Income inequality

In economics, income distribution covers how a country's total GDP is distributed amongst its population. Economic theory and economic policy have long seen income and its distribution as a central concern. Unequal distribution of income causes ...

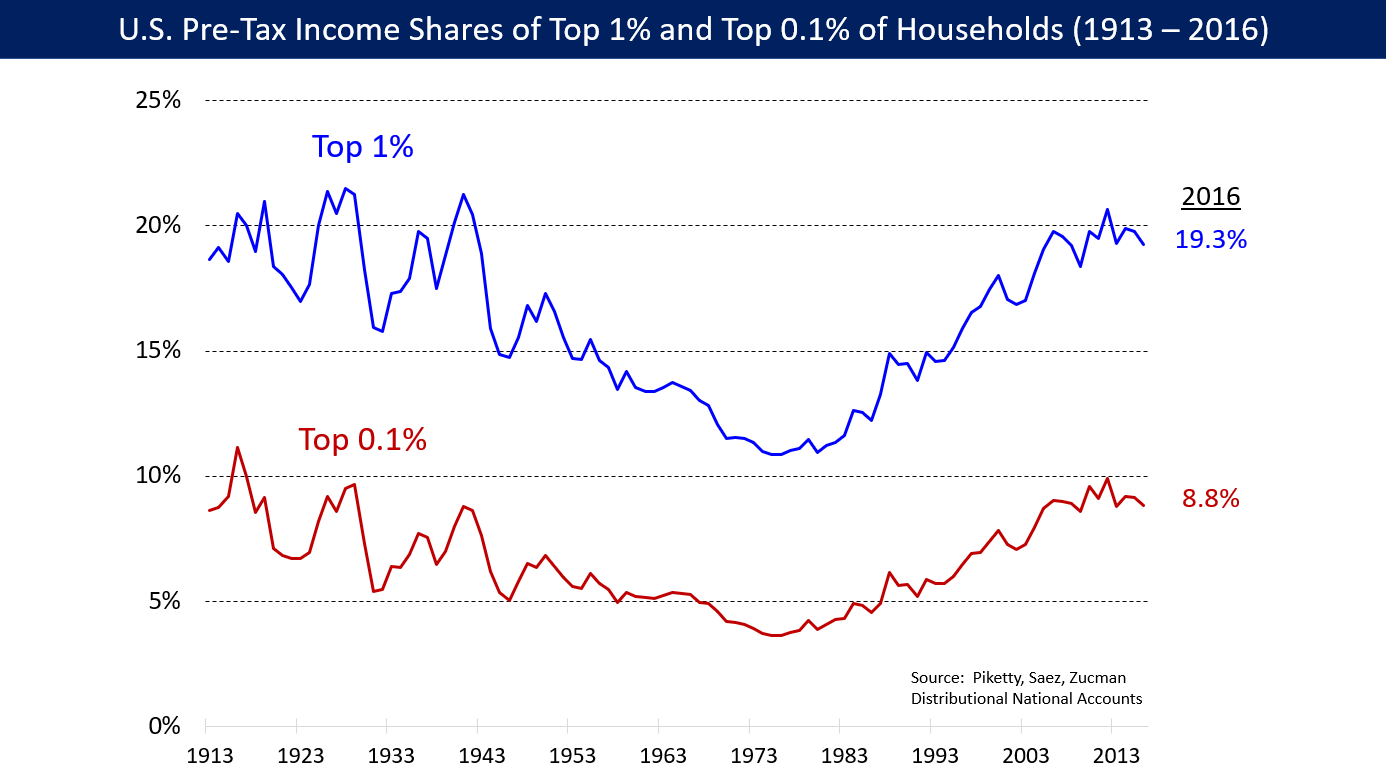

has fluctuated considerably in the United States since measurements began around 1915, moving in an arc between peaks in the 1920s and 2000s, with a lower level of inequality from approximately 1950-1980 (a period named the

Great Compression

The Great Compression refers to the period of substantial wage compression in the United States that began in the early 1940s. During that time, economic inequality as shown by wealth distribution and income distribution between the rich and poo ...

), followed by increasing inequality, in what has been coined as the

great divergence

The Great Divergence or European miracle is the socioeconomic shift in which the Western world (i.e. Western Europe along with its settler offshoots in Northern America and Australasia) overcame pre-modern growth constraints and emerged during ...

.

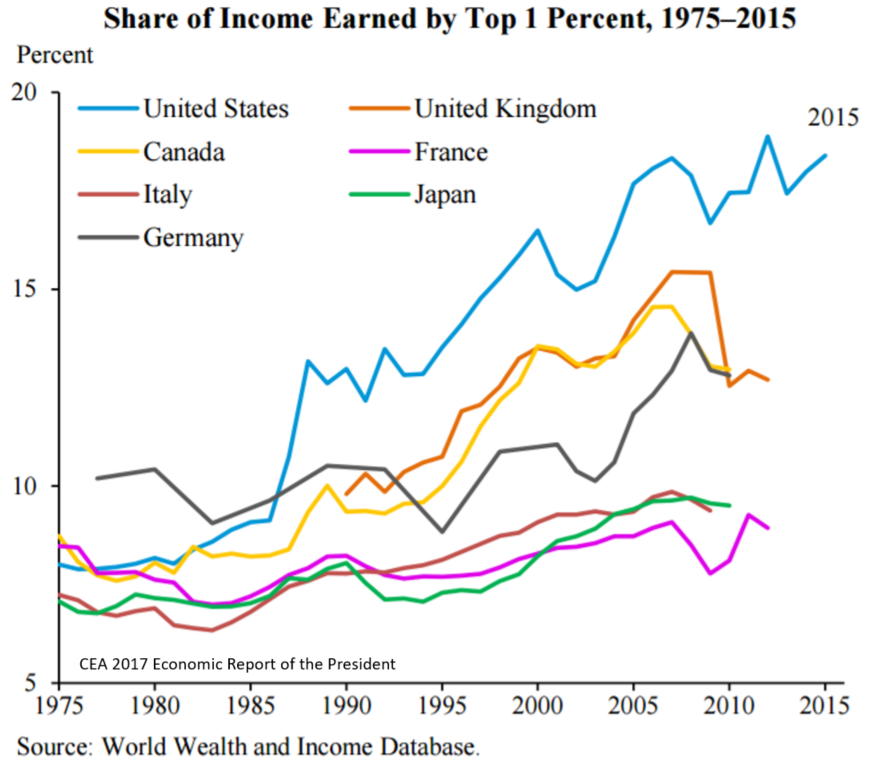

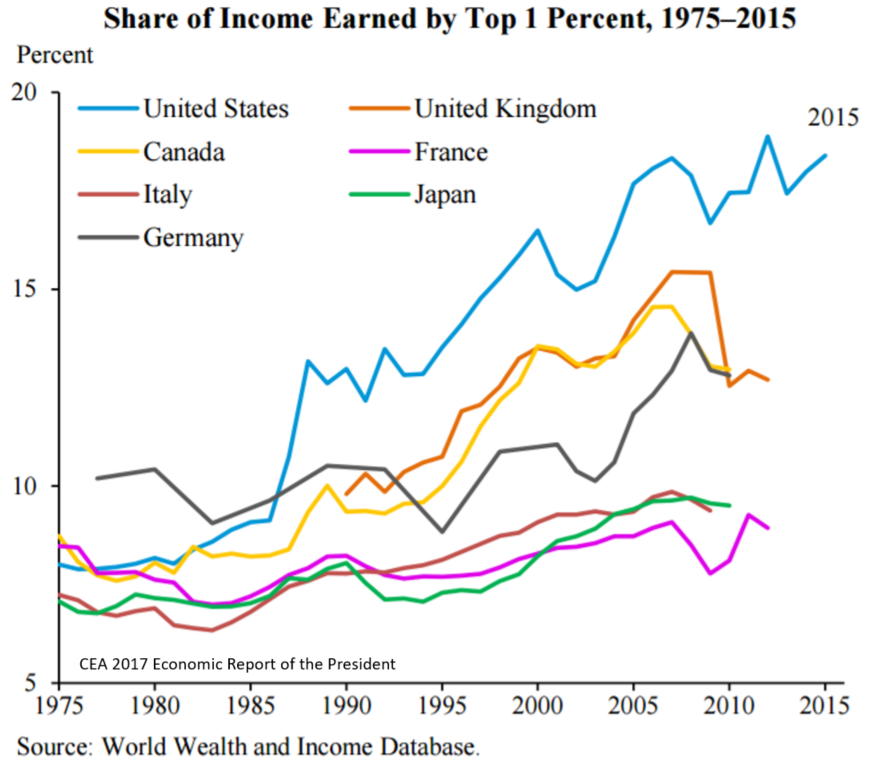

The U.S. has the highest level of income inequality among its (post-industrialized) peers.

[United Press International (UPI), June 22, 2018]

"U.N. Report: With 40M in Poverty, U.S. Most Unequal Developed Nation"

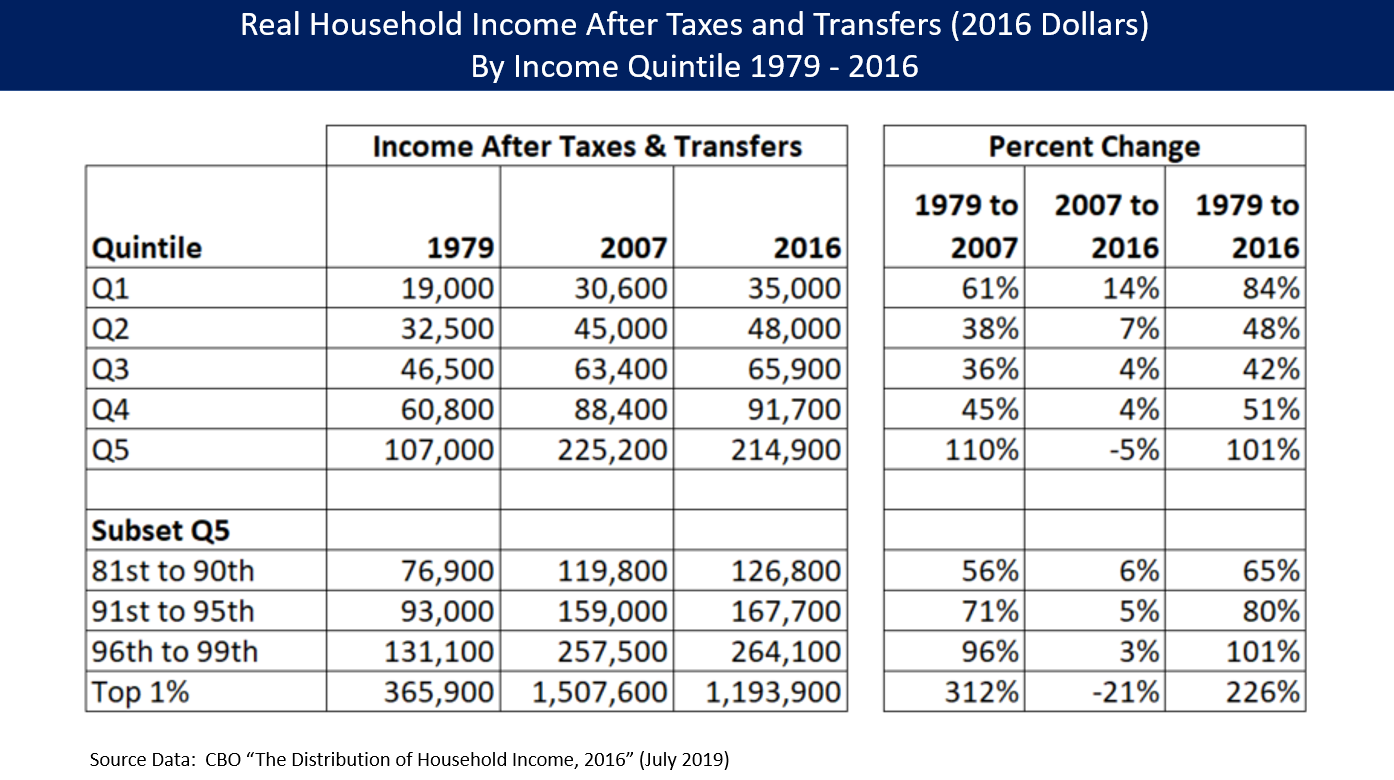

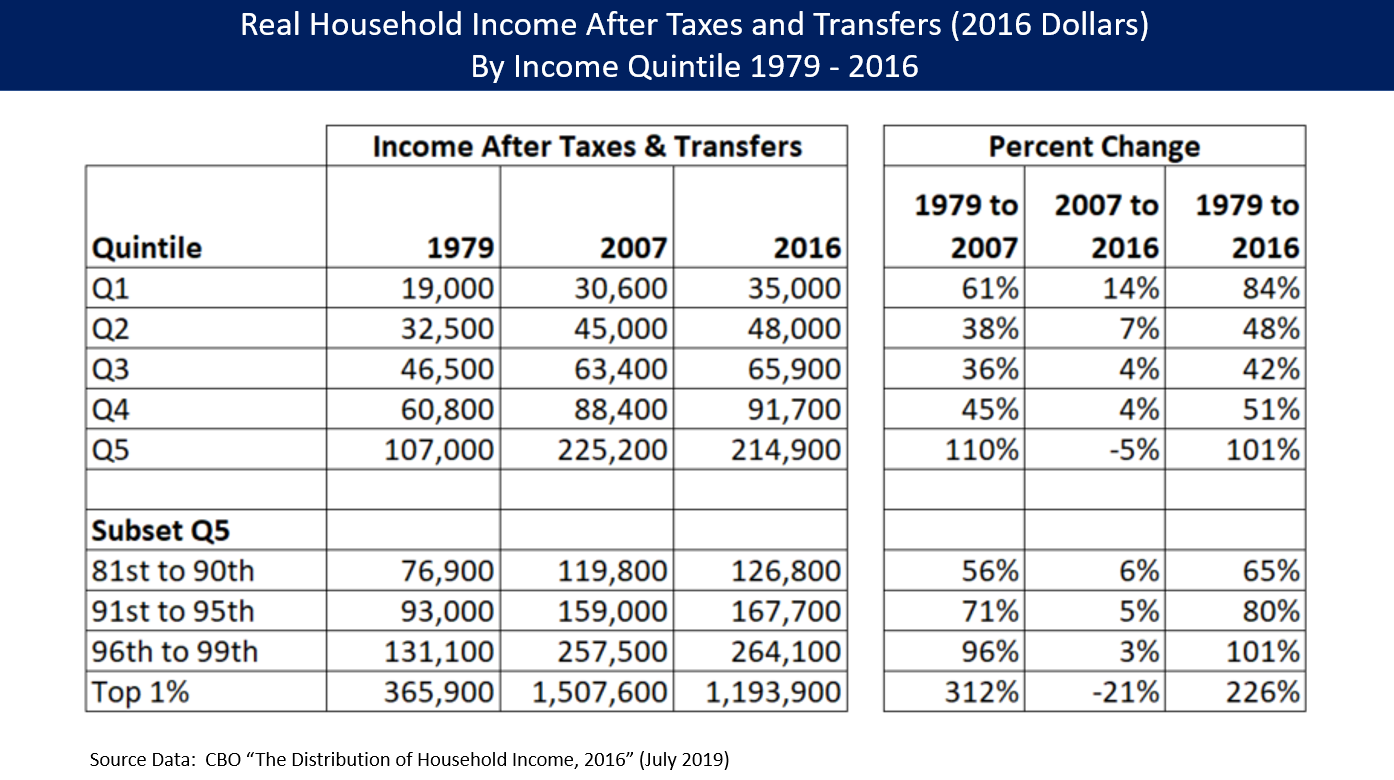

/ref> When measured for all households, U.S. income inequality is comparable to other developed countries before taxes and transfers, but is among the highest after taxes and transfers, meaning the U.S. shifts relatively less income from higher income households to lower income households. In 2016, average market income was $15,600 for the lowest quintile

Quintile may refer to:

*In statistics, a quantile

In statistics and probability, quantiles are cut points dividing the range of a probability distribution into continuous intervals with equal probabilities or dividing the observations in a ...

and $280,300 for the highest quintile. The degree of inequality accelerated within the top quintile, with the top 1% at $1.8 million, approximately 30 times the $59,300 income of the middle quintile.income mobility

Economic mobility is the ability of an individual, family or some other group to improve (or lower) their economic status—usually measured in income. Economic mobility is often measured by movement between income quintiles. Economic mobility ...

, higher poverty rates, greater usage of household debt

Household debt is the combined debt of all people in a household, including consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and s ...

leading to increased risk of financial crises, and political polarization

Political polarization (spelled ''polarisation'' in British English, Australian English, and New Zealand English) is the divergence of political attitudes away from the center, towards ideological extremes. Scholars distinguish between ideologi ...

.executive compensation

Executive compensation is composed of both the Salary, financial compensation (executive pay) and other non-financial benefits received by an Senior management, executive from their employing firm in return for their service. It is typically a mix ...

increasing relative to the average worker, financialization

Financialization (or financialisation in British English) is a term sometimes used to describe the development of financial capitalism during the period from 1980 to the present, in which debt-to-equity ratios increased, and financial service ...

, greater industry concentration

In economics, market concentration is a function of the number of firms and their respective shares of the total production (alternatively, total capacity or total reserves) in a market. Market concentration is the portion of a given market's ma ...

, lower unionization rates, lower effective tax rates on higher incomes, and technology changes that reward higher educational attainment.transfer payment

In macroeconomics and finance, a transfer payment (also called a government transfer or simply fiscal transfer) is a redistribution of income and wealth by means of the government making a payment, without goods or services being received in r ...

s. The Gini coefficient

In economics, the Gini coefficient ( ), also known as the Gini index or Gini ratio, is a measure of statistical dispersion intended to represent the income distribution, income inequality, the wealth distribution, wealth inequality, or the ...

is a widely accepted statistic that applies comparisons across jurisdictions, with a zero indicating perfect equality and 1 indicating maximum inequality. Further, various public and private data sets measure those incomes, e.g., from the Congressional Budget Office

The Congressional Budget Office (CBO) is a List of United States federal agencies, federal agency within the United States Congress, legislative branch of the United States government that provides budget and economic information to Congress.

I ...

(CBO),tax

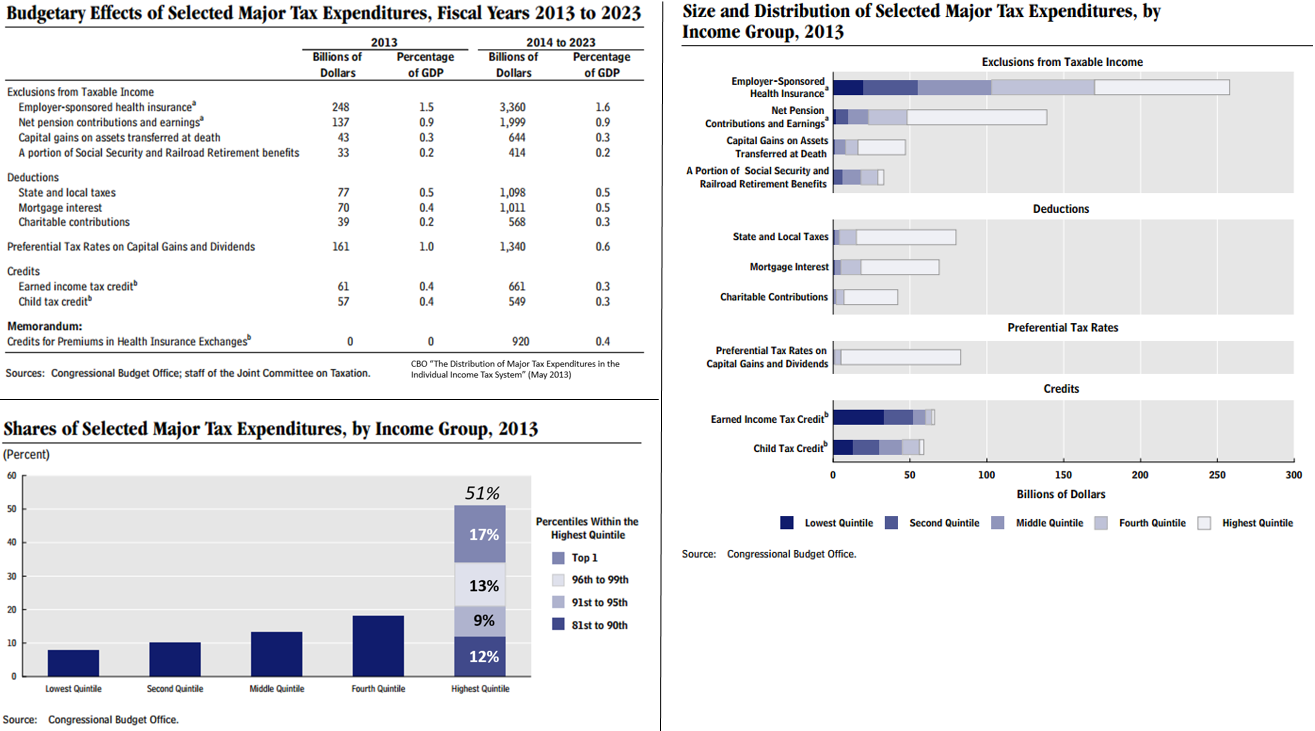

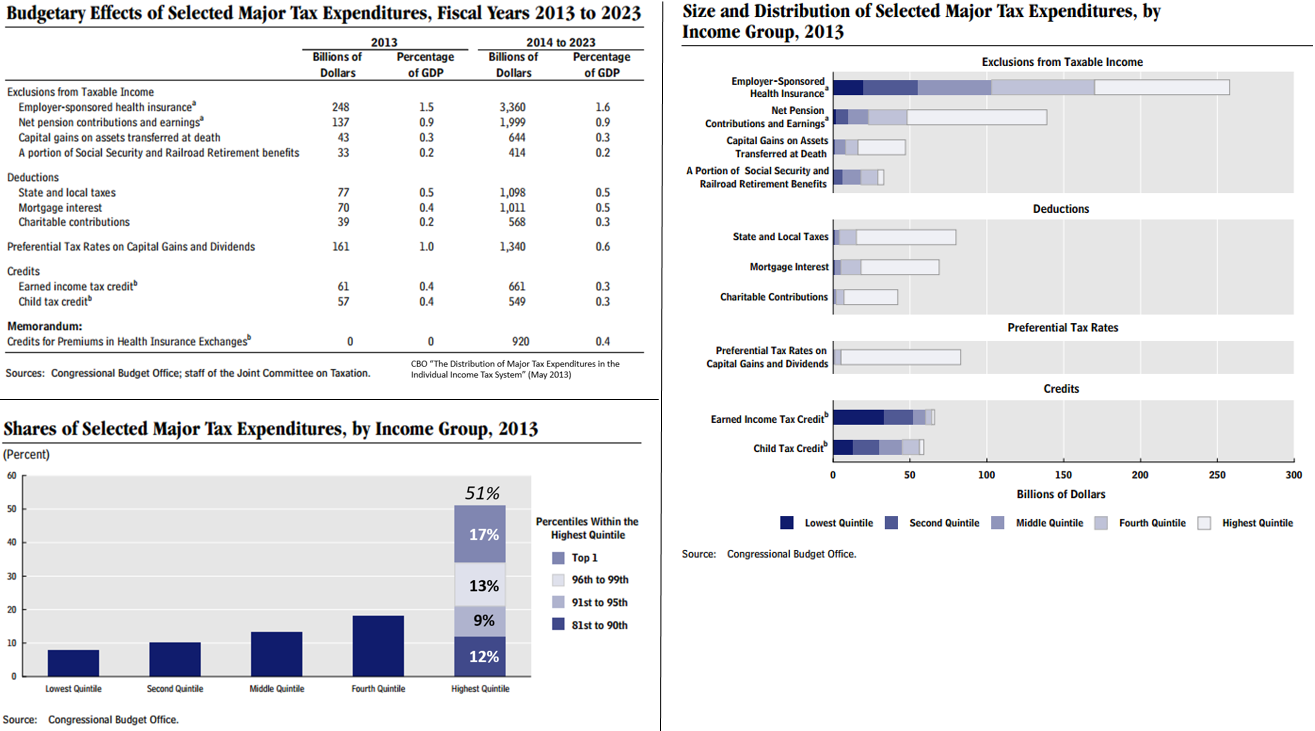

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax co ...

and transfer policies are progressive and therefore reduce effective income inequality, as rates of tax generally increase as taxable income increases. As a group, the lowest earning workers, especially those with dependents, pay no income taxes and may actually receive a small subsidy from the federal government (from child credits and the Earned Income Tax Credit

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depend ...

).Congressional Budget Office

The Congressional Budget Office (CBO) is a List of United States federal agencies, federal agency within the United States Congress, legislative branch of the United States government that provides budget and economic information to Congress.

I ...

(CBO) figures. The top 1% share of market income rose from 9.6% in 1979 to a peak of 20.7% in 2007, before falling to 17.5% by 2016. After taxes and transfers, these figures were 7.4%, 16.6%, and 12.5%, respectively.

Definitions

Income distribution can be assessed using a variety of income definitions. Adjustments are applied for various reasons, particularly to better reflect the actual economic resources available to a given individual/household.

* Market income—Labor income; business income; capital income (including capital gains); income received in retirement for past services; and other non-governmental sources of income

Income distribution can be assessed using a variety of income definitions. Adjustments are applied for various reasons, particularly to better reflect the actual economic resources available to a given individual/household.

* Market income—Labor income; business income; capital income (including capital gains); income received in retirement for past services; and other non-governmental sources of incomesocial insurance

Social insurance is a form of Social protection, social welfare that provides insurance against economic risks. The insurance may be provided publicly or through the subsidizing of private insurance. In contrast to other forms of Welfare spend ...

benefits (including benefits from Social Security

Welfare spending is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance ...

, Medicare, unemployment insurance

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is the proportion of people above a specified age (usually 15) not being in paid employment or self-employment but currently available for work du ...

, and workers’ compensation

Workers' compensation or workers' comp is a form of insurance providing wage replacement and medical benefits to employees injured in the course of employment in exchange for mandatory relinquishment of the employee's right to sue his or her emp ...

)employee benefits

Employee benefits and benefits in kind (especially in British English), also called fringe benefits, perquisites, or perks, include various types of non-wage compensation provided to an employee by an employer in addition to their normal wage o ...

and transfers

Transfer may refer to:

Arts and media

* ''Transfer'' (2010 film), a German science-fiction movie directed by Damir Lukacevic and starring Zana Marjanović

* ''Transfer'' (1966 film), a short film

* ''Transfer'' (journal), in management studies

* ...

such as housing subsidies

Subsidized housing is a subsidy aimed towards alleviating housing costs and expenses for impoverished people with low to moderate incomes. In the United States, subsidized housing is often called "affordable housing". Forms of subsidies include d ...

, minus taxes

* Gini coefficient

In economics, the Gini coefficient ( ), also known as the Gini index or Gini ratio, is a measure of statistical dispersion intended to represent the income distribution, income inequality, the wealth distribution, wealth inequality, or the ...

—Summarizes income distribution. It uses a scale from 0 to 1. Zero represents perfect equality (everyone having the same income), while 1 represents perfect inequality (one person receiving all the income). (Index scores are commonly multiplied by 100.)

The CBO explains the Gini as "A standard composite measure of income inequality is the Gini coefficient, which summarizes an entire distribution in a single number that ranges from zero to one. A value of zero indicates complete equality (for example, if each household received the same amount of income), and a value of one indicates complete inequality (for example, if a single household received all the income). Thus, a Gini coefficient that increases over time indicates rising income inequality."

"The Gini coefficient can also be interpreted as a measure of one-half of the average difference in income between every pair of households in the population, divided by the average income of the total population. For example, the Gini coefficient of 0.513 for 2016 indicates that the average difference in income between pairs of households in that year was equal to 102.6 percent (twice 0.513) of average household income in 2016, or about $70,700 (adjusted to account for differences in household size). Similarly, the Gini coefficient of 0.521 projected for 2021 indicates that the average difference in income between pairs of households would equal 104.2 percent (twice 0.521) of average household income in 2021, or about $77,800 (in 2016 dollars)."

History

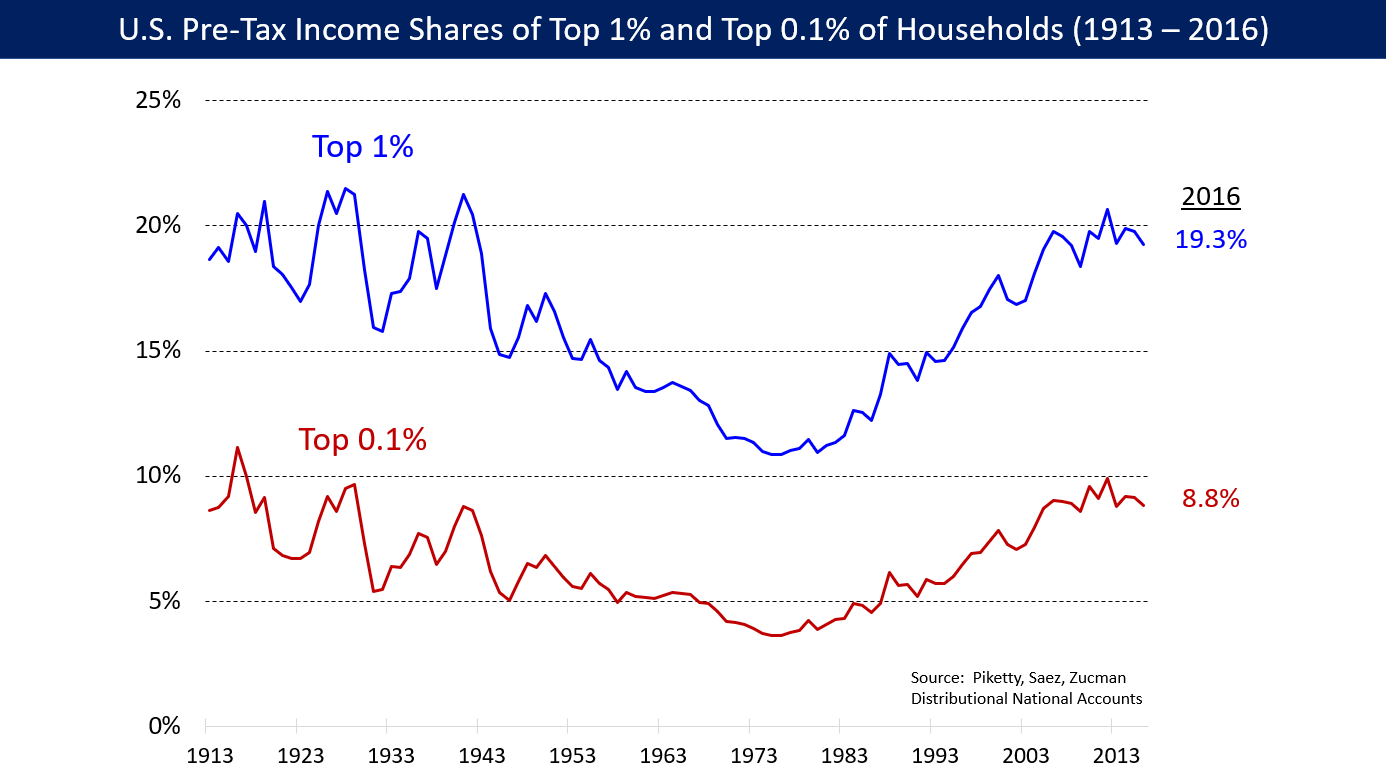

Income inequality has fluctuated considerably since measurements began around 1915, declining between peaks in the 1920s and 2007 (CBO data

Before 20th century

In the late 18th century, “incomes were more equally distributed in colonial America than in any other place that can be measured,” according to Peter Lindert and Jeffrey Williamson. The richest 1 percent of households held only 8.5% of total income in the late 18th century. Some reasons for this include the ease that the average American had in buying frontier

A frontier is a political and geographical term referring to areas near or beyond a boundary.

Australia

The term "frontier" was frequently used in colonial Australia in the meaning of country that borders the unknown or uncivilised, th ...

land, which was abundant at the time, and an overall scarcity of labor in non-slaveholding areas, which forced landowners to pay higher wages. There were also relatively few poor people in America at the time, since only those with at least some money could afford to come to America.property income

Property income refers to profit or income received by virtue of owning property. The three forms of property income are rent, received from the ownership of natural resources; interest, received by virtue of owning financial assets; and profit, ...

s, as compared to 13.7% in 1774. There was a great deal of competition for land in the cities and non-frontier areas during this time period, with those who had already acquired land becoming richer than everyone else. The newly burgeoning financial sector

Financial services are economic services tied to finance provided by financial institutions. Financial services encompass a broad range of service sector activities, especially as concerns financial management and consumer finance.

The financ ...

also greatly rewarded the already-wealthy, as they were the only ones financially sound enough to invest.

1913–1941

An early governmental measure that slightly reduced inequality was the enactment of the first income tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Tax ...

in 1913. The 1918 household Gini coefficient (excluding capital gains) was 40.8. A brief but sharp depression in 1920-1921 reduced incomes. Income inequality rose from 1913 to peaks in 1926 (1928 Gini 48.9, 1936 Gini 45.5) and 1941 (Gini 43.1), after which war-time measures of the Roosevelt administration began to equalize the income distribution

In economics, income distribution covers how a country's total GDP is distributed amongst its population. Economic theory and economic policy have long seen income and its distribution as a central concern. Unequal distribution of income causes e ...

.Social Security

Welfare spending is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance ...

was enacted in 1935. At several points in this pre-World War II

World War II or the Second World War (1 September 1939 – 2 September 1945) was a World war, global conflict between two coalitions: the Allies of World War II, Allies and the Axis powers. World War II by country, Nearly all of the wo ...

era, in which the Rockefellers

The Rockefeller family ( ) is an American industrial, political, and banking family that owns one of the world's largest fortunes. The fortune was made in the American petroleum industry during the late 19th and early 20th centuries by brot ...

and Carnegies dominated American industry, the richest 1% of Americans earned over 20% of the income share.

The Great Compression, 1937–1967

From about 1937 to 1947, a period dubbed as the "

From about 1937 to 1947, a period dubbed as the "Great Compression

The Great Compression refers to the period of substantial wage compression in the United States that began in the early 1940s. During that time, economic inequality as shown by wealth distribution and income distribution between the rich and poo ...

",New Deal

The New Deal was a series of wide-reaching economic, social, and political reforms enacted by President Franklin D. Roosevelt in the United States between 1933 and 1938, in response to the Great Depression in the United States, Great Depressi ...

taxation, stronger unions, strong post-war economic growth and regulation by the National War Labor Board broadly raised market incomes and lowered the after-tax incomes of top earners.Tax cuts

A tax cut typically represents a decrease in the amount of money taken from taxpayers to go towards government revenue. This decreases the revenue of the government and increases the disposable income of taxpayers. Tax rate cuts usually refer ...

in 1964 lowered marginal rates and closed loopholes. Medicare and Medicaid were enacted in 1965. The Earned Income Tax Credit

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depend ...

was enacted in 1975.

The income change was the product of relatively high wages for trade union

A trade union (British English) or labor union (American English), often simply referred to as a union, is an organization of workers whose purpose is to maintain or improve the conditions of their employment, such as attaining better wages ...

workers, lack of foreign manufacturing competition and political support for redistributive government policies. By 1947 more than a third of non-farm workers were union members.Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American New Keynesian economics, New Keynesian economist who is the Distinguished Professor of Economics at the CUNY Graduate Center, Graduate Center of the City University of New York. He ...

claimed that political support for equalizing government policies was provided by high voter turnout from union voting drives, Southern support for the New Deal, and prestige that the massive mobilization and victory of World War II

World War II or the Second World War (1 September 1939 – 2 September 1945) was a World war, global conflict between two coalitions: the Allies of World War II, Allies and the Axis powers. World War II by country, Nearly all of the wo ...

had given the government.

1979–2007 increase

The return to high inequality began in the 1980s.

The return to high inequality began in the 1980s.2007

2007 was designated as the International Heliophysical Year and the International Polar Year.

Events

January

* January 1

**Bulgaria and Romania 2007 enlargement of the European Union, join the European Union, while Slovenia joins the Eur ...

.1990

Important events of 1990 include the Reunification of Germany and the unification of Yemen, the formal beginning of the Human Genome Project (finished in 2003), the launch of the Hubble Space Telescope, the separation of Namibia from South ...

and 1993

The United Nations General Assembly, General Assembly of the United Nations designated 1993 as:

* International Year for the World's Indigenous People

The year 1993 in the Kwajalein Atoll in the Marshall Islands had only 364 days, since its ...

, expansion of the Children's Health Insurance Program

The Children's Health Insurance Program (CHIP) – formerly known as the State Children's Health Insurance Program (SCHIP) – is a program administered by the United States Department of Health and Human Services that provides matching funds to ...

in 1997,welfare reform

Welfare reforms are changes in the operation of a given welfare system aimed at improving the efficiency, equity, and administration of government assistance programs. Reform programs may have a various aims; sometimes the focus is on reducing th ...

, a 2000 recession, followed by tax cuts in 2001 and 2003 and increases in 2010.

CBO reported that for the 1979–2007 period, after-tax income (adjusted for inflation) of households in the top 1 percent of earners grew by 275%, compared to 65% for the next 19%, just under 40% for the next 60% and 18% for the bottom fifth. The share of after-tax income received by the top 1% more than doubled from about 8% in 1979 to over 17% in 2007. The share received by the other 19 percent of households in the highest quintile

Quintile may refer to:

*In statistics, a quantile

In statistics and probability, quantiles are cut points dividing the range of a probability distribution into continuous intervals with equal probabilities or dividing the observations in a ...

edged up from 35% to 36%.financialization

Financialization (or financialisation in British English) is a term sometimes used to describe the development of financial capitalism during the period from 1980 to the present, in which debt-to-equity ratios increased, and financial service ...

of the economy.

2007–2016 reduction

CBO

The household income Gini index for the United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 ...

was 45.6 in 2009, and 45.4 in 2015, indicating a reduction in inequality during that time.Great Recession

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009. , then increased thereafter, to 14.9% by 2012 as the economy recovered. It then fell somewhat, reaching 12.5% by 2016, reflecting Obama policies including the expiration of the Bush tax cuts

The phrase Bush tax cuts refers to changes to the United States tax code passed originally during the presidency of George W. Bush and extended during the presidency of Barack Obama, through:

* Economic Growth and Tax Relief Reconciliation Act ...

for top incomes, and both tax increases on top incomes and redistribution to lower income groups under the Affordable Care Act

The Affordable Care Act (ACA), formally known as the Patient Protection and Affordable Care Act (PPACA) and informally as Obamacare, is a landmark U.S. federal statute enacted by the 111th United States Congress and signed into law by Presid ...

.

Saez, et al.

The top 1% earned 12% of market income in 1979, 20% in 2007 and 19% in 2016. For the bottom 50%, these figures were 20%, 14% and 13%, respectively. For the middle 40% group, a proxy for the middle class, these figures were 45%, 41% and 41%, respectively.

The top 1% earned 12% of market income in 1979, 20% in 2007 and 19% in 2016. For the bottom 50%, these figures were 20%, 14% and 13%, respectively. For the middle 40% group, a proxy for the middle class, these figures were 45%, 41% and 41%, respectively.Great Recession

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009. market income inequality was as high as it was during the Roaring Twenties

The Roaring Twenties, sometimes stylized as Roaring '20s, refers to the 1920s decade in music and fashion, as it happened in Western world, Western society and Western culture. It was a period of economic prosperity with a distinctive cultura ...

, at just over 20%.Great Recession

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009. took place from December 2007 to June 2009. From 2007 to 2010 total income going to the bottom 99 percent of Americans declined by 11.6%, while the top 1% fell by 36.3%.

In 2014 Saez and Gabriel Zucman

Gabriel Zucman (born 30 October 1986) is a French economist who is currently an associate professor of public policy and economics at the University of California, Berkeley‘s Goldman School of Public Policy, Chaired Professor at the Paris Sch ...

reported that more than half of those in the top 1 percent had not experienced relative gains in wealth between 1960 and 2012. In fact, those between the top 1% and top .5% had lost relative wealth. Only those in the top .1% and above had made relative wealth gains during that time.

Events

The Great Recession

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009. lasted from 2008 to 2009, multiplying unemployment and crashing the stock market. Obama administration policies addressed inequality in three main ways, contributing to a reduction in the share of income going to the top 1% measured between 2007 and 2016, both pre-tax and after-tax:

* Tax increases on top incomes. The Bush tax cuts

The phrase Bush tax cuts refers to changes to the United States tax code passed originally during the presidency of George W. Bush and extended during the presidency of Barack Obama, through:

* Economic Growth and Tax Relief Reconciliation Act ...

were extended only for the bottom 98-99% incomes in 2013. CBO reported that the average federal tax rate on the top 1% increased from 28.6% in 2012 to 33.6% in 2013–2014, and remained at 33.3% in 2015–2016.Affordable Care Act

The Affordable Care Act (ACA), formally known as the Patient Protection and Affordable Care Act (PPACA) and informally as Obamacare, is a landmark U.S. federal statute enacted by the 111th United States Congress and signed into law by Presid ...

. CBO estimated the ACA shifted approximately $21,000 in after-tax income from the average top 1% household via the investment income tax and the Medicare tax, to provide $600 in health insurance subsidies to the average bottom 40% household via insurance subsidies and expanded Medicaid.Supplemental Nutrition Assistance Program

In the United States, the Supplemental Nutrition Assistance Program (SNAP), formerly known as the Food Stamp Program, is a federal government program that provides food-purchasing assistance for low- and no-income persons to help them maintai ...

(food stamps) and unemployment insurance were expanded.

Post-2016 increase

In 2017, the Tax Cuts and Jobs Act of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs ...

reduced personal and corporate income tax rates, which critics said would increase income inequality.

Also in 2017, ''Forbes

''Forbes'' () is an American business magazine founded by B. C. Forbes in 1917. It has been owned by the Hong Kong–based investment group Integrated Whale Media Investments since 2014. Its chairman and editor-in-chief is Steve Forbes. The co ...

'' found that just three individuals (Jeff Bezos

Jeffrey Preston Bezos ( ;; and Robinson (2010), p. 7. ; born January 12, 1964) is an American businessman best known as the founder, executive chairman, and former president and CEO of Amazon, the world's largest e-commerce and clou ...

, Warren Buffett

Warren Edward Buffett ( ; born August 30, 1930) is an American investor and philanthropist who currently serves as the chairman and CEO of the conglomerate holding company Berkshire Hathaway. As a result of his investment success, Buffett is ...

and Bill Gates

William Henry Gates III (born October 28, 1955) is an American businessman and philanthropist. A pioneer of the microcomputer revolution of the 1970s and 1980s, he co-founded the software company Microsoft in 1975 with his childhood friend ...

) held more wealth than the bottom half of the population.Trump tax cuts

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs ...

.

*Income inequality is projected to increase, both before taxes and transfers, and after taxes and transfers, from Ginis of .513 to .521 and .423 to .437, respectively. Economic Policy Institute

The Economic Policy Institute (EPI) is a 501(c)(3) organization, 501(c)(3) non-profit think tank based in Washington, D.C., that carries out economic research and analyzes the economic impact of policies and proposals. Affiliated with the Labor un ...

U.S. income inequality is worsening, as the earnings of the top 1% nearly doubled from 7.3% in 1979 to 13.2% in 2019 while over the same time period the average annual wages for the bottom 90% have stayed within the $30,000 range, increasing from $30,880 to $38,923, representing 69.8% of total earnings in 1979 and 60.9% in 2019 respectively. The earnings of the top 0.1% surged from $648,725 in 1979 to nearly $2.9 million in 2019, an increase of 345%.

Causes

According to CBO (and others), the precise reasons for the ecentrapid growth in income at the top are not well understood",

According to CBO (and others), the precise reasons for the ecentrapid growth in income at the top are not well understood",globalization

Globalization is the process of increasing interdependence and integration among the economies, markets, societies, and cultures of different countries worldwide. This is made possible by the reduction of barriers to international trade, th ...

'' – Low skilled American workers lost ground in the face of competition from low-wage workers in Asia and other "emerging" economies.American Economic Association

The American Economic Association (AEA) is a learned society in the field of economics, with approximately 23,000 members. It publishes several peer-reviewed journals, including the Journal of Economic Literature, American Economic Review, an ...

(AEA) members in 2000, 2011, and 2020 showed that consistent majorities of professional economists in the United States disagreed with the statement: "The increasing inequality in the distribution of income in the U.S. is due primarily to the benefits and pressures of a global economy."tournament

A tournament is a competition involving at least three competitors, all participating in a sport or game. More specifically, the term may be used in either of two overlapping senses:

# One or more competitions held at a single venue and concen ...

in which the winner is richly rewarded, while the runners-up get far less.Gross Domestic Product

Gross domestic product (GDP) is a monetary measure of the total market value of all the final goods and services produced and rendered in a specific time period by a country or countries. GDP is often used to measure the economic performanc ...

(GDP). Corporations began to shift executive compensation toward stock options

In finance, an option is a contract which conveys to its owner, the ''holder'', the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified dat ...

, increasing incentives for managers to make decisions to increase share prices. Average annual CEO options increased from $500,000 to over $3 million. Stock comprised almost 50% of CEO compensation. Managers were incentivized to increase shareholder wealth rather than to improve long-term contracts with workers; between 2000 and 2007, nearly 75% of increased stock growth came at the cost of labor wages and salaries.

* ''immigration of less-educated workers'' – Relatively high levels of immigration of low skilled workers since 1965 may have reduced wages for American-born high school dropouts

Dropping out refers to leaving high school, college, university or another group for practical reasons, necessities, inability, apathy, or disillusionment with the system from which the individual in question leaves.

Canada

In Canada, most ind ...

;

* ''college premium'' - Workers with college degrees traditionally earned more and faced a lower unemployment rate than others. Wealthy families are also more likely to send their children to schools which have large endowments, resulting in more grants and lower student debt. The cycle is completed when wealthier alums donate more and disproportionately increase the size of elite endowments. Elite colleges also have better access to financial expertise.

* ''automation'' - The Bureau of Labor Statistics

The Bureau of Labor Statistics (BLS) is a unit of the United States Department of Labor. It is the principal fact-finding agency for the government of the United States, U.S. government in the broad field of labor economics, labor economics and ...

(BLS) found that increased automation had led to "an overall drop in the need for labor input. This would cause capital share to increase, relative to labor share, as machines replace some workers."poverty

Poverty is a state or condition in which an individual lacks the financial resources and essentials for a basic standard of living. Poverty can have diverse Biophysical environmen ...

. According to Krugman, movement conservatives increased their influence over the Republican Party beginning in the 1970s. In the same era, it increased its political power. The result was less progressive tax

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax co ...

laws, anti-labor policies, and slower expansion of the welfare state relative to other developed nations (e.g., the unique absence of universal healthcare).Japan

Japan is an island country in East Asia. Located in the Pacific Ocean off the northeast coast of the Asia, Asian mainland, it is bordered on the west by the Sea of Japan and extends from the Sea of Okhotsk in the north to the East China Sea ...

, Sweden

Sweden, formally the Kingdom of Sweden, is a Nordic countries, Nordic country located on the Scandinavian Peninsula in Northern Europe. It borders Norway to the west and north, and Finland to the east. At , Sweden is the largest Nordic count ...

and France

France, officially the French Republic, is a country located primarily in Western Europe. Overseas France, Its overseas regions and territories include French Guiana in South America, Saint Pierre and Miquelon in the Atlantic Ocean#North Atlan ...

have income inequality around 1960 levels.neoliberalism

Neoliberalism is a political and economic ideology that advocates for free-market capitalism, which became dominant in policy-making from the late 20th century onward. The term has multiple, competing definitions, and is most often used pe ...

, which shifted the distribution of income from labor to capital, and whose focus on growth over equality spread to other countries over time. Nevertheless, the United States remains, according to Jonathan Hopkin, "the most extreme case of the subjection of society to the brute force of the market." As such, he argues this made the United States an outlier with economic inequality hitting "unprecedented levels for the rich democracies." The Center for Economic and Policy Research's (CEPR) Dean Baker

Dean Baker (born July 13, 1958) is an American macroeconomist who co-founded the Center for Economic and Policy Research (CEPR) with Mark Weisbrot. Baker has been credited as one of the first economists to have identified the 2007–08 United S ...

argued in 2006 that the driving force behind rising inequality in the United States has been a series of deliberate neoliberal policy choices, including anti-inflation

In economics, inflation is an increase in the average price of goods and services in terms of money. This increase is measured using a price index, typically a consumer price index (CPI). When the general price level rises, each unit of curre ...

ary bias, anti- unionism and profiteering in the healthcare industry

The healthcare industry (also called the medical industry or health economy) is an aggregation and integration of sectors within the economic system that provides goods and services to treat patients with curative, preventive, rehabilitative, ...

. The economists David Howell and Mamadou Diallo contend that neoliberal policies have contributed to a United States economy

The United States has a highly developed mixed economy. It is the world's largest economy by nominal GDP and second largest by purchasing power parity (PPP). As of 2025, it has the world's seventh highest nominal GDP per capita and ninth ...

in which 30% of workers earn low wages (less than two-thirds the median wage for full-time workers) and 35% of the labor force

In macroeconomics, the workforce or labour force is the sum of people either working (i.e., the employed) or looking for work (i.e., the unemployed):

\text = \text + \text

Those neither working in the marketplace nor looking for work are out ...

is underemployed while only 40% of the working-age population in the country is adequately employed.

* ''corporatism

Corporatism is an ideology and political system of interest representation and policymaking whereby Corporate group (sociology), corporate groups, such as agricultural, labour, military, business, scientific, or guild associations, come toget ...

decile

In descriptive statistics, a decile is any of the nine values that divide the sorted data into ten equal parts, so that each part represents 1/10 of the sample or population. A decile is one possible form of a quantile; others include the quartile ...

s increased from 33% to 40%. (High income earners are more likely to marry a high earnering spouse and low earners are more likely to marry a low earning spouse.)collective bargaining

Collective bargaining is a process of negotiation between employers and a group of employees aimed at agreements to regulate working salaries, working conditions, benefits, and other aspects of workers' compensation and labour rights, rights for ...

system.

Effects

Economic

Income inequality may contribute to slower economic growth, reduced income mobility

Economic mobility is the ability of an individual, family or some other group to improve (or lower) their economic status—usually measured in income. Economic mobility is often measured by movement between income quintiles. Economic mobility ...

, higher levels of household debt

Household debt is the combined debt of all people in a household, including consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and s ...

, and greater risk of financial crises and deflation.

While a 2000 survey of American Economic Association members found that only 53 percent disagreed with the statement that "The distribution of income and wealth has little, if any, impact on economic stability and growth",

While a 2000 survey of American Economic Association members found that only 53 percent disagreed with the statement that "The distribution of income and wealth has little, if any, impact on economic stability and growth",

Economic growth

Krueger wrote in 2012: "The rise in inequality in the United States over the last three decades has reached the point that inequality in incomes is causing an unhealthy division in opportunities, and is a threat to our economic growth. Restoring a greater degree of fairness to the U.S. job market would be good for businesses, good for the economy, and good for the country." Since the wealthy tend to save nearly 50% of their marginal income while the remainder of the population saves roughly 10%, other things equal this would reduce annual consumption (the largest component of GDP) by as much as 5%, but would increase investment, at least some of which would likely take place in the US. Krueger wrote that borrowing likely helped many households make up for this shift.Raghuram Rajan

Raghuram Govind Rajan (born 3 February 1963) is an Indian economist and the Katherine Dusak Merton Miller, Miller Distinguished Service Professor of Finance at the University of Chicago's Booth School of Business. Quote: "I am an Indian citizen ...

believe the "Great Divergence" may be connected to the 2008 financial crisis. A December 2013 ''

A December 2013 ''Associated Press

The Associated Press (AP) is an American not-for-profit organization, not-for-profit news agency headquartered in New York City.

Founded in 1846, it operates as a cooperative, unincorporated association, and produces news reports that are dist ...

'' survey of three dozen economists',Standard and Poor's

S&P Global Ratings (previously Standard & Poor's and informally known as S&P) is an American credit rating agency (CRA) and a division of S&P Global that publishes financial research and analysis on stocks, bonds, and commodities. S&P is cons ...

Gar Alperovitz

Gar Alperovitz (born May 5, 1936) is an American historian and political economist. Alperovitz served as a fellow of King's College, Cambridge; a founding fellow of the Harvard Institute of Politics; a founding Fellow at the Institute for Poli ...

, Robert Reich

Robert Bernard Reich (; born June 24, 1946) is an American professor, author, lawyer, and political commentator. He worked in the administrations of presidents Gerald Ford and Jimmy Carter, and he served as United States Secretary of Labor, Se ...

, Joseph Stiglitz

Joseph Eugene Stiglitz (; born February 9, 1943) is an American New Keynesian economist, a public policy analyst, political activist, and a professor at Columbia University. He is a recipient of the Nobel Memorial Prize in Economic Sciences (2 ...

, Branko Milanovic and Robert Gordon agree about the harms of inequality.

The majority of the ''Associated Press

The Associated Press (AP) is an American not-for-profit organization, not-for-profit news agency headquartered in New York City.

Founded in 1846, it operates as a cooperative, unincorporated association, and produces news reports that are dist ...

'' survey respondents agreed that widening income disparity was harming the US economy. They argue that wealthy Americans are receiving higher pay, but they spend less per dollar earned than middle class consumers, whose incomes have largely stagnated.Occupy movement

The Occupy movement was an international populist Social movement, socio-political movement that expressed opposition to Social equality, social and economic inequality and to the perceived lack of real democracy around the world. It aimed primar ...

, legal scholar Richard Epstein

Richard Allen Epstein (born April 17, 1943) is an American legal scholar known for his writings on torts, contracts, property rights, law and economics, classical liberalism, and libertarianism. He is the Laurence A. Tisch Professor of Law at Ne ...

defended inequality in a free market society, maintaining that "taxing the top one percent even more means less wealth and fewer jobs for the rest of us." According to Epstein, "the inequalities in wealth ... pay for themselves by the vast increases in wealth", while "forced transfers of wealth through taxation ... will destroy the pools of wealth that are needed to generate new ventures".

According to a 2020 study by the RAND Corporation

The RAND Corporation, doing business as RAND, is an American nonprofit global policy think tank, research institute, and public sector consulting firm. RAND engages in research and development (R&D) in several fields and industries. Since the ...

, the typical worker, defined in the study as a "Full-Year, Full-Time, Prime-Aged Worker",consumer spending

Consumer spending is the total money spent on final goods and services by individuals and households.

There are two components of consumer spending: induced consumption (which is affected by the level of income) and autonomous consumption (which ...

which constitutes 67% of GDP, are left behind.

Financial crises

Income inequality was cited as one of the causes of the Great Depression

The Great Depression was a severe global economic downturn from 1929 to 1939. The period was characterized by high rates of unemployment and poverty, drastic reductions in industrial production and international trade, and widespread bank and ...

by Supreme Court Justice Louis D. Brandeis

Louis may refer to:

People

* Louis (given name), origin and several individuals with this name

* Louis (surname)

* Louis (singer), Serbian singer

Other uses

* Louis (coin), a French coin

* HMS ''Louis'', two ships of the Royal Navy

See also

* ...

in 1933. In his dissent in the '' Louis K. Liggett Co. v. Lee'' (288 U.S. 517) case, he wrote: "Other writers have shown that, coincident with the growth of these giant corporations, there has occurred a marked concentration of individual wealth; and that the resulting disparity in incomes is a major cause of the existing depression."

Rajan argued that "systematic economic inequalities, within the United States and around the world, have created deep financial 'fault lines' that have made inancialcrises more likely to happen than in the past".

Monopoly, labor, consolidation, and competition

Greater income inequality can lead to monopolization

In United States antitrust law, monopolization is illegal monopoly behavior. The main categories of prohibited behavior include exclusive dealing, price discrimination, refusing to supply an essential facility, product tying and predatory prici ...

, resulting in fewer employers requiring fewer workers.

Aggregate demand

Income inequality is claimed to lower aggregate demand

In economics, aggregate demand (AD) or domestic final demand (DFD) is the total demand for final goods and services in an economy at a given time. It is often called effective demand, though at other times this term is distinguished. This is the ...

, leading to large segments of formerly middle class consumers unable to afford as many goods and services.

Income mobility

The ability to move from one income group into another (income mobility

Economic mobility is the ability of an individual, family or some other group to improve (or lower) their economic status—usually measured in income. Economic mobility is often measured by movement between income quintiles. Economic mobility ...

) is a measure of economic opportunity. A higher probability of upward income mobility theoretically would help mitigate higher income inequality, as each generation has a better chance of achieving higher income.

Several studies indicated that higher income inequality is associated with lower income mobility. In other words, income brackets tend to be increasingly "sticky" as income inequality increases. This is described by the Great Gatsby curve.Horatio Alger

Horatio Alger Jr. (; January 13, 1832 – July 18, 1899) was an American author who wrote young adult novels about impoverished boys and their rise from humble backgrounds to middle-class security and comfort through good works. His writings wer ...

-style upward mobility because (to use a frequently-employed metaphor) it's harder to climb a ladder when the rungs are farther apart."

Over lifetimes

A 2013 Brookings Institution

The Brookings Institution, often stylized as Brookings, is an American think tank that conducts research and education in the social sciences, primarily in economics (and tax policy), metropolitan policy, governance, foreign policy, global econo ...

study claimed that income inequality was increasing and becoming permanent, sharply reducing social mobility

Social mobility is the movement of individuals, families, households or other categories of people within or between social strata in a society. It is a change in social status relative to one's current social location within a given socie ...

.Studies by the Urban Institute

The Urban Institute is a Washington, D.C.–based think tank that conducts economic and social policy research to "open minds, shape decisions, and offer solutions". The institute receives funding from government contracts, foundations, and p ...

and the US Treasury

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States. It is one of 15 current U.S. government departments.

The department oversees the Bureau of Engraving and ...

have both found that about half of the families who start in either the top or the bottom quintile of the income distribution are still there after a decade, and that only 3 to 6% rise from bottom to top or fall from top to bottom.

On the issue of whether most Americans stay in the same income bracket over time, the 2011 CBO distribution of income study reported:Household income measured over a multi-year period is more equally distributed than income measured over one year, although only modestly so. Given the fairly substantial movement of households across income groups over time, it might seem that income measured over a number of years should be significantly more equally distributed than income measured over one year. However, much of the movement of households involves changes in income that are large enough to push households into different income groups but not large enough to greatly affect the overall distribution of income. Multi-year income measures also show the same pattern of increasing inequality over time as is observed in annual measures.

In other words,many people who have incomes greater than $1 million one year fall out of the category the next year – but that's typically because their income fell from, say, $1.05 million to .95 million, not because they went back to being middle class.

Disagreements about the correct procedure for measuring income inequality continues to be a topic of debate among economists, including a panel discussion at the 2019 American Economic Association annual meeting.

Between generations

Several studies found the ability of children from poor or middle-class families to rise to upper income – known as "upward relative intergenerational mobility" – is lower in the US than in other developed countries.

Several studies found the ability of children from poor or middle-class families to rise to upper income – known as "upward relative intergenerational mobility" – is lower in the US than in other developed countries.correlation

In statistics, correlation or dependence is any statistical relationship, whether causal or not, between two random variables or bivariate data. Although in the broadest sense, "correlation" may indicate any type of association, in statistics ...

between inequality and social mobility. The curve plotted intergenerational income mobility, the likelihood that someone will match their parents' relative income level – and inequality for various countries.

Poverty

Greater income inequality can increase the market income poverty rate, as income shifts from lower income brackets to upper brackets. Jared Bernstein wrote, "If less of the economy's market-generated growth – i.e., before taxes and transfers kick in – ends up in the lower reaches of the income scale, either there will be more poverty for any given level of GDP growth, or there will have to be a lot more transfers to offset inequality's poverty-inducing impact." The Economic Policy Institute

The Economic Policy Institute (EPI) is a 501(c)(3) organization, 501(c)(3) non-profit think tank based in Washington, D.C., that carries out economic research and analyzes the economic impact of policies and proposals. Affiliated with the Labor un ...

(EPI) estimated that greater income inequality added 5.5% to the poverty rate between 1979 and 2007, other factors equal. Income inequality was the largest driver of the change in the poverty rate, with economic growth, family structure, education and race other important factors. An estimated 11.8% of Americans lived in poverty in 2018, versus 16% in 2012 and 26% in 1967. The poverty threshold

The poverty threshold, poverty limit, poverty line, or breadline is the minimum level of income deemed adequate in a particular country. The poverty line is usually calculated by estimating the total cost of one year's worth of necessities for ...

in the United States was at $12,880 for a single-person household and $26,246 for a family of four in 2021. 0.25% of the U.S. population lived below the international poverty line of $2.15 per day in 2020.

A rise in income disparities weakens skills development among people with a poor educational background in terms of the quantity and quality of education attained.

Debt

Income inequality may be the driving factor in growing household debt,student loan debt

Student debt refers to the debt incurred by an individual to pay for education-related expenses. This debt is most commonly assumed to pay for tertiary education, such as university.

The amount loaned or the loan agreement is often referred to as ...

from $260 billion in 2004 to $1.6 trillion in 2019Q2. From 1995 to 2013, outstanding education debt grew from 26% of average yearly income to 58%, for households with net worth below the 50th percentile.

Democracy and society

Bernstein and Krugman assessed the concentration of income as variously "unsustainable"

Bernstein and Krugman assessed the concentration of income as variously "unsustainable"Paul Pierson

Paul Pierson (born 1959) is an American professor of political science specializing in comparative politics and holder of the John Gross Endowed Chair of Political Science at the University of California, Berkeley. From 2007-2010 he served at UC ...

quoted a warning by Greek-Roman historian Plutarch

Plutarch (; , ''Ploútarchos'', ; – 120s) was a Greek Middle Platonist philosopher, historian, biographer, essayist, and priest at the Temple of Apollo (Delphi), Temple of Apollo in Delphi. He is known primarily for his ''Parallel Lives'', ...

: "An imbalance between rich and poor is the oldest and most fatal ailment of all republics."oligarchy

Oligarchy (; ) is a form of government in which power rests with a small number of people. Members of this group, called oligarchs, generally hold usually hard, but sometimes soft power through nobility, fame, wealth, or education; or t ...

, through the influence of corporations, the wealthy and other special interest groups.

Political polarization

Rising income inequality has been linked to political polarization

Political polarization (spelled ''polarisation'' in British English, Australian English, and New Zealand English) is the divergence of political attitudes away from the center, towards ideological extremes. Scholars distinguish between ideologi ...

.House of Representatives

House of Representatives is the name of legislative bodies in many countries and sub-national entities. In many countries, the House of Representatives is the lower house of a bicameral legislature, with the corresponding upper house often ...

polarization measured by voting record followed. Inequality increased influence by the rich on the regulatory, legislative and electoral processes.

Political inequality

Several economists and political scientists argued that income inequality translates into political inequality, as when politicians have financial incentives to accommodate special interest groups. Researchers such as Larry Bartels found that politicians are significantly more responsive to the political opinions of the wealthy, even when controlling for a range of variables including educational attainment and political knowledge.

Several economists and political scientists argued that income inequality translates into political inequality, as when politicians have financial incentives to accommodate special interest groups. Researchers such as Larry Bartels found that politicians are significantly more responsive to the political opinions of the wealthy, even when controlling for a range of variables including educational attainment and political knowledge.

Class system

A ''class system'' is a society organized around the division of the population into groups having a permanent status that determines their relation to other groups. Such groups may be defined by income, religion and/or other characteristics. Class warfare is thus conflict between/among such classes.

Investor Warren Buffett

Warren Edward Buffett ( ; born August 30, 1930) is an American investor and philanthropist who currently serves as the chairman and CEO of the conglomerate holding company Berkshire Hathaway. As a result of his investment success, Buffett is ...

said in 2006, "There's class warfare, all right, but it's my class, the rich class, that's making war, and we're winning." He advocated much higher taxes on the wealthiest Americans.

George Packer

George Packer (born August 13, 1960) is an American journalist, novelist, and playwright. He is best known for his writings about U.S. foreign policy for ''The New Yorker'' and ''The Atlantic'' and for his book '' The Assassins' Gate: America in ...

wrote, "Inequality hardens society into a class system

A social class or social stratum is a grouping of people into a set of Dominance hierarchy, hierarchical social categories, the most common being the working class and the Bourgeoisie, capitalist class. Membership of a social class can for exam ...

... Inequality divides us from one another in schools, in neighborhoods, at work, on airplanes, in hospitals, in what we eat, in the condition of our bodies, in what we think, in our children's futures, in how we die. Inequality makes it harder to imagine the lives of others."Occupy movement

The Occupy movement was an international populist Social movement, socio-political movement that expressed opposition to Social equality, social and economic inequality and to the perceived lack of real democracy around the world. It aimed primar ...

and struggles over tax policy and redistribution. The movement spread to 600 communities in 2011. Its main political slogan – "We are the 99%

"We are the 99%" is a political slogan widely used and coined during the 2011 Occupy movement. The phrase directly refers to the income and wealth inequality in the United States, with a concentration of wealth among the top-earning 1%. It ref ...

" – referenced its dissatisfaction with the era's income inequality.

Political change

Increasing inequality is both a cause and effect of political change

Social change is the alteration of the social order of a society which may include changes in social institutions, social behaviours or social relations. Sustained at a larger scale, it may lead to social transformation or societal transformat ...

, according to journalist Hedrick Smith

Hedrick Smith is a Pulitzer Prize-winning former ''New York Times'' reporter and Emmy award-winning producer and correspondent. After serving 26 years with ''The New York Times'' from 1962-88 as correspondent, editor and bureau chief in both Mos ...

. The result was a political landscape dominated in the 1990s and 2000s by business groups, specifically "political insiders" – former members of Congress and government officials with an inside track – working for "Wall Street banks, the oil, defense, and pharmaceutical industries; and business trade associations." In the decade or so prior to the Great Divergence, middle-class-dominated reformist grassroots efforts – such as the civil rights movement, environmental movement

The environmental movement (sometimes referred to as the ecology movement) is a social movement that aims to protect the natural world from harmful environmental practices in order to create sustainable living. In its recognition of humanity a ...

, consumer movement

The consumer movement is an effort to promote consumer protection through an organized social movement, which is in many places led by consumer organizations. It advocates for the rights of consumers, especially when those rights are actively b ...

, labor movement – had considerable political impact.World Trade Organization

The World Trade Organization (WTO) is an intergovernmental organization headquartered in Geneva, Switzerland that regulates and facilitates international trade. Governments use the organization to establish, revise, and enforce the rules that g ...

and the negotiation of the North American Free Trade Agreement

The North American Free Trade Agreement (, TLCAN; , ALÉNA), referred to colloquially in the Anglosphere as NAFTA, ( ) was an agreement signed by Canada, Mexico, and the United States that created a trilateral trade bloc in North America. The ...

. These agreements and related policies were widely supported by business groups and economists such as Krugman and Stiglitz. One outcome was greatly expanded foreign outsourcing, which has been argued to have hollowed out the middle class.

Stiglitz later argued that inequality may explain political questions – such as why America's infrastructure (and other public investments) are deteriorating,Iraq War

The Iraq War (), also referred to as the Second Gulf War, was a prolonged conflict in Iraq lasting from 2003 to 2011. It began with 2003 invasion of Iraq, the invasion by a Multi-National Force – Iraq, United States-led coalition, which ...

. Top-earning families have the money to buy their own education, medical care, personal security, and parks. They showed little interest in helping pay for such things for the rest of society, and have the political influence to make sure they don't have to. The relatively few children of the wealthy who joined the military may have reduced their concern about going to war.populist

Populism is a contested concept used to refer to a variety of political stances that emphasize the idea of the " common people" and often position this group in opposition to a perceived elite. It is frequently associated with anti-establis ...

political candidates. Piketty attributed the victory of Donald Trump

Donald John Trump (born June 14, 1946) is an American politician, media personality, and businessman who is the 47th president of the United States. A member of the Republican Party (United States), Republican Party, he served as the 45 ...

in the 2016 presidential election, to "the explosion in economic and geographic inequality in the United States over several decades and the inability of successive governments to deal with this."

Health

Using statistics from 23 developed countries and the 50 states of the US, British researchers Richard G. Wilkinson

Richard Gerald Wilkinson (born 1943) is a British social epidemiologist, author, advocate, and left-wing political activist. He is Professor Emeritus of social epidemiology at the University of Nottingham, having retired in 2008. He is also Hon ...

and Kate Pickett

Kate Elizabeth Pickett (born 1965) is a British epidemiologist and political activist who is Professor of Epidemiology in the Department of Health Sciences at the University of York, and was a National Institute for Health and Care Research Car ...

found a correlation that remains after accounting for ethnicity, national culture and occupational classes or education levels. Their findings place the United States as the most unequal and ranks poorly on social and health problems among developed countries. The authors argue inequality creates psychosocial stress and status

Status (Latin plural: ''statūs''), is a state, condition, or situation, and may refer to:

* Status (law)

** Legal status, in law

** Political status, in international law

** Small entity status, in patent law

** Status conference

** Status c ...

anxiety that lead to social ills.The Earth Institute

{{Infobox organization

, name = The Earth Institute

, image = Ei blue1.gif

, map_size =

, map_alt =

, map_caption =

, map2 =

, type =

, tax_id ...

, life satisfaction

Life satisfaction is an evaluation of a person's quality of life. It is assessed in terms of mood, relationship satisfaction, achieved goals, self-concepts, and the self-perceived ability to cope with life. Life satisfaction involves a favorabl ...

in the US has been declining over several decades, which they attributed to increasing inequality, lack of social trust and loss of faith in government.

A 2015 study by Angus Deaton

Sir Angus Stewart Deaton (born 19 October 1945) is a British-American economist and academic. Deaton is currently a Senior Scholar and the Dwight D. Eisenhower Professor of Economics and International Affairs Emeritus at the Princeton School ...

and Anne Case found that income inequality could be a driving factor in a marked increase in deaths among white males between the ages of 45 and 54 in the period 1999 to 2013. So-called "deaths of despair

A disease of despair is one of three classes of behavior-related medical conditions that increase in groups of people who experience despair due to a sense that their long-term social and economic prospects are bleak. The three disease types are ...

", including suicide

Suicide is the act of intentionally causing one's own death.

Risk factors for suicide include mental disorders, physical disorders, and substance abuse. Some suicides are impulsive acts driven by stress (such as from financial or ac ...

and drug/alcohol related deaths, which have been pushing down life expectancy since 2014, reached record levels in 2017. Some researchers assert that income inequality, a shrinking middle class, the weakening labor union influence and stagnant wages have been significant factors in this development. In their 2020 book ''Deaths of Despair and the Future of Capitalism'', Case and Deaton put forth the argument that in the United States, globalization

Globalization is the process of increasing interdependence and integration among the economies, markets, societies, and cultures of different countries worldwide. This is made possible by the reduction of barriers to international trade, th ...

and technological advancement dramatically shifted political power away from labor and towards capital by empowering corporations and weakening labor union

A trade union (British English) or labor union (American English), often simply referred to as a union, is an organization of workers whose purpose is to maintain or improve the conditions of their employment, such as attaining better wages ...

s much more so than in peer countries such as those of Western Europe. As such, other rich countries, while facing their own challenges associated with globalization and technological change, did not experience a "long-term stagnation of wages, nor an epidemic of deaths of despair."

According to the Health Inequality Project, the wealthiest American men live 15 years longer than the poorest. For American women the life expectancy gap is 10 years. People in the richest 25 percent of the population studied across the United States and Europe were 40 percent less likely to die during the study period than those in the poorest quarter, according to a new study published in the New England Journal of Medicine.

Political extremism and violence

A 2020 paper published in ''Science Advances

''Science Advances'' is a peer-reviewed multidisciplinary open-access scientific journal established in early 2015 and published by the American Association for the Advancement of Science. The journal's scope includes all areas of science.

Hist ...

'' posits that there is a correlation between economic inequality, poor economic conditions and increased rates of political violence and right-wing extremism

Far-right politics, often termed right-wing extremism, encompasses a range of ideologies that are marked by ultraconservatism, authoritarianism, ultranationalism, and nativism. This political spectrum situates itself on the far end of the ...

.BMC Public Health

''BMC Public Health'' is a peer-reviewed open-access scientific journal that covers epidemiology of disease and various aspects of public health. The journal was established in 2001 and is published by BioMed Central.

Abstracting and indexing

...

'' found that communities with rising levels of income inequality are at an increased risk of mass shootings

A mass shooting is a violent crime in which one or more attackers use a firearm to Gun violence, kill or injure multiple individuals in rapid succession. There is no widely accepted specific definition, and different organizations tracking su ...

.

Financing of social programs

Krugman argues that the long-term funding problems of Social Security

Welfare spending is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance ...

and Medicare can be blamed in part on the growth in inequality as well as changes such as longer life expectancy. The source of funding for these programs is payroll taxes

Payroll taxes are taxes imposed on employers or employees. They are usually calculated as a percentage of the salaries that employers pay their employees. By law, some payroll taxes are the responsibility of the employee and others fall on the ...

, which are traditionally levied as a percent of salary up to a cap. Payroll taxes do not capture income from capital or income above the cap. Higher inequality thereby reduces the taxable pool.

Had inequality remained stable, increased payments would have covered about 43% of the projected Social Security

Welfare spending is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance ...

shortfall over the next 75 years.

Justice

Classical liberal economists such as Friedrich Hayek

Friedrich August von Hayek (8 May 1899 – 23 March 1992) was an Austrian-born British academic and philosopher. He is known for his contributions to political economy, political philosophy and intellectual history. Hayek shared the 1974 Nobe ...

maintained that because individuals are diverse and different, state intervention to redistribute income is inevitably arbitrary and incompatible with the rule of law, and that "what is called 'social' or distributive' justice is indeed meaningless within a spontaneous order". Those who would use the state to redistribute, "take freedom for granted and ignore the preconditions necessary for its survival".

Public attitudes

Americans are not generally aware of the extent of inequality or recent trends. In 1998 a Gallup poll found 52% of Americans agreeing that the gap between rich and the poor was a problem that needed to be fixed, while 45% regarded it as "an acceptable part of the economic system".

A December 2011 Gallup poll found a decline in the number of Americans who rated reducing the gap in income and wealth between the rich and the poor as extremely or very important (21 percent of Republicans, 43 percent of independents, and 72 percent of Democrats).Dan Ariely

Dan Ariely (; born April 29, 1967) is an Israeli-American professor and author. He serves as a James B. Duke Professor of psychology and behavioral economics at Duke University. He is the co-founder of several companies implementing insights f ...

and Michael Norton found in a 2011 study that US citizens significantly underestimated wealth inequality.

States and cities

The US household income Gini of 46.8 in 2009 varied significantly between states: after-tax income inequality in 2009 was greatest in

The US household income Gini of 46.8 in 2009 varied significantly between states: after-tax income inequality in 2009 was greatest in Texas

Texas ( , ; or ) is the most populous U.S. state, state in the South Central United States, South Central region of the United States. It borders Louisiana to the east, Arkansas to the northeast, Oklahoma to the north, New Mexico to the we ...

and lowest in Maine

Maine ( ) is a U.S. state, state in the New England region of the United States, and the northeasternmost state in the Contiguous United States. It borders New Hampshire to the west, the Gulf of Maine to the southeast, and the Provinces and ...

.Utah

Utah is a landlocked state in the Mountain states, Mountain West subregion of the Western United States. It is one of the Four Corners states, sharing a border with Arizona, Colorado, and New Mexico. It also borders Wyoming to the northea ...

, Alaska

Alaska ( ) is a non-contiguous U.S. state on the northwest extremity of North America. Part of the Western United States region, it is one of the two non-contiguous U.S. states, alongside Hawaii. Alaska is also considered to be the north ...

and Wyoming

Wyoming ( ) is a landlocked U.S. state, state in the Mountain states, Mountain West subregion of the Western United States, Western United States. It borders Montana to the north and northwest, South Dakota and Nebraska to the east, Idaho t ...

have a market income Gini coefficient that is 10% lower than the average, while Washington D.C.

Washington, D.C., formally the District of Columbia and commonly known as Washington or D.C., is the capital city and federal district of the United States. The city is on the Potomac River, across from Virginia, and shares land borders with ...

and Puerto Rico

; abbreviated PR), officially the Commonwealth of Puerto Rico, is a Government of Puerto Rico, self-governing Caribbean Geography of Puerto Rico, archipelago and island organized as an Territories of the United States, unincorporated territo ...

are 10% higher.

After-tax, the Federal Reserve estimated that 34 states in the US have a Gini index between 30 and 35, with Maine the lowest.

International comparisons

The United States has the highest level of income inequality in the

The United States has the highest level of income inequality in the Western world

The Western world, also known as the West, primarily refers to various nations and state (polity), states in Western Europe, Northern America, and Australasia; with some debate as to whether those in Eastern Europe and Latin America also const ...

, according to a 2018 study by the United Nations Special Rapporteur

Special rapporteur (or independent expert) is the title given to independent human rights experts whose expertise is called upon by the United Nations (UN) to report or advise on human rights from a thematic or country-specific perspective.

De ...

on extreme poverty and human rights. The United States has forty million people living in poverty, and more than half of these people live in "extreme" or "absolute" poverty. Income inequality has increased in recent decades, and large tax cuts that disproportionately favor the very wealthy are predicted to further increase U.S. income inequality.Luxembourg Income Study

LIS Cross-National Data Center, formerly known as the Luxembourg Income Study (LIS), is a non-profit organization registered in Luxembourg which produces a cross-national database of micro-economic income data for social science research. The proj ...

(LIS) or the OECD Income Distribution database (OECD IDD), or, when including developing countries, from the World Bank's Povcalnet database, or the World Income Inequality Database (WIID), maintained by the United Nations University World Institute for Development Economics Research

The United Nations University World Institute for Development Economics Research (UNU-WIDER) is part of the United Nations University (UNU). UNU-WIDER, the first research and training centre to be established by the UNU, is an international academ ...

(UNU-WIDER), or the World Inequality Database

World Inequality Database (WID), previously The World Wealth and Income Database, also known as WID.world, is an extensive, open and accessible database "on the historical evolution of the world distribution of income and wealth, both within count ...

(WID).

Reasons for relative performance

One 2013 study indicated that US market income inequality was comparable to other developed countries, but was the highest among 22 developed countries after taxes and transfers. This implies that public policy choices, rather than market factors, drive U.S. income inequality disparities relative to other developed nations.

One 2013 study indicated that US market income inequality was comparable to other developed countries, but was the highest among 22 developed countries after taxes and transfers. This implies that public policy choices, rather than market factors, drive U.S. income inequality disparities relative to other developed nations.social safety net

A social safety net (SSN) consists of non-contributory assistance existing to improve lives of vulnerable families and individuals experiencing poverty and destitution. Examples of SSNs are previously-contributory social pensions, in-kind and foo ...

among developed nations.

2014

In 2014 Canadian middle class incomes moved higher than those in the US and in some European nations citizens received higher raises than their American counterparts.

Policy responses

Debate continues over whether a public policy response is appropriate to income inequality. For example, Federal Reserve Economist Thomas Garrett wrote in 2010: "It is important to understand that income inequality is a byproduct of a well-functioning capitalist economy. Individuals' earnings are directly related to their productivity ... A wary eye should be cast on policies that aim to shrink the income distribution by redistributing income from the more productive to the less productive simply for the sake of 'fairness.'"Janet Yellen

Janet Louise Yellen (born August 13, 1946) is an American economist who served as the 78th United States secretary of the treasury from 2021 to 2025. She also served as chair of the Federal Reserve from 2014 to 2018. She was the first woman to h ...

described four "building blocks" in a 2014 speech. These included expanding resources available to children, affordable higher education, business ownership and inheritance.social safety net