|

Comparison Of Free Credit Report Websites

The following chart compares websites that provide United States credit reports or credit scores free of charge. Services limited to cardholders or only offering trial plans are excluded. The chart specifies what is free, what kind of credit reports are included, and whether a full Social Security number is needed. According to the Federal Trade Commission, " AnnualCreditReport.com is the only authorized source for the free annual credit report." Care should be taken when providing a full Social Security number to any other website. See also * Credit score in the United States * Criticism of credit scoring systems in the United States * Fair Credit Reporting Act The Fair Credit Reporting Act (FCRA), 15 U.S.C. § 1681 ''et seq'', is U.S. Federal Government legislation enacted to promote the accuracy, fairness, and privacy of consumer information contained in the files of consumer reporting agencies. It ... References {{Reflist Credit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit History

:''This article deals with the general concept of the term credit history. For detailed information about the same topic in the United States, see Credit score in the United States.'' A credit history is a record of a borrower's responsible repayment of debts. A credit report is a record of the borrower's credit history from a number of sources, including banks, credit card companies, collection agencies, and governments.http://money.usnews.com/money/blogs/my-money/2013/04/22/credit-report-vs-credit-score-do-you-know-the-difference A borrower's credit score is the result of a mathematical algorithm applied to a credit report and other sources of information to predict future delinquency. In many countries, when a customer submits an application for credit from a bank, credit card company, or a store, their information is forwarded to a credit bureau. The credit bureau matches the name, address and other identifying information on the credit applicant with information retained by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Sesame

Credit Sesame is a credit and loan company. Credit Sesame was launched in private beta at TechCrunch Disrupt TechCrunch is an American online newspaper focusing on high tech and startup companies. It was founded in June 2005 by Archimedes Ventures, led by partners Michael Arrington and Keith Teare. In 2010, AOL acquired the company for approximat ... 2010. By 2012, the company claimed to monitor almost $35 billion in loans. Leadership Credit Sesame was founded on April 1, 2010 by Adrian Nazari, the company's chief executive officer. Nazari previously co-founded Financial Crossing, Inc. and served as both its president and its CEO. He was also the founder, CEO, and Chairman of the Board at Financial Circuit, Inc. On June 8, 2022, David Bagatelle became the Chief Banking Officer and Head of Banking and Credit Sesame. Product and services As of 2018, Credit Sesame gives its members free access to credit score monitoring, credit reports, and identity protection tool ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Criticism Of Credit Scoring Systems In The United States

Credit scoring systems in the United States have garnered considerable criticism from various media outlets, consumer law organizations, government officials, debtors unions, and academics. Racial bias, discrimination against prospective employees,"Millions Need Not Apply" '''', May 29, 2011. discrimination against medical and student debt holders, poor predictability, manipulation of credit scoring |

Credit Score In The United States

A credit score is a number that provides a comparative estimate of an individual's creditworthiness based on an analysis of their credit report. It is an inexpensive and main alternative to other forms of consumer loan underwriting. Lenders, such as banks and credit card companies, use credit scores to evaluate the risk of lending money to consumers. Lenders contend that widespread use of credit scores has made credit more widely available and less expensive for many consumers. Under the Wall Street reform bill passed in 2010, a consumer is entitled to receive a free report of the specific credit score used if they are denied a loan, credit card or insurance due to their credit score. History Before credit scores, credit was evaluated using credit reports from credit bureaus. During the late 1950s, banks started using computerized credit scoring to redefine creditworthiness as abstract statistical risk. The Equal Credit Opportunity Act banned denying credit on gender or ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

WalletHub

WalletHub (formerly CardHub.com) is a personal finance website that was launched in August 2013. It is based in Miami and owned by Evolution Finance, Inc. WalletHub offers free consumer tools, such as its WalletLiteracy Quiz and its Financial Fitness Tool, which provides users with credit reports, scores and monitoring. The company also successfully overcame a public trademark dispute with Major League Baseball, brought on behalf of the Washington Nationals and Chicago Cubs. History According to Web reports, WalletHub initially positioned itself as a “personal finance social network” with a focus on reviews for financial advisors. The company also produces research reports, including a quarterly credit card debt report and reports comparing cities and states in financially relevant categories. For example, in mid-November 2021, a weekly New York Times feature used Wallethub's' data for what the Times ''The Times'' is a British daily national newspaper based in L ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dun & Bradstreet

The Dun & Bradstreet Corporation is an American company that provides commercial data, analytics, and insights for businesses. Headquartered in Jacksonville, Florida, the company offers a wide range of products and services for risk and financial analysis, operations and supply, and sales and marketing professionals, as well as research and insights on global business issues. It serves customers in government and industries such as communications, technology, strategic financial services, and retail, telecommunications, and manufacturing markets. Often referred to as D&B, the company's database contains over 500 million business records worldwide. History 1800s Dun & Bradstreet traces its history to July 20, 1841, with formation of The Mercantile Agency in New York City by Lewis Tappan. Recognizing the need for a centralized credit reporting system, Tappan formed the company to create a network of correspondents who would provide reliable, objective credit information to subsc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NerdWallet

NerdWallet is an American personal finance company, founded in 2009 by Tim Chen and Jacob Gibson. It has a website and app that earns money by promoting financial products to its users. History NerdWallet was founded in August 2009 by Tim Chen and Jacob Gibson, with an initial capital investment of $800. Its first product was a web application that provided comparative information about credit cards. Subsequently, it generated large quantities of content to help boost its search engine results. Website traffic grew quickly in 2010 and, by March 2014, the website had up to 30 million users. The following year, it raised $64 million in its first round of funding, at an estimated valuation of $500 million. In 2016, the company acquired the retirement planning firm AboutLife, and was valued at $520 million. In 2017, company growth slowed, resulting in the layoff of 11 percent of its employees. In August 2020, the company expanded its footprint into the UK by acquiring Know Your ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

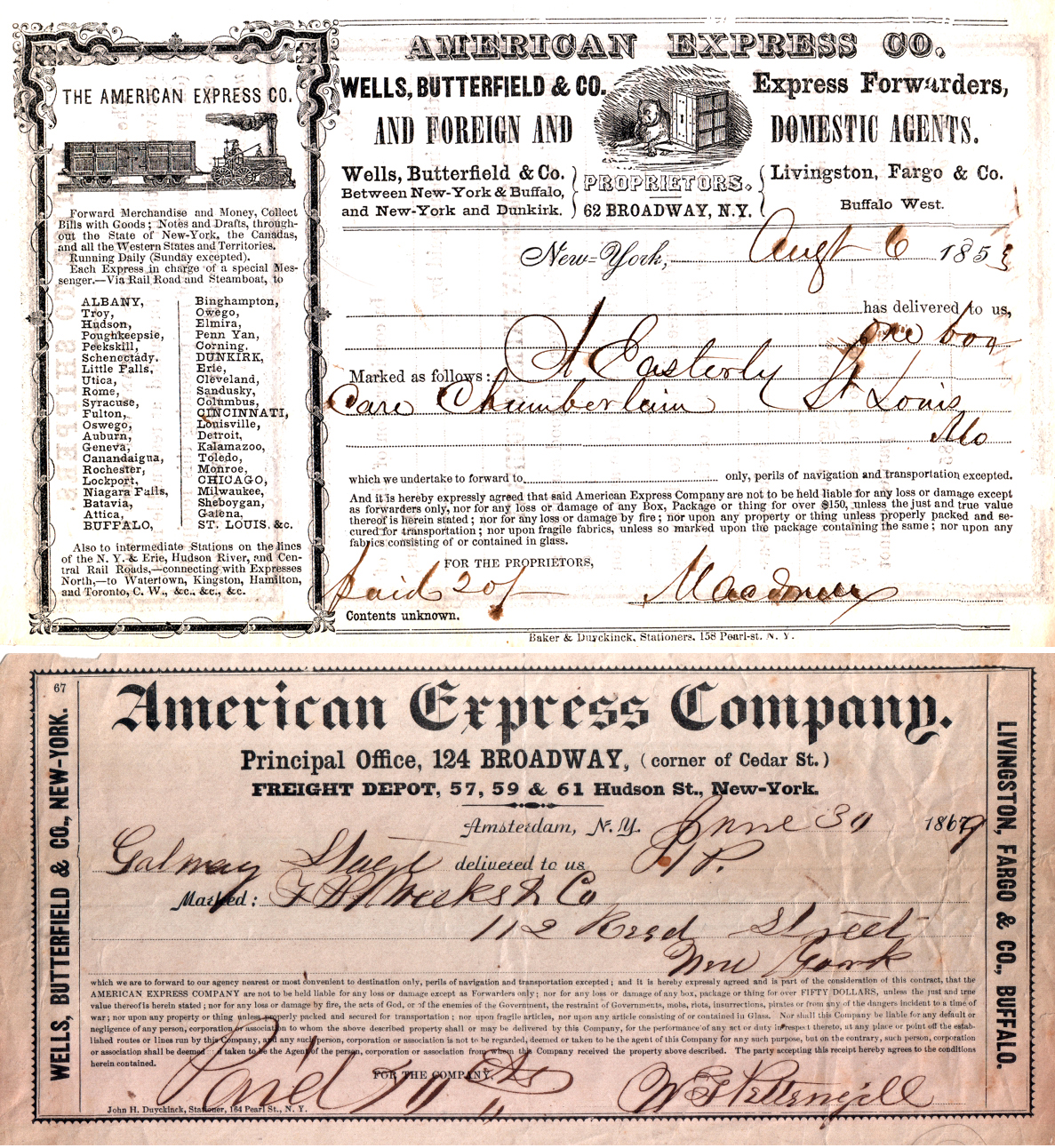

American Express

American Express Company (Amex) is an American multinational corporation specialized in payment card services headquartered at 200 Vesey Street in the Battery Park City neighborhood of Lower Manhattan in New York City. The company was founded in 1850 and is one of the 30 components of the Dow Jones Industrial Average. The company's logo, adopted in 1958, is a gladiator or centurion whose image appears on the company's well-known traveler's cheques, charge cards, and credit cards. During the 1980s, Amex invested in the brokerage industry, acquiring what became, in increments, Shearson Lehman Hutton and then divesting these into what became Smith Barney Shearson (owned by Primerica) and a revived Lehman Brothers. By 2008 neither the Shearson nor the Lehman name existed. In 2016, credit cards using the American Express network accounted for 22.9% of the total dollar volume of credit card transactions in the United States. , the company had 121.7million cards in force, in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Intuit

Intuit Inc. is an American business software company that specializes in financial software. The company is headquartered in Mountain View, California, and the CEO is Sasan Goodarzi. Intuit's products include the tax preparation application TurboTax, personal finance app Mint, the small business accounting program QuickBooks, the credit monitoring service Credit Karma, and email marketing platform Mailchimp. more than 95% of its revenues and earnings come from its activities within the United States. Intuit offers a free online service called TurboTax Free File as well as a similarly named service called TurboTax Free Edition which is not free for most users. In 2019, investigations by ProPublica found that Intuit deliberately steered taxpayers from the free TurboTax Free File to the paid TurboTax Free Edition using tactics including search engine delisting and a deceptive discount targeted to members of the military. Intuit has lobbied extensively against the IRS providin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mint

MiNT is Now TOS (MiNT) is a free software alternative operating system kernel for the Atari ST system and its successors. It is a multi-tasking alternative to TOS and MagiC. Together with the free system components fVDI device drivers, XaAES graphical user interface widgets, and TeraDesk file manager, MiNT provides a free TOS compatible replacement OS that can multitask. History Work on MiNT began in 1989, as the developer Eric Smith was trying to port the GNU library and related utilities on the Atari ST TOS. It turned out quickly, that it was much easier to add a Unix-like layer to the TOS, than to patch all of the GNU software, and MiNT began as a TOS extension to help in porting. MiNT was originally released by Eric Smith as "MiNT is Not TOS" (a recursive acronym in the style of "GNU's Not Unix") in May 1990. The new Kernel got traction, with people contributing a port of the MINIX Filesystem and a port to the Atari TT. At the same time Atari was looking to enhan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

LendingTree

LendingTree is an online lending marketplace headquartered in Charlotte, NC. The business platform allows potential borrowers to connect with multiple loan operators to find optimal terms for loans, credit cards, deposit accounts, insurance, etc. LendingTree allows borrowers to shop and compare competitive rates and terms across an array of financial products. Founded in 1996, the company is headquartered in Charlotte, North Carolina with offices in the San Francisco Bay Area, New York City, Chicago, Seattle and others. Other additional services include financing tools, comparative loan searches and borrowing information. History Founding After graduating from Bucknell University, Doug Lebda went to work for PricewaterhouseCoopers in Pittsburgh as an auditor and consultant. During the process of purchasing his first home via a mortgage, he found the process of comparing numerous resources time-consuming. Lebda sought a better way to improve this process in the marketplace. Lebda ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Karma

Credit Karma is an American multinational personal finance company founded in 2007, which has been a brand of Intuit since December 2020. It is best known as a free credit and financial management platform, but its features also include monitoring of unclaimed property databases and a tool to identify and dispute credit report errors. The company operates in the United States, Canada and the United Kingdom. All of Credit Karma’s services are free to consumers. Revenue from targeted advertisements for financial products offsets the costs of its free products and services. Credit Karma earns revenue from lenders, who pay the company when Credit Karma successfully recommends customers to the lenders. History Kenneth Lin, who previously founded Multilytics Marketing and worked with E-Loan and Upromise, launched Credit Karma in 2007 with co-founders Ryan Graciano and Nichole Mustard. The website went live in February 2008. Early investors included Chris Larson, CEO of Prosper ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |