|

Instinet

Instinet Incorporated is an institutional, agency-model broker that also serves as the independent equity trading arm of its parent, Nomura Group. It executes trades for asset management firms, hedge funds, insurance companies, mutual funds and pension funds. Headquartered in New York City, the company provides sales trading services and trading technologies such as the Newport EMS, algorithms, trade cost analytics, commission management, independent research and dark pools. However, Instinet is best known for being the first off-exchange trading alternatives, with its "green screen" terminals prevalent in the 1980s and 1990s, and as the founder of electronic communication networks, Chi-X Europe and Chi-X Global. According to industry research group Markit, in 2015 Instinet was the 3rd-largest cash equities broker in Europe. History Early history Instinet was founded by Jerome M. Pustilnik and Herbert R. Behrens and was incorporated in 1969 as Institutional Networks Corp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bill Lupien

William A. Lupien (October 6, 1941 – April 15, 2021) was an American business executive in the financial industry. He traded actively in the financial markets throughout his career. He was a Specialist and later Exchange Governor on the Pacific Exchange, Pacific Stock Exchange (PSE), a NASDAQ, Nasdaq market maker, the chairman and CEO of Instinet, the chairman and CEO of OptiMark Corporation, and the managing director of the general partner of a hedge fund, Kudu Partners LP. He helped develop the world's first electronic trading system. He also served on the advisory committee on the National Market System. In 1999 he was featured in a CNBC, CNBC television series as one of five people who had changed the course of the securities industry in the 20th century. Early life Lupien was born in Chicago, IL. He lived in the Chicago area until age 16, when his family moved to Pasadena, CA. He graduated from John Muir High School in 1959. He then attended Pasadena City College un ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inet

Inet was an electronic trading platform based on a system developed by Instinet in the 1970s that merged with Island ECN in 2002 and was subsequently acquired by NASDAQ in 2005. Inet, like other electronic communication networks, was an order-pairing system that give brokerage firms the power to electronically track and match reciprocal buy and sell orders at the same limit price and lot size. An efficient and reliable system that reduced costs to both brokerage firms and investors and facilitate high speed pairings of buy and sell orders. The Inet name continues to be used by Nasdaq for later trading platforms such as the ''Genium Inet trading platform''. Today the NASDAQ stock exchange system in New York is called "INET". INET uses a very fast middleware bus that is called Inet. The derivative exchange system Genium Inet uses the same middleware bus Inet. Genium Inet is the successor to the CLICK derivate exchange system. The main difference between INET and Genium Inet is tha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Electronic Communication Network

An electronic communication network (ECN) is a type of computerized forum or network that facilitates the trading of financial products outside traditional stock exchanges. An ECN is generally an electronic system accessed by an electronic trading platform that widely disseminates orders entered by market makers to third parties and permits the orders to be executed against them in whole or in part. The primary products that are traded on ECNs are stocks and currencies. ECNs are generally passive computer-driven networks that internally match limit orders and charge a very small per share transaction fee (often a fraction of a cent per share). The first ECN, Instinet, was created in 1969. ECNs increase competition among trading firms by lowering transaction costs, giving clients full access to their order books, and offering order matching outside traditional exchange hours. ECNs are sometimes also referred to as alternative trading systems or alternative trading networks. H ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Island ECN

Island ECN was one of the first electronic communication networks established for the trading equities in the United States. Founded in 1996 by Datek Securities veterans Jeff Citron and Joshua Levine, Island executed its first trades in 1997. History Prior to Island, Citron and Levine worked together at Datek Securities (now TD Ameritrade). Citron's background was in trading and Levine had experience with software development. While at Datek, they worked together to develop a software program called Watcher. Watcher was one of the first programs to provide real-time quote and electronic order capabilities for trading Nasdaq stocks through the Small Order Execution System (SOES). In 1995, Watcher was augmented with a system called "Jump Trades" that let users of Watcher skip the Nasdaq intermediary and trade directly with each other. On February 9, 1996, Levine announced the launch of Island. Unlike the existing Instinet system, which still used human traders to match buy and sel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NASDAQ

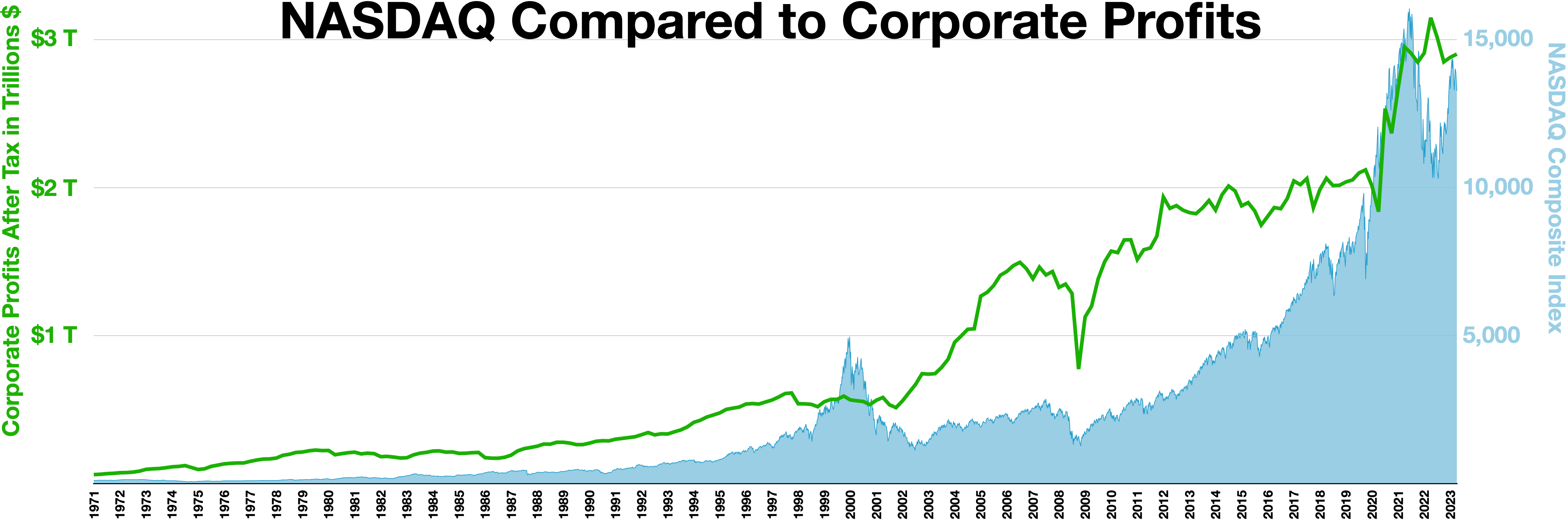

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc. (which the exchange also lists; ticker symbol NDAQ), which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. Although it trades stock of healthcare, financial, media, entertainment, retail, hospitality, and food businesses, it focuses more on technology stocks. The exchange is made up of both American and foreign firms, with China and Israel being the largest foreign sources. History 1972–2000 Nasdaq, Inc. was founded in 1971 by the National Association of Securities Dealers (NASD), which is now known as the Financial Industry Regulatory A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dark Pool

In finance, a dark pool (also black pool) is a private forum ( alternative trading system or ATS) for trading securities, derivatives, and other financial instruments."The New Financial Industry" (March 30, 2014). 65 ''Alabama Law Review'' 567 (2014); Temple University Legal Studies Research Paper No. 2014-11; via SSRN. Liquidity on these markets is called dark pool liquidity. The bulk of dark pool trades represent large trades by s that are offered away from pub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chi-X Europe

BATS Chi-X Europe is a London-based, order-driven pan-European equity exchange that has been a subsidiary of BATS Global Markets since 2011. It is a low latency, low cost alternative to exchange traded equities and exchange-traded funds (ETFs) that are listed on primary exchanges such as the London Stock Exchange, Frankfurt Stock Exchange, Euronext and OMX. Previously a multilateral trading facility (MTF), BATS Chi-X Europe received Recognised Investment Exchange (RIE) status from the Financial Conduct Authority (FCA) in May 2013, and was from then authorised to operate a Regulated Market for primary listings alongside its existing business. Initially two separate entities, Chi-X Europe was the first pan-European equities exchange to launch in 2007; BATS Europe was launched in 2008. In February 2011, BATS Global Markets agreed to buy Chi-X Europe for $300 million. The deal was referred by the Office of Fair Trading to the Competition Commission in June 2011 for further inve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nomura Group

is a financial holding company and a principal member of the Nomura Group, which is Japan's largest investment bank and brokerage group. It, along with its broker-dealer, banking and other financial services subsidiaries, provides investment, financing and related services to individual, institutional, and government customers on a global basis with an emphasis on securities businesses. History Origins The history of Nomura began on December 25, 1925, when Nomura Securities Co., Ltd. (NSC) was established in Osaka, as a spin-off from Securities Dept. of Osaka Nomura Bank Co., Ltd (the present day Resona Bank). NSC initially focused on the bond market. It was named after its founder Tokushichi Nomura II, a wealthy Japanese businessman and investor. He had earlier established Osaka Nomura bank in 1918, based on the Mitsui zaibatsu model with a capital of ¥10 million. Like the majority of Japanese conglomerates, or zaibatsu, its origins were in Osaka, but today operate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Electronic Trading Platform

In finance, an electronic trading platform, also known as an online trading platform, is a computer software program that can be used to place orders for financial products over a network with a financial intermediary. Various financial products can be traded by the trading platform, over a communication network with a financial intermediary or directly between the participants or members of the trading platform. This includes products such as stocks, bonds, currencies, commodities, derivatives and others, with a financial intermediary such as brokers, market makers, investment banks or stock exchanges. Such platforms allow electronic trading to be carried out by users from any location and are in contrast to traditional floor trading using open outcry and telephone-based trading. Sometimes the term trading platform is also used in reference to the trading software alone. Electronic trading platforms typically stream live market prices on which users can trade and may provid ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nomura Holdings

is a financial holding company and a principal member of the Nomura Group, which is Japan's largest List of investment banks#Largest full-service investment banks#Bulge Bracket#Membership, investment bank and Broker-dealer#Japan, brokerage group. It, along with its broker-dealer, banking and other financial services subsidiaries, provides investment, financing and related services to individual, institutional, and government customers on a global basis with an emphasis on securities businesses. History Origins The history of Nomura began on December 25, 1925, when Nomura Securities Co., Ltd. (NSC) was established in Osaka, as a spin-off from Securities Dept. of Osaka Nomura Bank Co., Ltd (the present day Resona Bank). NSC initially focused on the bond market. It was named after its founder Tokushichi Nomura II, a wealthy Japanese businessman and investor. He had earlier established Osaka Nomura bank in 1918, based on the Mitsui zaibatsu model with a capital of ¥10 million. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Initial Public Offering

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges. Through this process, colloquially known as ''floating'', or ''going public'', a privately held company is transformed into a public company. Initial public offerings can be used to raise new equity capital for companies, to monetize the investments of private shareholders such as company founders or private equity investors, and to enable easy trading of existing holdings or future capital raising by becoming publicly traded. After the IPO, shares are traded freely in the open market at what is known as the free float. Stock exchanges stipulate a minimum free float both in absolute terms (the total value as determined by the share price multiplied ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Silver Lake Partners

Silver Lake Technology Management, L.L.C., is an American global private equity firm focused on technology and technology-enabled investments. Silver Lake is headquartered in Silicon Valley and New York, and has offices in London, Hong Kong, and Singapore. In June 2024, Silver Lake was ranked 12th in Private Equity International's PEI 300 ranking of the largest private equity firms in the world. History Silver Lake was founded in 1999, at the height of the late 1990s technology boom to make private equity investments in mature technology companies as opposed to the startups pursued actively by venture capitalists. Among the firm's founders were Jim Davidson who had led the Technology Investment Banking business at Hambrecht & Quist; David Roux who had an operational and entrepreneurial background having served as chairman and CEO of Liberate Technologies, executive vice president at Oracle Corporation and senior vice president at Lotus Development; Roger McNamee, as the repr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |