Microfinance consists of financial services targeting individuals and

small business

Small businesses are types of corporations, partnerships, or sole proprietorships which have a small number of employees and/or less annual revenue than a regular-sized business or corporation. Businesses are defined as "small" in terms of being ...

es (SMEs) who lack access to conventional

banking

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital m ...

and related services.

Microfinance includes

microcredit

Microcredit is the extension of very small loans (microloans) to impoverished borrowers who typically do not have access to traditional banking services due to a lack of collateral (finance), collateral, steady employment, and a verifiable credi ...

, the provision of small loans to poor clients;

savings

Wealth is the abundance of valuable financial assets or physical possessions which can be converted into a form that can be used for transactions. This includes the core meaning as held in the originating Old English word , which is from an ...

and

checking account

A transaction account (also called a checking account, cheque account, chequing account, current account, demand deposit account, or share account at credit unions) is a deposit account or bank account held at a bank or other financial instituti ...

s;

microinsurance

Microinsurance is the protection of low-income people (defined as those living on more than approximately $1 but less than $4 per day) against specific perils in exchange for regular premium payment proportionate to the likelihood and cost of the r ...

; and

payment system

A payment system is any system used to settle financial transactions through the transfer of monetary value. This includes the institutions, payment instruments such as payment cards, people, rules, procedures, standards, and technologies that ...

s, among other services.

Microfinance product and services in MFI include:

# Savings

# Microcredit

# Microinsurance

# Microleasing and

# Fund transfer/remittance.

Microfinance services are designed to reach excluded customers, usually low income population segments, possibly socially marginalized, or geographically more isolated, and to help them become self-sufficient.

[Peck Christen, Robert; Rosenberg, Richard; Jayadeva, Veena. ''Financial institutions with a double-bottom line: Implications for the future of microfinance''. CGAP, Occasional Papers series, July 2004, pp. 2–3.] ID Ghana is an example of a microfinance institution.

Microfinance initially had a limited definition: the provision of

microloans

Microcredit is the extension of very small loans (microloans) to impoverished borrowers who typically do not have access to traditional banking services due to a lack of collateral (finance), collateral, steady employment, and a verifiable credi ...

to small scale entrepreneurs and small (informal sectors) businesses lacking access to

credit

Credit (from Latin verb ''credit'', meaning "one believes") is the trust which allows one party to provide money or resources to another party wherein the second party does not reimburse the first party immediately (thereby generating a debt) ...

. The two main mechanisms for the delivery of financial services to such clients were:

(1) relationship-based banking for individual entrepreneurs and small businesses; and

(2) group-based model, where several entrepreneurs come together to apply for loans and other services as a group. Over time, microfinance has emerged as a larger

movement whose object is: "a world in which as everyone, especially the lower income classes and socially marginalized people and households have access to a wide range of affordable, high quality financial products and services, including not just credit but also savings, insurance, payment services, and

fund transfers."

Proponents of microfinance often claim that such access will help struggling classes out of

poverty

Poverty is a state or condition in which an individual lacks the financial resources and essentials for a basic standard of living. Poverty can have diverse Biophysical environmen ...

, including participants in the

Microcredit Summit Campaign

The Microcredit Summit Campaign, an American non-profit organization, started as an effort to bring together microcredit practitioners, advocates, educational institutions, donor agencies, international financial institutions, non-governmental or ...

. For many, microfinance is a way to promote

economic development

In economics, economic development (or economic and social development) is the process by which the economic well-being and quality of life of a nation, region, local community, or an individual are improved according to targeted goals and object ...

, employment and growth through the support of micro-entrepreneurs and small businesses; for others it is a way for the disadvantaged/less privileged to manage their finances more effectively and take advantage of economic opportunities while managing the risks. Critics often point to some of the ills of microcredit that can create indebtedness. Many studies have tried to assess its impacts.

New research in the area of microfinance calls for better understanding of the microfinance ecosystem so that the microfinance institutions and other facilitators can formulate sustainable strategies that will help create social benefits through better service delivery to the low-income population.

History

Over the past centuries, practical visionaries, from the

Franciscan

The Franciscans are a group of related organizations in the Catholic Church, founded or inspired by the Italian saint Francis of Assisi. They include three independent Religious institute, religious orders for men (the Order of Friars Minor bei ...

friars who founded the community-oriented

pawnshops of the 15th century to the founders of the

Europe

Europe is a continent located entirely in the Northern Hemisphere and mostly in the Eastern Hemisphere. It is bordered by the Arctic Ocean to the north, the Atlantic Ocean to the west, the Mediterranean Sea to the south, and Asia to the east ...

an

credit union

A credit union is a member-owned nonprofit organization, nonprofit cooperative financial institution. They may offer financial services equivalent to those of commercial banks, such as share accounts (savings accounts), share draft accounts (che ...

movement in the 19th century (such as

Friedrich Wilhelm Raiffeisen

Friedrich Wilhelm Raiffeisen (30 March 1818 – 11 March 1888) was a German mayor and cooperative pioneer. Several credit union systems and cooperative banks have been named after Raiffeisen, who pioneered rural credit unions.

Life

Friedrich Wilh ...

) and the founders of the

microcredit

Microcredit is the extension of very small loans (microloans) to impoverished borrowers who typically do not have access to traditional banking services due to a lack of collateral (finance), collateral, steady employment, and a verifiable credi ...

movement in the 1970s (such as

Muhammad Yunus

Muhammad Yunus (born 28 June 1940) is a Bangladeshi economist, entrepreneur, and civil society leader who has been serving as the Chief Adviser of Bangladesh, Chief Adviser of the Interim government of Muhammad Yunus, interim Yunus ministry, g ...

and

Al Whittaker

Al Whittaker (1918 – September 27, 2006) founded the non-profit organization Opportunity International and helped to popularize microcredit lending.

In 1971, Whittaker left his job as president of Bristol Myers to found the Institute for Inter ...

), have tested practices and built institutions designed to bring the kinds of opportunities and risk-management tools that financial services can provide to the doorsteps of poor people.

The history of microfinancing can be traced back as far as the middle of the 1800s, when the theorist

Lysander Spooner

Lysander Spooner (January 19, 1808 – May 14, 1887) was an American abolitionist, entrepreneur, lawyer, essayist, natural rights legal theorist, pamphleteer, political philosopher, and writer often associated with the Boston anarchist tr ...

was writing about the benefits of small credits to entrepreneurs and farmers as a way of getting the people out of poverty. Independently of Spooner, Friedrich Wilhelm Raiffeisen founded the first cooperative lending banks to support farmers in rural

Germany

Germany, officially the Federal Republic of Germany, is a country in Central Europe. It lies between the Baltic Sea and the North Sea to the north and the Alps to the south. Its sixteen States of Germany, constituent states have a total popu ...

.

The modern use of the expression "microfinancing" has roots in the 1970s when

Grameen Bank

Grameen Bank () is a microfinance, specialized community development bank founded in Bangladesh. It provides small loans (known as microcredit or "grameencredit") to the impoverished without requiring collateral.

Grameen Bank is a statutory ...

of

Bangladesh

Bangladesh, officially the People's Republic of Bangladesh, is a country in South Asia. It is the List of countries and dependencies by population, eighth-most populous country in the world and among the List of countries and dependencies by ...

, founded by microfinance pioneer Muhammad Yunus, was starting and shaping the modern industry of microfinancing. The approach of microfinance was institutionalized by Yunus in 1976, with the foundation of Grameen Bank in Bangladesh. Another pioneer in this sector is Pakistani social scientist

Akhtar Hameed Khan

Akhter Hameed Khan (, pronounced ; 15 July 1914 – 9 October 1999) was a Pakistani-Bangladeshi development practitioner and social scientist. He promoted participatory rural development in Pakistan, West Pakistan, Bangladesh, East Pakistan and ...

.

Since people in the developing world still largely depend on subsistence farming or basic food trade for their livelihood, significant resources have gone into supporting

smallholder

A smallholding or smallholder is a small farm operating under a small-scale agriculture model. Definitions vary widely for what constitutes a smallholder or small-scale farm, including factors such as size, food production technique or technolo ...

agriculture in developing countries.

Poverty

In

developing economies

A developing country is a sovereign state with a less-developed industrial base and a lower Human Development Index (HDI) relative to developed countries. However, this definition is not universally agreed upon. There is also no clear agreemen ...

, and particularly in rural areas, many activities that would be classified in the

developed world

A developed country, or advanced country, is a sovereign state that has a high quality of life, developed economy, and advanced technological infrastructure relative to other less industrialized nations. Most commonly, the criteria for eval ...

as financial are not

monetized: that is,

money

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are: m ...

is not used to carry them out. This is often the case when people need the services money can provide but do not have dispensable funds required for those services. This forces them to revert to other means of acquiring the funds.

In their book, ''The Poor and Their Money'', Stuart Rutherford and Sukhwinder Arora cite several types of needs:

* ''Lifecycle Needs'': such as weddings, funerals, childbirth, education, home building, holidays, festivals, widowhood and old age

* ''Personal Emergencies'': such as sickness, injury, unemployment, theft, harassment or death

* ''Disasters'': such as wildfires, floods, cyclones and man-made events like war or bulldozing of dwellings

* ''Investment Opportunities'': expanding a business, buying land or equipment, improving housing, securing a job, etc.

People find creative and often collaborative ways to meet these needs, primarily through creating and exchanging different forms of non-cash value. Common substitutes for cash vary from country to country, but typically include livestock, grains, jewelry and precious metals.

As Marguerite S. Robinson describes in his book, ''The Micro Finance Revolution: Sustainable Finance for the Poor'', the 1980s demonstrated that "micro finance could provide large-scale outreach profitably", and in the 1990s, "micro finance began to develop as an industry".

In the 2000s, the microfinance industry's objective was to satisfy the unmet

demand

In economics, demand is the quantity of a goods, good that consumers are willing and able to purchase at various prices during a given time. In economics "demand" for a commodity is not the same thing as "desire" for it. It refers to both the desi ...

on a much larger scale, and to play a role in reducing poverty. While much progress has been made in developing a viable, commercial microfinance sector in the last few decades, several issues remain that need to be addressed before the industry will be able to satisfy massive worldwide demand.

The obstacles or challenges in building a sound commercial microfinance industry include:

* Inappropriate donor

subsidies

A subsidy, subvention or government incentive is a type of government expenditure for individuals and households, as well as businesses with the aim of stabilizing the economy. It ensures that individuals and households are viable by having acce ...

* Poor regulation and supervision of deposit-taking microfinance institutions (MFIs)

* Few MFIs that meet the needs for savings, remittances or insurance

* Limited management capacity in MFIs

* Institutional inefficiencies

* Need for more dissemination and adoption of rural, agricultural microfinance methodologies

* Members' lack of collateral to secure a loan

Microfinance is the proper tool to reduce income inequality, allowing citizens from lower socio-economical classes to participate in the economy. Moreover, its involvement has shown to lead to a downward trend in income inequality.

Ways in which poor people manage their money

Rutherford argues that the basic problem that poor people face as money managers is to gather a "usefully large" amount of money. Building a new home may involve saving and protecting diverse building materials for years until enough are available to proceed with construction. Children's schooling may be funded by buying chickens and raising them for sale as needed for expenses, uniforms, bribes, etc. Because all the value is accumulated before it is needed, this money management strategy is referred to as "saving up".

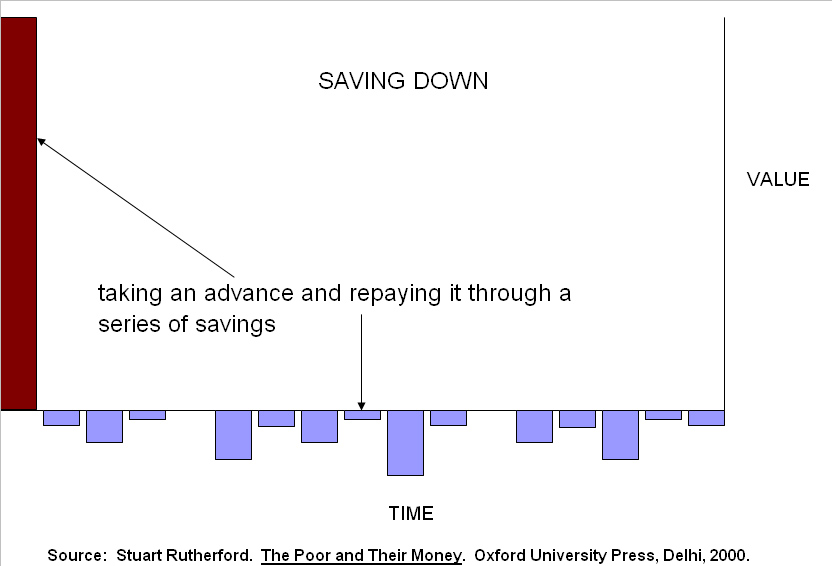

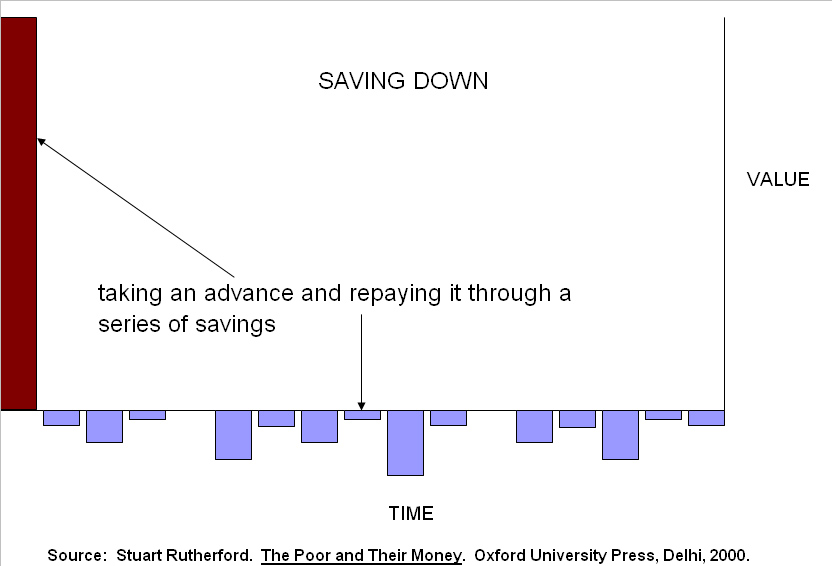

Often, people do not have enough money when they face a need, so they borrow. A poor family might borrow from relatives to buy land, from a moneylender to buy rice, or from a microfinance institution to buy a sewing machine. Since these loans must be repaid by saving after the cost is incurred, Rutherford calls this 'saving down'. Rutherford's point is that microcredit is addressing only half the problem, and arguably the less important half: poor people borrow to help them save and accumulate assets. However, microfinance is not the magical solution to take people out of poverty; it is merely a tool that the poor can use to raise their prospects for an escape from poverty.

Most needs are met through a mix of saving and credit. A benchmark impact assessment of Grameen Bank and two other large microfinance institutions in Bangladesh found that for every $1 they were lending to clients to finance rural non-farm

micro-enterprise

A micro-enterprise (or microenterprise) is generally defined as a small business employing nine people or fewer, and having a balance sheet or turnover less than a certain amount (e.g. euro, €2 million or Philippine peso, PhP 3 million). The ter ...

, about $2.50 came from other sources, mostly their clients' savings. This parallels the experience in the West, in which family businesses are funded mostly from savings, especially during start-up.

Recent studies have also shown that informal methods of saving are unsafe. For example, a study by Wright and Mutesasira in

Uganda

Uganda, officially the Republic of Uganda, is a landlocked country in East Africa. It is bordered to the east by Kenya, to the north by South Sudan, to the west by the Democratic Republic of the Congo, to the south-west by Rwanda, and to the ...

concluded that "those with no option but to save in the informal sector are almost bound to lose some money—probably around one quarter of what they save there".

The work of Rutherford, Wright and others has caused practitioners to reconsider a key aspect of the microcredit paradigm: that poor people get out of poverty by borrowing, building microenterprises and increasing their income. The new paradigm places more attention on the efforts of poor people to reduce their many vulnerabilities by keeping more of what they earn and building up their assets.

Examples

The microfinance project of "saving up" is exemplified in the slums of the south-eastern city of Vijayawada, India. This microfinance project functions as an unofficial banking system where Jyothi, a "deposit collector", collects money from slum dwellers, mostly women, in order for them to accumulate savings. Jyothi does her rounds throughout the city, collecting Rs5 a day from people in the slums for 220 days, however not always 220 days in a row since these women do not always have the funds available to put them into savings. They ultimately end up with Rs1000 at the end of the process. However, there are some issues with this microfinance saving program. One of the issues is that while saving, clients are actually losing part of their savings. Jyothi takes interest from each client—about 20 out of every 220 payments, or Rs100 out of 1,100 or 9%. When these slum dwellers find someone they trust, they are willing to pay up to 30% to someone to safely collect and keep their savings. There is also the risk of entrusting their savings to unlicensed, informal, peripatetic collectors. However, the slum dwellers are willing to accept this risk because they are unable to save at home, and unable to use the banks in the country because of illiteracy. This microfinance project also has many benefits, such as empowering women and giving parents the ability to save money for their children's education. This specific microfinance project is an example of the benefits and limitations of the "saving up" project.

[Rutherford, 2009.]

The microfinance project of "saving through" is shown in Nairobi, Kenya which includes a

Rotating Savings and Credit Association

A rotating savings and credit association (ROSCA) is a group of individuals who agree to meet for a defined period in order to save and borrow together, a form of combined peer-to-peer banking and peer-to-peer lending. Members all chip in regula ...

s or ROSCAs initiative. This is a small scale example, however Rutherford (2009) describes a woman he met in Nairobi and studied her ROSCA. Every day 15 women would save 100 shillings so there would be a lump sum of 1,500 shillings and every day 1 of the 15 women would receive that lump sum. This would continue for 15 days and another woman within this group would receive the lump sum. At the end of the 15 days a new cycle would start. This ROSCA initiative is different from the "saving up" example above because there are no interest rates affiliated with the ROSCA, additionally everyone receives back what they put forth. This initiative requires trust and social capital networks in order to work, so often these ROSCAs include people who know each other and have reciprocity. The ROSCA allows for marginalized groups to receive a lump sum at one time in order to pay or save for specific needs they have.

Debates and challenges

There are several key debates at the boundaries of microfinance.

Loan pricing

Before determining loan prices, one should take into account the following costs: 1) administrative costs by the bank (MFI) and 2) transaction cost by the client/customer. Customers, on the other hand, may have expenses for travelling to the bank branch, acquiring official documents for the loan application, and loss of time when dealing with the MFI ("

opportunity cost

In microeconomic theory, the opportunity cost of a choice is the value of the best alternative forgone where, given limited resources, a choice needs to be made between several mutually exclusive alternatives. Assuming the best choice is made, ...

s"). Hence, from a customer's point of view the cost of a loan is not only the interest and fees she/he has to pay, but also all other transaction costs that she/he has to cover.

One of the principal challenges of microfinance is providing small loans at an affordable cost. The global average interest and fee rate is estimated at 37%, with rates reaching as high as 70% in some markets. The reason for the high interest rates is not primarily cost of capital. Indeed, the local microfinance organizations that receive zero-interest loan capital from the online microlending platform

Kiva

A kiva (also ''estufa'') is a space used by Puebloans for rites and political meetings, many of them associated with the kachina belief system. Among the modern Hopi and most other Pueblo peoples, "kiva" means a large room that is circula ...

charge average interest and fee rates of 35.21%.

Rather, the main reason for the high cost of microfinance loans is the high

transaction cost

In economics, a transaction cost is a cost incurred when making an economic trade when participating in a market.

The idea that transactions form the basis of economic thinking was introduced by the institutional economist John R. Commons in 1 ...

of traditional microfinance operations relative to loan size.

Microfinance practitioners have long argued that such high interest rates are simply unavoidable, because the cost of making each loan cannot be reduced below a certain level while still allowing the lender to cover costs such as offices and staff salaries. For example, in Sub-Saharan Africa credit risk for microfinance institutes is very high, because customers need years to improve their livelihood and face many challenges during this time. Financial institutes often do not even have a system to check the person's identity. Additionally, they are unable to design new products and enlarge their business to reduce the risk. The result is that the traditional approach to microfinance has made only limited progress in resolving the problem it purports to address: that the world's poorest people pay the world's highest cost for small business growth capital. The high costs of traditional microfinance loans limit their effectiveness as a poverty-fighting tool. Offering loans at interest and fee rates of 37% mean that borrowers who do not manage to earn at least a 37% rate of return may actually end up poorer as a result of accepting the loans.

According to a recent survey of microfinance borrowers in Ghana published by the Center for Financial Inclusion, more than one-third of borrowers surveyed reported struggling to repay their loans. Some resorted to measures such as reducing their food intake or taking children out of school in order to repay microfinance debts that had not proven sufficiently profitable.

In recent years, the microfinance industry has shifted its focus from the objective of increasing the volume of lending capital available, to address the challenge of providing microfinance loans more affordably. Microfinance analyst David Roodman contends that, in mature markets, the average interest and fee rates charged by microfinance institutions tend to fall over time. However, global average interest rates for microfinance loans are still well above 30%.

The answer to providing microfinance services at an affordable cost may lie in rethinking one of the fundamental assumptions underlying microfinance: that microfinance borrowers need extensive monitoring and interaction with loan officers in order to benefit from and repay their loans. The P2P microlending service

Zidisha

Zidisha is a peer-to-peer microlending service that allows people to lend small amounts of money directly to entrepreneurs in developing countries. It is the first peer-to-peer microlending service to link borrowers and lenders across internatio ...

is based on this premise, facilitating direct interaction between individual lenders and borrowers via an internet community rather than physical offices. Zidisha has managed to bring the cost of microloans to below 10% for borrowers, including interest which is paid out to lenders. However, it remains to be seen whether such radical alternative models can reach the scale necessary to compete with traditional microfinance programs.

Use of loans

Practitioners and donors from the charitable side of microfinance frequently argue for restricting microcredit to loans for productive purposes—such as to start or expand a

microenterprise

A micro-enterprise (or microenterprise) is generally defined as a small business employing nine people or fewer, and having a balance sheet or turnover less than a certain amount (e.g. €2 million or PhP 3 million). The terms microenterprise and ...

. Those from the private-sector side respond that, because money is

fungible

In economics and law, fungibility is the property of something whose individual units are considered fundamentally interchangeable with each other.

For example, the fungibility of money means that a $100 bill (note) is considered entirely equ ...

, such a restriction is impossible to enforce, and that in any case it should not be up to rich people to determine how poor people use their money.

Reach versus depth of impact

There has been a long-standing debate over the sharpness of the trade-off between 'outreach' (the ability of a microfinance institution to reach poorer and more remote people) and its '

sustainability

Sustainability is a social goal for people to co-exist on Earth over a long period of time. Definitions of this term are disputed and have varied with literature, context, and time. Sustainability usually has three dimensions (or pillars): env ...

' (its ability to cover its operating costs—and possibly also its costs of serving new clients—from its operating revenues). Although it is generally agreed that microfinance practitioners should seek to balance these goals to some extent, there are a wide variety of strategies, ranging from the minimalist profit-orientation of

BancoSol in

Bolivia

Bolivia, officially the Plurinational State of Bolivia, is a landlocked country located in central South America. The country features diverse geography, including vast Amazonian plains, tropical lowlands, mountains, the Gran Chaco Province, w ...

to the highly integrated not-for-profit orientation of

BRAC in Bangladesh. This is true not only for individual institutions, but also for governments engaged in developing national microfinance systems. BRAC was ranked the number one NGO in the world in 2015 and 2016 by the Geneva-based NGO Advisor.

Women

Microfinance provides women around the world with financial and non-financial services, especially in the most rural areas that do not have access to traditional banking and other basic financial infrastructure. It creates opportunities for women to start-up and build their businesses using their own skills and talents.

Utilizing savings, credit, and microinsurance, Microfinance helps families create income-generating activities and better cope with risk. Women particularly benefit from microfinance as many microfinance institutions (MFIs) target female clients. Most microfinance institutions (MFIs) partner with other organizations like

Water.org

Water.org is an international nonprofit organization that helps people living in poverty get access to safe water and improved sanitation through affordable financing. This organization was founded by Matt Damon and Gary White.

Water.org curren ...

and

Habitat for Humanity

Habitat for Humanity International (HFHI), generally referred to as Habitat for Humanity or Habitat, is a U.S. non-governmental, and tax-exempt 501(C)(3) Christian nonprofit organization which seeks to build affordable housing. The international ...

to provide additional services for their clients.

Microfinance generally agree that women should be the primary focus of service delivery. Evidence shows that they are less likely to default on their loans than men. Industry data from 2006 for 704 MFIs reaching 52 million borrowers includes MFIs using the

solidarity lending

Solidarity lending is a lending practice where small groups borrow collectively and group members encourage one another to repay. It is an important building block of microfinance.

Operations

Solidarity lending takes place through 'solidarity gr ...

methodology (99.3% female clients) and MFIs using individual lending (51% female clients). The delinquency rate for solidarity lending was 0.9% after 30 days (individual lending—3.1%), while 0.3% of loans were written off (individual lending—0.9%). Because operating margins become tighter the smaller the loans delivered, many MFIs consider the risk of lending to men to be too high. This focus on women is questioned sometimes, however a recent study of microentrepreneurs from Sri Lanka published by the

World Bank

The World Bank is an international financial institution that provides loans and Grant (money), grants to the governments of Least developed countries, low- and Developing country, middle-income countries for the purposes of economic development ...

found that the return on capital for male-owned businesses (half of the sample) averaged 11%, whereas the return for women-owned businesses was 0% or slightly negative.

Microfinance's emphasis on female-oriented lending is the subject of controversy, as it is claimed that microfinance improves the status of women through an alleviation of poverty. It is argued that by providing women with initial capital, they will be able to support themselves independent of men, in a manner which would encourage

sustainable growth

Sustainable development is an approach to growth and human development that aims to meet the needs of the present without compromising the ability of future generations to meet their own needs.United Nations General Assembly (1987)''Report of th ...

of enterprise and eventual self-sufficiency. This claim has yet to be proven in any substantial form. Moreover, the attraction of women as a potential investment base is precisely because they are constrained by socio-cultural norms regarding such concepts of obedience, familial duty, household maintenance and passivity. The result of these norms is that while micro-lending may enable women to improve their daily subsistence to a more steady pace, they will not be able to engage in market-oriented business practice beyond a limited scope of low-skilled, low-earning, informal work. Part of this is a lack of permissivity in the society; part a reflection of the added burdens of household maintenance that women shoulder alone as a result of microfinancial empowerment; and part a lack of training and education surrounding gendered conceptions of economics. In particular, the shift in norms such that women continue to be responsible for all the domestic private sphere labour as well as undertaking public economic support for their families, independent of male aid increases rather than decreases burdens on already limited persons.

If there were to be an exchange of labour, or if women's income were supplemental rather than essential to household maintenance, there might be some truth to claims of establishing long-term businesses; however when so constrained it is impossible for women to do more than pay off a current loan only to take on another in a cyclic pattern which is beneficial to the financier but hardly to the borrower. This gender essentializing crosses over from institutionalized lenders such as the Grameen Bank into interpersonal direct lending through charitable crowd-funding operations, such as Kiva. More recently, the popularity of non-profit global online lending has grown, suggesting that a redress of gender norms might be instituted through individual selection fomented by the processes of such programs, but the reality is as yet uncertain. Studies have noted that the likelihood of lending to women, individually or in groups, is 38% higher than rates of lending to men.

This is also due to a general trend for interpersonal microfinance relations to be conducted on grounds of similarity and internal/external recognition: lenders want to see something familiar, something supportable in potential borrowers, so an emphasis on family, goals of education and health, and a commitment to community all achieve positive results from prospective financiers. Unfortunately, these labels disproportionately align with women rather than men, particularly in the developing world. The result is that microfinance continues to rely on restrictive gender norms rather than seek to subvert them through economic redress in terms of foundation change: training, business management and financial education are all elements which might be included in parameters of female-aimed loans and until they are the fundamental reality of women as a disadvantaged section of societies in developing states will go untested.

Organizations supporting this work

*ADA

*Khushhali Microfinance Bank Limited Pakistan

*

FINCA

''Finca'' () is a Spanish term for estate. In English usage, it refers to a piece of rural or agricultural land, typically with a cottage, farmhouse or estate building present, and often adjacent to a woodland or plantation.

Overview

Especial ...

*NWTF

*Akhuwat Foundation Pakistan

*

Alkhidmat Foundation Pakistan

Alkhidmat Foundation Pakistan () is a non-political, non-governmental, and non-profit organization that provides humanitarian and social welfare services to communities across Pakistan. The Foundation has been known for its active involvement in di ...

*Whole Planet Foundation

*

Kiva

A kiva (also ''estufa'') is a space used by Puebloans for rites and political meetings, many of them associated with the kachina belief system. Among the modern Hopi and most other Pueblo peoples, "kiva" means a large room that is circula ...

*MCPI

*

Women's World Banking

Women's World Banking is a global nonprofit organization dedicated to women's economic empowerment through financial inclusion.

__TOC__

Mission and vision

As an NGO, Women's World Banking (WWB) partners with financial institutions and policymak ...

*

Benefits and limitations

One of the benefits of microfinancing for poverty stricken and low-income households is that it is accessible. Banks today will not extend loans to those with little to no assets, and generally do not engage in small size loans typically associated with microfinancing. Microfinancing is based on the philosophy that even small amounts of credit can help end the cycle of poverty. Another benefit produced from the microfinancing initiative is that it presents opportunities, such as extending education and jobs. Families receiving microfinancing are less likely to pull their children out of school for economic reasons. As well, in relation to employment, people are more likely to open small businesses that will aid the creation of new jobs. Overall, the benefits outline that the microfinancing initiative is set out to improve the standard of living amongst impoverished communities.

There are also many social and financial challenges for microfinance initiatives. For example, more articulate and better-off community members may cheat poorer or less-educated neighbours. This may occur intentionally or inadvertently through loosely run organizations. As a result, many microfinance initiatives require a large amount of social capital or trust in order to work effectively. The ability of poorer people to save may also fluctuate over time as unexpected costs may take priority which could result in them being able to save little or nothing some weeks. Rates of inflation may cause funds to lose their value, thus financially harming the saver and not benefiting the collector.

While the success of the Grameen Bank (which now serves over 7 million poor Bangladeshi women) has inspired the world, it has proved difficult to replicate this success. In nations with lower population densities, meeting the operating costs of a retail branch by serving nearby customers has proven considerably more challenging. Hans Dieter Seibel, board member of the European Microfinance Platform, is in favour of the group model. This particular model (used by many Microfinance institutions) makes financial sense, he says, because it reduces transaction costs. Microfinance programmes also need to be based on local funds.

Standards and principles

Poor people borrow from

informal

Formal, formality, informal or informality imply the complying with, or not complying with, some set of requirements ( forms, in Ancient Greek). They may refer to:

Dress code and events

* Formal wear, attire for formal events

* Semi-formal att ...

moneylenders and save with informal collectors. They receive loans and

grants

Grant or Grants may refer to:

People

* Grant (given name), including a list of people and fictional characters

* Grant (surname), including a list of people and fictional characters

** Ulysses S. Grant (1822–1885), the 18th president of the U ...

from

charities

A charitable organization or charity is an organization whose primary objectives are philanthropy and social well-being (e.g. educational, religious or other activities serving the public interest or common good).

The legal definition of a cha ...

. They buy insurance from state-owned companies. They receive funds transfers through formal or informal

remittance

A remittance is a non-commercial transfer of money by a foreign worker, a member of a diaspora community, or a citizen with familial ties abroad, for household income in their home country or homeland.

Money sent home by migrants competes ...

networks. It is not easy to distinguish microfinance from similar activities. It could be claimed that a government that orders state banks to open deposit accounts for poor consumers, or a moneylender that engages in

usury

Usury () is the practice of making loans that are seen as unfairly enriching the lender. The term may be used in a moral sense—condemning taking advantage of others' misfortunes—or in a legal sense, where an interest rate is charged in e ...

, or a charity that runs a

heifer pool are engaged in microfinance. Ensuring financial services to poor people is best done by expanding the number of financial institutions available to them, as well as by strengthening the capacity of those institutions. In recent years there has also been increasing emphasis on expanding the diversity of institutions, since different institutions serve different needs.

Some principles that summarize a century and a half of development practice were encapsulated in 2004 by CGAP and endorsed by the

Group of Eight

The Group of Eight (G8) was an intergovernmental political forum from 1997 to 2014, formed by incorporating Russia into the G7. The G8 became the G7 again after Russia was expelled in 2014 after the Russian annexation of Crimea.

The forum ...

leaders at the G8 Summit on 10 June 2004:

#Poor people need not just loans but also savings,

insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect ...

and

money transfer services.

#Microfinance must be useful to poor households: helping them raise income, build up assets and/or cushion themselves against external shocks.

#"Microfinance can pay for itself." Subsidies from donors and government are scarce and uncertain and so, to reach large numbers of poor people, microfinance must pay for itself.

#Microfinance means building permanent local institutions.

#Microfinance also means integrating the financial needs of poor people into a country's mainstream financial system.

#"The job of government is to enable financial services, not to provide them."

[Helms (2006), p. xii]

#"Donor funds should complement private

capital

Capital and its variations may refer to:

Common uses

* Capital city, a municipality of primary status

** Capital region, a metropolitan region containing the capital

** List of national capitals

* Capital letter, an upper-case letter

Econom ...

, not compete with it."

#"The key

bottleneck

Bottleneck may refer to:

* the narrowed portion (neck) of a bottle

Science and technology

* Bottleneck (engineering), where the performance of an entire system is limited by a single component

* Bottleneck (network), in a communication network

* ...

is the shortage of strong institutions and managers."

Donors should focus on capacity building.

#

Interest rate ceiling

An interest rate ceiling (also known as an interest rate cap) is a regulatory measure that prevents banks or other financial institutions from charging more than a certain rate of interest.

Interest rate caps and their impact on financial inclusio ...

s hurt poor people by preventing microfinance institutions from covering their costs, which chokes off the supply of credit.

#Microfinance institutions should measure and disclose their performance – both financially and socially.

Microfinance is considered a tool for socio-economic development, and can be clearly distinguished from charity. Families who are destitute, or so poor they are unlikely to be able to generate the cash flow required to repay a loan, should be recipients of charity. Others are best served by financial institutions.

Scale of operations

No systematic effort to map the distribution of microfinance has yet been undertaken. A benchmark was established by an analysis of 'alternative financial institutions' in the developing world in 2004. The authors counted approximately 665 million client accounts at over 3,000 institutions that are serving people who are poorer than those served by the commercial banks. Of these accounts, 120 million were with institutions normally understood to practice microfinance. Reflecting the diverse historical roots of the movement, however, they also included postal

savings bank

A savings bank is a financial institution that is not run on a profit-maximizing basis, and whose original or primary purpose is collecting deposits on savings accounts that are invested on a low-risk basis and receive interest. Savings banks ha ...

s (318 million accounts), state agricultural and

development bank

Development finance institution (DFI), also known as a Development bank, is a financial institution that provides risk capital for economic development projects on a non-commercial basis.

DFIs are often established and owned by governments or ...

s (172 million accounts), financial

cooperatives

A cooperative (also known as co-operative, coöperative, co-op, or coop) is "an autonomous association of persons united voluntarily to meet their common economic, social and cultural needs and aspirations through a jointly owned and democr ...

and

credit unions

A credit union is a member-owned nonprofit cooperative financial institution. They may offer financial services equivalent to those of commercial banks, such as share accounts (savings accounts), share draft accounts ( cheque accounts), credit ...

(35 million accounts) and specialized rural banks (19 million accounts).

Regionally, the highest concentration of these accounts was in

India

India, officially the Republic of India, is a country in South Asia. It is the List of countries and dependencies by area, seventh-largest country by area; the List of countries by population (United Nations), most populous country since ...

(188 million accounts representing 18% of the total national population). The lowest concentrations were in

Latin America

Latin America is the cultural region of the Americas where Romance languages are predominantly spoken, primarily Spanish language, Spanish and Portuguese language, Portuguese. Latin America is defined according to cultural identity, not geogr ...

and the

Caribbean

The Caribbean ( , ; ; ; ) is a region in the middle of the Americas centered around the Caribbean Sea in the Atlantic Ocean, North Atlantic Ocean, mostly overlapping with the West Indies. Bordered by North America to the north, Central America ...

(14 million accounts representing 3% of the total population) and

Africa

Africa is the world's second-largest and second-most populous continent after Asia. At about 30.3 million km2 (11.7 million square miles) including adjacent islands, it covers 20% of Earth's land area and 6% of its total surfac ...

(27 million accounts representing 4% of the total population, with the highest rate of penetration in West Africa, and the highest growth rate in Eastern and Southern Africa ). Considering that most bank clients in the developed world need several active accounts to keep their affairs in order, these figures indicate that the task the microfinance movement has set for itself is still very far from finished.

By type of service, "savings accounts in alternative finance institutions outnumber loans by about four to one. This is a worldwide pattern that does not vary much by region."

An important source of detailed data on selected microfinance institutions is the ''MicroBanking Bulletin'', which is published by

Microfinance Information Exchange. At the end of 2009, it was tracking 1,084 MFIs that were serving 74 million borrowers ($38 billion in outstanding loans) and 67 million savers ($23 billion in deposits).

Another source of information regarding the environment of microfinance is the Global Microscope on the Microfinance Business Environment, prepared by the

Economist Intelligence Unit

The Economist Intelligence Unit (EIU) is the research and analysis division of the Economist Group, providing forecasting and advisory services through research and analysis, such as monthly country reports, five-year country economic forecasts ...

(EIU), the

Inter-American Development Bank

The Inter-American Development Bank (IDB or IADB) is an international development finance institution headquartered in Washington, D.C., United States of America. It serves as one of the leading sources of development financing for the countri ...

, and others. The 2011 report contains information on the environment of microfinance in 55 countries among two categories, the regulatory framework and the supporting institutional framework. This publication, also known as the Microscope, was first developed in 2007, focusing only on Latin America and the Caribbean, but by 2009, this report had become a global study.

As yet there are no studies that indicate the scale or distribution of 'informal' microfinance organizations like

ROSCA

A rotating savings and credit association (ROSCA) is a group of individuals who agree to meet for a defined period in order to save and borrow together, a form of combined peer-to-peer banking and peer-to-peer lending. Members all chip in regula ...

's and informal associations that help people manage costs like weddings, funerals and sickness. Numerous case studies have been published, however, indicating that these organizations, which are generally designed and managed by poor people themselves with little outside help, operate in most countries in the developing world.

Help can come in the form of more and better-qualified staff; thus, higher education is needed for microfinance institutions. This has begun in some universities, as Oliver Schmidt describes.

Ecosystem

In recent years, there have been calls for better understanding of the ecosystem of microfinance. The practitioners and researchers felt that it was important to understand the ecosystem in which microfinance institutions operated in order for the market system actors and facilitators to understand what they have to do to achieve their objectives of participating in the ecosystem.

Professors

Debapratim Purkayastha

Debapratim Purkayastha (Bengali language, Bengali: দেবপ্রতিম পুরকায়স্থ; born 1976) was a professor of strategy, academic leader and case method expert.

Early life and education

Purkayastha was born in Ha ...

, Trilochan Tripathy and Biswajit Das have designed a model for the ecosystem of microfinance institutions (MFIs) in India. The researchers mapped the ecosystem and found the ecosystem to be very complicated, with complex interactions among numerous actors themselves, and their environment. This ecosystem framework can be used by MFIs to understand the ecosystem of microfinance and formulate strategy. It can also help other stakeholders such as donors, investors, banks, government, etc. to formulate their own strategies relating to this sector.

[

]

In the United States and Canada

In Canada

Canada is a country in North America. Its Provinces and territories of Canada, ten provinces and three territories extend from the Atlantic Ocean to the Pacific Ocean and northward into the Arctic Ocean, making it the world's List of coun ...

and the US, microfinance organizations target marginalized populations unable to access mainstream bank financing. Close to 8% of Americans are unbanked, meaning around 9 million are without any kind of bank account or formal financial services. Most of these institutions are structured as nonprofit organizations

A nonprofit organization (NPO), also known as a nonbusiness entity, nonprofit institution, not-for-profit organization, or simply a nonprofit, is a non-governmental (private) legal entity organized and operated for a collective, public, or so ...

.

Impact

While all microfinance institutions aim at increasing incomes and employment, in developing countries the empowerment of women, improved nutrition and improved education of the borrower's children are frequently aims of microfinance institutions. In the US and Canada, aims of microfinance include the graduation of recipients from welfare programs and an improvement in their credit rating. In the US, microfinance has created jobs directly and indirectly, as 60% of borrowers were able to hire others.

United States

In the late 1980s, microfinance institutions developed in the United States. They served low-income and marginalized minority communities. By 2007, there were 500 microfinance organizations operating in the US with 200 lending capital.self-employment

Self-employment is the state of working for oneself rather than an employer. Tax authorities will generally view a person as self-employed if the person chooses to be recognised as such or if the person is generating income for which a tax return ...

, as a strategy for improving the lives of the poor.

# The increase in the proportion of Latin American

Latin Americans (; ) are the citizenship, citizens of Latin American countries (or people with cultural, ancestral or national origins in Latin America).

Latin American countries and their Latin American diaspora, diasporas are Metroethnicity, ...

and Asian immigrants who came from societies where microenterprises are prevalent.

These factors incentivized the public and private supports to have microlending activity in the United States.

Canada

Microfinance in Canada took shape through the development of credit unions. These credit unions provided financial services to the Canadians who could not get access to traditional financial means. Two separate branches of credit unions developed in Canada to serve the financially marginalized segment of the population. Alphonse Desjardins introduced the establishment of savings and credit services in late 1900 to the Quebec

Quebec is Canada's List of Canadian provinces and territories by area, largest province by area. Located in Central Canada, the province shares borders with the provinces of Ontario to the west, Newfoundland and Labrador to the northeast, ...

ois who did not have financial access. Approximately 30 years later Father Moses Coady introduced credit unions to Nova Scotia

Nova Scotia is a Provinces and territories of Canada, province of Canada, located on its east coast. It is one of the three Maritime Canada, Maritime provinces and Population of Canada by province and territory, most populous province in Atlan ...

. These were the models of the modern institutions still present in Canada today.

Efforts to transfer specific microfinance innovations such as solidarity lending

Solidarity lending is a lending practice where small groups borrow collectively and group members encourage one another to repay. It is an important building block of microfinance.

Operations

Solidarity lending takes place through 'solidarity gr ...

from developing countries to Canada have met with little success.

Selected microfinance institutions in Canada are:

* Rise Asset Development

Founded by Sandra Rotman in 2009, Rise is a Rotman and CAMH initiative that provides small business loans, leases, and lines of credit to entrepreneurs with mental health and addiction challenges.

* Alterna Savings

Formed in 2005 through the merging of the Civil Service Savings and Loan Society and the Metro Credit Union, Alterna is a financial alternative to Canadians. Their banking policy is based on cooperative values and expert financial advising.

*Access Community Capital Fund

Based in Toronto, Ontario, ACCESS is a Canadian charity that helps entrepreneurs without collateral or credit history find affordable small loans.

*Montreal Community Loan Fund

Created to help eradicate poverty, Montreal Community Loan Fund provides accessible credit and technical support to entrepreneurs with low income or credit for start-ups or expansion of organizations that cannot access traditional forms of credit.

*Momentum

Using the community economic development Community economic development (CED) is a field of study that actively elicits community involvement when working with government and private sectors to build strong communities, industries, and markets. It includes collaborative and participatory ...

approach, Momentum offers opportunities to people living in poverty in Calgary. Momentum provides individuals and families who want to better their financial situation take control of finances, become computer literate, secure employment, borrow and repay loans for business, and purchase homes.

*Vancity

Vancouver City Savings Credit Union, commonly referred to as Vancity, is a member-owned financial co-operative headquartered in Vancouver, British Columbia, Canada. By asset size, Vancity is the largest community credit union in Canada , with ...

Founded in 1946, Vancity is now the largest English speaking credit union in Canada.

Limitations

Complications specific to Canada include the need for loans of a substantial size in comparison to the ones typically seen in many international microfinance initiatives. Microfinance is also limited by the rules and limitations surrounding money-lending. For example, Canada Revenue Agency limits the loans made in these sorts of transactions to a maximum of $25,000. As a result, many people look to banks to provide these loans. Also, microfinance in Canada is driven by profit which, as a result, fails to advance the social development of community members. Within marginalized or impoverished Canadian communities, banks may not be readily accessible to deposit or take out funds. These banks which would have charged little or no interest on small amounts of cash are replaced by lending companies. Here, these companies may charge extremely large interest rates to marginalized community members thus increasing the cycle of poverty and profiting off of another's loss.

In Canada, microfinancing competes with pay-day loans institutions which take advantage of marginalized and low-income individuals by charging extremely high, predatory interest rates. Communities with low social capital often do not have the networks to implement and support microfinance initiatives, leading to the proliferation of pay day loan institutions. Pay day loan companies are unlike traditional microfinance in that they don't encourage collectivism and social capital building in low income communities, however exist solely for profit.

Networks and associations

There are several professional networks of microfinance institutions, and organisations that support microfinance and financial inclusion.

MicroFinance Network

The Microfinance Network is a network of 20 to 25 of the world's largest microfinance institutions, spread across Asia, Africa, the Middle East, Europe and Latin America. Established in 1993, the Microfinance Network provided support to members that helped steer many industry leaders to sustainability, and profitability in many of their largest markets. Today as the sector enters a new period of transition, with the rise of digital financial technology

Financial technology (abbreviated as fintech) refers to the application of innovative technologies to products and services in the financial industry. This broad term encompasses a wide array of technological advancements in financial services, ...

that increasingly competes with traditional microfinance institutions, the Microfinance Network provides a space to discuss opportunities and challenges that arise from emerging technological innovations in inclusive finance. The Microfinance Network convenes once a year. Members include Al Majmoua, BRAC, BancoSol, Gentera, Kamurj, LAPO, and SOGESOL.

Microfinance services including Easy Paisa by Telenor and Temeer Microfinance Bank, Jazz Cash by Jazz Telecom, and Zindigi have all been introduced by various telecom companies in Pakistan. These services provide lending services, retailer services, and online money transfer capabilities.

Partnership for Responsible Financial Inclusion

The Partnership for Responsible Financial, previously known as the Microfinance CEO Working Group, is a collaborative effort of leading international organizations and their CEOs active in the microfinance and inclusive finance space, including direct microfinance practitioners, and microfinance funders. It consists of 10 members, including Accion, Aga Khan Agency for Microfinance, BRAC, CARE USA, FINCA Impact Finance, Grameen Foundation, Opportunity International, Pro Mujer, Vision Fund International and Women's World Banking. Harnessing the power of the CEOs and their senior managers, the PRFI advocates for responsible financial services and seeks catalytic opportunities to accelerate financial access to the unserved. As part of this focus, PRFI is responsible for setting up the Smart Campaign, in response to negative microfinance practices that indicated the mistreatment of clients in certain markets. The network is made up of the CEO working group, that meet quarterly and several subcommittee working groups dedicated to communications, social performance, digital financial services, and legal and human resources issues.

European Microfinance Network

The European Microfinance Network (EMN) was established in response to many legal and political obstacles affecting the microfinance sector in Europe. The Network is involved in advocacy on a wide range of issues related to microfinance, micro-enterprises, social and financial exclusion, self-employment and employment creation. Its main activity is the organisation of its annual conference, which has taken place each year since 2004. The EMN has a wide network of over 100 members.

Microfinance Centre

The Microfinance Centre (MFC) has a membership of over 100 organisations, and is particularly strong in Eastern Europe, the Balkans and Central Asia.

Africa Microfinance Network (AFMIN)

The Africa Microfinance Network (AFMIN) is an association of microfinance networks in Africa resulting from an initiative led by African microfinance practitioners to create and strengthen country-level microfinance networks for the purpose of establishing shared performance standards, institutional capacity and policy change.

AFMIN was formally launched in November 2000 and has established its secretariat in Abidjan (Republic of Côte d'Ivoire), where AFMIN is legally recognized as an international Non-Governmental Organisation pursuant to Ivorian laws. Because of the political unrest in Côte d'Ivoire, AFMIN temporarily relocated its office to Cotonou in Benin.

Inclusive financial systems

The microcredit

Microcredit is the extension of very small loans (microloans) to impoverished borrowers who typically do not have access to traditional banking services due to a lack of collateral (finance), collateral, steady employment, and a verifiable credi ...

movement that began in the 1970s has emerged and morphed into a 'financial systems' approach for creating universal financial inclusion. While the Grameen model of delivering small credit achieved a great deal, especially in urban and near-urban areas and with entrepreneurial

Entrepreneurship is the creation or extraction of economic value in ways that generally entail beyond the minimal amount of risk (assumed by a traditional business), and potentially involving values besides simply economic ones.

An entrepreneu ...

families, its progress in delivering financial services in less densely populated rural areas was slow, creating the need for many and multiple models to emerge across the globe. The terms have evolved from microcredit, to microfinance, and now financial inclusion. Specialized microfinance institutions (MFIs) continue to expand their services, collaborating and competing with banks, credit unions, mobile money, and other informal and formal member-owned institutions.

The new financial systems approach pragmatically acknowledges the richness of centuries of microfinance history and the immense diversity of institutions serving poor people in developing and developed economies today. It is also rooted in an increasing awareness of diversity of the financial service needs of the world's poorest people, and the diverse settings in which they live and work. It also acknowledges that quality and range of financial services are also important for the banking system to achieve fuller and deeper financial inclusion, for all. Central banks and mainstream banks are now more intimately engaging in the financial inclusion agenda than ever before, though it is a long road, with 35–40% of world's adults remaining outside formal banking system, and many more remaining "under-banked". Advent of mobile-phone-based money management and digital finance is changing the scenario fast; though "social distance" between the economically poor or social marginalized and the banking system remains large.

; Informal financial service providers

: These include moneylenders, pawnbrokers

A pawnbroker is an individual that offers secured loans to people, with items of personal property used as Collateral (finance), collateral. A pawnbrokering business is called a pawnshop, and while many items can be pawned, pawnshops typic ...

, savings collectors, money-guards, ROSCAs, ASCAs and input supply shops. These continue their services because they know each other well and live in the same community, they understand each other's financial circumstances and can offer very flexible, convenient and fast services. These services can also be costly and the choice of financial products limited and very short-term. Informal services that involve savings are also risky; many people lose their money.

; Member-owned organizations

: These include self-help groups, Village Savings and Loan Associations

A village is a human settlement or community, larger than a hamlet but smaller than a town with a population typically ranging from a few hundred to a few thousand. Although villages are often located in rural areas, the term urban village ...

(VSLAs), credit union

A credit union is a member-owned nonprofit organization, nonprofit cooperative financial institution. They may offer financial services equivalent to those of commercial banks, such as share accounts (savings accounts), share draft accounts (che ...

s, CVECAs and a variety of other members owned and governed informal or formal financial institutions. Informal groups, like their more traditional cousins, are generally small and local, which means they have access to good knowledge about each other's financial circumstances and can offer convenience and flexibility. Since they are managed by poor people, their costs of operation are low. Often, they do not need regulation and supervision, unless they grow in scale and formalize themselves by coming together to form II or III tier federations. If not prepared well, they can be 'captured' by a few influential leaders, and run the risk of members losing their savings. Experience suggests though that these informal but highly disciplined groups are very sustainable, and continue to exist even after 20–25 years. Formalization, as a Cooperative of Credit Union, can help create links with the banking system for more sophisticated financial products and additional capital for loans; but requires strong leadership and systems. These models are highly popular in many rural regions of countries across Asia, Africa, and Latin America; and a platform for creating deeper financial inclusion.

; NGOs

: The Microcredit Summit Campaign

The Microcredit Summit Campaign, an American non-profit organization, started as an effort to bring together microcredit practitioners, advocates, educational institutions, donor agencies, international financial institutions, non-governmental or ...

counted 3,316 of these MFIs and NGO

A non-governmental organization (NGO) is an independent, typically nonprofit organization that operates outside government control, though it may get a significant percentage of its funding from government or corporate sources. NGOs often focus ...

s lending to about 133 million clients by the end of 2006. Led by Grameen Bank

Grameen Bank () is a microfinance, specialized community development bank founded in Bangladesh. It provides small loans (known as microcredit or "grameencredit") to the impoverished without requiring collateral.

Grameen Bank is a statutory ...

and BRAC in Bangladesh

Bangladesh, officially the People's Republic of Bangladesh, is a country in South Asia. It is the List of countries and dependencies by population, eighth-most populous country in the world and among the List of countries and dependencies by ...

, Prodem in Bolivia

Bolivia, officially the Plurinational State of Bolivia, is a landlocked country located in central South America. The country features diverse geography, including vast Amazonian plains, tropical lowlands, mountains, the Gran Chaco Province, w ...

, Opportunity International

Opportunity International is a 501(c)(3) nonprofit organization chartered in the United States. Through a network of 47 program and support partners, Opportunity International provides small business loans, savings, insurance and training to mor ...

, and FINCA International

FINCA International is a non-profit, microfinance organization, founded by John Hatch in 1984. FINCA is the innovator of the village banking methodology in microcredit and is widely regarded as one of the pioneers of modern-day microfinance. ...

, headquartered in Washington, DC, these NGOs have spread around the developing world in the past three decades; others, like the Gamelan Council, address larger regions. They have used proven banking techniques like solidarity lending

Solidarity lending is a lending practice where small groups borrow collectively and group members encourage one another to repay. It is an important building block of microfinance.

Operations

Solidarity lending takes place through 'solidarity gr ...

, village banking

Village banking is a microcredit and saving methodology whereby financial services are administered locally in a community bank rather than in a centralized commercial bank. Village banking has its roots in ancient cultures and was most recently a ...

and mobile banking to overcome barriers to serving poor populations. However, with boards that do not necessarily represent either their capital or their customers, their governance structures can be fragile, and they can become overly dependent on external donors.

; Formal financial institutions

: In addition to commercial banks, these include state banks, agricultural development banks, savings banks, rural banks and non-bank financial institutions. They are regulated and supervised, offer a wider range of financial services, and control a branch network that can extend across the country and internationally. However, they have proved reluctant to adopt social missions, and due to their high costs of operation, often cannot deliver services to poor or remote populations. The increasing use of alternative data

In economic policy, alternative data refers to the inclusion of non-financial payment reporting data in credit files, such as telecom and energy utility payments.

Types

Alternative data in the broadest sense refers to any non-financial informat ...

in credit scoring, such as trade credit

Trade credit is the loan extended by one trader to another when the goods and services are bought on credit. Trade credit facilitates the purchase of supplies without immediate payment. Trade credit is commonly used by business organizations as a ...

is increasing commercial banks' interest in microfinance.

;Automated loans

:Automated loans include point-of-sale loans offered by financial technology companies like Affirm, Klarna, Afterpay, and Quadpay. These "buy now, pay later" services are accelerating the automatization of the finance industry. Point-of-sale loans are embedded within retail websites to offer consumers the chance to take out a loan for the price of the product, and pay them back in installments. These "buy now, pay later" lenders either make money by having high late fees or a high interest rate,[https://download.asic.gov.au/media/4947847/buy-now-pay-later-infographic-nov-2018.pdf ] as 60% of users are 18–34 years old and 40% earn under $40,000. As a result, they are trapping young consumers into a cycle of debt by ease of taking out a loan. This reinforces risky consumer habits and results in 1 out of 6 borrowers[ defaulting on their payments to these point of sale lenders. Moreover, the companies benefit at the expense of the consumer, so they make it seem harmless while advertising. Yet, it may hurt the consumers' credit by reporting to a credit bureau, trap them with debt, and give the merchant access to the consumer data profile. This creates a "feedback loop of injustice."]digital literacy

Digital literacy is an individual's ability to find, evaluate, and communicate information using typing or digital media platforms. Digital literacy combines technical and cognitive abilities; it consists of using information and communication tec ...

skills.data privacy

Information privacy is the relationship between the collection and dissemination of data, technology, the public expectation of privacy, contextual information norms, and the legal and political issues surrounding them. It is also known as data ...

given that companies engage in data profiling

Data profiling is the process of examining the data available from an existing information source (e.g. a database or a file) and collecting statistics or informative summaries about that data. The purpose of these statistics may be to:

# Find ou ...

tactics, calling it "the price of using the internet."second class citizens

The second (symbol: s) is a unit of time derived from the division of the day first into 24 hours, then to 60 minutes, and finally to 60 seconds each (24 × 60 × 60 = 86400). The current and formal definition in the International System of U ...

".economies of scale

In microeconomics, economies of scale are the cost advantages that enterprises obtain due to their scale of operation, and are typically measured by the amount of Productivity, output produced per unit of cost (production cost). A decrease in ...

and scope, and to support efforts by commercial banks to 'down-scale' by integrating mobile banking and e-payment technologies into their extensive branch networks.

Brigit Helms, in her book ''Access for All: Building Inclusive Financial Systems'', distinguishes between four general categories of microfinance providers, and argues for a pro-active strategy of engagement with all of them to help them achieve the goals of the microfinance movement.

Microcredit and the Web

Due to the unbalanced emphasis on credit at the expense of microsavings, as well as a desire to link Western investors to the sector, peer-to-peer

Peer-to-peer (P2P) computing or networking is a distributed application architecture that partitions tasks or workloads between peers. Peers are equally privileged, equipotent participants in the network, forming a peer-to-peer network of Node ...

platforms have developed to expand the availability of microcredit through individual lenders in the developed world. New platforms that connect lenders to micro-entrepreneurs are emerging on the Web ('' peer-to-peer sponsors''), for example MYC4, Kiva, Zidisha, myELEN, Opportunity International

Opportunity International is a 501(c)(3) nonprofit organization chartered in the United States. Through a network of 47 program and support partners, Opportunity International provides small business loans, savings, insurance and training to mor ...

and the Microloan Foundation. Another Web-based microlender United Prosperity uses a variation on the usual microlending model; with United Prosperity the micro-lender provides a guarantee to a local bank which then lends back double that amount to the micro-entrepreneur. In 2009, the US-based nonprofit Zidisha became the first peer-to-peer microlending platform to link lenders and borrowers directly across international borders without local intermediaries.

The volume channeled through Kiva's peer-to-peer platform is about $100 million as of November 2009 (Kiva facilitates approximately $5M in loans each month). In comparison, the needs for microcredit are estimated about 250 bn USD as of end 2006.

Most experts agree that these funds must be sourced locally in countries that are originating microcredit, to reduce transaction costs and exchange rate risks.

There have been problems with disclosure on peer-to-peer sites, with some reporting interest rates of borrowers using the flat rate methodology instead of the familiar banking Annual Percentage Rate

The term annual percentage rate of charge (APR), corresponding sometimes to a nominal APR and sometimes to an effective APR (EAPR), is the interest rate for a whole year (annualized), rather than just a monthly fee/rate, as applied on a loan, mort ...

. The use of flat rates, which has been outlawed among regulated financial institutions in developed countries, can confuse individual lenders into believing their borrower is paying a lower interest rate than, in fact, they are. In the summer of 2017, within the framework of the joint project of the Central Bank of Russia

The Central Bank of the Russian Federation (), commonly known as the Bank of Russia (), also called the Central Bank of Russia (CBR), is the central bank of the Russia, Russian Federation. The bank was established on 13 July 1990. It traces its ...

and Yandex

Yandex LLC ( rus, Яндекс, r=Yandeks, p=ˈjandəks) is a Russian technology company that provides Internet-related products and services including a web browser, search engine, cloud computing, web mapping, online food ordering, streaming ...

, a special check mark

The check or check mark (American English), checkmark ( Philippine English), tickmark ( Indian English) or tick ( Australian, New Zealand and British English) is a mark (✓, ✔, etc.) used in many countries, including the English-speaking ...

(a green circle with a tick and 'State MFO Register' text box) appeared search results on the Yandex search engine, informing the consumer that the company's financial services are offered on the marked website, which has the status of a microfinance organization.

Social interventions

There are a few social interventions that have been combined with microfinancing to increase awareness of HIV/AIDS