The International Monetary Fund (IMF) is a major financial agency of the

United Nations

The United Nations (UN) is the Earth, global intergovernmental organization established by the signing of the Charter of the United Nations, UN Charter on 26 June 1945 with the stated purpose of maintaining international peace and internationa ...

, and an

international financial institution

An international financial institution (IFI) is a financial institution that has been established (or chartered) by more than one country, and hence is subject to international law. Its owners or shareholders are generally national governments, alt ...

funded by 191 member countries, with headquarters in

Washington, D.C.

Washington, D.C., formally the District of Columbia and commonly known as Washington or D.C., is the capital city and federal district of the United States. The city is on the Potomac River, across from Virginia, and shares land borders with ...

It is regarded as the global

lender of last resort

In public finance, a lender of last resort (LOLR) is a financial entity, generally a central bank, that acts as the provider of liquidity to a financial institution which finds itself unable to obtain sufficient liquidity in the interbank ...

to national governments, and a leading supporter of

exchange-rate

In finance, an exchange rate is the rate at which one currency will be exchanged for another currency. Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of ...

stability

Stability may refer to:

Mathematics

*Stability theory, the study of the stability of solutions to differential equations and dynamical systems

** Asymptotic stability

** Exponential stability

** Linear stability

**Lyapunov stability

** Marginal s ...

. Its stated mission is "working to foster global monetary cooperation, secure financial stability, facilitate

international trade

International trade is the exchange of capital, goods, and services across international borders or territories because there is a need or want of goods or services. (See: World economy.)

In most countries, such trade represents a significan ...

, promote high employment and sustainable economic growth, and

reduce poverty around the world."

Established in July 1944

at the

Bretton Woods Conference

The Bretton Woods Conference, formally known as the United Nations Monetary and Financial Conference, was the gathering of 730 delegates from all 44 allied nations at the Mount Washington Hotel, in Bretton Woods, New Hampshire, United States, to ...

, primarily according to the ideas of

Harry Dexter White

Harry Dexter White (October 29, 1892 – August 16, 1948) was an American government official in the United States Department of the Treasury. Working closely with the secretary of the treasury Henry Morgenthau Jr., he helped set American financia ...

and

John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes ( ; 5 June 1883 – 21 April 1946), was an English economist and philosopher whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originall ...

, it started with 29 member countries and the goal of reconstructing the

international monetary system

An international monetary system is a set of internationally agreed rules, conventions and supporting institutions that facilitate international trade, cross border investment and generally the reallocation of capital between states that have dif ...

after

World War II

World War II or the Second World War (1 September 1939 – 2 September 1945) was a World war, global conflict between two coalitions: the Allies of World War II, Allies and the Axis powers. World War II by country, Nearly all of the wo ...

. In its early years, the IMF primarily focused on facilitating fixed exchange rates across the developed world.

It now plays a central role in the management of

balance of payments

In international economics, the balance of payments (also known as balance of international payments and abbreviated BOP or BoP) of a country is the difference between all money flowing into the country in a particular period of time (e.g., a ...

difficulties and international financial crises.

Through a quota system, countries contribute funds to a pool from which countries can borrow if they experience balance of payments problems. The IMF works to stabilize and foster the economies of its member countries by its use of the fund, as well as other activities such as gathering and analyzing economic statistics and surveillance of its members' economies.

The current managing director (MD) and chairperson of the IMF is

Bulgaria

Bulgaria, officially the Republic of Bulgaria, is a country in Southeast Europe. It is situated on the eastern portion of the Balkans directly south of the Danube river and west of the Black Sea. Bulgaria is bordered by Greece and Turkey t ...

n economist

Kristalina Georgieva

Kristalina Ivanova Georgieva-Kinova (; ; born 13 August 1953) is a Bulgarian economist who has served as the 12th managing director of the International Monetary Fund since 2019. She is the first person from an emerging market economy to lead ...

, who has held the post since 1 October 2019. Indian-American economist

Gita Gopinath

Gita Gopinath (born 8 December 1971) is an Indian-American economist who has served as the first deputy managing director of the International Monetary Fund (IMF), since 21 January 2022. She had previously served as chief economist of the IMF ...

, previously the chief economist, was appointed as first deputy managing director, effective 21 January 2022.

Pierre-Olivier Gourinchas

Pierre-Olivier Gourinchas (born 30 March 1968) is a French economist who has been the chief economist of the International Monetary Fund since 2022. Gourinchas is also the S.K. and Angela Chan Professor of Management at the University of Californi ...

was appointed chief economist on 24 January 2022.

The IMF has been criticized for policies that centralize economic decision-making, impose conditions that limit

national sovereignty

A nation state, or nation-state, is a political entity in which the state (a centralized political organization ruling over a population within a territory) and the nation (a community based on a common identity) are (broadly or ideally) co ...

, and entrench the influence of powerful governments over

developing nations

A developing country is a sovereign state with a less-developed industrial base and a lower Human Development Index (HDI) relative to developed countries. However, this definition is not universally agreed upon. There is also no clear agreemen ...

.

Detractors argue that its interventions often prioritize the stability of

financial institutions

A financial institution, sometimes called a banking institution, is a business entity that provides service as an intermediary for different types of financial monetary transactions. Broadly speaking, there are three major types of financial ins ...

over

individual economic freedoms, restricting the ability of local markets to self-correct and develop organically.

Functions

According to the IMF itself, it works to foster global growth and

economic stability

Economic stability is the absence of excessive fluctuations in the macroeconomy. An economy with fairly constant output growth and low and stable inflation would be considered economically stable. An economy with frequent large recessions, a pronou ...

by providing policy advice and financing to its members. It also works with

developing countries

A developing country is a sovereign state with a less-developed Secondary sector of the economy, industrial base and a lower Human Development Index (HDI) relative to developed countries. However, this definition is not universally agreed upon. ...

to help them achieve macroeconomic stability and reduce poverty. The rationale for this is that private international capital markets function imperfectly and many countries have limited access to financial markets. Such market imperfections, together with balance-of-payments financing, provide the justification for official financing, without which many countries could only correct large external payment imbalances through measures with adverse economic consequences.

The IMF provides alternate sources of financing such as the

Poverty Reduction and Growth Facility

The Poverty Reduction and Growth Facility (PRGF) is an arm of the International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by 191 mem ...

.

Upon the founding of the IMF, its three primary functions were:

* to oversee the

fixed exchange rate

A fixed exchange rate, often called a pegged exchange rate, is a type of exchange rate regime in which a currency's value is fixed or pegged by a monetary authority against the value of another currency, a currency basket, basket of other currenc ...

arrangements between countries,

thus helping national governments manage their

exchange rate

In finance, an exchange rate is the rate at which one currency will be exchanged for another currency. Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of ...

s and allowing these governments to prioritize economic growth,

and

* to provide short-term capital to aid the

balance of payments

In international economics, the balance of payments (also known as balance of international payments and abbreviated BOP or BoP) of a country is the difference between all money flowing into the country in a particular period of time (e.g., a ...

and prevent the spread of international

financial crisis

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with Bank run#Systemic banki ...

.

* to help mend the pieces of the international economy after the

Great Depression

The Great Depression was a severe global economic downturn from 1929 to 1939. The period was characterized by high rates of unemployment and poverty, drastic reductions in industrial production and international trade, and widespread bank and ...

and

World War II

World War II or the Second World War (1 September 1939 – 2 September 1945) was a World war, global conflict between two coalitions: the Allies of World War II, Allies and the Axis powers. World War II by country, Nearly all of the wo ...

as well as to provide capital investments for economic growth and projects such as

infrastructure

Infrastructure is the set of facilities and systems that serve a country, city, or other area, and encompasses the services and facilities necessary for its economy, households and firms to function. Infrastructure is composed of public and pri ...

.

The IMF's role was fundamentally altered by the

floating exchange rate

In macroeconomics and economic policy, a floating exchange rate (also known as a fluctuating or flexible exchange rate) is a type of exchange rate regime in which a currency's value is allowed to fluctuate in response to foreign exchange market ...

s after 1971. It shifted to examining the economic policies of countries with IMF loan agreements to determine whether a shortage of capital was due to

economic fluctuations or economic policy. The IMF also researched what types of government policy would ensure economic recovery.

A particular concern of the IMF was to prevent financial crises, such as those in

Mexico

Mexico, officially the United Mexican States, is a country in North America. It is the northernmost country in Latin America, and borders the United States to the north, and Guatemala and Belize to the southeast; while having maritime boundar ...

in 1982,

Brazil

Brazil, officially the Federative Republic of Brazil, is the largest country in South America. It is the world's List of countries and dependencies by area, fifth-largest country by area and the List of countries and dependencies by population ...

in 1987, the

1997 Asian financial crisis

The 1997 Asian financial crisis gripped much of East Asia, East and Southeast Asia during the late 1990s. The crisis began in Thailand in July 1997 before spreading to several other countries with a ripple effect, raising fears of a worldwide eco ...

, and the

1998 Russian financial crisis

The Russian financial crisis (also called the ruble crisis or the Russian flu) began in Russia on 17 August 1998. It resulted in the Russian government and the Russian Central Bank devaluing the Russian rouble, ruble and sovereign default, defau ...

, from spreading and threatening the entire global financial and currency system. The challenge was to promote and implement a policy that reduced the frequency of crises among emerging market countries, especially the middle-income countries which are vulnerable to massive capital outflows. Rather than maintaining a position of oversight of only exchange rates, their function became one of surveillance of the overall macroeconomic performance of member countries. Their role became a lot more active because the IMF now manages economic policy rather than just exchange rates.

In addition, the IMF negotiates conditions on lending and loans under their policy of

conditionality

In political economy and international relations, conditionality is the use of conditions attached to the provision of benefits such as a loan, debt relief or bilateral aid. These conditions are typically imposed by international financial insti ...

,

which was established in the 1950s.

Low-income countries

A developing country is a sovereign state with a less-developed industrial base and a lower Human Development Index (HDI) relative to developed countries. However, this definition is not universally agreed upon. There is also no clear agreemen ...

can borrow on

concessional terms, which means there is a period of time with no interest rates, through the Extended Credit Facility (ECF), the Standby Credit Facility (SCF) and the Rapid Credit Facility (RCF). Non-concessional loans, which include interest rates, are provided mainly through the

Stand-By Arrangements (SBA), the Flexible Credit Line (FCL), the Precautionary and Liquidity Line (PLL), and the Extended Fund Facility. The IMF provides emergency assistance via the Rapid Financing Instrument (RFI) to members facing urgent balance-of-payments needs.

Surveillance of the global economy

The IMF is mandated to oversee the international monetary and financial system and monitor the economic and financial policies of its member countries.

Accurate estimations require a degree of participatory surveillance. Market sizes and economic facts are estimated using member-state data, shared and verifiable by the organization's other member-states. This transparency is intended to facilitate international co-operation and trade. Since the demise of the

Bretton Woods system

The Bretton Woods system of monetary management established the rules for commercial relations among 44 countries, including the United States, Canada, Western European countries, and Australia, after the 1944 Bretton Woods Agreement until the ...

of fixed exchange rates in the early 1970s, surveillance has evolved largely by way of changes in procedures rather than through the adoption of new obligations.

The Fund typically analyses the appropriateness of each member country's economic and financial policies for achieving orderly economic growth, and assesses the consequences of these policies for other countries and for the

global economy

The world economy or global economy is the economy of all humans in the world, referring to the global economic system, which includes all economic activities conducted both within and between nations, including production, consumption, econ ...

.

For instance, The IMF played a significant role in individual countries, such as Armenia and Belarus, in providing financial support to achieve stabilization financing from 2009 to 2019. The maximum sustainable debt level of a polity, which is watched closely by the IMF, was defined in 2011 by IMF economists to be 120%.

Indeed, it was at this number that the

Greek government-debt crisis

Greek may refer to:

Anything of, from, or related to Greece, a country in Southern Europe:

*Greeks, an ethnic group

*Greek language, a branch of the Indo-European language family

** Proto-Greek language, the assumed last common ancestor of all kn ...

started in 2010.

In 1995, the International Monetary Fund began to work on data dissemination standards with the view of guiding IMF member countries to disseminate their economic and financial data to the public. The International Monetary and Financial Committee (IMFC) endorsed the guidelines for the dissemination standards and they were split into two tiers: The

General Data Dissemination System (GDDS) and the

Special Data Dissemination Standard Special Data Dissemination Standard (SDDS) is an International Monetary Fund standard to guide member countries in the dissemination of national statistics to the public.

It was established in April 1996.

Members

There are currently 65 members.

...

(SDDS).

The executive board approved the SDDS and GDDS in 1996 and 1997, respectively, and subsequent amendments were published in a revised ''Guide to the General Data Dissemination System''. The system is aimed primarily at statisticians and aims to improve many aspects of statistical systems in a country. It is also part of the

World Bank

The World Bank is an international financial institution that provides loans and Grant (money), grants to the governments of Least developed countries, low- and Developing country, middle-income countries for the purposes of economic development ...

Millennium Development Goals

In the United Nations, the Millennium Development Goals (MDGs) were eight international development goals for the year 2015 created following the Millennium Summit, following the adoption of the United Nations Millennium Declaration. These w ...

(MDG) and

Poverty Reduction Strategic Papers (PRSPs).

The primary objective of the GDDS is to encourage member countries to build a framework to improve data quality and statistical capacity building to evaluate statistical needs, set priorities in improving timeliness,

transparency, reliability, and accessibility of financial and economic data. Some countries initially used the GDDS, but later upgraded to SDDS.

Some entities that are not IMF members also contribute statistical data to the systems:

*

Palestinian Authority

The Palestinian Authority (PA), officially known as the Palestinian National Authority (PNA), is the Fatah-controlled government body that exercises partial civil control over the Palestinian enclaves in the Israeli occupation of the West Bank, ...

– GDDS

*

Hong Kong

Hong Kong)., Legally Hong Kong, China in international treaties and organizations. is a special administrative region of China. With 7.5 million residents in a territory, Hong Kong is the fourth most densely populated region in the wor ...

– SDDS

*

Macau

Macau or Macao is a special administrative regions of China, special administrative region of the People's Republic of China (PRC). With a population of about people and a land area of , it is the most List of countries and dependencies by p ...

– GDDS

* Institutions of the

European Union

The European Union (EU) is a supranational union, supranational political union, political and economic union of Member state of the European Union, member states that are Geography of the European Union, located primarily in Europe. The u ...

:

** The

European Central Bank

The European Central Bank (ECB) is the central component of the Eurosystem and the European System of Central Banks (ESCB) as well as one of seven institutions of the European Union. It is one of the world's Big Four (banking)#International ...

for the

Eurozone

The euro area, commonly called the eurozone (EZ), is a Monetary union, currency union of 20 Member state of the European Union, member states of the European Union (EU) that have adopted the euro (Euro sign, €) as their primary currency ...

– SDDS

**

Eurostat

Eurostat ("European Statistical Office"; also DG ESTAT) is a department of the European Commission ( Directorate-General), located in the Kirchberg quarter of Luxembourg City, Luxembourg. Eurostat's main responsibilities are to provide statist ...

for the whole EU – SDDS, thus providing data from Cyprus (not using any DDSystem on its own) and Malta (using only GDDS on its own)

A 2021 study found that the IMF's surveillance activities have "a substantial impact on sovereign debt with much greater impacts in emerging than high-income economies".

Conditionality of loans

IMF conditionality is a set of policies or conditions that the IMF requires in exchange for financial resources.

The IMF does require

collateral from countries for loans but also requires the government seeking assistance to correct its macroeconomic imbalances in the form of policy reform.

If the conditions are not met, the funds are withheld.

The concept of conditionality was introduced in a 1952 executive board decision and later incorporated into the Articles of Agreement.

Conditionality is associated with economic theory as well as an enforcement mechanism for repayment. Stemming primarily from the work of

Jacques Polak, the theoretical underpinning of conditionality was the "monetary approach to the balance of payments".

Structural adjustment

Some of the conditions for structural adjustment can include:

* Cutting expenditures or raising revenues, also known as

austerity

In economic policy, austerity is a set of Political economy, political-economic policies that aim to reduce government budget deficits through Government spending, spending cuts, tax increases, or a combination of both. There are three prim ...

.

* Focusing economic output on direct export and

resource extraction

Natural resources are resources that are drawn from nature and used with few modifications. This includes the sources of valued characteristics such as commercial and industrial use, aesthetic value, scientific interest, and cultural value. ...

,

*

Devaluation

In macroeconomics and modern monetary policy, a devaluation is an official lowering of the value of a country's currency within a fixed exchange-rate system, in which a monetary authority formally sets a lower exchange rate of the national curre ...

of currencies,

*

Trade liberalisation

Free trade is a trade policy that does not restrict imports or exports. In government, free trade is predominantly advocated by political parties that hold economically liberal positions, while economic nationalist political parties generally ...

, or lifting import and export restrictions,

* Increasing the stability of investment (by supplementing

foreign direct investment

A foreign direct investment (FDI) is an ownership stake in a company, made by a foreign investor, company, or government from another country. More specifically, it describes a controlling ownership an asset in one country by an entity based i ...

with the opening of facilities for the domestic market),

*

Balancing budgets and not overspending,

* Removing

price control

Price controls are restrictions set in place and enforced by governments, on the prices that can be charged for goods and services in a market. The intent behind implementing such controls can stem from the desire to maintain affordability of go ...

s and state

subsidies

A subsidy, subvention or government incentive is a type of government expenditure for individuals and households, as well as businesses with the aim of stabilizing the economy. It ensures that individuals and households are viable by having acce ...

,

*

Privatization

Privatization (rendered privatisation in British English) can mean several different things, most commonly referring to moving something from the public sector into the private sector. It is also sometimes used as a synonym for deregulation w ...

, or

divestiture

In finance and economics, divestment or divestiture is the reduction of some kind of asset for financial, ethical, or political objectives or sale of an existing business by a firm. A divestment is the opposite of an investment. Divestiture is a ...

of all or part of state-owned enterprises,

* Enhancing the rights of

foreign investors vis-a-vis national laws,

* Improving

governance

Governance is the overall complex system or framework of Process, processes, functions, structures, Social norm, rules, Law, laws and Norms (sociology), norms born out of the Interpersonal relationship, relationships, Social interaction, intera ...

and fighting corruption,

These conditions are known as the

Washington Consensus

The Washington Consensus is a set of ten economic policy prescriptions considered in the 1980s and 1990s to constitute the "standard" reform package promoted for Economic crisis, crisis-wracked developing country, developing countries by the Was ...

.

Benefits

These loan conditions ensure that the borrowing country will be able to repay the IMF and that the country will not attempt to solve their balance-of-payment problems in a way that would negatively impact the

international economy

International political economy (IPE) is the study of how politics shapes the global economy and how the global economy shapes politics. A key focus in IPE is on the power of different actors such as nation states, international organizations and ...

.

The incentive problem of

moral hazard

In economics, a moral hazard is a situation where an economic actor has an incentive to increase its exposure to risk because it does not bear the full costs associated with that risk, should things go wrong. For example, when a corporation i ...

—when

economic agents

In economics, an agent is an actor (more specifically, a decision maker) in a model of some aspect of the economy. Typically, every agent makes decisions by solving a well- or ill-defined optimization or choice problem.

For example, ''buyers'' ( ...

maximise their own

utility

In economics, utility is a measure of a certain person's satisfaction from a certain state of the world. Over time, the term has been used with at least two meanings.

* In a normative context, utility refers to a goal or objective that we wish ...

to the detriment of others because they do not bear the full consequences of their actions—is mitigated through conditions rather than providing collateral; countries in need of IMF loans do not generally possess internationally valuable collateral anyway.

Conditionality also reassures the IMF that the funds lent to them will be used for the purposes defined by the Articles of Agreement and provides safeguards that the country will be able to rectify its macroeconomic and structural imbalances.

In the judgment of the IMF, the adoption by the member of certain corrective measures or policies will allow it to repay the IMF, thereby ensuring that the resources will be available to support other members.

, borrowing countries have had a good track record for repaying credit extended under the IMF's regular lending facilities with full interest over the duration of the loan. This indicates that IMF lending does not impose a burden on creditor countries, as lending countries receive market-rate interest on most of their quota subscription, plus any of their own-currency subscriptions that are loaned out by the IMF, plus all of the reserve assets that they provide the IMF.

History

20th century

The IMF was originally laid out as a part of the

Bretton Woods system

The Bretton Woods system of monetary management established the rules for commercial relations among 44 countries, including the United States, Canada, Western European countries, and Australia, after the 1944 Bretton Woods Agreement until the ...

exchange agreement in 1944.

During the

Great Depression

The Great Depression was a severe global economic downturn from 1929 to 1939. The period was characterized by high rates of unemployment and poverty, drastic reductions in industrial production and international trade, and widespread bank and ...

, countries sharply raised barriers to trade in an attempt to improve their failing economies. This led to the

devaluation

In macroeconomics and modern monetary policy, a devaluation is an official lowering of the value of a country's currency within a fixed exchange-rate system, in which a monetary authority formally sets a lower exchange rate of the national curre ...

of national currencies and a decline in world trade.

This breakdown in international monetary cooperation created a need for oversight. The representatives of 45 governments met at the

Bretton Woods Conference

The Bretton Woods Conference, formally known as the United Nations Monetary and Financial Conference, was the gathering of 730 delegates from all 44 allied nations at the Mount Washington Hotel, in Bretton Woods, New Hampshire, United States, to ...

in the Mount Washington Hotel in

Bretton Woods, New Hampshire

Bretton Woods is an area within the town of Carroll, New Hampshire, United States, whose principal points of interest are three leisure and recreation facilities. Being virtually surrounded by the White Mountain National Forest, the vista from B ...

, in the United States, to discuss a framework for postwar international economic cooperation and how to rebuild Europe.

There were two views on the role the IMF should assume as a global economic institution. American delegate

Harry Dexter White

Harry Dexter White (October 29, 1892 – August 16, 1948) was an American government official in the United States Department of the Treasury. Working closely with the secretary of the treasury Henry Morgenthau Jr., he helped set American financia ...

foresaw an IMF that functioned more like a bank, making sure that borrowing states could repay their debts on time.

Most of White's plan was incorporated into the final acts adopted at Bretton Woods. British economist

John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes ( ; 5 June 1883 – 21 April 1946), was an English economist and philosopher whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originall ...

, on the other hand, imagined that the IMF would be a cooperative fund upon which member states could draw to maintain economic activity and employment through periodic crises. This view suggested an IMF that helped governments and act as the United States government had during the New Deal to

the great depression of the 1930s.

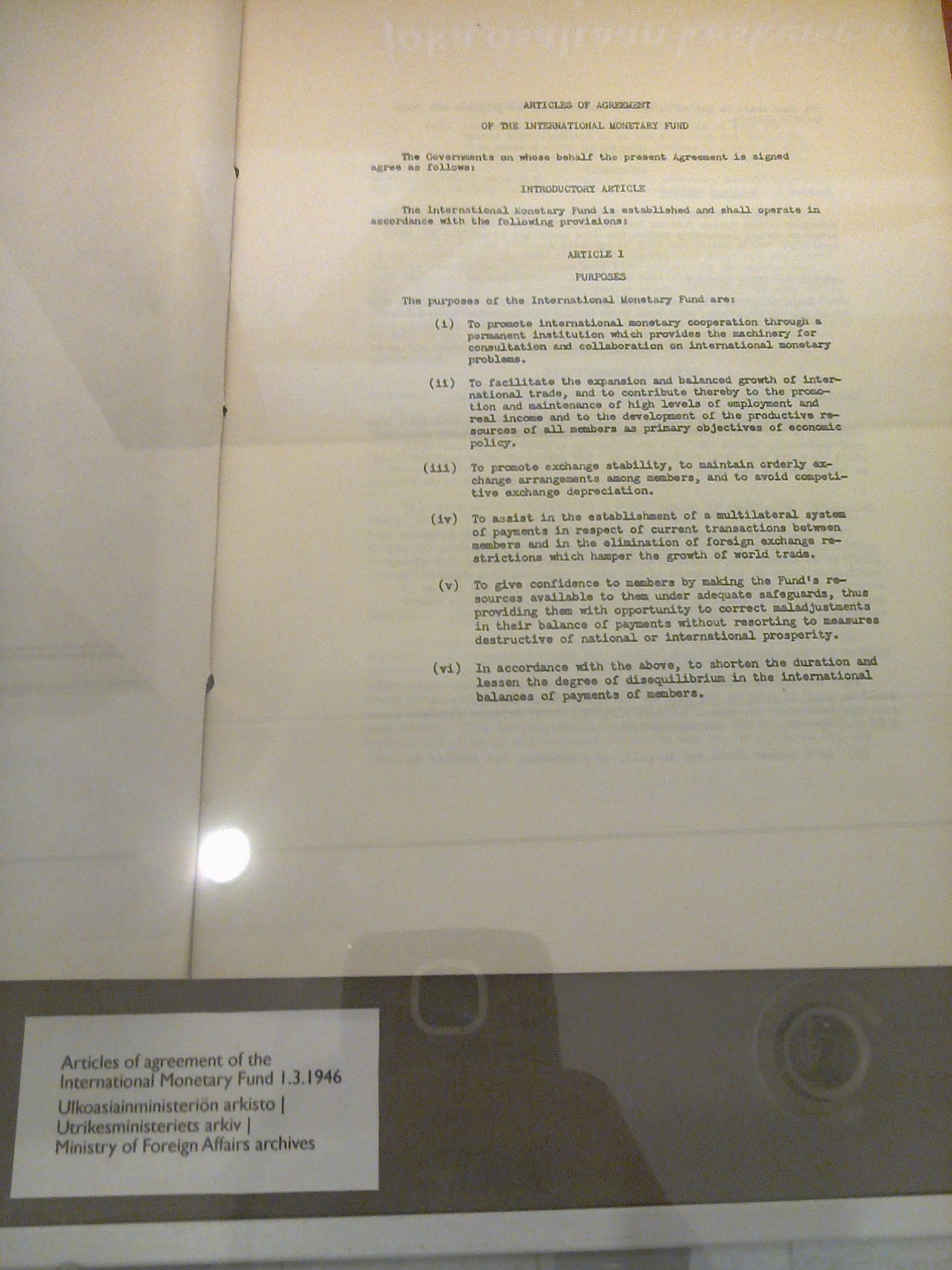

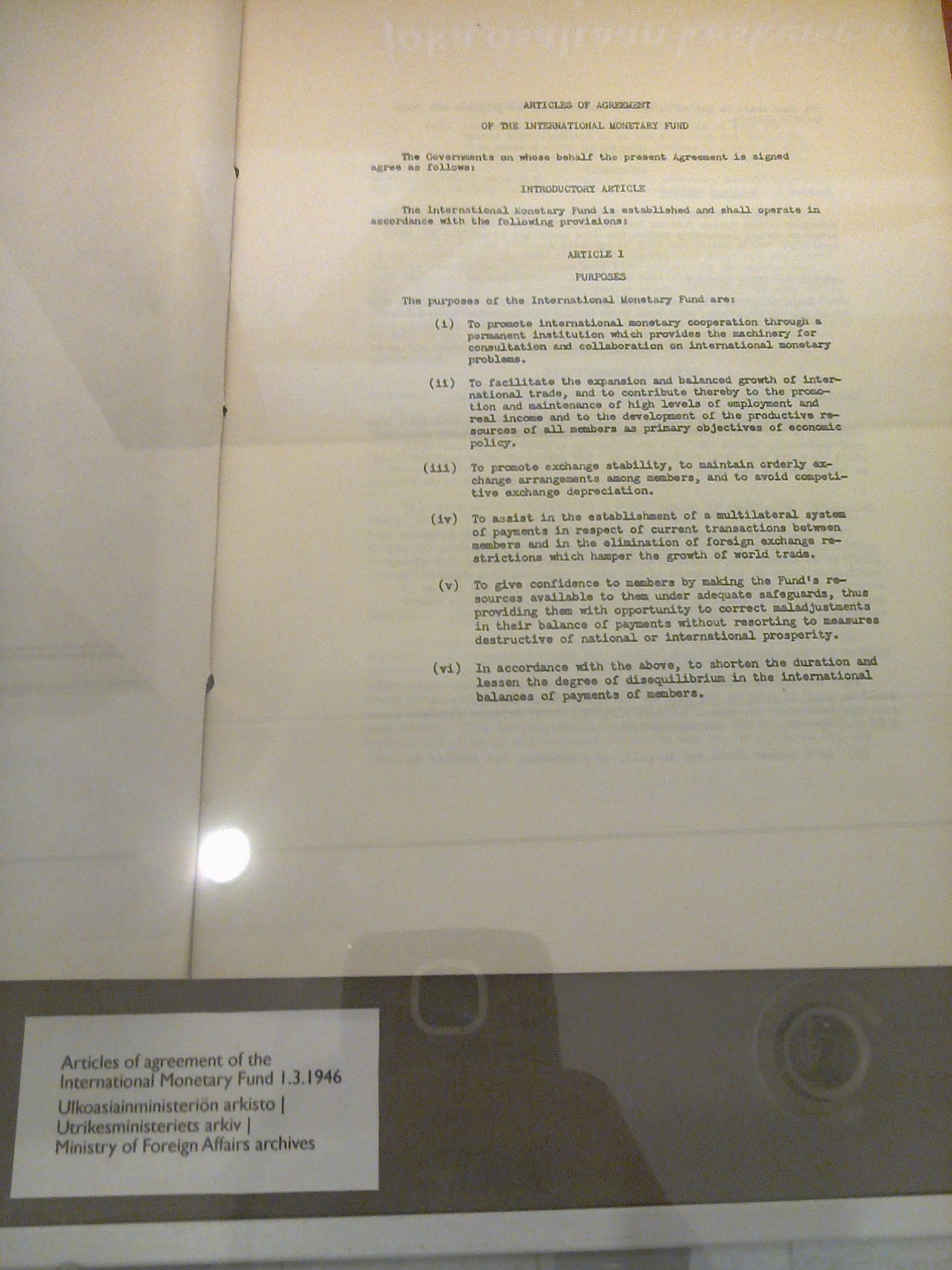

The IMF formally came into existence on 27 December 1945, when the first 29 countries

ratified

Ratification is a principal's legal confirmation of an act of its agent. In international law, ratification is the process by which a state declares its consent to be bound to a treaty. In the case of bilateral treaties, ratification is usuall ...

its Articles of Agreement. By the end of 1946 the IMF had grown to 39 members.

On 1 March 1947, the IMF began its financial operations, and on 8 May France became the first country to borrow from it.

[

The IMF was one of the key organizations of the international economic system; its design allowed the system to balance the rebuilding of international capitalism with the maximization of national economic sovereignty and human welfare, also known as ]embedded liberalism

Embedded liberalism is a term in international political economy for the global economic system and the associated international political orientation as they existed from the end of World War II to the 1970s. The system was set up to support a co ...

.Cold War

The Cold War was a period of global Geopolitics, geopolitical rivalry between the United States (US) and the Soviet Union (USSR) and their respective allies, the capitalist Western Bloc and communist Eastern Bloc, which lasted from 1947 unt ...

limited the Fund's membership, with most countries in the Soviet sphere of influence not joining until 1970s and 1980s.Jamaica Accords

The Jamaica Accords were a set of international agreements that ratified the end of the Bretton Woods monetary system. They took the form of recommendations to change the "articles of agreement" that the International Monetary Fund (IMF) was found ...

. Later in the 1970s, large commercial banks began lending to states because they were awash in cash deposited by oil exporters. The lending of the so-called money center banks led to the IMF changing its role in the 1980s after a world recession provoked a crisis that brought the IMF back into global financial governance.

In the mid-1980s, the IMF shifted its narrow focus from currency stabilization to a broader focus of promoting market-liberalizing reforms through structural adjustment programs.Ronald Reagan administration

Ronald is a masculine given name derived from the Old Norse ''Rögnvaldr'', Hanks; Hardcastle; Hodges (2006) p. 234; Hanks; Hodges (2003) § Ronald. or possibly from Old English '' Regenweald''. In some cases ''Ronald'' is an Anglicised form of ...

, in particular Treasury Secretary James Baker

James Addison Baker III (born April 28, 1930) is an American attorney, diplomat and statesman. A member of the Republican Party (United States), Republican Party, he served as the 10th White House chief of staff and 67th United States secretary ...

, his assistant secretary David Mulford

David Campbell Mulford (born 27 June 1937) is an American diplomat who served as the United States Ambassador to India from February 23, 2004 to January 15, 2009, and served as Vice-Chairman International of Credit Suisse from 2009 to 2016. He i ...

and deputy assistant secretary Charles Dallara, pressured the IMF to attach market-liberal reforms to the organization's conditional loans.

21st century

The IMF provided two major lending packages in the early 2000s to Argentina (during the 1998–2002 Argentine great depression

The 1998–2002 Argentine great depression was an economic depression in Argentina, which began in the third quarter of 1998 and lasted until the second quarter of 2002. It followed fifteen years of Economic history of Argentina#Stagnation (197 ...

) and Uruguay (after the 2002 Uruguay banking crisis). However, by the mid-2000s, IMF lending was at its lowest share of world GDP since the 1970s.

In May 2010, the IMF participated, in 3:11 proportion, in the first Greek bailout that totaled €110 billion, to address the great accumulation of public debt, caused by continuing large public sector deficits. As part of the bailout, the Greek government agreed to adopt austerity measures that would reduce the deficit from 11% in 2009 to "well below 3%" in 2014. The bailout did not include debt restructuring

Debt restructuring is a process that allows a private or public company or a sovereign entity facing cash flow problems and financial distress to reduce and renegotiate its delinquent debts to improve or restore liquidity so that it can continu ...

measures such as a haircut

A hairstyle, hairdo, haircut, or coiffure refers to the styling of hair, usually on the human head but sometimes on the face or body. The fashioning of hair can be considered an aspect of personal grooming, fashion, and cosmetics, although ...

, to the chagrin of the Swiss, Brazilian, Indian, Russian, and Argentinian Directors of the IMF, with the Greek authorities themselves (at the time, PM George Papandreou

George Andreas Papandreou (, , shortened to ''Giorgos'' () to distinguish him from his grandfather; born 16 June 1952) is an American-born Greek politician who served as Prime Minister of Greece from 2009 to 2011. He is currently serving as a ...

and Finance Minister Giorgos Papakonstantinou) ruling out a haircut.Troika

Troika or troyka (from Russian тройка, meaning 'a set of three' or the digit '3') may refer to:

* Troika (driving), a traditional Russian harness driving combination, a cultural icon of Russia

Politics

* Triumvirate, a political regime rul ...

, of which the IMF is part, are joint managers of this programme, which was approved by the executive directors of the IMF on 15 March 2012 for XDR 23.8 billion and saw private bondholders take a haircut

A hairstyle, hairdo, haircut, or coiffure refers to the styling of hair, usually on the human head but sometimes on the face or body. The fashioning of hair can be considered an aspect of personal grooming, fashion, and cosmetics, although ...

of upwards of 50%. In the interval between May 2010 and February 2012 the private banks of Holland, France, and Germany reduced exposure to Greek debt from €122 billion to €66 billion.bailout

A bailout is the provision of financial help to a corporation or country which otherwise would be on the brink of bankruptcy. A bailout differs from the term ''bail-in'' (coined in 2010) under which the bondholders or depositors of global syst ...

of Cyprus was agreed by the Troika

Troika or troyka (from Russian тройка, meaning 'a set of three' or the digit '3') may refer to:

* Troika (driving), a traditional Russian harness driving combination, a cultural icon of Russia

Politics

* Triumvirate, a political regime rul ...

, at the cost to the Cypriots of its agreement: to close the country's second-largest bank; to impose a one-time bank deposit levy on Bank of Cyprus uninsured deposits. No insured deposit of €100k or less were to be affected under the terms of a novel bail-in scheme.The Wall Street Journal

''The Wall Street Journal'' (''WSJ''), also referred to simply as the ''Journal,'' is an American newspaper based in New York City. The newspaper provides extensive coverage of news, especially business and finance. It operates on a subscriptio ...

''.capital levy

A capital levy is a tax on capital rather than income, collected once, rather than repeatedly (regular collection would make it a wealth tax). For example, a capital levy of 30% will see an individual or business with a net worth of $100,000 pay ...

capable of reducing Euro-area government debt ratios to "end-2007 levels" would require a very high tax rate of about 10%.

The Fiscal Affairs department of the IMF, headed at the time by Acting Director Sanjeev Gupta, produced a January 2014 report entitled "Fiscal Policy and Income Inequality" that stated that "Some taxes levied on wealth, especially on immovable property, are also an option for economies seeking more progressive taxation

A progressive tax is a tax in which the tax rate increases as the taxable amount increases. The term ''progressive'' refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the ...

... Property taxes are equitable and efficient, but underutilized in many economies ... There is considerable scope to exploit this tax more fully, both as a revenue source and as a redistributive instrument."

At the end of March 2014, the IMF secured an $18 billion bailout fund for the provisional government of Ukraine in the aftermath of the Revolution of Dignity

The Revolution of Dignity (), also known as the Maidan Revolution or the Ukrainian Revolution, took place in Ukraine in February 2014 at the end of the Euromaidan protests, when deadly clashes between protesters and state forces in the capit ...

.

Response and analysis of coronavirus

In late 2019, the IMF estimated global growth in 2020 to reach 3.4%, but due to the coronavirus, in November 2020, it expected the global economy to shrink by 4.4%.Kristalina Georgieva

Kristalina Ivanova Georgieva-Kinova (; ; born 13 August 1953) is a Bulgarian economist who has served as the 12th managing director of the International Monetary Fund since 2019. She is the first person from an emerging market economy to lead ...

announced that the IMF stood ready to mobilize $1 trillion as its response to the COVID-19 pandemic

The COVID-19 pandemic (also known as the coronavirus pandemic and COVID pandemic), caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), began with an disease outbreak, outbreak of COVID-19 in Wuhan, China, in December ...

.Iran

Iran, officially the Islamic Republic of Iran (IRI) and also known as Persia, is a country in West Asia. It borders Iraq to the west, Turkey, Azerbaijan, and Armenia to the northwest, the Caspian Sea to the north, Turkmenistan to the nort ...

.

Member countries

Not all member countries of the IMF are sovereign states, and therefore not all "member countries" of the IMF are members of the United Nations. Amidst "member countries" of the IMF that are not member states of the UN are non-sovereign areas with special jurisdictions that are officially under the sovereignty of full UN member states, such as Aruba

Aruba, officially the Country of Aruba, is a constituent island country within the Kingdom of the Netherlands, in the southern Caribbean Sea north of the Venezuelan peninsula of Paraguaná Peninsula, Paraguaná and northwest of Curaçao. In 19 ...

, Curaçao

Curaçao, officially the Country of Curaçao, is a constituent island country within the Kingdom of the Netherlands, located in the southern Caribbean Sea (specifically the Dutch Caribbean region), about north of Venezuela.

Curaçao includ ...

, Hong Kong

Hong Kong)., Legally Hong Kong, China in international treaties and organizations. is a special administrative region of China. With 7.5 million residents in a territory, Hong Kong is the fourth most densely populated region in the wor ...

, and Macao

Macau or Macao is a special administrative region of the People's Republic of China (PRC). With a population of about people and a land area of , it is the most densely populated region in the world.

Formerly a Portuguese colony, the ter ...

, as well as Kosovo

Kosovo, officially the Republic of Kosovo, is a landlocked country in Southeast Europe with International recognition of Kosovo, partial diplomatic recognition. It is bordered by Albania to the southwest, Montenegro to the west, Serbia to the ...

.International Bank for Reconstruction and Development

The International Bank for Reconstruction and Development (IBRD) is an international financial institution, established in 1944 and headquartered in Washington, D.C., United States; it is the lending arm of World Bank Group. The IBRD offers lo ...

(IBRD) members and vice versa.

Former members are Cuba

Cuba, officially the Republic of Cuba, is an island country, comprising the island of Cuba (largest island), Isla de la Juventud, and List of islands of Cuba, 4,195 islands, islets and cays surrounding the main island. It is located where the ...

(which left in 1964),Taiwan

Taiwan, officially the Republic of China (ROC), is a country in East Asia. The main geography of Taiwan, island of Taiwan, also known as ''Formosa'', lies between the East China Sea, East and South China Seas in the northwestern Pacific Ocea ...

, which was ejected from the IMF in 1980 after losing the support of the then United States President Jimmy Carter

James Earl Carter Jr. (October 1, 1924December 29, 2024) was an American politician and humanitarian who served as the 39th president of the United States from 1977 to 1981. A member of the Democratic Party (United States), Democratic Party ...

and was replaced by the People's Republic of China

China, officially the People's Republic of China (PRC), is a country in East Asia. With population of China, a population exceeding 1.4 billion, it is the list of countries by population (United Nations), second-most populous country after ...

.Taiwan Province of China

"Taiwan, China", "Taiwan, Province of China", and "Taipei, China" are controversial political terms that claim free area of the Republic of China, Taiwan and its associated territories as a province or territory of the China, People's Republ ...

" is still listed in the official IMF indices. Poland

Poland, officially the Republic of Poland, is a country in Central Europe. It extends from the Baltic Sea in the north to the Sudetes and Carpathian Mountains in the south, bordered by Lithuania and Russia to the northeast, Belarus and Ukrai ...

withdrew in 1950—allegedly pressured by the Soviet Union

The Union of Soviet Socialist Republics. (USSR), commonly known as the Soviet Union, was a List of former transcontinental countries#Since 1700, transcontinental country that spanned much of Eurasia from 1922 until Dissolution of the Soviet ...

—but returned in 1986. The former Czechoslovakia

Czechoslovakia ( ; Czech language, Czech and , ''Česko-Slovensko'') was a landlocked country in Central Europe, created in 1918, when it declared its independence from Austria-Hungary. In 1938, after the Munich Agreement, the Sudetenland beca ...

was expelled in 1954 for "failing to provide required data" and was readmitted in 1990, after the Velvet Revolution

The Velvet Revolution () or Gentle Revolution () was a non-violent transition of power in what was then Czechoslovakia, occurring from 17 November to 28 November 1989. Popular demonstrations against the one-party government of the Communist Pa ...

.Monaco

Monaco, officially the Principality of Monaco, is a Sovereign state, sovereign city-state and European microstates, microstate on the French Riviera a few kilometres west of the Regions of Italy, Italian region of Liguria, in Western Europe, ...

and North Korea

North Korea, officially the Democratic People's Republic of Korea (DPRK), is a country in East Asia. It constitutes the northern half of the Korea, Korean Peninsula and borders China and Russia to the north at the Yalu River, Yalu (Amnok) an ...

. Liechtenstein

Liechtenstein (, ; ; ), officially the Principality of Liechtenstein ( ), is a Landlocked country#Doubly landlocked, doubly landlocked Swiss Standard German, German-speaking microstate in the Central European Alps, between Austria in the east ...

became the 191st member on 21 October 2024.

Qualifications

Any country may apply to be a part of the IMF. Post-IMF formation, in the early postwar period, rules for IMF membership were left relatively loose. Members needed to make periodic membership payments towards their quota, to refrain from currency restrictions unless granted IMF permission, to abide by the Code of Conduct in the IMF Articles of Agreement, and to provide national economic information. However, stricter rules were imposed on governments that applied to the IMF for funding.

Benefits

Member countries of the IMF have access to information on the economic policies of all member countries, the opportunity to influence other members' economic policies, technical assistance

Development aid (or development cooperation) is a type of aid given by governments and other agencies to support the economic, environmental, social, and political development of developing countries. It is distinguished from humanitarian aid by ...

in banking, fiscal affairs, and exchange matters, financial support in times of payment difficulties, and increased opportunities for trade and investment.

Personnel

Board of Governors

The board of governors consists of one governor and one alternate governor for each member country. Each member country appoints its two governors. The Board normally meets once a year and is responsible for electing or appointing an executive director to the executive board. While the board of governors is officially responsible for approving quota increases, special drawing right

Special drawing rights (SDRs, code ) are supplementary foreign exchange reserve assets defined and maintained by the International Monetary Fund (IMF). SDRs are units of account for the IMF, and not a currency ''per se''. They represent a claim ...

allocations, the admittance of new members, compulsory withdrawal of members, and amendments to the Articles of Agreement and By-Laws, in practice it has delegated most of its powers to the IMF's executive board.developing countries

A developing country is a sovereign state with a less-developed Secondary sector of the economy, industrial base and a lower Human Development Index (HDI) relative to developed countries. However, this definition is not universally agreed upon. ...

.

Executive Board

25 Executive Directors make up the executive board. The executive directors represent all 191 member countries in a geographically based roster.[ Countries with large economies have their own executive director, but most countries are grouped in constituencies representing four or more countries.]

Managing Director

The IMF is led by a managing director, who is head of the staff and serves as chairman of the executive board. The managing director is the most powerful position at the IMF. Historically, the IMF's managing director has been a European citizen and the president of the World Bank

The World Bank is an international financial institution that provides loans and Grant (money), grants to the governments of Least developed countries, low- and Developing country, middle-income countries for the purposes of economic development ...

has been an American citizen

Citizenship of the United States is a legal status that entails Americans with specific rights, duties, protections, and benefits in the United States. It serves as a foundation of fundamental rights derived from and protected by the Consti ...

. However, this standard is increasingly being questioned and competition for these two posts may soon open up to include other qualified candidates from any part of the world.[.] In August 2019, the International Monetary Fund has removed the age limit which is 65 or over for its managing director position.

In 2011, the world's largest developing countries, the BRICS

BRICS is an intergovernmental organization comprising ten countriesBrazil, Russia, India, China, South Africa, Egypt, Ethiopia, Indonesia, Iran and the United Arab Emirates. The idea of a BRICS-like group can be traced back to Russian foreign ...

states, issued a statement declaring that the tradition of appointing a European as managing director undermined the legitimacy of the IMF and called for the appointment to be merit-based.

List of Managing Directors

Former managing director Dominique Strauss-Kahn

Dominique Gaston André Strauss-Kahn (; born 25 April 1949), also known as DSK, is a French economist and politician who served as the tenth managing director of the International Monetary Fund (IMF), and was a member of the French Socialist P ...

was arrested in connection with charges of sexually assaulting a New York hotel room attendant and resigned on 18 May. The charges were later dropped. On 28 June 2011 Christine Lagarde

Christine Madeleine Odette Lagarde (; , ; born 1 January 1956) is a French politician and lawyer who has been the President of the European Central Bank since 2019. She previously served as the 11th Managing Director of the International Monetar ...

was confirmed as managing director of the IMF for a five-year term starting on 5 July 2011.

First Deputy Managing Director

The managing director is assisted by a First Deputy managing director (FDMD) who, by convention, has always been a citizen of the United States. Together, the managing director and their First Deputy lead the senior management of the IMF. Like the managing director, the First Deputy traditionally serves a five-year term.

List of First Deputy Managing Directors

Chief Economist

The chief economist leads the research division of the IMF and is a "senior official" of the IMF.

List of Chief Economists

IMF staff

IMF staff have considerable autonomy and are known to shape IMF policy. According to Jeffrey Chwieroth, "It is the staff members who conduct the bulk of the IMF's tasks; they formulate policy proposals for consideration by member states, exercise surveillance, carry out loan negotiations and design the programs, and collect and systematize detailed information." Most IMF staff are economists. According to a 1968 study, nearly 60% of staff were from English-speaking developed countries.

Voting power

Voting power in the IMF is based on a quota system. Each member has a number of basic votes, equal to 5.502% of the total votes, plus one additional vote for each special drawing right

Special drawing rights (SDRs, code ) are supplementary foreign exchange reserve assets defined and maintained by the International Monetary Fund (IMF). SDRs are units of account for the IMF, and not a currency ''per se''. They represent a claim ...

(SDR) of 100,000 of a member country's quota.[.] The SDR is the unit of account of the IMF and represents a potential claim to currency. It is based on a basket of key international currencies. The basic votes generate a slight bias in favour of small countries, but the additional votes determined by SDR outweigh this bias.United States Congress

The United States Congress is the legislature, legislative branch of the federal government of the United States. It is a Bicameralism, bicameral legislature, including a Lower house, lower body, the United States House of Representatives, ...

adopted a legislation authorising the 2010 Quota and Governance Reforms. As a result,

* all 190 members' quotas will increase from a total of about XDR 238.5 billion to about XDR 477 billion, while the quota shares and voting power of the IMF's poorest member countries will be protected.

* more than 6 percent of quota shares will shift to dynamic emerging market and developing countries and also from over-represented to under-represented members.

* four emerging market countries (Brazil, China, India, and Russia) will be among the ten largest members of the IMF. Other top 10 members are the United States, Japan, Germany, France, the United Kingdom and Italy.

Effects of the quota system

The IMF's quota system was created to raise funds for loans.

Inflexibility of voting power

Quotas are normally reviewed every five years and can be increased when deemed necessary by the board of governors. IMF voting shares are relatively inflexible: countries that grow economically have tended to become under-represented as their voting power lags behind.developing countries

A developing country is a sovereign state with a less-developed Secondary sector of the economy, industrial base and a lower Human Development Index (HDI) relative to developed countries. However, this definition is not universally agreed upon. ...

within the IMF has been suggested.Joseph Stiglitz

Joseph Eugene Stiglitz (; born February 9, 1943) is an American New Keynesian economist, a public policy analyst, political activist, and a professor at Columbia University. He is a recipient of the Nobel Memorial Prize in Economic Sciences (2 ...

argues, "There is a need to provide more effective voice and representation for developing countries, which now represent a much larger portion of world economic activity since 1944, when the IMF was created." In 2008, a number of quota reforms were passed including shifting 6% of quota shares to dynamic emerging markets and developing countries.

Overcoming borrower/creditor divide

The IMF's membership is divided along income lines: certain countries provide financial resources while others use these resources. Both developed country

A developed country, or advanced country, is a sovereign state that has a high quality of life, developed economy, and advanced technological infrastructure relative to other less industrialized nations. Most commonly, the criteria for eval ...

"creditors" and developing country

A developing country is a sovereign state with a less-developed industrial base and a lower Human Development Index (HDI) relative to developed countries. However, this definition is not universally agreed upon. There is also no clear agreeme ...

"borrowers" are members of the IMF. The developed countries provide the financial resources but rarely enter into IMF loan agreements; they are the creditors. Conversely, the developing countries use the lending services but contribute little to the pool of money available to lend because their quotas are smaller; they are the borrowers. Thus, tension is created around governance issues because these two groups, creditors and borrowers, have fundamentally different interests.

Use

In 2008, the SAIS Review of International Affairs revealed that the average overall use of IMF credit per decade increased, in real terms, by 21% between the 1970s and 1980s, and increased again by just over 22% from the 1980s to the 1991–2005 period. Another study has suggested that since 1950 the continent of Africa alone has received $300 billion from the IMF, the World Bank, and affiliate institutions.

Exceptional Access Framework – sovereign debt

The Exceptional Access Framework was created in 2003 when John B. Taylor was Under Secretary of the US Treasury

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States. It is one of 15 current U.S. government departments.

The department oversees the Bureau of Engraving and ...

for International Affairs. The new Framework became fully operational in February 2003 and it was applied in the subsequent decisions on Argentina and Brazil. Its purpose was to place some sensible rules and limits on the way the IMF makes loans to support governments with debt problem—especially in emerging markets—and thereby move away from the bailout mentality of the 1990s. Such a reform was essential for ending the crisis atmosphere that then existed in emerging markets. The reform was closely related to and put in place nearly simultaneously with the actions of several emerging market countries to place collective action clause A collective action clause (CAC) allows a supermajority of bondholders to agree to a debt restructuring that is legally binding on all holders of the bond, including those who vote against the restructuring. Bondholders generally opposed such cla ...

s in their bond contracts.

In 2010, the framework was abandoned so the IMF could make loans to Greece in an unsustainable and political situation.The Wall Street Journal

''The Wall Street Journal'' (''WSJ''), also referred to simply as the ''Journal,'' is an American newspaper based in New York City. The newspaper provides extensive coverage of news, especially business and finance. It operates on a subscriptio ...

''.["The Fund's Lending Framework and Sovereign Debt – Preliminary Considerations" 22 May 2014](_blank)

(also bears date June 2014; team of 20 led by Reza Bakir and supervised by Olivier Blanchard

Olivier Jean Blanchard (; born December 27, 1948) is a French economist and professor. He is Robert M. Solow Professor Emeritus of Economics at the Massachusetts Institute of Technology, Professor of Economics at the Paris School of Economics, an ...

, Sean Hagan, Hugh Bredenkamp, and Peter Dattels) The staff proposed that "in circumstances where a (Sovereign) member has lost market access and debt is considered sustainable ... the IMF would be able to provide Exceptional Access on the basis of a debt operation that involves an extension of maturities", which was labeled a "reprofiling operation". These reprofiling operations would "generally be less costly to the debtor and creditors—and thus to the system overall—relative to either an upfront debt reduction operation or a bail-out that is followed by debt reduction ... (and) would be envisaged only when both (a) a member has lost market access and (b) debt is assessed to be sustainable, but not with high probability ... Creditors will only agree if they understand that such an amendment is necessary to avoid a worse outcome: namely, a default and/or an operation involving debt reduction ... Collective action clause A collective action clause (CAC) allows a supermajority of bondholders to agree to a debt restructuring that is legally binding on all holders of the bond, including those who vote against the restructuring. Bondholders generally opposed such cla ...

s, which now exist in most—but not all—bonds would be relied upon to address collective action problems."[

]

Impact

According to a 2002 study by Randall W. Stone, the academic literature on the IMF shows "no consensus on the long-term effects of IMF programs on growth".

Some research has found that IMF loans can reduce the chance of a future banking crisis, while other studies have found that they can increase the risk of political crises. IMF programs can reduce the effects of a currency crisis.

Some research has found that IMF programs are less effective in countries which possess a developed-country patron (be it by foreign aid, membership of postcolonial institutions or UN voting patterns), seemingly due to this patron allowing countries to flaunt IMF program rules as these rules are not consistently enforced. Some research has found that IMF loans reduce economic growth due to creating an economic moral hazard

In economics, a moral hazard is a situation where an economic actor has an incentive to increase its exposure to risk because it does not bear the full costs associated with that risk, should things go wrong. For example, when a corporation i ...

, reducing public investment, reducing incentives to create a robust domestic policies and reducing private investor confidence. Other research has indicated that IMF loans can have a positive impact on economic growth and that their effects are highly nuanced.

Criticisms

General

Overseas Development Institute

ODI Global (formerly Overseas Development Institute) is a global affairs think tank, founded in 1960. Its mission is "to inspire people to act on injustice and inequality through collaborative research and ideas that matter for people and the ...

(ODI) research undertaken in 1980 included criticisms of the IMF which support the analysis that it is a pillar of what activist Titus Alexander calls global apartheid

Global apartheid is a term for a concept of how Global North countries are engaged in a project of "racialization, segregation, political intervention, mobility controls, capitalist plunder, and labor exploitation" affecting people from the Global ...

.

* Developed countries were seen to have a more dominant role and control over less developed countries

A developing country is a sovereign state with a less-developed industrial base and a lower Human Development Index (HDI) relative to developed countries. However, this definition is not universally agreed upon. There is also no clear agreemen ...

(LDCs).

* The Fund worked on the incorrect assumption that all payments disequilibria were caused domestically. The Group of 24

The Intergovernmental Group of Twenty-Four on International Monetary Affairs and Development, or The Group of 24 (G-24) was established in 1971 as a chapter of the Group of 77 in order to help coordinate the positions of developing countries on ...

(G-24), on behalf of LDC members, and the United Nations Conference on Trade and Development

UN Trade and Development (UNCTAD) is an intergovernmental organization within the United Nations Secretariat that promotes the interests of developing countries in world trade. It was established in 1964 by the United Nations General Assembl ...

(UNCTAD) complained that the IMF did not distinguish sufficiently between disequilibria with predominantly external as opposed to internal causes. This criticism was voiced in the aftermath of the 1973 oil crisis

In October 1973, the Organization of Arab Petroleum Exporting Countries (OAPEC) announced that it was implementing a total oil embargo against countries that had supported Israel at any point during the 1973 Yom Kippur War, which began after Eg ...

. Then LDCs found themselves with payment deficits due to adverse changes in their terms of trade

The terms of trade (TOT) is the relative price of exports in terms of imports and is defined as the ratio of export prices to import prices. It can be interpreted as the amount of import goods an economy can purchase per unit of export goods.

An ...

, with the Fund prescribing stabilization programmes similar to those suggested for deficits caused by government over-spending. Faced with long-term, externally generated disequilibria, the G-24 argued for more time for LDCs to adjust their economies.

* Some IMF policies may be anti-developmental; the report said that deflationary

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% and becomes negative. While inflation reduces the value of currency over time, deflation increases it ...

effects of IMF programmes quickly led to losses of output and employment in economies where incomes were low and unemployment was high. Moreover, the burden of the deflation is disproportionately borne by the poor.

* The IMF's initial policies were based in theory and influenced by differing opinions and departmental rivalries. Critics suggest that its intentions to implement these policies in countries with widely varying economic circumstances were misinformed and lacked economic rationale.

ODI conclusions were that the IMF's very nature of promoting market-oriented approaches attracted unavoidable criticism. On the other hand, the IMF could serve as a scapegoat while allowing governments to blame international bankers. The ODI conceded that the IMF was insensitive to political aspirations of LDCs while its policy conditions were inflexible.

Argentina, which had been considered by the IMF to be a model country in its compliance to policy proposals by the Bretton Woods institutions, experienced a catastrophic economic crisis in 2001, which some believe to have been caused by IMF-induced budget restrictions—which undercut the government's ability to sustain national infrastructure even in crucial areas such as health, education, and security—and privatisation

Privatization (rendered privatisation in British English) can mean several different things, most commonly referring to moving something from the public sector into the private sector. It is also sometimes used as a synonym for deregulation w ...

of strategically vital national resources

''Resource'' refers to all the materials available in our environment which are Technology, technologically accessible, Economics, economically feasible and Culture, culturally Sustainability, sustainable and help us to satisfy our needs and want ...

. Others attribute the crisis to Argentina's misdesigned fiscal federalism

As a subfield of public economics, fiscal federalism is concerned with "understanding which functions and instruments are best centralized and which are best placed in the sphere of decentralized levels of government" (Oates, 1999). In other word ...

, which caused subnational spending to increase rapidly. The crisis added to widespread hatred of this institution in Argentina and other South American countries, with many blaming the IMF for the region's economic problems. The post-2000s trend toward moderate left-wing governments in the region and a growing concern with the development of a regional economic policy largely independent of big business pressures has been ascribed to this crisis.

In 2001, the Independent Evaluation Office, an autonomous body, was established to conduct independent evaluations of policies and activities of the International Monetary Fund.

In 2006, a senior ActionAid

ActionAid is an international non-governmental organization whose stated primary aim is to work against poverty and injustice worldwide.

ActionAid is a federation of 45 country offices that works with communities, often via local partner organi ...

policy analyst Akanksha Marphatia stated that IMF policies in Africa undermine any possibility of meeting the Millennium Development Goals (MDGs) due to imposed restrictions that prevent spending on important sectors, such as education and health.

In an interview (2008-05-19), the former Romanian Prime Minister Călin Popescu-Tăriceanu

Călin Constantin Anton Popescu-Tăriceanu (; born 14 January 1952) is a Romanian politician who served as Prime Minister of Romania, prime minister of Romania from 2004 to 2008. He was also president of the National Liberal Party (Romania), Na ...

claimed that "Since 2005, IMF is constantly making mistakes when it appreciates the country's economic performances".Julius Nyerere

Julius Kambarage Nyerere (; 13 April 1922 – 14 October 1999) was a Tanzanian politician, anti-colonial activist, and political theorist. He governed Tanganyika (1961–1964), Tanganyika as prime minister from 1961 to 1962 and then as presid ...

, who claimed that debt-ridden African states were ceding sovereignty to the IMF and the World Bank, famously asked, "Who elected the IMF to be the ministry of finance for every country in the world?"Reserve Bank of India

Reserve Bank of India, abbreviated as RBI, is the central bank of the Republic of India, and regulatory body responsible for regulation of the Indian banking system and Indian rupee, Indian currency. Owned by the Ministry of Finance (India), Min ...

(RBI) Governor Raghuram Rajan

Raghuram Govind Rajan (born 3 February 1963) is an Indian economist and the Katherine Dusak Merton Miller, Miller Distinguished Service Professor of Finance at the University of Chicago's Booth School of Business. Quote: "I am an Indian citizen ...

who predicted the 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

criticised the IMF for remaining a sideline player to the developed world. He criticised the IMF for praising the monetary policies of the US, which he believed were wreaking havoc in emerging markets. He had been critical of "ultra-loose money policies" of some unnamed countries.

Countries such as Zambia

Zambia, officially the Republic of Zambia, is a landlocked country at the crossroads of Central Africa, Central, Southern Africa, Southern and East Africa. It is typically referred to being in South-Central Africa or Southern Africa. It is bor ...

have not received proper aid with long-lasting effects, leading to concern from economists. Since 2005, Zambia (as well as 29 other African countries) did receive debt write-offs, which helped with the country's medical and education funds. However, Zambia returned to a debt of over half its GDP in less than a decade. American economist William Easterly

William Russell Easterly (born September 7, 1957) is an American economist specializing in economic development. He is a professor of economics at New York University, joint with Africa House, and co-director of NYU's Development Research Institut ...

, sceptical of the IMF's methods, had initially warned that "debt relief would simply encourage more reckless borrowing by crooked governments unless it was accompanied by reforms to speed up economic growth and improve governance", according to ''The Economist

''The Economist'' is a British newspaper published weekly in printed magazine format and daily on Electronic publishing, digital platforms. It publishes stories on topics that include economics, business, geopolitics, technology and culture. M ...

''.

Conditionality

The IMF has been criticised for being "out of touch" with local economic conditions, cultures, and environments in the countries they are requiring policy reform.Jeffrey Sachs

Jeffrey David Sachs ( ; born November 5, 1954) is an American economist and public policy analyst who is a professor at Columbia University, where he was formerly director of The Earth Institute. He worked on the topics of sustainable develop ...

argues that the IMF's "usual prescription is 'budgetary belt tightening to countries who are much too poor to own belts.Conditionality

In political economy and international relations, conditionality is the use of conditions attached to the provision of benefits such as a loan, debt relief or bilateral aid. These conditions are typically imposed by international financial insti ...

has also been criticised because a country can pledge collateral of "acceptable assets" to obtain waivers—if one assumes that all countries are able to provide "acceptable collateral".Gini coefficient

In economics, the Gini coefficient ( ), also known as the Gini index or Gini ratio, is a measure of statistical dispersion intended to represent the income distribution, income inequality, the wealth distribution, wealth inequality, or the ...

, it became clear that countries with IMF policies face increased income inequality.conditionalities

In political economy and international relations, conditionality is the use of conditions attached to the provision of benefits such as a loan, debt relief or bilateral aid. These conditions are typically imposed by international financial insti ...

hinder social stability and hence inhibit the stated goals of the IMF, while Structural Adjustment Programmes lead to an increase in poverty in recipient countries.[Hertz, Noreena. ''The Debt Threat''. New York: Harper Collins Publishers, 2004.] The IMF sometimes advocates " austerity programmes", cutting public spending and increasing taxes even when the economy is weak, to bring budgets closer to a balance, thus reducing budget deficit

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit, the opposite of budget surplus. The term may be applied to the budg ...

s. Countries are often advised to lower their corporate tax rate. In ''Globalization and Its Discontents

''Globalization and Its Discontents'' is a book published in 2002 by the 2001 Nobel laureate Joseph E. Stiglitz. The title is a reference to Freud's Civilization and Its Discontents.

The book draws on Stiglitz's personal experience as chairm ...

'', Joseph E. Stiglitz

Joseph Eugene Stiglitz (; born February 9, 1943) is an American New Keynesian economist, a public policy analyst, political activist, and a professor at Columbia University. He is a recipient of the Nobel Memorial Prize in Economic Sciences (2 ...

, former chief economist and senior vice-president at the World Bank

The World Bank is an international financial institution that provides loans and Grant (money), grants to the governments of Least developed countries, low- and Developing country, middle-income countries for the purposes of economic development ...

, criticises these policies.[Stiglitz, Joseph. ''Globalization and its Discontents''. New York: WW Norton & Company, 2002.] He argues that by converting to a more monetarist

Monetarism is a school of thought in monetary economics that emphasizes the role of policy-makers in controlling the amount of money in circulation. It gained prominence in the 1970s, but was mostly abandoned as a direct guidance to monetary ...

approach, the purpose of the fund is no longer valid, as it was designed to provide funds for countries to carry out Keynesian

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output an ...

reflations, and that the IMF "was not participating in a conspiracy, but it was reflecting the interests and ideology of the Western financial community."

Stiglitz concludes, "Modern high-tech warfare is designed to remove physical contact: dropping bombs from 50,000 feet ensures that one does not 'feel' what one does. Modern economic management is similar: from one's luxury hotel, one can callously impose policies about which one would think twice if one knew the people whose lives one was destroying."[

The researchers Eric Toussaint and Damien Millet argue that the IMF's policies amount to a new form of colonisation that does not need a military presence: