|

LJM (Lea Jeffrey Matthew)

LJM, which stands for Lea, Jeffrey, Matthew, the names of Andrew Fastow's wife and children, was a company created in 1999 by Enron Corporation's CFO, Andrew Fastow, to buy Enron's poorly performing assets and bolster Enron's financial statements by hiding its debts. LJM1 In 1999, the early days of the Dot-com boom, Enron invested in a Broadband Internet start-up, Rhythms NetConnections. In a desire to hedge this substantial investment (they owned at one point 50% of Rhythms' stock) and several others, Fastow met with Kenneth Lay and Jeffrey Skilling on June 18 to discuss the establishment of an SPE called LJM Cayman L.P. (LJM1) that would perform specific hedging transactions with Enron. At a board meeting on June 28, Fastow announced that he would serve as the general partner and would invest $1 million. Also at this meeting, Fastow introduced the structure of LJM, stated he would collect certain "management fees", and got Lay to approve the partnership pursuant to Enron's Code ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

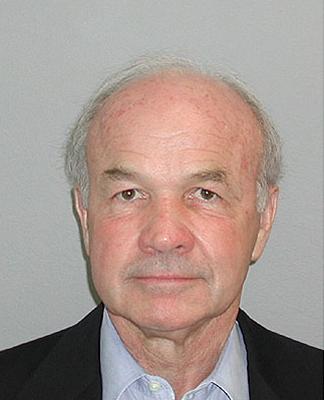

Enron

Enron Corporation was an American energy, commodities, and services company based in Houston, Texas. It was founded by Kenneth Lay in 1985 as a merger between Lay's Houston Natural Gas and InterNorth, both relatively small regional companies. Before its bankruptcy on December 2, 2001, Enron employed approximately 20,600 staff and was a major electricity, natural gas, communications, and pulp and paper company, with claimed revenues of nearly $101 billion during 2000. '' Fortune'' named Enron "America's Most Innovative Company" for six consecutive years. At the end of 2001, it was revealed that Enron's reported financial condition was sustained by an institutionalized, systematic, and creatively planned accounting fraud, known since as the Enron scandal. Enron has become synonymous with willful corporate fraud and corruption. The scandal also brought into question the accounting practices and activities of many corporations in the United States and was a factor in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Enron Scandal

The Enron scandal was an accounting scandal involving Enron Corporation, an American energy company based in Houston, Texas. Upon being publicized in October 2001, the company declared bankruptcy and its accounting firm, Arthur Andersen then one of the five largest audit and accountancy partnerships in the world was effectively dissolved. In addition to being the largest bankruptcy reorganization in U.S. history at that time, Enron was cited as the biggest audit failure. Enron was formed in 1985 by Kenneth Lay after merging Houston Natural Gas and InterNorth. Several years later, when Jeffrey Skilling was hired, Lay developed a staff of executives that – by the use of accounting loopholes, special purpose entities, and poor financial reporting – were able to hide billions of dollars in debt from failed deals and projects. Chief Financial Officer Andrew Fastow and other executives misled Enron's board of directors and audit committee on high-risk accounting practices ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Balance Sheet

In financial accounting, a balance sheet (also known as statement of financial position or statement of financial condition) is a summary of the financial balances of an individual or organization, whether it be a sole proprietorship, a business partnership, a corporation, private limited company or other organization such as government or not-for-profit entity. Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year. A balance sheet is often described as a "snapshot of a company's financial condition". Of the four basic financial statements, the balance sheet is the only statement which applies to a single point in time of a business's calendar year. A standard company balance sheet has two sides: assets on the left, and financing on the right–which itself has two parts; liabilities and ownership equity. The main categories of assets are usually listed first, and typically in order of liquidity. Assets are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Timeline Of The Enron Scandal

The Enron scandal was an accounting scandal involving Enron Corporation, an American energy company based in Houston, Texas. Upon being publicized in October 2001, the company declared bankruptcy and its accounting firm, Arthur Andersen then one of the five largest audit and accountancy partnerships in the world was effectively dissolved. In addition to being the largest bankruptcy reorganization in U.S. history at that time, Enron was cited as the biggest audit failure. Enron was formed in 1985 by Kenneth Lay after merging Houston Natural Gas and InterNorth. Several years later, when Jeffrey Skilling was hired, Lay developed a staff of executives that – by the use of accounting loopholes, special purpose entities, and poor financial reporting – were able to hide billions of dollars in debt from failed deals and projects. Chief Financial Officer Andrew Fastow and other executives misled Enron's board of directors and audit committee on high-risk accounting practices and pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chewco

Chewco Investments L. P. was a limited partnership associated with the Enron scandal, which resulted in the bankruptcy of Enron. It was named after the Star Wars character Chewbacca, because it was created to hide losses from the Joint Energy Development Investment Limited, known by its acronym "JEDI". Like Chewbacca, the Jedi Knights were prominent characters in Star Wars. Enron created Chewco as a limited partnership which would help keep the JEDI project off its books. It wanted to buy out the California Public Employees’ Retirement System’s interest in JEDI, but it did not want to be forced, by accepted accounting principles, to consolidate JEDI in the Enron financial statements and thus reflect debt and/or financial losses. Enron wanted to keep JEDI afloat, but it needed a partner to take at least a 3% stake, or the partnership's results would have to be included in Enron's financial statements. Chewco was created to be that partner. The Chewco structure did not me ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Raptor SPEs

Raptor or RAPTOR may refer to: Animals The word "raptor" refers to several groups of bird-like dinosaurs which primarily capture and subdue/kill prey with their talons. * Raptor (bird) or bird of prey, a bird that primarily hunts and feeds on vertebrates * Raptor- or -raptor, a taxonomic affix used in to describe dromeosaurs or similar animals * Dromaeosauridae, a family of dinosaurs including ''Velociraptor'', informally known as raptors Arts and entertainment Film and television * ''Raptor'' (film), a 2001 film * Raptor, a fictional spacecraft in '' Battlestar Galactica'' Gaming * '' Raptor: Call of the Shadows'', a 1994 video game * Raptor heavy fighter, a fictional craft in the ''Wing Commander'' game * Lord Raptor, a ''Darkstalkers'' character In print * ''Raptor'' (novel), a 1993 novel by Gary Jennings * Raptor (Gary Wilton, Jr.), a Marvel Comics character * Raptor (Damon Ryder), a Marvel Comics character * Raptor (Brenda Drago), a Marvel Comics character Roller coas ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Contract

A contract is a legally enforceable agreement between two or more parties that creates, defines, and governs mutual rights and obligations between them. A contract typically involves the transfer of goods, services, money, or a promise to transfer any of those at a future date. In the event of a breach of contract, the injured party may seek judicial remedies such as damages or rescission. Contract law, the field of the law of obligations concerned with contracts, is based on the principle that agreements must be honoured. Contract law, like other areas of private law, varies between jurisdictions. The various systems of contract law can broadly be split between common law jurisdictions, civil law jurisdictions, and mixed law jurisdictions which combine elements of both common and civil law. Common law jurisdictions typically require contracts to include consideration in order to be valid, whereas civil and most mixed law jurisdictions solely require a meeting of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Form 10-K

A Form 10-K is an annual report required by the U.S. Securities and Exchange Commission (SEC), that gives a comprehensive summary of a company's financial performance. Although similarly named, the annual report on Form 10-K is distinct from the often glossy "annual report to shareholders," which a company must send to its shareholders when it holds an annual meeting to elect directors (though some companies combine the annual report and the 10-K into one document). The 10-K includes information such as company history, organizational structure, executive compensation, equity, subsidiaries, and audited financial statements, among other information. Companies with more than $10 million in assets and a class of equity securities that is held by more than 2000 owners must file annual and other periodic reports, regardless of whether the securities are publicly or privately traded. Up until March 16, 2009, smaller companies could use Form 10-KSB. If a shareholder requests a company's ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gulf Of Mexico

The Gulf of Mexico ( es, Golfo de México) is an ocean basin and a marginal sea of the Atlantic Ocean, largely surrounded by the North American continent. It is bounded on the northeast, north and northwest by the Gulf Coast of the United States; on the southwest and south by the Mexican states of Tamaulipas, Veracruz, Tabasco, Campeche, Yucatan, and Quintana Roo; and on the southeast by Cuba. The Southern U.S. states of Texas, Louisiana, Mississippi, Alabama, and Florida, which border the Gulf on the north, are often referred to as the " Third Coast" of the United States (in addition to its Atlantic and Pacific coasts). The Gulf of Mexico took shape approximately 300 million years ago as a result of plate tectonics.Huerta, A.D., and D.L. Harry (2012) ''Wilson cycles, tectonic inheritance, and rifting of the North American Gulf of Mexico continental margin.'' Geosphere. 8(1):GES00725.1, first published on March 6, 2012, The Gulf of Mexico basin is roughly ov ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exposure At Default

Exposure at default or (EAD) is a parameter used in the calculation of economic capital or regulatory capital under Basel II for a banking institution. It can be defined as the gross exposure under a facility upon default of an obligor. Outside of Basel II, the concept is sometimes known as Credit Exposure (CE). It represents the immediate loss that the lender would suffer if the borrower (counterparty) fully defaults on its debt. The EAD is closely linked to the expected loss, which is defined as the product of the EAD, the probability of default (PD) and the loss given default (LGD). Definition In general, EAD is seen as an estimation of the extent to which a bank may be exposed to a counterparty in the event of, and at the time of, that counterparty’s default. EAD is equal to the current amount outstanding in case of fixed exposures such as term loans. For revolving exposures like lines of credit, EAD can be divided into drawn and undrawn commitments; typically the drawn ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Default (finance)

In finance, default is failure to meet the legal obligations (or conditions) of a loan, for example when a home buyer fails to make a mortgage payment, or when a corporation or government fails to pay a bond which has reached maturity. A national or sovereign default is the failure or refusal of a government to repay its national debt. The biggest private default in history is Lehman Brothers, with over $600 billion when it filed for bankruptcy in 2008. The biggest sovereign default is Greece, with $138 billion in March 2012. Distinction from insolvency, illiquidity and bankruptcy The term "default" should be distinguished from the terms " insolvency", illiquidity and "bankruptcy": * Default: Debtors have been passed behind the payment deadline on a debt whose payment was due. * Illiquidity: Debtors have insufficient cash (or other "liquefiable" assets) to pay debts. * Insolvency: A legal term meaning debtors are unable to pay their debts. * Bankruptcy: A legal finding ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |