The COVID-19 recession was a

global economic recession caused by

COVID-19 lockdowns

During the early stages of the COVID-19 pandemic, a number of Non-pharmaceutical intervention (epidemiology), non-pharmaceutical interventions, particularly lockdowns (encompassing stay-at-home orders, curfews, quarantines, and similar socie ...

. The recession began in most countries in February 2020. After a year of global economic slowdown that saw stagnation of economic growth and consumer activity, the

COVID-19 lockdowns

During the early stages of the COVID-19 pandemic, a number of Non-pharmaceutical intervention (epidemiology), non-pharmaceutical interventions, particularly lockdowns (encompassing stay-at-home orders, curfews, quarantines, and similar socie ...

and other precautions taken in early 2020 drove the global economy into crisis. Within seven months, every advanced economy had fallen to

recession

In economics, a recession is a business cycle contraction that occurs when there is a period of broad decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be tr ...

.

The first major sign of recession was the

2020 stock market crash

On 20 February 2020, stock markets across the world suddenly crashed after growing instability due to the COVID-19 pandemic. The crash ended on 7 April 2020.

Beginning on 13 May 2019, the yield curve on U.S. Treasury securities inverted, ...

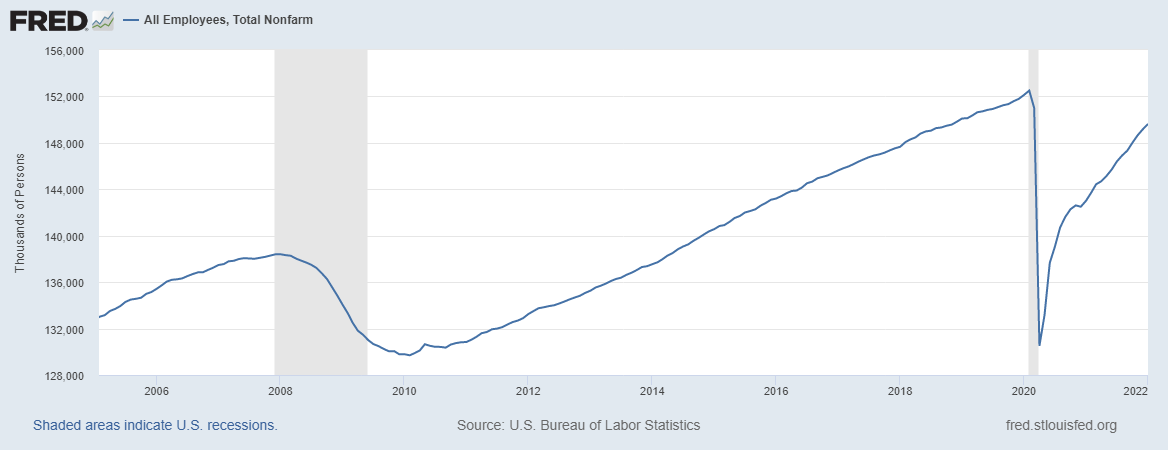

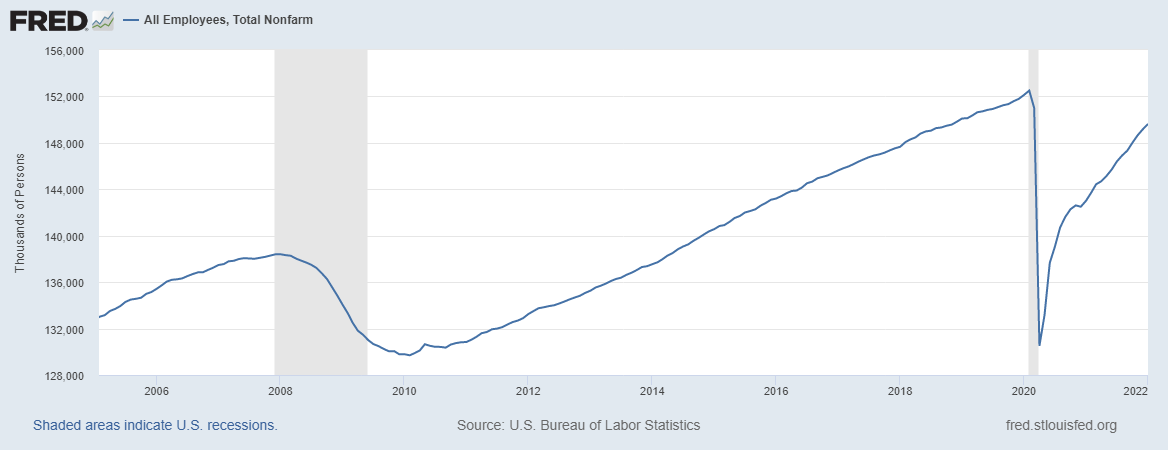

, which saw major indices drop 20 to 30% in late February and March. Recovery began in early April 2020; by April 2022, the GDP for most major economies had either returned to or exceeded pre-pandemic levels and many market indices recovered or even set new records by late 2020.

The recession saw unusually high and rapid increases in unemployment in many countries. By October 2020, more than 10 million unemployment cases had been filed in the United States, swamping state-funded

unemployment insurance

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is the proportion of people above a specified age (usually 15) not being in paid employment or self-employment but currently available for work du ...

computer systems and processes. The United Nations (UN) predicted in April 2020 that global unemployment would wipe out 6.7% of working hours globally in the second quarter of 2020—equivalent to 195 million full-time workers. In some countries, unemployment was expected to be around 10%, with more severely affected nations from the pandemic having higher unemployment rates.

Developing countries

A developing country is a sovereign state with a less-developed Secondary sector of the economy, industrial base and a lower Human Development Index (HDI) relative to developed countries. However, this definition is not universally agreed upon. ...

were also affected by a drop in

remittance

A remittance is a non-commercial transfer of money by a foreign worker, a member of a diaspora community, or a citizen with familial ties abroad, for household income in their home country or homeland.

Money sent home by migrants competes ...

s and exacerbating

COVID-19 pandemic-related famines.

The recession and the accompanying

2020 Russia–Saudi Arabia oil price war

On 8 March 2020, Saudi Arabia initiated a price war on oil with Russia, which facilitated a 65% quarterly fall in the price of oil. The price war was triggered by a break-up in dialogue between the Organization of the Petroleum Exporting Countr ...

led to a drop in

oil prices

The price of oil, or the oil price, generally refers to the spot price of a barrel () of benchmark crude oil—a reference price for buyers and sellers of crude oil such as West Texas Intermediate (WTI), Brent Crude, Dubai Crude, OPE ...

; the collapse of tourism, the

hospitality industry

The hospitality industry is a broad category of fields within the service industry that includes lodging, food and beverage services, event planning, theme parks, travel agency, tourism, hotels, restaurants, nightclubs, and bars.

Sector ...

, and the

energy industry

The energy industry refers to all of the industries involved in the production and sale of energy, including fuel extraction, manufacturing, oil refinery, refining and distribution. Modern society consumes large amounts of fuel, and the energy in ...

; and a downturn in consumer activity in comparison to the previous decade. The

2021–2023 global energy crisis was driven by a global surge in demand as the world exited the early recession caused by pandemic-related lockdown measures, particularly due to strong energy demand in Asia.

This was then further exacerbated by the reaction to escalations of the

Russo-Ukrainian War

The Russo-Ukrainian War began in February 2014 and is ongoing. Following Ukraine's Revolution of Dignity, Russia Russian occupation of Crimea, occupied and Annexation of Crimea by the Russian Federation, annexed Crimea from Ukraine. It then ...

, culminating in the

Russian invasion of Ukraine

On 24 February 2022, , starting the largest and deadliest war in Europe since World War II, in a major escalation of the Russo-Ukrainian War, conflict between the two countries which began in 2014. The fighting has caused hundreds of thou ...

and the

2022 Russian debt default

Russia defaulted on part of its foreign currency denominated debt on 27 June 2022, because of funds being stuck in Euroclear Bank. This was its first such default since 1918, back then it was just ruble-denominated bonds, not foreign currency ...

.

Background

Corporate debt bubble

After the

2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

, there was a large increase in corporate

debt

Debt is an obligation that requires one party, the debtor, to pay money Loan, borrowed or otherwise withheld from another party, the creditor. Debt may be owed by a sovereign state or country, local government, company, or an individual. Co ...

, rising from 84% of

gross world product

The gross world product (GWP), also known as gross world income (GWI), is the combined gross national income (previously, the "gross national product") of all the countries in the world. Because imports and exports balance exactly when consider ...

in 2009 to 92% in 2019, or about $72 trillion.

In the world's eight largest economies—China, United States, Japan, United Kingdom, France, Spain, Italy, and Germany—total corporate debt was about $51 trillion in 2019, compared to $34 trillion in 2009.

If the economic climate worsens, companies with high levels of debt run the risk of being unable to make their interest payments to lenders or

refinance their debt, forcing them into

restructuring

Restructuring or Reframing is the corporate management term for the act of reorganizing the legal, ownership, operational, or other structures of a company for the purpose of making it more profitable, or better organized for its present needs. ...

. The

Institute of International Finance

The Institute of International Finance (IIF) is the association or trade group for the global financial services industry. It was created by 38 banks of leading industrialized countries in 1983 in response to the international debt crisis of the ...

forecast in 2019 that, in an economic downturn half as severe as the 2008 crisis, $19 trillion in debt would be owed by non-financial firms without the earnings to cover the interest payments on the debt they issued.

The

McKinsey Global Institute

McKinsey & Company (informally McKinsey or McK) is an American multinational strategy and management consulting firm that offers professional services to corporations, governments, and other organizations. Founded in 1926 by James O. McKinsey ...

warned in 2018 that the greatest risks would be to

emerging market

An emerging market (or an emerging country or an emerging economy) is a market that has some characteristics of a developed market, but does not fully meet its standards. This includes markets that may become developed markets in the future or we ...

s such as China, India, and Brazil, where 25–30% of bonds have been issued by high-risk companies.

2019 global economic slowdown

During 2019, the

IMF

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by 191 member countries, with headquarters in Washington, D.C. It is regarded as the global lender of la ...

reported that the

world economy

The world economy or global economy is the economy of all humans in the world, referring to the global economic system, which includes all economic activities conducted both within and between nations, including production (economics), producti ...

was going through a "synchronized slowdown", which entered into its slowest pace since the

2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

.

'Cracks' were showing in the

consumer market

A consumer is a person or a group who intends to order, or use purchased goods, products, or services primarily for personal, social, family, household and similar needs, who is not directly related to entrepreneurial or business activities. Th ...

as global markets began to suffer through a 'sharp deterioration' of manufacturing activity. Global growth was believed to have peaked in 2017, when the world's total

industrial output began to start a sustained decline in early 2018. The

IMF

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by 191 member countries, with headquarters in Washington, D.C. It is regarded as the global lender of la ...

blamed 'heightened trade and geopolitical tensions' as the main reason for the slowdown, citing

Brexit

Brexit (, a portmanteau of "Britain" and "Exit") was the Withdrawal from the European Union, withdrawal of the United Kingdom (UK) from the European Union (EU).

Brexit officially took place at 23:00 GMT on 31 January 2020 (00:00 1 February ...

and the

China–United States trade war

An economic conflict between China and the United States has been ongoing since January 2018, when U.S. president Donald Trump began Tariffs in the first Trump administration, imposing tariffs and other trade barriers on China with the aim of fo ...

as primary reasons for slowdown in 2019, while other economists blamed liquidity issues.

In April 2019, the U.S.

yield curve

In finance, the yield curve is a graph which depicts how the Yield to maturity, yields on debt instruments – such as bonds – vary as a function of their years remaining to Maturity (finance), maturity. Typically, the graph's horizontal ...

inverted, which sparked fears of a 2020 recession across the world. The inverted yield curve and

China–U.S. trade war fears prompted a sell-off in global

stock market

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include ''securities'' listed on a public stock exchange a ...

s during March 2019, which prompted more fears that a recession was imminent. Rising debt levels in the European Union and the United States had always been a concern for economists. However, in 2019, that concern was heightened during the economic slowdown, and economists began warning of a 'debt bomb' occurring during the next

financial crisis

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with Bank run#Systemic banki ...

. Debt in 2019 was 50% higher than that during the

2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

. Economists have argued that this increased debt is what led to debt defaults in

economies

An economy is an area of the production, distribution and trade, as well as consumption of goods and services. In general, it is defined as a social domain that emphasize the practices, discourses, and material expressions associated with ...

and businesses across the world during the recession. The first signs of trouble leading up to the collapse occurred in September 2019, when the US

Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of ...

began intervening in the role of investor to provide funds in the

repo market

A repurchase agreement, also known as a repo, RP, or sale and repurchase agreement, is a form of secured short-term borrowing, usually, though not always using government securities as collateral. A contracting party sells a security to a lend ...

s; the overnight repo rate spiked above an unprecedented 6% during that time, which would play a crucial factor in triggering the events that led up to the crash.

Trump tariffs against China

From 2018 to early 2020, U.S. President

Donald Trump

Donald John Trump (born June 14, 1946) is an American politician, media personality, and businessman who is the 47th president of the United States. A member of the Republican Party (United States), Republican Party, he served as the 45 ...

set tariffs and other trade barriers on China with the goal of forcing it to make changes to what the U.S. described as "unfair trade practices". Among those trade practices and their effects had been the growing trade deficit, the theft of intellectual property, and the forced transfer of American technology to China.

Trump's tariffs caused significant damage to the economy of countries around the world. In the United States, it brought struggles for farmers and manufacturers and higher prices for consumers, which resulted in the U.S. manufacturing industry entering into a "mild recession" during 2019. In other countries it also caused economic damage, including violent protests in Chile and Ecuador due to transport and energy price surges, though some countries had benefited from increased manufacturing to fill the gaps. It also led to stock market instability. Governments around the world took steps to address some of the damage caused by the tariffs. During the recession, the downturn of consumerism and manufacturing from the trade war is believed to have worsened the economic crisis.

Brexit

In Europe, economies were hampered due to uncertainty surrounding the United Kingdom's

withdrawal from the European Union

Article 50 of the Treaty on European Union (TEU) provides for the possibility of an EU member state leaving the European Union "in accordance with its own constitutional requirements".

Currently, the United Kingdom is the only state to ha ...

, better known as

Brexit

Brexit (, a portmanteau of "Britain" and "Exit") was the Withdrawal from the European Union, withdrawal of the United Kingdom (UK) from the European Union (EU).

Brexit officially took place at 23:00 GMT on 31 January 2020 (00:00 1 February ...

. British and EU growth stagnated during 2019 leading up to Brexit, mainly due to uncertainty in the UK caused by political figures and movements aiming to oppose, reverse or otherwise impede the 2016 Brexit Referendum, resulting in delays and extensions.

Many businesses left the United Kingdom to move into the EU, which resulted in trade loss and economic downturn for both EU members and the UK.

Aggravating circumstances

Evergrande liquidity crisis in 2021

In August 2021, it was reported that China's second-largest property developer,

Evergrande Group

The China Evergrande Group was a Chinese property developer, and it was the second largest in China by sales. It was founded in 1996 by Hui Ka Yan (Xu Jiayin). It sold apartments mostly to upper- and middle-income dwellers. Evergrande was i ...

, was entrenched in $300 billion (~$ in ) of debt. As the company missed several payment deadlines in September 2021, it seemed likely the company would fail without government intervention, as stocks within the company having already plummeted by 85%. Since China is the second largest economy in the world and property makes up a large amount of their GDP, it threatens to destabilise the COVID-19 recession even further, especially considering China is currently deep within a housing bubble eclipsing the

United States housing bubble

The 2000s United States housing bubble or house price boom or 2000s housing cycle was a sharp run up and subsequent collapse of house asset prices affecting over half of the U.S. states. In many regions a Real-estate bubble, real estate bubb ...

that led to the previous global recession.

2021–2023 global energy crisis and sanctions on Russia

The 2021–2023 global energy shortage is the most recent in a series of cyclical energy shortages experienced over the last fifty years. The Russian military buildup outside Ukraine and subsequent invasion have also threatened the energy supply from Russia to Europe, while increasing the cost of oil causing European countries to diversify their source of energy import.

The economic fallout from the

2021–2023 global energy crisis and the

2022 Russian invasion of Ukraine

On 24 February 2022, , starting the largest and deadliest war in Europe since World War II, in a major escalation of the Russo-Ukrainian War, conflict between the two countries which began in 2014. The fighting has caused hundreds of thou ...

has had an impact on oil prices worldwide, most notably the unprecedented measures taken on the SWIFT System and Tit-for-Tat Responses to comprehensive sanctions from other countries. Preceding an official announcement regarding import bans on 8 March 2022, there were reports of proposed bans regarding Russian oil and gas imports by the US and the EU.

This was in addition to the already existing actions taken by American companies on multiple Russian entities with ties to the Russian government, with Russia's trading status also being called into question on security grounds. Prior to the ban having been implemented, the value of the Russian ruble had dropped by record levels as the price of oil hit a 14-year high. The talks about whether or not to implement an International Energy Embargo were already reported to have been impacting the Russian oil market due to pre-existing fears by investors by 10 March, there were reports stating that Russia's debt rating was downgraded by Fitch from "B" to "C", indicating a potential default was imminent. This ultimately came to pass after 27 June with the

2022 Russian debt default

Russia defaulted on part of its foreign currency denominated debt on 27 June 2022, because of funds being stuck in Euroclear Bank. This was its first such default since 1918, back then it was just ruble-denominated bonds, not foreign currency ...

.

Causes

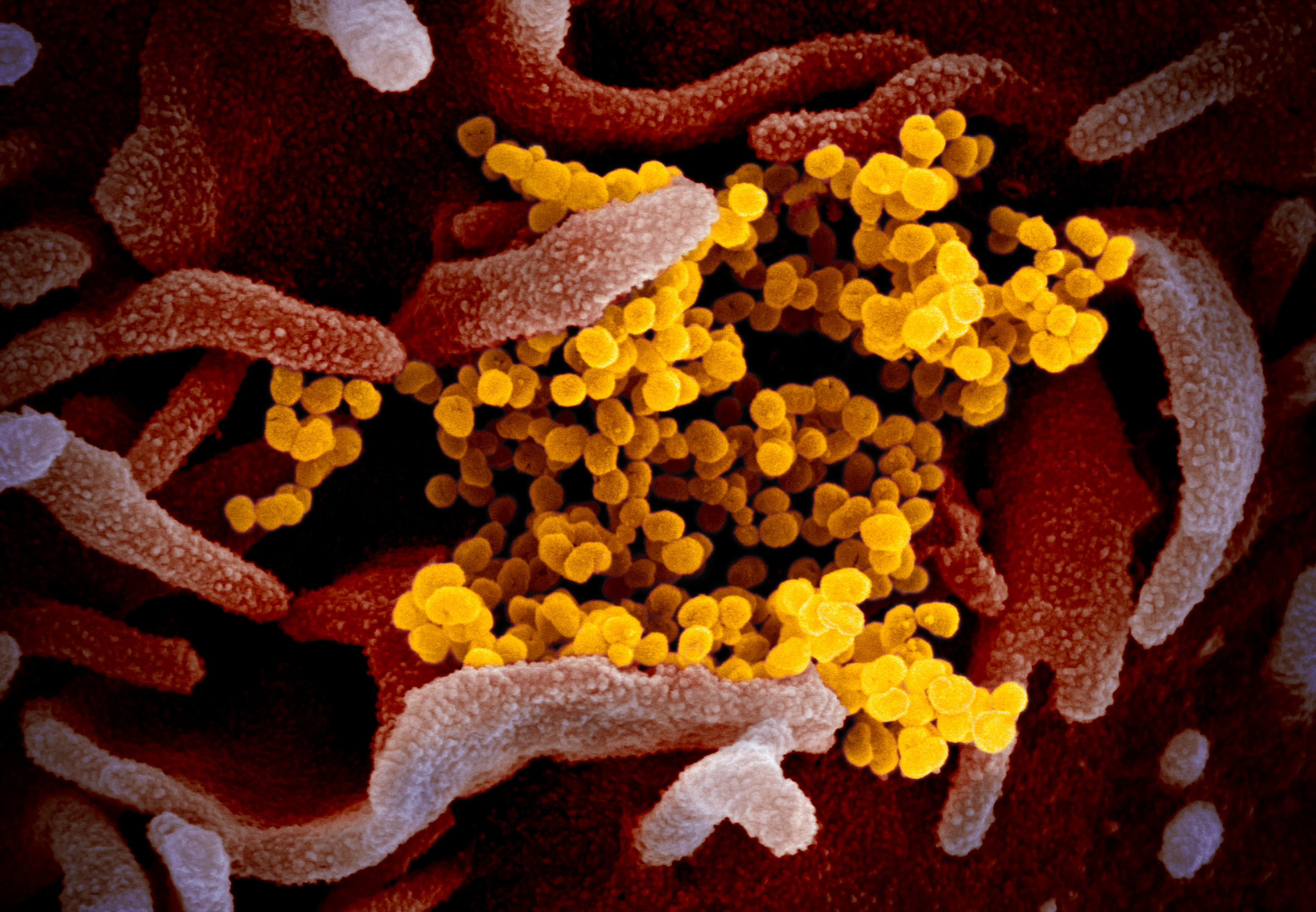

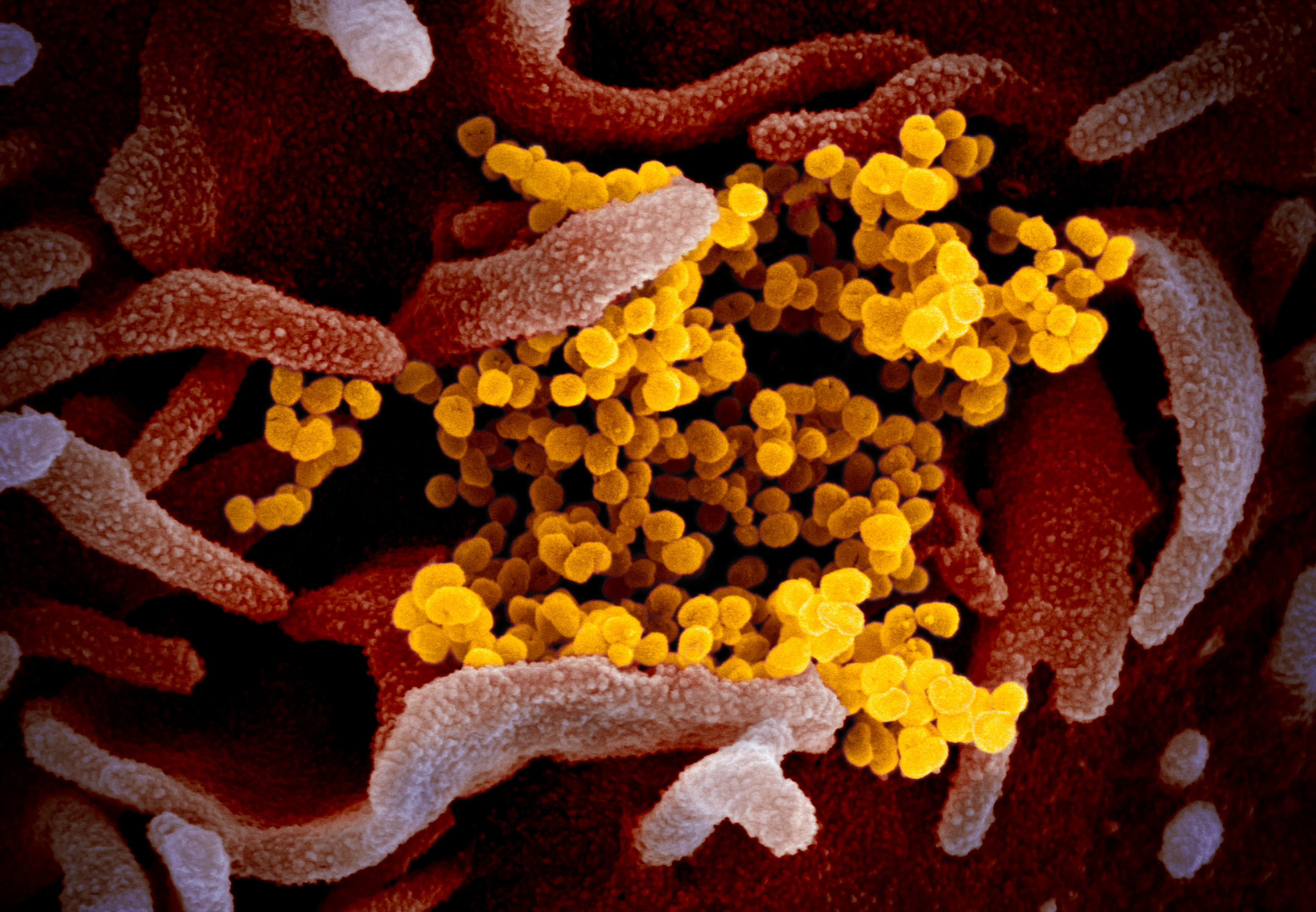

The

COVID-19 pandemic

The COVID-19 pandemic (also known as the coronavirus pandemic and COVID pandemic), caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), began with an disease outbreak, outbreak of COVID-19 in Wuhan, China, in December ...

is the most disruptive

pandemic

A pandemic ( ) is an epidemic of an infectious disease that has a sudden increase in cases and spreads across a large region, for instance multiple continents or worldwide, affecting a substantial number of individuals. Widespread endemic (epi ...

since the

Spanish flu

The 1918–1920 flu pandemic, also known as the Great Influenza epidemic or by the common misnomer Spanish flu, was an exceptionally deadly global influenza pandemic caused by the H1N1 subtype of the influenza A virus. The earliest docum ...

in 1918. When the pandemic first arose in late 2019 and more consequently in 2020, the world was going through

economic stagnation

Economic stagnation is a prolonged period of slow economic growth (traditionally measured in terms of the GDP growth), usually accompanied by high unemployment. Under some definitions, ''slow'' means significantly slower than potential growth as ...

and significant consumer downturn. Most economists believed a

recession

In economics, a recession is a business cycle contraction that occurs when there is a period of broad decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be tr ...

, though one which would not be particularly severe, was coming. As a result of the rapid spread of the pandemic,

economies

An economy is an area of the production, distribution and trade, as well as consumption of goods and services. In general, it is defined as a social domain that emphasize the practices, discourses, and material expressions associated with ...

across the world initiated

population lockdowns to curb the spread of the pandemic. This resulted in the collapse of various

industries and

consumerism

Consumerism is a socio-cultural and economic phenomenon that is typical of industrialized societies. It is characterized by the continuous acquisition of goods and services in ever-increasing quantities. In contemporary consumer society, the ...

all at once, which put major pressure on banks and employment. This caused a stock market crash and, thereafter, the recession. With new

social distancing

In public health, social distancing, also called physical distancing, (NB. Regula Venske is president of the PEN Centre Germany.) is a set of non-pharmaceutical interventions or measures intended to prevent the spread of a contagious dise ...

measures taken in response to the pandemic, lockdowns occurred across much of the

world economy

The world economy or global economy is the economy of all humans in the world, referring to the global economic system, which includes all economic activities conducted both within and between nations, including production (economics), producti ...

.

COVID-19 pandemic

The

COVID-19 pandemic

The COVID-19 pandemic (also known as the coronavirus pandemic and COVID pandemic), caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), began with an disease outbreak, outbreak of COVID-19 in Wuhan, China, in December ...

was a

pandemic

A pandemic ( ) is an epidemic of an infectious disease that has a sudden increase in cases and spreads across a large region, for instance multiple continents or worldwide, affecting a substantial number of individuals. Widespread endemic (epi ...

of

Coronavirus disease 2019

Coronavirus disease 2019 (COVID-19) is a contagious disease caused by the coronavirus SARS-CoV-2. In January 2020, the disease spread worldwide, resulting in the COVID-19 pandemic.

The symptoms of COVID‑19 can vary but often include f ...

(COVID-19) caused by

severe acute respiratory syndrome coronavirus 2

Severe acute respiratory syndrome coronavirus 2 (SARS‑CoV‑2) is a strain of coronavirus that causes COVID-19, the respiratory illness responsible for the COVID-19 pandemic. The virus previously had the Novel coronavirus, provisional nam ...

(SARS-CoV-2); the outbreak was identified in

Wuhan

Wuhan; is the capital of Hubei, China. With a population of over eleven million, it is the most populous city in Hubei and the List of cities in China by population, eighth-most-populous city in China. It is also one of the nine National cent ...

, China, in December 2019, declared to be a

Public Health Emergency of International Concern from 30 January 2020 to 5 May 2023, and recognized as a pandemic by the

World Health Organization

The World Health Organization (WHO) is a list of specialized agencies of the United Nations, specialized agency of the United Nations which coordinates responses to international public health issues and emergencies. It is headquartered in Gen ...

on 11 March 2020.

The response to the pandemic led to

severe global economic disruption,

the postponement or cancellation of sporting, religious, political and cultural events,

and widespread shortages of supplies exacerbated by

panic buying

Panic buying (alternatively hyphenated as panic-buying; also known as panic purchasing) occurs when consumers buy unusually large amounts of a product in anticipation of, or after, a disaster or perceived disaster, or in anticipation of a large p ...

.

either on a nationwide or local basis in countries, affecting approximately percent of the world's student population. Many governments restricted or advised against all non-essential travel to and from countries and areas affected by the outbreak.

However, the virus is already spreading within communities in large parts of the world, with many not knowing where or how they were infected.

The COVID-19 pandemic has had far-reaching consequences beyond the spread of the disease and efforts to quarantine it. As the pandemic spread around the globe, concerns shifted from supply-side manufacturing issues to decreased business in the services sector. The pandemic is considered unanimously as a major factor in causing the recession. The pandemic affected nearly every major industry negatively, was one of the main causes of the stock market crash and resulted in major restrictions of social liberties and movement.

The COVID-19 crisis affected worldwide economic activity, resulting in a 7% drop in global commercial commerce in 2020. While

global value chain

A global value chain (GVC) refers to the full range of activities that economic actors engage in to bring a product to market. The global value chain does not only involve production processes, but preproduction (such as design) and postproduction ...

s (GVC) persisted, several demand and supply mismatches caused by the pandemic resurfaced throughout the recovery period and spread internationally through trade.

During the first wave of the

COVID-19 pandemic

The COVID-19 pandemic (also known as the coronavirus pandemic and COVID pandemic), caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), began with an disease outbreak, outbreak of COVID-19 in Wuhan, China, in December ...

, businesses lost 25% of their revenue and 11% of their workforce, with contact-intensive sectors and

SMEs being particularly heavily impacted. However, considerable policy assistance helped to avert large-scale bankruptcies, with just 4% of enterprises declaring for

insolvency

In accounting, insolvency is the state of being unable to pay the debts, by a person or company ( debtor), at maturity; those in a state of insolvency are said to be ''insolvent''. There are two forms: cash-flow insolvency and balance-sheet i ...

or permanently shutting at the time of the COVID wave.

Aid to people and businesses in the form of employment retention schemes, subsidies, tax relief, and loan guarantee programs totalled roughly 9% of GDP, with substantial cross-country variance, which might reflect policy space and development levels. In the face of considerable

liquidity

Liquidity is a concept in economics involving the convertibility of assets and obligations. It can include:

* Market liquidity

In business, economics or investment, market liquidity is a market's feature whereby an individual or firm can quic ...

challenges,

debt moratorium

A debt moratorium is a delay in the payment of debts or obligations. The term is generally used to refer to acts by national governments. Moratory laws are usually passed at times of special political or commercial stress: for instance, on severa ...

s and revisions to bankruptcy rules also safeguarded businesses and people during the COVID-19 pandemic.

In response to the pandemic's infection rates and death toll, countries in the Western Balkans, the Eastern Neighborhood, and Central and Eastern Europe faced severe recessions.

Lockdowns

While

stay-at-home order

A stay-at-home order, safer-at-home order, movement control order – also referred to by loose use of the terms quarantine, isolation, or lockdown – is an order from a government authority that restricts movements of a population as a mass qu ...

s clearly affect many types of business, especially those that provide in-person services (including retail stores, restaurants and hotels, entertainment venues and museums, medical offices, and beauty salons and spas), government orders are not the sole pressure on those businesses. In the United States, people began to change their economic behavior 10–20 days before their local governments declared stay-at-home orders, and by May, changes in individuals' rates of movement (according to smartphone data) did not always correlate with local laws. According to a 2021 study, only 7% of the decline in economic activity was due to government-imposed restrictions on activity; the vast majority of the decline was due to individuals voluntarily disengaging from commerce.

Russia–Saudi Arabia oil price war

The reduction in the demand for travel and the lack of factory activity due to the

COVID-19 pandemic

The COVID-19 pandemic (also known as the coronavirus pandemic and COVID pandemic), caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), began with an disease outbreak, outbreak of COVID-19 in Wuhan, China, in December ...

significantly impacted demand for oil, causing its price to fall. The Russian–Saudi Arabia oil price war further worsened the recession, due to it crashing the price of oil. In mid-February, the

International Energy Agency

The International Energy Agency (IEA) is a Paris-based autonomous intergovernmental organization, established in 1974, that provides policy recommendations, analysis and data on the global energy sector. The 31 member countries and 13 associatio ...

forecasted that oil demand growth in 2020 would be the smallest since 2011. A slump in Chinese demand resulted in a meeting of the

Organization of the Petroleum Exporting Countries

The Organization of the Petroleum Exporting Countries (OPEC ) is an organization enabling the co-operation of leading oil-producing and oil-dependent countries in order to collectively influence the global oil market and maximize Profit (eco ...

(OPEC) to discuss a potential cut in production to balance the loss in demand. The cartel initially made a tentative agreement to cut oil production by 1.5 million barrels per day following a meeting in Vienna on 5March 2020, which would bring the production levels to the lowest it has been since the

Iraq War

The Iraq War (), also referred to as the Second Gulf War, was a prolonged conflict in Iraq lasting from 2003 to 2011. It began with 2003 invasion of Iraq, the invasion by a Multi-National Force – Iraq, United States-led coalition, which ...

.

After

OPEC

The Organization of the Petroleum Exporting Countries (OPEC ) is an organization enabling the co-operation of leading oil-producing and oil-dependent countries in order to collectively influence the global oil market and maximize Profit (eco ...

and Russia failed to agree on oil production cuts on 6March and

Saudi Arabia and Russia both announced increases in oil production on 7 March, oil prices fell by 25 percent. On 8March, Saudi Arabia unexpectedly announced that it would increase production of crude oil and sell it at a discount (of $6–8 a barrel) to customers in Asia, the US, and Europe, following the breakdown of negotiations, as Russia resisted calls to cut production. The biggest discounts targeted Russian oil customers in northwestern Europe.

Prior to the announcement, the price of oil had gone down by more than 30% since the start of the year, and upon Saudi Arabia's announcement, it dropped a further 30 percent, though later recovered somewhat.

Brent Crude

Brent Crude may refer to any or all of the components of the Brent Complex, a physically and financially traded oil market based around the North Sea of Northwest Europe; colloquially, Brent Crude usually refers to the price of the ICE (Intercon ...

, an oil market used to price two-thirds of the world's crude oil supplies, experienced the largest drop since the 1991

Gulf War

, combatant2 =

, commander1 =

, commander2 =

, strength1 = Over 950,000 soldiers3,113 tanks1,800 aircraft2,200 artillery systems

, page = https://www.govinfo.gov/content/pkg/GAOREPORTS-PEMD-96- ...

on the night of 8March. Concurrently, the price of

West Texas Intermediate

West Texas Intermediate (WTI) is a grade or mix of crude oil; the term is also used to refer to the spot price, the futures price, or assessed price for that oil. In colloquial usage, WTI usually refers to the WTI Crude Oil futures contract t ...

, another market used as a benchmark for global oil prices, fell to its lowest level since February 2016. Energy expert

Bob McNally noted, "This is the first time since 1930 and '31 that a massive negative

demand shock

In economics, a demand shock is a sudden event that increases or decreases demand for goods or services temporarily.

A positive demand shock increases aggregate demand (AD) and a negative demand shock decreases aggregate demand. Prices of goods ...

has coincided with a

supply shock

A supply shock is an event that suddenly increases or decreases the supply of a commodity or service, or of commodities and services in general. This sudden change affects the equilibrium price of the good or service or the economy's general pr ...

;" in that case it was the

Smoot–Hawley Tariff Act

The Tariff Act of 1930, also known as the Smoot–Hawley Tariff Act, was a protectionist trade measure signed into law in the United States by President Herbert Hoover on June 17, 1930. Named after its chief congressional sponsors, Senator Reed ...

precipitating a collapse in international trade during the

Great Depression

The Great Depression was a severe global economic downturn from 1929 to 1939. The period was characterized by high rates of unemployment and poverty, drastic reductions in industrial production and international trade, and widespread bank and ...

, coinciding with discovery of the

East Texas Oil Field

The East Texas Oil Field is a large oil reservoir, oil and gas field in east Texas. Covering and parts of five counties, and having 30,340 historic and active oil wells, it is the second-largest oil field in the United States outside Alaska, a ...

during the

Texas oil boom

The Texas oil boom, sometimes called the gusher age, was a period of dramatic change and economic growth in the U.S. state of Texas during the early 20th century that began with the discovery of a large petroleum reserve near Beaumont, Texas. ...

. Fears surrounding the Russian–Saudi Arabian oil price war caused a plunge in U.S. stocks, and have had a particular impact on American producers of

shale oil

Shale oil is an unconventional oil produced from oil shale rock fragments by pyrolysis, hydrogenation, or thermal dissolution. These processes convert the organic matter within the rock (kerogen) into synthetic oil and gas. The resulting oil c ...

.

In early April 2020, Saudi Arabia and Russia both agreed to

cut their oil production.

Reuters

Reuters ( ) is a news agency owned by Thomson Reuters. It employs around 2,500 journalists and 600 photojournalists in about 200 locations worldwide writing in 16 languages. Reuters is one of the largest news agencies in the world.

The agency ...

reported that "If Saudi Arabia failed to rein in output, US senators called on the White House to impose sanctions on Riyadh, pull out

US troops

The United States Armed Forces are the military forces of the United States. U.S. federal law names six armed forces: the Army, Marine Corps, Navy, Air Force, Space Force, and the Coast Guard. Since 1949, all of the armed forces, except the C ...

from the kingdom and impose import tariffs on Saudi oil." The price of oil briefly went negative on 20 April 2020.

Financial crisis

The

2020 stock market crash

On 20 February 2020, stock markets across the world suddenly crashed after growing instability due to the COVID-19 pandemic. The crash ended on 7 April 2020.

Beginning on 13 May 2019, the yield curve on U.S. Treasury securities inverted, ...

began on 20 February 2020, although the economic aspects of the COVID-19 recession began to materialize in late 2019. Due to

COVID-19 lockdowns

During the early stages of the COVID-19 pandemic, a number of Non-pharmaceutical intervention (epidemiology), non-pharmaceutical interventions, particularly lockdowns (encompassing stay-at-home orders, curfews, quarantines, and similar socie ...

, global markets, banks and businesses were all facing crises not seen since the

Great Depression

The Great Depression was a severe global economic downturn from 1929 to 1939. The period was characterized by high rates of unemployment and poverty, drastic reductions in industrial production and international trade, and widespread bank and ...

in 1929.

From 24 to 28 February, stock markets declined the most in a week since the

2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

,

thus entering a

correction. Global markets into early March became extremely volatile, with large swings occurring. On 9 March, most global markets reported severe contractions, mainly in response to the

COVID-19 pandemic

The COVID-19 pandemic (also known as the coronavirus pandemic and COVID pandemic), caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), began with an disease outbreak, outbreak of COVID-19 in Wuhan, China, in December ...

and an

oil price war between Russia and the OPEC countries led by Saudi Arabia. This became colloquially known as Black Monday I, and at the time was the worst drop since the

Great Recession

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009. in 2008.

Three days after Black Monday I there was another drop, Black Thursday, where stocks across Europe and North America fell more than 9%.

Wall Street

Wall Street is a street in the Financial District, Manhattan, Financial District of Lower Manhattan in New York City. It runs eight city blocks between Broadway (Manhattan), Broadway in the west and South Street (Manhattan), South Str ...

experienced its largest single-day percentage drop since

Black Monday

Black Monday refers to specific Mondays when undesirable or turbulent events have occurred. It has been used to designate massacres, military battles, and stock market crashes.

Historic events

*1209, Dublin – when a group of 500 recently arriv ...

in 1987, and the

FTSE MIB

The FTSE MIB (Milano Indice di Borsa) (the S&P/MIB prior to June 2009) is the benchmark stock market index for the Borsa Italiana, the Italian national stock exchange, which superseded the MIB-30 in September 2004. The index consists of the 40 m ...

of the

Borsa Italiana

Borsa Italiana () or Borsa di Milano (), based in Milan at Palazzo Mezzanotte, Mezzanotte Palace, is the Italy, Italian stock exchange. It manages and organises domestic market, regulating procedures for admission and listing of companies and i ...

fell nearly 17%, becoming the worst-hit market during Black Thursday. Despite a temporary rally on 13 March (with markets posting their best day since 2008), all three Wall Street indexes fell more than 12% when markets re-opened on 16 March. During this time, one benchmark

stock market index

In finance, a stock index, or stock market index, is an Index (economics), index that measures the performance of a stock market, or of a subset of a stock market. It helps investors compare current stock price levels with past prices to calcul ...

in all

G7 countries and 14 of the

G20

The G20 or Group of 20 is an intergovernmental forum comprising 19 sovereign countries, the European Union (EU), and the African Union (AU). It works to address major issues related to the global economy, such as international financial stabil ...

countries had been declared to be in

Bear market

A market trend is a perceived tendency of the financial markets to move in a particular direction over time. Analysts classify these trends as ''secular'' for long time-frames, ''primary'' for medium time-frames, and ''secondary'' for short time ...

s.

Black Monday I (9 March)

Crash

Prior to opening, the

Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow (), is a stock market index of 30 prominent companies listed on stock exchanges in the United States.

The DJIA is one of the oldest and most commonly followed equity indice ...

futures market experienced a 1,300-point drop based on the pandemic and fall in the oil price described above, triggering a

trading curb

A trading curb (also known as a circuit breaker in Wall Street parlance) is a financial regulatory instrument that is in place to prevent stock market crashes from occurring, and is implemented by the relevant stock exchange organization. Since t ...

, or circuit breaker, that caused the futures market to suspend trading for 15 minutes.

This predicted 1,300-point drop on 9March would be among the

most points the Dow Jones Industrial Average has dropped in a single day. When the market opened on 9March, the

Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow (), is a stock market index of 30 prominent companies listed on stock exchanges in the United States.

The DJIA is one of the oldest and most commonly followed equity indice ...

plummeted 1800 points on opening, 500 points lower than the prediction.

The United States'

Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow (), is a stock market index of 30 prominent companies listed on stock exchanges in the United States.

The DJIA is one of the oldest and most commonly followed equity indice ...

lost more than 2000 points, described by ''

The News International

''The News International'', published in broadsheet size, is one of the largest English language newspapers in Pakistan.

It is published daily from Karachi, Lahore and Rawalpindi/ Islamabad.

An overseas edition is published from London th ...

'' as "the biggest ever fall in intraday trading". The Dow Jones Industrial Average hit a number of

trading "circuit breakers" to curb panicked selling.

Oil firms

Chevron and

ExxonMobil

Exxon Mobil Corporation ( ) is an American multinational List of oil exploration and production companies, oil and gas corporation headquartered in Spring, Texas, a suburb of Houston. Founded as the Successors of Standard Oil, largest direct s ...

fell about 15%. The

Nasdaq Composite

The Nasdaq Composite (ticker symbol ^IXIC) is a stock market index that includes almost all stocks listed on the Nasdaq stock exchange. Along with the Dow Jones Industrial Average and S&P 500, it is one of the three most-followed stock market i ...

, also in the United States, lost over 620 points. The

S&P 500

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 leading companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and in ...

fell by 7.6%. Oil prices fell 22%, and the yields on 10-year and 30-year U.S. Treasury securities fell below 0.40% and 1.02% respectively. Canada's

S&P/TSX Composite Index

The S&P/TSX Composite Index is the benchmark Canadian stock market index representing roughly 70% of the total market capitalization on the Toronto Stock Exchange (TSX). Having replaced the TSE 300 Composite Index on May 1, 2002, the S&P/TSX Com ...

finished the day off by more than 10%. Brazil's

IBOVESPA gave up 12%, erasing over 15 months of gains for the index. Australia's

ASX 200 lost 7.3%—its biggest daily drop since 2008, though it rebounded later in the day. London's

FTSE 100

The Financial Times Stock Exchange 100 Index, also called the FTSE 100 Index, FTSE 100, FTSE, or, informally, the "Footsie" , is the United Kingdom's best-known stock market index of the 100 most market capitalisation, highly capitalised ...

lost 7.7%, suffering its worst drop since the

2008 financial crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners ...

.

BP and

Shell Oil

Shell plc is a British multinational oil and gas company, headquartered in London, England. Shell is a public limited company with a primary listing on the London Stock Exchange (LSE) and secondary listings on Euronext Amsterdam and the New Y ...

experienced intraday price drops of nearly 20% The

FTSE MIB

The FTSE MIB (Milano Indice di Borsa) (the S&P/MIB prior to June 2009) is the benchmark stock market index for the Borsa Italiana, the Italian national stock exchange, which superseded the MIB-30 in September 2004. The index consists of the 40 m ...

,

CAC 40

The CAC 40 () () is a Benchmark (computing), benchmark French stock market index. The index represents a capitalization-weighted measure of the 40 most significant stocks among the 100 largest market capitalization, market caps on the Euronext Pa ...

, and

DAX

The DAX (''Deutscher Aktienindex'' (German stock index); ) is a stock market index consisting of the 40 major German blue chip companies trading on the Frankfurt Stock Exchange. It is a total return index. Prices are taken from the Xetra t ...

tanked as well, with Italy affected the most as the

COVID-19 pandemic in the country continues. They fell 11.2%, 8.4%, and 7.9% respectively. The

STOXX Europe 600 fell to more than 20% below its peak earlier in the year.

In a number of Asian markets—Japan, Singapore, the Philippines and Indonesia—shares declined over 20% from their most recent peaks, entering

bear market

A market trend is a perceived tendency of the financial markets to move in a particular direction over time. Analysts classify these trends as ''secular'' for long time-frames, ''primary'' for medium time-frames, and ''secondary'' for short time ...

territory. In Japan, the

Nikkei 225

The Nikkei 225, or , more commonly called the ''Nikkei'' or the ''Nikkei index'' (), is a stock market index for the Tokyo Stock Exchange (TSE). It is a price-weighted index, operating in the Japanese yen, Japanese Yen (JP¥), and its compone ...

plummeted 5.1%. In Singapore, the

Straits Times Index

The FTSE Straits Times Index (abbreviation: STI) is a capitalisation-weighted stock market index that is regarded as the benchmark index for the stock market in Singapore. It tracks the performance of the top 30 companies that are listed on the ...

fell 6.03%. In China, the

CSI 300 Index

The CSI 300 () is a capitalization-weighted stock market index designed to replicate the performance of the top 300 stocks traded on the Shanghai Stock Exchange and the Shenzhen Stock Exchange. It has two sub-indexes: the CSI 100 Index and the C ...

lost 3%. In Hong Kong, the

Hang Seng index sank 4.2%. In Pakistan, the

PSX saw the largest ever intra-day plunge in the country's history, losing 2,302 points or 6.0%. The market closed with the

KSE 100 Index

The KSE-100 Index is a total return stock index acting as a benchmark to compare prices on the Pakistan Stock Exchange (PSX) over a period.

In determining representative companies to compute the index on, companies with the highest market ca ...

down 3.1%. In India, the

BSE SENSEX

The BSE SENSEX (also known as the S&P Bombay Stock Exchange Sensitive Index or simply SENSEX) is a free-float market-weighted stock market index of 30 well-established and financially sound companies listed on the Bombay Stock Exchange. The 30 ...

closed 1,942 points lower at 35,635 while the

NSE Nifty 50 was down by 538 points to 10,451.

''

The Washington Post

''The Washington Post'', locally known as ''The'' ''Post'' and, informally, ''WaPo'' or ''WP'', is an American daily newspaper published in Washington, D.C., the national capital. It is the most widely circulated newspaper in the Washington m ...

'' posited that pandemic-related turmoil could spark a collapse of the

corporate debt bubble

The corporate debt bubble is the large increase in corporate bonds, excluding that of financial institutions, following the 2008 financial crisis. Global corporate debt rose from 84% of gross world product in 2009 to 92% in 2019, or about $72 ...

, sparking and worsening a

recession

In economics, a recession is a business cycle contraction that occurs when there is a period of broad decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be tr ...

. The

Central Bank of Russia

The Central Bank of the Russian Federation (), commonly known as the Bank of Russia (), also called the Central Bank of Russia (CBR), is the central bank of the Russia, Russian Federation. The bank was established on 13 July 1990. It traces its ...

announced that it would suspend

foreign exchange market

The foreign exchange market (forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. By trading volume, ...

purchases in domestic markets for 30 days, while the

Central Bank of Brazil

The Central Bank of Brazil (, ) is Brazil's central bank, the bank is autonomous in exercising its functions, and its main objective is to achieve stability in the purchasing power of the national currency. It was established on Thursday, 31 Dece ...

auctioned an additional $3.465 billion the foreign exchange market in two separate transactions and the Bank of Mexico increased its foreign exchange auctions program from $20 billion to $30 billion. After announcing a $120 billion

fiscal stimulus

In economics, stimulus refers to attempts to use monetary policy or fiscal policy (or stabilization policy in general) to stimulate the economy. Stimulus can also refer to monetary policies such as lowering interest rates and quantitative eas ...

programs on 2December, Japanese Prime Minister

Shinzo Abe

Shinzo Abe (21 September 1954 – 8 July 2022) was a Japanese politician who served as Prime Minister of Japan and President of the Liberal Democratic Party (Liberal Democratic Party (Japan), LDP) from 2006 to 2007 and again from 2012 to 2020. ...

announced additional government spending, while Indonesian Finance Minister

Sri Mulyani

Sri Mulyani Indrawati (born 26 August 1962) is an Indonesian economist who has served as Minister of Finance of Indonesia since 2016 under President Joko Widodo and Prabowo Subianto. She has previously served in the role under Susilo Bambang Yu ...

announced additional stimulus as well.

Black Thursday (12 March)

Black Thursday was a global

stock market crash

A stock market crash is a sudden dramatic decline of stock prices across a major cross-section of a stock market, resulting in a significant loss of paper wealth. Crashes are driven by panic selling and underlying economic factors. They often fol ...

on 12 March 2020, as part of the greater 2020 stock market crash. US stock markets suffered from the greatest single-day percentage fall since the

1987 stock market crash

Black Monday (also known as Black Tuesday in some parts of the world due to time zone differences) was a global, severe and largely unexpected stock market crash on Monday, October 19, 1987. Worldwide losses were estimated at US$1.71 trillion. ...

.

Following Black Monday three days earlier, Black Thursday was attributed to the

COVID-19 pandemic

The COVID-19 pandemic (also known as the coronavirus pandemic and COVID pandemic), caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), began with an disease outbreak, outbreak of COVID-19 in Wuhan, China, in December ...

and a lack of investor confidence in US President

Donald Trump

Donald John Trump (born June 14, 1946) is an American politician, media personality, and businessman who is the 47th president of the United States. A member of the Republican Party (United States), Republican Party, he served as the 45 ...

after he declared a 30-day

travel ban

A travel ban is one of a variety of mobility restrictions imposed by governments. Bans can be universal or selective. The restrictions can be geographic, imposed by either the originating or destination jurisdiction. They can also be based on indi ...

against the

Schengen Area

The Schengen Area ( , ) encompasses European countries that have officially abolished border controls at their common borders. As an element within the wider area of freedom, security and justice (AFSJ) policy of the European Union (EU), it ...

.

Additionally, the

European Central Bank

The European Central Bank (ECB) is the central component of the Eurosystem and the European System of Central Banks (ESCB) as well as one of seven institutions of the European Union. It is one of the world's Big Four (banking)#International ...

, under the lead of

Christine Lagarde

Christine Madeleine Odette Lagarde (; , ; born 1 January 1956) is a French politician and lawyer who has been the President of the European Central Bank since 2019. She previously served as the 11th Managing Director of the International Monetar ...

, decided to not cut interest rates despite market expectations,

leading to a drop in

S&P 500

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 leading companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and in ...

futures of more than 200 points in less than an hour.

Bank Indonesia announced open market purchases of

Rp4 trillion (or $276.53 million) in government bonds, while Bank Indonesia Governor

Perry Warjiyo stated that Bank Indonesia's open market purchases of government bonds had climbed to Rp130 trillion on the year and Rp110 trillion since the end of January. Despite declining to cut its deposit rate, the European Central Bank increased its

asset purchases by €120 billion (or $135 billion), while the Federal Reserve announced $1.5 trillion in open market purchases. Australian Prime Minister

Scott Morrison

Scott John Morrison (born 13 May 1968) is an Australian former politician who served as the 30th prime minister of Australia from 2018 to 2022. He held office as leader of the Liberal Party of Australia, leader of the Liberal Party and was ...

announced a A$17.6 billion fiscal stimulus package. The

Reserve Bank of India

Reserve Bank of India, abbreviated as RBI, is the central bank of the Republic of India, and regulatory body responsible for regulation of the Indian banking system and Indian rupee, Indian currency. Owned by the Ministry of Finance (India), Min ...

announced that it would conduct a six-month $2 billion

currency swap

In finance, a currency swap (more typically termed a cross-currency swap, XCS) is an interest rate derivative (IRD). In particular it is a linear IRD, and one of the most liquid benchmark products spanning multiple currencies simultaneously. It ...

for

U.S. dollars

The United States dollar (symbol: $; currency code: USD) is the official currency of the United States and several other countries. The Coinage Act of 1792 introduced the U.S. dollar at par with the Spanish silver dollar, divided it int ...

, while the Reserve Bank of Australia announced A$8.8 billion in repurchases of government bonds. The Central Bank of Brazil auctioned $1.78 billion

Foreign exchange spots.

Asia-Pacific stock markets closed down (with the

Nikkei 225

The Nikkei 225, or , more commonly called the ''Nikkei'' or the ''Nikkei index'' (), is a stock market index for the Tokyo Stock Exchange (TSE). It is a price-weighted index, operating in the Japanese yen, Japanese Yen (JP¥), and its compone ...

of the

Tokyo Stock Exchange

The , abbreviated as Tosho () or TSE/TYO, is a stock exchange located in Tokyo, Japan.

The exchange is owned by Japan Exchange Group (JPX), a holding company that it also lists (), and operated by Tokyo Stock Exchange, Inc., a wholly owned sub ...

, the

Hang Seng Index

The Hang Seng Index (HSI) is a market-Capitalization-weighted index, capitalisation-weighted stock market index in Hong Kong adjusted for free float. It tracks and records daily changes in the largest stock listings on the Hong Kong Stock Exch ...

of the

Hong Kong Stock Exchange

The Stock Exchange of Hong Kong (, SEHK, also known as Hong Kong Stock Exchange) is a stock exchange based in Hong Kong. It is one of the largest stock exchanges in Asia and the List of major stock exchanges, 9th largest globally by market ...

, and the

IDX Composite of the

Indonesia Stock Exchange

Indonesia Stock Exchange (IDX) ( (BEI)) is a stock exchange based in Jakarta, Indonesia. It was previously known as the Jakarta Stock Exchange (JSX) before its name changed in 2007 after merging with the Surabaya Stock Exchange (SSX). In rece ...

falling to more than 20% below their 52-week highs), European stock markets closed down 11% (with the

FTSE 100 Index

The Financial Times Stock Exchange 100 Index, also called the FTSE 100 Index, FTSE 100, FTSE, or, informally, the "Footsie" , is the United Kingdom's best-known stock market index of the 100 most highly capitalised blue chips listed on ...

on the

London Stock Exchange

The London Stock Exchange (LSE) is a stock exchange based in London, England. the total market value of all companies trading on the LSE stood at US$3.42 trillion. Its current premises are situated in Paternoster Square close to St Paul's Cath ...

, the

DAX

The DAX (''Deutscher Aktienindex'' (German stock index); ) is a stock market index consisting of the 40 major German blue chip companies trading on the Frankfurt Stock Exchange. It is a total return index. Prices are taken from the Xetra t ...

on the

Frankfurt Stock Exchange

The Frankfurt Stock Exchange (, former German name: , ''FWB'') is the world's 3rd oldest and 12th largest stock exchange by market capitalization. It has operations from 8:00 am to 10:00 pm ( German time).

Organisation

Located in Frankfurt, ...

, the

CAC 40

The CAC 40 () () is a Benchmark (computing), benchmark French stock market index. The index represents a capitalization-weighted measure of the 40 most significant stocks among the 100 largest market capitalization, market caps on the Euronext Pa ...

on the

Euronext Paris

Euronext Paris, formerly known as the Paris Bourse (), is a regulated securities trading venue in France. It is Europe's second largest stock exchange by market capitalization, behind the London Stock Exchange, as of December 2023. As of 2022, th ...

, and the

FTSE MIB

The FTSE MIB (Milano Indice di Borsa) (the S&P/MIB prior to June 2009) is the benchmark stock market index for the Borsa Italiana, the Italian national stock exchange, which superseded the MIB-30 in September 2004. The index consists of the 40 m ...

on the

Borsa Italiana

Borsa Italiana () or Borsa di Milano (), based in Milan at Palazzo Mezzanotte, Mezzanotte Palace, is the Italy, Italian stock exchange. It manages and organises domestic market, regulating procedures for admission and listing of companies and i ...

all closing more than 20% below their most recent peaks), while the Dow Jones Industrial Average closed down an additional 10% (eclipsing the one-day record set on 9March), the NASDAQ Composite was down 9.4%, and the S&P 500 was down 9.5% (with the NASDAQ and S&P 500 also falling to more than 20% below their peaks), and the declines activated the trading curb at the

New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District, Manhattan, Financial District of Lower Manhattan in New York City. It is the List of stock exchanges, largest stock excha ...

for the second time that week. Oil prices dropped by 8%, while the yields on 10-year and 30-year U.S. Treasury securities increased to 0.86% and 1.45% (and their

yield curve

In finance, the yield curve is a graph which depicts how the Yield to maturity, yields on debt instruments – such as bonds – vary as a function of their years remaining to Maturity (finance), maturity. Typically, the graph's horizontal ...

finished

normal).

Crash

The US's

Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow (), is a stock market index of 30 prominent companies listed on stock exchanges in the United States.

The DJIA is one of the oldest and most commonly followed equity indice ...

and

S&P 500 Index

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 leading companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and in ...

suffered from the greatest single-day percentage fall since the

1987 stock market crash

Black Monday (also known as Black Tuesday in some parts of the world due to time zone differences) was a global, severe and largely unexpected stock market crash on Monday, October 19, 1987. Worldwide losses were estimated at US$1.71 trillion. ...

, as did the UK's

FTSE 100

The Financial Times Stock Exchange 100 Index, also called the FTSE 100 Index, FTSE 100, FTSE, or, informally, the "Footsie" , is the United Kingdom's best-known stock market index of the 100 most market capitalisation, highly capitalised ...

, which fell 10.87%. The Canadian

S&P/TSX Composite Index

The S&P/TSX Composite Index is the benchmark Canadian stock market index representing roughly 70% of the total market capitalization on the Toronto Stock Exchange (TSX). Having replaced the TSE 300 Composite Index on May 1, 2002, the S&P/TSX Com ...

dropped 12%, its largest one-day drop since 1940. The

FTSE MIB

The FTSE MIB (Milano Indice di Borsa) (the S&P/MIB prior to June 2009) is the benchmark stock market index for the Borsa Italiana, the Italian national stock exchange, which superseded the MIB-30 in September 2004. The index consists of the 40 m ...

Italian index closed with a 16.92% loss, the worst in its history. Germany's

DAX

The DAX (''Deutscher Aktienindex'' (German stock index); ) is a stock market index consisting of the 40 major German blue chip companies trading on the Frankfurt Stock Exchange. It is a total return index. Prices are taken from the Xetra t ...

fell 12.24% and France's CAC 12.28%. In Brazil, the

IBOVESPA plummeted 14.78%, after trading in the

B3 was halted twice within the

intraday; it also moved below the 70,000 mark before closing above it. The

NIFTY 50

The NIFTY 50 is an Indian stock market index that represents the Capitalization-weighted index#Free-float weighting, float-weighted average of 50 of the largest Indian companies listed on the National Stock Exchange of India, National Stock E ...

on the

National Stock Exchange of India

National Stock Exchange of India Limited, also known as the National Stock Exchange (NSE), is an Indian stock exchange based in Mumbai. It is the List of stock exchanges, 5th largest stock exchange in the world by total market capitalization, ...

fell 7.89% to more than 20% below its most recent peak, while the

BSE SENSEX

The BSE SENSEX (also known as the S&P Bombay Stock Exchange Sensitive Index or simply SENSEX) is a free-float market-weighted stock market index of 30 well-established and financially sound companies listed on the Bombay Stock Exchange. The 30 ...

on the

Bombay Stock Exchange

BSE Limited, also known as the Bombay Stock Exchange (BSE), is an Indian stock exchange based in Mumbai. It is the 6th largest stock exchange in the world by total market capitalization, exceeding $5 trillion in May 2024.

Established with t ...

fell 2,919 (or 8.18%) to 32,778. The benchmark stock market index on the

Johannesburg Stock Exchange

JSE Limited (previously the JSE Securities Exchange and the Johannesburg Stock Exchange) is the largest stock exchange in Africa. It is located in Sandton, Johannesburg, South Africa, after it moved from downtown Johannesburg in 2000. In 2003 ...

fell by 9.3%. The

MERVAL

The S&P MERVAL Index (''MERcado de VALores'', ) is the most important index of the Buenos Aires Stock Exchange. It is a price-weighted index, calculated as the market value of a portfolio of stocks selected based on their market share, number of ...

on the

Buenos Aires Stock Exchange

The Buenos Aires Stock Exchange (BCBA; ) is the organization responsible for the operation of Economy of Argentina, Argentina's primary stock exchange located at Buenos Aires central business district. Founded in 1854, it is the successor to the ' ...

fell 9.5% to 19.5% on the week. 12 March was the second time, following 9March, that the 7%-drop circuit breaker was triggered since being implemented in 2013.

In Colombia, the

peso

The peso is the monetary unit of several Hispanophone, Spanish-speaking countries in Latin America, as well as the Philippines. Originating in the Spanish Empire, the word translates to "weight". In most countries of the Americas, the symbol com ...

set an all-time low against the U.S. dollar, when it traded above 4000 pesos for the first time on record. The

Mexican peso

The Mexican peso (Currency symbol, symbol: $; ISO 4217, currency code: MXN; also abbreviated Mex$ to distinguish it from peso, other peso-denominated currencies; referred to as the peso, Mexican peso, or colloquially varo) is the official curre ...

also set an all-time record low against the U.S. dollar, trading at 22.99 pesos.

Black Monday II (16 March)

Over the preceding weekend, the Saudi Arabian Monetary Authority announced a $13 billion credit-line package to small- and medium-sized companies, while South African President

Cyril Ramaphosa

Matamela Cyril Ramaphosa (born 17 November 1952) is a South African businessman and politician serving as the 5th and current President of South Africa since 2018. A former Anti-Apartheid Movement, anti-apartheid activist and trade union leade ...

announced a fiscal stimulus package. The Federal Reserve announced that it would cut the federal funds rate target to 0%–0.25%, lower reserve requirements to zero, and begin a $700 billion quantitative easing program.

Dow futures tumbled more than 1,000 points and Standard & Poor's 500 futures dropped 5%, triggering a circuit breaker. On Monday 16 March, Asia-Pacific and European stock markets closed down (with the

S&P/ASX 200

The S&P/ASX 200 (XJO) index is a market-capitalisation weighted and float-adjusted stock market index of stocks listed on the Australian Securities Exchange. The index is maintained by Standard & Poor's and is considered the benchmark for A ...

setting a one-day record fall of 9.7%, collapsing 30% from the peak that was reached on 20 February). The Dow Jones Industrial Average, the NASDAQ Composite, and the S&P 500 all fell by 12–13%, with the Dow eclipsing the one-day drop record set on 12 March and the trading curb being activated at the beginning of trading for the third time (after 9and 12 March).

Oil prices fell by 10%, while the yields on 10-year and 30-year U.S. Treasury securities fell to 0.76% and 1.38% respectively (while their

yield curve

In finance, the yield curve is a graph which depicts how the Yield to maturity, yields on debt instruments – such as bonds – vary as a function of their years remaining to Maturity (finance), maturity. Typically, the graph's horizontal ...

remained

normal for the third straight trading session).

The

Cboe Volatility Index

VIX is the ticker symbol and popular name for the Chicago Board Options Exchange's CBOE Volatility Index, a popular measure of the stock market's expectation of volatility based on S&P 500 index options. It is calculated and disseminated on a ...

closed at 82.69 on 16 March, the highest ever closing for the index (though there were higher intraday peaks in 2008). Around noon on 16 March, the

Federal Reserve Bank of New York

The Federal Reserve Bank of New York is one of the 12 Federal Reserve Banks of the United States. It is responsible for the Second District of the Federal Reserve System, which encompasses the New York (state), State of New York, the 12 norther ...

announced that it would conduct a $500 billion

repurchase

A repurchase agreement, also known as a repo, RP, or sale and repurchase agreement, is a form of secured short-term borrowing, usually, though not always using government securities as collateral. A contracting party sells a security to a lend ...

through the afternoon of that day. Indonesian Finance Minister Sri Mulyani announced an additional Rp22 trillion in tax-related fiscal stimulus. The Central Bank of the Republic of Turkey lowered its reserve requirement from 8% to 6%. The Bank of Japan announced that it would not cut its bank rate lower from minus 0.1% but that it would conduct more open market purchases of

Exchange-traded fund

An exchange-traded fund (ETF) is a type of investment fund that is also an exchange-traded product, i.e., it is traded on stock exchanges. ETFs own financial assets such as stocks, bonds, currencies, debts, futures contracts, and/or comm ...

s. After cutting its bank rate by 25 basis points on 7February, the Central Bank of Russia announced that it would keep its bank rate at 6%, while the Bank of Korea announced that it would cut its overnight rate by 50 basis points to 0.75%. The

Central Bank of Chile

The Central Bank of Chile () is the central bank of Chile. It was established in 1925 and is incorporated into the current Chilean Constitution as an autonomous institution of constitutional rank. Its monetary policy is currently guided by an infl ...

cut its benchmark rate, while the

Reserve Bank of New Zealand

The Reserve Bank of New Zealand (RBNZ) () is the central bank of New Zealand. It was established in 1934 and is currently constituted under the ''Reserve Bank of New Zealand Act 2021''. The current acting governor of the Reserve Bank, Christian ...

cut its

official cash rate

The official cash rate (OCR) is the term used in Australia and New Zealand for the bank rate and is the rate of interest which the central bank charges on overnight loans between commercial banks. This allows the Reserve Bank of Australia and the ...

by 75 basis points to 0.25%. The

Czech National Bank

The Czech National Bank, (, ČNB) is the central bank and financial market supervisor in the Czech Republic, headquartered in Prague. It is a member of the European System of Central Banks. It was established on from the division of the State ...

announced that it would cut its bank rate by 50 basis points to 1.75%.

Impact by region or country

Africa

In April 2020,

Sub-Saharan Africa

Sub-Saharan Africa is the area and regions of the continent of Africa that lie south of the Sahara. These include Central Africa, East Africa, Southern Africa, and West Africa. Geopolitically, in addition to the list of sovereign states and ...

appeared poised to enter its first recession in 25 years, but this time for a longer duration.

The

World Bank

The World Bank is an international financial institution that provides loans and Grant (money), grants to the governments of Least developed countries, low- and Developing country, middle-income countries for the purposes of economic development ...

predicted that overall sub-Saharan Africa's economy would shrink by 2.1%–5.1% during 2020.

African countries cumulatively owe $152 billion to China from loans taken 2000–2018; as of May 2020, China was considering granting deadline extensions for repayment, and in June 2020,

Chinese leader Xi Jinping

Xi Jinping, pronounced (born 15 June 1953) is a Chinese politician who has been the general secretary of the Chinese Communist Party (CCP) and Chairman of the Central Military Commission (China), chairman of the Central Military Commission ...

said that some interest-free loans to certain countries would be forgiven.

Botswana

Botswana has been affected by sharp falls in the

diamond trade

Diamond is a solid form of the element carbon with its atoms arranged in a crystal structure called diamond cubic. Diamond is tasteless, odourless, strong, brittle solid, colourless in pure form, a poor conductor of electricity, and insol ...

, tourism and other sectors.

Egypt

The

Economy of Egypt

The economy of Egypt is a developing country, developing, mixed economy, combining private enterprise with centralized economic planning and government regulation. It is the second-largest economy in Africa, and List of countries by GDP (nominal ...

suffered from the COVID-19 recession. Tourism, which employs one in ten Egyptians and contributes about 5% of the GDP, has largely stopped, while remittances from migrant workers abroad (9% of GDP) are also expected to fall.

The cheap fuel prices and slower demand also led some shipping companies to avoid the

Suez Canal

The Suez Canal (; , ') is an artificial sea-level waterway in Egypt, Indo-Mediterranean, connecting the Mediterranean Sea to the Red Sea through the Isthmus of Suez and dividing Africa and Asia (and by extension, the Sinai Peninsula from the rest ...

, and instead opt for traveling by the

Cape of Good Hope

The Cape of Good Hope ( ) is a rocky headland on the Atlantic Ocean, Atlantic coast of the Cape Peninsula in South Africa.

A List of common misconceptions#Geography, common misconception is that the Cape of Good Hope is the southern tip of Afri ...

, leading to reduced transit fees for the government.

However, despite this, Egypt were one of the few African countries to have a positive growth rate during the recession.

Ethiopia

Ethiopia is heavily dependent for export income on its national carrier,

Ethiopian Airlines

Ethiopian Airlines (), formerly ''Ethiopian Air Lines'' (EAL), is the flag carrier of Ethiopia, and is wholly owned by the country's government. EAL was founded on 21 December 1945 and commenced operations on 8 April 1946, expanding to intern ...

, which has announced suspensions on 80 flight routes.

Exports of flowers and other agricultural products dropped sharply.

Namibia

Namibia's

central bank

A central bank, reserve bank, national bank, or monetary authority is an institution that manages the monetary policy of a country or monetary union. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the mo ...

sees the nation's economy shrinking by 6.9%

This will be the biggest shrink of GDP since its

independence

Independence is a condition of a nation, country, or state, in which residents and population, or some portion thereof, exercise self-government, and usually sovereignty, over its territory. The opposite of independence is the status of ...

in 1990. The tourism and hospitality industries has accounted for N$26 billion being lost as 125,000 jobs were affected. The central bank also announced that the

diamond-mining sector will decline by 14.9% in 2020, while uranium mining may shrink 22%.

Zambia

Zambia faced a severe

debt crisis