|

Alternative Data

In economic policy, alternative data refers to the inclusion of non-financial payment reporting data in credit files, such as telecom and energy utility payments. Types Alternative data in the broadest sense refers to any non-financial information that can be used to estimate the lending risk of an individual. Information includes: * Utility bills (such as electricity, gas, and heating oil) * Telecommunications bills (such as landlines and mobile telephones) * Rental payments * Electronic payments ( remittances, withdrawals, transfers, etc.) * Social media activity * Psychometric data * Telco data * Smartphone device metadata In North America United States In the United States, credit files include negative information, such as delinquencies as well as positive information, such as repayment of debts. Still, an estimated 35 to 54 million Americans have insufficient credit information to qualify for mainstream credit. If immigrants in the United States are included, th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Policy

''Economic Policy'' is a quarterly peer-reviewed academic journal published by Oxford University Press, Oxford Academic on behalf of the Centre for Economic Policy Research, the Center for Economic Studies (University of Munich), and the Paris School of Economics. The journal was established in 1985 and covers international economic policy topics such as macroeconomics, microeconomics, the labour market, trade, exchange rate, taxation, economic growth, government spending, and Human migration, migration. The journal had an impact factor of 2.844 in 2016, ranking it 33/347 in the category "Economics". References External links * {{Official website, https://academic.oup.com/economicpolicy Wiley-Blackwell academic journals English-language journals Academic journals established in 1985 Quarterly journals Economics journals ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

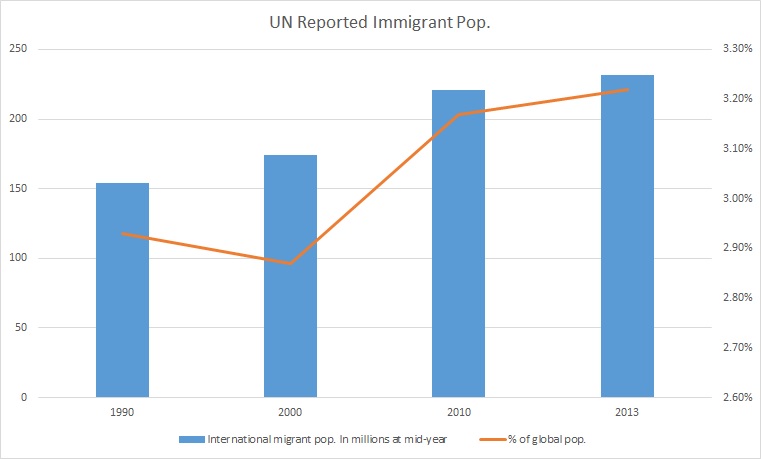

Immigrants

Immigration is the international movement of people to a destination country of which they are not usual residents or where they do not possess nationality in order to settle as permanent residents. Commuters, tourists, and other short-term stays in a destination country do not fall under the definition of immigration or migration; seasonal labour immigration is sometimes included, however. Economically, research suggests that migration can be beneficial both to the receiving and sending countries. The academic literature provides mixed findings for the relationship between immigration and crime worldwide. Research shows that country of origin matters for speed and depth of immigrant assimilation, but that there is considerable assimilation overall for both first- and second-generation immigrants. Discrimination based on nationality is legal in most countries. Extensive evidence of discrimination against foreign-born persons in criminal justice, business, the economy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cash And Carry (wholesale)

Cash and carry (or inspect and pay) is a type of operation within the wholesale sector. Overview The main features of cash and carry are summarized best by the following definitions: *Cash and carry is a form of trade in which goods are sold from a wholesale warehouse operated either on a self-service basis or on the basis of samples (with the customer selecting from specimen articles using a manual or computerized ordering system but not serving themselves) or a combination of the two. *Customers (retailers, professional users, caterers, institutional buyers, etc.) settle the invoice on the spot in cash and carry the goods away themselves. *There are significant differences between "classical" sales at the wholesale stage and the cash and carry wholesaler: namely, ''cash and carry'' customers arrange the transport of the goods themselves and pay for the goods on the spot, rather than on credit. *Access to purchase at a cash and carry is typically limited to operators of bona f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trade Credit

Trade credit is the loan extended by one trader to another when the goods and services are bought on credit. Trade credit facilitates the purchase of supplies without immediate payment. Trade credit is commonly used by business organizations as a source of short-term financing. It is granted to those customers who have a reasonable amount of financial standing and goodwill. (Kuveya, 2020) There are many forms of trade credit in common use. Various industries use various specialized forms. They all have, in common, the collaboration of businesses to make efficient use of capital to accomplish various business objectives. Trade credit is the largest use of capital for a majority of business-to-business (B2B) sellers in the United States and is a critical source of capital for a majority of all businesses. For example, Wal-Mart, the largest retailer in the world, has used trade credit as a larger source of capital than bank borrowings; trade credit for Wal-Mart is 8 times the amo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Developing Country

A developing country is a sovereign state with a less-developed industrial base and a lower Human Development Index (HDI) relative to developed countries. However, this definition is not universally agreed upon. There is also no clear agreement on which countries fit this category. The terms low-and middle-income country (LMIC) and newly emerging economy (NEE) are often used interchangeably but they refer only to the economy of the countries. The World Bank classifies the world's economies into four groups, based on gross national income per capita: high-, upper-middle-, lower-middle-, and low-income countries. Least developed countries, landlocked developing countries, and small island developing states are all sub-groupings of developing countries. Countries on the other end of the spectrum are usually referred to as high-income countries or developed countries. There are controversies over the terms' use, as some feel that it perpetuates an outdated concept of "us" and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

World Bank

The World Bank is an international financial institution that provides loans and Grant (money), grants to the governments of Least developed countries, low- and Developing country, middle-income countries for the purposes of economic development. The World Bank is the collective name for the International Bank for Reconstruction and Development (IBRD) and International Development Association (IDA), two of five international organizations owned by the World Bank Group. It was established along with the International Monetary Fund at the 1944 Bretton Woods Conference. After a slow start, its first loan was to France in 1947. In its early years, it primarily focused on rebuilding Europe. Over time, it focused on providing loans to developing world countries. In the 1970s, the World Bank re-conceptualized its mission of facilitating development as being oriented around poverty reduction. For the last 30 years, it has included NGOs and environmental groups in its loan portfolio. Its ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Rating Agency

A credit rating agency (CRA, also called a ratings service) is a company that assigns credit ratings, which rate a debtor's ability to pay back debt by making timely principal and interest payments and the likelihood of default. An agency may rate the creditworthiness of issuers of debt obligations, of debt instruments, and in some cases, of the servicers of the underlying debt, but not of individual consumers. Other forms of a rating agency include environmental, social and corporate governance (ESG) rating agencies and the Chinese Social Credit System. The debt instruments rated by CRAs include government bonds, corporate bonds, CDs, municipal bonds, preferred stock, and collateralized securities, such as mortgage-backed securities and collateralized debt obligations. The issuers of the obligations or securities may be companies, special purpose entities, state or local governments, non-profit organizations, or sovereign nations. A credit rating facilitates the trading of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

LexisNexis

LexisNexis is an American data analytics company headquartered in New York, New York. Its products are various databases that are accessed through online portals, including portals for computer-assisted legal research (CALR), newspaper search, and consumer information. During the 1970s, LexisNexis began to make legal and journalistic documents more accessible electronically. the company had the world's largest electronic database for legal and public-records–related information. The company is a subsidiary of RELX. History LexisNexis is owned by RELX (formerly known as Reed Elsevier). According to Trudi Bellardo Hahn and Charles P. Bourne, LexisNexis (originally founded as LEXIS) is historically significant because it was the first of the early information services to both envision and actually bring about a future in which large populations of end users would directly interact with computer databases, rather than going through professional intermediaries like librari ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

TransUnion

TransUnion LLC is an American consumer credit reporting agency. TransUnion collects and aggregates information on over one billion individual consumers in over thirty countries including "200 million files profiling nearly every credit-active consumer in the United States". Its customers include over 65,000 businesses. Based in Chicago, Illinois, TransUnion's 2014 revenue was US$1.3 billion. It is the smallest of the three largest credit agencies, along with Experian and Equifax (known as the "Big Three"). TransUnion also markets credit reports and other credit and fraud-protection products directly to consumers. Like all credit reporting agencies, the company is required by U.S. law to provide consumers with one free credit report every year. Additionally a growing segment of TransUnion's business is its business offerings that use advanced big data, particularly its deep AI-TLOxp product. History TransUnion was originally formed in 1968 as a holding company for Union Tank ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kennesaw, Georgia

Kennesaw is a suburban city northwest of Atlanta in Cobb County, Georgia, United States, located within the greater Atlanta metropolitan area. Known from its original settlement in the 1830s until 1887 as Big Shanty, it became Kennesaw under its 1887 charter. According to the 2020 census, Kennesaw had a population of 33,036, a 10.9% increase in population over the preceding decade. Kennesaw has an important place in railroad history. During the Civil War, Kennesaw was the staging ground for the Great Locomotive Chase on April 12, 1862. Kennesaw is home to Kennesaw State University, an R2 research institution and the third-largest public university in the state of Georgia. Etymology The name "Kennesaw" is derived from the Cherokee word ''gah-nee-sah'', meaning 'cemetery' or 'burial ground'. History As the Western and Atlantic Railroad was being built in the late 1830s, shanty towns arose to house the workers. These were near a big spring. A grade up from the Etowah River beca ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer Credit Reporting Agency

A credit bureau is a data collection agency that gathers account information from various creditors and provides that information to a consumer reporting agency in the United States, a credit reference agency in the United Kingdom, a credit reporting body in Australia, a credit information company (CIC) in India, a Special Accessing Entity in the Philippines, and also to private lenders. It is not the same as a credit rating agency. Description A consumer reporting agency is an organization providing information on individuals' borrowing and bill-paying habits. Such credit information institutions reduce the effect of asymmetric information between borrowers and lenders, and alleviate problems of adverse selection and moral hazard. For example, adequate credit information could facilitate lenders in screening and monitoring borrowers as well as avoiding giving loans to high risk individuals. Lenders use this to evaluate credit worthiness, the ability to pay back a loan, and can a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

PRBC (company)

Connect, formerly PRBC, is a consumer credit reporting agency, more commonly referred to as a credit bureau in the United States. It is similar to the other four U.S. credit bureaus (Equifax, Experian, TransUnion and Innovis) in that it is an FCRA (Fair Credit Reporting Act) compliant national data repository. Connect differs in that consumers are able to self-enroll and report their own non-debt payment history, and they can build a positive credit file based on alternative data, such as timely payments for bills including rent, utilities, cable, telephone, and insurance that are not automatically reported to the other bureaus. The Connect service is offered free of charge. When someone takes out a loan, the lender or merchant will pay a fee to Connect so they can see his or her alternative credit rating. Company history Connect was incorporated on March 12, 2002, under the name Pay Rent, Build Credit, Inc. The company name was later shortened to PRBC because all recurring bil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |