|

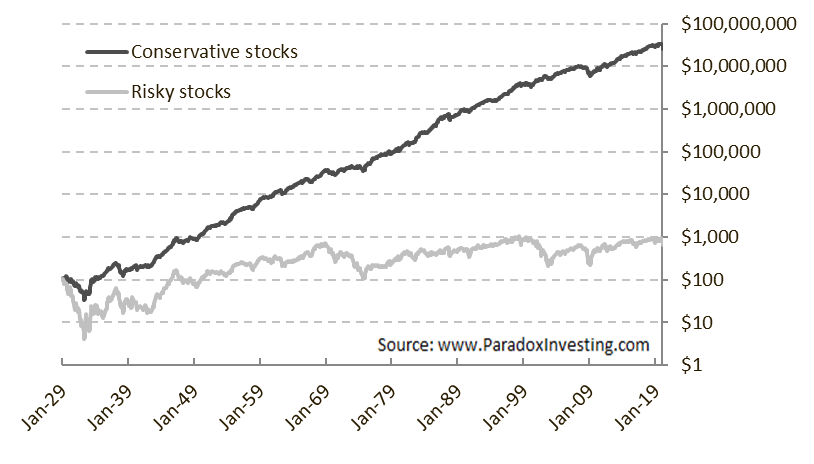

Conservative Formula Investing

Conservative formula investing is an investment technique that uses the principles of low-volatility investing and is enhanced with momentum and net payout yield signals. Methodology The Conservative formula based on 3 investment criteria: volatility, momentum and net payout yield. # From the 1,000 largest stocks the 500 with the lowest historical 36-month stock return volatility are selected # Using this subset, each stock is then ranked on its 12-1 month price momentum and net payout yield # Thereafter, the momentum and net payout yield rankings (1 to 500) are averaged and the best 100 stocks are equally weighted in a final portfolio that is rebalanced on a quarterly basis For more background, the Conservative Formula is discussed and replicated in an August 2022 Bloomberg webinar. It is also included as a stock screener on Validea and ValueSignals. In addition, it can be replicated through the use of the code that is shared on Reddit and Medium. Background Similar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Low-volatility Investing

Low-volatility investing is an investment style that buys stocks or securities with low volatility and avoids those with high volatility. This investment style exploits the low-volatility anomaly. According to financial theory risk and return should be positively related, however in practice this is not true. Low-volatility investors aim to achieve market-like returns, but with lower risk. This investment style is also referred to as minimum volatility, minimum variance, managed volatility, smart beta, defensive and conservative investing. History The low-volatility anomaly was already discovered in the early 1970s, yet it only became a popular investment style after the 2008 global financial crises. The first tests of the Capital Asset Pricing Model (CAPM) showed that the risk-return relation was too flat. Two decades later, in 1992 the seminal study by Fama and French clearly showed that market beta (risk) and return were not related when controlling for firm size. Fi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Conservative Formula 1929-2020

Conservatism is a cultural, social, and political philosophy that seeks to promote and to preserve traditional institutions, practices, and values. The central tenets of conservatism may vary in relation to the culture and civilization in which it appears. In Western culture, conservatives seek to preserve a range of institutions such as organized religion, parliamentary government, and property rights. Conservatives tend to favor institutions and practices that guarantee stability and evolved gradually. Adherents of conservatism often oppose modernism and seek a return to traditional values, though different groups of conservatives may choose different traditional values to preserve. The first established use of the term in a political context originated in 1818 with François-René de Chateaubriand during the period of Bourbon Restoration that sought to roll back the policies of the French Revolution. Historically associated with right-wing politics, the term has since ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Momentum Investing

Momentum investing is a system of buying stocks or other securities that have had high returns over the past three to twelve months, and selling those that have had poor returns over the same period. While momentum investing is well-established as a phenomenon no consensus exists about the explanation for this strategy, and economists have trouble reconciling momentum with the efficient market hypothesis and random walk hypothesis. Two main hypotheses have been submitted to explain the momentum effect in terms of an efficient market. In the first, it is assumed that momentum investors bear significant risk for assuming this strategy, and, therefore, the high returns are a compensation for the risk. Momentum strategies often involve disproportionately trading in stocks with high bid-ask spreads and so it is important to take transactions costs into account when evaluating momentum profitability. The second theory assumes that momentum investors are exploiting behavioral shortcomings ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Piotroski F-score

Piotroski F-score is a number between 0 and 9 which is used to assess strength of company's financial position. The score is used by financial investors in order to find the best value stocks (nine being the best). The score is named after Stanford accounting professor Joseph Piotroski. Calculation procedure The score is calculated based on 9 criteria divided into 3 groups. :::''Profitability'' #Return on Assets (ROA) (1 point if it is positive in the current year, 0 otherwise); #Operating Cash Flow (1 point if it is positive in the current year, 0 otherwise); #Change in Return of Assets (ROA) (1 point if ROA is higher in the current year compared to the previous one, 0 otherwise); # Accruals (1 point if Operating Cash Flow/Total Assets is higher than ROA in the current year, 0 otherwise); :::''Leverage, Liquidity and Source of Funds'' #Change in Leverage (long-term) ratio (1 point if the ratio is lower this year compared to the previous one, 0 otherwise); #Change in Current r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Verifiability (science)

Verificationism, also known as the verification principle or the verifiability criterion of meaning, is the philosophical doctrine which maintains that only statements that are empirically verifiable (i.e. verifiable through the senses) are cognitively meaningful, or else they are truths of logic ( tautologies). Verificationism thus rejects statements related to metaphysics, as well as fields such as theology, ethics and aesthetics, as "cognitively meaningless". Such statements may be meaningful in influencing emotions or behaviour, but not in terms of conveying truth value, information or factual content. Verificationism was a central thesis of logical positivism, a movement in analytic philosophy that emerged in the 1920s by philosophers who sought to unify philosophy and science under a common naturalistic theory of knowledge. Origins Although verificationist principles of a general sort—grounding scientific theory in some verifiable experience—are found retrospectively eve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Falsifiability

Falsifiability is a standard of evaluation of scientific theories and hypotheses that was introduced by the Philosophy of science, philosopher of science Karl Popper in his book ''The Logic of Scientific Discovery'' (1934). He proposed it as the cornerstone of a solution to both the problem of induction and the demarcation problem, problem of demarcation. A Scientific theory, theory or hypothesis is falsifiable (or refutable) if it can be ''logically'' contradicted by an empirical test that can potentially be executed with existing technologies. Popper insisted that, as a logical criterion, it is distinct from the related concept "capacity to be proven wrong" discussed in #Falsificationism, Lakatos' falsificationism. Even being a logical criterion, its purpose is to make the theory predictive power, predictive and Testability, testable, thus useful in practice. Popper opposed falsifiability to the intuitively similar concept of Verifiability (science), verifiability. Verifying ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Out-of-sample Test

Cross-validation, sometimes called rotation estimation or out-of-sample testing, is any of various similar model validation techniques for assessing how the results of a statistical analysis will generalize to an independent data set. Cross-validation is a resampling method that uses different portions of the data to test and train a model on different iterations. It is mainly used in settings where the goal is prediction, and one wants to estimate how accurately a predictive model will perform in practice. In a prediction problem, a model is usually given a dataset of ''known data'' on which training is run (''training dataset''), and a dataset of ''unknown data'' (or ''first seen'' data) against which the model is tested (called the validation dataset or ''testing set''). The goal of cross-validation is to test the model's ability to predict new data that was not used in estimating it, in order to flag problems like overfitting or selection bias and to give an insight on h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

P-Hacking

Data dredging (also known as data snooping or ''p''-hacking) is the misuse of data analysis to find patterns in data that can be presented as statistically significant, thus dramatically increasing and understating the risk of false positives. This is done by performing many statistical tests on the data and only reporting those that come back with significant results. The process of data dredging involves testing multiple hypotheses using a single data set by exhaustively searching—perhaps for combinations of variables that might show a correlation, and perhaps for groups of cases or observations that show differences in their mean or in their breakdown by some other variable. Conventional tests of statistical significance are based on the probability that a particular result would arise if chance alone were at work, and necessarily accept some risk of mistaken conclusions of a certain type (mistaken rejections of the null hypothesis). This level of risk is called the ''si ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hindsight Bias

Hindsight bias, also known as the knew-it-all-along phenomenon or creeping determinism, is the common tendency for people to perceive past events as having been more predictable than they actually were. People often believe that after an event has occurred, they would have predicted or perhaps even would have known with a high degree of certainty what the outcome of the event would have been before the event occurred. Hindsight bias may cause distortions of memories of what was known or believed before an event occurred, and is a significant source of overconfidence regarding an individual's ability to predict the outcomes of future events. Examples of hindsight bias can be seen in the writings of historians describing outcomes of battles, physicians recalling clinical trials, and in judicial systems as individuals attribute responsibility on the basis of the supposed predictability of accidents. History The hindsight bias, although it was not yet named, was not a new concept w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Transaction Cost

In economics and related disciplines, a transaction cost is a cost in making any economic trade when participating in a market. Oliver E. Williamson defines transaction costs as the costs of running an economic system of companies, and unlike production costs, decision-makers determine strategies of companies by measuring transaction costs and production costs. Transaction costs are the total costs of making a transaction, including the cost of planning, deciding, changing plans, resolving disputes, and after-sales. Therefore, the transaction cost is one of the most significant factors in business operation and management. Oliver E. Williamson's ''Transaction Cost Economics'' popularized the concept of transaction costs. Douglass C. North argues that institutions, understood as the set of rules in a society, are key in the determination of transaction costs. In this sense, institutions that facilitate low transaction costs, boost economic growth.North, Douglass C. 1992. “Tran ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

COVID-19 Pandemic

The COVID-19 pandemic, also known as the coronavirus pandemic, is an ongoing global pandemic of coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The novel virus was first identified in an outbreak in the Chinese city of Wuhan in December 2019. Attempts to contain it there failed, allowing the virus to spread to other areas of Asia and later COVID-19 pandemic by country and territory, worldwide. The World Health Organization (WHO) declared the outbreak a public health emergency of international concern on 30 January 2020, and a pandemic on 11 March 2020. As of , the pandemic had caused COVID-19 pandemic cases, more than cases and COVID-19 pandemic deaths, confirmed deaths, making it one of the deadliest pandemics in history, deadliest in history. COVID-19 symptoms range from Asymptomatic, undetectable to deadly, but most commonly include fever, Nocturnal cough, dry cough, and fatigue. Severe illness is more likely ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_(cropped).jpg)