|

In-kind

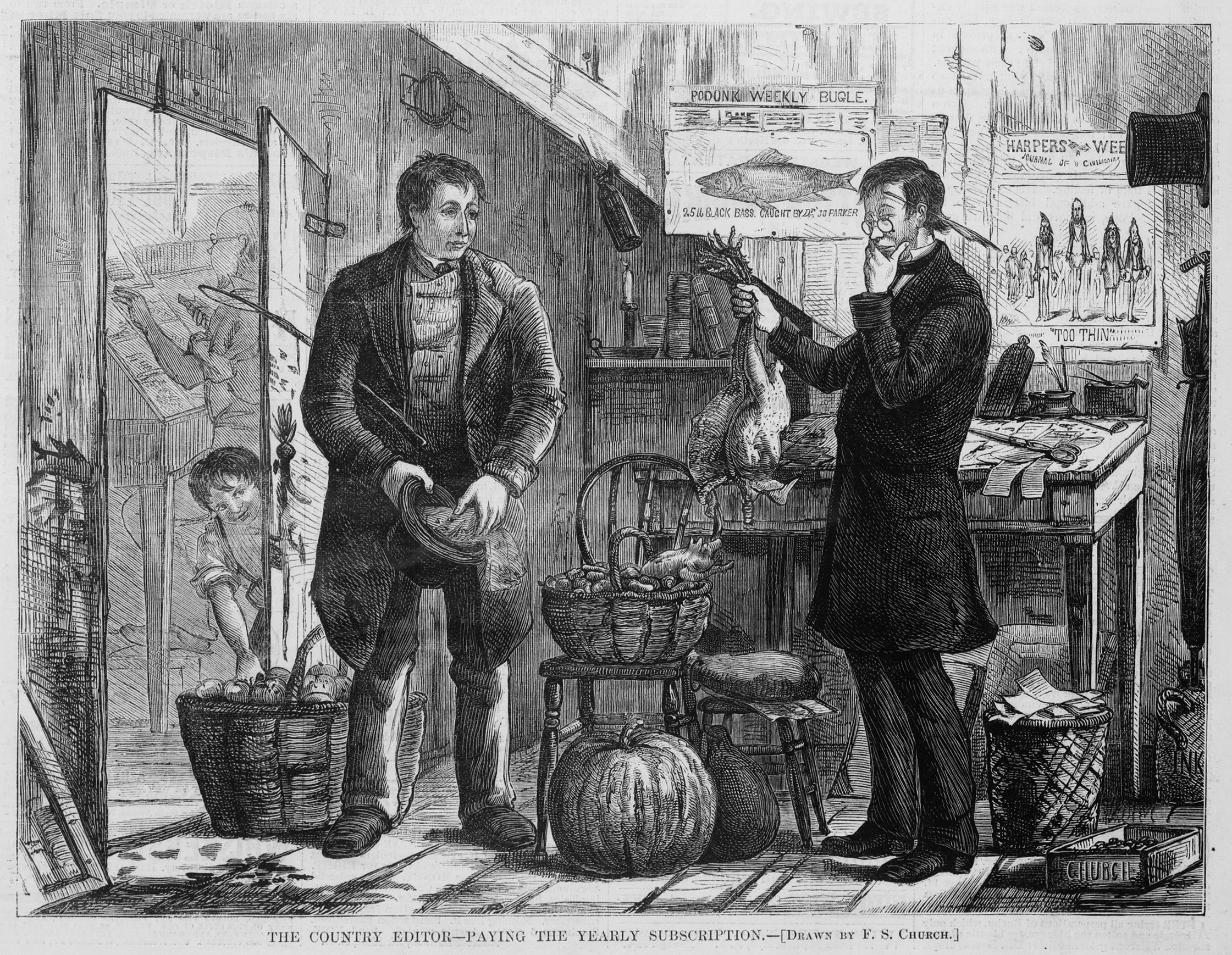

The term in kind (or in-kind) generally refers to goods, services, and transactions not involving money or not measured in monetary terms. It is a part of many spheres, mainly economics, finance, but also politics, work career, food, health and others. There are many different types of in kind actions throughout the mentioned branches, which can be identified and distinguished. In-kind contributions An in-kind contribution is a non-cash contribution of goods or a service. Those are either offered free or at less than usual charge for them. Similarly, when a person or entity pays for services on the committee’s behalf, the payment is also considered as an in-kind contribution. In-kind services and contributions are valued at their fair market value or at their actual cost. In other words, they are valued at what you would pay for them if they were not donated. There are two types of receivers of in-kind contributions: individuals and companies. For individuals, the provider of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income In Kind

Income in kind, or in-kind income, is income other than money income. It includes many employee benefits and government-provided goods and services, such as toll-free roads, food stamps, public schooling, or socialized medicine. Types of Income in Kind # Free rent in exchange for caretaking duties. ## Note: If the caretaker receives a paycheck with an amount for rent deducted, the gross earnings are earned income, not in-kind income. # Free room and board provided by a friend or relative. # Free clothing or household goods provided by a community organization. # Exchange of services, such as babysitting. See also * Barter In trade, barter (derived from ''bareter'') is a system of exchange (economics), exchange in which participants in a financial transaction, transaction directly exchange good (economics), goods or service (economics), services for other goods ... * In kind * Local exchange trading system * Truck system References Employee benefits Public ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Spending

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual or collective needs of the community, is classed as government final consumption expenditure. Government acquisition of goods and services intended to create future benefits, such as infrastructure investment or research spending, is classed as government investment (government gross capital formation). These two types of government spending, on final consumption and on gross capital formation, together constitute one of the major components of gross domestic product. Spending by a government that issues its own currency is nominally self-financing. However, under a full employment assumption, to acquire resources produced by its population without potential inflationary pressures, removal of purchasing power must occur via government bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Donation

A donation is a gift for Charity (practice), charity, humanitarian aid, or to benefit a cause. A donation may take various forms, including money, alms, Service (economics), services, or goods such as clothing, toys, food, or vehicles. A donation may satisfy medical needs such as blood or Organ transplant, organs for transplant. Charitable donations of goods or services are also called ''gifts in kind''. Donating statistics In the United States, in 2007, the Bureau of Labor Statistics found that American households in the lowest fifth in terms of wealth, gave on average a higher percentage of their incomes to charitable organizations than those households in the highest fifth. Charity Navigator writes that, according to Giving USA, Americans gave $298 billion in 2011 (about 2% of GDP). The majority of donations were from individuals (73%), then from bequests (about 12%), foundations (2%) and less than 1% from corporations. The largest sector to receive donations was Religio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Goods

In economics, goods are anything that is good, usually in the sense that it provides welfare or utility to someone. Alan V. Deardorff, 2006. ''Terms Of Trade: Glossary of International Economics'', World Scientific. Online version: Deardorffs' Glossary of International Economics"good" an Goods can be contrasted with bads, i.e. things that provide negative value for users, like chores or waste. A bad lowers a consumer's overall welfare. Economics focuses on the study of economic goods, i.e. goods that are scarce; in other words, producing the good requires expending effort or resources. Economic goods contrast with free goods such as air, for which there is an unlimited supply.Samuelson, P. Anthony., Samuelson, W. (1980). Economics. 11th ed. / New York: McGraw-Hill. Goods are the result of the Secondary sector of the economy which involves the transformation of raw materials or intermediate goods into goods. Utility and characteristics of goods The change in utility (pl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Brokerage Account

A securities account, sometimes known as a brokerage account, is an account which holds financial assets such as securities A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any for ... on behalf of an investor with a bank, broker or custodian. Investors and traders typically have a securities account with the broker or bank they use to buy and sell securities. Securities accounts can be of different types, such as a share account, options account, margin account or cash account. Securities accounts are typically treated as client funds, keeping them separate from the firm's funds. This separation meets the financial regulations of most countries. References Securities (finance) Stock market {{Finance stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Quid Pro Quo

''Quid pro quo'' (Latin: "something for something") is a Latin phrase used in English to mean an exchange of goods or services, in which one transfer is contingent upon the other; "a favor for a favor". Phrases with similar meanings include: "give and take", " tit for tat", "you scratch my back, and I'll scratch yours", "this for that," and "one hand washes the other". Other languages use other phrases for the same purpose. Origins The Latin phrase ''quid pro quo'' originally implied that something had been substituted, meaning "something for something" as in ''I gave you sugar for salt''. Early usage by English speakers followed the original Latin meaning, with occurrences in the 1530s where the term referred to substituting one medicine for another, whether unintentionally or fraudulently. By the end of the same century, ''quid pro quo'' evolved into a more current use to describe equivalent exchanges. In 1654, the expression ''quid pro quo'' was used to generally refer t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

PIK Loan

A PIK, or payment in kind, is a type of high-risk loan or bond that allows borrowers to pay interest with additional debt, rather than cash. That makes it an expensive, high-risk financing instrument since the size of the debt may increase quickly, leaving lenders with big losses if the borrower is unable to pay back the loan. Types There are three types of PIKs, which are characterized by differences in interest repayment. True PIKs True PIKs, also known as "mandatory" PIKs, establish the interest payment structure at the time of issuance. That is to say, there is "no variation from period to period other than as scheduled at the time of issuance". Interest is required to be paid solely in kind or through a combination of cash and in kind interest, and may shift to all cash at a given point in time, but all of this is predetermined and agreed upon at issuance. PIK toggles PIK toggles, also known as "pay if you want", are slightly less risky than PIKs, as borrowers pay interest i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gift Economy

A gift economy or gift culture is a system of exchange where valuables are not sold, but rather given without an explicit agreement for immediate or future rewards. Social norms and customs govern giving a gift in a gift culture; although there is some expectation of reciprocity, gifts are not given in an explicit exchange of goods or services for money, or some other good or service.R. Kranton: ''Reciprocal exchange: a self-sustaining system'', American Economic Review, V. 86 (1996), Issue 4 (September), pp. 830–851 This contrasts with a market economy or bartering, where goods and services are primarily explicitly exchanged for value received. The nature of gift economies is the subject of a foundational debate in anthropology. Anthropological research into gift economies began with Bronisław Malinowski's description of the Kula ring in the Trobriand Islands during World War I. The Kula trade appeared to be gift-like since Trobrianders would travel great distances over ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Barter

In trade, barter (derived from ''bareter'') is a system of exchange (economics), exchange in which participants in a financial transaction, transaction directly exchange good (economics), goods or service (economics), services for other goods or services without using a medium of exchange, such as money. Economists usually distinguish barter from gift economy, gift economies in many ways; barter, for example, features immediate reciprocity (cultural anthropology), reciprocal exchange, not one delayed in time. Barter usually takes place on a bilateral trade, bilateral basis, but may be multilateral exchange, multilateral (if it is mediated through a trade exchange). In most developed countries, barter usually exists parallel to monetary systems only to a very limited extent. Market actors use barter as a replacement for money as the method of exchange in times of monetary crisis, such as when currency becomes unstable (such as hyperinflation or a Deflation#Deflationary spiral, de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange-traded Fund

An exchange-traded fund (ETF) is a type of investment fund that is also an exchange-traded product, i.e., it is traded on stock exchanges. ETFs own financial assets such as stocks, bonds, currencies, debts, futures contracts, and/or commodities such as gold bars. Many ETFs provide some level of diversification compared to owning an individual stock. An ETF divides ownership of itself into shares that are held by shareholders. Depending on the country, the legal structure of an ETF can be a corporation, trust, open-end management investment company, or unit investment trust. Shareholders indirectly own the assets of the fund and are entitled to a share of the profits, such as interest or dividends, and would be entitled to any residual value if the fund undergoes liquidation. They also receive annual reports. An ETF generally operates with an arbitrage mechanism designed to keep it trading close to its net asset value, although deviations can occur. The larges ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Certificates Of Deposit

A certificate of deposit (CD) is a time deposit sold by banks, thrift institutions, and credit unions in the United States. CDs typically differ from savings accounts because the CD has a specific, fixed term before money can be withdrawn without penalty and generally higher interest rates. CDs require a minimum deposit and may offer higher rates for larger deposits. The bank expects the CDs to be held until maturity, at which time they can be withdrawn and interest paid. In the United States, CDs are insured by the Federal Deposit Insurance Corporation (FDIC) for banks and by the National Credit Union Administration (NCUA) for credit unions. The consumer who opens a CD may receive a paper certificate, but it is now common for a CD to consist simply of a book entry and an item shown in the consumer's periodic bank statements. Consumers who want a hard copy that verifies their CD purchase may request a paper statement from the bank, or print out their own from the financial in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Market Fund

A money market fund (also called a money market mutual fund) is an open-end mutual fund that invests in short-term debt securities such as US Treasury bills and commercial paper. Money market funds are managed with the goal of maintaining a highly stable asset value through liquid investments, while paying income to investors in the form of dividends. Although they are not insured against loss, actual losses have been quite rare in practice. Regulated in the United States under the Investment Company Act of 1940, and in Europe under Regulation 2017/1131, money market funds are important providers of liquidity to financial intermediaries. Explanation Money market funds seek to limit exposure to losses due to credit, market, and liquidity risks. Money market funds in the United States are regulated by the Securities and Exchange Commission (SEC) under the Investment Company Act of 1940. Rule 2a-7 of the act restricts the quality, maturity and diversity of investments by money ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |