|

Donchian Channel

The Donchian channel is an indicator used in market trading developed by Richard Donchian. It is formed by taking the highest high and the lowest low of the last ''n'' periods. The area between the high and the low is the channel for the period chosen. Donchian Channels are a technical indicator that seeks to identify bullish and bearish extremes that favor reversals, higher and lower breakouts, breakdowns, and other emerging trends. The formulas for calculating the upper channel, lower channel, and the middle line at any given point of the chart are the following: \textit = \textit(N) \textit = \textit(N) \textit = , where N is usually equal to 20. It is commonly available on most trading platforms. On a charting program, a line is marked for the high and low values visually demonstrating the channel on the markets price (or other) values. The Donchian channel is a useful indicator for seeing the volatility of a market price. If a price is stable the Donchian channel will be ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Example Of The Donchian Channel Indicator With Support And Resistance Zones

Example may refer to: * ''exempli gratia'' (e.g.), usually read out in English as "for example" * .example, reserved as a domain name that may not be installed as a top-level domain of the Internet ** example.com, example.net, example.org, and example.edu: second-level domain names reserved for use in documentation as examples * HMS ''Example'' (P165), an Archer-class patrol and training vessel of the Royal Navy Arts * ''The Example'', a 1634 play by James Shirley * ''The Example'' (comics), a 2009 graphic novel by Tom Taylor and Colin Wilson * Example (musician), the British dance musician Elliot John Gleave (born 1982) * ''Example'' (album), a 1995 album by American rock band For Squirrels See also * Exemplar (other), a prototype or model which others can use to understand a topic better * Exemplum, medieval collections of short stories to be told in sermons * Eixample The Eixample (, ) is a district of Barcelona between the old city (Ciutat Vella) a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Richard Donchian

Richard Davoud Donchian (September 1905 – April 24, 1993) was an American commodities and futures trader, and a pioneer in the field of managed futures. The first publicly managed futures fund, Futures, Inc., was started by Donchian in 1949. He also developed the trend timing method of futures investing and introduced the mutual fund concept to the field of money management. Richard Donchian is considered to be the creator of the managed futures industry and is credited with developing a systematic approach to futures money management. His professional trading career was dedicated to advancing a more conservative approach to futures trading. Biography Donchian's parents were Armenian immigrants from Western Armenia, which was controlled by the Ottoman Empire in the 1880s, and had come to settle in the United States. As a young man Donchian went to school in Connecticut, later graduating from Yale University with a Bachelor of Arts degree in Economics. He later received ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Electronic Trading Platform

In finance, an electronic trading platform, also known as an online trading platform, is a computer software program that can be used to place orders for financial products over a network with a financial intermediary. Various financial products can be traded by the trading platform, over a communication network with a financial intermediary or directly between the participants or members of the trading platform. This includes products such as stocks, bonds, currencies, commodities, derivatives and others, with a financial intermediary such as brokers, market makers, investment banks or stock exchanges. Such platforms allow electronic trading to be carried out by users from any location and are in contrast to traditional floor trading using open outcry and telephone-based trading. Sometimes the term trading platform is also used in reference to the trading software alone. Electronic trading platforms typically stream live market prices on which users can trade and may provid ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Volatility (finance)

In finance, volatility (usually denoted by "sigma, σ") is the Variability (statistics), degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns. Historic volatility measures a time series of past market prices. Implied volatility looks forward in time, being derived from the market price of a market-traded derivative (in particular, an option). Volatility terminology Volatility as described here refers to the actual volatility, more specifically: * actual current volatility of a financial instrument for a specified period (for example 30 days or 90 days), based on historical prices over the specified period with the last observation the most recent price. * actual historical volatility which refers to the volatility of a financial instrument over a specified period but with the last observation on a date in the past **near synonymous is realized volatility, the square root of the realized variance, in turn c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Long (finance)

In finance, a long position in a financial instrument means the holder of the position owns a positive amount of the instrument. The holder of the position has the expectation that the financial instrument will increase in value. This is known as a bullish position. The term "long position" is often used in context of buying options contracts. Ownership When an investor holds a long position in a stock they are buying a share of ownership in a company. Depending on the type of Stock purchased this can entitle the shareholder to voting rights at shareholder meetings or dividend payments. Security In terms of a security, such as a stock or a bond, or equivalently ''to be long'' in a security, means the holder of the position owns the security, on the expectation that the security will increase in value, and will profit if the price of the security goes up. ''Going long'' a security is the more conventional practice of investing. Future Going long in a future means th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Short Selling

In finance, being short in an asset means investing in such a way that the investor will profit if the market value of the asset falls. This is the opposite of the more common Long (finance), long Position (finance), position, where the investor will profit if the market value of the asset rises. An investor that sells an asset short is, as to that asset, a short seller. There are a number of ways of achieving a short position. The most basic is physical selling short or short-selling, by which the short seller Securities lending, borrows an asset (often a security (finance), security such as a share (finance), share of stock or a bond (finance), bond) and sells it. The short seller must later buy the same amount of the asset to return it to the lender. If the market price of the asset has fallen in the meantime, the short seller will have made a profit equal to the difference in price. Conversely, if the price has risen then the short seller will bear a loss. The short seller ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Modeling

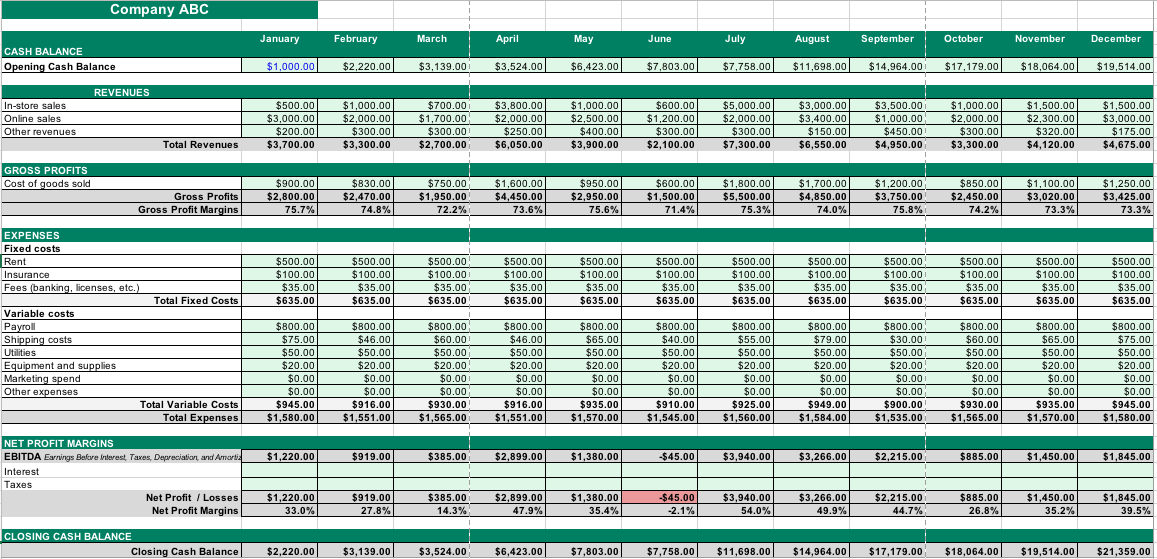

Financial modeling is the task of building an abstract representation (a model) of a real world financial situation. This is a mathematical model designed to represent (a simplified version of) the performance of a financial asset or portfolio of a business, project, or any other investment. Typically, then, financial modeling is understood to mean an exercise in either asset pricing or corporate finance, of a quantitative nature. It is about translating a set of hypotheses about the behavior of markets or agents into numerical predictions. At the same time, "financial modeling" is a general term that means different things to different users; the reference usually relates either to accounting and corporate finance applications or to quantitative finance applications. Accounting In corporate finance and the accounting profession, ''financial modeling'' typically entails financial statement forecasting; usually the preparation of detailed company-specific models used for deci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chart Overlays

A chart (sometimes known as a graph) is a graphical representation for data visualization, in which "the data is represented by symbols, such as bars in a bar chart, lines in a line chart, or slices in a pie chart". A chart can represent tabular numeric data, functions or some kinds of quality structure and provides different info. The term "chart" as a graphical representation of data has multiple meanings: * A data chart is a type of diagram or graph, that organizes and represents a set of numerical or qualitative data. * Maps that are adorned with extra information (map surround) for a specific purpose are often known as charts, such as a nautical chart or aeronautical chart, typically spread over several map sheets. * Other domain-specific constructs are sometimes called charts, such as the chord chart in music notation or a record chart for album popularity. Charts are often used to ease understanding of large quantities of data and the relationships between parts of t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Technical Analysis

In finance, technical analysis is an analysis methodology for analysing and forecasting the direction of prices through the study of past market data, primarily price and volume. As a type of active management, it stands in contradiction to much of modern portfolio theory. The efficacy of technical analysis is disputed by the efficient-market hypothesis, which states that stock market prices are essentially unpredictable, and research on whether technical analysis offers any benefit has produced mixed results.Osler, Karen (July 2000). "Support for Resistance: Technical Analysis and Intraday Exchange Rates," FRBNY Economic Policy Reviewabstract and paper here. It is distinguished from fundamental analysis, which considers a company's financial statements, health, and the overall state of the market and economy. History The principles of technical analysis are derived from hundreds of years of financial market data. Some aspects of technical analysis began to appear in Amste ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |