|

Hartman–Watson Distribution

The Hartman–Watson distribution is an absolutely continuous probability distribution which arises in the study of Brownian motion, Brownian Functional (mathematics), functionals. It is named after Philip Hartman and Geoffrey S. Watson, who encountered the distribution while studying the relationship between Brownian motion on the n-sphere, ''n''-sphere and the von Mises distribution. Important contributions to the distribution, such as an explicit form of the density in integral representation and a connection to Brownian motion, Brownian exponential functionals, came from Marc Yor. In financial mathematics, the distribution is used to compute the prices of Asian option, Asian options with the Black–Scholes model. Hartman–Watson distribution Definition The Hartman–Watson distributions are the probability distributions (\mu_r)_, which satisfy the following relationship between the Laplace transform and the Bessel's differential equation#Modified Bessel functions, modifie ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

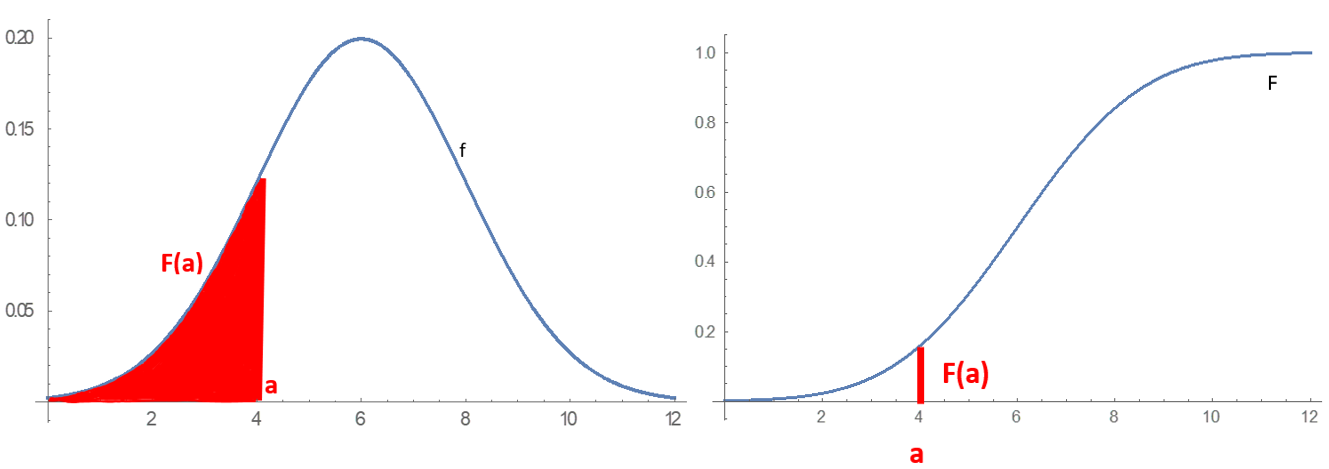

Absolutely Continuous Probability Distribution

In probability theory and statistics, a probability distribution is a function that gives the probabilities of occurrence of possible events for an experiment. It is a mathematical description of a random phenomenon in terms of its sample space and the probabilities of events (subsets of the sample space). For instance, if is used to denote the outcome of a coin toss ("the experiment"), then the probability distribution of would take the value 0.5 (1 in 2 or 1/2) for , and 0.5 for (assuming that the coin is fair). More commonly, probability distributions are used to compare the relative occurrence of many different random values. Probability distributions can be defined in different ways and for discrete or for continuous variables. Distributions with special properties or for especially important applications are given specific names. Introduction A probability distribution is a mathematical description of the probabilities of events, subsets of the sample space. The sa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Brownian Motion

Brownian motion is the random motion of particles suspended in a medium (a liquid or a gas). The traditional mathematical formulation of Brownian motion is that of the Wiener process, which is often called Brownian motion, even in mathematical sources. This motion pattern typically consists of Randomness, random fluctuations in a particle's position inside a fluid sub-domain, followed by a relocation to another sub-domain. Each relocation is followed by more fluctuations within the new closed volume. This pattern describes a fluid at thermal equilibrium, defined by a given temperature. Within such a fluid, there exists no preferential direction of flow (as in transport phenomena). More specifically, the fluid's overall Linear momentum, linear and Angular momentum, angular momenta remain null over time. The Kinetic energy, kinetic energies of the molecular Brownian motions, together with those of molecular rotations and vibrations, sum up to the caloric component of a fluid's in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Functional (mathematics)

In mathematics, a functional is a certain type of function. The exact definition of the term varies depending on the subfield (and sometimes even the author). * In linear algebra, it is synonymous with a linear form, which is a linear mapping from a vector space V into its field of scalars (that is, it is an element of the dual space V^*) "Let ''E'' be a free module over a commutative ring ''A''. We view ''A'' as a free module of rank 1 over itself. By the dual module ''E''∨ of ''E'' we shall mean the module Hom(''E'', ''A''). Its elements will be called functionals. Thus a functional on ''E'' is an ''A''-linear map ''f'' : ''E'' → ''A''." * In functional analysis and related fields, it refers to a mapping from a space X into the field of real or complex numbers. "A numerical function ''f''(''x'') defined on a normed linear space ''R'' will be called a ''functional''. A functional ''f''(''x'') is said to be ''linear'' if ''f''(α''x'' + β''y'') = α''f''(''x'') + β ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Philip Hartman

Philip Hartman (May 16, 1915 – August 28, 2015) was an American mathematician at Johns Hopkins University The Johns Hopkins University (often abbreviated as Johns Hopkins, Hopkins, or JHU) is a private university, private research university in Baltimore, Maryland, United States. Founded in 1876 based on the European research institution model, J ... working on differential equations who introduced the Hartman–Grobman theorem. He served as Chairman of the Mathematics Department at Johns Hopkins for several years. He has an Erdös number of 2. His book gives a necessary and sufficient condition for solutions of ordinary initial value problems to be unique and to depend on a class C1 manner on the initial conditions for solutions. He died in August 2015 at the age of 100. The Hartman–Watson distribution is named after him and Geoffrey S. Watson. Publications * References External links * {{DEFAULTSORT:Hartman, Philip 1915 births 2015 deaths Edu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Geoffrey S

Geoffrey, Geoffroy, Geoff, etc., may refer to: People * Geoffrey (given name), including a list of people with the name Geoffrey or Geoffroy * Geoffroy (surname), including a list of people with the name * Geoffroy (musician) (born 1987), Canadian singer and songwriter Fictional characters * Geoffrey the Giraffe, the Toys "R" Us mascot * Geoff Peterson, an animatronic robot sidekick on ''The Late Late Show with Craig Ferguson'' * Geoff, a character from the cartoon series '' Total Drama'' * Geoff, Mark Corrigon's romantic rival on '' Peep Show'' Other uses * Geoff (Greyhawk), a fictional land in the World of Greyhawk ''Dungeons & Dragons'' campaign setting See also * Galfrid * Geof * Gofraid/Goraidh * Godfrey (name) * Gottfried * Godefroy (other) * Goffredo * Jeffery (name) * Jeffrey (name) * Jeffries * Jeffreys * Jeffers * Jeoffry (cat) * Jeff Jeff is a masculine name, often a short form (hypocorism) of the English given name Jefferson or Jeffrey, which ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

N-sphere

In mathematics, an -sphere or hypersphere is an - dimensional generalization of the -dimensional circle and -dimensional sphere to any non-negative integer . The circle is considered 1-dimensional and the sphere 2-dimensional because a point within them has one and two degrees of freedom respectively. However, the typical embedding of the 1-dimensional circle is in 2-dimensional space, the 2-dimensional sphere is usually depicted embedded in 3-dimensional space, and a general -sphere is embedded in an -dimensional space. The term ''hyper''sphere is commonly used to distinguish spheres of dimension which are thus embedded in a space of dimension , which means that they cannot be easily visualized. The -sphere is the setting for -dimensional spherical geometry. Considered extrinsically, as a hypersurface embedded in -dimensional Euclidean space, an -sphere is the locus of points at equal distance (the ''radius'') from a given '' center'' point. Its interior, consisting of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Von Mises Distribution

In probability theory and directional statistics, the Richard von Mises, von Mises distribution (also known as the circular normal distribution or the Andrey Nikolayevich Tikhonov, Tikhonov distribution) is a continuous probability distribution on the circle. It is a close approximation to the wrapped normal distribution, which is the circular analogue of the normal distribution. A freely diffusing angle \theta on a circle is a wrapped normally distributed random variable with an Phase unwrapping, unwrapped variance that grows linearly in time. On the other hand, the von Mises distribution is the stationary distribution of a drift and diffusion process on the circle in a harmonic potential, i.e. with a preferred orientation. The von Mises distribution is the Maximum entropy probability distribution, maximum entropy distribution for circular data when the real and imaginary parts of the first Directional statistics, circular moment are specified. The von Mises distribution is a spe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marc Yor

Marc Yor (24 July 1949 – 9 January 2014) was a French mathematician well known for his work on stochastic processes, especially properties of semimartingales, Brownian motion and other Lévy processes, the Bessel processes, and their applications to mathematical finance Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling in the financial field. In general, there exist two separate branches of finance that req .... Background Yor was a professor at the Paris VI University in Paris, France, from 1981 until his death in 2014. He was a recipient of several awards, including the Humboldt Prize, the Montyon Prize,Official biography at the French Academy website and was awarded t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Mathematics

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling in the Finance#Quantitative_finance, financial field. In general, there exist two separate branches of finance that require advanced quantitative techniques: Derivative (finance), derivatives pricing on the one hand, and risk management, risk and Investment management#Investment managers and portfolio structures, portfolio management on the other. Mathematical finance overlaps heavily with the fields of computational finance and financial engineering. The latter focuses on applications and modeling, often with the help of stochastic asset models, while the former focuses, in addition to analysis, on building tools of implementation for the models. Also related is quantitative investing, which relies on statistical and numerical models (and lately machine learning) as opposed to traditional fundamental analysis when investment ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asian Option

An Asian option (or ''average value'' option) is a special type of option contract. For Asian options, the payoff is determined by the average underlying price over some pre-set period of time. This is different from the case of the usual European option and American option, where the payoff of the option contract depends on the price of the underlying instrument at exercise; Asian options are thus one of the basic forms of exotic options. There are two types of Asian options: Average Price Option (fixed strike), where the strike price is predetermined and the averaging price of the underlying asset is used for payoff calculation; and Average Strike Option (floating strike), where the averaging price of the underlying asset over the duration becomes the strike price. One advantage of Asian options is that these reduce the risk of market manipulation of the underlying instrument at maturity. Another advantage of Asian options involves the relative cost of Asian options compared to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Black–Scholes Model

The Black–Scholes or Black–Scholes–Merton model is a mathematical model for the dynamics of a financial market containing Derivative (finance), derivative investment instruments. From the parabolic partial differential equation in the model, known as the Black–Scholes equation, one can deduce the Black–Scholes formula, which gives a theoretical estimate of the price of option style, European-style option (finance), options and shows that the option has a ''unique'' price given the risk of the security and its expected return (instead replacing the security's expected return with the risk-neutral rate). The equation and model are named after economists Fischer Black and Myron Scholes. Robert C. Merton, who first wrote an academic paper on the subject, is sometimes also credited. The main principle behind the model is to hedge (finance), hedge the option by buying and selling the underlying asset in a specific way to eliminate risk. This type of hedging is called "continuou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Laplace Transform

In mathematics, the Laplace transform, named after Pierre-Simon Laplace (), is an integral transform that converts a Function (mathematics), function of a Real number, real Variable (mathematics), variable (usually t, in the ''time domain'') to a function of a Complex number, complex variable s (in the complex-valued frequency domain, also known as ''s''-domain, or ''s''-plane). The transform is useful for converting derivative, differentiation and integral, integration in the time domain into much easier multiplication and Division (mathematics), division in the Laplace domain (analogous to how logarithms are useful for simplifying multiplication and division into addition and subtraction). This gives the transform many applications in science and engineering, mostly as a tool for solving linear differential equations and dynamical systems by simplifying ordinary differential equations and integral equations into algebraic equation, algebraic polynomial equations, and by simplifyin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |