|

Property Income

Property income refers to profit or income received by virtue of owning property. The three forms of property income are rent, received from the ownership of natural resources; interest, received by virtue of owning financial assets; and profit, received from the ownership of capital equipment. As such, property income is a subset of unearned income and is often classified as passive income. Economics Property income is nominal revenues minus expenses for variable inputs (labor, purchased materials and services). Property income represents the return for the supply of both physical capital and financial capital. Capitalist economic systems are usually defined as those systems where the means of production are privately owned through equity, stock, bonds or privately held by a group of owners who bear the risk of investment and production to generate returns. In Marxian economics and related schools, property income is a portion of the surplus value produced by an econo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Good

Capital and its variations may refer to: Common uses * Capital city, a municipality of primary status ** Capital region, a metropolitan region containing the capital ** List of national capitals * Capital letter, an upper-case letter Economics and social sciences * Capital (economics), the durable produced goods used for further production * Capital (Marxism), a central concept in Marxian critique of political economy * Economic capital * Financial capital, an economic resource measured in terms of money * Capital good * Human capital * Natural capital * Public capital * Social capital Architecture and buildings * Capital (architecture), the topmost member of a column or pilaster * The Capital (building), a commercial building in Mumbai, India * Capital (fortification), a proportion of a bastion Arts, entertainment and media Literature Books * ''Capital'' (novel), by John Lanchester, 2012 * ''Das Kapital'' ('Capital: Critique of Political Economy'), a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unearned Income

Unearned income is a term coined by Henry George to refer to income gained through ownership of land and other monopoly. Today the term often refers to income received by virtue of owning property (known as property income), inheritance, pensions and payments received from public welfare. The three major forms of unearned income based on property ownership are rent, received from the ownership of natural resources; interest, received by virtue of owning financial assets; and profit, received from the ownership of capital equipment. As such, unearned income is often categorized as " passive income". Unearned income can be discussed from either an economic or accounting perspective, but is more commonly used in economics. Economics 'Unearned income' is a term coined by Henry George to popularize the economic concept of land rent and 'rent' generally. George modified John Stuart Mill's term ' unearned increment of land' to broaden the concept to include all land rent, not jus ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Surplus Value

In Marxian economics, surplus value is the difference between the amount raised through a sale of a product and the amount it cost to manufacture it: i.e. the amount raised through sale of the product minus the cost of the materials, plant and labour power. The concept originated in Ricardian socialism, with the term "surplus value" itself being coined by William Thompson (philosopher), William Thompson in 1824; however, it was not consistently distinguished from the related concepts of surplus labor and surplus product. The concept was subsequently developed and popularized by Karl Marx. Marx's formulation is the standard sense and the primary basis for further developments, though how much of Marx's concept is original and distinct from the Ricardian concept is disputed (see ). Marx's term is the German word "''Mehrwert''", which simply means value added (sales revenue minus the cost of materials used up), and is cognate to English "more worth". It is a major concept in Karl M ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rentier Capitalism

Rentier capitalism is a concept in Marxian economics, Marxist and heterodox economics to refer to rent-seeking and exploitation by companies in capitalist systems. The term was developed by Austrian social geographer Hans Bobek describing an economic system that was widespread in antiquity and still widespread in the Middle East, where productive investments are largely lacking and the highest possible share of income is skimmed off from ground rent, ground-rents, lease, leases and renting, rents. Consequently, in many developing countries, rentier capitalism is an obstacle to economic development. A rentier is someone who earns income from capital without working. This is generally done through ownership of assets that generate Yield (finance), yield (cash generated by assets), such as Real estate investing, rental properties, Share (finance), shares in dividend-paying companies, or Bond (finance), bonds that pay interest. Usage by Marxists Although the combination of words "wi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Profit (economics)

In economics, profit is the difference between revenue that an economic entity has received from its outputs and total costs of its inputs, also known as surplus value. It is equal to total revenue minus total cost, including both Explicit cost, explicit and implicit cost, implicit costs. It is different from accounting profit, which only relates to the explicit costs that appear on a firm's financial statements. An accountant measures the firm's accounting profit as the firm's total revenue minus only the firm's explicit costs. An Economists, economist includes all costs, both explicit and implicit costs, when analyzing a firm. Therefore, economic profit is smaller than accounting profit. ''Normal profit'' is often viewed in conjunction with economic profit. Normal profits in business refer to a situation where a company generates revenue that is equal to the total costs incurred in its operation, thus allowing it to remain operational in a competitive industry. It is the mi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Property

Private property is a legal designation for the ownership of property by non-governmental Capacity (law), legal entities. Private property is distinguishable from public property, which is owned by a state entity, and from Collective ownership, collective or cooperative property, which is owned by one or more non-governmental entities. Private property is foundational to capitalism, an economic system based on the private ownership of the means of production and their operation for Profit (economics), profit. As a legal concept, private property is defined and enforced by a country's political system. History The first evidence of private property may date back to the Babylonians in 1800 BC, as evidenced by the archeological discovery of Plimpton 322, a clay tablet used for calculating property boundaries; however, written discussions of private property were not seen until the Persian Empire, and emerged in the Western tradition at least as far back as Plato. Before the 1 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Passive Income

Passive income is a type of unearned income that is acquired with little to no labor to earn or maintain. It is often combined with another source of income, such as regular employment or a side job. Passive income, as an acquired income, is typically taxable. Examples of passive income include rental income and business activities in which the earner does not materially participate. Some jurisdictions' taxing authorities, such as the Internal Revenue Service in the United States, distinguish passive income from other forms of income, such as income from regular or contractual employment, and may tax it differently. It can take a long period of work and accumulation before passive income can be acquired. Passive income can be a way of creating financial independence and early retirement, because the beneficiary will receive an income regardless of whether they are materially active in the activity creating the revenue. Passive income can come in the form of a lump sum ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Landlord

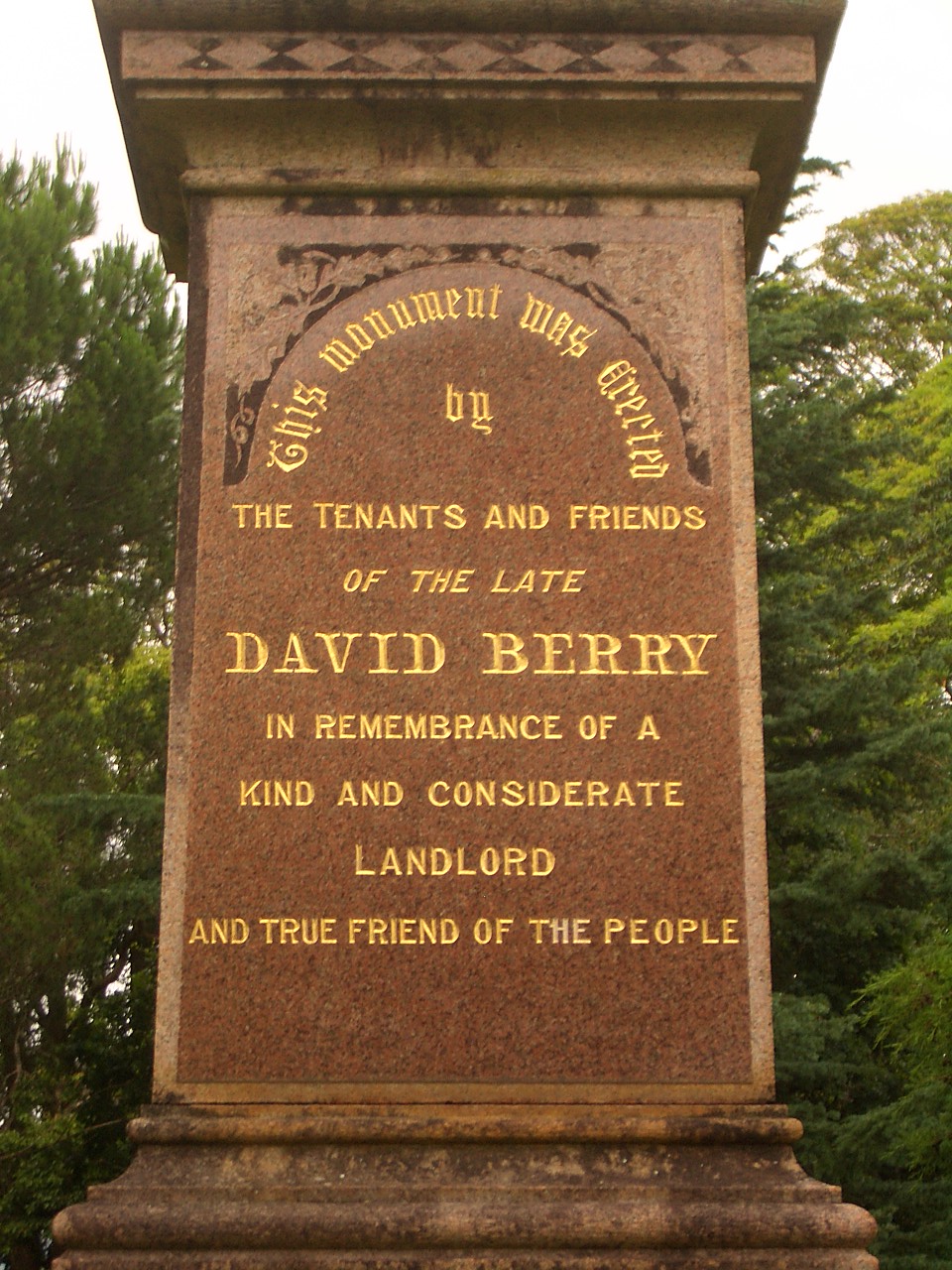

A landlord is the owner of property such as a house, apartment, condominium, land, or real estate that is rented or leased to an individual or business, known as a tenant (also called a ''lessee'' or ''renter''). The term landlord applies when a juristic person occupies this position. Alternative terms include lessor and owner. For female property owners, the term landlady may be used. In the United Kingdom, the manager of a pub, officially a licensed victualler, is also referred to as the landlord/landlady. In political economy, landlord specifically refers to someone who owns natural resources (such as land, excluding buildings) from which they derive economic rent, a form of passive income. History The concept of a landlord can be traced to the feudal system of manoralism ( seignorialism), where landed estates were owned by Lords of the Manor ( mesne lords). These lords were typically members of the lower nobility who later formed the rank of knights during ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

FIRE Economy

A FIRE economy is any economy based primarily on the finance, insurance, and real estate sectors. Finance, insurance, and real estate are United States Census Bureau classifications. Barry Popik describes some early uses as far back as 1982. Since 2008, the term has been commonly used by Michael Hudson and Eric Janszen. It is New York City's largest industry and a prominent part of the service industry in the United States overall economy and other Western developed countries. Census Bureau classification This term is frequently used in the financial press and blogs. Its origin is in the realm of North American industrial classification. "Finance, Insurance, and Real Estate" is the title of ''1992 U.S. Census Bureau Standard Industrial Classification (SIC) Division H''. Its coverage was "All domestic establishments that provide financial, insurance, or real estate services." Its coverage was elaborated in two-digit SIC codes 60 through 67. The SIC was replaced by the North ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Rent

In economics, economic rent is any payment to the owner of a factor of production in excess of the costs needed to bring that factor into production. In classical economics, economic rent is any payment made (including imputed value) or benefit received for non-produced inputs such as location (land) and for assets formed by creating official privilege over natural opportunities (e.g., patents). In the moral economy of neoclassical economics, assuming the market is natural, and does not come about by state and social contrivance, economic rent includes income gained by labor or state beneficiaries or other "contrived" exclusivity, such as labor guilds and unofficial corruption. Overview In the moral economy of the economics tradition broadly, economic rent is distinct from producer surplus, or normal profit, both of which are theorized to involve productive human action. Economic rent is also independent of opportunity cost, unlike economic profit, where opportunity c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Earned Income

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depends on a recipient's income and number of children. Low-income adults with no children are eligible. For a person or couple to claim one or more persons as their qualifying child, requirements such as relationship, age, and shared residency must be met.Tax Year 2020 1040 and 1040-SR Instructions, including the instructions for Schedules 1 through 3 Rules for EIC begin on page 40 for 2020 Tax Year. The earned income tax credit has been part of political debates in the United States over ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |