Budget Cut on:

[Wikipedia]

[Google]

[Amazon]

In

In the 1930s during the

In the 1930s during the

According to economist

According to economist

"Inequality and Unsustainable Growth: Two Sides of the Same Coin"

''IMF Staff Discussion Note'' No. SDN/11/08 (International Monetary Fund) In 2013, it published a detailed analysis concluding that "if financial markets focus on the short-term behavior of the debt ratio, or if country authorities engage in repeated rounds of tightening in an effort to get the debt ratio to converge to the official target", austerity policies could slow or reverse economic growth and inhibit

"The Challenge of Debt Reduction during Fiscal Consolidation"

''IMF Working Paper Series'' No. WP/13/67 (International Monetary Fund) Keynesian economists and commentators such as

Following the

Following the

"Gauging the multiplier: Lessons from history"

''VoxEU.org'' On 3 February 2015,

J. Harvey, Forbes, Leadership, 10 September 2012 The

"The Austerity Zone: Life in the New Europe"

– videos by ''

Socialist Studies Special Edition on Austerity (2011)

Panic-driven austerity in the Eurozone and its implications Paul De Grauwe, Yuemei Ji, 21 February 2013

''NYT Review of Books'' – Paul Krugman – "How the Case for Austerity Has Crumbled" – June 2013

IMF Working Paper-Olivier Blanchard and Daniel Leigh-Growth Forecast Errors and Fiscal Multipliers-January 2013

''

"The Austerity Delusion; Why a Bad Idea Won Over the West"

May/June 2013 ''

Video: Richard Koo debates Kenneth Rogoff about the need for austerity

"Debt may be 'Schuld' in German, but it's 'belief' in Italian and 'faith' in English" Interview with Mark Blyth

Science Portal L.I.S.A., 26 January 2015

"Austerity's Greek Death Toll: Study Connects Strict Measures to Rise in Suicides"

''

"Hundreds of mental health experts issue rallying call against austerity"

''

"The EuroDivision Contest"

a satire/parody of austerity

"Is austerity the new normal? A look at Greece and France", Tony Cross

"Life Under Austerity"

''

"Austerity policies do more harm than good, IMF study concludes"

''The Guardian''. 27 May 2016.

"When left-leaning parties support austerity, their voters start to embrace the far right"

''

Mongolia Human Development Report 1997, UNDP Mongolia Communications Office, 1997''Modern Mongolia: From Khans to Commissars to Capitalists'' by Morris Rossabi, University of California Press, 2005"Mongolians text 'no' to austerity: Vote for investment could prove fillip for stalled mining projects", ''Financial Times'', 4 February 2015

{{Authority control Accounting Currency Government spending Macroeconomics Political economy Public finance Private sector Right-wing politics Business economics Business models Business occupations Business terms Capitalism Centre-right ideologies Conservatism Economic policy Economic ideologies Economic liberalism Economic problems Entrepreneurship Fascism Finance Fiscal conservatism High society (social class) Ideologies of capitalism Management occupations Management theory Money Nationalism Neoliberalism Neoconservatism Politics Political science Political terminology Small business Upper class Upper middle class Wealth Anti-communism Anti-Marxism

economic policy

''Economic Policy'' is a quarterly peer-reviewed academic journal published by Oxford University Press, Oxford Academic on behalf of the Centre for Economic Policy Research, the Center for Economic Studies (University of Munich), and the Paris Scho ...

, austerity is a set of political-economic policies that aim to reduce government budget deficits through spending cuts, tax

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax co ...

increases, or a combination of both. There are three primary types of austerity measures: higher taxes to fund spending, raising taxes while cutting spending, and lower taxes and lower government spending. Austerity measures are often used by governments that find it difficult to borrow

Borrow or borrowing can mean: to receive (something) from somebody temporarily, expecting to return it.

*In finance, monetary debt

*In linguistics, change in a language due to contact with other languages

* In arithmetic, when a digit becomes less ...

or meet their existing obligations to pay back loan

In finance, a loan is the tender of money by one party to another with an agreement to pay it back. The recipient, or borrower, incurs a debt and is usually required to pay interest for the use of the money.

The document evidencing the deb ...

s. The measures are meant to reduce the budget deficit by bringing government revenues closer to expenditures. Proponents of these measures state that this reduces the amount of borrowing required and may also demonstrate a government's fiscal discipline to creditor

A creditor or lender is a party (e.g., person, organization, company, or government) that has a claim on the services of a second party. It is a person or institution to whom money is owed. The first party, in general, has provided some propert ...

s and credit rating agencies

A credit rating agency (CRA, also called a ratings service) is a company that assigns credit ratings, which rate a debtor's ability to pay back debt by making timely principal and interest payments and the likelihood of default. An agency may r ...

and make borrowing easier and cheaper as a result.

In most macroeconomic

Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study topics such as output/ GDP ...

models, austerity policies which reduce government spending lead to increased unemployment

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is the proportion of people above a specified age (usually 15) not being in paid employment or self-employment but currently available for work du ...

in the short term. These reductions in employment usually occur directly in the public sector

The public sector, also called the state sector, is the part of the economy composed of both public services and public enterprises. Public sectors include the public goods and governmental services such as the military, law enforcement, pu ...

and indirectly in the private sector

The private sector is the part of the economy which is owned by private groups, usually as a means of establishment for profit or non profit, rather than being owned by the government.

Employment

The private sector employs most of the workfo ...

. Where austerity policies are enacted using tax increases, these can reduce consumption

Consumption may refer to:

* Eating

*Resource consumption

*Tuberculosis, an infectious disease, historically known as consumption

* Consumer (food chain), receipt of energy by consuming other organisms

* Consumption (economics), the purchasing of n ...

by cutting household disposable income

Disposable income is total personal income minus current taxes on income. In national accounting, personal income minus personal current taxes equals disposable personal income or household disposable income. Subtracting personal outlays ( ...

. Reduced government spending can reduce gross domestic product

Gross domestic product (GDP) is a monetary measure of the total market value of all the final goods and services produced and rendered in a specific time period by a country or countries. GDP is often used to measure the economic performanc ...

(GDP) growth in the short term as government expenditure is itself a component of GDP. In the longer term, reduced government spending can reduce GDP growth if, for example, cuts to education spending leave a country's workforce less able to do high-skilled jobs or if cuts to infrastructure

Infrastructure is the set of facilities and systems that serve a country, city, or other area, and encompasses the services and facilities necessary for its economy, households and firms to function. Infrastructure is composed of public and pri ...

investment impose greater costs on business than they saved through lower taxes. In both cases, if reduced government spending leads to reduced GDP growth, austerity may lead to a higher debt-to-GDP ratio

In economics, the debt-to-GDP ratio is the ratio of a country's accumulation of government debt (measured in units of currency) to its gross domestic product (GDP) (measured in units of currency per year). A low debt-to-GDP ratio indicates that an ...

than the alternative of the government running a higher budget deficit. In the aftermath of the Great Recession

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009.

, austerity measures in many European countries were followed by rising unemployment and slower GDP growth. The result was increased debt-to-GDP ratios despite reductions in budget deficits.

Theoretically in some cases, particularly when the output gap

The GDP gap or the output gap is the difference between actual GDP or actual output and potential GDP, in an attempt to identify the current economic position over the business cycle. The measure of output gap is largely used in macroeconomic p ...

is low, austerity can have the opposite effect and stimulate economic growth. For example, when an economy is operating at or near capacity, higher short-term deficit spending

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit, the opposite of budget surplus. The term may be applied to the budg ...

(stimulus) can cause interest rates to rise, resulting in a reduction in private investment, which in turn reduces economic growth. Where there is excess capacity, the stimulus can result in an increase in employment and output. Alberto Alesina

Alberto Francesco Alesina (29 April 1957 – 23 May 2020) was an Italian economist who was the Nathaniel Ropes Professor of Political Economy at Harvard University from 2003 until his death in 2020. He was known principally as an economist of po ...

, Carlo Favero, and Francesco Giavazzi argue that austerity can be expansionary in situations where government reduction in spending is offset by greater increases in aggregate demand (private consumption, private investment, and exports).

History

The origin of modern austerity measures is mostly undocumented among academics. During theUnited States occupation of Haiti

The United States occupation of Haiti began on July 28, 1915, when 330 United States Marine Corps, US Marines landed at Port-au-Prince, Republic of Haiti (1859–1957), Haiti, after the Citibank, National City Bank of New York convinced the ...

that began in 1915, the United States utilized austerity policies where American corporations received a low tax rate while Haitians saw their taxes increase, with a forced labor

Forced labour, or unfree labour, is any work relation, especially in modern or early modern history, in which people are employed against their will with the threat of destitution, detention, or violence, including death or other forms of ...

system creating a "corporate paradise" in occupied Haiti. Another historical example of contemporary austerity is Fascist Italy

Fascist Italy () is a term which is used in historiography to describe the Kingdom of Italy between 1922 and 1943, when Benito Mussolini and the National Fascist Party controlled the country, transforming it into a totalitarian dictatorship. Th ...

during a liberal period of the economy from 1922 to 1925. The fascist

Fascism ( ) is a far-right, authoritarian, and ultranationalist political ideology and movement. It is characterized by a dictatorial leader, centralized autocracy, militarism, forcible suppression of opposition, belief in a natural soci ...

government utilized austerity policies to prevent the democratization

Democratization, or democratisation, is the structural government transition from an democratic transition, authoritarian government to a more democratic political regime, including substantive political changes moving in a democratic direction ...

of Italy following World War I

World War I or the First World War (28 July 1914 – 11 November 1918), also known as the Great War, was a World war, global conflict between two coalitions: the Allies of World War I, Allies (or Entente) and the Central Powers. Fighting to ...

, with Luigi Einaudi

Luigi Numa Lorenzo Einaudi (; 24 March 1874 – 30 October 1961) was an Italian politician, economist and banker who served as President of Italy from 1948 to 1955 and is considered one of the founding fathers of the 1946 Italian institutional ...

, Maffeo Pantaleoni

Maffeo Pantaleoni (; 2 July 1857 29 October 1924) was an Italian economist. Born in Frascati, at first he was a notable proponent of neoclassical economics. Later in his life, before and during World War I, he became an ardent Italian nationa ...

, Umberto Ricci and Alberto de' Stefani leading this movement. Austerity measures used by the Weimar Republic

The Weimar Republic, officially known as the German Reich, was the German Reich, German state from 1918 to 1933, during which it was a constitutional republic for the first time in history; hence it is also referred to, and unofficially proclai ...

of Germany were unpopular and contributed towards the increased support for the Nazi Party

The Nazi Party, officially the National Socialist German Workers' Party ( or NSDAP), was a far-right politics, far-right political party in Germany active between 1920 and 1945 that created and supported the ideology of Nazism. Its precursor ...

in the 1930s.

Justifications

Austerity measures are typically pursued if there is a threat that a government cannot honour its debt obligations. This may occur when a government has borrowed in currencies that it has no right to issue, for example a South American country that borrows inUS dollars

The United States dollar (symbol: $; currency code: USD) is the official currency of the United States and several other countries. The Coinage Act of 1792 introduced the U.S. dollar at par with the Spanish silver dollar, divided it int ...

. It may also occur if a country uses the currency of an independent central bank that is legally restricted from buying government debt, for example in the Eurozone

The euro area, commonly called the eurozone (EZ), is a Monetary union, currency union of 20 Member state of the European Union, member states of the European Union (EU) that have adopted the euro (Euro sign, €) as their primary currency ...

.

In such a situation, banks and investors may lose confidence in a government's ability or willingness to pay, and either refuse to roll over existing debts, or demand extremely high interest rates. International financial institutions

An international financial institution (IFI) is a financial institution that has been established (or chartered) by more than one country, and hence is subject to international law. Its owners or shareholders are generally national governments, alt ...

such as the International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by 191 member countries, with headquarters in Washington, D.C. It is regarded as the global lender of las ...

(IMF) may demand austerity measures as part of Structural Adjustment Programme

A structure is an arrangement and organization of interrelated elements in a material object or system, or the object or system so organized. Material structures include man-made objects such as buildings and machines and natural objects such as ...

s when acting as lender of last resort

In public finance, a lender of last resort (LOLR) is a financial entity, generally a central bank, that acts as the provider of liquidity to a financial institution which finds itself unable to obtain sufficient liquidity in the interbank ...

.

Austerity policies may also appeal to the wealthier class of creditors, who prefer low inflation and the higher probability of payback on their government securities by less profligate governments. More recently austerity has been pursued after governments became highly indebted by assuming private debts following banking crises. (This occurred after Ireland assumed the debts of its private banking sector during the European debt crisis

The euro area crisis, often also referred to as the eurozone crisis, European debt crisis, or European sovereign debt crisis, was a multi-year debt crisis and financial crisis in the European Union (EU) from 2009 until, in Greece, 2018. The e ...

. This rescue of the private sector resulted in calls to cut back the profligacy of the public sector.)

According to Mark Blyth, the concept of austerity emerged in the 20th century, when large states acquired sizable budgets. However, Blyth argues that the theories and sensibilities about the role of the state and capitalist markets that underline austerity emerged from the 17th century onwards. Austerity is grounded in liberal economics

Economic liberalism is a political and economic ideology that supports a market economy based on individualism and private property in the means of production. Adam Smith is considered one of the primary initial writers on economic liberalism, ...

' view of the state and sovereign debt as deeply problematic. Blyth traces the discourse of austerity back to John Locke

John Locke (; 29 August 1632 (Old Style and New Style dates, O.S.) – 28 October 1704 (Old Style and New Style dates, O.S.)) was an English philosopher and physician, widely regarded as one of the most influential of the Enlightenment thi ...

's theory of private property and derivative theory of the state, David Hume

David Hume (; born David Home; – 25 August 1776) was a Scottish philosopher, historian, economist, and essayist who was best known for his highly influential system of empiricism, philosophical scepticism and metaphysical naturalism. Beg ...

's ideas about money and the virtue of merchant

A merchant is a person who trades in goods produced by other people, especially one who trades with foreign countries. Merchants have been known for as long as humans have engaged in trade and commerce. Merchants and merchant networks operated i ...

s, and Adam Smith

Adam Smith (baptised 1723 – 17 July 1790) was a Scottish economist and philosopher who was a pioneer in the field of political economy and key figure during the Scottish Enlightenment. Seen by some as the "father of economics"——— or ...

's theories on economic growth and taxes. On the basis of classic liberal ideas, austerity emerged as a doctrine of neoliberalism

Neoliberalism is a political and economic ideology that advocates for free-market capitalism, which became dominant in policy-making from the late 20th century onward. The term has multiple, competing definitions, and is most often used pe ...

in the 20th century.

Economist David M. Kotz suggests that the implementation of austerity measures following the 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

was an attempt to preserve the neoliberal capitalist model.

Theoretical considerations

In the 1930s during the

In the 1930s during the Great Depression

The Great Depression was a severe global economic downturn from 1929 to 1939. The period was characterized by high rates of unemployment and poverty, drastic reductions in industrial production and international trade, and widespread bank and ...

, anti-austerity arguments gained more prominence. John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes ( ; 5 June 1883 – 21 April 1946), was an English economist and philosopher whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originall ...

became a well known anti-austerity economist, arguing that "The boom, not the slump, is the right time for austerity at the Treasury."

Contemporary Keynesian

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output an ...

economists argue that budget deficits are appropriate when an economy is in recession, to reduce unemployment and help spur GDP growth. According to Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American New Keynesian economics, New Keynesian economist who is the Distinguished Professor of Economics at the CUNY Graduate Center, Graduate Center of the City University of New York. He ...

, since a government is not like a household, reductions in government spending during economic downturns worsen the crisis.

Across an economy, one person's spending is another person's income. In other words, if everyone is trying to reduce their spending, the economy can be trapped in what economists call the paradox of thrift, worsening the recession as GDP falls. In the past this has been offset by encouraging consumerism to rely on debt, but after the 2008 crisis, this has looked like a less and less viable option for sustainable economics.

Krugman argues that, if the private sector is unable or unwilling to consume at a level that increases GDP and employment sufficiently, then the government should be spending more in order to offset the decline in private spending. Keynesian theory is proposed as being responsible for post-war boom years, before the 1970s, and when public sector investment was at its highest across Europe, partially encouraged by the Marshall Plan

The Marshall Plan (officially the European Recovery Program, ERP) was an American initiative enacted in 1948 to provide foreign aid to Western Europe. The United States transferred $13.3 billion (equivalent to $ in ) in economic recovery pr ...

.

An important component of economic output is business investment, but there is no reason to expect it to stabilize at full utilization of the economy's resources. High business profits do not necessarily lead to increased economic growth. (When businesses and banks have a disincentive to spend accumulated capital, such as cash repatriation taxes from profits in overseas tax haven

A tax haven is a term, often used pejoratively, to describe a place with very low tax rates for Domicile (law), non-domiciled investors, even if the official rates may be higher.

In some older definitions, a tax haven also offers Bank secrecy, ...

s and interest on excess reserves

Excess reserves are bank reserves held by a bank in excess of a reserve requirement for it set by a central bank.

In the United States, bank reserves for a commercial bank are represented by its cash holdings and any credit balance in an accoun ...

paid to banks, increased profits can lead to decreasing growth.)

Economists Kenneth Rogoff

Kenneth Saul Rogoff (born March 22, 1953) is an American economist and chess Grandmaster.

He is the Maurits C. Boas Chair of International Economics at Harvard University. During the Great Recession, Rogoff was an influential proponent of auste ...

and Carmen Reinhart

Carmen M. Reinhart (née Castellanos, born October 7, 1955) is a Cuban-American economist and the Minos A. Zombanakis Professor of the International Financial System at Harvard Kennedy School. Previously, she was the Dennis Weatherstone Senior Fe ...

wrote in April 2013, "Austerity seldom works without structural reforms – for example, changes in taxes, regulations and labor market policies – and if poorly designed, can disproportionately hit the poor and middle class. Our consistent advice has been to avoid withdrawing fiscal stimulus too quickly, a position identical to that of most mainstream economists."

To help improve the US economy, they (Rogoff and Reinhart) advocated reductions in mortgage principal for 'underwater homes' – those whose negative equity

Negative equity is a deficit of owner's equity, occurring when the value of an asset used to secure a loan is less than the outstanding balance on the loan. In the United States, assets (particularly real estate, whose loans are mortgages) with ...

(where the value of the asset is less than the mortgage principal) can lead to a stagnant housing market with no realistic opportunity to reduce private debts.

Multiplier effects

In October 2012, the IMF announced that its forecasts for countries that implemented austerity programs have been consistently overoptimistic, suggesting that tax hikes and spending cuts have been doing more damage than expected and that countries that implementedfiscal stimulus

In economics, stimulus refers to attempts to use monetary policy or fiscal policy (or stabilization policy in general) to stimulate the economy. Stimulus can also refer to monetary policies such as lowering interest rates and quantitative eas ...

, such as Germany and Austria, did better than expected.

The IMF reported that this was due to fiscal multipliers that were considerably larger than expected: for example, the IMF estimated that fiscal multipliers based on data from 28 countries ranged between 0.9 and 1.7. In other words, a 1% GDP fiscal consolidation (i.e., austerity) would reduce GDP between 0.9% and 1.7%, thus inflicting far more economic damage than the 0.5 previously estimated in IMF forecasts.

In many countries, little is known about the size of multipliers, as data availability limits the scope for empirical research.

For these countries, Nicoletta Batini, Luc Eyraud and Anke Weber propose a simple method—dubbed the "bucket approach"—to come up with reasonable multiplier estimates. The approach bunches countries into groups (or "buckets") with similar multiplier values, based on their characteristics, and taking into account the effect of (some) temporary factors such as the state of the business cycle.

Different tax and spending choices of equal magnitude have different economic effects:

For example, the US Congressional Budget Office

The Congressional Budget Office (CBO) is a List of United States federal agencies, federal agency within the United States Congress, legislative branch of the United States government that provides budget and economic information to Congress.

I ...

estimated that the payroll tax (levied on all wage earners) has a higher multiplier (impact on GDP) than does the income tax (which is levied primarily on wealthier workers). In other words, raising the payroll tax by $1 as part of an austerity strategy would slow the economy more than would raising the income tax by $1, resulting in less net deficit reduction.

In theory, it would stimulate the economy and reduce the deficit if the payroll tax were lowered and the income tax raised in equal amounts.

Crowding in or out

The term "crowding out" refers to the extent to which an increase in the budget deficit offsets spending in the private sector. EconomistLaura Tyson

Laura D'Andrea Tyson (born June 28, 1947) is an American economist and university administrator who is currently a Distinguished Professor of the Graduate School at the Haas School of Business of the University of California, Berkeley and a senio ...

wrote in June 2012, "By itself an increase in the deficit, either in the form of an increase in government spending or a reduction in taxes, causes an increase in demand". How this affects output, employment, and growth depends on what happens to interest rates:

When the economy is operating near capacity, government borrowing to finance an increase in the deficit causes interest rates to rise and higher interest rates reduce or "crowd out" private investment, reducing growth. This theory explains why large and sustained government deficits take a toll on growth: they reduce capital formation. But this argument rests on how government deficits affect interest rates, and the relationship between government deficits and interest rates varies.

When there is considerable excess capacity, an increase in government borrowing to finance an increase in the deficit does not lead to higher interest rates and does not crowd out private investment. Instead, the higher demand resulting from the increase in the deficit bolsters employment and output directly. The resultant increase in income and economic activity in turn encourages, or "crowds in", additional private spending.

Some argue that the "crowding-in" model is an appropriate solution for current economic conditions.

Government budget balance as a sectoral component

According to economist

According to economist Martin Wolf

Martin Harry Wolf (born 16 August 1946 in London) is a British journalist who focuses on economics. He is the chief economics commentator at the ''Financial Times''. He also writes a weekly column for the French newspaper ''Le Monde''.

Earl ...

, the US and many Eurozone countries experienced rapid increases in their budget deficits in the wake of the 2008 crisis as a result of significant private-sector retrenchment and ongoing capital account

In macroeconomics and international finance, the capital account, also known as the capital and financial account, records the net flow of Foreign direct investment, investment into an economy. It is one of the two primary components of the balan ...

surpluses.

Policy choices had little to do with these deficit increases. This makes austerity measures counterproductive. Wolf explained that government fiscal balance is one of three major financial sectoral balances in a country's economy, along with the foreign financial sector (capital account) and the private financial sector.

By definition, the sum of the surpluses or deficits across these three sectors must be zero. In the US and many Eurozone countries other than Germany, a foreign financial surplus exists because capital is imported (net) to fund the trade deficit

Balance of trade is the difference between the monetary value of a nation's exports and imports of goods over a certain time period. Sometimes, trade in services is also included in the balance of trade but the official IMF definition only consi ...

. Further, there is a private-sector financial surplus because household savings exceed business investment.

By definition, a government budget deficit must exist so all three net to zero: for example, the US government budget deficit in 2011 was approximately 10% of GDP (8.6% of GDP of which was federal), offsetting a foreign financial surplus of 4% of GDP and a private-sector surplus of 6% of GDP.

Wolf explained in July 2012 that the sudden shift in the private sector from deficit to surplus forced the US government balance into deficit: "The financial balance of the private sector shifted towards surplus by the almost unbelievable cumulative total of 11.2 per cent of gross domestic product between the third quarter of 2007 and the second quarter of 2009, which was when the financial deficit of US government (federal and state) reached its peak. ... No fiscal policy changes explain the collapse into massive fiscal deficit between 2007 and 2009, because there was none of any importance. The collapse is explained by the massive shift of the private sector from financial deficit into surplus or, in other words, from boom to bust."

Wolf also wrote that several European economies face the same scenario and that a lack of deficit spending would likely have resulted in a depression. He argued that a private-sector depression (represented by the private- and foreign-sector surpluses) was being "contained" by government deficit spending.

Economist Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American New Keynesian economics, New Keynesian economist who is the Distinguished Professor of Economics at the CUNY Graduate Center, Graduate Center of the City University of New York. He ...

also explained in December 2011 the causes of the sizable shift from private-sector deficit to surplus in the US: "This huge move into surplus reflects the end of the housing bubble, a sharp rise in household saving, and a slump in business investment due to lack of customers."

One reason why austerity can be counterproductive in a downturn is due to a significant private-sector financial surplus, in which consumer savings is not fully invested by businesses. In a healthy economy, private-sector savings placed into the banking system by consumers are borrowed and invested by companies. However, if consumers have increased their savings but companies are not investing the money, a surplus develops.

Business investment is one of the major components of GDP. For example, a US private-sector financial deficit from 2004 to 2008 transitioned to a large surplus of savings over investment that exceeded $1 trillion by early 2009, and remained above $800 billion into September 2012. Part of this investment reduction was related to the housing market, a major component of investment. This surplus explains how even significant government deficit spending would not increase interest rates (because businesses still have access to ample savings if they choose to borrow and invest it, so interest rates are not bid upward) and how Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of ...

action to increase the money supply does not result in inflation (because the economy is awash with savings with no place to go).

Economist Richard Koo described similar effects for several of the developed world economies in December 2011: "Today private sectors in the US, the UK, Spain, and Ireland (but not Greece) are undergoing massive deleveraging aying down debt rather than spendingin spite of record low interest rates. This means these countries are all in serious balance sheet recessions. The private sectors in Japan and Germany are not borrowing, either. With borrowers disappearing and banks reluctant to lend, it is no wonder that, after nearly three years of record low interest rates and massive liquidity injections, industrial economies are still doing so poorly. Flow of funds data for the US show a massive shift away from borrowing to savings by the private sector since the housing bubble burst in 2007. The shift for the private sector as a whole represents over 9 percent of US GDP at a time of zero interest rates. Moreover, this increase in private sector savings exceeds the increase in government borrowings (5.8 percent of GDP), which suggests that the government is not doing enough to offset private sector deleveraging."

Framing of the debate surrounding austerity

Many scholars have argued that how the debate surrounding austerity is framed has a heavy impact on the view of austerity in the public eye, and how the public understands macroeconomics as a whole. Wren-Lewis, for example, coined the term 'mediamacro', which refers to "the role of the media reproducing particularly corrosive forms of economic illiteracy—of which the idea that deficits are ipso facto 'bad' is a strong example." This can go as far as ignoring economists altogether; however, it often manifests itself as a drive in which a minority of economists whose ideas about austerity have been thoroughly debunked being pushed to the front to justify public policy, such as in the case of Alberto Alesina (2009), whose pro-austerity works were "thoroughly debunked by the likes of the economists, the IMF, and the Centre for Budget and Policy Priorities (CBPP)." Other anti-austerity economists, such as Seymour have argued that the debate must be reframed as a social and class movement, and its impact judged accordingly, since statecraft is viewed as the main goal. Further, critics such as Major have highlighted how the OECD and associated international finance organisations have framed the debate to promote austerity, for example, the concept of 'wage-push inflation' which ignores the role played by the profiteering of private companies, and seeks to blame inflation on wages being too high.Empirical considerations

According to a 2020 study, austerity increases the risk of default in situations of severe fiscal stress, but reduces the risk of default in situations of low fiscal stress.Europe

Eurozone

During theEuropean debt crisis

The euro area crisis, often also referred to as the eurozone crisis, European debt crisis, or European sovereign debt crisis, was a multi-year debt crisis and financial crisis in the European Union (EU) from 2009 until, in Greece, 2018. The e ...

, many countries embarked on austerity programs, reducing their budget deficits relative to GDP from 2010 to 2011.

According to the ''CIA World Factbook

''The World Factbook'', also known as the ''CIA World Factbook'', is a reference resource produced by the United States' Central Intelligence Agency (CIA) with almanac-style information about the countries of the world. The official print ve ...

'', Greece decreased its budget deficit from 10.4% of GDP in 2010 to 9.6% in 2011. Iceland, Italy, Ireland, Portugal, France, and Spain also decreased their budget deficits from 2010 to 2011 relative to GDP but the austerity policy of the Eurozone achieves not only the reduction of budget deficits. The goal of economic consolidation influences the future development of the European social model

The European social model is a concept that emerged in the discussion of economic globalisation and typically contrasts the degree of employment regulation and social protection in European countries to conditions in the United States. It is ...

.

With the exception of Germany, each of these countries had public-debt-to-GDP ratios that increased from 2010 to 2011, as indicated in the chart at right. Greece's public-debt-to-GDP ratio increased from 143% in 2010 to 165% in 2011 Indicating despite declining budget deficits GDP growth was not sufficient to support a decline in the debt-to-GDP ratio for these countries during this period.

Eurostat

Eurostat ("European Statistical Office"; also DG ESTAT) is a department of the European Commission ( Directorate-General), located in the Kirchberg quarter of Luxembourg City, Luxembourg. Eurostat's main responsibilities are to provide statist ...

reported that the overall debt-to-GDP ratio for the EA17 was 70.1% in 2008, 80.0% in 2009, 85.4% in 2010, 87.3% in 2011, and 90.6% in 2012.

Further, real GDP in the EA17 declined for six straight quarters from Q4 2011 to Q1 2013.

Unemployment is another variable considered in evaluating austerity measures. According to the ''CIA World Factbook'', from 2010 to 2011, the unemployment rates in Spain, Greece, Ireland, Portugal, and the UK increased. France and Italy had no significant changes, while in Germany and Iceland the unemployment rate declined. Eurostat reported that Eurozone unemployment reached record levels in March 2013 at 12.1%, up from 11.6% in September 2012 and 10.3% in 2011. Unemployment varied significantly by country.

Economist Martin Wolf

Martin Harry Wolf (born 16 August 1946 in London) is a British journalist who focuses on economics. He is the chief economics commentator at the ''Financial Times''. He also writes a weekly column for the French newspaper ''Le Monde''.

Earl ...

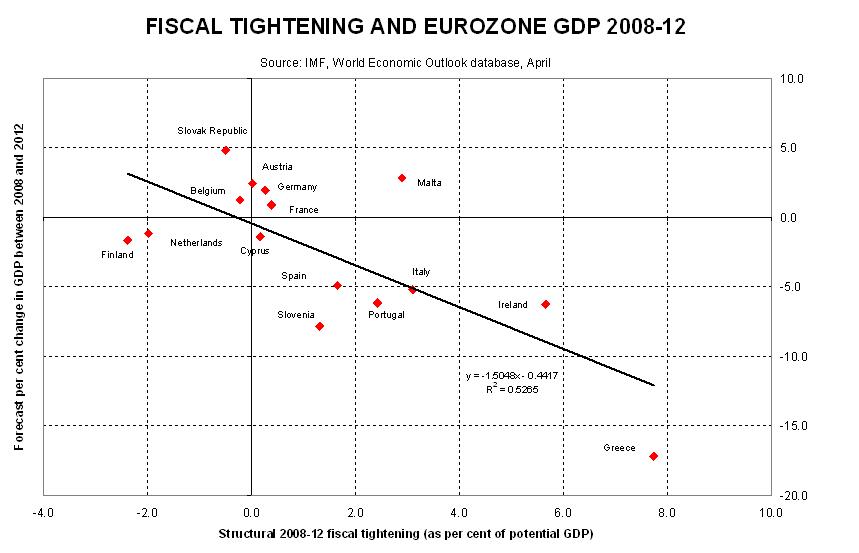

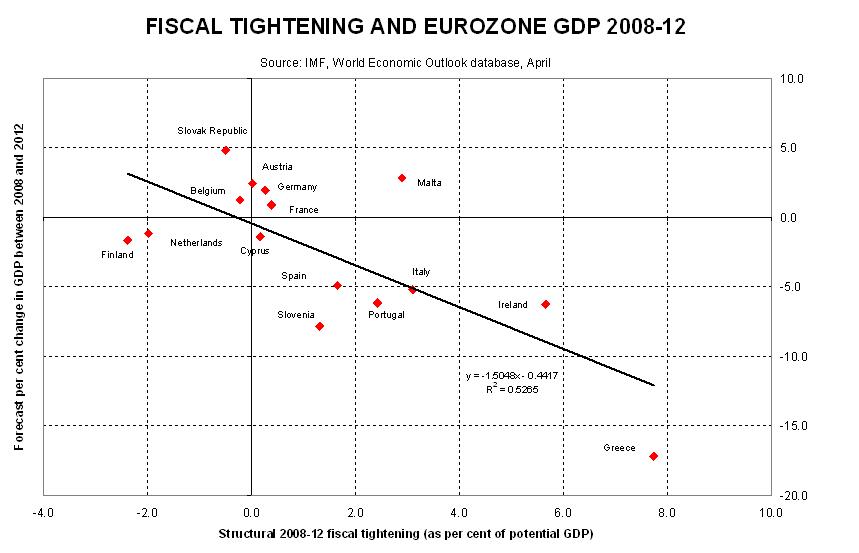

analyzed the relationship between cumulative GDP growth in 2008 to 2012 and total reduction in budget deficits due to austerity policies in several European countries during April 2012 (see chart at right). He concluded, "In all, there is no evidence here that large fiscal contractions budget deficit reductions bring benefits to confidence and growth that offset the direct effects of the contractions. They bring exactly what one would expect: small contractions bring recessions and big contractions bring depressions." Changes in budget balances (deficits or surpluses) explained approximately 53% of the change in GDP, according to the equation derived from the IMF data used in his analysis.

Similarly, economist Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American New Keynesian economics, New Keynesian economist who is the Distinguished Professor of Economics at the CUNY Graduate Center, Graduate Center of the City University of New York. He ...

analyzed the relationship between GDP and reduction in budget deficits for several European countries in April 2012 and concluded that austerity was slowing growth. He wrote: "this also implies that 1 euro of austerity yields only about 0.4 euros of reduced deficit, even in the short run. No wonder, then, that the whole austerity enterprise is spiraling into disaster."

=Greece

= TheGreek government-debt crisis

Greek may refer to:

Anything of, from, or related to Greece, a country in Southern Europe:

*Greeks, an ethnic group

*Greek language, a branch of the Indo-European language family

** Proto-Greek language, the assumed last common ancestor of all kn ...

brought a package of austerity measures, put forth by the EU and the IMF mostly in the context of the three successive bailouts the country endured from 2010 to 2018; it was met with great anger by the Greek public, leading to riots and social unrest. On 27 June 2011, trade union organizations began a 48-hour labour strike in advance of a parliamentary vote on the austerity package, the first such strike since 1974.

Massive demonstrations were organized throughout Greece, intended to pressure members of parliament into voting against the package. The second set of austerity measures was approved on 29 June 2011, with 155 out of 300 members of parliament voting in favor. However, one United Nations official warned that the second package of austerity measures in Greece could pose a violation of human rights.

Around 2011, the IMF started issuing guidance suggesting that austerity could be harmful when applied without regard to an economy's underlying fundamentals.Andrew Berg and Jonathan Ostry. (2011"Inequality and Unsustainable Growth: Two Sides of the Same Coin"

''IMF Staff Discussion Note'' No. SDN/11/08 (International Monetary Fund) In 2013, it published a detailed analysis concluding that "if financial markets focus on the short-term behavior of the debt ratio, or if country authorities engage in repeated rounds of tightening in an effort to get the debt ratio to converge to the official target", austerity policies could slow or reverse economic growth and inhibit

full employment

Full employment is an economic situation in which there is no cyclical or deficient-demand unemployment. Full employment does not entail the disappearance of all unemployment, as other kinds of unemployment, namely structural and frictional, may ...

.Luc Eyraud and Anke Weber. (2013"The Challenge of Debt Reduction during Fiscal Consolidation"

''IMF Working Paper Series'' No. WP/13/67 (International Monetary Fund) Keynesian economists and commentators such as

Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American New Keynesian economics, New Keynesian economist who is the Distinguished Professor of Economics at the CUNY Graduate Center, Graduate Center of the City University of New York. He ...

have suggested that this has, in fact, been occurring, with austerity yielding worse results in proportion to the extent to which it has been imposed.

Overall, Greece lost 25% of its GDP during the crisis. Although the government debt increased only 6% between 2009 and 2017 (from €300 bn to €318 bn)thanks, in part, to the 2012 debt restructuring

Debt restructuring is a process that allows a private or public company or a sovereign entity facing cash flow problems and financial distress to reduce and renegotiate its delinquent debts to improve or restore liquidity so that it can continu ...

– the critical debt-to-GDP ratio shot up from 127% to 179% mostly due to the severe GDP drop during the handling of the crisis. In all, the Greek economy suffered the longest recession of any advanced capitalist economy to date, overtaking the US Great Depression

The Great Depression was a severe global economic downturn from 1929 to 1939. The period was characterized by high rates of unemployment and poverty, drastic reductions in industrial production and international trade, and widespread bank and ...

. As such, the crisis adversely affected the populace as the series of sudden reforms and austerity measures led to impoverishment and loss of income and property, as well as a small-scale humanitarian crisis

A humanitarian crisis (or sometimes humanitarian disaster) is defined as a singular event or a series of events that are threatening in terms of health, safety or well-being of a community or large group of people. It may be an internal or exter ...

. Unemployment shot up from 8% in 2008 to 27% in 2013 and remained at 22% in 2017. As a result of the crisis, Greek political system has been upended, social exclusion

Social exclusion or social marginalisation is the social disadvantage and relegation to the fringe of society. It is a term that has been used widely in Europe and was first used in France in the late 20th century. In the EU context, the Euro ...

increased, and hundreds of thousands of well-educated Greeks left the country.

=France

= In April and May 2012, France held apresidential election

A presidential election is the election of any head of state whose official title is President.

Elections by country

Albania

The president of Albania is elected by the Assembly of Albania who are elected by the Albanian public.

Chile

The p ...

in which the winner, François Hollande

François Gérard Georges Nicolas Hollande (; born 12 August 1954) is a French politician who served as President of France from 2012 to 2017. Before his presidency, he was First Secretary of the Socialist Party (France), First Secretary of th ...

, had opposed austerity measures, promising to eliminate France's budget deficit by 2017 by canceling recently enacted tax cuts and exemptions for the wealthy, raising the top tax bracket rate to 75% on incomes over one million euros, restoring the retirement age to 60 with a full pension for those who have worked 42 years, restoring 60,000 jobs recently cut from public education, regulating rent increases, and building additional public housing for the poor. In the legislative elections

A general election is an electoral process to choose most or all members of a governing body at the same time. They are distinct from by-elections, which fill individual seats that have become vacant between general elections. General elections ...

in June, Hollande's Socialist Party

Socialist Party is the name of many different political parties around the world. All of these parties claim to uphold some form of socialism, though they may have very different interpretations of what "socialism" means. Statistically, most of th ...

won a supermajority

A supermajority is a requirement for a proposal to gain a specified level of support which is greater than the threshold of one-half used for a simple majority. Supermajority rules in a democracy can help to prevent a majority from eroding fun ...

capable of amending the French Constitution and enabling the immediate enactment of the promised reforms. Interest rates on French government bonds fell by 30% to record lows, fewer than 50 basis point

A basis point (often abbreviated as bp, often pronounced as "bip" or "beep") is one hundredth of 1 percentage point. Changes of interest rates are often stated in basis points. For example, if an existing interest rate of 10 percent is increased ...

s above German government bond rates.

=Latvia

= Latvia's economy returned to growth in 2011 and 2012, outpacing the 27 nations in the EU, while implementing significant austerity measures. Advocates of austerity argue that Latvia represents an empirical example of the benefits of austerity, while critics argue that austerity created unnecessary hardship with the output in 2013 still below the pre-crisis level. While Anders Åslund maintains that internal devaluation was not opposed by the Latvian public, Jokubas Salyga has recently chronicled widespread protests against austerity in the country. According to the CIA World Fact Book, "Latvia's economy experienced GDP growth of more than 10% per year during 2006–07, but entered a severe recession in 2008 as a result of an unsustainable current account deficit and large debt exposure amid the softening world economy. Triggered by the collapse of the second largest bank, GDP plunged 18% in 2009. The economy has not returned to pre-crisis levels despite strong growth, especially in the export sector in 2011–12. The IMF, EU, and other international donors provided substantial financial assistance to Latvia as part of an agreement to defend the currency's peg to the euro in exchange for the government's commitment to stringent austerity measures. The IMF/EU program successfully concluded in December 2011. The government of Prime MinisterValdis Dombrovskis

Valdis Dombrovskis (; born 5 August 1971) is a Latvian politician serving as Executive Vice President of the European Commission for An Economy that Works for People since 2019 and European Commissioner for Trade since 2020. He previously serv ...

remained committed to fiscal prudence and reducing the fiscal deficit from 7.7% of GDP in 2010, to 2.7% of GDP in 2012." The CIA estimated that Latvia's GDP declined by 0.3% in 2010, then grew by 5.5% in 2011 and 4.5% in 2012. Unemployment was 12.8% in 2011 and rose to 14.3% in 2012. Latvia's currency, the Lati, fell from $0.47 per US dollar in 2008 to $0.55 in 2012, a decline of 17%. Latvia entered the euro zone in 2014. Latvia's trade deficit improved from over 20% of GDP in 2006 to 2007 to under 2% GDP by 2012.

Eighteen months after harsh austerity measures were enacted (including both spending cuts and tax increases), economic growth began to return, although unemployment remained above pre-crisis levels. Latvian exports have skyrocketed and both the trade deficit and budget deficit have decreased dramatically. More than one-third of government positions were eliminated, and the rest received sharp pay cuts. Exports increased after goods prices were reduced due to private business lowering wages in tandem with the government.

Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American New Keynesian economics, New Keynesian economist who is the Distinguished Professor of Economics at the CUNY Graduate Center, Graduate Center of the City University of New York. He ...

wrote in January 2013 that Latvia had yet to regain its pre-crisis level of employment. He also wrote, "So we're looking at a Depression-level slump, and 5 years later only a partial bounceback; unemployment is down but still very high, and the decline has a lot to do with emigration. It's not what you'd call a triumphant success story, any more than the partial US recovery from 1933 to 1936—which was actually considerably more impressive—represented a huge victory over the Depression. And it's in no sense a refutation of Keynesianism, either. Even in Keynesian models, a small open economy can, in the long run, restore full employment through deflation and internal devaluation; the point, however, is that it involves many years of suffering".

Latvian Prime Minister Valdis Dombrovskis defended his policies in a television interview, stating that Krugman refused to admit his error in predicting that Latvia's austerity policy would fail. Krugman had written a blog post in December 2008 entitled "Why Latvia is the New Argentina", in which he argued for Latvia to devalue its currency as an alternative or in addition to austerity.

United Kingdom

=Post war austerity

= Following theSecond World War

World War II or the Second World War (1 September 1939 – 2 September 1945) was a World war, global conflict between two coalitions: the Allies of World War II, Allies and the Axis powers. World War II by country, Nearly all of the wo ...

the United Kingdom had huge debts, large commitments, and had sold many income producing assets. Rationing of food and other goods which had started in the war continued for some years.

=21st century austerity programme

= Following the

Following the 2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

, a period of economic recession began in the UK. The austerity programme was initiated in 2010 by the Conservative and Liberal Democrat coalition government, despite some opposition from the academic community. In his June 2010 budget speech, the Chancellor George Osborne

George Gideon Oliver Osborne (born 23 May 1971) is a British retired politician and newspaper editor who served as Chancellor of the Exchequer from 2010 to 2016 and as First Secretary of State from 2015 to 2016 in the Cameron government. A ...

identified two goals. The first was that the structural current budget deficit would be eliminated to "achieve cyclically-adjusted current balance by the end of the rolling, five-year forecast period". The second was that national debt as a percentage of GDP would fall. The government intended to achieve both of its goals through substantial reductions in public expenditure. This was to be achieved by a combination of public spending reductions and tax increases. Economists Alberto Alesina

Alberto Francesco Alesina (29 April 1957 – 23 May 2020) was an Italian economist who was the Nathaniel Ropes Professor of Political Economy at Harvard University from 2003 until his death in 2020. He was known principally as an economist of po ...

, Carlo A. Favero and Francesco Giavazzi, writing in ''Finance & Development

''Finance & Development'' is a quarterly journal published by the International Monetary Fund (the IMF).

The journal publishes analysis on issues related to the financial system, monetary policy, economic development, poverty reduction, and ot ...

'' in 2018, argued that deficit reduction policies based on spending cuts typically have almost no effect on output, and hence form a better route to achieving a reduction in the debt-to-GDP ratio than raising taxes. The authors commented that the UK government austerity programme had resulted in growth that was higher than the European average and that the UK's economic performance had been much stronger than the International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by 191 member countries, with headquarters in Washington, D.C. It is regarded as the global lender of las ...

had predicted. This claim was challenged most strongly by Mark Blyth, whose 2014 book on austerity claims that austerity not only fails to stimulate growth, but effectively passes that debt down to the working classes. As such, many academics such as Andrew Gamble view Austerity in Britain less as an economic necessity, and more as a tool of statecraft, driven by ideology and not economic requirements. A study published in ''The BMJ

''The BMJ'' is a fortnightly peer-reviewed medical journal, published by BMJ Publishing Group Ltd, which in turn is wholly-owned by the British Medical Association (BMA). ''The BMJ'' has editorial freedom from the BMA. It is one of the world ...

'' in November 2017 found the Conservative government austerity programme had been linked to approximately 120,000 deaths since 2010; however, this was disputed, for example on the grounds that it was an observational study which did not show cause and effect. More studies claim adverse effects of austerity on population health

Population health has been defined as "the health outcomes of a group of individuals, including the distribution of such outcomes within the group". It is an approach to health that aims to improve the health of an entire human population. It ha ...

, which include an increase in the mortality rate among pensioners which has been linked to unprecedented reductions in income support, an increase in suicides and the prescription of antidepressants for patients with mental health issues, and an increase in violence, self-harm, and suicide in prisons.

United States

The United States's response to the 2008 economic crash was largely influenced by Wall Street and IMF interests, who favored fiscal retrenchment in the face of the economic crash. Evidence exists to suggest thatPete Peterson

Douglas Brian "Pete" Peterson (born June 26, 1935) is an American politician and diplomat. He served as a United States Air Force pilot during the Vietnam War and spent over six years as a prisoner of the North Vietnamese army after his plane was ...

(and the Petersonites) have heavily influenced US policy on economic recovery since the Nixon era, and presented itself in 2008, despite austerity measures being "wildly out of step with public opinion and reputable economic policy... nd showinganti-Keynesian

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output an ...

bias of supply-side economics

Supply-side economics is a Macroeconomics, macroeconomic theory postulating that economic growth can be most effectively fostered by Tax cuts, lowering taxes, Deregulation, decreasing regulation, and allowing free trade. According to supply- ...

and a political system skewed to favor Wall Street over Main Street". The nuance of the economic logic of Keynesianism is, however, difficult to put across to the American Public, and compares poorly to the simplistic message which blames government spending, which might explain Obama's preferred position of a halfway point between economic stimulus followed by austerity, which led to him being criticized by economists such as Joseph Stiglitz

Joseph Eugene Stiglitz (; born February 9, 1943) is an American New Keynesian economist, a public policy analyst, political activist, and a professor at Columbia University. He is a recipient of the Nobel Memorial Prize in Economic Sciences (2 ...

. The US began sweeping austerity measures to services such as healthcare, human services, US grants, and federal jobs during the second presidency of Donald Trump

Donald Trump's second and current tenure as the president of the United States began upon Second inauguration of Donald Trump, his inauguration as the List of presidents of the United States, 47th president on January 20, 2025.

On his first ...

.

Controversy

Austerity programs can be controversial. In theOverseas Development Institute

ODI Global (formerly Overseas Development Institute) is a global affairs think tank, founded in 1960. Its mission is "to inspire people to act on injustice and inequality through collaborative research and ideas that matter for people and the ...

(ODI) briefing paper "The IMF and the Third World", the ODI addresses five major complaints against the IMF's austerity conditions. Complaints include such measures being "anti-developmental", "self-defeating", and tending "to have an adverse impact on the poorest segments of the population".

In many situations, austerity programs are implemented by countries that were previously under dictatorial regimes, leading to criticism that citizens are forced to repay the debts of their oppressors.

In 2009, 2010, and 2011, workers and students in Greece and other European countries demonstrated against cuts to pensions, public services, and education spending as a result of government austerity measures.

Following the announcement of plans to introduce austerity measures in Greece, massive demonstrations occurred throughout the country aimed at pressing parliamentarians to vote against the austerity package. In Athens alone, 19 arrests were made, while 46 civilians and 38 policemen had been injured by 29 June 2011. The third round of austerity was approved by the Greek parliament on 12 February 2012 and met strong opposition, especially in Athens

Athens ( ) is the Capital city, capital and List of cities and towns in Greece, largest city of Greece. A significant coastal urban area in the Mediterranean, Athens is also the capital of the Attica (region), Attica region and is the southe ...

and Thessaloniki

Thessaloniki (; ), also known as Thessalonica (), Saloniki, Salonika, or Salonica (), is the second-largest city in Greece (with slightly over one million inhabitants in its Thessaloniki metropolitan area, metropolitan area) and the capital cit ...

, where police clashed with demonstrators.

Opponents argue that austerity measures depress economic growth and ultimately cause reduced tax revenues that outweigh the benefits of reduced public spending. Moreover, in countries with already anemic economic growth, austerity can engender deflation, which inflates existing debt. Such austerity packages can also cause the country to fall into a liquidity trap

A liquidity trap is a situation, described in Keynesian economics, in which, "after the rate of interest has fallen to a certain level, liquidity preference may become virtually absolute in the sense that almost everyone prefers holding cash rathe ...

, causing credit markets to freeze up and unemployment to increase. Opponents point to cases in Ireland and Spain in which austerity measures instituted in response to financial crises in 2009 proved ineffective in combating public debt and placed those countries at risk of defaulting in late 2010.

In October 2012, the IMF announced that its forecasts for countries that implemented austerity programs have been consistently overoptimistic, suggesting that tax hikes and spending cuts have been doing more damage than expected and that countries that implemented fiscal stimulus

In economics, stimulus refers to attempts to use monetary policy or fiscal policy (or stabilization policy in general) to stimulate the economy. Stimulus can also refer to monetary policies such as lowering interest rates and quantitative eas ...

, such as Germany and Austria, did better than expected. These data have been scrutinized by the ''Financial Times'', which found no significant trends when outliers like Germany and Greece were excluded. Determining the multipliers used in the research to achieve the results found by the IMF was also described as an "exercise in futility" by Professor Carlos Vegh of the University of Michigan. Moreover, Barry Eichengreen of the University of California, Berkeley and Kevin H. O'Rourke of Oxford University write that the IMF's new estimate of the extent to which austerity restricts growth was much lower than historical data suggest.Barry Eichengreen and Kevin H O'Rourke (23 October 2012"Gauging the multiplier: Lessons from history"

''VoxEU.org'' On 3 February 2015,

Joseph Stiglitz

Joseph Eugene Stiglitz (; born February 9, 1943) is an American New Keynesian economist, a public policy analyst, political activist, and a professor at Columbia University. He is a recipient of the Nobel Memorial Prize in Economic Sciences (2 ...

wrote: "Austerity had failed repeatedly from its early use under US president Herbert Hoover, which turned the stock-market crash into the Great Depression, to the IMF programs imposed on East Asia and Latin America in recent decades. And yet when Greece got into trouble, it was tried again." Government spending actually rose significantly under Hoover, while revenues were flat.

According to a 2020 study, which used survey experiments in the UK, Portugal, Spain, Italy and Germany, voters strongly disapprove of austerity measures, in particular spending cuts. Voters disapprove of fiscal deficits but not as strongly as austerity. A 2021 study found that incumbent European governments that implemented austerity measures in the Great Recession lost support in opinion polls.

Austerity has been blamed for at least 120,000 deaths between 2010 and 2017 in the UK, with one study putting it at 130,000 and another at 30,000 in 2015 alone. The first study added that "no firm conclusions can be drawn about cause and effect, but the findings back up other research in the field" and campaigners have claimed that cuts to benefits, healthcare and mental health services lead to more deaths including through suicide.

Balancing stimulus and austerity

Strategies that involve short-term stimulus with longer-term austerity are not mutually exclusive. Steps can be taken in the present that will reduce future spending, such as "bending the curve" on pensions by reducing cost of living adjustments or raising the retirement age for younger members of the population, while at the same time creating short-term spending or tax cut programs to stimulate the economy to create jobs. IMF managing directorChristine Lagarde

Christine Madeleine Odette Lagarde (; , ; born 1 January 1956) is a French politician and lawyer who has been the President of the European Central Bank since 2019. She previously served as the 11th Managing Director of the International Monetar ...

wrote in August 2011, "For the advanced economies, there is an unmistakable need to restore fiscal sustainability through credible consolidation plans. At the same time we know that slamming on the brakes too quickly will hurt the recovery and worsen job prospects. So fiscal adjustment must resolve the conundrum of being neither too fast nor too slow. Shaping a Goldilocks fiscal consolidation is all about timing. What is needed is a dual focus on medium-term consolidation and short-term support for growth. That may sound contradictory, but the two are mutually reinforcing. Decisions on future consolidation, tackling the issues that will bring sustained fiscal improvement, create space in the near term for policies that support growth."

Federal Reserve Chair Ben Bernanke

Ben Shalom Bernanke ( ; born December 13, 1953) is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Federal Reserve, he was appointed a distinguished fellow at the Brookings Insti ...

wrote in September 2011, "the two goals—achieving fiscal sustainability, which is the result of responsible policies set in place for the longer term, and avoiding creation of fiscal headwinds for the recovery—are not incompatible. Acting now to put in place a credible plan for reducing future deficits over the long term, while being attentive to the implications of fiscal choices for the recovery in the near term, can help serve both objectives."

"Age of austerity"

The term "age of austerity" was popularised by UK Conservative Party leaderDavid Cameron

David William Donald Cameron, Baron Cameron of Chipping Norton (born 9 October 1966) is a British politician who served as Prime Minister of the United Kingdom from 2010 to 2016. Until 2015, he led the first coalition government in the UK s ...

in his keynote speech to the Conservative Party forum in Cheltenham

Cheltenham () is a historic spa town and borough adjacent to the Cotswolds in Gloucestershire, England. Cheltenham became known as a health and holiday spa town resort following the discovery of mineral springs in 1716, and claims to be the mo ...

on 26 April 2009, in which he committed to end years of what he called "excessive government spending". Theresa May

Theresa Mary May, Baroness May of Maidenhead (; ; born 1 October 1956), is a British politician who served as Prime Minister of the United Kingdom and Leader of the Conservative Party from 2016 to 2019. She previously served as Home Secretar ...

claimed that "Austerity is over" as of 3 October 2018, a statement which was almost immediately met with criticism on the reality of its central claim, particularly in relation to the high possibility of a substantial economic downturn due to Brexit

Brexit (, a portmanteau of "Britain" and "Exit") was the Withdrawal from the European Union, withdrawal of the United Kingdom (UK) from the European Union (EU).

Brexit officially took place at 23:00 GMT on 31 January 2020 (00:00 1 February ...

.

Word of the year

'' Merriam-Webster's Dictionary'' named the word ''austerity'' as its " Word of the year" for 2010 because of the number of web searches this word generated that year. According to the president and publisher of the dictionary, "''austerity'' had more than 250,000 searches on the dictionary's free online ebsitetool" and the spike in searches "came with more coverage of the debt crisis".Examples of austerity

* Albania — 1962 * Argentina — 1952,1985

The year 1985 was designated as the International Youth Year by the United Nations.

Events January

* January 1

** The Internet's Domain Name System is created.

** Greenland withdraws from the European Economic Community as a result of a n ...

, 1998–2003, 2012

2012 was designated as:

*International Year of Cooperatives

*International Year of Sustainable Energy for All

Events January

*January 4 – The Cicada 3301 internet hunt begins.

* January 12 – Peaceful protests begin in the R ...

, 2018–2019, 2022–

*Australia — 2014

* Brazil — 2003–2006, 2015–2018

* Canada — 1994

* China — 2013

* Cuba — 1991–2000, 2008

* Czech Republic — 2010

* Ecuador — 2017– ,

* Estonia — 2007–2009

* European countries — 2012

* Finland — 1991–1999, 2011–2015, 2015–2019, 2023–

* France — 1926–1929, 1932, 1934–1936, 1938–1940, 1958, 1976–1981, 1982–1986, 1995, 2010, 2014, 2024–

* Germany — 1930, 2011

* Greece — 2010–2018

*Haiti — 1915–1934 ( American occupation)

* Ireland — 2010–2014

* Israel — 1949–1959

* Italy — 1922–1925, 2011–2013

* Japan — 1949 ( American Occupation), 1997–1998, 2010

* Latvia — 2009–2013

* Mexico — 1985, 2020

* Netherlands — 1982–1990, 2003–2006, 2011–2014

* Nicaragua — 1997, 2018

* Palestinian Authority — 2006

* Portugal — 1977–1979, 1983–1985, 2002–2015,

* Puerto Rico — 2009–2018

* Romania — Ceaușescu's 1981–1989 austerity, 2010

* Spain — 1979, 2010–2014

* Sweden — 1995–1997

* United States — 1921, 1937, 1946, Omnibus Budget Reconciliation Act of 1993

The Omnibus Budget Reconciliation Act of 1993 (or OBRA-93) was a federal law that was enacted by the 103rd United States Congress and signed into law by President Bill Clinton on August 10, 1993. It has also been unofficially referred to as the ...

* United Kingdom — during and after the two World Wars, 1976–1979, 2011–2019

* Venezuela — 1989

1989 was a turning point in political history with the "Revolutions of 1989" which ended communism in Eastern Bloc of Europe, starting in Poland and Hungary, with experiments in power-sharing coming to a head with the opening of the Berlin W ...

, 2016

Criticism

According to economist David Stuckler and physician Sanjay Basu in their study ''The Body Economic: Why Austerity Kills'', a health crisis is being triggered by austerity policies, including up to 10,000 additional suicides that have occurred across Europe and the US since the introduction of austerity programs. Much of the acceptance of austerity in the general public has centred on the way debate has been framed, and relates to an issue with representative democracy; since the public do not have widely available access to the latest economic research, which is highly critical of economic retrenchment in times of crisis, the public must rely on which politician sounds most plausible. An analysis by Hübscher et al. of 166 elections across Europe since 1980 demonstrates that austerity measures lead to increased electoral abstention and a rise in votes for non-mainstream parties, thereby exacerbating political polarization. Their detailed examination of specific austerity episodes reveals that new, small, and radical parties are the primary beneficiaries of such policies. A study by Gabriel et al., analyzing elections in 124 European regions from eight countries between 1980 and 2015, found that fiscal consolidations increased the vote share of extreme parties, lowered voter turnout, and heightened political fragmentation. Notably, after theEuropean debt crisis

The euro area crisis, often also referred to as the eurozone crisis, European debt crisis, or European sovereign debt crisis, was a multi-year debt crisis and financial crisis in the European Union (EU) from 2009 until, in Greece, 2018. The e ...

, a 1% reduction in regional public spending resulted in an approximate 3 percentage point rise in the vote share of extreme parties. The findings suggest that austerity measures diminish trust in political institutions and encourage support for more extreme political positions.

According to a 2020 study, austerity does not pay off in terms of reducing the default premium in situations of severe fiscal stress. Rather, austerity increases the default premium. However, in situations of low fiscal stress, austerity does reduce the default premium. The study also found that increases in government consumption had no substantial impact on the default premium.

Clara E. Mattei, assistant professor of economics at the New School for Social Research

The New School for Social Research (NSSR), previously known as The University in Exile and The New School University, is a graduate-level educational division of The New School in New York City, United States. NSSR enrolls more than 1,000 stud ...

, posits that austerity is less of a means to "fix the economy" and is more of an ideological weapon of class oppression wielded by economic and political elites in order to suppress revolts and unrest by the working class public and close off any alternatives to the capitalist system. She traces the origins of modern austerity to post-World War I

World War I or the First World War (28 July 1914 – 11 November 1918), also known as the Great War, was a World war, global conflict between two coalitions: the Allies of World War I, Allies (or Entente) and the Central Powers. Fighting to ...

Britain and Italy

Italy, officially the Italian Republic, is a country in Southern Europe, Southern and Western Europe, Western Europe. It consists of Italian Peninsula, a peninsula that extends into the Mediterranean Sea, with the Alps on its northern land b ...

, when it served as a "powerful counteroffensive" to rising working class agitation and anti-capitalist

Anti-capitalism is a political ideology and Political movement, movement encompassing a variety of attitudes and ideas that oppose capitalism. Anti-capitalists seek to combat the worst effects of capitalism and to eventually replace capitalism ...

sentiment. In this, she quotes British economist G. D. H. Cole writing on the British response to the economic downturn of 1921:

"The big working-class offensive had been successfully stalled off; and British capitalism, though threatened with economic adversity, felt itself once more safely in the saddle and well able to cope, both industrially and politically, with any attempt that might still be made from the labour side to unseat it."

DeLong–Summers condition

J. Bradford DeLong andLawrence Summers

Lawrence Henry Summers (born November 30, 1954) is an American economist who served as United States Secretary of the Treasury from 1999 to 2001 and as the director of the National Economic Council from 2009 to 2010. He also served as presiden ...

explained why an expansionary fiscal policy is effective in reducing a government's future debt burden, pointing out that the policy has a positive impact on its future productivity level.J. DeLong and L. Summers, Brookings Papers on Economic Activity, 233 (2012) They pointed out that when an economy is depressed and its nominal interest rate is near zero, the real interest rate charged to firms is linked to the output as . This means that the rate decreases as the real GDP increases, and the actual fiscal multiplier is higher than that in normal times; a fiscal stimulus is more effective for the case where the interest rates are at the zero bound. As the economy is boosted by government spending, the increased output yields higher tax revenue, and so we have

:

where is a baseline marginal tax-and-transfer rate. Also, we need to take account of the economy's long-run growth rate , as a steady economic growth rate may reduce its debt-to-GDP ratio. Then we can see that an expansionary fiscal policy is self-financing:

:

:

as long as is less than zero. Then we can find that a fiscal stimulus makes the long-term budget in surplus if the real government borrowing rate satisfies the following condition:

:

Impacts on short-run budget deficit