|

Chipknip

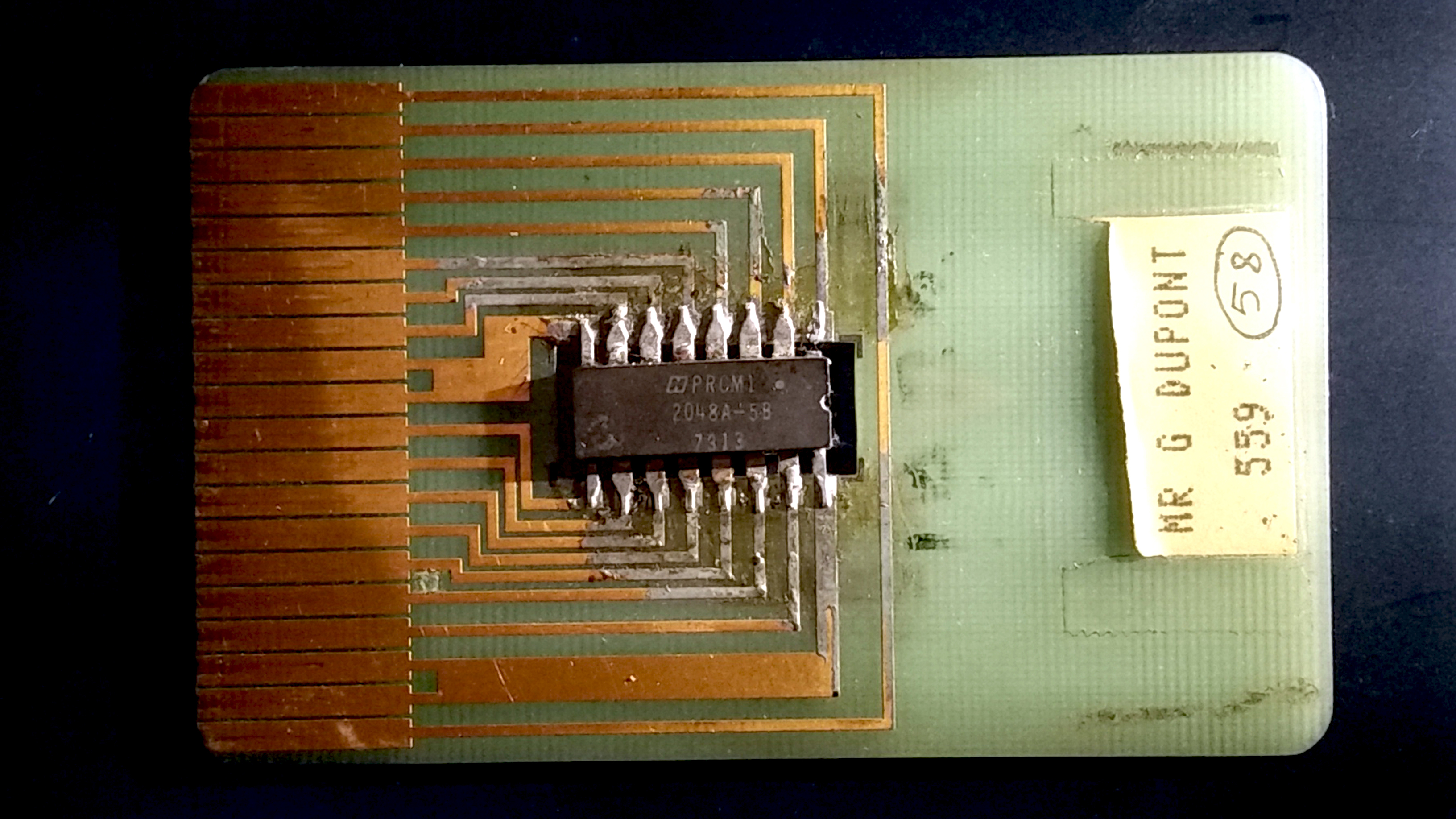

Chipknip (a portmanteau of ''Smart card, chip card'' and ''knip'', Dutch for coin purse, purse) was a Stored-value card, stored-value payment card system used in the Netherlands. Based on the Belgian Proton (debit card), Proton system, it was started by Interpay on 26 October 1995, as a Pilot experiment, pilot project in the city of Arnhem and a year later rolled out countrywide. Chipknip was taken over by Currence due to a restructuring on 17 May 2005, who managed it with their licensees until its discontinuation on 1 January 2015. The Chipknip was primarily used for small retail transactions, as the card could contain a maximum value of 500 euros. The money needed to be transferred from a card holders main bank account using a loading station which were generally located next to Automated teller machine, ATMs. In 1996, The Postbank N.V., Postbank left the Chipknip project and started the Chipper project with other organisations such as PTT Telecom to compete with the Chipknip un ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chipknip Logo

Chipknip (a portmanteau of ''chip card'' and ''knip'', Dutch for purse) was a stored-value payment card system used in the Netherlands. Based on the Belgian Proton system, it was started by Interpay on 26 October 1995, as a pilot project in the city of Arnhem and a year later rolled out countrywide. Chipknip was taken over by Currence due to a restructuring on 17 May 2005, who managed it with their licensees until its discontinuation on 1 January 2015. The Chipknip was primarily used for small retail transactions, as the card could contain a maximum value of 500 euros. The money needed to be transferred from a card holders main bank account using a loading station which were generally located next to ATMs. In 1996, The Postbank left the Chipknip project and started the Chipper project with other organisations such as PTT Telecom to compete with the Chipknip until 2001, when it merged into the Chipknip system. Its peak was in 2010, when a total of 178 million transactions were ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chipknip

Chipknip (a portmanteau of ''Smart card, chip card'' and ''knip'', Dutch for coin purse, purse) was a Stored-value card, stored-value payment card system used in the Netherlands. Based on the Belgian Proton (debit card), Proton system, it was started by Interpay on 26 October 1995, as a Pilot experiment, pilot project in the city of Arnhem and a year later rolled out countrywide. Chipknip was taken over by Currence due to a restructuring on 17 May 2005, who managed it with their licensees until its discontinuation on 1 January 2015. The Chipknip was primarily used for small retail transactions, as the card could contain a maximum value of 500 euros. The money needed to be transferred from a card holders main bank account using a loading station which were generally located next to Automated teller machine, ATMs. In 1996, The Postbank N.V., Postbank left the Chipknip project and started the Chipper project with other organisations such as PTT Telecom to compete with the Chipknip un ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currence

Currence is a Dutch trade association set up by banks that coordinates the payment systems in the Netherlands. Its aim is to "facilitate and provide market transparency while maintaining the quality and safety of the payment systems of the Netherlands." Currence is the brand owner of a number of the Dutch payment systems that included PIN, Chipknip until these were discontinued, Acceptgiro, Incasso/Machtigen and up until 2023 iDEAL. History Currence was founded on 1 January 2005 through an initiative by eight Dutch banks ( ABN AMRO, Rabobank Rabobank (; full name: ''Coöperatieve Rabobank U.A.'') is a Dutch multinational banking and financial services company headquartered in Utrecht, Netherlands. The group comprises 89 local Dutch Rabobanks (2019), a central organisation (Raboban ..., ING Groep, Fortis, SNS Bank, BNG, Friesland Bank and Van Lanschot Kempen). It was originally known as ''Brandts & Licences Betalingsverkeer Nederland B.V.'' during its developm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interpay

Interpay Nederland B.V. was the Dutch payment processor and payment product provider that operated from 1994 until 2006. Interpay owned the payment systems PIN, Chipknip, Acceptgiro and Incasso. The organisation was owned by a consortium of Dutch banks. In 2005, they spun off Currence which in 2006 merged with German company ''Transaktionsinstitut für Zahlungsverkehrsdienstleistungen AG'' to form Equens. History Interpay was founded as a merger between BeaNet, the Bankgirocentrale and Eurocard Nederland. ING Group was the largest shareholder of Interpay, at around 30%. In 1995, Interpay started with a pilot of the Chipknip. Trouw noted in 2001 that a smooth transition to the Euro was dependent on Interpay. In 2003, Annemarie Jorritsma became a commissioner at Interpay. In September 2003, Interpay started together with Banksys and SSB the company Sinsys for credit cards, to reduce costs. Sinsys ultimately became wholly owned by SIA in 2012. Director Willem Stolwijk lef ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Smart Card

A smart card (SC), chip card, or integrated circuit card (ICC or IC card), is a card used to control access to a resource. It is typically a plastic credit card-sized card with an Embedded system, embedded integrated circuit (IC) chip. Many smart cards include a pattern of metal contacts to electrically connect to the internal chip. Others are Contactless smart card, contactless, and some are both. Smart cards can provide personal identification, authentication, data storage, and application processing. Applications include identification, financial, public transit, computer security, schools, and healthcare. Smart cards may provide strong security authentication for single sign-on (SSO) within organizations. Numerous nations have deployed smart cards throughout their populations. The universal integrated circuit card (UICC) for mobile phones, installed as pluggable SIM card or embedded eSIM, is also a type of smart card. , 10.5billion smart card IC chips are manufactured annually ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stored-value Card

A stored-value card (SVC) or cash card is a payment card with a monetary value stored on the card itself, not in an external account maintained by a financial institution. This means no network access is required by the payment collection terminals as funds can be withdrawn and deposited straight from the card. Like cash, payment cards can be used anonymously as the person holding the card can use the funds. They are an electronic development of token coins and are typically used in low-value payment systems or where network access is difficult or expensive to implement, such as parking machines, public transport systems, and closed payment systems in locations such as ships. Stored-value cards differ from debit cards, where money is on deposit with the issuer, and credit cards which are subject to credit limits set by the issuer and are connected to accounts at financial institutions. Another difference between stored-value cards and debit and credit cards is that debit and cre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

PIN (debit Card)

PIN was a debit card brand in the Netherlands from 1990 until 2012, owned by Currence. PIN was a magnetic stripe card, which never migrated to the EMV chip. It was therefore discontinued in 2012, after the switch-over from magnetic stripe authentication to EMV chip authentication in the Netherlands was completed. PIN was replaced by Maestro (debit card), Maestro and V Pay debit cards, but as most PIN cards were already co-branded with Maestro long before 2012, consumers noticed little of the change. Like in many neighbouring countries, the PIN debit card often doubled as a cheque guarantee card for Eurocheque until those cheques were abolished on 1 January 2002. In contrast to its neighbouring countries (e.g. Belgium's and Germany's Girocard), the Netherlands has not operated a national debit card network since 2012. History In 1987, the Dutch Central Bank investigated the possibility of merging the individual debit card schemes of the various banks in the Netherlands into a si ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Proton (bank Card)

Proton was a stored-value card payment system in Belgium from 1995 until 2014. It was introduced with the goal to replace cash primarily for small transactions around €15. For security, the card was limited to storing 125 EUR of available electronic cash (originally 5,000 BEF). The card was used for small payments without a pin code or signature, and users ran the same risk as with cash in that if the card was lost the cash value allocated to it would also be lost. The advantage to merchants was that they could accept payments without the necessity for a bank terminal to be connected to a centralised system for approving the transaction (the transaction was approved by the card itself), and the transaction was very quick. In August 1998, Proton World International was founded, a joint venture between Banksys, Visa, American Express and EGR. The goal was to promote the Proton technology worldwide. In 2001, the Australian company ERG bought the remaining shares of Proton World ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

BeaNet

BeaNet (abbreviation of Betaalautomaten Netwerk, Dutch for payment terminal network) was a Dutch system and organization for electronic payments, which was founded in 1988. Adoption In March 1990, Esso included the possibility to pay with BeaNet. In January 1992, Albert Heijn was the first large supermarket in the Netherlands that adopted the usage of BeaNet. Criticism Yvonne van Rooy, the staatssecretaris of economic affairs in the Third Lubbers cabinet, wanted to get rid of the monopolistic position of BeaNet in 1992. Merger In 1993, a merger was announced between BeaNet, Bankgirocentrale and Eurocard Nederland. In 1994, they formed Interpay.Trouw, 4 February 1993: ''Giirale, Eurocard en Beanet gaan samenwerken'' See also * Chipknip References External links * {{Dutch financial services companies Payment systems organizations Financial services in the Netherlands Banking organizations ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Belgian Franc

The Belgian franc was the currency of the Kingdom of Belgium from 1832 until 2002 when the euro was introduced. It was subdivided into 100 subunits, each known as a in Dutch, or in French and German. History The ''gulden'' (guilder) of 20 ''stuivers'' was the currency of present-day Belgium from the 15th to 19th centuries until its replacement in 1832 by the Belgian franc. Its value differed from the Dutch guilder, gulden of the Dutch Republic during the latter's separation from Belgium from 1581 to 1816. Standard coins issued in Belgium include: * From 1618: the :nl:Patagon, ''patagon'' or ''Albertusthaler'' of 24.55 g fine silver, worth 2.4 gulden or 48 stuiver (or 10.23 g fine silver per gulden) * From 1754: the ''kronenthaler'' of 25.71 g fine silver, worth 3.15 gulden ''currency'' or 2.7 ''gulden of exchange'' (9.52 g silver per exchange gulden). The French Écu#Silver écu of 1726, silver écu of 26.67 g silver was also accepted for 2.8 exchange gulden. * From 1816 to 1832 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Maestro (debit Card)

Mastercard Maestro is a brand of debit cards and prepaid cards owned by Mastercard that was introduced in 1991. Maestro is accepted at around fifteen million point of sale outlets in 93 countries. On July 1, 2023, Mastercard began phasing out Maestro across Europe. European banks and other card issuers are now required to replace expired or lost Maestro cards with a different card. Functionality Maestro debit cards are obtained from associate banks and are linked to the cardholder's savings account, current account or any of several other types of accounts, while prepaid cards do not require a bank account to operate. Maestro cards can be used at point of sale The point of sale (POS) or point of purchase (POP) is the time and place at which a retail transaction is completed. At the point of sale, the merchant calculates the amount owed by the customer, indicates that amount, may prepare an invoice f ... (POS) and ATMs. Payments are made by swiping cards through th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |