|

STOXX

STOXX Ltd. is a global index provider which covers global markets across various asset classes developing, maintaining, distributing and marketing a comprehensive global family of strictly rules-based and transparent indices. STOXX, headquartered in Zug (Switzerland) with key locations in New York, Eschborn (Germany) and London, is part of ISS STOXX which is part of Deutsche Börse Group. STOXX calculates more than 17,000 indices and in addition acts as the administrator for the DAX indices. STOXX indices are licensed to financial institutions and other users for use with exchange-traded funds (ETFs), mutual funds, futures, options, structured products, and other purposes. History STOXX Limited began operations in 1998, when the EURO STOXX 50 blue-chip benchmark and other indices were launched. In 2000 STOXX was the first index provider to implement free float market capitalization in all its indices. In December 2009 Deutsche Börse and SIX Group became sole shareholders ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

STOXX Europe 600

The STOXX Europe 600, also called STOXX 600, SXXP, is a stock index of European stocks designed by STOXX Ltd. This index has a fixed number of 600 components representing large-, mid- and small-capitalization companies among 17 European countries, covering approximately 90% of the free-float market capitalization of the European stock market (not limited to the Eurozone). The countries that make up the index are the United Kingdom (composing around 22.3% of the index), France (composing around 16.6% of the index), Switzerland (composing around 14.9% of the index) and Germany (composing around 14.1% of the index), as well as Austria, Belgium, Denmark, Finland, Ireland, Italy, Luxembourg, the Netherlands, Norway, Poland, Portugal, Spain, and Sweden. The STOXX Europe 600 was introduced in 1998. Its composition is reviewed four times a year, in March, June, September, December. The index is available in several currency (AUD, CAD, CHF, EUR, GBP, JPY, USD) and return (Price, Net Retur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

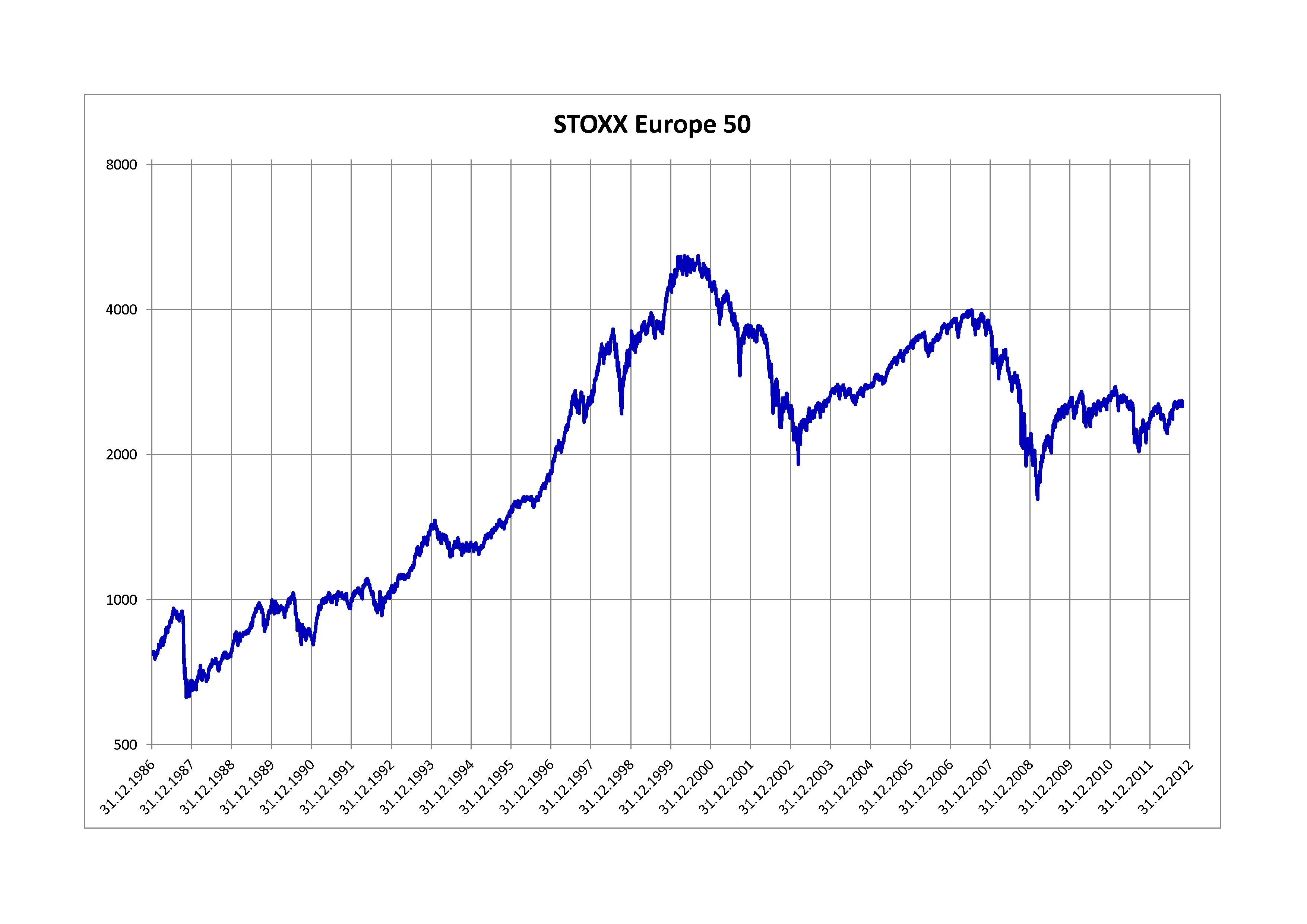

STOXX Europe 50

The STOXX Europe 50 is a stock index of 50 European stocks designed and administered by STOXX Ltd., an index provider owned by Deutsche Börse Group. The index was introduced in February 1998. The STOXX Europe 50 index provides a blue-chip representation of supersector leaders in Europe covering almost 50% of the free-float market capitalization of the European stock market. The index covers 50 stocks from 18 European countries: Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom. The index is weighted quarterly according to free-float market capitalization with components capped at a maximum of 10% and is reviewed annually in September. It is licensed to financial institutions to serve as underlying for a wide range of investment products such as exchange-traded funds (ETFs), futures, options, and structured products worldwide. Versions ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deutsche Börse

Deutsche Börse AG (), or the Deutsche Börse Group, is a German multinational corporation that offers a marketplace for organizing the trading of shares and other securities. It is also a transaction services provider, giving companies and investors access to global capital markets. It is a joint stock company and was founded in 1992, with headquarters in Frankfurt. On 1 October 2014, Deutsche Börse AG became the 14th announced member of the United Nations Sustainable Stock Exchanges initiative. It is the third-largest stock market in Europe by market cap after Euronext Paris and the London Stock Exchange. On 23 August 2023, the company formed EuroCTP as a joint venture with 13 other bourses, to provide a consolidated tape for the European Union, as part of the Capital Markets Union proposed by the European Commission. Company More than 3,200 employees service customers in Europe, the United States, and Asia. Deutsche Börse has locations in Germany, Luxembourg, Switzerl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

DAX

The DAX (''Deutscher Aktienindex'' (German stock index); ) is a stock market index consisting of the 40 major German blue chip companies trading on the Frankfurt Stock Exchange. It is a total return index. Prices are taken from the Xetra trading venue. According to Deutsche Börse, the operator of Xetra, DAX measures the performance of the Prime Standard's 40 largest German companies in terms of order book volume and market capitalization. DAX is the equivalent of the UK FTSE 100 and the US Dow Jones Industrial Average, and because of its small company selection it does not necessarily represent the vitality of the German economy as a whole. The L-DAX Index is an indicator of the German benchmark DAX index's performance after the Xetra trading venue closes based on the floor trading at the Börse Frankfurt trading venue. The L-DAX Index basis is the "floor" trade (''Parketthandel'') at the Frankfurt stock exchange; it is computed daily between 09:00 and 17:45 Hours CET. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Market Indices

In finance, a stock index, or stock market index, is an index that measures the performance of a stock market, or of a subset of a stock market. It helps investors compare current stock price levels with past prices to calculate market performance. Two of the primary criteria of an index are that it is ''investable'' and ''transparent'': The methods of its construction are specified. Investors may be able to invest in a stock market index by buying an index fund, which is structured as either a mutual fund or an exchange-traded fund, and "track" an index. The difference between an index fund's performance and the index, if any, is called '' tracking error''. Types of indices by coverage Stock market indices may be classified and segmented by the set of underlying stocks included in the index, sometimes referred to as the "coverage". The underlying stocks are typically grouped together based on their underlying economics or underlying investor demand that the index is seekin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subsidiary

A subsidiary, subsidiary company, or daughter company is a company (law), company completely or partially owned or controlled by another company, called the parent company or holding company, which has legal and financial control over the subsidiary company. Unlike regional branches or divisions, subsidiaries are considered to be distinct entities from their parent companies; they are required to follow the laws of where they are incorporated, and they maintain their own executive leadership. Two or more subsidiaries primarily controlled by same entity/group are considered to be sister companies of each other. Subsidiaries are a common feature of modern business, and most multinational corporations organize their operations via the creation and purchase of subsidiary companies. Examples of holding companies are Berkshire Hathaway, Jefferies Financial Group, The Walt Disney Company, Warner Bros. Discovery, and Citigroup, which have subsidiaries involved in many different Industry (e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Free Float

In the context of stock markets, the public float or free float represents the portion of Share (finance), shares of a corporation that are in the hands of public investors as opposed to locked-in shares held by promoters, company officers, controlling-interest investors, or governments. This number is sometimes seen as a better way of calculating market capitalization, because it provides a more accurate reflection (than entire market capitalization) of what public investors consider the company to be worth. In this context, the ''float'' may refer to all the shares outstanding that can be publicly traded. Calculating public float The float is calculated by subtracting the locked-in shares from outstanding shares. For example, a company may have 10 million outstanding shares, with 3 million of them in a locked-in position; this company's float would be 7 million (multiplied by the share price). Stocks with smaller floats tend to be more Volatility (finance), volatile than those ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Low-carbon Economy

A low-carbon economy (LCE) is an economy which absorbs as much greenhouse gas as it emits. Greenhouse gas (GHG) emissions due to human activity are the dominant cause of observed climate change since the mid-20th century. There are many proven approaches for moving to a low-carbon economy, such as encouraging renewable energy transition, energy conservation, and electrification of transportation (e.g. electric vehicles). An example are zero-carbon cities. Shifting from high-carbon economies to low-carbon economies on a global scale could bring substantial benefits for all countries. It would also contribute to climate change mitigation. Definition and terminology There are many synonyms or similar terms in use for ''low-carbon economy'' which stress different aspects of the concept, for example: green economy, sustainable economy, carbon-neutral economy, low-emissions economy, climate-friendly economy, decarbonised economy. The term ''carbon'' in ''low-carbon economy' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Central Bank

The European Central Bank (ECB) is the central component of the Eurosystem and the European System of Central Banks (ESCB) as well as one of seven institutions of the European Union. It is one of the world's Big Four (banking)#International use, most important central banks with a balance sheet total of around 7 trillion. The Governing Council of the European Central Bank, ECB Governing Council makes monetary policy for the Eurozone and the European Union, administers the foreign exchange reserves of EU member states, engages in foreign exchange operations, and defines the intermediate monetary objectives and key interest rate of the EU. The Executive Board of the European Central Bank, ECB Executive Board enforces the policies and decisions of the Governing Council, and may direct the national central banks when doing so. The ECB has the exclusive right to authorise the issuance of euro banknotes. Member states can issue euro coins, but the volume must be approved by the EC ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Eastern Europe

Eastern Europe is a subregion of the Europe, European continent. As a largely ambiguous term, it has a wide range of geopolitical, geographical, ethnic, cultural and socio-economic connotations. Its eastern boundary is marked by the Ural Mountains, and its western boundary is defined in various ways. Narrow definitions, in which Central Europe, Central and Southeast Europe are counted as separate regions, include Belarus, Russia and Ukraine. In contrast, broader definitions include Moldova and Romania, but also some or all of the Balkans, the Baltic states, the Caucasus, and the Visegrád Group, Visegrád group. The region represents a significant part of Culture of Europe, European culture; the main socio-cultural characteristics of Eastern Europe have historically largely been defined by the traditions of the Slavs, as well as by the influence of Eastern Christianity as it developed through the Byzantine Empire, Eastern Roman Empire and the Ottoman Empire. Another definition was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Eurozone

The euro area, commonly called the eurozone (EZ), is a Monetary union, currency union of 20 Member state of the European Union, member states of the European Union (EU) that have adopted the euro (Euro sign, €) as their primary currency and sole legal tender, and have thus fully implemented Economic and Monetary Union of the European Union, EMU policies. The 20 eurozone members are: : Austria, Belgium, Croatia, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain. The seven non-eurozone members of the EU are Bulgaria, the Czech Republic, Denmark, Hungary, Poland, Romania, and Sweden. They continue to use their own national currencies, although all but Denmark are obliged to join once they meet the euro convergence criteria. Bulgaria is targeting to join the eurozone on 1 January 2026. Bulgaria is expected to become the 21st eurozone member from January 1, 2026. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |