DJIA on:

[Wikipedia]

[Google]

[Amazon]

The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow (), is a

E-mini Dow ($5) Futures (YM)

which track the average and trade on their exchange floors respectively. Trading is typically carried out in an open outcry auction, or over an electronic network such as CME's Globex platform.

In 1884,

In 1884,

. Automationinformation.com. In 1928, the components of the Dow were increased to 30 stocks near the economic height of that decade, which was nicknamed the

The 1980s began with the early 1980s recession. In early 1981, the index broke above 1,000 several times, but then retreated. After closing above 2,000 in January 1987, the largest one-day percentage drop occurred on Black Monday, October 19, 1987, when the average fell 22.61%. There were no clear reasons given to explain the crash.

On October 13, 1989, the

The 1980s began with the early 1980s recession. In early 1981, the index broke above 1,000 several times, but then retreated. After closing above 2,000 in January 1987, the largest one-day percentage drop occurred on Black Monday, October 19, 1987, when the average fell 22.61%. There were no clear reasons given to explain the crash.

On October 13, 1989, the

On September 17, 2001, the first day of trading after the

On September 17, 2001, the first day of trading after the

Despite the emerging

Despite the emerging

stock market index

In finance, a stock index, or stock market index, is an Index (economics), index that measures the performance of a stock market, or of a subset of a stock market. It helps investors compare current stock price levels with past prices to calcul ...

of 30 prominent companies listed on stock exchange

A stock exchange, securities exchange, or bourse is an exchange where stockbrokers and traders can buy and sell securities, such as shares of stock, bonds and other financial instruments. Stock exchanges may also provide facilities for ...

s in the United States.

The DJIA is one of the oldest and most commonly followed equity indices. It is price-weighted, unlike other common indexes such as the Nasdaq Composite

The Nasdaq Composite (ticker symbol ^IXIC) is a stock market index that includes almost all stocks listed on the Nasdaq stock exchange. Along with the Dow Jones Industrial Average and S&P 500, it is one of the three most-followed stock market i ...

or S&P 500

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 leading companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and in ...

, which use market capitalization

Market capitalization, sometimes referred to as market cap, is the total value of a publicly traded company's outstanding common shares owned by stockholders.

Market capitalization is equal to the market price per common share multiplied by ...

. The DJIA also contains fewer stocks, which could exhibit higher risk; however, it could be less volatile when the market is rapidly rising or falling due to its components being well-established large-cap companies.

The value of the index can also be calculated as the sum of the stock prices of the companies included in the index, divided by a factor, which is approximately 0.163 . The factor is changed whenever a constituent company undergoes a stock split

A stock split or stock divide increases the number of shares in a company. For example, after a 2-for-1 split, each investor will own double the number of shares, and each share will be worth half as much.

A stock split causes a decrease of mar ...

so that the value of the index is unaffected by the stock split.

First calculated on May 26, 1896, the index is the second-oldest among U.S. market indices, after the Dow Jones Transportation Average

The Dow Jones Transportation Average, (DJTA, also called the "Dow Jones Transports"), index ticker symbol DJT is a U.S. stock market index from S&P Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the ...

. It was created by Charles Dow

Charles Henry Dow (; November 6, 1851 – December 4, 1902) was an American journalist who co-founded Dow Jones & Company with Edward Jones and Charles Bergstresser.

Dow also co-founded ''The Wall Street Journal'', which has become one of th ...

, co-founder of both ''The Wall Street Journal

''The Wall Street Journal'' (''WSJ''), also referred to simply as the ''Journal,'' is an American newspaper based in New York City. The newspaper provides extensive coverage of news, especially business and finance. It operates on a subscriptio ...

'' and Dow Jones & Company

Dow Jones & Company, Inc. (also known simply as Dow Jones) is an American publishing firm owned by News Corp, and led by CEO Almar Latour. The company publishes ''The Wall Street Journal'', '' Barron's'', '' MarketWatch'', ''Mansion Global'' ...

, and named after him and his business associate, statistician Edward Jones. The first published value of the Dow Jones was 40.94.

The index is maintained by S&P Dow Jones Indices, an entity majority-owned by S&P Global

S&P Global Inc. (prior to 2016, McGraw Hill Financial, Inc., and prior to 2013, The McGraw–Hill Companies, Inc.) is an American publicly traded corporation headquartered in Manhattan, New York City. Its primary areas of business are financia ...

. Its components are selected by a committee. The ten components with the largest dividend yield

The dividend yield or dividend–price ratio of a share is the dividend per share divided by the price per share. It is also a company's total annual dividend payments divided by its market capitalization, assuming the number of shares is constan ...

s are commonly referred to as the Dogs of the Dow. As with all stock prices, the prices of the constituent stocks and consequently the value of the index itself are affected by the performance of the respective companies as well as macroeconomic factors.

Components

the Dow Jones Industrial Average consists of the following companies, with a weighting as shown:Former components

As of November 8, 2024, the components of the DJIA have changed 59 times since its beginning on May 26, 1896.General Electric

General Electric Company (GE) was an American Multinational corporation, multinational Conglomerate (company), conglomerate founded in 1892, incorporated in the New York (state), state of New York and headquartered in Boston.

Over the year ...

had the longest presence on the index, beginning in the original index in 1896 and ending in 2018, but was dropped and re-added twice between 1898 and 1907. Changes to the index since 1991 are as follows:

* On May 6, 1991, Caterpillar Inc., J.P. Morgan & Co., and The Walt Disney Company

The Walt Disney Company, commonly referred to as simply Disney, is an American multinational mass media and entertainment conglomerate headquartered at the Walt Disney Studios complex in Burbank, California. Disney was founded on October 16 ...

replaced American Can

The American Can Company was a manufacturer of tin cans. It was a member of the Tin Can Trust, that controlled a "large percentage of business in the United States in tin cans, containers, and packages of tin." American Can Company ranked 97th amon ...

, Navistar

International Motors, LLC (formerly Navistar International Corporation) is an American manufacturer of commercial vehicles and engines, established in 1986 as a successor to the International Harvester company. International Motors produces ...

, and U.S. Steel.

* On March 17, 1997, Travelers Inc., Hewlett-Packard

The Hewlett-Packard Company, commonly shortened to Hewlett-Packard ( ) or HP, was an American multinational information technology company. It was founded by Bill Hewlett and David Packard in 1939 in a one-car garage in Palo Alto, California ...

, Johnson & Johnson

Johnson & Johnson (J&J) is an American multinational pharmaceutical, biotechnology, and medical technologies corporation headquartered in New Brunswick, New Jersey, and publicly traded on the New York Stock Exchange. Its common stock is a c ...

, and Walmart

Walmart Inc. (; formerly Wal-Mart Stores, Inc.) is an American multinational retail corporation that operates a chain of hypermarkets (also called supercenters), discount department stores, and grocery stores in the United States and 23 other ...

replaced Westinghouse Electric, Texaco

Texaco, Inc. ("The Texas Company") is an American Petroleum, oil brand owned and operated by Chevron Corporation. Its flagship product is its Gasoline, fuel "Texaco with Techron". It also owned the Havoline motor oil brand. Texaco was an Independ ...

, Bethlehem Steel, and F. W. Woolworth Company.

* On November 1, 1999, Microsoft

Microsoft Corporation is an American multinational corporation and technology company, technology conglomerate headquartered in Redmond, Washington. Founded in 1975, the company became influential in the History of personal computers#The ear ...

, Intel

Intel Corporation is an American multinational corporation and technology company headquartered in Santa Clara, California, and Delaware General Corporation Law, incorporated in Delaware. Intel designs, manufactures, and sells computer compo ...

, SBC Communications, and Home Depot

The Home Depot, Inc., often referred to as Home Depot, is an American multinational corporation, multinational home improvement retail corporation that sells tools, construction products, appliances, and services, including fuel and transportat ...

replaced Goodyear Tire, Sears Roebuck, Union Carbide, and Chevron Corporation. Intel and Microsoft became the first and second companies traded on the Nasdaq to be part of the Dow.

* On April 8, 2004, American International Group, Pfizer

Pfizer Inc. ( ) is an American Multinational corporation, multinational Pharmaceutical industry, pharmaceutical and biotechnology corporation headquartered at The Spiral (New York City), The Spiral in Manhattan, New York City. Founded in 184 ...

, and Verizon Communications replaced AT&T Corporation

AT&T Corporation, an abbreviation for its former name, the American Telephone and Telegraph Company, was an American telecommunications company that provided voice, video, data, and Internet telecommunications and professional services to busi ...

, Kodak, and International Paper.

* On February 19, 2008, Chevron Corporation and Bank of America

The Bank of America Corporation (Bank of America) (often abbreviated BofA or BoA) is an American multinational investment banking, investment bank and financial services holding company headquartered at the Bank of America Corporate Center in ...

replaced Altria Group and Honeywell

Honeywell International Inc. is an American publicly traded, multinational conglomerate corporation headquartered in Charlotte, North Carolina. It primarily operates in four areas of business: aerospace, building automation, industrial automa ...

. Chevron was previously a Dow component from July 18, 1930, to November 1, 1999. During Chevron's absence, its split-adjusted price per share went from $44 to $85, while the price of petroleum rose from $24 to $100 per barrel.

* On September 22, 2008, Kraft Foods Inc. replaced American International Group (AIG) in the index.

* On June 8, 2009, The Travelers Companies

The Travelers Companies, Inc., commonly known as Travelers, is an American multinational insurance company. It is the second-largest writer of U.S. commercial property casualty insurance, and the sixth-largest writer of U.S. personal insurance t ...

and Cisco Systems

Cisco Systems, Inc. (using the trademark Cisco) is an American multinational corporation, multinational digital communications technology conglomerate (company), conglomerate corporation headquartered in San Jose, California. Cisco develops, m ...

replaced Motors Liquidation Company (formerly General Motors

General Motors Company (GM) is an American Multinational corporation, multinational Automotive industry, automotive manufacturing company headquartered in Detroit, Michigan, United States. The company is most known for owning and manufacturing f ...

) and Citigroup

Citigroup Inc. or Citi (Style (visual arts), stylized as citi) is an American multinational investment banking, investment bank and financial services company based in New York City. The company was formed in 1998 by the merger of Citicorp, t ...

. Cisco became the third company traded on the NASDAQ to be part of the Dow.

* On September 24, 2012, UnitedHealth Group

UnitedHealth Group Incorporated is an American Multinational corporation, multinational for-profit company specializing in health insurance and health care services based in Eden Prairie, Minnesota. Selling insurance products under UnitedHealth ...

replaced Kraft Foods Inc. following Kraft's split into Mondelez International and Kraft Foods

Kraft Foods Group, Inc. was an American food manufacturing and processing conglomerate (company), conglomerate, split from Kraft Foods Inc. on October 1, 2012, and was headquartered in Chicago, Illinois. It became part of Kraft Heinz on July ...

.

* On September 23, 2013, Goldman Sachs

The Goldman Sachs Group, Inc. ( ) is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered in Lower Manhattan in New York City, with regional headquarters in many internationa ...

, Nike, Inc., and Visa Inc. replaced Alcoa, Bank of America

The Bank of America Corporation (Bank of America) (often abbreviated BofA or BoA) is an American multinational investment banking, investment bank and financial services holding company headquartered at the Bank of America Corporate Center in ...

, and Hewlett-Packard

The Hewlett-Packard Company, commonly shortened to Hewlett-Packard ( ) or HP, was an American multinational information technology company. It was founded by Bill Hewlett and David Packard in 1939 in a one-car garage in Palo Alto, California ...

. Visa replaced Hewlett-Packard because of the split into HP Inc. and Hewlett Packard Enterprise.

* On March 19, 2015, Apple Inc. replaced AT&T

AT&T Inc., an abbreviation for its predecessor's former name, the American Telephone and Telegraph Company, is an American multinational telecommunications holding company headquartered at Whitacre Tower in Downtown Dallas, Texas. It is the w ...

, which had been a component of the DJIA since November 1916. Apple became the fourth company traded on the NASDAQ to be part of the Dow.

* On September 1, 2017, DowDuPont replaced DuPont

Dupont, DuPont, Du Pont, duPont, or du Pont may refer to:

People

* Dupont (surname) Dupont, also spelled as DuPont, duPont, Du Pont, or du Pont is a French surname meaning "of the bridge", historically indicating that the holder of the surname re ...

. DowDuPont was formed by the merger of Dow Chemical Company with DuPont.

* On June 26, 2018, Walgreens Boots Alliance replaced General Electric

General Electric Company (GE) was an American Multinational corporation, multinational Conglomerate (company), conglomerate founded in 1892, incorporated in the New York (state), state of New York and headquartered in Boston.

Over the year ...

, which had been a component of the DJIA since November 1907, after being part of the inaugural index in May 1896 and much of the 1896 to 1907 period.

* On April 2, 2019, Dow Inc. replaced DowDuPont. Dow, Inc. is a spin-off of DowDuPont, itself a merger of Dow Chemical Company and DuPont

Dupont, DuPont, Du Pont, duPont, or du Pont may refer to:

People

* Dupont (surname) Dupont, also spelled as DuPont, duPont, Du Pont, or du Pont is a French surname meaning "of the bridge", historically indicating that the holder of the surname re ...

.

* On April 6, 2020, Raytheon Technologies replaced United Technologies

United Technologies Corporation (UTC) was an American multinational corporation, multinational list of conglomerates, conglomerate headquartered in Farmington, Connecticut. It researched, developed, and manufactured products in numerous are ...

. Raytheon is the name of the combination of United Technologies and the Raytheon Company

Raytheon is a business unit of RTX Corporation and is a major List of United States defense contractors, U.S. defense contractor and industrial corporation with manufacturing concentrations in weapons and military and commercial electronics. Fou ...

, which merged as of April 3, 2020. The newly combined conglomerate does not include previous subsidiaries Carrier Global or Otis Worldwide.

* On August 31, 2020, Amgen, Honeywell

Honeywell International Inc. is an American publicly traded, multinational conglomerate corporation headquartered in Charlotte, North Carolina. It primarily operates in four areas of business: aerospace, building automation, industrial automa ...

, and Salesforce.com replaced ExxonMobil

Exxon Mobil Corporation ( ) is an American multinational List of oil exploration and production companies, oil and gas corporation headquartered in Spring, Texas, a suburb of Houston. Founded as the Successors of Standard Oil, largest direct s ...

, Pfizer

Pfizer Inc. ( ) is an American Multinational corporation, multinational Pharmaceutical industry, pharmaceutical and biotechnology corporation headquartered at The Spiral (New York City), The Spiral in Manhattan, New York City. Founded in 184 ...

, and Raytheon Technologies.

* On February 26, 2024, Amazon

Amazon most often refers to:

* Amazon River, in South America

* Amazon rainforest, a rainforest covering most of the Amazon basin

* Amazon (company), an American multinational technology company

* Amazons, a tribe of female warriors in Greek myth ...

replaced Walgreens Boots Alliance.

* On November 8, 2024, Nvidia

Nvidia Corporation ( ) is an American multinational corporation and technology company headquartered in Santa Clara, California, and incorporated in Delaware. Founded in 1993 by Jensen Huang (president and CEO), Chris Malachowsky, and Curti ...

replaced Intel

Intel Corporation is an American multinational corporation and technology company headquartered in Santa Clara, California, and Delaware General Corporation Law, incorporated in Delaware. Intel designs, manufactures, and sells computer compo ...

, and Sherwin-Williams replaced Dow Inc.

Investment methods

Investing in the DJIA is possible viaindex fund

An index fund (also index tracker) is a mutual fund or exchange-traded fund (ETF) designed to follow certain preset rules so that it can replicate the performance of a specified basket of underlying investments.

The main advantage of index fun ...

s as well as via derivatives such as option contracts and futures contract

In finance, a futures contract (sometimes called futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The item tr ...

s.

Mutual and exchange-traded funds

Index fund

An index fund (also index tracker) is a mutual fund or exchange-traded fund (ETF) designed to follow certain preset rules so that it can replicate the performance of a specified basket of underlying investments.

The main advantage of index fun ...

s, including mutual fund

A mutual fund is an investment fund that pools money from many investors to purchase Security (finance), securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV in ...

s and exchange-traded fund

An exchange-traded fund (ETF) is a type of investment fund that is also an exchange-traded product, i.e., it is traded on stock exchanges. ETFs own financial assets such as stocks, bonds, currencies, debts, futures contracts, and/or comm ...

s (ETF) can replicate, before fees and expenses, the performance of the index by holding the same stocks as the index in the same proportions. An ETF that replicates the performance of the index is issued by State Street Corporation ().

ProShares offers leveraged ETFs that attempt to produce three times the daily result of either investing in () or shorting () the Dow Jones Industrial Average.

Futures contracts

In the derivatives market, the CME Group through its subsidiaries theChicago Mercantile Exchange

The Chicago Mercantile Exchange (CME) (often called "the Chicago Merc", or "the Merc") is an American derivatives marketplace based in Chicago and located at 20 S. Wacker Drive. The CME was founded in 1898 as the Chicago Butter and Egg Board ...

(CME) and the Chicago Board of Trade (CBOT), issues Futures Contracts; thE-mini Dow ($5) Futures (YM)

which track the average and trade on their exchange floors respectively. Trading is typically carried out in an open outcry auction, or over an electronic network such as CME's Globex platform.

Options contracts

The Chicago Board Options Exchange (CBOE) issues option contracts on the Dow through the root symbol DJX. Options on various Dow-underlying ETFs are also available for trading.Annual returns

The following table shows the annual development of the Dow Jones Index, which was calculated back to 1896.History

Precursor

In 1884,

In 1884, Charles Dow

Charles Henry Dow (; November 6, 1851 – December 4, 1902) was an American journalist who co-founded Dow Jones & Company with Edward Jones and Charles Bergstresser.

Dow also co-founded ''The Wall Street Journal'', which has become one of th ...

composed his first stock average, which contained nine railroads and two industrial companies that appeared in the ''Customer's Afternoon Letter'', a daily two-page financial news bulletin which was the precursor to ''The Wall Street Journal

''The Wall Street Journal'' (''WSJ''), also referred to simply as the ''Journal,'' is an American newspaper based in New York City. The newspaper provides extensive coverage of news, especially business and finance. It operates on a subscriptio ...

''. On January 2, 1886, the number of stocks represented in what is now the ''Dow Jones Transportation Average'' dropped from 14 to 12, as the Central Pacific Railroad and Central Railroad of New Jersey were removed. Though comprising the same number of stocks, this index contained only one of the original twelve industrials that would eventually form Dow's most famous index.

Initial components

Dow calculated his first average purely of industrial stocks on May 26, 1896, creating what is now known as the ''Dow Jones Industrial Average''. None of the original 12 industrials still remain part of the index. * American Cotton Oil Company, a predecessor company to Hellmann's and Best Foods, now part ofUnilever

Unilever PLC () is a British multinational consumer packaged goods company headquartered in London, England. It was founded on 2 September 1929 following the merger of Dutch margarine producer Margarine Unie with British soap maker Lever B ...

.

* American Sugar Refining Company

The American Sugar Refining Company (ASR) was the most significant American business unit in the sugar refining industry in the early 1900s. It had interests in Puerto Rico and other Caribbean locations and operated one of the world's largest s ...

, became Domino Sugar in 1900, now Domino Foods, Inc.

* American Tobacco Company, broken up in a 1911 antitrust

Competition law is the field of law that promotes or seeks to maintain market competition by regulating anti-competitive conduct by companies. Competition law is implemented through public and private enforcement. It is also known as antitrust l ...

action.

* Chicago Gas Company, bought by Peoples Gas Light in 1897, was an operating subsidiary of the now-defunct Integrys Energy Group until 2014.

* Distilling & Cattle Feeding Company, now Millennium Chemicals, formerly a division of LyondellBasell.

* General Electric

General Electric Company (GE) was an American Multinational corporation, multinational Conglomerate (company), conglomerate founded in 1892, incorporated in the New York (state), state of New York and headquartered in Boston.

Over the year ...

, still in operation, removed from the Dow Jones Industrial Average in 2018.

* Laclede Gas Company, still in operation as Spire Inc, removed from the Dow Jones Industrial Average in 1899.

* National Lead Company, now NL Industries, removed from the Dow Jones Industrial Average in 1916.

* North American Company, an electric utility

An electric utility, or a power company, is a company in the electric power industry (often a public utility) that engages in electricity generation and distribution of electricity for sale generally in a regulated market. Electric utilities are ...

holding company

A holding company is a company whose primary business is holding a controlling interest in the Security (finance), securities of other companies. A holding company usually does not produce goods or services itself. Its purpose is to own Share ...

, broken up by the U.S. Securities and Exchange Commission (SEC) in 1946.

* Tennessee Coal, Iron and Railroad Company in Birmingham, Alabama

Birmingham ( ) is a city in the north central region of Alabama, United States. It is the county seat of Jefferson County, Alabama, Jefferson County. The population was 200,733 at the 2020 United States census, 2020 census, making it the List ...

, bought by U.S. Steel in 1907; U.S. Steel was removed from the Dow Jones Industrial Average in 1991.

* United States Leather Company, dissolved in 1952.

* United States Rubber Company, changed its name to Uniroyal in 1961, merged with private Goodrich Corporation

The Goodrich Corporation, formerly the B.F. Goodrich Company, was an American manufacturing company based in Charlotte, North Carolina. Founded in Akron, Ohio in 1870 as Goodrich, Tew & Co. by Benjamin Goodrich, Dr. Benjamin Franklin Go ...

in 1986, tire business bought by Michelin

Michelin ( , ), in full ("General Company of the Michelin Enterprises P.L.S."), is a French multinational tyre manufacturing company based in Clermont-Ferrand in the Auvergne-Rhône-Alpes '' région'' of France. It is the second largest t ...

in 1990. The remainder of Goodrich remained independent until it was acquired by United Technologies

United Technologies Corporation (UTC) was an American multinational corporation, multinational list of conglomerates, conglomerate headquartered in Farmington, Connecticut. It researched, developed, and manufactured products in numerous are ...

in 2012 and became a part of UTC Aerospace Systems, now Collins Aerospace

Collins Aerospace is an American technology company that is one of the world's largest suppliers of aerospace and defense products. It was formed in 2018 from the merger of Rockwell Collins and UTC Aerospace Systems. Headquartered in Charlotte, ...

, a Raytheon Technologies subsidiary.

Early years

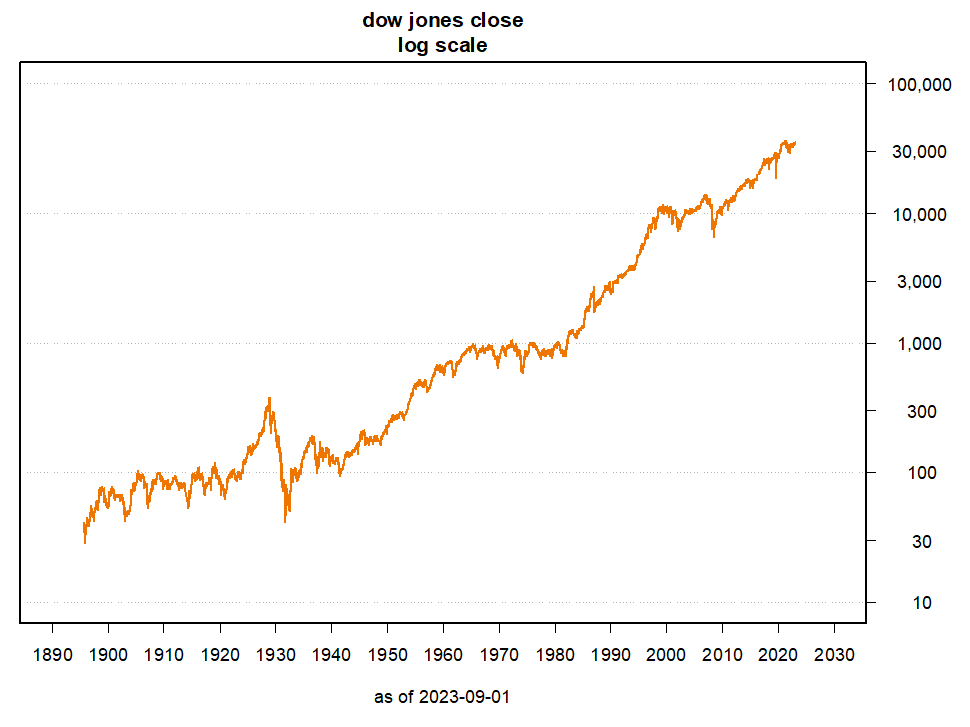

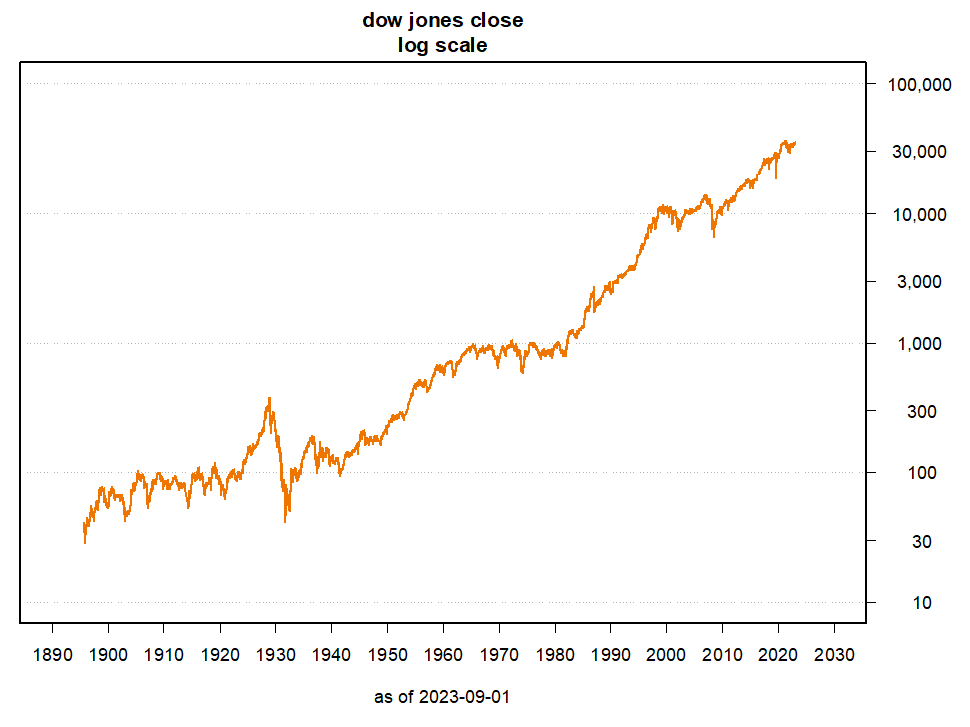

When it was first published in the mid-1880s, the index stood at a level of 62.76. It reached a peak of 78.38 during the summer of 1890, but reached its all-time low of 28.48 in the summer of 1896 during the Panic of 1896. Many of the biggest percentage price moves in the Dow occurred early in its history, as the nascent industrial economy matured. In the 1900s, the Dow halted its momentum as it worked its way through two financial crises: the Panic of 1901 and the Panic of 1907. The Dow remained stuck in a range between 53 and 103 until late 1914. The negativity surrounding the1906 San Francisco earthquake

At 05:12 AM Pacific Time Zone, Pacific Standard Time on Wednesday, April 18, 1906, the coast of Northern California was struck by a major earthquake with an estimated Moment magnitude scale, moment magnitude of 7.9 and a maximum Mercalli inte ...

did little to improve the economic climate; the index broke 100 for the first time in 1906.

At the start of the 1910s, the Panic of 1910–1911 stifled economic growth. On July 30, 1914, as the average stood at a level of 71.42, a decision was made to close the New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District, Manhattan, Financial District of Lower Manhattan in New York City. It is the List of stock exchanges, largest stock excha ...

, and suspend trading for a span of four and a half months. Some historians believe the exchange was closed because of a concern that markets would plunge as a result of panic over the onset of World War I

World War I or the First World War (28 July 1914 – 11 November 1918), also known as the Great War, was a World war, global conflict between two coalitions: the Allies of World War I, Allies (or Entente) and the Central Powers. Fighting to ...

. An alternative explanation is that the United States Secretary of the Treasury

The United States secretary of the treasury is the head of the United States Department of the Treasury, and is the chief financial officer of the federal government of the United States. The secretary of the treasury serves as the principal a ...

, William Gibbs McAdoo, closed the exchange to conserve the U.S. gold stock in order to launch the Federal Reserve System

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of ...

later that year, with enough gold to keep the United States on par with the gold standard

A gold standard is a backed currency, monetary system in which the standard economics, economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the ...

. When the markets reopened on December 12, 1914, the index closed at 74.56, a gain of 4.4%. This is frequently reported as a large drop, due to using a later redefinition. Reports from the time say that the day was positive. Following World War I, the United States experienced another economic downturn, the Post–World War I recession. The Dow's performance remained unchanged from the closing value of the previous decade, adding only 8.26%, from 99.05 at the beginning of 1910, to a level of 107.23 at the end of 1919.

The Dow experienced a long bull run from 1920 to late 1929 when it rose from 73 to 381 points.Dow Jones Closing Prices 1921 to 1930. Automationinformation.com. In 1928, the components of the Dow were increased to 30 stocks near the economic height of that decade, which was nicknamed the

Roaring Twenties

The Roaring Twenties, sometimes stylized as Roaring '20s, refers to the 1920s decade in music and fashion, as it happened in Western world, Western society and Western culture. It was a period of economic prosperity with a distinctive cultura ...

. This period downplayed the influence of the Depression of 1920–1921 and certain international conflicts such as the Polish–Soviet War

The Polish–Soviet War (14 February 1919 – 18 March 1921) was fought primarily between the Second Polish Republic and the Russian Soviet Federative Socialist Republic, following World War I and the Russian Revolution.

After the collapse ...

, the Irish Civil War

The Irish Civil War (; 28 June 1922 – 24 May 1923) was a conflict that followed the Irish War of Independence and accompanied the establishment of the Irish Free State, an entity independent from the United Kingdom but within the British Emp ...

, the Turkish War of Independence

, strength1 = May 1919: 35,000November 1920: 86,000Turkish General Staff, ''Türk İstiklal Harbinde Batı Cephesi'', Edition II, Part 2, Ankara 1999, p. 225August 1922: 271,000Celâl Erikan, Rıdvan Akın: ''Kurtuluş Savaşı tarih ...

and the initial phase of the Chinese Civil War

The Chinese Civil War was fought between the Kuomintang-led Nationalist government, government of the Republic of China (1912–1949), Republic of China and the forces of the Chinese Communist Party (CCP). Armed conflict continued intermitt ...

. After a peak of 381.17 on September 3, 1929, the bottom of the 1929 crash came just 2 months later on November 13, 1929, at 195.35 intraday, closing slightly higher at 198.69. The Wall Street Crash of 1929 and the ensuing Great Depression

The Great Depression was a severe global economic downturn from 1929 to 1939. The period was characterized by high rates of unemployment and poverty, drastic reductions in industrial production and international trade, and widespread bank and ...

over the next several years saw the Dow continue to fall until July 8, 1932, when it closed at 41.22, roughly two-thirds of its mid-1880s starting point and almost 90% below its peak. Overall for the 1920s decade, the Dow still ended with a healthy 131.7% gain, from 107.23 to 248.48 at the end of 1929. In inflation-adjusted numbers, the high of 381.17 on September 3, 1929, was not surpassed until 1954.

Marked by global instability and the Great Depression, the 1930s contended with several consequential European and Asian outbreaks of war, leading to the catastrophic World War II

World War II or the Second World War (1 September 1939 – 2 September 1945) was a World war, global conflict between two coalitions: the Allies of World War II, Allies and the Axis powers. World War II by country, Nearly all of the wo ...

in 1939. Other conflicts during the decade which affected the stock market included the 1936–1939 Spanish Civil War

The Spanish Civil War () was a military conflict fought from 1936 to 1939 between the Republican faction (Spanish Civil War), Republicans and the Nationalist faction (Spanish Civil War), Nationalists. Republicans were loyal to the Left-wing p ...

, the 1935–1936 Second Italo-Abyssinian War

The Second Italo-Ethiopian War, also referred to as the Second Italo-Abyssinian War, was a war of aggression waged by Italy against Ethiopia, which lasted from October 1935 to February 1937. In Ethiopia it is often referred to simply as the Ita ...

, the Soviet-Japanese Border War of 1939, and the Second Sino-Japanese War

The Second Sino-Japanese War was fought between the Republic of China (1912–1949), Republic of China and the Empire of Japan between 1937 and 1945, following a period of war localized to Manchuria that started in 1931. It is considered part ...

of 1937. The United States experienced the Recession of 1937–1938, which temporarily brought economic recovery to a halt. The largest one-day percentage gain in the index happened in the depths of the 1930s bear market on March 15, 1933, when the Dow gained 15.34% to close at 62.10. However, as a whole throughout the Great Depression, the Dow posted some of its worst performances, for a negative return during most of the 1930s for new and old stock market investors. For the decade, the Dow Jones average was down from 248.48 at the beginning of 1930, to a stable level of 150.24 at the end of 1939, a loss of about 40%.

1940s

Post-war reconstruction during the 1940s, along with renewed optimism of peace and prosperity, brought about a 33% surge in the Dow from 150.24 to 200.13. The strength in the Dow occurred despite the Recession of 1949 and various global conflicts.1950s

During the 1950s, theKorean War

The Korean War (25 June 1950 – 27 July 1953) was an armed conflict on the Korean Peninsula fought between North Korea (Democratic People's Republic of Korea; DPRK) and South Korea (Republic of Korea; ROK) and their allies. North Korea was s ...

and the Cold War

The Cold War was a period of global Geopolitics, geopolitical rivalry between the United States (US) and the Soviet Union (USSR) and their respective allies, the capitalist Western Bloc and communist Eastern Bloc, which lasted from 1947 unt ...

did not stop the Dow's climb higher. A nearly 240% increase in the average from 200.13 to 679.36 ensued over the course of that decade.

1960s

The Dow began to stall during the 1960s as the markets trudged through the Kennedy Slide of 1962, but still managed an 18% gain from 679.36 to 800.36.1970s

The 1970s marked a time of economic uncertainty and troubled relations between the U.S. and certain Middle-Eastern countries. The1970s energy crisis

The 1970s energy crisis occurred when the Western world, particularly the United States, Canada, Western Europe, Australia, and New Zealand, faced substantial petroleum shortages as well as elevated prices. The two worst crises of this period wer ...

was a prelude to a disastrous economic climate along with stagflation, the combination of high unemployment and high inflation. However, on November 14, 1972, the average closed at 1,003.16, above the 1,000 mark for the first time, during a brief relief rally in the midst of a lengthy bear market. Between January 1973 and December 1974, the average lost 48% of its value in what became known as the 1973–1974 stock market crash, closing at 577.60 on December 6, 1974. The nadir came after prices dropped more than 45% over two years since the NYSE's high point of 1,003.16 on November 4, 1972. In 1976, the index reached 1,000 several times and it closed the year at 1,004.75. Although the Vietnam War

The Vietnam War (1 November 1955 – 30 April 1975) was an armed conflict in Vietnam, Laos, and Cambodia fought between North Vietnam (Democratic Republic of Vietnam) and South Vietnam (Republic of Vietnam) and their allies. North Vietnam w ...

ended in 1975, new tensions arose towards Iran

Iran, officially the Islamic Republic of Iran (IRI) and also known as Persia, is a country in West Asia. It borders Iraq to the west, Turkey, Azerbaijan, and Armenia to the northwest, the Caspian Sea to the north, Turkmenistan to the nort ...

surrounding the Iranian Revolution

The Iranian Revolution (, ), also known as the 1979 Revolution, or the Islamic Revolution of 1979 (, ) was a series of events that culminated in the overthrow of the Pahlavi dynasty in 1979. The revolution led to the replacement of the Impe ...

in 1979. Performance-wise for the 1970s, the index remained virtually flat, rising 4.8% from 800.36 to 838.74.

1980s

Friday the 13th mini-crash

The Friday the 13th mini-crash, or Black Friday, was a stock market crash that occurred on Friday, October 13, 1989. The crash was apparently caused by a reaction to a news story of the breakdown of a $6.75 billion leveraged buyout deal for UAL ...

, which initiated the collapse of the junk bond

In finance, a high-yield bond (non-investment-grade bond, speculative-grade bond, or junk bond) is a bond that is rated below investment grade by credit rating agencies. These bonds have a higher risk of default or other adverse credit eve ...

market, resulted in a loss of almost 7% of the index in a single day.

During the 1980s, the Dow increased 228% from 838.74 to 2,753.20; despite the market crashes, Silver Thursday, an early 1980s recession, the 1980s oil glut, the Japanese asset price bubble, and other political distractions. The index had only two negative years in the 1980s: in 1981 and 1984.

1990s

The 1990s brought on rapid advances in technology along with the introduction of the dot-com era. The markets contended with the 1990 oil price shock compounded with the effects of the early 1990s recession and a brief European situation surrounding Black Wednesday. Certain influential foreign conflicts such as the1991 Soviet coup d'état attempt

The 1991 Soviet coup attempt, also known as the August Coup, was a failed attempt by hardliners of the Communist Party of the Soviet Union (CPSU) to Coup d'état, forcibly seize control of the country from Mikhail Gorbachev, who was President ...

which took place as part of the initial stages of the Dissolution of the Soviet Union

The Soviet Union was formally dissolved as a sovereign state and subject of international law on 26 December 1991 by Declaration No. 142-N of the Soviet of the Republics of the Supreme Soviet of the Soviet Union. Declaration No. 142-Н of ...

and the Revolutions of 1989

The revolutions of 1989, also known as the Fall of Communism, were a revolutionary wave of liberal democracy movements that resulted in the collapse of most Communist state, Marxist–Leninist governments in the Eastern Bloc and other parts ...

; the First Chechen War

The First Chechen War, also referred to as the First Russo-Chechen War, was a struggle for independence waged by the Chechen Republic of Ichkeria against the invading Russia, Russian Federation from 1994 to 1996. After a mutually agreed on treaty ...

and the Second Chechen War, the Gulf War

, combatant2 =

, commander1 =

, commander2 =

, strength1 = Over 950,000 soldiers3,113 tanks1,800 aircraft2,200 artillery systems

, page = https://www.govinfo.gov/content/pkg/GAOREPORTS-PEMD-96- ...

, and the Yugoslav Wars

The Yugoslav Wars were a series of separate but related#Naimark, Naimark (2003), p. xvii. ethnic conflicts, wars of independence, and Insurgency, insurgencies that took place from 1991 to 2001 in what had been the Socialist Federal Republic of ...

failed to dampen economic enthusiasm surrounding the ongoing Information Age

The Information Age is a historical period that began in the mid-20th century. It is characterized by a rapid shift from traditional industries, as established during the Industrial Revolution, to an economy centered on information technology ...

and the " irrational exuberance" (a phrase coined by Alan Greenspan) of the dot-com bubble

The dot-com bubble (or dot-com boom) was a stock market bubble that ballooned during the late-1990s and peaked on Friday, March 10, 2000. This period of market growth coincided with the widespread adoption of the World Wide Web and the Interne ...

. Between late 1992 and early 1993, the Dow staggered through the 3,000 level making only modest gains as the biotechnology

Biotechnology is a multidisciplinary field that involves the integration of natural sciences and Engineering Science, engineering sciences in order to achieve the application of organisms and parts thereof for products and services. Specialists ...

sector suffered through the downfall of the Biotech Bubble; as many biotech companies saw their share prices rapidly rise to record levels and then subsequently fall to new all-time lows.

The Dow soared from 2,753 to 8,000 between January 1990 to July 1997. In October 1997, the events surrounding the 1997 Asian financial crisis

The 1997 Asian financial crisis gripped much of East Asia, East and Southeast Asia during the late 1990s. The crisis began in Thailand in July 1997 before spreading to several other countries with a ripple effect, raising fears of a worldwide eco ...

plunged the Dow into a 554-point loss to a close of 7,161.15; a retrenchment of 7.18% in what became known as the October 27, 1997 mini-crash.

However, the Dow continued climbing past 9,000 despite negativity surrounding the 1998 Russian financial crisis

The Russian financial crisis (also called the ruble crisis or the Russian flu) began in Russia on 17 August 1998. It resulted in the Russian government and the Russian Central Bank devaluing the Russian rouble, ruble and sovereign default, defau ...

along with the subsequent fallout from the 1998 collapse of Long-Term Capital Management

Long-Term Capital Management L.P. (LTCM) was a highly leveraged hedge fund. In 1998, it received a $3.6 billion bailout from a group of 14 banks, in a deal brokered and put together by the Federal Reserve Bank of New York.

LTCM was founded in ...

due to bad bets placed on the movement of the Russian ruble

The ruble or rouble (; Currency symbol, symbol: ₽; ISO 4217, ISO code: RUB) is the currency of the Russia, Russian Federation. Banknotes and coins are issued by the Central Bank of Russia, which is Russia's central bank, monetary authority ind ...

.

On March 29, 1999, the average closed at 10,006.78, its first close above 10,000. This prompted a celebration on the New York Stock Exchange trading floor, complete with party hats. Total gains for the decade exceeded 315%; from 2,753.20 to 11,497.12, which equates to 12.3% annually.

The Dow averaged a 5.3% return compounded annually for the 20th century, a record Warren Buffett called "a wonderful century"; when he calculated that to achieve that return again, the index would need to close at about 2,000,000 by December 2099.

2000s

September 11 attacks

The September 11 attacks, also known as 9/11, were four coordinated Islamist terrorist suicide attacks by al-Qaeda against the United States in 2001. Nineteen terrorists hijacked four commercial airliners, crashing the first two into ...

on the United States, the Dow fell 7.1%. However, the Dow began an upward trend shortly after the attacks, and regained all lost ground to close above 10,000 for the year. In 2002, the Dow dropped to a four-year low of 7,286 on September 24, 2002, due to the stock market downturn of 2002 and lingering effects of the dot-com bubble

The dot-com bubble (or dot-com boom) was a stock market bubble that ballooned during the late-1990s and peaked on Friday, March 10, 2000. This period of market growth coincided with the widespread adoption of the World Wide Web and the Interne ...

. Overall, while the NASDAQ index fell roughly 75% and the S&P 500 index fell roughly 50% between 2000 and 2002, the Dow only fell 27% during the same period. In 2003, the Dow held steady within the 7,000 to 9,000-point level and recovered to the 10,000 mark by year end.

The Dow continued climbing and reached a record high of 14,198.10 on October 11, 2007, a mark which was not matched until March 2013. It then dropped over the next year due to the 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

.

On September 15, 2008, a wider financial crisis

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with Bank run#Systemic banki ...

became evident after the Bankruptcy of Lehman Brothers

The bankruptcy of Lehman Brothers, also known as the Crash of '08 and the Lehman Shock, on September 15, 2008, was the climax of the subprime mortgage crisis. After the financial services firm was notified of a pending credit downgrade due to i ...

along with the economic effect of record high oil prices which had reached almost $150 per barrel

A barrel or cask is a hollow cylindrical container with a bulging center, longer than it is wide. They are traditionally made of wooden stave (wood), staves and bound by wooden or metal hoops. The word vat is often used for large containers ...

two months earlier. The Dow lost more than 500 points for the day, returning to its mid-July lows below 11,000. A series of bailout

A bailout is the provision of financial help to a corporation or country which otherwise would be on the brink of bankruptcy. A bailout differs from the term ''bail-in'' (coined in 2010) under which the bondholders or depositors of global syst ...

packages, including the Emergency Economic Stabilization Act of 2008, proposed and implemented by the Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of ...

and United States Department of the Treasury

The Department of the Treasury (USDT) is the Treasury, national treasury and finance department of the federal government of the United States. It is one of 15 current United States federal executive departments, U.S. government departments.

...

did not prevent further losses. After nearly six months of extreme volatility during which the Dow experienced its largest one-day point loss, largest daily point gain, and largest intraday range (of more than 1,000 points) at the time, the index closed at a new 12-year low of 6,547.05 on March 9, 2009, its lowest close since April 1997. The Dow had lost 20% of its value in only six weeks.

Towards the latter half of 2009, the average rallied towards the 10,000 level amid optimism that the Great Recession

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009.

, the United States housing bubble and the 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

, were easing and possibly coming to an end. For the decade, the Dow saw a rather substantial pullback for a negative return from 11,497.12 to 10,428.05, a loss of a 9.3%.

2010s

During the first half of the 2010s decade, aided by theFederal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of ...

's loose monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability (normally interpreted as a low and stable rat ...

including quantitative easing, the Dow made a notable rally attempt. This was despite significant volatility due to growing global concerns such as the European debt crisis

The euro area crisis, often also referred to as the eurozone crisis, European debt crisis, or European sovereign debt crisis, was a multi-year debt crisis and financial crisis in the European Union (EU) from 2009 until, in Greece, 2018. The e ...

, the Dubai World

Dubai World () is an investment company that manages and supervises a portfolio of businesses and projects for the Government of Dubai across a wide range of industry segments and projects that promote Dubai as a hub for commerce and trading. A ...

2009 debt standstill, and the 2011 United States debt-ceiling crisis.

On May 6, 2010, the Dow lost 9.2% intra-day and regained nearly all of it within a single hour. This event, which became known as the 2010 Flash Crash, sparked new regulations to prevent future incidents.

Six years after its previous high in 2007, the Dow finally closed at a new record high on March 5, 2013. It continued rising for the next several years past 17,000 points until a brief 2015–2016 stock market selloff in the second half of 2015. It then picked up again in early 2016 and climbed past 25,000 points on January 4, 2018.

On November 9, 2016, the day after Donald Trump

Donald John Trump (born June 14, 1946) is an American politician, media personality, and businessman who is the 47th president of the United States. A member of the Republican Party (United States), Republican Party, he served as the 45 ...

's victory over Hillary Clinton

Hillary Diane Rodham Clinton ( Rodham; born October 26, 1947) is an American politician, lawyer and diplomat. She was the 67th United States secretary of state in the administration of Barack Obama from 2009 to 2013, a U.S. senator represent ...

in the U.S. presidential election, the index soared, coming within roughly 25 points of its all-time intraday high to that point.

Volatility returned in 2018 when the Dow fell nearly 20%. By early January 2019, the index had quickly rallied more than 10% from its Christmas Eve low.

Overall in the 2010s decade, the Dow increased from 10,428.05 to 28,538.44 for a substantial gain of 174%.

2020s

Despite the emerging

Despite the emerging COVID-19 pandemic

The COVID-19 pandemic (also known as the coronavirus pandemic and COVID pandemic), caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), began with an disease outbreak, outbreak of COVID-19 in Wuhan, China, in December ...

, the Dow continued its bull run from the previous decade before peaking at 29,551.42 on February 12, 2020 (29,568.57 intraday on the same day). The index slowly retreated for the remainder of the week and into the next week, before coronavirus fears and an oil price war between Saudi Arabia and Russia sent the index into a tailspin, recording several days of losses (and gains) of at least 1,000 points, a typical symptom of a bear market as previously seen in October 2008 during the 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

. Volatility rose high enough to trigger multiple 15-minute trading halts. In the first quarter of 2020, the DJIA fell 23%, its worst quarter since 1987. The market recovered in the third quarter, returning to 28,837.52 on October 12, 2020, and peaked momentarily at a new all-time high of 29,675.25 on November 9, 2020, at 14:00 ET, following that day's announcement of the success of the Pfizer–BioNTech COVID-19 vaccine in Phase III clinical trials. The Dow (as reported by the United Press International) closed over 30,000 on December 31, 2020, at a record 30,606.48. On November 24, following news that the presidential transition of Joe Biden was approved, the Dow increased by more than 500 points, closing at 30,046.24. On January 22, 2024, the Dow Jones crossed 38,000 points for the first time; a month later it surpassed 39,000; and in May, it surpassed 40,000 points.

Computation

The DJIA is computed as the sum of the prices of all thirty stocks divided by adivisor

In mathematics, a divisor of an integer n, also called a factor of n, is an integer m that may be multiplied by some integer to produce n. In this case, one also says that n is a '' multiple'' of m. An integer n is divisible or evenly divisibl ...

, the Dow Divisor. The divisor is adjusted in case of stock splits, spinoffs or similar structural changes, to ensure that such events do not in themselves alter the numerical value of the DJIA. Early on, the initial divisor was composed of the original number of component companies; this initially made the DJIA a simple arithmetic

Arithmetic is an elementary branch of mathematics that deals with numerical operations like addition, subtraction, multiplication, and division. In a wider sense, it also includes exponentiation, extraction of roots, and taking logarithms.

...

average. The present divisor, after many adjustments, is less than one, making the index larger than the sum of the prices of the components. That is:

:

where ''p'' are the prices of the component stocks and ''d'' is the ''Dow Divisor''.

Events such as stock split

A stock split or stock divide increases the number of shares in a company. For example, after a 2-for-1 split, each investor will own double the number of shares, and each share will be worth half as much.

A stock split causes a decrease of mar ...

s or changes in the list of the companies composing the index alter the sum of the component prices. In these cases, in order to avoid discontinuity in the index, the Dow Divisor is updated so that the quotations right before and after the event coincide:

:

the Dow Divisor is 0.16268413125742 and every $1 change in price in a particular stock within the average equates to a 6.146881 (or 1 ÷ 0.16268413125742) point movement.

Assessment

Quality as a proxy of the stock market

Despite its unusual weighting by price rather than market capitalization, the Dow Jones Industrial Average is highly correlated with other proxies of the US equities market, particularly the S&P 500 Index. Between , the DJIA returned an annualized 8.90%, with the S&P 500 returning a nearly identical 8.91%.Issues with market representation

With the inclusion of only 30 stocks, critics such asRic Edelman

Fredric Mark "Ric" Edelman is an American investor and author. He is the founder of Edelman Financial Services (later, Edelman Financial Engines), the author of several personal finance books, and the host of a weekly personal finance talk rad ...

argue that the DJIA is an inaccurate representation of overall market performance compared to more comprehensive indices such as the S&P 500 Index or the Russell 3000 Index. Additionally, the DJIA is criticized for being a price-weighted index, which gives higher-priced stocks more influence over the average than their lower-priced counterparts, but takes no account of the relative industry size or market capitalization of the components. For example, a $1 increase in a lower-priced stock can be negated by a $1 decrease in a much higher-priced stock, even though the lower-priced stock experienced a larger percentage

In mathematics, a percentage () is a number or ratio expressed as a fraction (mathematics), fraction of 100. It is often Denotation, denoted using the ''percent sign'' (%), although the abbreviations ''pct.'', ''pct'', and sometimes ''pc'' are ...

change. In addition, a $1 move in the smallest component of the DJIA has the same effect as a $1 move in the largest component of the average. For example, during September–October 2008, former component AIG

American International Group, Inc. (AIG) is an American multinational finance and insurance corporation with operations in more than 80 countries and jurisdictions. As of 2023, AIG employed 25,200 people. The company operates through three core ...

's reverse split-adjusted stock price collapsed from $22.76 on September 8 to $1.35 on October 27; contributing to a roughly 3,000-point drop in the index.

Goldman Sachs and UnitedHealth Group are among the highest-priced stocks in the average and therefore have the greatest influence on it. Alternately, Cisco Systems and Coca-Cola are among the lowest-priced stocks in the average and have the least sway in the price movement. Critics of the DJIA and most securities professionals recommend the market-capitalization weighted S&P 500 Index or the Wilshire 5000

The Wilshire 5000 Total Market Index, or more simply the Wilshire 5000, is a market-capitalization-weighted index of the market value of all American stocks actively traded in the United States. As of December 31, 2023, the index contained 3,40 ...

, the latter of which includes most publicly listed U.S. stocks, as better indicators of the U.S. stock market.

Correlation among components

A study between the correlation of components of the Dow Jones Industrial Average compared with the movement of the index finds that the correlation is higher when the stocks are declining. The correlation is lowest in a time when the average is flat or rises a modest amount.See also

* Closing milestones of the Dow Jones Industrial Average *List of largest daily changes in the Dow Jones Industrial Average

This is a list of the largest daily changes in the Dow Jones Industrial Average from 1896. Compare to the list of largest daily changes in the S&P 500 Index.

Largest percentage changes

The first four tables show only the largest one-day chan ...

* William Peter Hamilton

* S&P 500

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 leading companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and in ...

References

Further reading

*External links

* {{Authority control 1896 establishments in the United States American stock market indices Dow Jones & Company S&P Dow Jones Indices