|

Tax Haven

A tax haven is a term, often used pejoratively, to describe a place with very low tax rates for Domicile (law), non-domiciled investors, even if the official rates may be higher. In some older definitions, a tax haven also offers Bank secrecy, financial secrecy. However, while countries with high levels of secrecy but also high rates of taxation, most notably the United States and Germany in the Financial Secrecy Index (FSI) rankings, can be featured in some tax haven lists, they are often omitted from lists for political reasons or through lack of subject matter knowledge. In contrast, countries with lower levels of secrecy but also low "effective" rates of taxation, most notably Ireland in the FSI rankings, appear in most . The consensus on ''effective tax rates'' has led academics to note that the term "tax haven" and "offshore financial centre" are almost synonymous. In reality, many offshore financial centers do not have harmful tax practices and are at the forefront among ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Singapore

Singapore, officially the Republic of Singapore, is an island country and city-state in Southeast Asia. The country's territory comprises one main island, 63 satellite islands and islets, and one outlying islet. It is about one degree of latitude () north of the equator, off the southern tip of the Malay Peninsula, bordering the Strait of Malacca to the west, the Singapore Strait to the south along with the Riau Islands in Indonesia, the South China Sea to the east, and the Straits of Johor along with the State of Johor in Malaysia to the north. In its early history, Singapore was a maritime emporium known as '' Temasek''; subsequently, it was part of a major constituent part of several successive thalassocratic empires. Its contemporary era began in 1819, when Stamford Raffles established Singapore as an entrepôt trading post of the British Empire. In 1867, Singapore came under the direct control of Britain as part of the Straits Settlements. During World ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax Haven

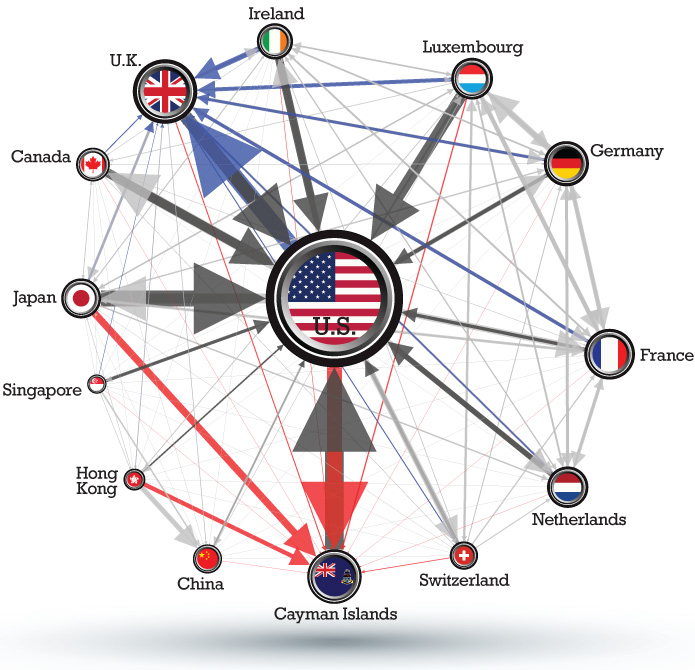

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly due to favourable tax regimes (not just the headline tax rate), and/or favourable secrecy laws (such as the avoidance of regulations or disclosure of tax schemes), and/or favourable regulatory regimes (such as weak data-protection or employment laws). Unlike traditional tax havens, modern corporate tax havens reject they have anything to do with near-zero effective tax rates, due to their need to encourage jurisdictions to enter into bilateral tax treaties that accept the haven's base erosion and profit shifting (BEPS) tools. CORPNET show each corporate tax haven is strongly connected with specific traditional tax havens (via additional BEPS tool "backdoors" like the double Irish, the Dutch sandwich, and single malt). Corporate tax hav ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Haven

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or Incorporation (business), incorporation of regional or main company headquarters, mostly due to favourable tax regimes (not just the headline tax rate), and/or favourable secrecy laws (such as the avoidance of regulations or disclosure of tax schemes), and/or favourable regulatory regimes (such as weak data-protection or employment laws). Unlike traditional tax havens, modern corporate tax havens reject they have anything to do with near-zero Corporation tax in the Republic of Ireland#Effective tax rate (ETR), effective tax rates, due to their need to encourage jurisdictions to enter into bilateral Tax treaty, tax treaties that accept the haven's base erosion and profit shifting (BEPS) tools. CORPNET show each corporate tax haven is strongly connected with specific traditional tax havens (via additional ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Domicile (law)

In law and conflict of laws, domicile is relevant to an individual's "personal law", which includes the law that governs a person's status and their property. It is independent of a person's nationality. Although a domicile may change from time to time, a person has only one domicile, or residence, at any point in their life, no matter what their circumstances. Domicile is distinct from habitual residence, where there is less focus on future intent. As domicile is one of the connecting factors ordinarily used in common law legal systems, a person can never be left without a domicile and a domicile is acquired by everyone at birth. Generally domicile can be divided into domicile of origin, domicile of choice, and domicile by operation of law (also known as domicile of dependency). When determining the domicile of an individual, a court applies its own law and understanding of what domicile is. In some common-law countries, such as Australia and New Zealand, the concept of domic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Multinational Corporation

A multinational corporation (MNC; also called a multinational enterprise (MNE), transnational enterprise (TNE), transnational corporation (TNC), international corporation, or stateless corporation, is a corporate organization that owns and controls the production of goods or services in at least one country other than its home country. Control is considered an important aspect of an MNC to distinguish it from international portfolio investment organizations, such as some international mutual funds that invest in corporations abroad solely to diversify financial risks. Most of the current largest and most influential companies are Public company, publicly traded multinational corporations, including Forbes Global 2000, ''Forbes'' Global 2000 companies. History Colonialism The history of multinational corporations began with the history of colonialism. The first multinational corporations were founded to set up colonial "factories" or port cities. The two main examples were the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bermuda

Bermuda is a British Overseas Territories, British Overseas Territory in the Atlantic Ocean, North Atlantic Ocean. The closest land outside the territory is in the American state of North Carolina, about to the west-northwest. Bermuda is an archipelago consisting of List of islands of Bermuda, 181 islands, although the most significant islands are connected by bridges and appear to form one landmass. It has a land area of . Bermuda has a tropical climate, with warm winters and hot summers. Its climate also exhibits Oceanic climate, oceanic features similar to other coastal areas in the Northern Hemisphere with warm, moist air from the ocean ensuring relatively high humidity and stabilising temperatures. Bermuda is prone to severe weather from Westerlies#Interaction with tropical cyclones, recurving tropical cyclones; however, it receives some protection from a coral reef and its position north of the Main Development Region, which limits the direction and severity of approach ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cayman Islands

The Cayman Islands () is a self-governing British Overseas Territories, British Overseas Territory, and the largest by population. The territory comprises the three islands of Grand Cayman, Cayman Brac and Little Cayman, which are located south of Cuba and north-east of Honduras, between Jamaica and Mexico's Yucatán Peninsula. The capital city is George Town, Cayman Islands, George Town on Grand Cayman, which is the most populous of the three islands. The Cayman Islands is considered to be part of the geographic Western Caribbean zone as well as the Greater Antilles. The territory is a major offshore financial centre for international businesses and High-net-worth individual, the rich mainly due to the state charging no tax on income earned or stored. With a GDP per capita of US$97,750 in 2023, the Cayman Islands has the highest standard of living in the Caribbean, and one of the highest in the world. Immigrants from over 140 countries and territories reside in the Cayman I ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hong Kong

Hong Kong)., Legally Hong Kong, China in international treaties and organizations. is a special administrative region of China. With 7.5 million residents in a territory, Hong Kong is the fourth most densely populated region in the world. Hong Kong was established as a colony of the British Empire after the Qing dynasty ceded Hong Kong Island in 1841–1842 as a consequence of losing the First Opium War. The colony expanded to the Kowloon Peninsula in 1860 and was further extended when the United Kingdom obtained a 99-year lease of the New Territories in 1898. Hong Kong was occupied by Japan from 1941 to 1945 during World War II. The territory was handed over from the United Kingdom to China in 1997. Hong Kong maintains separate governing and economic systems from that of mainland China under the principle of one country, two systems. Originally a sparsely populated area of farming and fishing villages,. the territory is now one of the world's most signific ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Luxembourg

Luxembourg, officially the Grand Duchy of Luxembourg, is a landlocked country in Western Europe. It is bordered by Belgium to the west and north, Germany to the east, and France on the south. Its capital and most populous city, Luxembourg City, is one of the four institutional seats of the European Union and hosts several EU institutions, notably the Court of Justice of the European Union, the highest judicial authority in the EU. As part of the Low Countries, Luxembourg has close historic, political, and cultural ties to Belgium and the Netherlands. Luxembourg's culture, people, and languages are greatly influenced by France and Germany: Luxembourgish, a Germanic language, is the only recognized national language of the Luxembourgish people and of the Grand Duchy of Luxembourg; French is the sole language for legislation; and both languages along with German are used for administrative matters. With an area of , Luxembourg is Europe's seventh-smallest count ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotland, Wales and Northern Ireland. The UK includes the island of Great Britain, the north-eastern part of the island of Ireland, and most of List of islands of the United Kingdom, the smaller islands within the British Isles, covering . Northern Ireland shares Republic of Ireland–United Kingdom border, a land border with the Republic of Ireland; otherwise, the UK is surrounded by the Atlantic Ocean, the North Sea, the English Channel, the Celtic Sea and the Irish Sea. It maintains sovereignty over the British Overseas Territories, which are located across various oceans and seas globally. The UK had an estimated population of over 68.2 million people in 2023. The capital and largest city of both England and the UK is London. The cities o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Republic Of Ireland

Ireland ( ), also known as the Republic of Ireland (), is a country in Northwestern Europe, north-western Europe consisting of 26 of the 32 Counties of Ireland, counties of the island of Ireland, with a population of about 5.4 million. Its capital city, capital and largest city is Dublin, on the eastern side of the island, with a population of over 1.5 million. The sovereign state shares its only land border with Northern Ireland, which is Countries of the United Kingdom, part of the United Kingdom. It is otherwise surrounded by the Atlantic Ocean, with the Celtic Sea to the south, St George's Channel to the south-east and the Irish Sea to the east. It is a Unitary state, unitary, parliamentary republic. The legislature, the , consists of a lower house, ; an upper house, ; and an elected President of Ireland, president () who serves as the largely ceremonial head of state, but with some important powers and duties. The head of government is the (prime minister, ), ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Netherlands

, Terminology of the Low Countries, informally Holland, is a country in Northwestern Europe, with Caribbean Netherlands, overseas territories in the Caribbean. It is the largest of the four constituent countries of the Kingdom of the Netherlands. The Netherlands consists of Provinces of the Netherlands, twelve provinces; it borders Germany to the east and Belgium to the south, with a North Sea coastline to the north and west. It shares Maritime boundary, maritime borders with the United Kingdom, Germany, and Belgium. The official language is Dutch language, Dutch, with West Frisian language, West Frisian as a secondary official language in the province of Friesland. Dutch, English_language, English, and Papiamento are official in the Caribbean Netherlands, Caribbean territories. The people who are from the Netherlands is often referred to as Dutch people, Dutch Ethnicity, Ethnicity group, not to be confused by the language. ''Netherlands'' literally means "lower countries" i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |