|

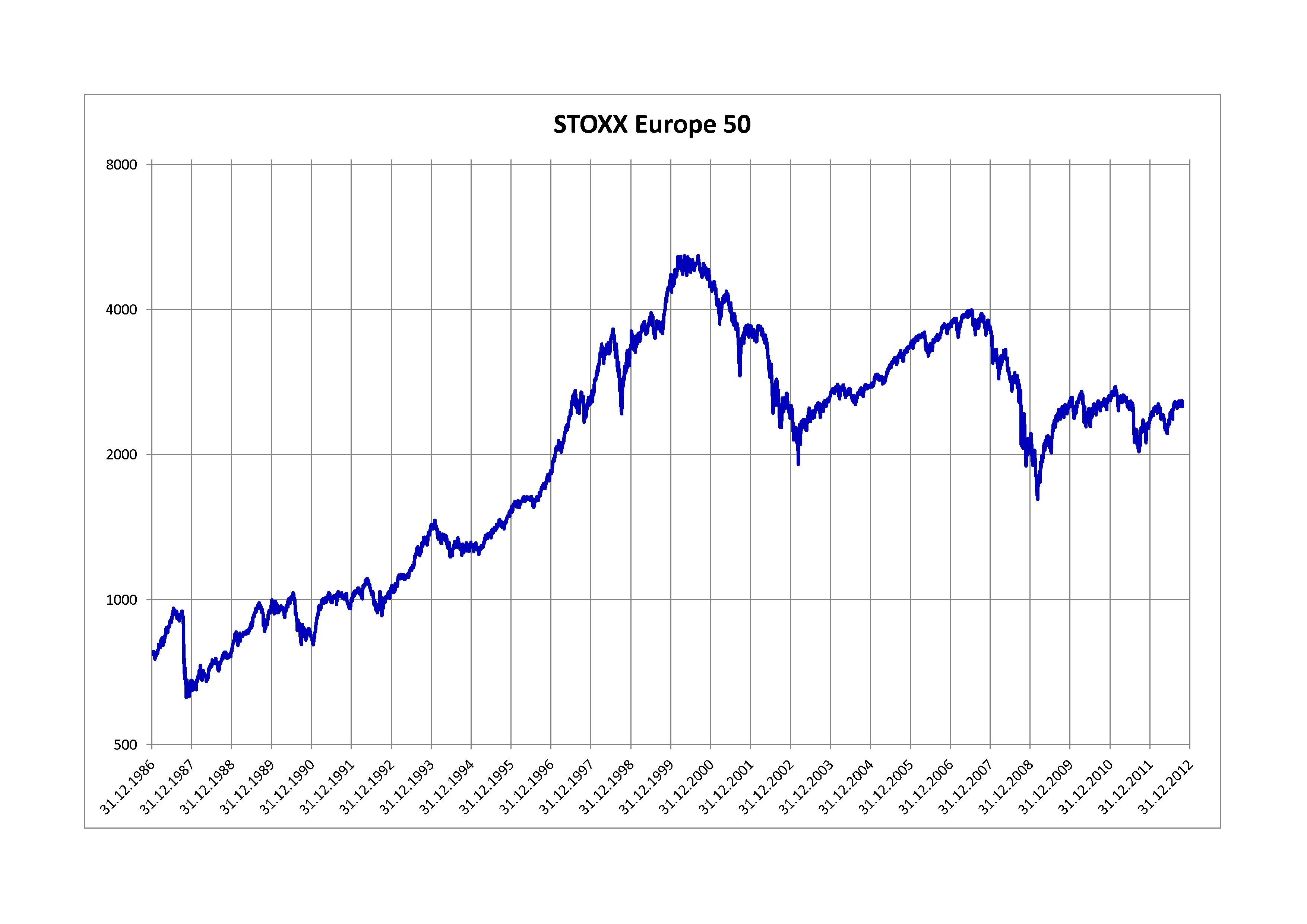

STOXX Europe 50

The STOXX Europe 50 is a stock index of 50 European stocks designed and administered by STOXX Ltd., an index provider owned by Deutsche Börse Group. The index was introduced in February 1998. The STOXX Europe 50 index provides a blue-chip representation of supersector leaders in Europe covering almost 50% of the free-float market capitalization of the European stock market. The index covers 50 stocks from 18 European countries: Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom. The index is weighted quarterly according to free-float market capitalization with components capped at a maximum of 10% and is reviewed annually in September. It is licensed to financial institutions to serve as underlying for a wide range of investment products such as exchange-traded funds (ETFs), futures, options, and structured products worldwide. Versions ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Index

In finance, a stock index, or stock market index, is an index that measures the performance of a stock market, or of a subset of a stock market. It helps investors compare current stock price levels with past prices to calculate market performance. Two of the primary criteria of an index are that it is ''investable'' and ''transparent'': The methods of its construction are specified. Investors may be able to invest in a stock market index by buying an index fund, which is structured as either a mutual fund or an exchange-traded fund, and "track" an index. The difference between an index fund's performance and the index, if any, is called '' tracking error''. Types of indices by coverage Stock market indices may be classified and segmented by the set of underlying stocks included in the index, sometimes referred to as the "coverage". The underlying stocks are typically grouped together based on their underlying economics or underlying investor demand that the index is seeking ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

STOXX

STOXX Ltd. is a global index provider which covers global markets across various asset classes developing, maintaining, distributing and marketing a comprehensive global family of strictly rules-based and transparent indices. STOXX, headquartered in Zug (Switzerland) with key locations in New York, Eschborn (Germany) and London, is part of ISS STOXX which is part of Deutsche Börse Group. STOXX calculates more than 17,000 indices and in addition acts as the administrator for the DAX indices. STOXX indices are licensed to financial institutions and other users for use with exchange-traded funds (ETFs), mutual funds, futures, options, structured products, and other purposes. History STOXX Limited began operations in 1998, when the EURO STOXX 50 blue-chip benchmark and other indices were launched. In 2000 STOXX was the first index provider to implement free float market capitalization in all its indices. In December 2009 Deutsche Börse and SIX Group became sole shareholders ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deutsche Börse Group

Deutsch ( , ) or Deutsche ( , ) may refer to: * or : the German language or in particular Standard German, spoken in central European countries and other places *Old High German language refers to Deutsch as a way to define the primary characteristic of the people of the land with importance given to masculine strength - Dhaithya in Samskrutham (aka Sanskrit) meaning a physically very strong man, who is not concerned about his actions and their consequences that use his strength, as he is blinded by the temporary power he possesses at the moment. *: Germans, as a weak masculine, feminine, or plural demonym * ''Deutsch'' (word), originally referring to the Germanic vernaculars of the Early Middle Ages Businesses and organisations *André Deutsch, an imprint of Carlton Publishing Group * Deutsch Inc., a former American advertising agency that split in 2020 into: **Deutsch NY, a New York City-based advertising agency * Deutsche Aerospace AG *Deutsche Akademie, a cultural organisat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Blue Chip (stock Market)

A blue chip is capital stock of a Corporation, stock corporation with a national reputation for quality, reliability, and the ability to operate profitably in both good and bad times. Origin As befits the sometimes high-risk nature of stock picking, the term "blue chip" derives from the card game poker. The simplest sets of casino token, poker chips include casino token#Colors, white, red, and blue chips, with American tradition dictating that the blues are highest in value. In the United States, blue chips were traditionally used for higher values such that "blue chip" used in noun and adjectival word sense, senses are attested since 1873 and 1894, respectively. This established connotation was first extended to the sense of a blue-chip stock in the 1920s. According to Dow Jones & Company, Dow Jones company folklore, this sense extension was coined by Oliver Gingold (an early employee of the company that would become Dow Jones) sometime in the 1920s, when Gingold was standing ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Free Float

In the context of stock markets, the public float or free float represents the portion of Share (finance), shares of a corporation that are in the hands of public investors as opposed to locked-in shares held by promoters, company officers, controlling-interest investors, or governments. This number is sometimes seen as a better way of calculating market capitalization, because it provides a more accurate reflection (than entire market capitalization) of what public investors consider the company to be worth. In this context, the ''float'' may refer to all the shares outstanding that can be publicly traded. Calculating public float The float is calculated by subtracting the locked-in shares from outstanding shares. For example, a company may have 10 million outstanding shares, with 3 million of them in a locked-in position; this company's float would be 7 million (multiplied by the share price). Stocks with smaller floats tend to be more Volatility (finance), volatile than those ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange-traded Fund

An exchange-traded fund (ETF) is a type of investment fund that is also an exchange-traded product, i.e., it is traded on stock exchanges. ETFs own financial assets such as stocks, bonds, currencies, debts, futures contracts, and/or commodities such as gold bars. Many ETFs provide some level of diversification compared to owning an individual stock. An ETF divides ownership of itself into shares that are held by shareholders. Depending on the country, the legal structure of an ETF can be a corporation, trust, open-end management investment company, or unit investment trust. Shareholders indirectly own the assets of the fund and are entitled to a share of the profits, such as interest or dividends, and would be entitled to any residual value if the fund undergoes liquidation. They also receive annual reports. An ETF generally operates with an arbitrage mechanism designed to keep it trading close to its net asset value, although deviations can occur. The larges ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Contract

In finance, a futures contract (sometimes called futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The item transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the ''forward price'' or ''delivery price''. The specified time in the future when delivery and payment occur is known as the ''delivery date''. Because it derives its value from the value of the underlying asset, a futures contract is a Derivative (finance), derivative. Contracts are traded at futures exchanges, which act as a marketplace between buyers and sellers. The buyer of a contract is said to be the Long (finance), long position holder and the selling party is said to be the Short (finance), short position holder. As both parties risk their counter-party reneging if the price goes against them, the contract may involve both ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Option (finance)

In finance, an option is a contract which conveys to its owner, the ''holder'', the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset (or contingent liability) and have a valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in '' over-the-counter'' (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts. Definition and application An option is a contract that allows the holder the right to buy or sell an underlying asset or financia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Structured Product

A structured product, also known as a market-linked investment, is a pre-packaged structured finance investment strategy based on a single security, a basket of securities, options, indices, commodities, debt issuance or foreign currencies, and to a lesser extent, derivatives. Structured products are not homogeneous — there are numerous varieties of derivatives and underlying assets — but they can be classified under the aside categories. Typically, a desk will employ a specialized " structurer" to design and manage its structured-product offering. Formal definitions U.S. Securities and Exchange Commission (SEC) Rule 434 (regarding certain prospectus deliveries) defines structured securities as "securities whose cash flow characteristics depend upon one or more indices or that have embedded forwards or options or securities where an investor's investment return and the issuer's payment obligations are contingent on, or highly sensitive to, changes in the value of under ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Eurozone

The euro area, commonly called the eurozone (EZ), is a Monetary union, currency union of 20 Member state of the European Union, member states of the European Union (EU) that have adopted the euro (Euro sign, €) as their primary currency and sole legal tender, and have thus fully implemented Economic and Monetary Union of the European Union, EMU policies. The 20 eurozone members are: : Austria, Belgium, Croatia, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain. The seven non-eurozone members of the EU are Bulgaria, the Czech Republic, Denmark, Hungary, Poland, Romania, and Sweden. They continue to use their own national currencies, although all but Denmark are obliged to join once they meet the euro convergence criteria. Bulgaria is targeting to join the eurozone on 1 January 2026. Bulgaria is expected to become the 21st eurozone member from January 1, 2026. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |