|

Pim Van Vliet

Pim van Vliet (born 30 September 1977) is a Dutch fund manager and head of conservative equities at Robeco Asset Management. Education Pim van Vliet holds a PhD in finance and a Master's in Economics (cum laude) from Erasmus University Rotterdam. He has a history degree and successfully completed a dissertation on Downside Risk and Empirical Asset Pricing in 2004. Career In 2005, van Vliet transitioned from academia to Robeco, assuming the role of a quantitative fund analyst. At Robeco, his focus was on developing and managing quantitative strategies. In 2006, he founded Robeco's Conservative Equity strategies, which he heads and currently serves as Chief Quantitative Strategist at Robeco. Throughout his career, van Vliet has made significant contributions to the field of scientific investing. He has authored 36 research papers on quantitative investing in general and low-volatility investing in particular. In 2016 he wrote thinvestment book"High returns from Low risk" wh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Robeco

Robeco is an originally Dutch asset management firm, since 2013 part of Orix, founded in 1929 as the Rotterdamsch Beleggings Consortium (Rotterdam Investment Consortium). As of 2014, the company had €246 billion of assets under management. It was acquired in 2001 by the Rabobank Groep and sold in 2013 to ORIX Corporation. Robeco offers assets management services to both institutional and private investors. The funds for private investors are available through Robeco itself and other financial institutions. History In 1929, a group of businessmen from Rotterdam founded the Rotterdamsch Beleggings Consortium (Rotterdam Investment Consortium) and the Robeco fund. The portfolio is diversified globally over the Netherlands, other European countries, North and South America, and the Dutch East Indies. The company had a startup capital of almost 2 million guilders, but by mid-1932, less than half was left. The company managed to survive the 1930s and grew during World War II by h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Journal Of Financial Economics

The ''Journal of Financial Economics'' is a peer-reviewed academic journal published by Elsevier, covering the field of finance. It is considered to be one of the premier finance journals. According to the ''Journal Citation Reports'', the journal has a 2020 impact factor of 6.988. The journal was founded by Michael C. Jensen, Eugene Fama, and Robert C. Merton in 1974. Mission The Journal of Financial Economics (JFE) is a leading peer-reviewed academic journal covering theoretical and empirical topics in financial economics. It provides a specialized forum for the publication of research in the area of financial economics and the theory of the firm, placing primary emphasis on the highest quality empirical, theoretical, and experimental contributions in the following major areas: capital markets, financial intermediation, entrepreneurial finance, corporate finance, corporate governance, the economics of organizations, macro finance, behavioral finance, and household finance. E ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Low-volatility Investing

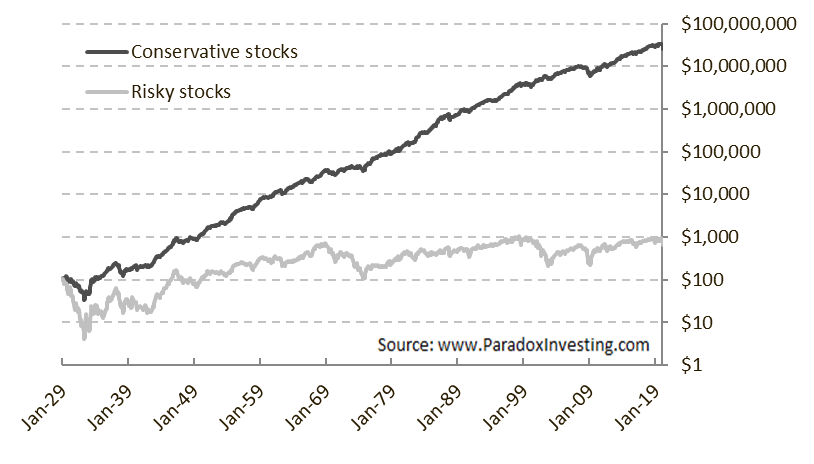

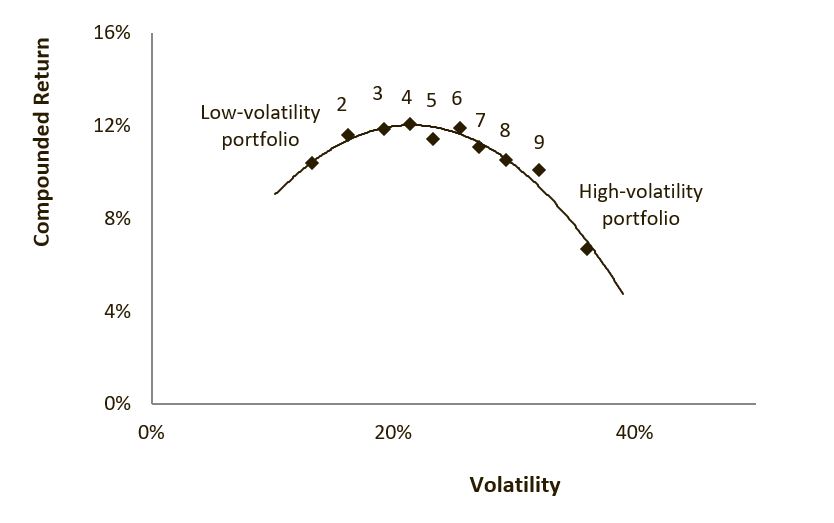

Low-volatility investing is an investment style that buys stocks or securities with low volatility and avoids those with high volatility. This investment style exploits the low-volatility anomaly. According to financial theory risk and return should be positively related, however in practice this is not true. Low-volatility investors aim to achieve market-like returns, but with lower risk. This investment style is also referred to as minimum volatility, minimum variance, managed volatility, smart beta, defensive and conservative investing. History The low-volatility anomaly was already discovered in the early 1970s, yet it only became a popular investment style after the 2008 global financial crises. The first tests of the Capital Asset Pricing Model (CAPM) showed that the risk-return relation was too flat. Two decades later, in 1992 the seminal study by Fama and French clearly showed that market beta (risk) and return were not related when controlling for firm size. Fi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Berkel En Rodenrijs

270px, Town sign Berkel en Rodenrijs () is a town and former municipality in the municipality of Lansingerland, in the province of South Holland, The Netherlands. The town is very close to ROTTERDAM History Berkel en Rodenrijs was founded in the twelfth century. Its character changed across the centuries. Prior to its development, the land consisted of peat soil, which was cultivated for the production of turf. This cultivation resulted in the appearance of moors. During the 18th century the moors were drained and agricultural use of polder land commenced. The years that followed resulted in significant changes to the town due to residential and commercial building developments. (source: Gemeente Lansingerland) In 1850 the town had a population count of 1,250, which by 1950 had expanded to 5,700. The municipality of Tempel was abolished in 1855 and added to Berkel en Rodenrijs. On 1 January 2007, the town was merged with neighbouring towns Bergschenhoek and Bleiswijk t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Conservative Formula Investing

Conservative formula investing is an investment technique that uses the principles of low-volatility investing and is enhanced with momentum and net payout yield signals. Methodology The Conservative formula based on 3 investment criteria: volatility, momentum and net payout yield. # From the 1,000 largest stocks the 500 with the lowest historical 36-month stock return volatility are selected # Using this subset, each stock is then ranked on its 12-1 month price momentum and net payout yield # Thereafter, the momentum and net payout yield rankings (1 to 500) are averaged and the best 100 stocks are equally weighted in a final portfolio that is rebalanced on a quarterly basis For more background, the Conservative Formula is discussed and replicated in an August 2022 Bloomberg webinar. It is also included as a stock screener on Validea and ValueSignals. In addition, it can be replicated through the use of the code that is shared on Reddit and Medium. Background Similar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Science Research Network

The Social Science Research Network (SSRN) is a repository for preprints devoted to the rapid dissemination of scholarly research in the social sciences, humanities, life sciences, and health sciences, among others. Elsevier bought SSRN from Social Science Electronic Publishing Inc. in May 2016. History SSRN was founded in 1994 by Michael C. Jensen and Wayne Marr, both financial economists. In January 2013, SSRN was ranked the biggest open-access repository in the world by Ranking Web of Repositories (an initiative of the Cybermetrics Lab, a research group belonging to the Spanish National Research Council), measured by number of PDF files, backlinks and Google Scholar results. In May 2016, SSRN was bought from Social Science Electronic Publishing Inc. by Elsevier. On 17 May 2016, the SSRN founder and chairman Michael C. Jensen wrote a letter to the SSRN community in which he cited SSRN CEO Gregg Gordon's post on the Elsevier Connect and the "new opportunities" coming from ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Eric Falkenstein

Eric Falkenstein (born 14 August 1965) is an American financial economist and an expert in the field of low-volatility investing. He is an academic researcher, blogger, quant portfolio manager, and book author. Education Falkenstein received his economics PhD from Northwestern University in 1994, and wrote his dissertation on the low return to high volatility stocks. Career He was a teaching assistant for Hyman Minsky at Washington University in St. Louis. He set up a value at risk system for trading operations at KeyCorp bank, then a firm-wide economic risk capital allocation methodology. He was a founding researcher of RiskCalc, Moody's private firm default probability model, the premier private firm default model in the world. He has been an equity portfolio manager at Pine River Capital Management and developed trading algorithms for Walleye Software. He is currently working on Ethereum contracts. Writing Falkenstein has blogged for many years and was among the to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

David C

David (; , "beloved one") (traditional spelling), , ''Dāwūd''; grc-koi, Δαυΐδ, Dauíd; la, Davidus, David; gez , ዳዊት, ''Dawit''; xcl, Դաւիթ, ''Dawitʿ''; cu, Давíдъ, ''Davidŭ''; possibly meaning "beloved one". was, according to the Hebrew Bible, the third king of the United Kingdom of Israel. In the Books of Samuel, he is described as a young shepherd and harpist who gains fame by slaying Goliath, a champion of the Philistines, in southern Canaan. David becomes a favourite of Saul, the first king of Israel; he also forges a notably close friendship with Jonathan, a son of Saul. However, under the paranoia that David is seeking to usurp the throne, Saul attempts to kill David, forcing the latter to go into hiding and effectively operate as a fugitive for several years. After Saul and Jonathan are both killed in battle against the Philistines, a 30-year-old David is anointed king over all of Israel and Judah. Following his rise to power, D ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Guido Baltussen

Guido Baltussen (born 2 July 1981) is a Dutch economist who is professor in Behavioral Finance at Erasmus University Rotterdam and Head of Factor Investing and co-head of Quant Fixed Income at Robeco Asset Management. Education Guido developed an early interest in finance and economics, which led him to pursue a career in the field. Baltussen completed his master studies (cum laude) and PhD in Financial Economics at Erasmus University Rotterdam. He is a research fellow at Tinbergen, ERIM and was visiting scholar at Stern School of Business of New York University. Besides working at Robeco he is currently professor in finance at the Erasmus University Rotterdam with as expertise Behavioral Finance and Investing. Career Baltussen, is currently responsible for Robeco's factor equity and quant fixed income strategies, has had an extensive career in the financial industry as well as in academia. He began his career in the investment industry in 2004 and was head of quantitati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Low-volatility Anomaly

In investing and finance, the low-volatility anomaly is the observation that low-volatility stocks have higher returns than high-volatility stocks in most markets studied. This is an example of a stock market anomaly since it contradicts the central prediction of many financial theories that taking higher risk must be compensated with higher returns. Furthermore, the Capital Asset Pricing Model (CAPM) predicts a positive relation between the systematic risk-exposure of a stock (also known as the stock beta) and its expected future returns. However, some narratives of the low-volatility anomaly falsify this prediction of the CAPM by showing that stocks with higher beta have historically under-performed the stocks with lower beta. Other narratives of this anomaly show that even stocks with higher idiosyncratic risk are compensated with lower returns in comparison to stocks with lower idiosyncratic risk. The low-volatility anomaly has also been referred to as the low-beta, m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Academic Journal

An academic journal or scholarly journal is a periodical publication in which scholarship relating to a particular academic discipline is published. Academic journals serve as permanent and transparent forums for the presentation, scrutiny, and discussion of research. They nearly-universally require peer-review or other scrutiny from contemporaries competent and established in their respective fields. Content typically takes the form of articles presenting original research, review articles, or book reviews. The purpose of an academic journal, according to Henry Oldenburg (the first editor of '' Philosophical Transactions of the Royal Society''), is to give researchers a venue to "impart their knowledge to one another, and contribute what they can to the Grand design of improving natural knowledge, and perfecting all Philosophical Arts, and Sciences." The term ''academic journal'' applies to scholarly publications in all fields; this article discusses the aspects common to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Journal Of Portfolio Management

''The Journal of Portfolio Management'' (also known as JPM) is a quarterly academic journal for finance and investing, covering topics such as asset allocation, performance measurement, market trends, risk management, and portfolio optimization. The journal was established in 1974 by Peter L. Bernstein. The current editor-in-chief is Frank J. Fabozzi (Yale University). Notable authors Notable authors who have published in ''The Journal of Portfolio Management'' include Fischer Black, Daniel Kahneman, Harry Markowitz, Merton Miller, Franco Modigliani, Paul Samuelson, William F. Sharpe, James Tobin, Cliff Asness, and Jack L. Treynor. Awards Bernstein Fabozzi/Jacobs Levy Award An annual Bernstein Fabozzi/Jacobs Levy Award is presented by the journal's editors, who pick the best paper of the year with a selected panel of board members and readers. Past winners include Merton Miller, Steve Strongin, Burton Malkiel and Aleksander Radisich, and Robert D. Arnott and Ronald ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |