|

Implicit Carbon Prices

Implicit carbon prices arise from measures which impact on the marginal cost of emitting greenhouse gas (GHG) emissions without targeting GHG emissions or the carbon content of fuel directly. As such, they contribute to climate change mitigation. Examples of these instruments include fuel taxes applied to reduce local pollution and the removal of subsidies for fossil fuel consumption. In contrast to implicit carbon prices, explicit carbon prices are measures designed specifically to target GHG emissions or the carbon content of fuel. Measures such as carbon taxes or emissions trading schemes put an explicit price on GHG emissions. The sum of implicit and explicit carbon prices is referred to as the effective carbon price. Considering both the implicit and explicit carbon prices can contribute to a better understanding of a country's progress on tackling emissions. It can also lead to better policy alignment and reduce inconsistencies in the fiscal system—such as when subsidi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Cost

In economics, the marginal cost is the change in the total cost that arises when the quantity produced is increased, i.e. the cost of producing additional quantity. In some contexts, it refers to an increment of one unit of output, and in others it refers to the rate of change of total cost as output is increased by an infinitesimal amount. As Figure 1 shows, the marginal cost is measured in dollars per unit, whereas total cost is in dollars, and the marginal cost is the slope of the total cost, the rate at which it increases with output. Marginal cost is different from average cost, which is the total cost divided by the number of units produced. At each level of production and time period being considered, marginal cost includes all costs that vary with the level of production, whereas costs that do not vary with production are fixed. For example, the marginal cost of producing an automobile will include the costs of labor and parts needed for the additional automobile but not t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

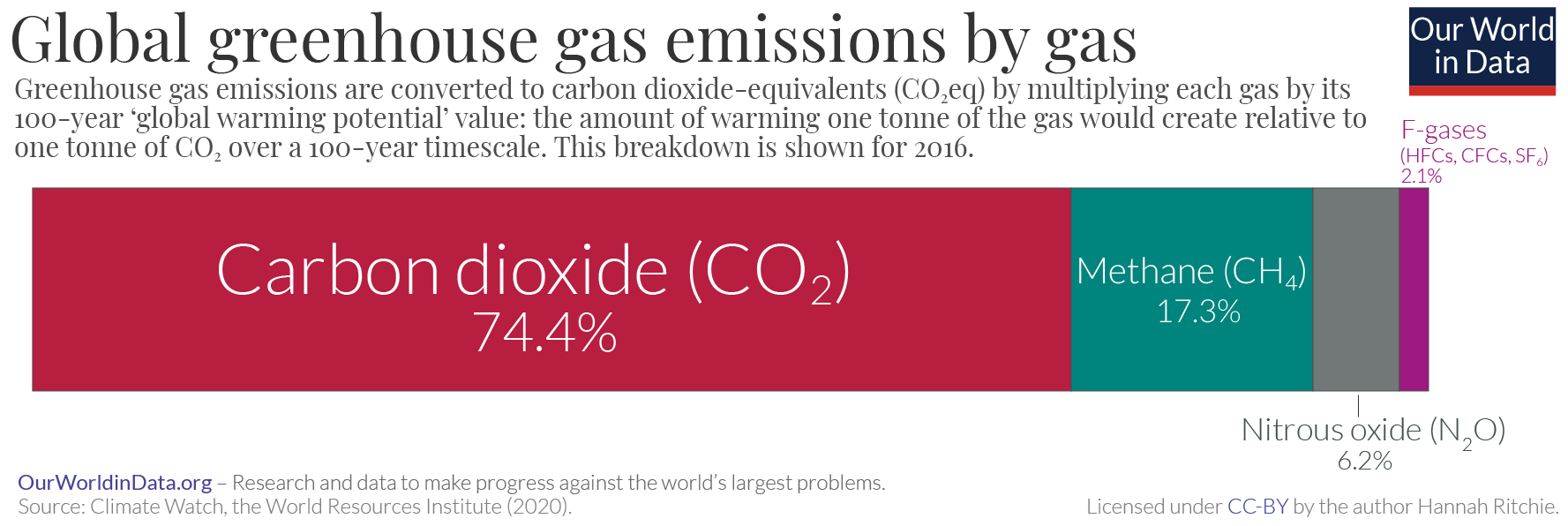

Greenhouse Gas Emissions

Greenhouse gas (GHG) emissions from human activities intensify the greenhouse effect. This contributes to climate change. Carbon dioxide (), from burning fossil fuels such as coal, petroleum, oil, and natural gas, is the main cause of climate change. The top contributors to greenhouse gas emissions, largest annual emissions are from China followed by the United States. The United States has List of countries by greenhouse gas emissions per capita, higher emissions per capita. The main producers fueling the emissions globally are Big Oil, large oil and gas companies. Emissions from human activities have increased Carbon dioxide in Earth's atmosphere, atmospheric carbon dioxide by about 50% over pre-industrial levels. The growing levels of emissions have varied, but have been consistent among all greenhouse gases. Emissions in the 2010s averaged 56 billion tons a year, higher than any decade before. Total cumulative emissions from 1870 to 2022 were 703 (2575 ), of which 484±20 (177 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Climate Change Mitigation

Climate change mitigation (or decarbonisation) is action to limit the greenhouse gases in the atmosphere that cause climate change. Climate change mitigation actions include energy conservation, conserving energy and Fossil fuel phase-out, replacing fossil fuels with sustainable energy, clean energy sources. Secondary mitigation strategies include changes to land use and carbon sequestration, removing carbon dioxide (CO2) from the atmosphere. Current climate change mitigation policies are insufficient as they would still result in global warming of about 2.7 °C by 2100, significantly above the 2015 Paris Agreement's goal of limiting global warming to below 2 °C. Solar energy and wind power can replace fossil fuels at the lowest cost compared to other renewable energy options.IPCC (2022Summary for policy makersiClimate Change 2022: Mitigation of Climate Change. Contribution of Working Group III to the Sixth Assessment Report of the Intergovernmental Panel on Climate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fuel Tax

A fuel tax (also known as a petrol, gasoline or gas tax, or as a fuel duty) is an excise tax imposed on the sale of fuel. In most countries, the fuel tax is imposed on fuels which are intended for transportation. Fuel tax receipts are often dedicated or hypothecated to transportation projects, in which case the fuel tax can be considered a user fee. In other countries, the fuel tax is a source of general revenue. Sometimes, a fuel tax is used as an ecotax, to promote ecological sustainability. Fuel taxes are often considered by government agencies such as the Internal Revenue Service as regressive taxes. Fuels used to power agricultural vehicles, as well as home heating oil which is similar to diesel, are taxed at a different, usually lower rate. These fuels may be dyed to prevent their use for transportation. Aviation fuel is typically charged at a different rate to fuel for ground-based vehicles. Jet fuel and avgas can attract different rates. In many jurisdictions such as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fossil Fuel Subsidies

Fossil fuel subsidies are energy subsidies on fossil fuels. Under a narrow definition, fossil fuel subsidies totalled around $1.5 trillion in 2022. Under more expansive definition, they totalled around $7 trillion. They may be tax breaks on consumption, such as a lower sales tax on natural gas for residential heating; or subsidies on production, such as tax breaks on exploration for oil. Or they may be free or cheap negative externalities; such as air pollution or climate change due to burning gasoline, diesel and jet fuel. Some fossil fuel subsidies are via electricity generation, such as subsidies for coal-fired power stations. Eliminating fossil fuel subsidies would reduce the health risks of air pollution, and would greatly reduce global carbon emissions thus helping to limit climate change. , policy researchers estimate that substantially more money is spent on fossil fuel subsidies than on environmentally harmful agricultural subsidies or environmentally harmfu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carbon Price

Carbon pricing (or pricing) is a method for governments to mitigate climate change, in which a monetary cost is applied to greenhouse gas emissions. This is done to encourage polluters to reduce fossil fuel combustion, the main driver of climate change. A carbon price usually takes the form of a carbon tax, or an emissions trading scheme (ETS) that requires firms to purchase allowances to emit. The method is widely agreed to be an efficient policy for reducing greenhouse gas emissions. Carbon pricing seeks to address the economic problem that emissions of and other greenhouse gases are a negative externality – a detrimental product that is not charged for by any market. 21.7% of global GHG emissions are covered by carbon pricing in 2021, a major increase due to the introduction of the Chinese national carbon trading scheme. Regions with carbon pricing include most European countries and Canada. On the other hand, top emitters like India, Russia, the Gulf states and many ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carbon Tax

A carbon tax is a tax levied on the carbon emissions from producing goods and services. Carbon taxes are intended to make visible the hidden Social cost of carbon, social costs of carbon emissions. They are designed to reduce greenhouse gas emissions by essentially increasing the price of fossil fuels. This both decreases demand for goods and services that produce high emissions and incentivizes making them less emission intensity, carbon-intensive. When a fossil fuel such as coal, petroleum, or natural gas is burned, most or all of its carbon is converted to . Greenhouse gas emissions cause climate change. This negative externality can be reduced by taxing carbon content at any point in the product cycle. A carbon tax as well as carbon emission trading is used within the carbon price concept. Two common economic alternatives to carbon taxes are tradable permits with Carbon offsets and credits, carbon credits and Subsidy, subsidies. In its simplest form, a carbon tax covers only ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Emissions Trading

Emissions trading is a market-oriented approach to controlling pollution by providing economic incentives for reducing the emissions of pollutants. The concept is also known as cap and trade (CAT) or emissions trading scheme (ETS). One prominent example is carbon emission trading for and other greenhouse gases which is a tool for climate change mitigation. Other schemes include sulfur dioxide and other pollutants. In an emissions trading scheme, a central authority or governmental body allocates or sells a limited number (a "cap") of permits that allow a discharge of a specific quantity of a specific pollutant over a set time period. Polluters are required to hold permits in amount equal to their emissions. Polluters that want to increase their emissions must buy permits from others willing to sell them. Emissions trading is a type of flexible environmental regulation that allows organizations and markets to decide how best to meet policy targets. This is in contrast to comma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fossil Fuel

A fossil fuel is a flammable carbon compound- or hydrocarbon-containing material formed naturally in the Earth's crust from the buried remains of prehistoric organisms (animals, plants or microplanktons), a process that occurs within geological formations. Reservoirs of such compound mixtures, such as coal, petroleum and natural gas, can be extracted and burnt as fuel for human consumption to provide energy for direct use (such as for cooking, heating or lighting), to power heat engines (such as steam or internal combustion engines) that can propel vehicles, or to generate electricity via steam turbine generators. Some fossil fuels are further refined into derivatives such as kerosene, gasoline and diesel, or converted into petrochemicals such as polyolefins ( plastics), aromatics and synthetic resins. The origin of fossil fuels is the anaerobic decomposition of buried dead organisms. The conversion from these organic materials to high-carbon fossil fuels is ty ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Energy Tax

An energy tax is a tax that increases the price of energy. Arguments in favour of energy taxes have included the pursuit of macroeconomic objectives, e.g., fiscal deficit reduction in the 1990s, as well as environmental benefits, i.e., reduced pollution. A weakness of energy taxes is that they impose a burden (or cost) in the form of reduced economic output and employment. United States In 1993, then President Bill Clinton proposed a BTU tax. A BTU tax is a type of energy tax. The tax would have taxed all fuel sources based on their heat content except for wind, solar, and geothermal. It was never adopted. The BTU tax passed the House, but was rejected by the Senate in light of the lobbying effort mobilized against its adoption. The rejected proposal was watered down, as the Clinton administration tried to salvage their efforts by offering to exempt manufacturers and base the tax on the cost rather than the heat content of energy. Many of the House Democrats who voted for the tax ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Air Pollution

Air pollution is the presence of substances in the Atmosphere of Earth, air that are harmful to humans, other living beings or the environment. Pollutants can be Gas, gases like Ground-level ozone, ozone or nitrogen oxides or small particles like soot and dust. It affects both outdoor air and indoor air. Natural sources of air pollution include Wildfire, wildfires, Dust storm, dust storms, and Volcanic eruption, volcanic eruptions. Indoor air pollution is often Energy poverty and cooking, caused by the use of biomass (e.g. wood) for cooking and heating. Outdoor air pollution comes from some industrial processes, the burning of Fossil fuel, fossil fuels for electricity and transport, waste management and agriculture. Many of the contributors of local air pollution, especially the burning of fossil fuels, also cause greenhouse gas emissions that cause climate change, global warming. Air pollution causes around 7 or 8 million deaths each year. It is a significant risk factor for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Traffic Congestion

Traffic congestion is a condition in transport that is characterized by slower speeds, longer trip times, and increased vehicular queueing. Traffic congestion on urban road networks has increased substantially since the 1950s, resulting in many of the roads becoming obsolete. When traffic demand is great enough that the interaction between vehicles slows the traffic stream, this results in congestion. While congestion is a possibility for any mode of transportation, this article will focus on automobile congestion on public roads. Mathematically, traffic is modeled as a flow through a fixed point on the route, analogously to fluid dynamics. As demand approaches the capacity of a road (or of the intersections along the road), extreme traffic congestion sets in. When vehicles are fully stopped for periods of time, this is known as a traffic jam or (informally) a traffic snarl-up or a tailback. Drivers can become frustrated and engage in road rage. Drivers and driver-focused r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |