|

Islamic Finance

Islamic banking, Islamic finance ( ''masrifiyya 'islamia''), or Sharia-compliant finance is banking or financing activity that complies with Sharia (Islamic law) and its practical application through the development of Islamic economics. Some of the modes of Islamic finance include '' mudarabah'' (profit-sharing and loss-bearing), '' wadiah'' (safekeeping), '' musharaka'' (joint venture), '' murabahah'' (cost-plus), and '' ijarah'' (leasing). Sharia prohibits ''riba'', or usury, generally defined as interest paid on all loans of money (although some Muslims dispute whether there is a consensus that interest is equivalent to ''riba''). Investment in businesses that provide goods or services considered contrary to Islamic principles (e.g. pork or alcohol) is also ''haram'' ("sinful and prohibited"). These prohibitions have been applied historically in varying degrees in Muslim countries/communities to prevent un-Islamic practices. In the late 20th century, as part of the reviv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Murabaha

''Murabaḥah'', ''murabaḥa'', or ''murâbaḥah'' (, derived from ''ribh'' , meaning profit) was originally a term of ''fiqh'' (Islamic jurisprudence) for a sales contract where the buyer and seller agree on the Markup (business), markup (profit) or "Cost-plus pricing, cost-plus" price for the item(s) being sold. In recent decades it has become a term for a very common form of Islamic (i.e., "shariah compliant") Islamic banking and finance, financing, where the price is marked up in exchange for allowing the buyer to pay over time—for example with monthly payments (a contract with deferred payment being known as ''bai-muajjal''). ''Murabaha'' financing is basically the same as a rent-to-own arrangement in the non-Muslim world, with the intermediary (e.g., the lending bank) retaining ownership of the item being sold until the loan is paid in full. There are also Islamic investment funds and ''sukuk'' (Islamic bonds) that use ''murabahah'' contracts.Sukuk#FJIFD2012, Jamaldeen, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Riba

''Riba'' (, or , ) is an Arabic word used in Islamic law and roughly translated as " usury": unjust, exploitative gains made in trade or business. ''Riba'' is mentioned and condemned in several different verses in the Qur'an3:130 and most commonl 2:275-2:280 . It is also mentioned in many '''' (reports of the life of [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Iran

Iran, officially the Islamic Republic of Iran (IRI) and also known as Persia, is a country in West Asia. It borders Iraq to the west, Turkey, Azerbaijan, and Armenia to the northwest, the Caspian Sea to the north, Turkmenistan to the northeast, Afghanistan to the east, Pakistan to the southeast, and the Gulf of Oman and the Persian Gulf to the south. With a Ethnicities in Iran, multi-ethnic population of over 92 million in an area of , Iran ranks 17th globally in both List of countries and dependencies by area, geographic size and List of countries and dependencies by population, population. It is the List of Asian countries by area, sixth-largest country entirely in Asia and one of the world's List of mountains in Iran, most mountainous countries. Officially an Islamic republic, Iran is divided into Regions of Iran, five regions with Provinces of Iran, 31 provinces. Tehran is the nation's Capital city, capital, List of cities in Iran by province, largest city and financial ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mutual Fund

A mutual fund is an investment fund that pools money from many investors to purchase Security (finance), securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV in Europe ('investment company with variable capital'), and the open-ended investment company (OEIC) in the UK. Mutual funds are often classified by their principal investments: money market funds, bond fund, bond or fixed income funds, stock fund, stock or equity funds, or hybrid funds. Funds may also be categorized as index funds, which are passively managed funds that track the performance of an index, such as a stock market index or bond market index, or actively managed funds, which seek to outperform stock market indices but generally charge higher fees. The primary structures of mutual funds are open-end funds, closed-end funds, and unit investment trusts. Over long durations, passively managed funds consistently outperform actively m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gulf Cooperation Council

The Cooperation Council for the Arab States of the Gulf (), also known as the Gulf Cooperation Council (GCC; ), is a Regional integration, regional, intergovernmental organization, intergovernmental, political, and economic union comprising Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates. The council's main headquarters is located in Riyadh, the capital of Saudi Arabia. The Charter of the GCC was signed on 25 May 1981, formally establishing the institution. All current member states are monarchy, monarchies, including three Constitutional monarchy, constitutional monarchies (Qatar, Kuwait, and Bahrain), two absolute monarchies (Saudi Arabia and Oman), and one federal monarchy (the United Arab Emirates, which is composed of seven member states, each of which is an absolute monarchy with its own emir). There have been discussions regarding the future membership of Jordan, Morocco, and Yemen. Iraq is the only Arab states of the Persian Gulf, Gulf Arab stat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bangladesh

Bangladesh, officially the People's Republic of Bangladesh, is a country in South Asia. It is the List of countries and dependencies by population, eighth-most populous country in the world and among the List of countries and dependencies by population density, most densely populated with a population of over 171 million within an area of . Bangladesh shares land borders with India to the north, west, and east, and Myanmar to the southeast. It has a coastline along the Bay of Bengal to its south and is separated from Bhutan and Nepal by the Siliguri Corridor, and from China by the List of Indian states, Indian state of Sikkim to its north. Dhaka, the capital and list of cities and towns in Bangladesh, largest city, is the nation's political, financial, and cultural centre. Chittagong is the second-largest city and the busiest port of the country. The territory of modern Bangladesh was a stronghold of many List of Buddhist kingdoms and empires, Buddhist and List of Hindu empir ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pakistan

Pakistan, officially the Islamic Republic of Pakistan, is a country in South Asia. It is the List of countries and dependencies by population, fifth-most populous country, with a population of over 241.5 million, having the Islam by country#Countries, second-largest Muslim population as of 2023. Islamabad is the nation's capital, while Karachi is List of cities in Pakistan by population, its largest city and financial centre. Pakistan is the List of countries and dependencies by area, 33rd-largest country by area. Bounded by the Arabian Sea on the south, the Gulf of Oman on the southwest, and the Sir Creek on the southeast, it shares land borders with India to the east; Afghanistan to the west; Iran to the southwest; and China to the northeast. It shares a maritime border with Oman in the Gulf of Oman, and is separated from Tajikistan in the northwest by Afghanistan's narrow Wakhan Corridor. Pakistan is the site of History of Pakistan, several ancient cultures, including the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dubai Islamic Bank - Panoramio

Dubai (Help:IPA/English, /duːˈbaɪ/ Help:Pronunciation respelling key, ''doo-BYE''; Modern Standard Arabic, Modern Standard Arabic: ; Emirati Arabic, Emirati Arabic: , Romanization of Arabic, romanized: Help:IPA/English, /diˈbej/) is the List of cities in the United Arab Emirates#Major cities, most populous city in the United Arab Emirates and the capital of the Emirate of Dubai. It is located on a Dubai Creek, creek on the south-eastern coast of the Persian Gulf, Persian Gulf. As of 2025, the city population stands at 4 million, 92% of whom are Expatriates in the United Arab Emirates, expatriates. The wider urban area includes Sharjah and has a population of 5 million people as of 2023,https://www.demographia.com/db-worldua.pdf while the Dubai–Sharjah–Ajman metropolitan area counts 6 million inhabitants. Founded in the early 18th century as a Cultured pearl, pearling and fishing settlement, Dubai became a regional trade hub in the 20th century after declaring itself a f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Malaysia

Malaysia is a country in Southeast Asia. Featuring the Tanjung Piai, southernmost point of continental Eurasia, it is a federation, federal constitutional monarchy consisting of States and federal territories of Malaysia, 13 states and three federal territories, separated by the South China Sea into two regions: Peninsular Malaysia on the Mainland Southeast Asia, Indochinese Peninsula and East Malaysia on the island of Borneo. Peninsular Malaysia shares land and maritime Malaysia–Thailand border, borders with Thailand, as well as maritime borders with Singapore, Vietnam, and Indonesia; East Malaysia shares land borders with Brunei and Indonesia, and a maritime border with the Philippines and Vietnam. Kuala Lumpur is the country's national capital, List of cities and towns in Malaysia by population, largest city, and the seat of the Parliament of Malaysia, legislative branch of the Government of Malaysia, federal government, while Putrajaya is the federal administrative capi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commercial Bank

A commercial bank is a financial institution that accepts deposits from the public and gives loans for the purposes of consumption and investment to make a profit. It can also refer to a bank or a division of a larger bank that deals with wholesale banking to corporations or large or middle-sized businesses, to differentiate from retail banks and investment banks. Commercial banks include private sector banks and public sector banks. However, central banks function differently from commercial banks, despite a common misconception known as the "bank analogy". Unlike commercial banks, central banks are not primarily focused on generating profits and cannot become insolvent in the same way as commercial banks in a fiat currency system. History The name ''bank'' derives from the Italian word ''banco'' 'desk/bench', used during the Italian Renaissance era by Florentine bankers, who used to carry out their transactions on a desk covered by a green tablecloth. However, traces of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

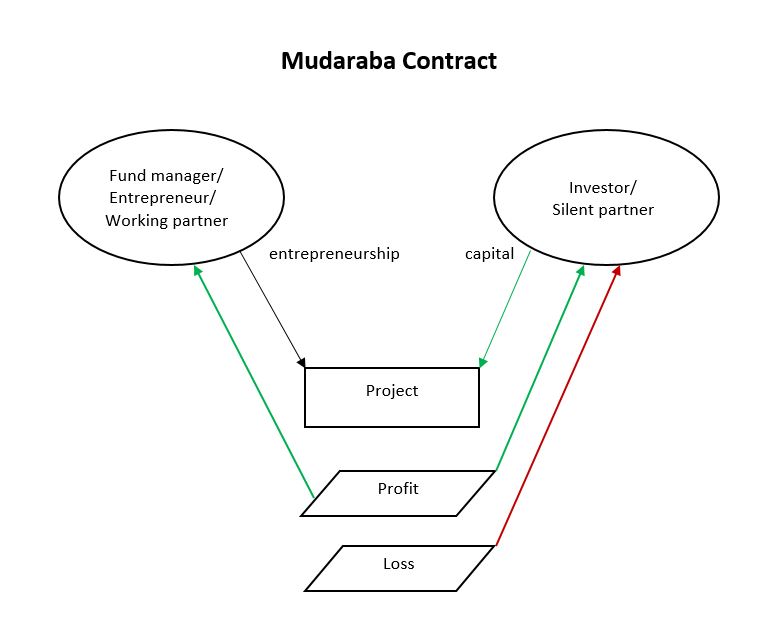

Profit And Loss Sharing

Profit and Loss Sharing (also called PLS or participatory banking) refers to Sharia-compliant forms of equity financing such as mudarabah and musharakah. These mechanisms comply with the religious prohibition on interest on loans that most Muslims subscribe to. ''Mudarabah'' (مضاربة) refers to "trustee finance" or passive partnership contract, while ''Musharakah'' (مشاركة or مشركة) refers to equity participation contract. Other sources include sukuk (also called "Islamic bonds") and direct equity investment (such as purchase of common shares of stock) as types of PLS. Khan, ''Islamic Banking in Pakistan'', 2015: p.91 The profits and losses shared in PLS are those of a business enterprise or person which/who has obtained capital from the Islamic bank/financial institution (the terms "debt", "borrow", "loan" and "lender" are not used). As financing is repaid, the provider of capital collects some agreed upon percentage of the profits (or deducts if there are losses ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |