NASDAQ on:

[Wikipedia]

[Google]

[Amazon]

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American

On March 10, 2000, the

On March 10, 2000, the

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American stock exchange

A stock exchange, securities exchange, or bourse is an exchange where stockbrokers and traders can buy and sell securities, such as shares of stock, bonds and other financial instruments. Stock exchanges may also provide facilities for ...

based in New York City

New York, often called New York City (NYC), is the most populous city in the United States, located at the southern tip of New York State on one of the world's largest natural harbors. The city comprises five boroughs, each coextensive w ...

. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges

A list is a set of discrete items of information collected and set forth in some format for utility, entertainment, or other purposes. A list may be memorialized in any number of ways, including existing only in the mind of the list-maker, but ...

by market capitalization of shares traded, behind the New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District, Manhattan, Financial District of Lower Manhattan in New York City. It is the List of stock exchanges, largest stock excha ...

. The exchange platform is owned by Nasdaq, Inc. (which the exchange also lists; ticker symbol NDAQ), which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. Although it trades stock of healthcare, financial, media, entertainment, retail, hospitality, and food businesses, it focuses more on technology stock

Stocks (also capital stock, or sometimes interchangeably, shares) consist of all the Share (finance), shares by which ownership of a corporation or company is divided. A single share of the stock means fractional ownership of the corporatio ...

s. The exchange is made up of both American and foreign firms, with China

China, officially the People's Republic of China (PRC), is a country in East Asia. With population of China, a population exceeding 1.4 billion, it is the list of countries by population (United Nations), second-most populous country after ...

and Israel

Israel, officially the State of Israel, is a country in West Asia. It Borders of Israel, shares borders with Lebanon to the north, Syria to the north-east, Jordan to the east, Egypt to the south-west, and the Mediterranean Sea to the west. Isr ...

being the largest foreign sources.

History

1972–2000

Nasdaq, Inc. was founded in 1971 by the National Association of Securities Dealers (NASD), which is now known as theFinancial Industry Regulatory Authority

The Financial Industry Regulatory Authority (FINRA) is a private American corporation that acts as a self-regulatory organization (SRO) that regulates member brokerage firms and exchange markets. FINRA is the successor to the National Associati ...

(FINRA). "Nasdaq" (originally and still commonly spelled with all-capital letters as "NASDAQ") was initially an acronym

An acronym is a type of abbreviation consisting of a phrase whose only pronounced elements are the initial letters or initial sounds of words inside that phrase. Acronyms are often spelled with the initial Letter (alphabet), letter of each wor ...

for the National Association of Securities Dealers Automated Quotations. On February 8, 1971, the NASDAQ Stock Market commenced operations as the world's first fully electronic stock market. Initially, NASDAQ served as a "quotation system" rather than a platform for electronic trading. Intel Corporation

Intel Corporation is an American multinational corporation and technology company headquartered in Santa Clara, California, and incorporated in Delaware. Intel designs, manufactures, and sells computer components such as central processing ...

was one of the first major corprations to list its shares on NASDAQ; other major companies that have been listed on NASDAQ since its early years include Comcast

Comcast Corporation, formerly known as Comcast Holdings,Before the AT&T Broadband, AT&T merger in 2001, the parent company was Comcast Holdings Corporation. Comcast Holdings Corporation now refers to a subsidiary of Comcast Corporation, not th ...

and Applied Materials.

Since the launch of NASDAQ, many major companies trading on the over-the-counter (OTC) market began switching to NASDAQ. As late as 1987, the NASDAQ exchange was still commonly referred to as "OTC" in media reports and also in the monthly Stock Guides (stock guides and procedures) issued by Standard & Poor's

S&P Global Ratings (previously Standard & Poor's and informally known as S&P) is an American credit rating agency (CRA) and a division of S&P Global that publishes financial research and analysis on stocks, bonds, and commodities. S&P is co ...

Corporation. Over the years, it became more of a stock market with the addition of trade and volume reporting and automated trading systems. In 1981, NASDAQ traded 37% of the U.S. securities markets' total of 21 billion shares. By 1991, NASDAQ's share had grown to 46%. In 1992, the NASDAQ Stock Market joined with the London Stock Exchange

The London Stock Exchange (LSE) is a stock exchange based in London, England. the total market value of all companies trading on the LSE stood at US$3.42 trillion. Its current premises are situated in Paternoster Square close to St Paul's Cath ...

to form the first intercontinental linkage of capital markets.

In 1996, the SEC issued a report alleging that NASDAQ market makers fixed prices by avoiding "odd-eighths" quotes (at the time, stock prices were quoted in increments of an eighth of a dollar) to artificially widen spreads. The report was followed by a new set of rules for how NASDAQ handled orders.

In 1998, it became the first stock market in the United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 ...

to trade online, using the slogan "the stock market for the next hundred years". The NASDAQ Stock Market attracted many companies during the dot-com bubble

The dot-com bubble (or dot-com boom) was a stock market bubble that ballooned during the late-1990s and peaked on Friday, March 10, 2000. This period of market growth coincided with the widespread adoption of the World Wide Web and the Interne ...

.

The exchange's main index is the NASDAQ Composite

The Nasdaq Composite (ticker symbol ^IXIC) is a stock market index that includes almost all stocks listed on the Nasdaq stock exchange. Along with the Dow Jones Industrial Average and S&P 500, it is one of the three most-followed stock market i ...

, which has been published since its inception. The QQQ exchange-traded fund

An exchange-traded fund (ETF) is a type of investment fund that is also an exchange-traded product, i.e., it is traded on stock exchanges. ETFs own financial assets such as stocks, bonds, currencies, debts, futures contracts, and/or comm ...

tracks the large-cap NASDAQ-100 index, which was introduced in 1985 alongside the NASDAQ Financial-100 Index, which tracks the largest 100 companies in terms of market capitalization.

2000–present

On March 10, 2000, the

On March 10, 2000, the NASDAQ Composite

The Nasdaq Composite (ticker symbol ^IXIC) is a stock market index that includes almost all stocks listed on the Nasdaq stock exchange. Along with the Dow Jones Industrial Average and S&P 500, it is one of the three most-followed stock market i ...

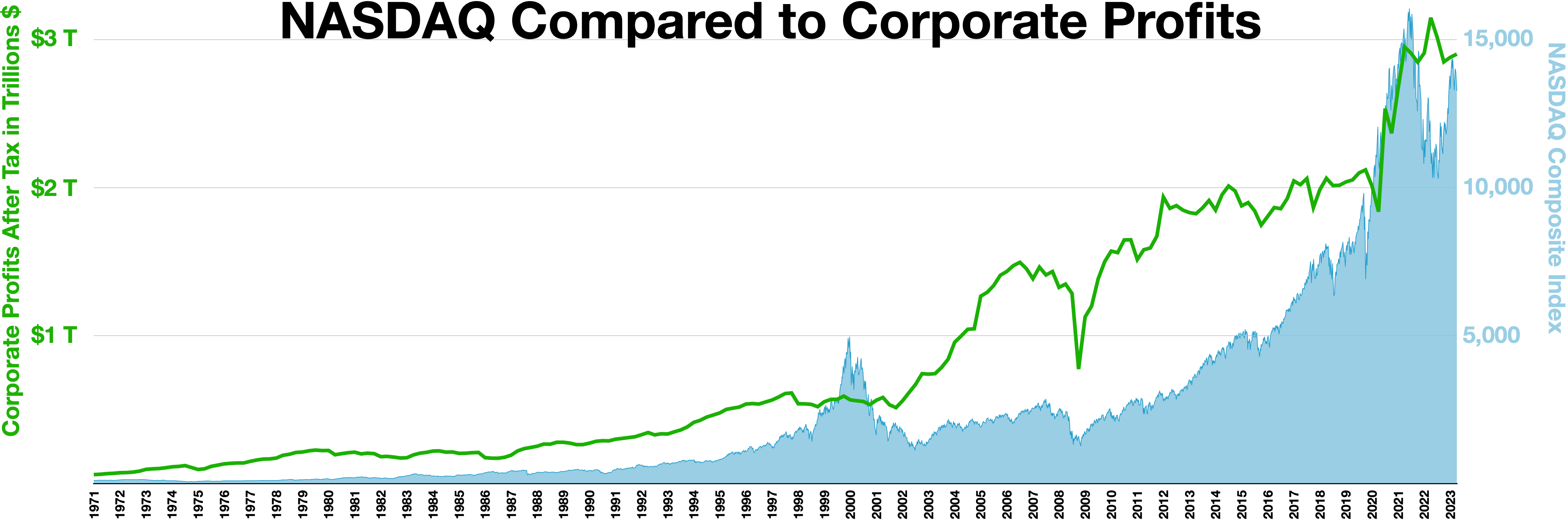

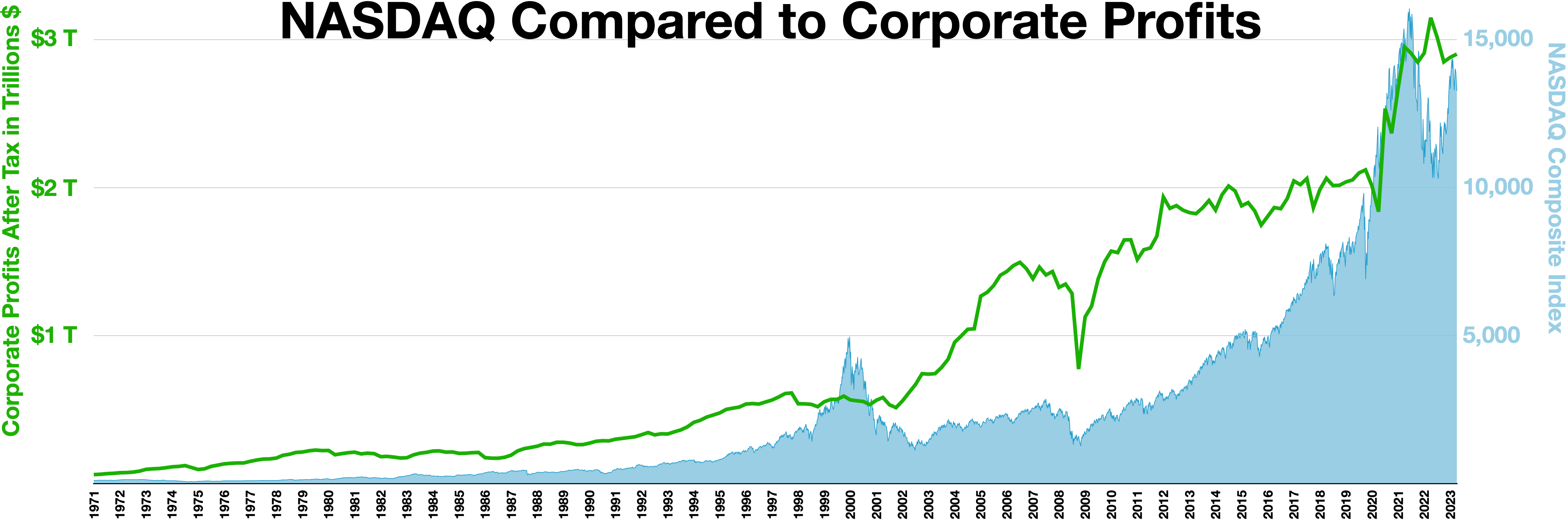

stock market index peaked at 5,132.52, but fell to 3,227 by April 17, and, in the following 30 months, fell 78% from its peak.

In a series of sales in 2000 and 2001, FINRA sold its stake in the NASDAQ. On July 2, 2002, Nasdaq, Inc. became a public company

A public company is a company whose ownership is organized via shares of share capital, stock which are intended to be freely traded on a stock exchange or in over-the-counter (finance), over-the-counter markets. A public (publicly traded) co ...

via an initial public offering

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investm ...

, listing its own shares on the exchange (traded under the ticker symbol NDAQ). In 2006, the status of the NASDAQ Stock Market was changed from a stock market to a licensed national securities exchange. In 2007, it merged with OMX, a leading exchange operator in the Nordic countries, expanded its global footprint, and changed its name to the NASDAQ OMX Group.

To qualify for listing on the exchange, a company must be registered with the United States Securities and Exchange Commission

The United States Securities and Exchange Commission (SEC) is an independent agencies of the United States government, independent agency of the United States federal government, created in the aftermath of the Wall Street crash of 1929. Its ...

(SEC), must have at least three market maker

A market maker or liquidity provider is a company or an individual that quotes both a buy and a sell price in a tradable asset held in inventory, hoping to make a profit on the difference, which is called the ''bid–ask spread'' or ''turn.'' Thi ...

s (financial firms that act as brokers or dealers for specific securities) and must meet minimum requirements for assets, capital, public shares, and shareholders.

In February 2011, in the wake of an announced merger of NYSE Euronext

NYSE Euronext, Inc. was a Transatlantic relations, transatlantic Multinational corporation, multinational financial services corporation that operated multiple Stock exchange, securities exchanges, including the New York Stock Exchange, Euronext ...

with , speculation developed that NASDAQ OMX and Intercontinental Exchange (ICE) could mount a counter-bid of their own for NYSE. NASDAQ OMX could be looking to acquire the American exchange's cash equities business, ICE the derivatives business. At the time, "NYSE Euronext's market value was $9.75 billion. NASDAQ was valued at $5.78 billion, while ICE was valued at $9.45 billion." Late in the month, NASDAQ was reported to be considering asking either ICE or the Chicago Mercantile Exchange

The Chicago Mercantile Exchange (CME) (often called "the Chicago Merc", or "the Merc") is an American derivatives marketplace based in Chicago and located at 20 S. Wacker Drive. The CME was founded in 1898 as the Chicago Butter and Egg Board ...

to join in what would probably have to be, if it proceeded, an $11–12 billion counterbid.

In December 2005, NASDAQ acquired Instinet for $1.9 billion, retaining the Inet ECN and subsequently selling the agency brokerage business to Silver Lake Partners and Instinet management.

The European Association of Securities Dealers Automatic Quotation System (EASDAQ) was founded as a European equivalent to the NASDAQ Stock Market. It was purchased by NASDAQ in 2001 and became NASDAQ Europe. In 2003, operations were shut down as a result of the burst of the dot-com bubble

The dot-com bubble (or dot-com boom) was a stock market bubble that ballooned during the late-1990s and peaked on Friday, March 10, 2000. This period of market growth coincided with the widespread adoption of the World Wide Web and the Interne ...

. In 2007, NASDAQ Europe was revived first as Equiduct and was acquired by Börse Berlin later that year.

On November 7, 2007, Nasdaq acquired the Philadelphia Stock Exchange, the oldest stock exchange in the U.S.

On June 18, 2012, NASDAQ OMX became a founding member of the United Nations Sustainable Stock Exchanges Initiative on the eve of the United Nations Conference on Sustainable Development

The United Nations Conference on Sustainable Development (UNCSD), also known as Rio 2012, Rio+20 (), or Earth Summit 2012 was the third international conference on sustainable development aimed at reconciling the economic and environmental goals ...

(Rio+20).

In November 2016, chief operating officer Adena Friedman was promoted to chief executive officer

A chief executive officer (CEO), also known as a chief executive or managing director, is the top-ranking corporate officer charged with the management of an organization, usually a company or a nonprofit organization.

CEOs find roles in variou ...

, becoming the first woman to run a major exchange in the U.S.

In 2016, Nasdaq earned $272 million in listings-related revenues.

In October 2018, the SEC ruled that the New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District, Manhattan, Financial District of Lower Manhattan in New York City. It is the List of stock exchanges, largest stock excha ...

and Nasdaq did not justify the continued price increases when selling market data

In finance, market data is price and other related data for a financial instrument reported by a trading venue such as a stock exchange. Market data allows traders and investors to know the latest price and see historical trends for instruments ...

.

In December 2020, NASDAQ announced that it would strip its indexes of four Chinese companies in response to Executive Order 13959.

In September 2024, the European Commission

The European Commission (EC) is the primary Executive (government), executive arm of the European Union (EU). It operates as a cabinet government, with a number of European Commissioner, members of the Commission (directorial system, informall ...

said it had carried out an unannounced inspection at the offices of Nasdaq over potential anti-competitive practices

Anti-competitive practices are business or government practices that prevent or reduce Competition (economics), competition in a market. Competition law, Antitrust laws ensure businesses do not engage in competitive practices that harm other, u ...

.

In March 2025 the NASDAQ announced plans to introduce 24-hour 5-day a week trading on its United States exchange sometime during the second half of 2026 in response to increased global demand for U.S. equities pending approval by the U.S. Securities and Exchange Commission.

Contract specifications

Nasdaq 100 futures are traded on the CME (Chicago Mercantile Exchange) while its derivatives, E-Mini Nasdaq 100 and Micro E-Mini Nasdaq 100 futures are traded on the EMiniCME. Below are the contract specifications for the Nasdaq 100 and derivatives.Quote availability

Nasdaq quotes are available at three levels: * Level 1 shows the highest bid and lowest ask—inside quote. * Level 2 shows all public quotes ofmarket maker

A market maker or liquidity provider is a company or an individual that quotes both a buy and a sell price in a tradable asset held in inventory, hoping to make a profit on the difference, which is called the ''bid–ask spread'' or ''turn.'' Thi ...

s together with information of market dealers wishing to buy or sell stock and recently executed orders.

* Level 3 is used by the market maker

A market maker or liquidity provider is a company or an individual that quotes both a buy and a sell price in a tradable asset held in inventory, hoping to make a profit on the difference, which is called the ''bid–ask spread'' or ''turn.'' Thi ...

s and allows them to enter their quotes and execute orders.

Trading schedule

The Nasdaq Stock Market sessions,Eastern Time Zone

The Eastern Time Zone (ET) is a time zone encompassing part or all of 23 U.S. states, states in the eastern part of the United States, parts of eastern Canada, and the state of Quintana Roo in Mexico.

* Eastern Standard Time (EST) is five ...

are:

4:00 a.m. to 9:30 a.m.: extended-hours trading session (premarket)

9:30 a.m. to 4:00 p.m.: normal trading session

4:00 p.m. to 8:00 p.m.: extended-hours trading session (postmarket)

The Nasdaq Stock Market averages about 253 trading days per year.

Market tiers

The Nasdaq Stock Market has three different market tiers: * Capital Market (NASDAQ-CM small cap) is an equity market for companies that have relatively small levels of market capitalization. Listing requirements for such "small cap" companies are less stringent than for other Nasdaq markets that list larger companies with significantly higher market capitalization. * Global Market (NASDAQ-GM mid cap) is made up of stocks that represent the Nasdaq Global Market. The Global Market consists of 1,450 stocks that meet Nasdaq's strict financial and liquidity requirements, and corporate governance standards. The Global Market is less exclusive than the Global Select Market. It was formerly known as the National Market until July 1, 2006. * Global Select Market (NASDAQ-GS large cap) is a market capitalization-weighted index made up of US-based and international stocks that represent the NASDAQ Global Select Market Composite (NQGS). The Global Select Market consists of 1,200 stocks that meet Nasdaq's strict financial and liquidity requirements and corporate governance standards. The Global Select Market is more exclusive than the Global Market. Every October, the Nasdaq Listing Qualifications Department reviews the Global Market Composite to determine if any of its stocks have become eligible for listing on the Global Select Market.Difference between NYSE and Nasdaq

After the NYSE, Nasdaq is the second largest stock exchange in the United States with a market capitalization of $19 trillion, which is about $5.5 trillion less than the NYSE as of 2021. Nasdaq is a much younger organization than the NYSE, having been founded in just 1971. In addition to age and market capitalization, there are other key differences between the two exchanges: *Exchange systems. Before theCOVID-19 pandemic

The COVID-19 pandemic (also known as the coronavirus pandemic and COVID pandemic), caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), began with an disease outbreak, outbreak of COVID-19 in Wuhan, China, in December ...

, the NYSE maintained both an electronic trading system and a trading floor system staffed by live professionals who help conduct auctions. Nasdaq has been an all-electronic exchange since its inception.

*Market Types. The NYSE uses an auction market to set prices, while Nasdaq uses a dealer market. In the NYSE auction market, buyers and sellers submit competitive bids simultaneously. When the buyer's bid and the seller's request match, a transaction occurs. In the Nasdaq dealer market model, all prices are set by dealers. Dealers continually update bid (sell) and ask (buy) prices throughout the trading day.

*Listing fees. There is a big difference in listing fees on the major stock exchanges. Listing fees on the Nasdaq range from $55,000 to $80,000 for the lowest tier of the capital market. The NYSE is significantly more expensive, with the lowest listing fee of $150,000.

*Sectors. Investors typically view the NYSE as an exchange for older, more established companies. Nasdaq tends to be home to newer companies focused on technology and innovation, so some investors consider Nasdaq listings to be riskier.

See also

* ACT (NASDAQ) * Advanced Computerized Execution System * Directors Desk * Economy of New York City * List of stock exchange mergers in the Americas * List of stock exchanges in the Americas *NASDAQ futures

NASDAQ futures are financial Futures contract, futures which launched on June 21, 1999. It is the financial contract futures that allow an investor to hedge with or speculate on the future value of various components of the NASDAQ market index.

Se ...

* Supermontage (SM) integrated trading system

* United States corporate law

* CCP Global

CCP Global (CCPG) is a global body that brings together central counterparty clearing houses (CCPs) from the world's major jurisdictions.

Overview

CCP Global was originally formed in 2001 as an informal group named CCP12 by twelve founding CCPs ...

References

External links

* {{Authority control 1971 establishments in New York City American companies established in 1971 Economy of New York City Electronic trading platforms Financial services companies based in New York City Financial services companies established in 1971 Private equity portfolio companies Stock exchanges in the United States