|

Multiplicative Noise

In signal processing, the term multiplicative noise refers to an unwanted random signal that gets multiplied into some relevant signal during capture, transmission, or other processing. Multiplicative noise is a type of signal-dependent noise where the noise amplitude scales with the signal's intensity. Unlike additive noise, which is independent of the signal, multiplicative noise complicates processing due to its dependence on the underlying signal. An important example is the speckle noise commonly observed in radar imagery. Examples of multiplicative noise affecting digital photographs are proper shadows due to undulations on the surface of the imaged objects, shadows cast by complex objects like foliage and Venetian blinds, dark spots caused by dust in the lens or image sensor, and variations in the gain of individual elements of the image sensor array. Maria Petrou, Costas Petrou (2010Image Processing: The Fundamentals John Wiley & Sons. 818 pages. Multiplicative No ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

|

|

Signal Processing

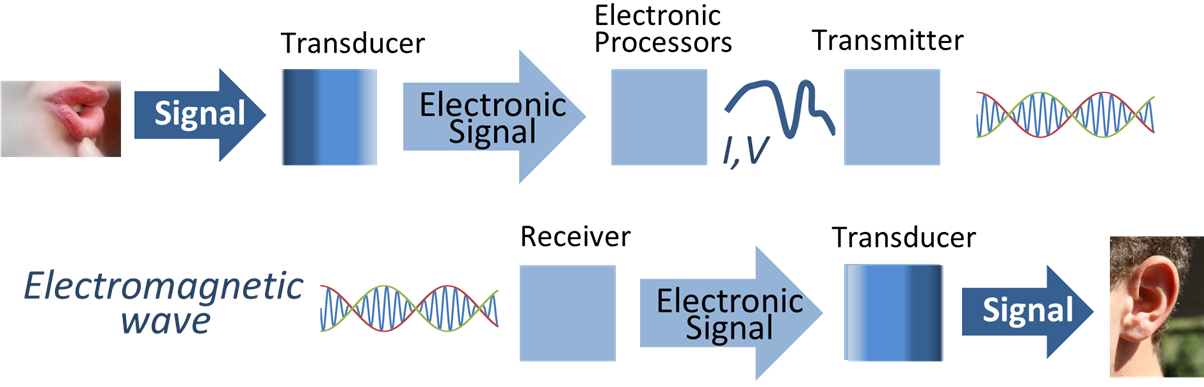

Signal processing is an electrical engineering subfield that focuses on analyzing, modifying and synthesizing ''signals'', such as audio signal processing, sound, image processing, images, Scalar potential, potential fields, Seismic tomography, seismic signals, Altimeter, altimetry processing, and scientific measurements. Signal processing techniques are used to optimize transmissions, Data storage, digital storage efficiency, correcting distorted signals, improve subjective video quality, and to detect or pinpoint components of interest in a measured signal. History According to Alan V. Oppenheim and Ronald W. Schafer, the principles of signal processing can be found in the classical numerical analysis techniques of the 17th century. They further state that the digital refinement of these techniques can be found in the digital control systems of the 1940s and 1950s. In 1948, Claude Shannon wrote the influential paper "A Mathematical Theory of Communication" which was publis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

|

Wiener Process

In mathematics, the Wiener process (or Brownian motion, due to its historical connection with Brownian motion, the physical process of the same name) is a real-valued continuous-time stochastic process discovered by Norbert Wiener. It is one of the best known Lévy processes (càdlàg stochastic processes with stationary increments, stationary independent increments). It occurs frequently in pure and applied mathematics, economy, economics, quantitative finance, evolutionary biology, and physics. The Wiener process plays an important role in both pure and applied mathematics. In pure mathematics, the Wiener process gave rise to the study of continuous time martingale (probability theory), martingales. It is a key process in terms of which more complicated stochastic processes can be described. As such, it plays a vital role in stochastic calculus, diffusion processes and even potential theory. It is the driving process of Schramm–Loewner evolution. In applied mathematics, the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

|

Truncation (statistics)

In statistics, truncation results in values that are limited above or below, resulting in a truncated sample. A random variable y is said to be truncated from below if, for some threshold value c, the exact value of y is known for all cases y > c, but unknown for all cases y \leq c. Similarly, truncation from above means the exact value of y is known in cases where y < c, but unknown when . Truncation is similar to but distinct from the concept of Censoring (statistics), statistical censoring. A truncated sample can be thought of as being equivalent to an underlying sample with all values outside the bounds entirely omitted, with not even a count of those omitted being kept. With statistical censoring, a note would be recorded documenting which bound (upper or lower) had been exceeded and the value of that bound. With truncated sampling, no note is recorded. Applications Usually the values that insurance adjusters receive are either l ...[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

|

|

Euler–Maruyama Method

In Itô calculus, the Euler–Maruyama method (also simply called the Euler method) is a method for the approximate numerical analysis, numerical solution of a stochastic differential equation (SDE). It is an extension of the Euler method for ordinary differential equations to stochastic differential equations named after Leonhard Euler and Gisiro Maruyama. The same generalization cannot be done for any arbitrary deterministic method. Definition Consider the stochastic differential equation (see Itô calculus) :\mathrm X_t = a(X_t, t) \, \mathrm t + b(X_t, t) \, \mathrm W_t, with initial condition ''X''0 = ''x''0, where ''W''''t'' denotes the Wiener process, and suppose that we wish to solve this SDE on some interval of time [0, ''T'']. Then the Euler–Maruyama approximation to the true solution ''X'' is the Markov chain ''Y'' defined as follows: * Partition the interval [0, ''T''] into ''N'' equal subintervals of width \Delta t>0: ::0 = \tau_ < \tau_ < \ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

|

Chi-squared Distribution

In probability theory and statistics, the \chi^2-distribution with k Degrees of freedom (statistics), degrees of freedom is the distribution of a sum of the squares of k Independence (probability theory), independent standard normal random variables. The chi-squared distribution \chi^2_k is a special case of the gamma distribution and the univariate Wishart distribution. Specifically if X \sim \chi^2_k then X \sim \text(\alpha=\frac, \theta=2) (where \alpha is the shape parameter and \theta the scale parameter of the gamma distribution) and X \sim \text_1(1,k) . The scaled chi-squared distribution s^2 \chi^2_k is a reparametrization of the gamma distribution and the univariate Wishart distribution. Specifically if X \sim s^2 \chi^2_k then X \sim \text(\alpha=\frac, \theta=2 s^2) and X \sim \text_1(s^2,k) . The chi-squared distribution is one of the most widely used probability distributions in inferential statistics, notably in hypothesis testing and in constru ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

|

|

Cox–Ingersoll–Ross Model

In mathematical finance, the Cox–Ingersoll–Ross (CIR) model describes the evolution of interest rates. It is a type of "one factor model" (short-rate model) as it describes interest rate movements as driven by only one source of market risk. The model can be used in the valuation of interest rate derivatives. It was introduced in 1985 by John C. Cox, Jonathan E. Ingersoll and Stephen A. Ross as an extension of the Vasicek model, itself an Ornstein–Uhlenbeck process. The model The CIR model describes the instantaneous interest rate r_t with a Feller square-root process, whose stochastic differential equation is :dr_t = a(b-r_t)\, dt + \sigma\sqrt\, dW_t, where W_t is a Wiener process (modelling the random market risk factor) and a , b , and \sigma\, are the parameters. The parameter a corresponds to the speed of adjustment to the mean b , and \sigma\, to volatility. The drift factor, a(b-r_t), is exactly the same as in the Vasicek model. It ensures mean rev ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

|

Black–Scholes Model

The Black–Scholes or Black–Scholes–Merton model is a mathematical model for the dynamics of a financial market containing Derivative (finance), derivative investment instruments. From the parabolic partial differential equation in the model, known as the Black–Scholes equation, one can deduce the Black–Scholes formula, which gives a theoretical estimate of the price of option style, European-style option (finance), options and shows that the option has a ''unique'' price given the risk of the security and its expected return (instead replacing the security's expected return with the risk-neutral rate). The equation and model are named after economists Fischer Black and Myron Scholes. Robert C. Merton, who first wrote an academic paper on the subject, is sometimes also credited. The main principle behind the model is to hedge (finance), hedge the option by buying and selling the underlying asset in a specific way to eliminate risk. This type of hedging is called "continuou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

|

Log-normal Distribution

In probability theory, a log-normal (or lognormal) distribution is a continuous probability distribution of a random variable whose logarithm is normal distribution, normally distributed. Thus, if the random variable is log-normally distributed, then has a normal distribution. Equivalently, if has a normal distribution, then the exponential function of , , has a log-normal distribution. A random variable which is log-normally distributed takes only positive real values. It is a convenient and useful model for measurements in exact and engineering sciences, as well as medicine, economics and other topics (e.g., energies, concentrations, lengths, prices of financial instruments, and other metrics). The distribution is occasionally referred to as the Galton distribution or Galton's distribution, after Francis Galton. The log-normal distribution has also been associated with other names, such as Donald MacAlister#log-normal, McAlister, Gibrat's law, Gibrat and Cobb–Douglas. A l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

|

|

Brownian Motion

Brownian motion is the random motion of particles suspended in a medium (a liquid or a gas). The traditional mathematical formulation of Brownian motion is that of the Wiener process, which is often called Brownian motion, even in mathematical sources. This motion pattern typically consists of Randomness, random fluctuations in a particle's position inside a fluid sub-domain, followed by a relocation to another sub-domain. Each relocation is followed by more fluctuations within the new closed volume. This pattern describes a fluid at thermal equilibrium, defined by a given temperature. Within such a fluid, there exists no preferential direction of flow (as in transport phenomena). More specifically, the fluid's overall Linear momentum, linear and Angular momentum, angular momenta remain null over time. The Kinetic energy, kinetic energies of the molecular Brownian motions, together with those of molecular rotations and vibrations, sum up to the caloric component of a fluid's in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

|

Noise (signal Processing)

In signal processing, noise is a general term for unwanted (and, in general, unknown) modifications that a signal may suffer during capture, storage, transmission, processing, or conversion.Vyacheslav Tuzlukov (2010), ''Signal Processing Noise'', Electrical Engineering and Applied Signal Processing Series, CRC Press. 688 pages. Sometimes the word is also used to mean signals that are random (Predictability, unpredictable) and carry no useful information; even if they are not interfering with other signals or may have been introduced intentionally, as in comfort noise. Noise reduction, the recovery of the original signal from the noise-corrupted one, is a very common goal in the design of signal processing systems, especially filter (signal processing), filters. The mathematical limits for noise removal are set by information theory. Types of noise Signal processing noise can be classified by its statistical properties (sometimes called the "colors of noise, color" of the noi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

|

|

Financial Mathematics

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling in the Finance#Quantitative_finance, financial field. In general, there exist two separate branches of finance that require advanced quantitative techniques: Derivative (finance), derivatives pricing on the one hand, and risk management, risk and Investment management#Investment managers and portfolio structures, portfolio management on the other. Mathematical finance overlaps heavily with the fields of computational finance and financial engineering. The latter focuses on applications and modeling, often with the help of stochastic asset models, while the former focuses, in addition to analysis, on building tools of implementation for the models. Also related is quantitative investing, which relies on statistical and numerical models (and lately machine learning) as opposed to traditional fundamental analysis when investment ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |