|

CCP Global

CCP Global (CCPG) is a global body that brings together central counterparty clearing houses (CCPs) from the world's major jurisdictions. Overview CCP Global was originally formed in 2001 as an informal group named CCP12 by twelve founding CCPs, and established a permanent executive committee in 2008. In 2015, it decide to evolve into a non-profit organization that opened in Shanghai in 2017. In 2022, CCP12 relocated to Amsterdam Amsterdam ( , ; ; ) is the capital of the Netherlands, capital and Municipalities of the Netherlands, largest city of the Kingdom of the Netherlands. It has a population of 933,680 in June 2024 within the city proper, 1,457,018 in the City Re ... and, given expanded membership, rebranded as CCP Global in 2023. Membership As of early 2025, the members of CCP Global were as follows. * Argentina Clearing * Australian Securities Exchange (ASX) * Bursa Malaysia * Brasil Bolsa Balçao (B3) * Cboe Clear * Cámara de Riesgo Central de Cont ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Counterparty Clearing House

A central clearing counterparty (CCP), also referred to as a central counterparty, is a financial market infrastructure organization that takes on counterparty credit risk between parties to a transaction and provides clearing (finance), clearing and settlement (finance), settlement services for trades in wikt:foreign exchange, foreign exchange, Security (finance), securities, Option (finance), options, and derivative contracts. CCPs are highly regulated institutions that specialize in managing counterparty credit risk. CCPs "mutualize" (share among their members) counterparty credit risk in the markets in which they operate. A CCP reduces the settlement risks by netting offsetting transactions between multiple counterparties, by requiring Collateral (finance), collateral deposits (also called "Margin (finance), margin deposits"), by providing independent valuation of trades and collateral, by monitoring the creditworthiness of the member firms, and in many cases, by providing a gua ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hong Kong Exchanges And Clearing

Hong Kong Exchanges and Clearing Limited (HKEX; ) operates a range of equity, commodity, fixed income and currency markets through its wholly owned subsidiaries The Stock Exchange of Hong Kong Limited (SEHK), Hong Kong Futures Exchange Limited (HKFE) and London Metal Exchange (LME). As of December 2024, HKEX has a market capitalization of approximately US$35 trillion and 2,631 listed companies, making it the List of major stock exchanges, 8th largest stock exchange globally. HKEX was the 10th largest stock exchange in terms of IPO proceeds in the first quarter of 2024. The Group also operates four clearing houses in Hong Kong: Hong Kong Securities Clearing Company Limited (HKSCC), HKFE Clearing Corporation Limited (HKCC), the SEHK Options Clearing House Limited (SEOCH) and OTC Clearing Hong Kong Limited (OTC Clear). HKSCC, HKCC and SEOCH provide Clearing (finance), integrated clearing, Settlement (finance), settlement, depository and nominee activities to their participants, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NSE Clearing

National Stock Exchange of India Limited, also known as the National Stock Exchange (NSE), is an Indian stock exchange based in Mumbai. It is the 5th largest stock exchange in the world by total market capitalization, exceeding $5 trillion in May 2024. NSE is under the ownership of various financial institutions such as banks and insurance companies. As of 2024, it is the world's largest derivatives exchange by number of contracts traded and the third largest in cash equities by number of trades for the calendar year 2023. History National Stock Exchange was incorporated in 1992 to bring about transparency in the Indian equity markets. NSE was set up at the behest of the Government of India, based on the recommendations laid out by the Pherwani committee in 1991 and the blueprint was prepared by a team of five members (Ravi Narain, Raghavan Puthran, K Kumar, Chitra Ramkrishna and Ashishkumar Chauhan) along with R H Patil and SS Nadkarni who were deputed by IDBI in 1992. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Muqassa

Saudi Exchange () or Tadāwul () is a stock exchange in Saudi Arabia. Tadāwul was formed in 2007 as a joint stock company and the sole entity authorized to act as a securities exchange in Saudi Arabia, but trading began in 1954 as an informal financial market. It continued as such with only 14 listed companies through the 1970s and began to acquire some formal status as the Saudi Company for Share Registration in 1980. It is regulated by the Capital Market Authority but has become partially self-regulating since 2018. It lists 239 publicly traded companies on the main market (as of 10 October 2024). It is among the world's largest stock exchanges, with a market capitalization exceeding US$3 trillion in July 2024. As of 31 December 2020, its trading hours are 10:00 AM to 3:10 PM, Sunday to Thursday. On 26 February 2017, the Saudi Parallel Market (Nomu) was launched as a parallel equity market with lighter listing requirements to provide companies an alternative platform for th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nasdaq

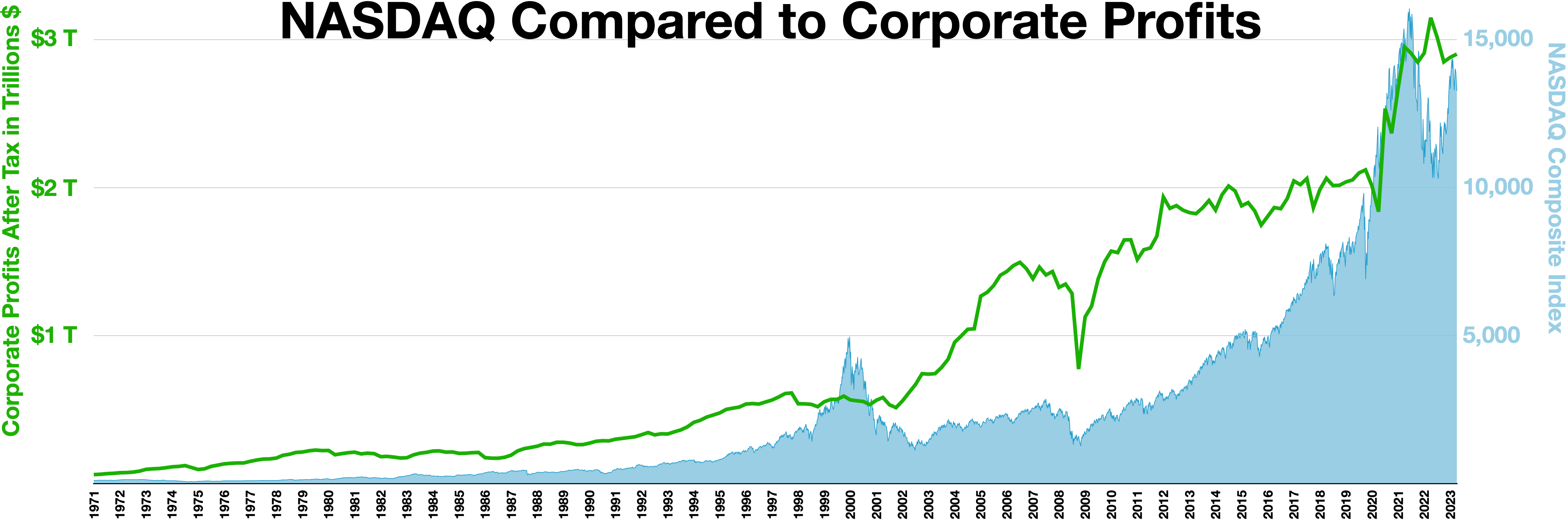

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc. (which the exchange also lists; ticker symbol NDAQ), which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. Although it trades stock of healthcare, financial, media, entertainment, retail, hospitality, and food businesses, it focuses more on technology stocks. The exchange is made up of both American and foreign firms, with China and Israel being the largest foreign sources. History 1972–2000 Nasdaq, Inc. was founded in 1971 by the National Association of Securities Dealers (NASD), which is now known as the Financial Industry Regulatory A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Miami International Holdings

MIAX’s parent holding company, Miami International Holdings, Inc., owns Miami International Securities Exchange, LLC (MIAX®), MIAX PEARL, LLC (MIAX Pearl®), MIAX Emerald, LLC (MIAX Emerald®), MIAX Sapphire LLC (MIAX Sapphire™), MIAX Futures Exchange, LLC (MIAX Futures™), MIAX Derivatives Exchange (MIAXdx™), Dorman Trading, LLC (Dorman Trading), The Bermuda Stock Exchange (BSX) and The International Stock Exchange (TISE). MIAX, MIAX Pearl, MIAX Emerald and MIAX Sapphire are national securities exchanges registered with the Securities and Exchange Commission that are enabled by MIAX’s in-house built, proprietary technology. MIAX offers trading of options on all four exchanges as well as cash equities through MIAX Pearl Equities™. The MIAX trading platform was built to meet the high-performance quoting demands of the U.S. options trading industry and is differentiated by throughput, latency, reliability and wire-order determinism. MIAX Futures is a registered exc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

MCXCCL

Multi Commodity Exchange of India Limited, also known as the Multi Commodity Exchange of India (MCX), is an Indian commodity exchange. It was established in 2003 and is currently based in Mumbai. It is India's largest commodity derivatives exchange. The average daily turnover of commodity futures contracts increased by 26% to ₹32,424 crore during FY2019-20, as against ₹25,648 crore in FY2018-19. The total turnover of commodity futures traded on the Exchange stood at ₹83.98 lakh crore in FY2019-20. MCX offers options trading in gold and futures trading in non-ferrous metals, bullions, oil, natural gas, and agricultural commodities (e.g., mentha oil, cardamom, palm oil, and cotton). MCX was among the top global commodity exchanges in terms of the number of futures contracts trade, the latest yearly data from Futures Industry Association (FIA) showed. MCX launched the MCX India Commodity Indices (MCX iCOMDEX) series on December 20, 2019, which conform to the global bes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

London Stock Exchange Group

London Stock Exchange Group plc, also known as LSEG, is a global provider of financial markets data and infrastructure headquartered in London, England. It owns the London Stock Exchange (on which it is also listed), Refinitiv, LSEG Technology, FTSE Russell, and majority stakes in LCH and Tradeweb. History The London Stock Exchange was founded in Sweeting's Alley in London in 1801. It moved to Capel Court the following year. In 1972, the Exchange moved to a new purpose-built building and trading floor in Threadneedle Street. Deregulation, sometimes known as "big bang", came in 1986 and external ownership of member firms was allowed for the first time. In 1995, the Alternative Investment Market was launched and in 2004 the Exchange moved again, this time to Paternoster Square. Between April and May 2006, having been rebuffed in an informal approach, Nasdaq built up a 23% stake in the Exchange. The stake grew to 29% as a result of the London exchange's share consolidation. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Korea Exchange

Korea Exchange (KRX, ) is the sole securities exchange operator in South Korea. It is headquartered in Busan, and has an office for cash markets and market oversight in Seoul. History The Korea Exchange was created through the integration of Korea Stock Exchange (KSE), Korea Futures Exchange and KOSDAQ Stock Market under the Korea Stock & Futures Exchange Act. The securities and derivatives markets of former exchanges are now business divisions of Korea Exchange: the Stock Market Division, KOSDAQ Market Division and Derivatives Market Division. As of December 2020, Korea Exchange had 2,409 listed companies with a combined market capitalization of ₩2.3 quadrillion KRW (US$2.1 trillion). The exchange has normal trading sessions from 09:00 am to 03:30 pm on all days of the week except Saturdays, Sundays and holidays declared by the Exchange in advance. On 22 May 2015, the Korea Exchange joined the United Nations Sustainable Stock Exchanges initiative in an event with the UN-SG ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

KDPW CCP

The National Securities Depository (, KDPW) is a Polish financial market infrastructure that operates a central counterparty clearing house branded KDPW_CCP, a central securities depository, and a trade repository. Overview KDPW had originally operated as a department of the Polish Stock Exchange from 1991, then became a joint-stock company in November 1994. Since then, it has been owned by three shareholders, each of which holds one-third of KDPW's equity capital: the Polish Ministry of Treasury, the Warsaw Stock Exchange, and the National Bank of Poland. KDPW holds securities in uncertificated ( dematerialized) form. It participates in the Association of National Numbering Agencies and in the European Central Securities Depositories Association. See also * TARGET2-Securities * CCP Global CCP Global (CCPG) is a global body that brings together central counterparty clearing houses (CCPs) from the world's major jurisdictions. Overview CCP Global was originally formed in 2 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

KELER CCP

The KELER Group (for , ) is a financial market infrastructure in Hungary, based in Budapest. It consists of two companies: KELER CSD, a central securities depository established in 1993; and KELER CCP, a central counterparty clearing house established in 2008. The KELER Group is majority-owned by the Hungarian National Bank (MNB). Overview KELER CSD is owned by the MNB (53.33 percent) and the Budapest Stock Exchange (BSE, 46.67 percent). KELER CCP is in turn mainly owned by KELER CSD (99.81 percent), with the MNB holding 0.1 percent and the BSE holding 0.09 percent. In 2015, the MNB also acquired majority control of the BSE, in which it held an equity stake of 81.35 percent as of . KELER CSD has been connected to TARGET2-Securities since 2017. In addition to ownership, both KELER CSD and KELER CCP are under the MNB's oversight. See also * European Central Securities Depositories Association * CCP Global CCP Global (CCPG) is a global body that brings together central counterpa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |