|

FloQast

FloQast is an American accounting software provider based in Los Angeles, California. Founded in 2013, the company provides close management software for corporate accounting departments. History FloQast was founded by CPAs and former corporate accountants Mike Whitmire and Chris Sluty, along with veteran software engineer Cullen Zandstra. Whitmire first conceived the idea for the company during his time at Cornerstone OnDemand where he was a senior accountant. After devising the concept, Whitmire recruited Zandstra as co-founder and CTO. The name FloQast was created with the help of a word generator using a combination of accounting terms and contemporary vernacular words. The two developed a minimum viable product (MVP), and were accepted into the Amplify.LA accelerator program. Following the company's initial funding, Whitmire recruited his former Syracuse University classmate, Sluty, to join the team as co-founder and COO. In November 2014, the company raised a $1.3 mil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Close Management

Financial close management (FCM) is a recurring process in management accounting by which accounting teams verify and adjust account balances at the end of a designated period in order to produce financial reports representative of the company's true financial position to inform stakeholders such as management, investors, lenders, and regulatory agencies. The process starts with recording transactions as journal entries and end with preparing the financial reports for the period. Overview Closing the books involves consolidating transactions from multiple accounts, reconciling the information to ensure its validity, and identifying irregularities and errors that need to be adjusted. Accountants typically perform the close process monthly or annually. In the end, the trial balance — the list of all accounts from the general ledger — must balance: The sum of all debts must equal the sum of all credits. Fluctuation analysis In addition to reconciliations and adjustments, accounting ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Company

A privately held company (or simply a private company) is a company whose Stock, shares and related rights or obligations are not offered for public subscription or publicly negotiated in their respective listed markets. Instead, the Private equity, company's stock is offered, owned, traded or exchanged privately, also known as "over-the-counter (finance), over-the-counter". Related terms are unlisted organisation, unquoted company and private equity. Private companies are often less well-known than their public company, publicly traded counterparts but still have major importance in the world's economy. For example, in 2008, the 441 list of largest private non-governmental companies by revenue, largest private companies in the United States accounted for $1.8 trillion in revenues and employed 6.2 million people, according to ''Forbes''. In general, all companies that are not owned by the government are classified as private enterprises. This definition encompasses both publ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insight Partners

Insight Venture Management, LLC (commonly referred to as Insight Partners and previously Insight Venture Partners) is a global venture capital and private equity firm that invests in high-growth technology, software, and internet businesses. The company is headquartered in New York City, also has offices in London, Tel Aviv, and Palo Alto, California, Palo Alto. History Insight Partners was founded in 1995 by Jeff Horing and Jerry Murdock. As of December 31, 2022, the firm managed over $75 billion in regulatory assets under management. Insight Partners has invested in more than 750 companies worldwide and has seen over 55 portfolio companies achieve an Initial public offering, IPO. The firm has an in-house team called Onsite that assists portfolio companies in their growth. In April 2021, Insight Partners raised $1.56 billion for the Insight Partners Opportunities Fund I LP, a separate fund from its primary growth-investment vehicles. Also in 2021, Insight Partners put $15 milli ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Enterprise Resource Planning

Enterprise resource planning (ERP) is the integrated management of main business processes, often in real time and mediated by software and technology. ERP is usually referred to as a category of business management software—typically a suite of integrated applications—that an organization can use to collect, store, manage and interpret data from many business activities. ERP systems can be local-based or cloud-based. Cloud-based applications have grown in recent years due to the increased efficiencies arising from information being readily available from any location with Internet access. ERP differs from integrated business management systems by including planning all resources that are required in the future to meet business objectives. This includes plans for getting suitable staff and manufacturing capabilities for future needs. ERP provides an integrated and continuously updated view of the core business processes using common databases maintained by a database manag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Software As A Service

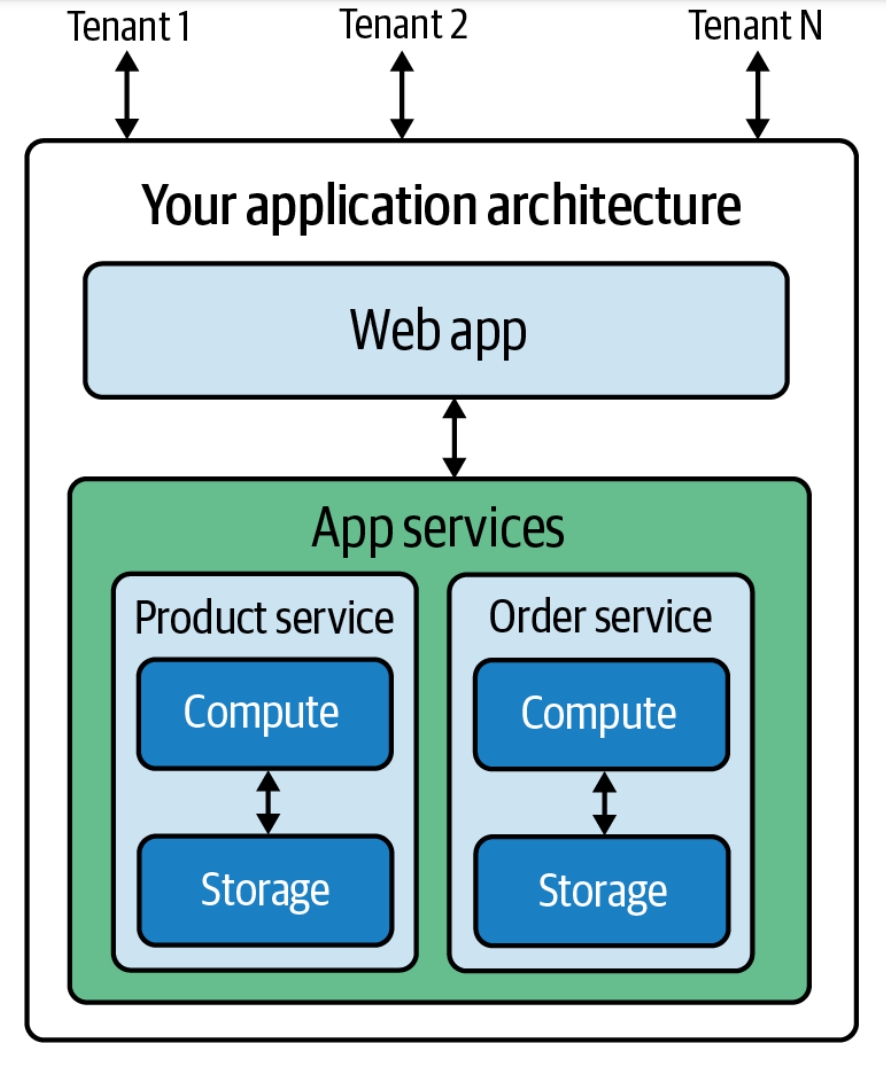

Software as a service (SaaS ) is a cloud computing service model where the provider offers use of application software to a client and manages all needed physical and software resources. SaaS is usually accessed via a web application. Unlike other software delivery models, it separates "the possession and ownership of software from its use". SaaS use began around 2000, and by 2023 was the main form of software application deployment. Unlike most self-hosted software products, only one version of the software exists and only one operating system and configuration is supported. SaaS products typically run on rented infrastructure as a service (IaaS) or platform as a service (PaaS) systems including hardware and sometimes operating systems and middleware, to accommodate rapid increases in usage while providing instant and continuous availability to customers. SaaS customers have the abstraction of limitless computing resources, while economy of scale drives down the cost. Sa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

BDT & MSD Partners

BDT & MSD Partners is an American merchant bank that is co-headquartered in Chicago and New York City. The firm has both an advisory platform and an investment platform. History In January 2023, BDT & MSD was formed from the merger of BDT & Company, a merchant bank founded by Byron Trott that provides advice and capital to family and founder-led companies, and MSD Partners, an investment firm that manages the wealth of Michael Dell and his family. Trott is currently the Chairman and co-CEO of the firm while Gregg Lemkau who was previously CEO of MSD Partners is the other co-CEO. Dina Powell left Goldman Sachs to join the firm in May 2023. BDT & MSD is co-headquartered in Chicago and New York City with additional offices in Santa Monica, Dallas, and elsewhere. In January 2025, it was announced that Goldman Sachs Group veteran Greg Olafson would join BDT & MSD as president, co-head of global credit and co-chief investment officer. Olafson joined Goldman in 2001 as an employee ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Norwest Venture Partners

Norwest Venture Partners (Norwest) is an American venture and growth equity investment firm. The firm targets early to late-stage venture and growth equity investments across several sectors, including cloud computing and information technology, Internet, SaaS, business and financial services, and healthcare. Headquartered in Menlo Park, California, Norwest has offices in San Francisco and subsidiaries in Mumbai, India and Tel Aviv, Israel. The firm has funded more than 700 companies since inception. History Northwest Venture Fund, a private equity and venture capital affiliate of Norwest Corporation, was founded in Minneapolis in 1961. It later merged with Wells Fargo in 1998. The Northwest Growth Fund grew under the leadership of CEO Robert Zicarelli, including the opening of an office in Silicon Valley. Zicarelli retired in 1988 and was succeeded by Daniel Haggerty who retired in the 1990s. George J, Still, Jr. (now partner emeritus) and Promod Haque took over as managing ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Polaris Partners

Polaris Partners is a venture capital firm active in the field of healthcare and biotechnology companies. The company has offices in Boston, Massachusetts, New York, New York and San Francisco, California. History Polaris Partners was founded in 1996 by Jon Flint, Terry McGuire, Steve Arnold. The firm has over $5 billion in committed capital and is now making investments through its tenth fund. The current managing partners are Amy Schulman, and Brian Chee. Polaris Partners also has two affiliate funds. Polaris Growth Fund targets investments in profitable, founder-owned technology companies and is led by managing partners Bryce Youngren and Dan Lombard. Polaris Innovation Fund focuses on the commercial and therapeutic potential of early-stage academic research and is led by managing partners Amy Schulman and Ellie McGuire. See also Polaris Growth FundPolaris Innovation Fund References * Gupta, Udayan.Done Deals: Venture Capitalists Tell Their Stories 2000 * ttps://we ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Coupa

Coupa Software Incorporated is an American technology platform for AI-driven total spend management and supply chain. The company is headquartered in Foster City, California with offices throughout Europe, Latin America, and Asia Pacific. Coupa helps companies gain visibility into and control over how they spend money, optimize supply chains, and manage cash. In 2016, Coupa Software went public on the Nasdaq, trading as COUP. It was taken private by Thoma Bravo in February 2023. Leagh Turner became CEO of Coupa in November 2023. History Dave Stephens and Noah EisnerCoupa Software Press Release March 13, 2007E-Procurement Software Innovator Coupa Secures Series-A Funding" March 13, 2007. Retrieved October 31, 2013. founded Coupa in 2006. Rob Bernshteyn took over as Coupa's CEO in February 2009. In September 2009, Coupa secured a $7.5 million Series C funding round. In May, Ariba, a unit of SAP and a competitor of Coupa, filed a lawsuit alleging that Coupa misappropriated Ar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sapphire Ventures

Sapphire Ventures (stylized as SAPPHIRE) is a venture capital firm with offices in Menlo Park, San Francisco, Austin, and London. The firm is considered one of the world's premier venture capital firms. The firm primarily invests in Series B through IPO technology companies, as well as tech-focused early stage venture firms, seed, and Series A early-stage sports, media, and entertainment start-ups. Notable Sapphire-backed companies include 23andMe, Alteryx, Auth0, Block (Square), Box, Current, Degreed, DocuSign, Fitbit, IAS, JumpCloud, Kaltura, Linkedin, Livongo, Looker, MuleSoft, Monday.com, Paytm, Ping Identity, Sumo Logic, Wise ( TransferWise). History The firm was founded in 1996 as the venture capital arm of multinational software conglomerate SAP and spun out as an independent company in 2011, rebranding to Sapphire Ventures in 2014. At the time, Sapphire Ventures managed $1.4 billion and had invested in more than 125 companies, with 10 companies going public a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |