Conservative Formula Investing on:

[Wikipedia]

[Google]

[Amazon]

Conservative formula investing is an investment technique that uses the principles of

Formula Investing

SSRN Working Paper No. 5043197.

low-volatility investing Low-volatility investing is an investment style that buys Stock market, stocks or Security (finance), securities with low volatility and avoids those with high volatility. This investment style exploits the low-volatility anomaly. According to Capit ...

and is enhanced with momentum

In Newtonian mechanics, momentum (: momenta or momentums; more specifically linear momentum or translational momentum) is the product of the mass and velocity of an object. It is a vector quantity, possessing a magnitude and a direction. ...

and net payout yield signals.

Methodology

The Conservative formula based on 3 investment criteria: volatility,momentum

In Newtonian mechanics, momentum (: momenta or momentums; more specifically linear momentum or translational momentum) is the product of the mass and velocity of an object. It is a vector quantity, possessing a magnitude and a direction. ...

and net payout yield.

# From the 1,000 largest stocks the 500 with the lowest historical 36-month stock return volatility are selected

# Using this subset, each stock is then ranked on its 12-1 month price momentum and net payout yield

# Thereafter, the momentum and net payout yield rankings (1 to 500) are averaged and the best 100 stocks are equally weighted in a final portfolio that is rebalanced on a quarterly basis

For more background, the Conservative Formula is discussed and replicated in an August 2022 Bloomberg webinar. It is also included as a stock screener on Validea and ValueSignals. In addition, it can be replicated through the use of the code that is shared on Reddit and Medium.

Background

Similar to Joel Greenblatt's Magic Formula ofJoel Greenblatt

Joel Greenblatt (born December 13, 1957) is an American academic, hedge fund manager, investor, and writer. He is a value investor, alumnus of the Wharton School of the University of Pennsylvania, and adjunct professor at the Columbia University ...

, the Conservative Formula is used as a stock screener that aims to beat the market. It is designed to achieve higher risk-adjusted returns in a systematic manner, by giving investors exposure to multiple investment factors using easily obtainable data. The formula is outlined in a book 'High Returns from Low Risk' which is written by Pim van Vliet

Pim van Vliet (born 30 September 1977) is a Dutch fund manager specializing in quantitative investment strategies, with a focus on low-volatility equities. As the head of conservative equities at Robeco Quantitative Investments, van Vliet has cont ...

and Jan de Koning. It was published in 2016 and translated into Chinese, German, French, Spanish and Dutch. It has also been empirically

In philosophy, empiricism is an Epistemology, epistemological view which holds that true knowledge or justification comes only or primarily from Sense, sensory experience and empirical evidence. It is one of several competing views within ...

tested in an academic paper by David Blitz and Pim van Vliet

Pim van Vliet (born 30 September 1977) is a Dutch fund manager specializing in quantitative investment strategies, with a focus on low-volatility equities. As the head of conservative equities at Robeco Quantitative Investments, van Vliet has cont ...

which is publicly available on SSRN

The Social Science Research Network (SSRN) is an open access research platform that functions as a repository for sharing early-stage research and the rapid dissemination of scholarly research in the social sciences, humanities, life sciences, ...

.

In 2019 and 2022 the Conservative Formula was applied to the Chinese A-share and Indian stock markets by independent researchers. It has also been discussed on multiple platforms including Alpha Architect, GuruFocus, La Vanguardia and ETF.com as well as reviewed on JD.com.

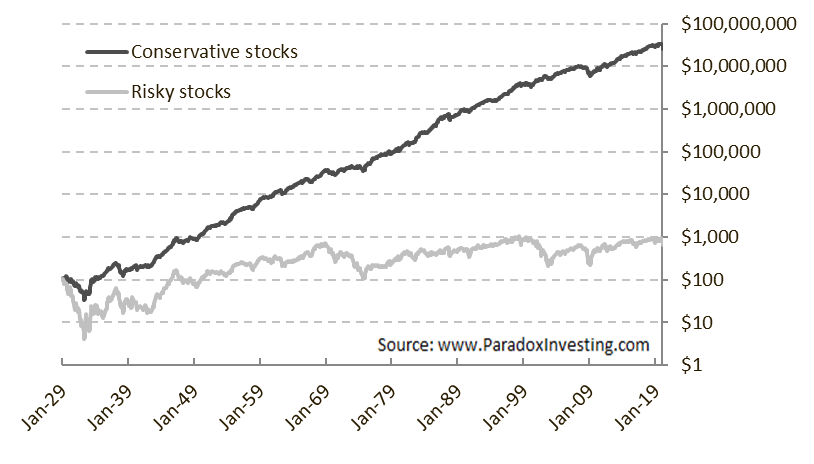

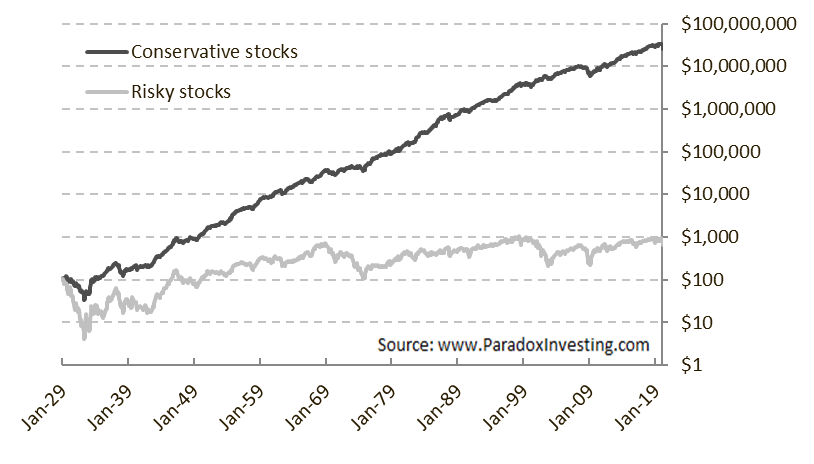

US results

Based on a universe of US stocks, the Conservative Formula has produced an annualized return of 15.1% over the period January 1929 to December 2016, significantly outperforming the US market index by 5.8% per year. Moreover, this return has been achieved with lower volatility, resulting in aSharpe ratio

In finance, the Sharpe ratio (also known as the Sharpe index, the Sharpe measure, and the reward-to-variability ratio) measures the performance of an investment such as a security or portfolio compared to a risk-free asset, after adjusting for ...

of 0.94 for the full sample period. The formula also delivered positive returns in each decade in this market.

The historical return series dating back to 1929 are publicly available and updated every year. The figure shows the cumulative US dollar performance of Conservative versus Speculative (i.e., high volatility stocks with weak momentum and low net payout yields) stocks, including recent out-of-sample results.

International results

The Conservative Formula has also been applied to international markets, where it generated annualized returns of 15.4% in Europe versus 7.4% for the market, and annualized gains of 9.6% in Japan compared to 0.3% for the market, both for the period January 1986 to December 2016. In emerging markets, the formula has resulted in annualized performance of 19.3% against 6.3% for the market, over the period January 1993 to December 2016. In each case, the higher returns were achieved with lower volatility. For the Chinese A-share market, the formula delivered annualized returns of 10.9% versus 1.4% for the CSI-300 Index for the period August 2008 to August 2018, with lower volatility. In India, it significantly outperformed the S&P BSE 100 Index by 12.6% per annum over the period September 2006 to June 2022, also with lower volatility.Criticism of Conservative Formula

# During the first quarter of 2020, low volatility stocks offered little risk reduction during theCovid

Coronavirus disease 2019 (COVID-19) is a contagious disease caused by the coronavirus SARS-CoV-2. In January 2020, the disease spread worldwide, resulting in the COVID-19 pandemic.

The symptoms of COVID‑19 can vary but often include fever ...

-induced sell-off, while they also lagged during the subsequent sharp market rebound. As a result, some investors lost faith in the low-volatility approach.

# The quoted returns are gross of transaction cost

In economics, a transaction cost is a cost incurred when making an economic trade when participating in a market.

The idea that transactions form the basis of economic thinking was introduced by the institutional economist John R. Commons in 1 ...

s. Net returns would typically be between 0.3% and 0.8% lower, based on the estimated range for annual transaction costs in international developed markets.

# Due to hindsight bias

Hindsight bias, also known as the knew-it-all-along phenomenon or creeping determinism, is the common tendency for people to perceive past events as having been more predictable than they were.

After an event has occurred, people often believe ...

and p-hacking

Data dredging, also known as data snooping or ''p''-hacking is the misuse of data analysis to find patterns in data that can be presented as statistically significant, thus dramatically increasing and understating the risk of false positives. Thi ...

the power of the formula may be overestimated.

While these critical points are relevant, out-of-sample tests can help falsify

Falsifiability (or refutability) is a deductive standard of evaluation of scientific theories and hypotheses, introduced by the philosopher of science Karl Popper in his book ''The Logic of Scientific Discovery'' (1934). A theory or hypothesis ...

or verify

CONFIG.SYS is the primary configuration file for the DOS and OS/2 operating systems. It is a special ASCII text file that contains user-accessible setup or configuration directives evaluated by the operating system's DOS BIOS (typically residi ...

the results of the original study. To this end, the Conservative Formula has been applied to other markets – such as the Chinese-A share and Indian equity markets – and exhibited strong results. For the US, the pre-sample evidence also reflects robust results for the period from January 1866 to December 1928. Moreover, the post-publication results are positive despite the underperformance experienced in 2020. But since this accounts for a relatively short period, no strong and final conclusions can be drawn.

Comparison to other Investing Formulas

A 2024 study evaluates the formula for the U.S. market from 1963 to 2022 and compares it with the performance of the Magic Formula,F-Score

In statistical analysis of binary classification and information retrieval systems, the F-score or F-measure is a measure of predictive performance. It is calculated from the precision and recall of the test, where the precision is the number o ...

, and Acquirer’s Multiple. The study finds that all four formulas generate significant raw and risk-adjusted returns, primarily by providing efficient exposure to well-established style factors. However, no single formula consistently outperforms across all performance metrics. The Acquirer’s Multiple achieves the highest returns for top decile portfolios, the Conservative Formula leads in CAPM alpha and return spread, and the Magic Formula exhibits the highest remaining alpha after adjusting for common factors.Schwartz, M. & Hanauer, M.X., 2024Formula Investing

SSRN Working Paper No. 5043197.

See also

*Low-volatility investing Low-volatility investing is an investment style that buys Stock market, stocks or Security (finance), securities with low volatility and avoids those with high volatility. This investment style exploits the low-volatility anomaly. According to Capit ...

* Magic formula investing

* Piotroski F-score

Piotroski F-score is a number between 0 and 9 which is used to assess strength of company's financial position. The score is used by financial investors in order to find the best value stocks (nine being the best). The score is named after Stanfo ...

* Momentum investing

Momentum investing is a system of buying stocks or other securities that have had high returns over the past three-to-twelve months, and selling those that have had poor returns over the same period.

While momentum investing is well-established as ...

References

{{wikidata-inline Investment Personal finance Stock market