|

Canada Child Tax Benefit

The Canada Child Benefit (CCB), previously the Canada Child Tax Benefit (CCTB), is an income-tested basic income program for Canadian families. It is delivered as a tax-free monthly payment available to eligible Canadian families to help with the cost of raising children. The CCTB could incorporate the National Child Benefit (NCB), a monthly benefit for low-income families with children, and the Child Disability Benefit (CDB), a monthly benefit for families caring for children with severe and prolonged mental or physical disabilities. History The CCTB was enacted in response to a commitment made by the Canadian parliament, in November 1989, to eradicate child poverty in Canada by the year 2000.Garcia, Miguel Roberto Sanchez (2002). Targeting child poverty in Canada' (Ph.D. Dissertation) Wilfrid Laurier University Child Tax Benefit (CTB, 1993–1998) The federal finance minister, Don Mazankowski, announced in the 1992 Canadian federal budget the introduction in January ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Basic Income

Universal basic income (UBI) is a social welfare proposal in which all citizens of a given population regularly receive a minimum income in the form of an unconditional transfer payment, i.e., without a means test or need to perform Work (human activity), work. In contrast, a ''guaranteed minimum income'' is paid only to those who do not already receive an income that is enough to live on. A UBI would be received independently of any other income. If the level is sufficient to meet a person's basic needs (i.e., at or above the poverty line), it is considered a ''full basic income''; if it is less than that amount, it is called a ''partial basic income''. As of 2025, no country has implemented a full UBI system, but two countries—Mongolia and Iran—have had a partial UBI in the past. There have been Universal basic income pilots, numerous pilot projects, and the idea Universal basic income around the world, is discussed in many countries. Some have labelled UBI as utopian du ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1997 Canadian Federal Budget

The Canadian federal budget for fiscal year 1997–98 was presented by Minister of Finance Paul Martin in the House of Commons of Canada on 18 February 1997. It is the last budget of the 35th Canadian Parliament and the last budget before the 1997 Canadian federal election. The budget's unofficial subtitle is ''Building the Future for Canadians'' (and for the first time the subtitle is used on the cover page of all budget documents). Taxes Personal income taxes The budget focused on increased support for education, healthcare and childcare-related expenses. Tax measures for students * Indefinite carry-forward for Tuition and Education Tax Credit for all tax credits incurred in 1997 and after; * Increase in the Education Tax Credit: from $100 annually in 1996 to $150 in 1997 and $200 in 1998 and subsequent years; * The list of expenses eligible for the tuition tax credit is expanded to include mandatory ancillary fees (except student association fees); * The first $500 of sc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Credits And Benefits In Canada

A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures collectively or to regulate and reduce negative externalities. Tax compliance refers to policy actions and individual behavior aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax relief. The first known taxation occurred in Ancient Egypt around 3000–2800 BC. Taxes consist of direct or indirect taxes and may be paid in money or as labor equivalent. All countries have a tax system in place to pay for public, common societal, or agreed national needs and for the functions of government. Some countries levy a flat percentage rate of taxation on personal annual income, but most scale taxes are progressive based on brackets of yearly income amounts. Most countries charge a tax on an individual's income and corporate income. Count ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In Canada

In Canada, taxation is a prerogative shared between the federal government and the various provincial and territorial legislatures. Legislation Under the ''Constitution Act, 1867'', taxation powers are vested in the Parliament of Canada under s. 91(3) for: The provincial legislatures have a more restricted authority under ss. 92(2) and 92(9) for: In turn, the provincial legislatures have authorized municipal councils to levy specific types of direct tax, such as property tax. The powers of taxation are circumscribed by ss. 53 and 54 (both extended to the provinces by s. 90), and 125, which state: Nature of the taxation power in Canada Since the 1930 Supreme Court of Canada ruling in ''Lawson v. Interior Tree Fruit and Vegetables Committee of Direction'', taxation is held to consist of the following characteristics: :* it is enforceable by law; :* imposed under the authority of the legislature; :* levied by a public body; and :* intended for a public purpose. In order ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Globe And Mail

''The Globe and Mail'' is a Newspapers in Canada, Canadian newspaper printed in five cities in Western Canada, western and central Canada. With a weekly readership of more than 6 million in 2024, it is Canada's most widely read newspaper on weekdays and Saturdays, although it falls slightly behind the ''Toronto Star'' in overall weekly circulation because the ''Star'' publishes a Sunday edition, whereas the ''Globe'' does not. ''The Globe and Mail'' is regarded by some as Canada's "newspaper of record". ''The Globe and Mail''s predecessors, ''The Globe (Toronto newspaper), The Globe'' and ''The Daily Mail and Empire'' were both established in the 19th century. The former was established in 1844, while the latter was established in 1895 through a merger of ''The Toronto Mail'' and ''The Empire (Toronto), The Empire''. In 1936, ''The Globe'' and ''The Mail and Empire'' merged to form ''The Globe and Mail''. The newspaper was acquired by FP Publications in 1965, who later sold the p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Guaranteed Minimum Income

Guaranteed minimum income (GMI), also called minimum income (or mincome for short), is a social-welfare spending, welfare system that guarantees all citizens or families an income sufficient to live on, provided that certain eligibility conditions are met, typically: citizenship and that the person in question does not already receive a minimum level of income to live on. The primary goal of a guaranteed minimum income is poverty reduction, reduction of poverty. Under more unconditional requirements, when citizenship is the sole qualification, the program becomes a ''universal basic income'' (UBI) system. Unlike a guaranteed minimum income, UBI does not typically take into account what a recipient already earns before receiving a UBI. A form of guaranteed minimum income that considers income as a criterion is the negative income tax. In this system, only individuals earning below a certain threshold receive subsidies. Elements A system of guaranteed minimum income can consist of s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Child Benefit

Child benefit or children's allowance is a social security payment which is distributed to the parents or guardians of children, teenagers and in some cases, young adult (psychology), young adults. Countries operate different versions of the benefit. In most child benefit is means-testing, means-tested and the amount paid is usually dependent on the number of children. Conditions for payment A number of conditional cash transfer programs in Latin America and Africa link payment to the receivers' actions, such as enrolling children into schools, and health check-ups and vaccinations. In the UK, in 2011 CentreForum proposed an additional child benefit dependent on parenting activities. Australia In Australia, the system of child benefit payments, once termed child endowment and currently called Social Security (Australia)#Family Tax benefit, Family Tax Benefit, is income tested and linked to the Income tax in Australia#Family Tax Benefit, Australian Income tax system. It can be clai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Basic Income

Universal basic income (UBI) is a social welfare proposal in which all citizens of a given population regularly receive a minimum income in the form of an unconditional transfer payment, i.e., without a means test or need to perform Work (human activity), work. In contrast, a ''guaranteed minimum income'' is paid only to those who do not already receive an income that is enough to live on. A UBI would be received independently of any other income. If the level is sufficient to meet a person's basic needs (i.e., at or above the poverty line), it is considered a ''full basic income''; if it is less than that amount, it is called a ''partial basic income''. As of 2025, no country has implemented a full UBI system, but two countries—Mongolia and Iran—have had a partial UBI in the past. There have been Universal basic income pilots, numerous pilot projects, and the idea Universal basic income around the world, is discussed in many countries. Some have labelled UBI as utopian du ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

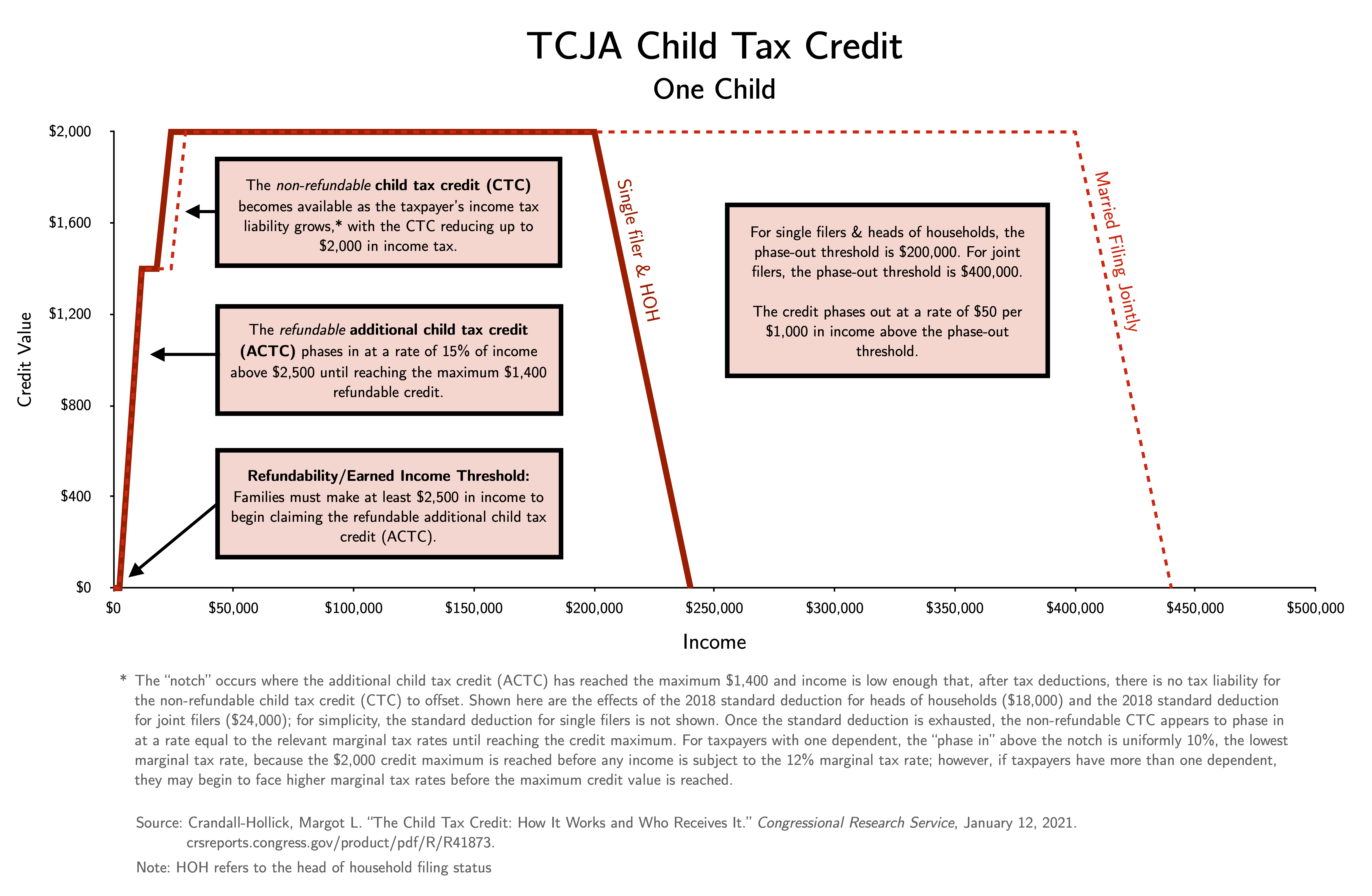

Child Tax Credit (United States)

The United States federal child tax credit (CTC) is a partially-refundable tax credit for parents with Dependant, dependent children. It provides $2,000 in tax relief per qualifying child, with up to $1,600 of that Tax credit#Refundable vs non Refundable, refundable (subject to a refundability threshold, phase-in and phase-out). In 2021, following the passage of the American Rescue Plan Act of 2021, it was temporarily raised to $3,600 per child under the age of 6 and $3,000 per child between the ages of 6 and 17; it was also made fully-refundable and half was paid out as monthly benefits. The CTC is scheduled to revert to a $1,000 credit after 2025. The CTC was estimated to have lifted about 3 million children out of poverty in 2016. A Columbia University study estimated that the expansion of the CTC in the American Rescue Plan Act, 2021 American Rescue Plan Act reduced child poverty by an additional 26%, and would have decreased child poverty by an additional 40% had all eligible ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2010 Canadian Federal Budget

The Canadian federal budget for the 2010–11 fiscal year (April 1, 2010 – March 31, 2011) was presented to the House of Commons of Canada by Finance Minister Jim Flaherty on March 4, 2010 after returning from a two-month prorogued parliament. Areas of direction *$3.2 billion in personal income tax relief. *Over $4 billion in actions to create and protect jobs. *$7.7 billion in infrastructure stimulus to create jobs. *Nearly $2 billion to help create the "Economy of Tomorrow" *$2.2 billion to support industries and communities. * Fiscal spending of $1.6 billion on unemployment benefits and $1 billion in new skills and training programs. * Youth-related spending of $108 million During the budget speech on 4 March 2010, Flaherty announced the use of a polymer substrate for the upcoming Frontier Series of banknotes of the Canadian dollar and that future versions of the loonie ($1 coin) and toonie ($2 coin) would be made of steel instead ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Canada Revenue Agency

The Canada Revenue Agency (CRA; ; ) is the revenue service of the Government of Canada, Canadian federal government, and most Provinces and territories of Canada, provincial and territorial governments. The CRA collects Taxation in Canada, taxes, administers tax law and tax policy, policy, and delivers Welfare spending, benefit programs and tax credits. Legislation administered by the CRA includes the ''Income Tax Act,'' parts of the ''Excise Tax Act'', and parts of laws relating to the Canada Pension Plan, employment insurance (EI), tariffs and Duty (tax), duties. The agency also oversees the registration of Canadian Charity Law, charities in Canada, and enforces much of the country's tax laws. From 1867 to 1999, tax services and programs were administered by the Department of National Revenue, otherwise known as Revenue Canada. In 1999, Revenue Canada was reorganized into the Canada Customs and Revenue Agency (CCRA). In 2003, the Canada Border Services Agency (CBSA) was created ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stephen Harper

Stephen Joseph Harper (born April 30, 1959) is a Canadian politician who served as the 22nd prime minister of Canada from 2006 to 2015. He is to date the only prime minister to have come from the modern-day Conservative Party of Canada, serving as the party's first leader from 2004 to 2015. Since 2018, he has also been the chairman of the International Democracy Union. Harper studied economics, earning a bachelor's degree in 1985 and a master's degree in 1991 at the University of Calgary. He was one of the founders of the Reform Party of Canada and was first elected in 1993 in Calgary West. He did not seek re-election in the 1997 federal election, instead joining and later leading the National Citizens Coalition, a conservative lobbyist group. In 2002, he succeeded Stockwell Day as leader of the Canadian Alliance, the successor to the Reform Party, and returned to parliament as leader of the Official Opposition. In 2003, Harper negotiated the merger of the Canadian Al ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |