externality on:

[Wikipedia]

[Google]

[Amazon]

In

In

A negative externality is any difference between the private cost of an action or decision to an economic agent and the social cost. In simple terms, a negative externality is anything that causes an

A negative externality is any difference between the private cost of an action or decision to an economic agent and the social cost. In simple terms, a negative externality is anything that causes an

There are a number of theoretical means of improving overall social utility when negative externalities are involved. The market-driven approach to correcting externalities is to ''internalize'' third party costs and benefits, for example, by requiring a polluter to repair any damage caused. But in many cases, internalizing costs or benefits is not feasible, especially if the true monetary values cannot be determined.

There are a number of theoretical means of improving overall social utility when negative externalities are involved. The market-driven approach to correcting externalities is to ''internalize'' third party costs and benefits, for example, by requiring a polluter to repair any damage caused. But in many cases, internalizing costs or benefits is not feasible, especially if the true monetary values cannot be determined.

A negative externality (also called "external cost" or "external diseconomy") is an economic activity that imposes a negative effect on an unrelated third party, not captured by the market price. It can arise either during the production or the consumption of a good or service. Pollution is termed an externality because it imposes costs on people who are "external" to the producer and consumer of the polluting product. Barry Commoner commented on the costs of externalities:

A negative externality (also called "external cost" or "external diseconomy") is an economic activity that imposes a negative effect on an unrelated third party, not captured by the market price. It can arise either during the production or the consumption of a good or service. Pollution is termed an externality because it imposes costs on people who are "external" to the producer and consumer of the polluting product. Barry Commoner commented on the costs of externalities:

Examples for negative production externalities include:

*

Examples for negative production externalities include:

*

*

*

* A

* A

Conspicuous consumption (originally articulated by Veblen, 1899) refers to the consumption of goods or services primarily for the purpose of displaying social status or wealth. In simpler terms, individuals engange in conspicuous consumption to signal their economic standing or to gain social recognition. Positional goods (introduced by Hirsch, 1977) are such goods, whose value is heavily contingent upon how they compare to similar goods owned by others. Their desirability is or derived utility is intrinsically tied to their relative scarcity or exclusivity within a particular social context.

The economic concept of Positional externalities originates from Duesenberry's

Conspicuous consumption (originally articulated by Veblen, 1899) refers to the consumption of goods or services primarily for the purpose of displaying social status or wealth. In simpler terms, individuals engange in conspicuous consumption to signal their economic standing or to gain social recognition. Positional goods (introduced by Hirsch, 1977) are such goods, whose value is heavily contingent upon how they compare to similar goods owned by others. Their desirability is or derived utility is intrinsically tied to their relative scarcity or exclusivity within a particular social context.

The economic concept of Positional externalities originates from Duesenberry's

Are Positional Externalities Different from Other Externalities

? " (draft for presentation for ''Why Inequality Matters: Lessons for Policy from the Economics of Happiness'',

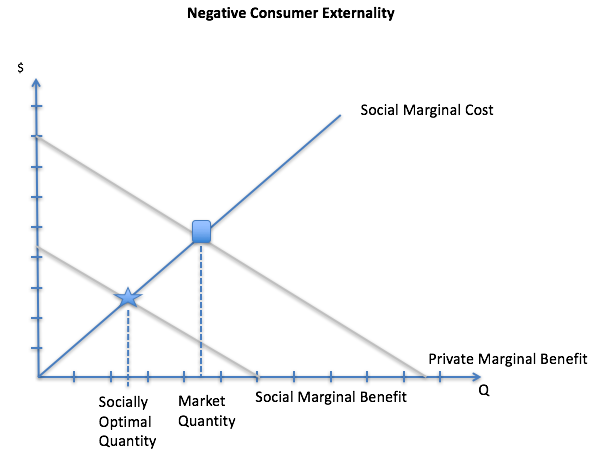

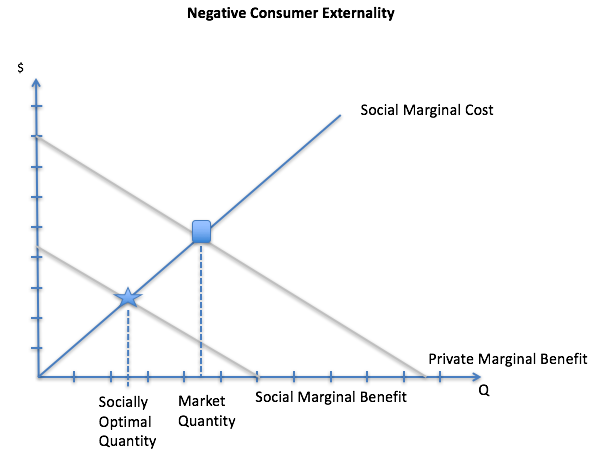

The graph shows the effects of a negative externality. For example, the steel industry is assumed to be selling in a competitive market – before pollution-control laws were imposed and enforced (e.g. under

The graph shows the effects of a negative externality. For example, the steel industry is assumed to be selling in a competitive market – before pollution-control laws were imposed and enforced (e.g. under

The graph shows the effects of a positive or beneficial externality. For example, the industry supplying smallpox vaccinations is assumed to be selling in a competitive market. The marginal private benefit of getting the vaccination is less than the marginal social or public benefit by the amount of the external benefit (for example, society as a whole is increasingly protected from smallpox by each vaccination, including those who refuse to participate). This marginal external benefit of getting a smallpox shot is represented by the vertical distance between the two demand curves. Assume there are no external costs, so that social cost ''equals'' individual cost.

If consumers only take into account their own private benefits from getting vaccinations, the market will end up at price Pp and quantity Qp as before, instead of the more efficient price Ps and quantity Qs. This latter again reflect the idea that the marginal social benefit should equal the marginal social cost, i.e., that production should be increased as long as the marginal social benefit exceeds the marginal social cost. The result in an unfettered market is '' inefficient'' since at the quantity Qp, the social benefit is greater than the societal cost, so society as a whole would be better off if more goods had been produced. The problem is that people are buying ''too few'' vaccinations.

The issue of external benefits is related to that of

The graph shows the effects of a positive or beneficial externality. For example, the industry supplying smallpox vaccinations is assumed to be selling in a competitive market. The marginal private benefit of getting the vaccination is less than the marginal social or public benefit by the amount of the external benefit (for example, society as a whole is increasingly protected from smallpox by each vaccination, including those who refuse to participate). This marginal external benefit of getting a smallpox shot is represented by the vertical distance between the two demand curves. Assume there are no external costs, so that social cost ''equals'' individual cost.

If consumers only take into account their own private benefits from getting vaccinations, the market will end up at price Pp and quantity Qp as before, instead of the more efficient price Ps and quantity Qs. This latter again reflect the idea that the marginal social benefit should equal the marginal social cost, i.e., that production should be increased as long as the marginal social benefit exceeds the marginal social cost. The result in an unfettered market is '' inefficient'' since at the quantity Qp, the social benefit is greater than the societal cost, so society as a whole would be better off if more goods had been produced. The problem is that people are buying ''too few'' vaccinations.

The issue of external benefits is related to that of

A 2020 scientific analysis of external climate costs of foods indicates that external greenhouse gas costs are typically highest for animal-based products – conventional and organic to about the same extent within that

A 2020 scientific analysis of external climate costs of foods indicates that external greenhouse gas costs are typically highest for animal-based products – conventional and organic to about the same extent within that

CC BY 4.0

New York: Routledge. * Berger, Sebastian (2017) The Social Costs of Neoliberalism: Essays in the Economics of K. William Kapp. Nottingham: Spokesman. * Berger, Sebastian (ed) (2015) The Heterodox Theory of Social Costs - by K. William Kapp. London: Routledge. * * Johnson, Paul M

Definition

"A Glossary of Economic Terms" * * * * *

ExternE – European Union project to evaluate external costs

Econ 120 – Externalities

{{Authority control Environmental economics Market failure Welfare economics Public economics Inefficiency in game theory

In

In economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services.

Economics focuses on the behaviour and interac ...

, an externality is an indirect cost

Indirect costs are costs that are not directly accountable to a cost object (such as a particular project, facility, function or product). Like direct costs, indirect costs may be either fixed or variable. Indirect costs include administration, ...

(external cost) or indirect benefit (external benefit) to an uninvolved third party that arises as an effect of another party's (or parties') activity. Externalities can be considered as unpriced components that are involved in either consumer or producer consumption. Air pollution

Air pollution is the presence of substances in the Atmosphere of Earth, air that are harmful to humans, other living beings or the environment. Pollutants can be Gas, gases like Ground-level ozone, ozone or nitrogen oxides or small particles li ...

from motor vehicle

A motor vehicle, also known as a motorized vehicle, automotive vehicle, automobile, or road vehicle, is a self-propelled land vehicle, commonly wheeled, that does not operate on railway track, rails (such as trains or trams), does not fly (such ...

s is one example. The cost of air pollution to society is not paid by either the producers or users of motorized transport. Water pollution from mills and factories are another example. All (water) consumers are made worse off by pollution but are not compensated by the market for this damage.

The concept of externality was first developed by Alfred Marshall

Alfred Marshall (26 July 1842 – 13 July 1924) was an English economist and one of the most influential economists of his time. His book ''Principles of Economics (Marshall), Principles of Economics'' (1890) was the dominant economic textboo ...

in the 1890s and achieved broader attention in the works of economist Arthur Pigou in the 1920s. The prototypical example of a negative externality is environmental pollution. Pigou argued that a tax, equal to the marginal damage or marginal external cost, (later called a "Pigouvian tax

A Pigouvian tax (also spelled Pigovian tax) is a tax on any Market (economics), market activity that generates negative externalities (i.e., external costs incurred by third parties that are not included in the market price). It is a method that ...

") on negative externalities could be used to reduce their incidence to an efficient level. Subsequent thinkers have debated whether it is preferable to tax or to regulate negative externalities, the optimally efficient level of the Pigouvian taxation, and what factors cause or exacerbate negative externalities, such as providing investors in corporations with limited liability for harms committed by the corporation.

Externalities often occur when the production or consumption of a product or service's private price equilibrium cannot reflect the true costs or benefits of that product or service for society as a whole. This causes the externality competitive equilibrium to not adhere to the condition of Pareto optimality. Thus, since resources can be better allocated, externalities are an example of market failure

In neoclassical economics, market failure is a situation in which the allocation of goods and services by a free market is not Pareto efficient, often leading to a net loss of economic value.Paul Krugman and Robin Wells Krugman, Robin Wells (2006 ...

.

Externalities can be either positive or negative. Governments and institutions often take actions to internalize externalities, thus market-priced transactions can incorporate all the benefits and costs associated with transactions between economic agents. The most common way this is done is by imposing taxes on the producers of this externality. This is usually done similar to a quote where there is no tax imposed and then once the externality reaches a certain point there is a very high tax imposed. However, since regulators do not always have all the information on the externality it can be difficult to impose the right tax. Once the externality is internalized through imposing a tax the competitive equilibrium is now Pareto optimal.

History of the concept

The term "externality" was first coined by the British economistAlfred Marshall

Alfred Marshall (26 July 1842 – 13 July 1924) was an English economist and one of the most influential economists of his time. His book ''Principles of Economics (Marshall), Principles of Economics'' (1890) was the dominant economic textboo ...

in his seminal work, " Principles of Economics," published in 1890. Marshall introduced the concept to elucidate the effects of production and consumption activities that extend beyond the immediate parties involved in a transaction. Marshall's formulation of externalities laid the groundwork for subsequent scholarly inquiry into the broader societal impacts of economic actions. While Marshall provided the initial conceptual framework for externalities, it was Arthur Pigou, a British economist, who further developed the concept in his influential work, "The Economics of Welfare," published in 1920. Pigou expanded upon Marshall's ideas and introduced the concept of "Pigovian taxes" or corrective taxes aimed at internalizing externalities by aligning private costs with social costs. His work emphasized the role of government intervention in addressing market failures resulting from externalities.

Additionally, the American economist Frank Knight contributed to the understanding of externalities through his writings on social costs and benefits in the 1920s and 1930s. Knight's work highlighted the inherent challenges in quantifying and mitigating externalities within market systems, underscoring the complexities involved in achieving optimal resource allocation. Throughout the 20th century, the concept of externalities continued to evolve with advancements in economic theory and empirical research. Scholars such as Ronald Coase

Ronald Harry Coase (; 29 December 1910 – 2 September 2013) was a British economist and author. Coase was educated at the London School of Economics, where he was a member of the faculty until 1951. He was the Clifton R. Musser Professor of Eco ...

and Harold Hotelling

Harold Hotelling (; September 29, 1895 – December 26, 1973) was an American mathematical statistician and an influential economic theorist, known for Hotelling's law, Hotelling's lemma, and Hotelling's rule in economics, as well as Hotelling ...

made significant contributions to the understanding of externalities and their implications for market efficiency and welfare.

The recognition of externalities as a pervasive phenomenon with wide-ranging implications has led to its incorporation into various fields beyond economics, including environmental science, public health, and urban planning. Contemporary debates surrounding issues such as climate change

Present-day climate change includes both global warming—the ongoing increase in Global surface temperature, global average temperature—and its wider effects on Earth's climate system. Climate variability and change, Climate change in ...

, pollution, and resource depletion underscore the enduring relevance of the concept of externalities in addressing pressing societal challenges.

Definitions

A negative externality is any difference between the private cost of an action or decision to an economic agent and the social cost. In simple terms, a negative externality is anything that causes an

A negative externality is any difference between the private cost of an action or decision to an economic agent and the social cost. In simple terms, a negative externality is anything that causes an indirect cost

Indirect costs are costs that are not directly accountable to a cost object (such as a particular project, facility, function or product). Like direct costs, indirect costs may be either fixed or variable. Indirect costs include administration, ...

to individuals. An example is the toxic gases that are released from industries or mines, these gases cause harm to individuals within the surrounding area and have to bear a cost (indirect cost) to get rid of that harm. Conversely, a positive externality is any difference between the private benefit of an action or decision to an economic agent and the social benefit. A positive externality is anything that causes an indirect benefit to individuals and for which the producer of that positive externality is not compensated. For example, planting trees makes individuals' property look nicer and it also cleans the surrounding areas.

In microeconomic theory, externalities are factored into competitive equilibrium analysis as the social effect, as opposed to the private market which only factors direct economic effects. The social effect of economic activity is the sum of the indirect (the externalities) and direct factors. The Pareto optimum, therefore, is at the levels in which the social marginal benefit equals the social marginal cost.

Externalities are the residual effects of economic activity on persons not directly participating in the transaction. The consequences of producer or consumer behaviors that result in external costs or advantages imposed on others are not taken into account by market pricing and can have both positive and negative effects. To further elaborate on this, when expenses associated with the production or use of an item or service are incurred by others but are not accounted for in the market price, this is known as a negative externality. The health and well-being of local populations may be negatively impacted by environmental deterioration resulting from the extraction of natural resources. Comparably, the tranquility of surrounding inhabitants might be disturbed by noise pollution from industry or transit, which lowers their quality of life. On the other hand, positive externalities occur when the activities of producers or consumers benefit other parties in ways that are not accounted for in market exchanges. A prime example of a positive externality is education, as those who invest in it gain knowledge and production for society as a whole in addition to personal profit."Microeconomics" by Robert S. Pindyck and Daniel L. Rubinfeld

Government involvement is frequently necessary to address externalities. This can be done by enacting laws, Pigovian taxes, or other measures that encourage positive externalities or internalize external costs. Through the integration of externalities into economic research and policy formulation, society may endeavor to get results that optimize aggregate well-being and foster sustainable growth.

Implications

A voluntary exchange may reduce societal welfare if external costs exist. The person who is affected by the negative externalities in the case ofair pollution

Air pollution is the presence of substances in the Atmosphere of Earth, air that are harmful to humans, other living beings or the environment. Pollutants can be Gas, gases like Ground-level ozone, ozone or nitrogen oxides or small particles li ...

will see it as lowered utility

In economics, utility is a measure of a certain person's satisfaction from a certain state of the world. Over time, the term has been used with at least two meanings.

* In a normative context, utility refers to a goal or objective that we wish ...

: either subjective displeasure or potentially explicit costs, such as higher medical expenses. The externality may even be seen as a trespass on their health or violating their property rights (by reduced valuation). Thus, an external cost may pose an ethical

Ethics is the philosophical study of moral phenomena. Also called moral philosophy, it investigates normative questions about what people ought to do or which behavior is morally right. Its main branches include normative ethics, applied e ...

or political

Politics () is the set of activities that are associated with decision-making, making decisions in social group, groups, or other forms of power (social and political), power relations among individuals, such as the distribution of Social sta ...

problem. Negative externalities are Pareto inefficient, and since Pareto efficiency underpins the justification for private property, they undermine the whole idea of a market economy. For these reasons, negative externalities are more problematic than positive externalities.

Although positive externalities may appear to be beneficial, while Pareto efficient, they still represent a failure in the market as it results in the production of the good falling under what is optimal for the market. By allowing producers to recognise and attempt to control their externalities production would increase as they would have motivation to do so. With this comes the free rider problem. The free rider problem arises when people overuse a shared resource without doing their part to produce or pay for it. It represents a failure in the market where goods and services are not able to be distributed efficiently, allowing people to take more than what is fair. For example, if a farmer has honeybees a positive externality of owning these bees is that they will also pollinate the surrounding plants. This farmer has a next door neighbour who also benefits from this externality even though he does not have any bees himself. From the perspective of the neighbour he has no incentive to purchase bees himself as he is already benefiting from them at zero cost. But for the farmer, he is missing out on the full benefits of his own bees which he paid for, because they are also being used by his neighbour.

There are a number of theoretical means of improving overall social utility when negative externalities are involved. The market-driven approach to correcting externalities is to ''internalize'' third party costs and benefits, for example, by requiring a polluter to repair any damage caused. But in many cases, internalizing costs or benefits is not feasible, especially if the true monetary values cannot be determined.

There are a number of theoretical means of improving overall social utility when negative externalities are involved. The market-driven approach to correcting externalities is to ''internalize'' third party costs and benefits, for example, by requiring a polluter to repair any damage caused. But in many cases, internalizing costs or benefits is not feasible, especially if the true monetary values cannot be determined.

Laissez-faire

''Laissez-faire'' ( , from , ) is a type of economic system in which transactions between private groups of people are free from any form of economic interventionism (such as subsidies or regulations). As a system of thought, ''laissez-faire'' ...

economists such as Friedrich Hayek

Friedrich August von Hayek (8 May 1899 – 23 March 1992) was an Austrian-born British academic and philosopher. He is known for his contributions to political economy, political philosophy and intellectual history. Hayek shared the 1974 Nobe ...

and Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and ...

sometimes refer to externalities as "neighborhood effects" or "spillovers", although externalities are not necessarily minor or localized. Similarly, Ludwig von Mises

Ludwig Heinrich Edler von Mises (; ; September 29, 1881 – October 10, 1973) was an Austrian-American political economist and philosopher of the Austrian school. Mises wrote and lectured extensively on the social contributions of classical l ...

argues that externalities arise from lack of "clear personal property definition."

Examples

Externalities may arise between producers, between consumers or between consumers and producers. Externalities can be negative when the action of one party imposes costs on another, or positive when the action of one party benefits another.Negative

A negative externality (also called "external cost" or "external diseconomy") is an economic activity that imposes a negative effect on an unrelated third party, not captured by the market price. It can arise either during the production or the consumption of a good or service. Pollution is termed an externality because it imposes costs on people who are "external" to the producer and consumer of the polluting product. Barry Commoner commented on the costs of externalities:

A negative externality (also called "external cost" or "external diseconomy") is an economic activity that imposes a negative effect on an unrelated third party, not captured by the market price. It can arise either during the production or the consumption of a good or service. Pollution is termed an externality because it imposes costs on people who are "external" to the producer and consumer of the polluting product. Barry Commoner commented on the costs of externalities:

Clearly, we have compiled a record of serious failures in recent technological encounters with the environment. In each case, the new technology was brought into use before the ultimate hazards were known. We have been quick to reap the benefits and slow to comprehend the costs.Many negative externalities are related to the environmental consequences of production and use. The article on

environmental economics

Environmental economics is a sub-field of economics concerned with environmental issues. It has become a widely studied subject due to growing environmental concerns in the twenty-first century. Environmental economics "undertakes theoretical ...

also addresses externalities and how they may be addressed in the context of environmental issues.

Negative production externalities

Examples for negative production externalities include:

*

Examples for negative production externalities include:

* Air pollution

Air pollution is the presence of substances in the Atmosphere of Earth, air that are harmful to humans, other living beings or the environment. Pollutants can be Gas, gases like Ground-level ozone, ozone or nitrogen oxides or small particles li ...

from burning fossil fuels

A fossil fuel is a flammable carbon compound- or hydrocarbon-containing material formed naturally in the Earth's crust from the buried remains of prehistoric organisms (animals, plants or microplanktons), a process that occurs within geologica ...

. This activity causes damages to crops, materials and (historic) buildings and public health.

* Anthropogenic climate change as a consequence of greenhouse gas emissions

Greenhouse gas (GHG) emissions from human activities intensify the greenhouse effect. This contributes to climate change. Carbon dioxide (), from burning fossil fuels such as coal, petroleum, oil, and natural gas, is the main cause of climate chan ...

from the burning of fossil fuels and the rearing of livestock. The '' Stern Review on the Economics of Climate Change'' says "Climate change presents a unique challenge for economics: it is the greatest example of market failure

In neoclassical economics, market failure is a situation in which the allocation of goods and services by a free market is not Pareto efficient, often leading to a net loss of economic value.Paul Krugman and Robin Wells Krugman, Robin Wells (2006 ...

we have ever seen."

* Water pollution

Water pollution (or aquatic pollution) is the contamination of Body of water, water bodies, with a negative impact on their uses. It is usually a result of human activities. Water bodies include lakes, rivers, oceans, aquifers, reservoirs and ...

from industrial effluents can harm plants, animals, and humans

* Spam emails during the sending of unsolicited messages by email.

* Government regulation: Any costs required to comply with a law, regulation, or policy, either in terms of time or money, that are not covered by the entity issuing the edict (see also unfunded mandate

An unfunded mandate is a statute or regulation that requires any entity to perform certain actions, with no money provided for fulfilling the requirements. This can be imposed on state or local government, as well as private individuals or organiz ...

).

* Noise pollution

Noise pollution, or sound pollution, is the propagation of noise or sound with potential harmful effects on humans and animals. The source of outdoor noise worldwide is mainly caused by machines, transport and propagation systems.Senate Publi ...

during the production process, which may be mentally and psychologically disruptive.

* Systemic risk

In finance, systemic risk is the risk of collapse of an entire financial system or entire market, as opposed to the risk associated with any one individual entity, group or component of a system, that can be contained therein without harming the ...

: the risks to the overall economy arising from the risks that the banking system takes. A condition of moral hazard

In economics, a moral hazard is a situation where an economic actor has an incentive to increase its exposure to risk because it does not bear the full costs associated with that risk, should things go wrong. For example, when a corporation i ...

can occur in the absence of well-designed banking regulation

Banking regulation and supervision refers to a form of financial regulation which subjects banks to certain requirements, restrictions and guidelines, enforced by a financial regulatory authority generally referred to as banking supervisor, with ...

, or in the presence of badly designed regulation.

* Negative effects of Industrial farm animal production, including "the increase in the pool of antibiotic-resistant bacteria because of the overuse of antibiotics; air quality problems; the contamination of rivers, streams, and coastal waters with concentrated animal waste; animal welfare problems, mainly as a result of the extremely close quarters in which the animals are housed."

* The depletion of the stock of fish in the ocean due to overfishing

Overfishing is the removal of a species of fish (i.e. fishing) from a body of water at a rate greater than that the species can replenish its population naturally (i.e. the overexploitation of the fishery's existing Fish stocks, fish stock), resu ...

. This is an example of a common property resource

In economics, a common-pool resource (CPR) is a type of good (economics), good consisting of a natural resource, natural or human-made Resource (economics), resource system (e.g. an irrigation system or fishing grounds), whose size or characteristi ...

, which is vulnerable to the tragedy of the commons in the absence of appropriate environmental governance.

* In the United States, the cost of storing nuclear waste

Radioactive waste is a type of hazardous waste that contains radioactive material. It is a result of many activities, including nuclear medicine, nuclear research, nuclear power generation, nuclear decommissioning, rare-earth mining, and nuclear ...

from nuclear plants for more than 1,000 years (over 100,000 for some types of nuclear waste) is, in principle, included in the cost of the electricity the plant produces in the form of a fee paid to the government and held in the nuclear waste superfund, although much of that fund was spent on Yucca Mountain nuclear waste repository without producing a solution. Conversely, the costs of managing the long-term risks of disposal of chemicals, which may remain hazardous on similar time scales, is not commonly internalized in prices. The USEPA regulates chemicals for periods ranging from 100 years to a maximum of 10,000 years.

Negative consumption externalities

Examples of negative consumption externalities include: *

* Noise pollution

Noise pollution, or sound pollution, is the propagation of noise or sound with potential harmful effects on humans and animals. The source of outdoor noise worldwide is mainly caused by machines, transport and propagation systems.Senate Publi ...

: Sleep deprivation due to a neighbor listening to loud music late at night.

* Antibiotic resistance

Antimicrobial resistance (AMR or AR) occurs when microbes evolve mechanisms that protect them from antimicrobials, which are drugs used to treat infections. This resistance affects all classes of microbes, including bacteria (antibiotic resis ...

, caused by increased usage of antibiotics: Individuals do not consider this efficacy cost when making usage decisions. Government policies proposed to preserve future antibiotic effectiveness include educational campaigns, regulation, Pigouvian taxes, and patents.

* Passive smoking

Passive smoking is the inhalation of tobacco smoke, called passive smoke, secondhand smoke (SHS) or environmental tobacco smoke (ETS), by individuals other than the active Tobacco smoking, smoker. It occurs when tobacco smoke diffuses into the ...

: Shared costs of declining health and vitality caused by smoking or alcohol abuse. Here, the "cost" is that of providing minimum social welfare. Economists more frequently attribute this problem to the category of moral hazard

In economics, a moral hazard is a situation where an economic actor has an incentive to increase its exposure to risk because it does not bear the full costs associated with that risk, should things go wrong. For example, when a corporation i ...

s, the prospect that parties insulated from risk may behave differently from the way they would if they were fully exposed to the risk. For example, individuals with insurance against automobile theft may be less vigilant about locking their cars, because the negative consequences of automobile theft are (partially) borne by the insurance company.

* Traffic congestion: When more people use public roads, road users experience congestion costs such as more waiting in traffic and longer trip times. Increased road users also increase the likelihood of road accidents.

* Price increases: Consumption by one party causes prices to rise and therefore makes other consumers worse off, perhaps by preventing, reducing or delaying their consumption. These effects are sometimes called " pecuniary externalities" and are distinguished from "real externalities" or "technological externalities". Pecuniary externalities appear to be externalities, but occur within the market mechanism and are not considered to be a source of market failure

In neoclassical economics, market failure is a situation in which the allocation of goods and services by a free market is not Pareto efficient, often leading to a net loss of economic value.Paul Krugman and Robin Wells Krugman, Robin Wells (2006 ...

or inefficiency, although they may still result in substantial harm to others.

* Weak public infrastructure, air pollution, climate change, work misallocation, resource requirements and land/space requirements as in the externalities of automobiles.

Positive

A positive externality (also called "external benefit" or "external economy" or "beneficial externality") is the positive effect an activity imposes on an unrelated third party. Similar to a negative externality, it can arise either on the production side, or on the consumption side. A positive production externality occurs when a firm's production increases the well-being of others but the firm is uncompensated by those others, while a positive consumption externality occurs when an individual's consumption benefits other but the individual is uncompensated by those others.Positive production externalities

Examples of positive production externalities * A

* A beekeeper

A beekeeper is a person who keeps honey bees, a profession known as beekeeping. The term beekeeper refers to a person who keeps honey bees in beehives, boxes, or other receptacles. The beekeeper does not control the creatures. The beekeeper ow ...

who keeps the bees for their honey

Honey is a sweet and viscous substance made by several species of bees, the best-known of which are honey bees. Honey is made and stored to nourish bee colonies. Bees produce honey by gathering and then refining the sugary secretions of pl ...

. A side effect or externality associated with such activity is the pollination

Pollination is the transfer of pollen from an anther of a plant to the stigma (botany), stigma of a plant, later enabling fertilisation and the production of seeds. Pollinating agents can be animals such as insects, for example bees, beetles or bu ...

of surrounding crops by the bees. The value generated by the pollination may be more important than the value of the harvested honey.

* The corporate development of some free software

Free software, libre software, libreware sometimes known as freedom-respecting software is computer software distributed open-source license, under terms that allow users to run the software for any purpose as well as to study, change, distribut ...

(studied notably by Jean Tirole and Steven Weber)

* Research and development

Research and development (R&D or R+D), known in some countries as OKB, experiment and design, is the set of innovative activities undertaken by corporations or governments in developing new services or products. R&D constitutes the first stage ...

, since much of the economic benefits of research are not captured by the originating firm.

* An industrial company providing first aid classes for employees to increase on the job safety. This may also save lives outside the factory.

* Restored historic buildings may encourage more people to visit the area and patronize nearby businesses.

* A foreign firm that demonstrates up-to-date technologies to local firms and improves their productivity.

* Public transport

Public transport (also known as public transit, mass transit, or simply transit) are forms of transport available to the general public. It typically uses a fixed schedule, route and charges a fixed fare. There is no rigid definition of whic ...

can increase economic welfare by providing transit services to other economic activities, however the benefits of those other economic activities are not felt by the operator, it can also decrease the negative externalities of increasing road patronage in the absence of a congestion charge.

* The personal cost of an education will have an external benefit to society.

Positive consumption externalities

Examples of positive consumption externalities include: * An individual who maintains an attractive house may confer benefits to neighbors in the form of increased market values for their properties. This is an example of a pecuniary externality, because the positive spillover is accounted for in market prices. In this case, house prices in the neighborhood will increase to match the increased real estate value from maintaining their aesthetic. (such as by mowing the lawn, keeping the trash orderly, and getting the house painted) * Anything that reduces the rate of transmission of an infectious disease carries positive externalities. This includes vaccines, quarantine, tests and other diagnostic procedures. For airborneinfection

An infection is the invasion of tissue (biology), tissues by pathogens, their multiplication, and the reaction of host (biology), host tissues to the infectious agent and the toxins they produce. An infectious disease, also known as a transmis ...

s, it also includes masking. For waterborne diseases, it includes improved sewers and sanitation. (See '' herd immunity'')

* Increased education

Education is the transmission of knowledge and skills and the development of character traits. Formal education occurs within a structured institutional framework, such as public schools, following a curriculum. Non-formal education als ...

of individuals, as this can lead to broader society benefits in the form of greater economic productivity

Productivity is the efficiency of production of goods or services expressed by some measure. Measurements of productivity are often expressed as a ratio of an aggregate output to a single input or an aggregate input used in a production proce ...

, a lower unemployment rate

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is the proportion of people above a specified age (usually 15) not being in paid employment or self-employment but currently available for work d ...

, greater household mobility and higher rates of political participation

Citizen participation or public participation in social science refers to different mechanisms for the public to express opinions—and ideally exert influence—regarding political, economic, management or other social decisions. Participato ...

.

* An individual buying a product that is interconnected in a network (e.g., a smartphone

A smartphone is a mobile phone with advanced computing capabilities. It typically has a touchscreen interface, allowing users to access a wide range of applications and services, such as web browsing, email, and social media, as well as multi ...

). This will increase the usefulness of such phones to other people who have a video cellphone. When each new user of a product increases the value of the same product owned by others, the phenomenon is called a network externality or a network effect

In economics, a network effect (also called network externality or demand-side economies of scale) is the phenomenon by which the Value (economics), value or utility a user derives from a Goods, good or Service (economics), service depends on th ...

. Network externalities often have " tipping points" where, suddenly, the product reaches general acceptance and near-universal usage.

* In an area that does not have a public

In public relations and communication science, publics are groups of individual people, and the public (a.k.a. the general public) is the totality of such groupings. This is a different concept to the sociology, sociological concept of the ''Öf ...

fire department

A fire department (North American English) or fire brigade (English in the Commonwealth of Nations, Commonwealth English), also known as a fire company, fire authority, fire district, fire and rescue, or fire service in some areas, is an organi ...

, homeowners who purchase private fire protection services provide a positive externality to neighboring properties, which are less at risk of the protected neighbor's fire spreading to their (unprotected) house.

Collective solutions or public policies are implemented to regulate activities with positive or negative externalities.

Positional

The sociological basis of Positional externalities is rooted in the theories ofconspicuous consumption

In sociology and in economics, the term conspicuous consumption describes and explains the consumer practice of buying and using goods of a higher quality, price, or in greater quantity than practical. In 1899, the sociologist Thorstein Veblen c ...

and positional goods.

Conspicuous consumption (originally articulated by Veblen, 1899) refers to the consumption of goods or services primarily for the purpose of displaying social status or wealth. In simpler terms, individuals engange in conspicuous consumption to signal their economic standing or to gain social recognition. Positional goods (introduced by Hirsch, 1977) are such goods, whose value is heavily contingent upon how they compare to similar goods owned by others. Their desirability is or derived utility is intrinsically tied to their relative scarcity or exclusivity within a particular social context.

The economic concept of Positional externalities originates from Duesenberry's

Conspicuous consumption (originally articulated by Veblen, 1899) refers to the consumption of goods or services primarily for the purpose of displaying social status or wealth. In simpler terms, individuals engange in conspicuous consumption to signal their economic standing or to gain social recognition. Positional goods (introduced by Hirsch, 1977) are such goods, whose value is heavily contingent upon how they compare to similar goods owned by others. Their desirability is or derived utility is intrinsically tied to their relative scarcity or exclusivity within a particular social context.

The economic concept of Positional externalities originates from Duesenberry's Relative Income Hypothesis

The relative income hypothesis was developed by James Duesenberry in 1949. It consists of two separate consumption hypothesis.

The first hypothesis states that an individual's attitude to consumption is dictated more by their income in relation ...

. This hypothesis challenges the conventional microeconomic model, as outlined by the Common Pool Resource (CPR) mechanism, which typically assumes that an individual's utility derived from consuming a particular good or service remains unaffected by other's consumption choices. Instead, Duesenberry posits that individuals gauge the utility of their consumption based on a comparison with other consumption bundles, thus introducing the notion of relative income into economic analysis. Consequently, the consumption of positional goods becomes highly sought after, as it directly impacts one's perceived status relative to others in their social circle.

Example: consider a scenario where individuals within a social group vie for the latest luxury cars. As one member acquires a top-of-the-line vehicle, others may feel compelled to upgrade their own cars to preserve their status within the group. This cycle of competitive consumption can result in inefficient allocation of resources and exacerbate income inequality within society.

The consumption of positional goods engenders negative externalities, wherein the acquisition of such goods by one individual diminishes the utility or value of similar goods held by others within the same reference group. This positional externality, can lead to a cascade of overconsumption, as individuals strive to maintain or improve their relative position through excessive spending.

Positional externalities are related, but not similar to Percuniary externalities.

Pecuniary

Pecuniary externalities are those which affect a third party's profit but not their ability to produce or consume. These externalities "occur when new purchases alter the relevant context within which an existing positional good is evaluated." Robert H. Frank,Are Positional Externalities Different from Other Externalities

? " (draft for presentation for ''Why Inequality Matters: Lessons for Policy from the Economics of Happiness'',

Brookings Institution

The Brookings Institution, often stylized as Brookings, is an American think tank that conducts research and education in the social sciences, primarily in economics (and tax policy), metropolitan policy, governance, foreign policy, global econo ...

, Washington, D.C., June 4–5, 2003). Robert H. Frank gives the following example:

:if some job candidates begin wearing expensive custom-tailored suits, a side effect of their action is that other candidates become less likely to make favorable impressions on interviewers. From any individual job seeker's point of view, the best response might be to match the higher expenditures of others, lest her chances of landing the job fall. But this outcome may be inefficient since when all spend more, each candidate's probability of success remains unchanged. All may agree that some form of collective restraint on expenditure would be useful."

Frank notes that treating positional externalities like other externalities might lead to "intrusive economic and social regulation." He argues, however, that less intrusive and more efficient means of "limiting the costs of expenditure cascades"—i.e., the hypothesized increase in spending of middle-income families beyond their means "because of indirect effects associated with increased spending by top earners"—exist; one such method is the personal income tax.

The effect that rising demand has on prices in marketplaces with intense competition is a typical illustration of pecuniary externalities. Prices rise in response to shifts in consumer preferences or income levels, which raise demand for a product and benefit suppliers by increasing sales and profits. But other customers who now have to pay more for identical goods might also suffer from this price hike. As a result, consumers who were not involved in the initial transaction suffer a monetary externality in the form of diminished buying power, while producers profit from increased prices. Furthermore, markets with economies of scale or network effects may experience pecuniary externalities. For example, when it comes to network products, like social media platforms or communication networks, the more people use the technology or engage in it, the more valuable the product becomes. Consequently, early adopters could gain financially from positive pecuniary externalities such as enhanced network effects or greater resale prices of related products or services. As a conclusion, pecuniary externalities draw attention to the intricate relationships that exist between market players and the effects that market transactions have on distribution. Comprehending pecuniary externalities is essential for assessing market results and formulating policies that advance economic efficiency and equality, even if they might not have the same direct impact on welfare or resource allocation as traditional externalities.

Inframarginal

The concept of inframarginal externalities was introduced by James Buchanan and Craig Stubblebine in 1962. Inframarginal externalities differ from other externalities in that there is no benefit or loss to the marginal consumer. At the relevant margin to the market, the externality does not affect the consumer and does not cause a market inefficiency. The externality only affects at the inframarginal range outside where the market clears. These types of externalities do not cause inefficient allocation of resources and do not require policy action.Technological

Technological externalities directly affect a firm's production and therefore, indirectly influence an individual's consumption; and the overall impact of society; for exampleOpen-source software

Open-source software (OSS) is Software, computer software that is released under a Open-source license, license in which the copyright holder grants users the rights to use, study, change, and Software distribution, distribute the software an ...

or free software

Free software, libre software, libreware sometimes known as freedom-respecting software is computer software distributed open-source license, under terms that allow users to run the software for any purpose as well as to study, change, distribut ...

development by corporations.

These externalities occur when technology spillovers from the acts of one economic agent impact the production or consumption potential of another agency. Depending on their nature, these spillovers may produce positive or negative externalities. The creation of new technologies that help people in ways that go beyond the original inventor is one instance of positive technical externalities. Let us examine the instance of research and development (R&D) inside the pharmaceutical sector. In addition to possible financial gain, a pharmaceutical company's R&D investment in the creation of a new medicine helps society in other ways. Better health outcomes, higher productivity, and lower healthcare expenses for both people and society at large might result from the new medication. Furthermore, the information created via research and development frequently spreads to other businesses and sectors, promoting additional innovation and economic expansion. For example, biotechnology advances could have uses in agriculture, environmental cleanup, or renewable energy, not just in the pharmaceutical industry. However, technical externalities can also take the form of detrimental spillovers that cost society money. Pollution from industrial manufacturing processes is a prime example. Businesses might not be entirely responsible for the expenses of environmental deterioration if they release toxins into the air or rivers as a result of their production processes. Rather, these expenses are shifted to society in the form of decreased quality of life for impacted populations, harm to the environment, and health risks. In addition, workers in some industries may experience job displacement and unemployment as a result of disruptive developments in labor markets brought about by technological improvements. For instance, individuals with outdated skills may lose their jobs as a result of the automation of manufacturing processes through robots and artificial intelligence, causing social and economic unrest in the affected areas.

Supply and demand diagram

The usual economic analysis of externalities can be illustrated using a standardsupply and demand

In microeconomics, supply and demand is an economic model of price determination in a Market (economics), market. It postulates that, Ceteris_paribus#Applications, holding all else equal, the unit price for a particular Good (economics), good ...

diagram if the externality can be valued in terms of money

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are: m ...

. An extra supply or demand curve is added, as in the diagrams below. One of the curves is the ''private cost'' that consumers pay as individuals for additional quantities of the good, which in competitive markets, is the marginal private cost. The other curve is the ''true'' cost that society as a whole pays for production and consumption of increased production the good, or the marginal social cost. Similarly, there might be two curves for the demand or benefit of the good. The social demand curve would reflect the benefit to society as a whole, while the normal demand curve reflects the benefit to consumers as individuals and is reflected as effective demand in the market.

What curve is added depends on the type of externality that is described, but not whether it is positive or negative. Whenever an externality arises on the production side, there will be two supply curves (private and social cost). However, if the externality arises on the consumption side, there will be two demand curves instead (private and social benefit). This distinction is essential when it comes to resolving inefficiencies that are caused by externalities.

External costs

laissez-faire

''Laissez-faire'' ( , from , ) is a type of economic system in which transactions between private groups of people are free from any form of economic interventionism (such as subsidies or regulations). As a system of thought, ''laissez-faire'' ...

). The marginal private cost is less than the marginal social or public cost by the amount of the external cost, i.e., the cost of air pollution

Air pollution is the presence of substances in the Atmosphere of Earth, air that are harmful to humans, other living beings or the environment. Pollutants can be Gas, gases like Ground-level ozone, ozone or nitrogen oxides or small particles li ...

and water pollution

Water pollution (or aquatic pollution) is the contamination of Body of water, water bodies, with a negative impact on their uses. It is usually a result of human activities. Water bodies include lakes, rivers, oceans, aquifers, reservoirs and ...

. This is represented by the vertical distance between the two supply curves. It is assumed that there are no external benefits, so that social benefit ''equals'' individual benefit.

If the consumers only take into account their own private cost, they will end up at price Pp and quantity Qp, instead of the more efficient price Ps and quantity Qs. These latter reflect the idea that the marginal social benefit should equal the marginal social cost, that is that production should be increased ''only'' as long as the marginal social benefit exceeds the marginal social cost. The result is that a free market

In economics, a free market is an economic market (economics), system in which the prices of goods and services are determined by supply and demand expressed by sellers and buyers. Such markets, as modeled, operate without the intervention of ...

is '' inefficient'' since at the quantity Qp, the social benefit is less than the social cost, so society as a whole would be better off if the goods between Qp and Qs had not been produced. The problem is that people are buying and consuming ''too much'' steel.

This discussion implies that negative externalities (such as pollution) are ''more than'' merely an ethical problem. The problem is one of the disjunctures between marginal private and social costs that are not solved by the free market. It is a problem of societal communication and coordination to balance costs and benefits. This also implies that pollution is not something solved by competitive markets. Some ''collective'' solution is needed, such as a court system to allow parties affected by the pollution to be compensated, government intervention banning or discouraging pollution, or economic incentives such as green taxes.

External benefits

public goods

In economics, a public good (also referred to as a social good or collective good)Oakland, W. H. (1987). Theory of public goods. In Handbook of public economics (Vol. 2, pp. 485–535). Elsevier. is a goods, commodity, product or service that ...

, which are goods where it is difficult if not impossible to exclude people from benefits. The production of a public good has beneficial externalities for all, or almost all, of the public. As with external costs, there is a problem here of societal communication and coordination to balance benefits and costs. This also implies that vaccination is not something solved by competitive markets. The government may have to step in with a collective solution, such as subsidizing or legally requiring vaccine use. If the government does this, the good is called a merit good. Examples include policies to accelerate the introduction of electric vehicles

An electric vehicle (EV) is a motor vehicle whose propulsion is powered fully or mostly by electricity. EVs encompass a wide range of transportation modes, including road vehicle, road and rail vehicles, electric boats and Submersible, submer ...

or promote cycling

Cycling, also known as bicycling or biking, is the activity of riding a bicycle or other types of pedal-driven human-powered vehicles such as balance bikes, unicycles, tricycles, and quadricycles. Cycling is practised around the world fo ...

, both of which benefit public health

Public health is "the science and art of preventing disease, prolonging life and promoting health through the organized efforts and informed choices of society, organizations, public and private, communities and individuals". Analyzing the de ...

.

Causes

Externalities often arise from poorly definedproperty right

The right to property, or the right to own property (cf. ownership), is often classified as a human right for natural persons regarding their possessions. A general recognition of a right to private property is found more rarely and is typicall ...

s. While property rights to some things, such as objects, land, and money can be easily defined and protected, air, water, and wild animals often flow freely across personal and political borders, making it much more difficult to assign ownership. This incentivizes agents to consume them without paying the full cost, leading to negative externalities. Positive externalities similarly accrue from poorly defined property rights. For example, a person who gets a flu vaccination cannot own part of the herd immunity this confers on society, so they may choose not to be vaccinated.

When resources are managed poorly or there are no well-defined property rights, externalities frequently result, especially when it comes to common pool resources. Due to their rivalrous usage and non-excludability, common pool resources including fisheries, forests, and grazing areas are vulnerable to abuse and deterioration when access is unrestrained. Without clearly defined property rights or efficient management structures, people or organizations may misuse common pool resources without thinking through the long-term effects, which might have detrimental externalities on other users and society at large. This phenomenon—famously referred to by Garrett Hardin as the "tragedy of the commons"—highlights people's propensity to put their immediate self-interests ahead of the sustainability of shared resources.

Imagine, for instance, that there are no rules or limits in place and that several fishers have access to a single fishing area. In order to maintain their way of life and earn income, fishers are motivated to maximize their catches, which eventually causes overfishing and the depletion of fish populations. Fish populations decrease, and as a result, ecosystems are irritated, and the fishing industry experiences financial losses. These consequences have an adverse effect on subsequent generations and other people who depend on the resource. Nevertheless, the reduction of externalities linked to resources in common pools frequently necessitates the adoption of collaborative management approaches, like community-based management frameworks, tradable permits, and quotas. Communities can lessen the tragedy of the commons and encourage sustainable resource use and conservation for the benefit of current and future generations by establishing property rights or controlling access to shared resources.

Another common cause of externalities is the presence of transaction costs. Transaction costs are the cost of making an economic trade. These costs prevent economic agents from making exchanges they should be making. The costs of the transaction outweigh the benefit to the agent. When not all mutually beneficial exchanges occur in a market, that market is inefficient. Without transaction costs, agents could freely negotiate and internalize all externalities.

In order to further understand transactional costs, it is crucial to discuss Ronald Coase's methodologies. The standard theory of externalities, which holds that internalizing external costs or benefits requires government action through measures like Pigovian taxes or regulations, has been challenged by Coase. He presents the idea of transaction costs, which include the expenses related to reaching, upholding, and keeping an eye on agreements between parties. In the existence of externalities, transaction costs may hinder the effectiveness of private bargaining and result in worse-than-ideal results, according to Coase. He does, however, contend that private parties can establish mutually advantageous arrangements to internalize externalities without the involvement of the government, provided that there are minimal transaction costs and clearly defined property rights. Nevertheless, Coase uses the example of the distribution of property rights between a farmer and a rancher to support his claims. Assume there is a negative externality because the farmer's crops are harmed by the rancher's livestock. In a society where property rights are well-defined and transaction costs are minimal, the farmer and rancher can work out a voluntary agreement to settle the dispute. For example, the farmer may invest in preventive measures to lessen the impact, or the rancher could pay the farmer back for the harm the cattle caused. Coase's approach emphasizes how crucial it is to take property rights and transaction costs into account when managing externalities. He highlights that voluntary transactions between private parties can allow private parties to internalise externalities and that property rights distribution and transaction cost reduction can help make this possible.

Possible solutions

Solutions in non-market economies

* Inplanned economies

A planned economy is a type of economic system where investment, production and the allocation of capital goods takes place according to economy-wide economic plans and production plans. A planned economy may use centralized, decentralized, ...

, production is typically limited only to necessity, which would eliminate externalities created by overproduction.

* The central planner can decide to create and allocate jobs in industries that work to mitigate externalities, rather than waiting for the market to create a demand for these jobs.

Solutions in market economies

There are several general types of solutions to the problem of externalities, including both public- and private-sector resolutions: *Corporations

A corporation or body corporate is an individual or a group of people, such as an association or company, that has been authorized by the State (polity), state to act as a single entity (a legal entity recognized by private and public law as ...

or partnerships

A partnership is an agreement where parties agree to cooperate to advance their mutual interests. The partners in a partnership may be individuals, businesses, interest-based organizations, schools, governments or combinations. Organizations m ...

will allow confidential sharing of information among members, reducing the positive externalities that would occur if the information were shared in an economy consisting only of individuals.

* Pigovian taxes or subsidies

A subsidy, subvention or government incentive is a type of government expenditure for individuals and households, as well as businesses with the aim of stabilizing the economy. It ensures that individuals and households are viable by having acce ...

intended to redress economic injustices or imbalances.

* Regulation

Regulation is the management of complex systems according to a set of rules and trends. In systems theory, these types of rules exist in various fields of biology and society, but the term has slightly different meanings according to context. Fo ...

to limit activity that might cause negative externalities

* Government provision of services with positive externalities

* Lawsuit

A lawsuit is a proceeding by one or more parties (the plaintiff or claimant) against one or more parties (the defendant) in a civil court of law. The archaic term "suit in law" is found in only a small number of laws still in effect today ...

s to compensate affected parties for negative externalities

* Voting to cause participants to internalize externalities subject to the conditions of the efficient voter rule.

* Mediation

Mediation is a structured, voluntary process for resolving disputes, facilitated by a neutral third party known as the mediator. It is a structured, interactive process where an independent third party, the mediator, assists disputing parties ...

or negotiation between those affected by externalities and those causing them

A Pigovian tax (also called Pigouvian tax, after economist Arthur C. Pigou) is a tax imposed that is equal in value to the negative externality. In order to fully correct the negative externality, the per unit tax should equal the marginal external cost. The result is that the market outcome would be reduced to the efficient amount. A side effect is that revenue is raised for the government, reducing the amount of distortionary taxes that the government must impose elsewhere. Governments justify the use of Pigovian taxes saying that these taxes help the market reach an efficient outcome because this tax bridges the gap between marginal social costs and marginal private costs.

Some arguments against Pigovian taxes say that the tax does not account for all the transfers and regulations involved with an externality. In other words, the tax only considers the amount of externality produced. Another argument against the tax is that it does not take private property into consideration. Under the Pigovian system, one firm, for example, can be taxed more than another firm, even though the other firm is actually producing greater amounts of the negative externality.

Further arguments against Pigou disagree with his assumption every externality has someone at fault or responsible for the damages. Coase argues that externalities are reciprocal in nature. Both parties must be present for an externality to exist. He uses the example of two neighbors. One neighbor possesses a fireplace, and often lights fires in his house without issue. Then one day, the other neighbor builds a wall that prevents the smoke from escaping and sends it back into the fire-building neighbor’s home. This illustrates the reciprocal nature of externalities. Without the wall, the smoke would not be a problem, but without the fire, the smoke would not exist to cause problems in the first place. Coase also takes issue with Pigou’s assumption of a “benevolent despot” government. Pigou assumes the government’s role is to see the external costs or benefits of a transaction and assign an appropriate tax or subsidy. Coase argues that the government faces costs and benefits just like any other economic agent, so other factors play into its decision-making.

However, the most common type of solution is a tacit agreement through the political process. Governments are elected to represent citizens and to strike political compromises between various interests. Normally governments pass laws and regulations to address pollution and other types of environmental harm. These laws and regulations can take the form of "command and control" regulation (such as enforcing standards and limiting process variables), or environmental pricing reform (such as ecotaxes or other Pigovian taxes, tradable pollution permits or the creation of markets for ecological services). The second type of resolution is a purely private agreement between the parties involved.

Government intervention might not always be needed. Traditional ways of life may have evolved as ways to deal with external costs and benefits. Alternatively, democratically run communities can agree to deal with these costs and benefits in an amicable way. Externalities can sometimes be resolved by agreement between the parties involved. This resolution may even come about because of the threat of government action.

The use of taxes and subsidies in solving the problem of externalities

Correction tax, respectively subsidy, means essentially any mechanism that increases, respectively decreases, the costs (and thus price) associated with the activities of an individual or company.

The private-sector may sometimes be able to drive society to the socially optimal resolution. Ronald Coase

Ronald Harry Coase (; 29 December 1910 – 2 September 2013) was a British economist and author. Coase was educated at the London School of Economics, where he was a member of the faculty until 1951. He was the Clifton R. Musser Professor of Eco ...

argued that an efficient outcome can sometimes be reached without government intervention. Some take this argument further, and make the political argument that government should restrict its role to facilitating bargaining among the affected groups or individuals and to enforcing any contracts that result.

This result, often known as the Coase theorem, requires that

* Property rights be well-defined

* People act rationally

* Transaction costs

In economics, a transaction cost is a cost incurred when making an economic trade when participating in a market.

The idea that transactions form the basis of economic thinking was introduced by the institutional economist John R. Commons in 1 ...

be minimal (costless bargaining)

* Complete information

If all of these conditions apply, the private parties can bargain to solve the problem of externalities. The second part of the Coase theorem asserts that, when these conditions hold, whoever holds the property rights, a Pareto efficient outcome will be reached through bargaining.

This theorem would not apply to the steel industry case discussed above. For example, with a steel factory that trespasses on the lungs of a large number of individuals with pollution, it is difficult if not impossible for any one person to negotiate with the producer, and there are large transaction costs. Hence the most common approach may be to regulate the firm (by imposing limits on the amount of pollution considered "acceptable") while paying for the regulation and enforcement with taxes

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax co ...

. The case of the vaccinations would also not satisfy the requirements of the Coase theorem. Since the potential external beneficiaries of vaccination are the people themselves, the people would have to self-organize to pay each other to be vaccinated. But such an organization that involves the entire populace would be indistinguishable from government action.

In some cases, the Coase theorem is relevant. For example, if a logger is planning to clear-cut a forest

A forest is an ecosystem characterized by a dense ecological community, community of trees. Hundreds of definitions of forest are used throughout the world, incorporating factors such as tree density, tree height, land use, legal standing, ...

in a way that has a negative impact on a nearby resort

A resort (North American English) is a self-contained commercial establishment that aims to provide most of a vacationer's needs. This includes food, drink, swimming, accommodation, sports, entertainment and shopping, on the premises. A hotel ...

, the resort-owner and the logger could, in theory, get together to agree to a deal. For example, the resort-owner could pay the logger not to clear-cut – or could buy the forest. The most problematic situation, from Coase's perspective, occurs when the forest literally does not belong to anyone, or in any example in which there are not well-defined and enforceable property rights; the question of "who" owns the forest is not important, as any specific owner will have an interest in coming to an agreement with the resort owner (if such an agreement is mutually beneficial).

However, the Coase theorem is difficult to implement because Coase does not offer a negotiation method. Moreover, Coasian solutions are unlikely to be reached due to the possibility of running into the assignment problem

The assignment problem is a fundamental combinatorial optimization problem. In its most general form, the problem is as follows:

:The problem instance has a number of ''agents'' and a number of ''tasks''. Any agent can be assigned to perform any t ...

, the holdout problem, the free-rider problem

In economics, the free-rider problem is a type of market failure that occurs when those who benefit from resources, public goods and common pool resources do not pay for them or under-pay. Free riders may overuse common pool resources by not ...

, or transaction costs. Additionally, firms could potentially bribe each other since there is little to no government interaction under the Coase theorem. For example, if one oil firm has a high pollution rate and its neighboring firm is bothered by the pollution, then the latter firm may move depending on incentives. Thus, if the oil firm were to bribe the second firm, the first oil firm would suffer no negative consequences because the government would not know about the bribing.

In a dynamic setup, Rosenkranz and Schmitz (2007) have shown that the impossibility to rule out Coasean bargaining tomorrow may actually justify Pigouvian intervention today. To see this, note that unrestrained bargaining in the future may lead to an underinvestment problem (the so-called hold-up problem

In economics, the hold-up problem is central to the theory of incomplete contracts, and shows the difficulty in writing complete contracts. A hold-up problem arises when two factors are present:

# Parties to a future transaction must make non ...

). Specifically, when investments are relationship-specific and non-contractible, then insufficient investments will be made when it is anticipated that parts of the investments’ returns will go to the trading partner in future negotiations (see Hart and Moore, 1988). Hence, Pigouvian taxation can be welfare-improving precisely because Coasean bargaining will take place in the future. Antràs and Staiger (2012) make a related point in the context of international trade.

Kenneth Arrow suggests another private solution to the externality problem. He believes setting up a market for the externality is the answer. For example, suppose a firm produces pollution that harms another firm. A competitive market for the right to pollute may allow for an efficient outcome. Firms could bid the price they are willing to pay for the amount they want to pollute, and then have the right to pollute that amount without penalty. This would allow firms to pollute at the amount where the marginal cost of polluting equals the marginal benefit of another unit of pollution, thus leading to efficiency.