|

Consumer Leverage Ratio

The consumer leverage ratio (CLR) is the ratio of total household debt to disposable personal income. In the United States these are reported, respectively, by the Federal Reserve (as the household debt service ratio (DSR)) and the Bureau of Economic Analysis of the US Department of Commerce. \mbox = The concept has been used to quantify the amount of debt an average consumer has, relative to their disposable income. In essence, the consumer leverage ratio demonstrates how many years it would take an average consumer to pay off their debt if their entire annual disposable income went toward it. Overview The concept, popularized by William Jarvis and Dr. Ian C MacMillan in a series of articles in the Harvard Business Review, is being used in economic analysis and reporting, having been compared to other relevant economic indicators since the 1970s. The consumer leverage ratio in the US was increasing in the years before the 2008 financial crisis, peaking at 1.29x in 2007 and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2008 Financial Crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners and financial institutions that led to the 2000s United States housing bubble, exacerbated by predatory lending for subprime mortgages and deficiencies in regulation. Cash out refinancings had fueled an increase in consumption that could no longer be sustained when home prices declined. The first phase of the crisis was the subprime mortgage crisis, which began in early 2007, as mortgage-backed securities (MBS) tied to U.S. real estate, and a vast web of Derivative (finance), derivatives linked to those MBS, collapsed in value. A liquidity crisis spread to global institutions by mid-2007 and climaxed with the bankruptcy of Lehman Brothers in September 2008, which triggered a stock market crash and bank runs in several countries. The crisis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer Economics

Microeconomics is a branch of economics that studies the behavior of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms. Microeconomics focuses on the study of individual markets, sectors, or industries as opposed to the economy as a whole, which is studied in macroeconomics. One goal of microeconomics is to analyze the market mechanisms that establish relative prices among goods and services and allocate limited resources among alternative uses. Microeconomics shows conditions under which free markets lead to desirable allocations. It also analyzes market failure, where markets fail to produce efficient results. While microeconomics focuses on firms and individuals, macroeconomics focuses on the total of economic activity, dealing with the issues of growth, inflation, and unemployment—and with national policies relating to these issues. Microeconomics also deals with the effe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

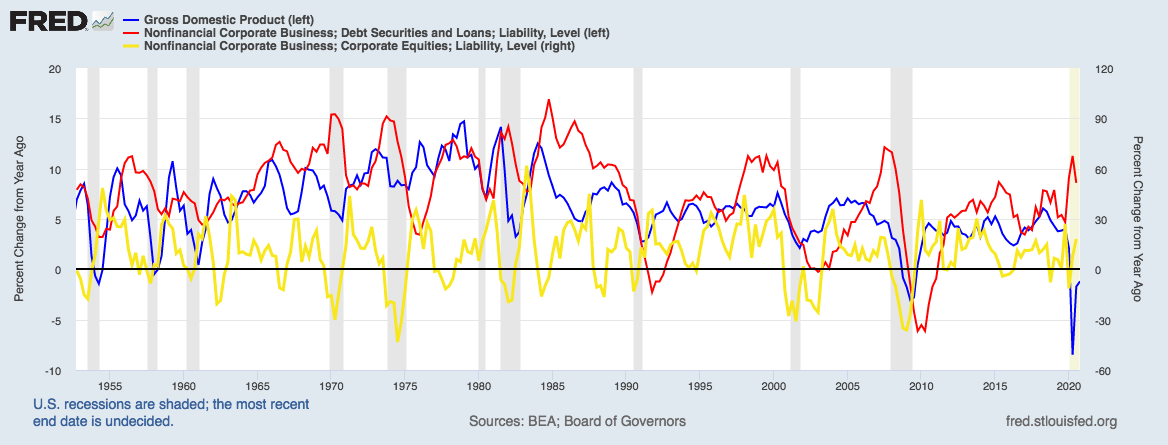

Debt-to-GDP Ratio

In economics, the debt-to-GDP ratio is the ratio of a country's accumulation of government debt (measured in units of currency) to its gross domestic product (GDP) (measured in units of currency per year). A low debt-to-GDP ratio indicates that an economy produces goods and services sufficient to pay back debts without incurring further debt. Geopolitical and economic considerations – including interest rates, war, recessions, and other variables – influence the borrowing practices of a nation and the choice to incur further debt. It should not be confused with a deficit-to-GDP ratio, which, for countries running budget deficits, measures a country's annual net fiscal loss in a given year ( government budget balance, or the net change in debt per annum) as a percentage share of that country's GDP; for countries running budget surpluses, a ''surplus-to-GDP ratio'' measures a country's annual net fiscal ''gain'' as a share of that country's GDP. Particularly in macroeconomics, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt Ratio

The debt ratio or debt to assets ratio is a financial ratio which indicates the percentage of a company's assets which are funded by debt.Drake, P. P., Financial ratio analysis, p. 9, published on 15 December 2012 It is measured as the ratio of total debt to total assets, which is also equal to the ratio of total liabilities and total assets: : Financial analysts and financial managers use the ratio in assessing the financial position of the firm. Companies with high debt to asset ratios are said to be highly leveraged, and are associated with greater risk. A high debt to asset ratio may also indicate a low borrowing capacity, which in turn will limit the firm's financial flexibility. See also *Equity ratio * Debt-to-income ratio, for households *Debt-to-GDP ratio In economics, the debt-to-GDP ratio is the ratio of a country's accumulation of government debt (measured in units of currency) to its gross domestic product (GDP) (measured in units of currency per year). A low ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gross Income

For households and individuals, gross income is the sum of all wages, salaries, profits, interest payments, rents, and other forms of earnings, before any deductions or taxes. It is opposed to net income, defined as the gross income minus taxes and other deductions (e.g., mandatory pension contributions). For a business, gross income (also gross profit, sales profit, or credit sales) is the difference between revenue and the cost of making a product or providing a service, before deducting overheads, payroll, taxation, and interest payments. This is different from operating profit (earnings before interest and taxes). Gross margin is often used interchangeably with gross profit, but the terms are different. When speaking about a monetary amount, it is technically correct to use the term "gross profit", but when referring to a percentage or ratio, it is correct to use "gross margin". Relationship with other accounting terms The various deductions (and their corresponding me ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt-to-income Ratio

In the consumer mortgage industry, debt-to-income ratio (DTI) is the percentage of a consumer's monthly gross income that goes toward paying debts. (Speaking precisely, DTIs often cover more than just debts; they can include principal, taxes, fees, and insurance premiums as well. Nevertheless, the term is a set phrase that serves as a convenient, well-understood shorthand.) There are two main kinds of DTI, as discussed below. Two main kinds of DTI The two main kinds of DTI are expressed as a pair using the notation x/y (for example, 28/36). # The first DTI, known as the ''front-end ratio'', indicates the percentage of income that goes toward housing costs, which for renters is the rent amount and for homeowners is PITI (mortgage principal and interest, mortgage insurance premium hen applicable hazard insurance premium, property taxes, and homeowners' association dues hen applicable. # The second DTI, known as the ''back-end ratio'', indicates the percentage of income that g ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economy Of The United States

The United States has a highly developed mixed economy. It is the world's largest economy by nominal GDP and second largest by purchasing power parity (PPP). As of 2025, it has the world's seventh highest nominal GDP per capita and ninth highest GDP per capita by PPP. The U.S. accounts for 27% of the global economy in 2025 in nominal terms, and about 16% in PPP terms. The U.S. dollar is the currency of record most used in international transactions and is the world's reserve currency, backed by a large U.S. treasuries market, its role as the reference standard for the petrodollar system, and its linked eurodollar. Several countries use it as their official currency and in others it is the ''de facto'' currency.Benjamin J. Cohen, ''The Future of Money'', Princeton University Press, 2006, ; ''cf.'' "the dollar is the de facto currency in Cambodia", Charles Agar, '' Frommer's Vietnam'', 2006, , p. 17 Since the end of World War II, the economy has achieved relatively ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Earnings Growth

Earnings growth is the annual compound annual growth rate (CAGR) of earnings from investments. Overview When the dividend payout ratio is the same, the dividend growth rate is equal to the earnings growth rate. Earnings growth rate is a key value that is needed when the Discounted cash flow model, or the Gordon's model is used for stock valuation. The present value is given by: :P = D\cdot\sum_^\left(\frac\right)^ . where P = the present value, k = discount rate, D = current dividend and g_i is the revenue growth rate for period i. If the growth rate is constant for i=n+1 to \infty, then, :P = D\cdot\frac + D\cdot(\frac)^2 +...+ D\cdot(\frac)^n+ D\cdot\sum_^\left(\frac\right)^ The last term corresponds to the terminal case. When the growth rate is always the same for perpetuity, Gordon's model results: :P = D\times\frac. As Gordon's model suggests, the valuation is very sensitive to the value of g used. Part of the earnings is paid out as dividends and part of it is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leverage (finance)

In finance, leverage, also known as gearing, is any technique involving borrowing funds to buy an investment. Financial leverage is named after a lever in physics, which amplifies a small input force into a greater output force. Financial leverage uses borrowed money to augment the available capital, thus increasing the funds available for (perhaps risky) investment. If successful this may generate large amounts of profit. However, if unsuccessful, there is a risk of not being able to pay back the borrowed money. Normally, a lender will set a limit on how much risk it is prepared to take, and will set a limit on how much leverage it will permit. It would often require the acquired asset to be provided as collateral security for the loan. Leverage can arise in a number of situations. Securities like options and futures are effectively leveraged bets between parties where the principal is implicitly borrowed and lent at interest rates of very short treasury bills.Mock, E. J., R. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Indicator

An economic indicator is a statistic about an Economics, economic activity. Economic indicators allow analysis of economic performance and predictions of future performance. One application of economic indicators is the study of business cycles. Economic indicators include various indices, earnings reports, and economic summaries: for example, the unemployment rate, quits rate (quit rate in American English), housing starts, consumer price index (a measure for inflation (economics), inflation), inverted yield curve, consumer leverage ratio, industrial production, bankruptcies, gross domestic product, broadband internet access, broadband internet penetration, retail sales, price index, and changes in credit conditions. The leading business cycle dating committee in the United States, United States of America is the private National Bureau of Economic Research. The Bureau of Labor Statistics is the principal fact-finding agency for the U.S. government in the field of labor economics ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

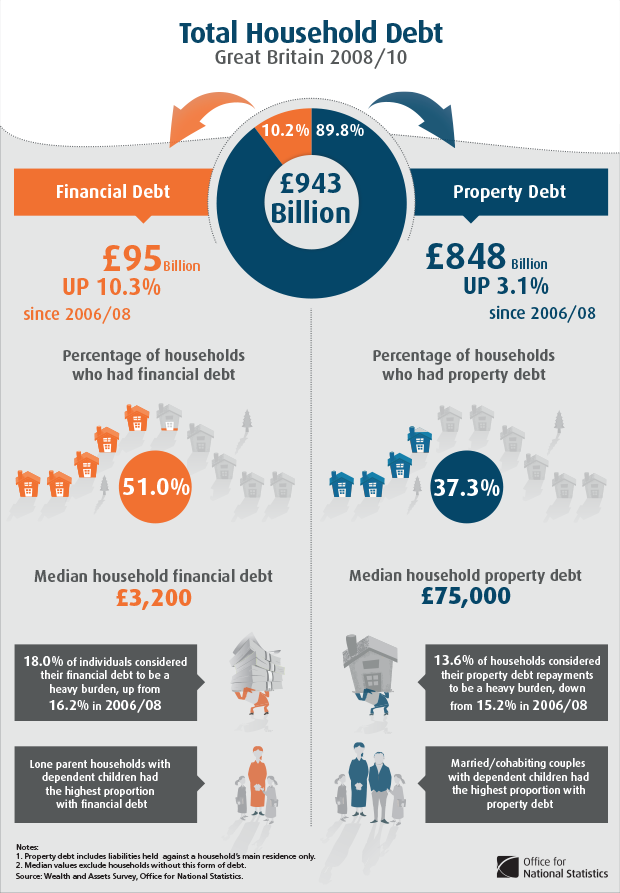

Household Debt

Household debt is the combined debt of all people in a household, including consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and subsequent euro area crisis. Several economists have argued that lowering this debt is essential to economic recovery in the U.S. and selected Eurozone countries. Overview Household debt can be defined in several ways, based on what types of debt are included. Common debt types include home mortgages, home equity loans, auto loans, student loans, and credit cards. Household debt can also be measured across an economy, to measure how indebted households are relative to various measures of income (e.g., pre-tax and disposable income) or relative to the size of the economy (GDP). The burden of debt can also be measured in terms of the amount of interest it generates relative to the income of the borrower. For example, the U.S. Federal Reser ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |