|

Friday The 13th Mini-crash

The Friday the 13th mini-crash was a stock market crash that occurred on Friday, October 13, 1989. The crash, referred to by some as "Black Friday", was apparently caused by a reaction to a news story of the breakdown of a $6.75 billion leveraged buyout deal for UAL Corporation, the parent company of United Airlines. When the UAL deal fell through, it helped trigger the collapse of the junk bond market. The deal unraveled because the Association of Flight Attendants pulled out of the deal when management, in negotiations over an Employee Stock Ownership Plan (ESOP) designed to fund the leveraged buyout, refused to agree to terms. The close Moments after the UAL deal fell through, the indices began their plunge. When the closing bell rang, the Dow Jones Industrial Average had dropped 190.58 points, or 6.91 percent, to 2,569.26; the NASDAQ Composite had shed 14.90 points, or 3.09 percent, to 467.30; and the S&P 500 Index had fallen 21.74 points, or 6.12 percent, to 333.65. The Dow ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Market Crash

A stock market crash is a sudden dramatic decline of stock prices across a major cross-section of a stock market, resulting in a significant loss of paper wealth. Crashes are driven by panic selling and underlying economic factors. They often follow speculation and economic bubbles. A stock market crash is a social phenomenon where external economic events combine with crowd psychology in a positive feedback loop where selling by some market participants drives more market participants to sell. Generally speaking, crashes usually occur under the following conditions: a prolonged period of rising stock prices (a bull market) and excessive economic optimism, a market where price–earnings ratios exceed long-term averages, and extensive use of margin debt and leverage by market participants. Other aspects such as wars, large corporate hacks, changes in federal laws and regulations, and natural disasters within economically productive areas may also influence a significant d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Robert Shiller

Robert James Shiller (born March 29, 1946) is an American economist, academic, and author. As of 2019, he serves as a Sterling Professor of Economics at Yale University and is a fellow at the Yale School of Management's International Center for Finance. Shiller has been a research associate of the National Bureau of Economic Research (NBER) since 1980, was vice president of the American Economic Association in 2005, its president-elect for 2016, and president of the Eastern Economic Association for 2006–2007. He is also the co‑founder and chief economist of the investment management firm MacroMarkets LLC. Shiller was ranked by the ''IDEAS'' RePEc publications monitor in 2008 as among the 100 most influential economists of the world; and was still on the list in 2019. Eugene Fama, Lars Peter Hansen and Shiller jointly received the 2013 Nobel Memorial Prize in Economic Sciences, "for their empirical analysis of asset prices".* Background Shiller was born in Detroit, Mich ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Market Crashes

A stock market crash is a sudden dramatic decline of stock prices across a major cross-section of a stock market, resulting in a significant loss of paper wealth. Crashes are driven by panic selling and underlying economic factors. They often follow speculation and economic bubbles. A stock market crash is a social phenomenon where external economic events combine with crowd psychology in a positive feedback loop where selling by some market participants drives more market participants to sell. Generally speaking, crashes usually occur under the following conditions: a prolonged period of rising stock prices (a bull market) and excessive economic optimism, a market where price–earnings ratios exceed long-term averages, and extensive use of margin debt and leverage by market participants. Other aspects such as wars, large corporate hacks, changes in federal laws and regulations, and natural disasters within economically productive areas may also influence a significant decline ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1989 In The United States

Events from the year 1989 in the United States. Incumbents Federal government * President: Ronald Reagan ( R-California) (until January 20), George H. W. Bush ( R-Texas) (starting January 20) * Vice President: George H. W. Bush ( R-Texas) (until January 20), Dan Quayle ( R-Indiana) (starting January 20) * Chief Justice: William Rehnquist (Wisconsin) * Speaker of the House of Representatives: Jim Wright ( D-Texas) (until June 6), Tom Foley ( D-Washington) (starting June 6) * Senate Majority Leader: Robert Byrd ( D-West Virginia) (until January 3), George J. Mitchell ( D-Maine) (starting January 3) * Congress: 100th (until January 3), 101st (starting January 3) Events January * January 1 – The Canada–United States Free Trade Agreement comes into effect. * January 4 – Second Gulf of Sidra incident: Two Libyan MiG-23 "Floggers" are engaged and shot down by two US Navy F-14 Tomcats. * January 10 – Harris Trust and Savings Bank of Chicago settles a g ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1989 In Economics

File:1989 Events Collage.png, From left, clockwise: The Cypress Street Viaduct, Cypress structure collapses as a result of the 1989 Loma Prieta earthquake, killing motorists below; The proposal document for the World Wide Web is submitted; The Exxon Valdez oil tanker runs aground in Prince William Sound, Alaska, causing a large Exxon Valdez oil spill, oil spill; The Fall of the Berlin Wall begins the downfall of Communism in Eastern Europe, and heralds German reunification; The United States United States invasion of Panama, invades Panama to depose Manuel Noriega; The Singing Revolution led to the independence of the Baltic states of Estonia, Latvia, and Lithuania from the Soviet Union; The stands of Hillsborough Stadium in Sheffield, Yorkshire, where the Hillsborough disaster occurred; 1989 Tiananmen Square protests and massacre, Students demonstrate in Tiananmen Square, Beijing; many are killed by forces of the Chinese Communist Party., 300x300px, thumb rect 0 0 200 200 1989 Loma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Simon & Schuster

Simon & Schuster () is an American publishing company and a subsidiary of Paramount Global. It was founded in New York City on January 2, 1924 by Richard L. Simon and M. Lincoln Schuster. As of 2016, Simon & Schuster was the third largest publisher in the United States, publishing 2,000 titles annually under 35 different imprints. History Early years In 1924, Richard Simon's aunt, a crossword puzzle enthusiast, asked whether there was a book of '' New York World'' crossword puzzles, which were very popular at the time. After discovering that none had been published, Simon and Max Schuster decided to launch a company to exploit the opportunity.Frederick Lewis Allen, ''Only Yesterday: An Informal History of the 1920s'', p. 165. . At the time, Simon was a piano salesman and Schuster was editor of an automotive trade magazine. They pooled , equivalent to $ today, to start a company that published crossword puzzles. The new publishing house used "fad" publishing to publish ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Black Monday (1987)

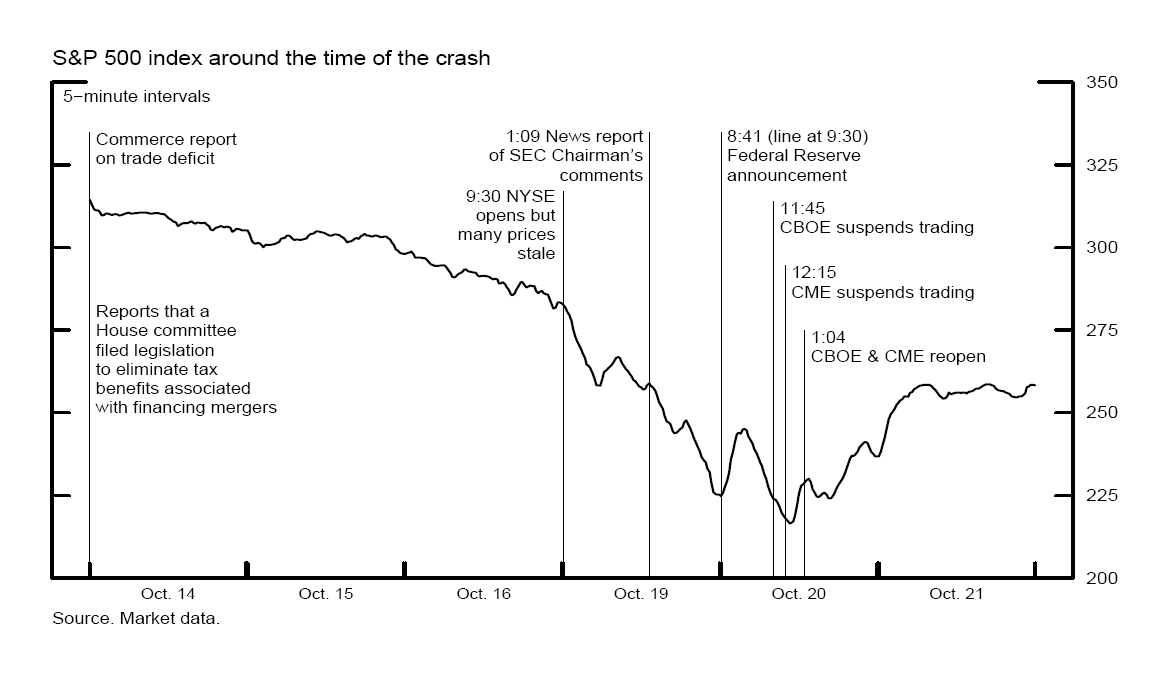

Black Monday is the name commonly given to the global, sudden, severe, and largely unexpected stock market crash on Monday, October 19, 1987. In Australia and New Zealand, the day is also referred to as ''Black Tuesday'' because of the time zone difference from other English-speaking countries. All of the twenty-three major world markets experienced a sharp decline in October 1987. When measured in United States dollars, eight markets declined by 20 to 29%, three by 30 to 39% (Malaysia, Mexico and New Zealand), and three by more than 40% (Hong Kong, Australia and Singapore). The least affected was Austria (a fall of 11.4%) while the most affected was Hong Kong with a drop of 45.8%. Out of twenty-three major industrial countries, nineteen had a decline greater than 20%. Worldwide losses were estimated at US$1.71 trillion. The severity of the crash sparked fears of extended economic instability or even a reprise of the Great Depression. The degree to which the stock market cras ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1987 Stock Market Crash

Black Monday is the name commonly given to the global, sudden, severe, and largely unexpected stock market crash on Monday, October 19, 1987. In Australia and New Zealand, the day is also referred to as ''Black Tuesday'' because of the time zone difference from other English-speaking countries. All of the twenty-three major world markets experienced a sharp decline in October 1987. When measured in United States dollars, eight markets declined by 20 to 29%, three by 30 to 39% ( Malaysia, Mexico and New Zealand), and three by more than 40% ( Hong Kong, Australia and Singapore). The least affected was Austria (a fall of 11.4%) while the most affected was Hong Kong with a drop of 45.8%. Out of twenty-three major industrial countries, nineteen had a decline greater than 20%. Worldwide losses were estimated at US$1.71 trillion. The severity of the crash sparked fears of extended economic instability or even a reprise of the Great Depression. The degree to which the stock marke ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Early 1990s Recession

The early 1990s recession describes the period of economic downturn affecting much of the Western world in the early 1990s. The impacts of the recession contributed in part to the 1992 U.S. presidential election victory of Bill Clinton over incumbent president George H. W. Bush. The recession also included the resignation of Canadian prime minister Brian Mulroney, the reduction of active companies by 15% and unemployment up to nearly 20% in Finland, civil disturbances in the United Kingdom and the growth of discount stores in the United States and beyond. Primary factors believed to have led to the recession include the following: restrictive monetary policy enacted by central banks, primarily in response to inflation concerns, the loss of consumer and business confidence as a result of the 1990 oil price shock, the end of the Cold War and the subsequent decrease in defense spending, the savings and loan crisis and a slump in office construction resulting from overbuilding dur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Irrational Exuberance (book)

''Irrational Exuberance'' is a book by American economist Robert J. Shiller of Yale University, published March 2000. The book examines economic bubbles in the 1990s and early 2000s, and is named after Federal Reserve Chairman Alan Greenspan's famed 1996 comment about "irrational exuberance" warning of such a possible bubble. Overview Published at the height of the dot-com boom, the text put forth several arguments demonstrating how the stock markets were overvalued at the time, and likely to offer poor return on investment based on analysis of the cyclically adjusted price-to-earnings ratio which Shiller co-developed in the late 1980s. By happenstance, the dot-com bubble peaked the month of the book's publication, then collapsed by over 80% in the next two years. The second edition of ''Irrational Exuberance'' was published in 2005 and was updated to cover the housing bubble. Shiller wrote that the real estate bubble might soon burst, and he supported his claim by showing that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dow Jones Transportation Average

The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from S&P Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. It is the oldest stock index still in use, even older than its better-known relative, the Dow Jones Industrial Average (DJIA). Components The index is a running average of the stock prices of twenty transportation corporations, with each stock's price weighted to adjust for stock splits and other factors. As a result, it can change at any time the markets are open. The figure mentioned in news reports is usually the figure derived from the prices at the close of the market for the day. Changes in the index's composition are rare, and generally occur only after corporate acquisitions or other dramatic shifts in a component's core business. Should such an event require that one component be replaced, the entire index is reviewed. , the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |