the United States, federal taxes through the Internal Revenue Service, manages United States Treasury security, U.S. government debt instruments, Bank regulation#Licensing and supervision, licenses and supervises banks and Savings and loan association, thrift institutions, and advises the Federal government of the United States#Legislative branch, legislative and Federal government of the United Stat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

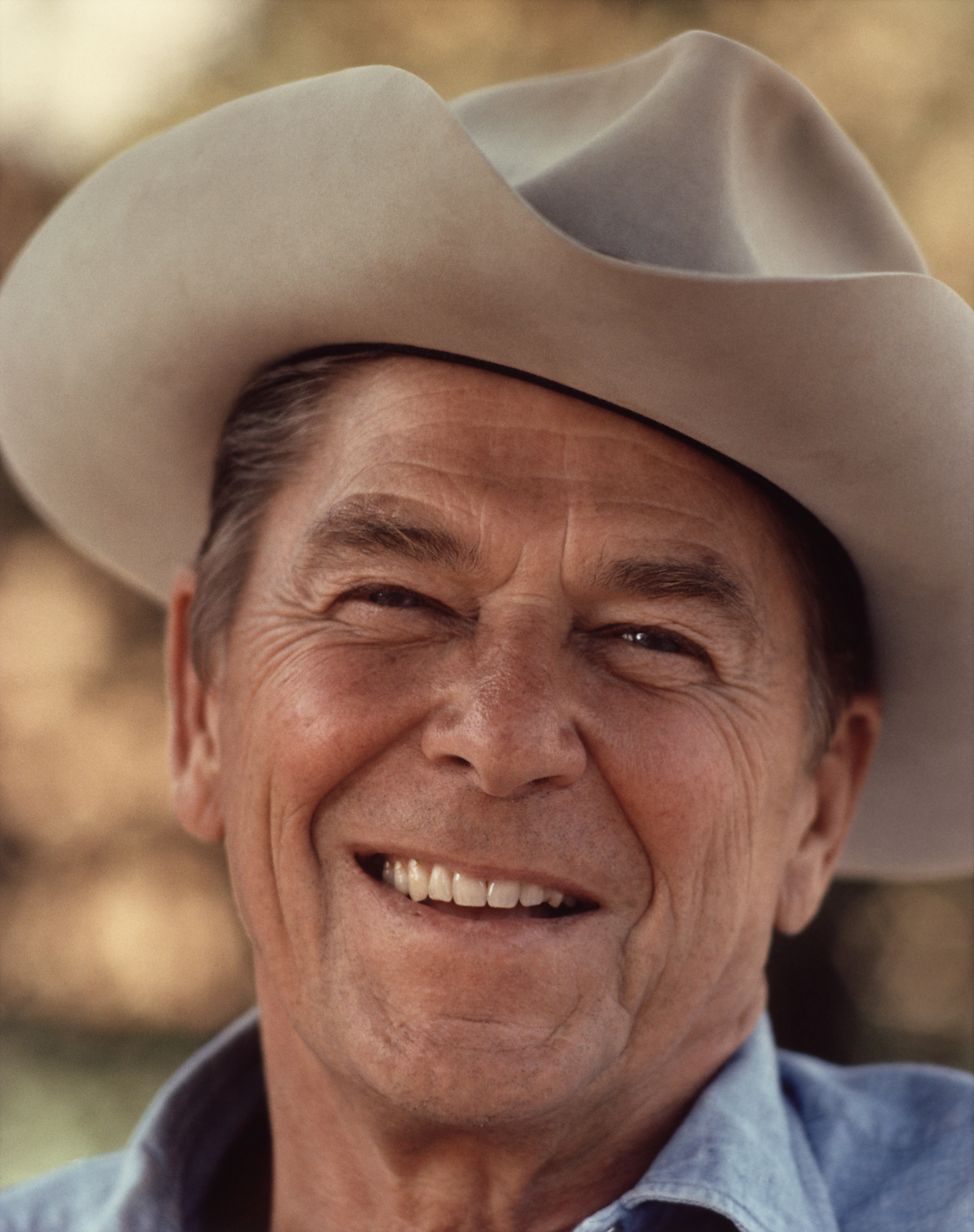

Reagan Presidency

Ronald Reagan's tenure as the List of presidents of the United States, 40th president of the United States began with First inauguration of Ronald Reagan, his first inauguration on January 20, 1981, and ended on January 20, 1989. Reagan, a Republican Party (United States), Republican from California, took office following his landslide victory over Democratic Party (United States), Democratic incumbent president Jimmy Carter and Independent politicians in the United States, independent congressman John B. Anderson in the 1980 United States presidential election, 1980 presidential election. Four years later in the 1984 United States presidential election, 1984 presidential election, he defeated Democratic former vice president Walter Mondale to win re-election in a larger landslide. Reagan served two terms and was succeeded by his vice president, George H. W. Bush, who won the 1988 United States presidential election, 1988 presidential election. Reagan's 1980 landslide election r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Deficit

The government budget balance, also referred to as the general government balance, public budget balance, or public fiscal balance, is the difference between government revenues and spending. For a government that uses accrual accounting (rather than cash accounting) the budget balance is calculated using only spending on current operations, with expenditure on new capital assets excluded. A positive balance is called a ''government budget surplus'', and a negative balance is a ''government budget deficit''. A government budget presents the government's proposed revenues and spending for a financial year. The government budget balance can be broken down into the ''primary balance'' and interest payments on accumulated government debt; the two together give the budget balance. Furthermore, the budget balance can be broken down into the ''structural balance'' (also known as ''cyclically-adjusted balance'') and the cyclical component: the structural budget balance attempts ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Supply-siders

Supply-side economics is a Macroeconomics, macroeconomic theory postulating that economic growth can be most effectively fostered by Tax cuts, lowering taxes, Deregulation, decreasing regulation, and allowing free trade. According to supply-side economics theory, consumers will benefit from greater supply of goods and services at lower prices, and employment will increase. Supply-side fiscal policies are designed to increase aggregate supply, as opposed to aggregate demand, thereby expanding output and employment while lowering prices. Such policies are of several general varieties: #Investments in human capital, such as education, healthcare, and encouraging the transfer of technologies and business processes, to improve productivity (output per worker). Encouraging globalized free trade via containerization is a major recent example. #Tax reduction, to provide incentives to work, invest and take risks. Lowering income tax rates and eliminating or lowering tariffs are example ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Postwar Period

A post-war or postwar period is the interval immediately following the end of a war. The term usually refers to a varying period of time after World War II, which ended in 1945. A post-war period can become an interwar period or interbellum, when a war between the same parties resumes at a later date (such as the period between World War I and World War II). By contrast, a post-war period marks the cessation of armed conflict entirely. Post-World War II in the United States Chronology of the post–World War II era The term "post-war" can have different meanings in different countries and refer to a period determined by local considerations based on the effect of the war there. Considering the post-war era as equivalent to the Cold War era, post-war sometimes includes the 1980s, putting the end at 26 December 1991, with the dissolution of the Soviet Union. The 1990s and the 21st century are sometimes described as part of the post-war era, but the more specific designation " ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Equity And Fiscal Responsibility Act Of 1982

The Tax Equity and Fiscal Responsibility Act of 1982 (), also known as TEFRA, is a United States federal law that rescinded some of the effects of the Kemp-Roth Act passed the year before. Between summer 1981 and summer 1982, tax revenue fell by about 6% in real terms, caused by the dual effects of the economy dipping back into recession (the second dip of the "double dip recession") and Kemp-Roth's reduction in tax rates, and the deficit was likewise rising rapidly because of the fall in revenue and the rise in government expenditures. The rapid rise in the budget deficit created concern among many in Congress. TEFRA was created to reduce the budget gap by generating revenue through closure of tax loopholes; introduction of tougher enforcement of tax rules; rescinding some of Kemp-Roth's reductions in marginal personal income tax rates that had not yet gone into effect; and raising some rates, especially corporate rates. TEFRA was introduced November 13, 1981 and was sponsored ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Estate Tax In The United States

In the United States, the estate tax is a federal tax on the transfer of the estate of a person who dies. The tax applies to property that is transferred by will or, if the person has no will, according to state laws of intestacy. Other transfers that are subject to the tax can include those made through a trust and the payment of certain life insurance benefits or financial accounts. The estate tax is part of the federal unified gift and estate tax in the United States. The other part of the system, the gift tax, applies to transfers of property during a person's life. In addition to the federal government, 12 states tax the estate of the deceased. Six states have " inheritance taxes" levied on the person who receives money or property from the estate of the deceased. The estate tax is periodically the subject of political debate. Some opponents have called it the "death tax" [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation

In economics, inflation is an increase in the average price of goods and services in terms of money. This increase is measured using a price index, typically a consumer price index (CPI). When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of CPI inflation is deflation, a decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. Changes in inflation are widely attributed to fluctuations in Real versus nominal value (economics), real demand for goods and services (also known as demand shocks, including changes in fiscal policy, fiscal or monetary policy), changes in available supplies such as during energy crisis, energy crises (also known as supply shocks), or changes in inflation expectations, which may be self-fulfilling. Moderat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bracket Creep

Bracket creep is usually defined as the process by which inflation pushes wages and salaries into higher tax brackets, leading to fiscal drag. However, even if there is only one tax bracket, or one remains within the same tax bracket, there will still be bracket creep resulting in a higher proportion of income being paid in tax. That is, although the marginal tax rate remains unchanged with inflation, the average tax rate will increase. Most progressive tax systems are not adjusted for inflation. As wages and salaries rise in nominal terms under the influence of inflation they become more highly taxed, even though in real terms the value of the wages and salaries has not increased at all. The net effect is that in real terms taxes rise unless the tax rates or brackets are adjusted to compensate. Examples Suppose a person earns $20,000 per year and is liable to 20% tax on earnings above a threshold of $5,000 per year. Then they pay ($20,000–$5,000)*0.2 = $3,000 in taxes, or 1 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

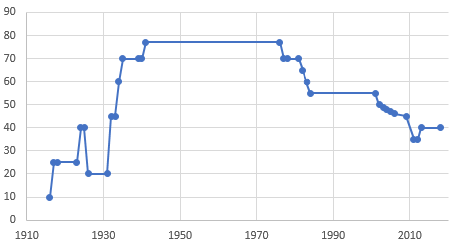

Income Tax In The United States

The United States federal government and most State governments in the United States, state governments impose an income tax. They are determined by applying a tax rate, which Progressive tax, may increase as income increases, to taxable income, which is the total income less allowable tax deduction, deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnership taxation in the United States, Partnerships are not taxed (with some exceptions in the case of federal income taxation), but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of tax credit, credits reduce tax, and some types of credits may exceed tax before credits. Most business expenses are deductible. Individuals may deduct certain personal expenses, including home mort ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |