A tax haven is a term, often used pejoratively, to describe a place with very low tax rates for

non-domiciled investors, even if the official rates may be higher.

In some older definitions, a tax haven also offers

financial secrecy.

However, while countries with high levels of secrecy but also high rates of taxation, most notably the United States and Germany in the

Financial Secrecy Index

The Financial Secrecy Index (FSI) is the report published by the advocacy organization Tax Justice Network (TJN) which ranks countries by ''financial secrecy indicators'', weighted by the economic flows of each country.

It looks at how wealt ...

(FSI) rankings, can be featured in some tax haven lists, they are often omitted from lists for political reasons or through lack of subject matter knowledge. In contrast, countries with lower levels of secrecy but also low "effective" rates of taxation, most notably Ireland in the FSI rankings, appear in most .

The consensus on ''effective tax rates'' has led academics to note that the term "tax haven" and "

offshore financial centre" are almost synonymous.

In reality, many offshore financial centers do not have harmful tax practices and are at the forefront among financial centers regarding AML practices and international tax reporting.

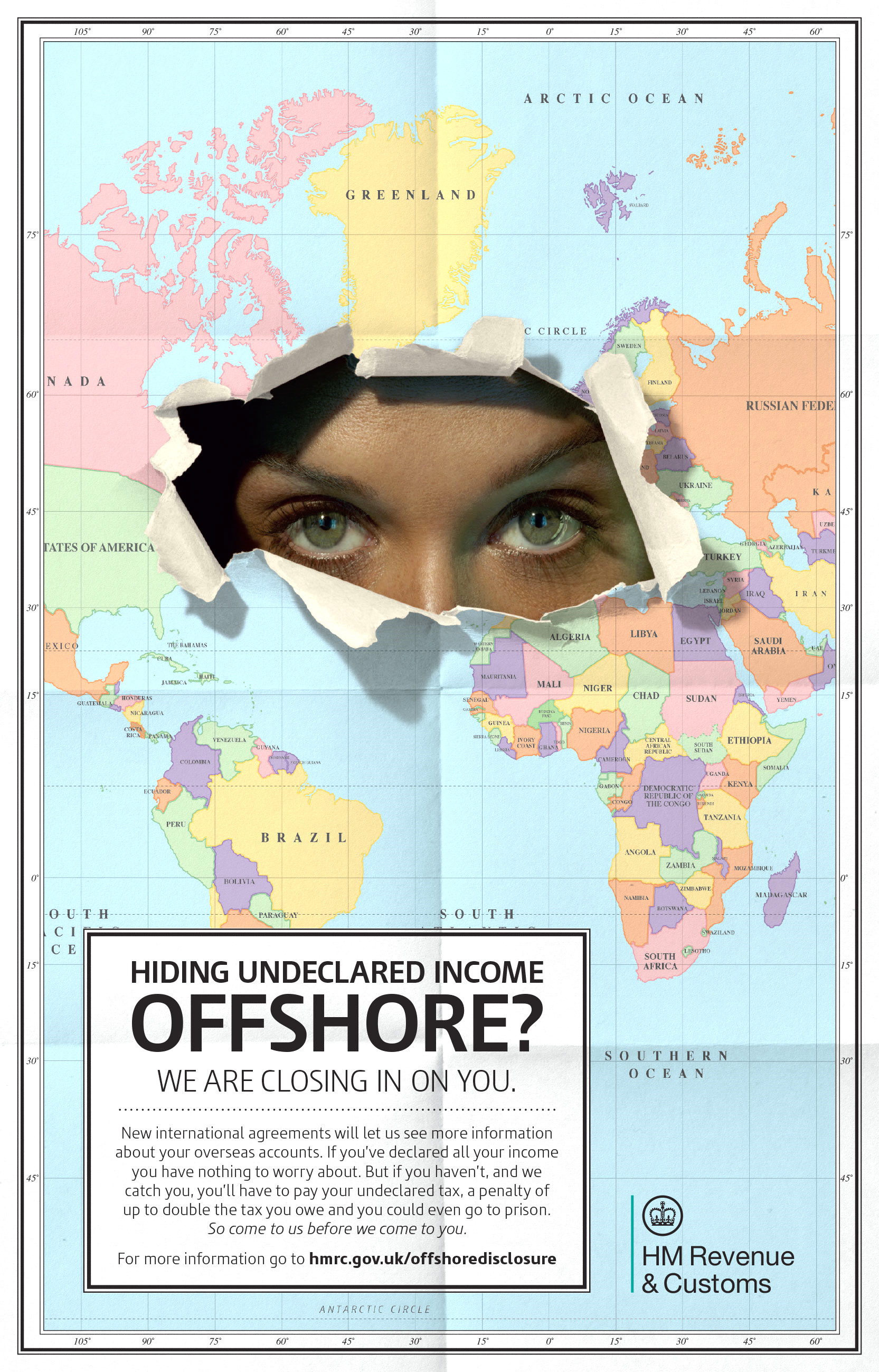

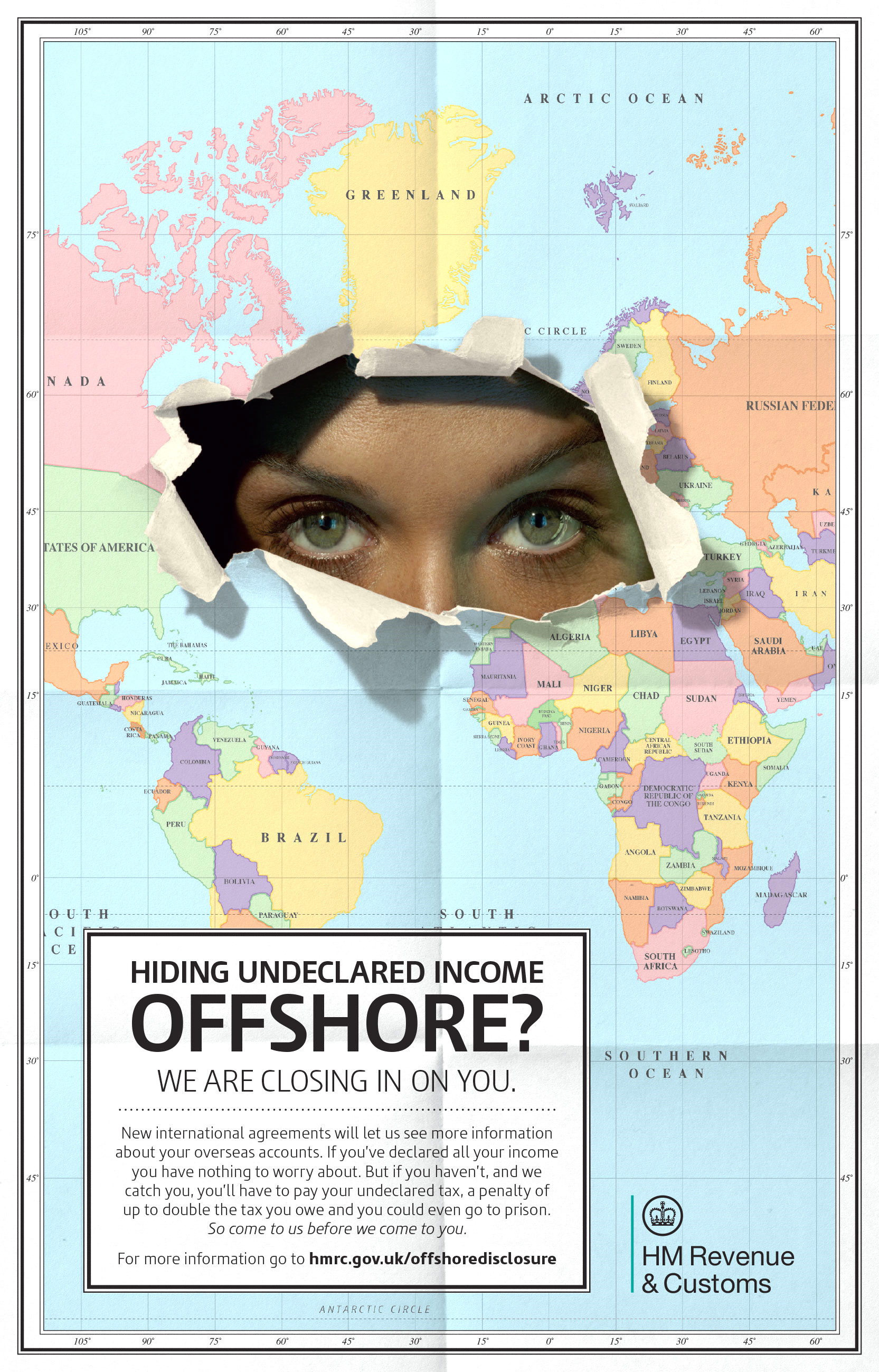

Developments since the early 21st century have substantially reduced the ability of individuals or corporations to use tax havens for

tax evasion

Tax evasion or tax fraud is an illegal attempt to defeat the imposition of taxes by individuals, corporations, trusts, and others. Tax evasion often entails the deliberate misrepresentation of the taxpayer's affairs to the tax authorities to red ...

(illegal non-payment of taxes owed). These include the end of banking secrecy in many jurisdictions including

Switzerland

Switzerland, officially the Swiss Confederation, is a landlocked country located in west-central Europe. It is bordered by Italy to the south, France to the west, Germany to the north, and Austria and Liechtenstein to the east. Switzerland ...

following the passing of the US

Foreign Account Tax Compliance Act

The Foreign Account Tax Compliance Act (FATCA) is a 2010 U.S. federal law requiring all non-U.S. foreign financial institutions (FFIs) to search their records for customers with indicia of a connection to the U.S., including indications in r ...

and the adoption by most countries, including typical tax havens, of the

Common Reporting Standard

The Common Reporting Standard (CRS) is an information standard for the Automatic Exchange Of Information (AEOI) regarding financial accounts on a global level, between tax authorities, which the Organisation for Economic Co-operation and Develo ...

(CRS) ŌĆō a multilateral automatic taxpayer data exchange agreement initiated by the

OECD

The Organisation for Economic Co-operation and Development (OECD; , OCDE) is an international organization, intergovernmental organization with 38 member countries, founded in 1961 to stimulate economic progress and international trade, wor ...

. CRS countries require banks and other entities to identify the residence of account holders, beneficial owners of corporate entities and record yearly account balances and communicate such information to local tax agencies, which will report back to tax agencies where account holders or beneficial owners of corporations reside. CRS intends to end offshore financial secrecy and

tax evasion

Tax evasion or tax fraud is an illegal attempt to defeat the imposition of taxes by individuals, corporations, trusts, and others. Tax evasion often entails the deliberate misrepresentation of the taxpayer's affairs to the tax authorities to red ...

giving tax agencies knowledge to tax offshore income and assets. However, huge and complex corporations, like

multinationals, can still shift profits to

corporate tax havens using intricate schemes.

Traditional tax havens, like

Jersey

Jersey ( ; ), officially the Bailiwick of Jersey, is an autonomous and self-governing island territory of the British Islands. Although as a British Crown Dependency it is not a sovereign state, it has its own distinguishing civil and gov ...

, are open to zero rates of taxation, and as a consequence, they have few bilateral

tax treaties

A tax treaty, also called double tax agreement (DTA) or double tax avoidance agreement (DTAA), is an agreement between two countries to avoid or mitigate double taxation. Such treaties may cover a range of taxes including income taxes, inheritance ...

. Modern

corporate tax haven

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly due ...

s have non-zero official (or "headline") rates of taxation and high levels of

OECD

The Organisation for Economic Co-operation and Development (OECD; , OCDE) is an international organization, intergovernmental organization with 38 member countries, founded in 1961 to stimulate economic progress and international trade, wor ...

compliance, and thus have large networks of bilateral tax treaties. However, their

base erosion and profit shifting (BEPS) toolsŌĆösuch as ample opportunities to render income exempt from tax, for instanceŌĆöenable corporations and non-domiciled investors to achieve ''de facto'' tax rates closer to zero, not just in the haven but in all countries with which the haven has tax treaties; thereby putting them on tax haven lists. According to modern studies, the include corporate-focused havens like the

Netherlands

, Terminology of the Low Countries, informally Holland, is a country in Northwestern Europe, with Caribbean Netherlands, overseas territories in the Caribbean. It is the largest of the four constituent countries of the Kingdom of the Nether ...

,

Singapore

Singapore, officially the Republic of Singapore, is an island country and city-state in Southeast Asia. The country's territory comprises one main island, 63 satellite islands and islets, and one outlying islet. It is about one degree ...

, the

Republic of Ireland

Ireland ( ), also known as the Republic of Ireland (), is a country in Northwestern Europe, north-western Europe consisting of 26 of the 32 Counties of Ireland, counties of the island of Ireland, with a population of about 5.4 million. ...

, and the

United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotlan ...

; while

Luxembourg

Luxembourg, officially the Grand Duchy of Luxembourg, is a landlocked country in Western Europe. It is bordered by Belgium to the west and north, Germany to the east, and France on the south. Its capital and most populous city, Luxembour ...

,

Hong Kong

Hong Kong)., Legally Hong Kong, China in international treaties and organizations. is a special administrative region of China. With 7.5 million residents in a territory, Hong Kong is the fourth most densely populated region in the wor ...

, the

Cayman Islands

The Cayman Islands () is a self-governing British Overseas Territories, British Overseas Territory, and the largest by population. The territory comprises the three islands of Grand Cayman, Cayman Brac and Little Cayman, which are located so ...

,

Bermuda

Bermuda is a British Overseas Territories, British Overseas Territory in the Atlantic Ocean, North Atlantic Ocean. The closest land outside the territory is in the American state of North Carolina, about to the west-northwest.

Bermuda is an ...

, the

British Virgin Islands

The British Virgin Islands (BVI), officially the Virgin Islands, are a British Overseas Territories, British Overseas Territory in the Caribbean, to the east of Puerto Rico and the United States Virgin Islands, US Virgin Islands and north-west ...

, and Switzerland feature as both major traditional tax havens and major corporate tax havens. Corporate tax havens often serve as

"conduits" to traditional tax havens.

The use of tax havens results in a loss of tax revenues to countries that are not tax havens. Estimates of the of taxes avoided vary, but the most credible have a range of US$100-250 billion per annum.

In addition, capital held in tax havens can permanently leave the tax base (base erosion). Estimates of capital held in tax havens also vary: the most credible estimates are between US$7-10 trillion (up to 10% of global assets).

[ The harm of traditional and corporate tax havens has been particularly noted in developing nations, where tax revenues are needed to build infrastructure.]Celtic Tiger

The "Celtic Tiger" () is a term referring to the economy of the Republic of Ireland, economy of Ireland from the mid-1990s to the late 2000s, a period of rapid real economic growth fuelled by foreign direct investment. The boom was dampened by ...

, and the subsequent financial crisis in 2009-13, is an example.IMF

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by 191 member countries, with headquarters in Washington, D.C. It is regarded as the global lender of la ...

projects) had been on common standards, transparency and data sharing.Tax Cuts and Jobs Act of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs ...

("TCJA") GILTI-BEAT-FDII tax regimes and move to a hybrid "territorial" tax system, and proposed EU Digital Services Tax regime, and EU Common Consolidated Corporate Tax Base).[

]

History

Overview

While areas of low taxation are recorded in Ancient Greece, tax academics identify what we know as tax havens as being a modern phenomenon,Leon Abbett

Leon Abbett (October 8, 1836December 4, 1894) was an American Democratic Party (United States), Democratic Party politician and lawyer who served two nonconsecutive terms as the 26th Governor of New Jersey from 1884 to 1887 and 1890 to 1893. His ...

, backed a plan by a New York lawyer, Mr. Dill, to create a more liberal regime for establishing corporate structures, including the availability of "off-the-shelf companies" (but not non-resident companies). Delaware followed with the General Incorporation Act in 1898, on the basis of lobbying from other New York lawyers. Because of the restrictive incorporation regime in the Anglo-Saxon world as a result of the South Sea Bubble

South is one of the cardinal directions or compass points. The direction is the opposite of north and is perpendicular to both west and east.

Etymology

The word ''south'' comes from Old English ''s┼½├Š'', from earlier Proto-Germanic ''*sun├Ša ...

, New Jersey and Delaware were successful, and though not explicitly tax havens (e.g. US federal and state taxes applied), many future tax havens would copy their "liberal" incorporation regimes.World War I

World War I or the First World War (28 July 1914 ŌĆō 11 November 1918), also known as the Great War, was a World war, global conflict between two coalitions: the Allies of World War I, Allies (or Entente) and the Central Powers. Fighting to ...

.Bermuda

Bermuda is a British Overseas Territories, British Overseas Territory in the Atlantic Ocean, North Atlantic Ocean. The closest land outside the territory is in the American state of North Carolina, about to the west-northwest.

Bermuda is an ...

sometimes claims to have been the first tax haven based upon the creation of the first offshore companies

The term "offshore company" or "offshore corporation" is used in at least two distinct and different ways. An offshore company may be a reference to:

* a company, Corporate group, group or sometimes a division thereof, which engages in offshorin ...

legislation in 1935 by the newly created law firm of Conyers Dill & Pearman. However, most tax academics identify the Zurich-Zug-Liechtenstein triangle as the first "tax haven hub" created during the mid-1920s.Aktiengesellschaft

(; abbreviated AG ) is a German language, German word for a corporation limited by Share (finance), share ownership (i.e., one which is owned by its shareholders) whose shares may be traded on a stock market. The term is used in Germany, Austria ...

''/'' Societ├® Anonyme'' and other brass plate companies.Sol Picciotto

Sol Picciotto (born 1942) is a British academic, emeritus professor of law at Lancaster University.

Life

Sol Picciotto was born in Aleppo, Syria in 1942, of Jewish parents. His family left Syria in 1947 to 1948, and he was educated at Manchester ...

noted the creation of such "non-resident" companies was "a loophole which, in a sense, made Britain a tax haven". The ruling applied to the British Empire, including Bermuda, Barbados, and the Cayman Islands.Tangier International Zone

The Tangier International Zone (; ; ) was a international zone centered on the city of Tangier, Morocco, which existed from 1925 until its reintegration into independent Morocco in 1956, with interruption during the Spanish occupation of Tang ...

was an extreme case of tax leniency and banking secrecy in the period following its wartime suspension, but that was brought to an end in 1960 as a consequence of Moroccan independence

The Revolution of the King and the People () was a Moroccan anti-colonial national liberation movement with the goal of ending the French and Spanish protectorates in Morocco in order to break free from colonial rule. The name refers to the ...

. London's position as a global financial centre

A financial centre (financial center in American English) or financial hub is a location with a significant concentration of commerce in financial services.

The commercial activity that takes place in a financial centre may include banking, ...

for these OFCs was secured when the Bank of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the Kingdom of England, English Government's banker and debt manager, and still one ...

ruled in 1957 that transactions executed by British banks on behalf of a lender and borrower who were not located in the UK, were not to be officially viewed as having taken place in the UK for regulatory or tax purposes, even though the transaction was only ever recorded as taking place in London.Norfolk Island

Norfolk Island ( , ; ) is an States and territories of Australia, external territory of Australia located in the Pacific Ocean between New Zealand and New Caledonia, directly east of Australia's Evans Head, New South Wales, Evans Head and a ...

(1966), a self-governing external territory of Australia. It was followed by Vanuatu (1970ŌĆō71), Nauru (1972), the Cook Islands (1981), Tonga (1984), Samoa (1988), the Marshall Islands (1990), and Nauru (1994).tax inversion

A tax inversion or corporate tax inversion is a form of tax avoidance where a corporation restructures so that the current parent is replaced by a foreign parent, and the original parent company becomes a subsidiary of the foreign parent, thus mov ...

to Panama.Double Irish

The Double Irish arrangement was a base erosion and profit shifting (BEPS) corporate tax avoidance tool used mainly by United States multinationals since the late 1980s to avoid corporate taxation on non-U.S. profits. (The US was one of a sma ...

BEPS tool as early as 1991. US tax academic James R. Hines Jr. showed in 1994 that US corporations were achieving effective rates of taxation of circa 4% in corporate-focused OECD tax havens like Ireland.

Notable events

* 1929: British courts rule in ''Egyptian Delta Land and Investment Co. Ltd. V. Todd.'' that a British-registered company with no business activities in Britain is not liable to British taxation. Sol Picciotto

Sol Picciotto (born 1942) is a British academic, emeritus professor of law at Lancaster University.

Life

Sol Picciotto was born in Aleppo, Syria in 1942, of Jewish parents. His family left Syria in 1947 to 1948, and he was educated at Manchester ...

noted the creation of such "non-resident" companies was "a loophole which, in a sense, made Britain a tax haven". The ruling applied to the British Empire, including Bermuda, Barbados, and the Cayman Islands.tax inversion

A tax inversion or corporate tax inversion is a form of tax avoidance where a corporation restructures so that the current parent is replaced by a foreign parent, and the original parent company becomes a subsidiary of the foreign parent, thus mov ...

as McDermott International

McDermott International, Ltd provides engineering and construction services to the energy industry. Operating in over 54 countries, McDermott has more than 30,000 employees, as well as a fleet of specialty marine construction vessels and fabri ...

moves from Texas

Texas ( , ; or ) is the most populous U.S. state, state in the South Central United States, South Central region of the United States. It borders Louisiana to the east, Arkansas to the northeast, Oklahoma to the north, New Mexico to the we ...

to a tax haven, Panama.IMF

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by 191 member countries, with headquarters in Washington, D.C. It is regarded as the global lender of la ...

define an offshore financial centre (OFC) with a list of 42ŌĆō46 OFCs using a qualitative list of criteria;American Jobs Creation Act of 2004

The American Jobs Creation Act of 2004 () was a federal tax act that repealed the export tax incentive (ETI), which had been declared illegal by the World Trade Organization several times and sparked retaliatory tariffs by the European Union. I ...

(AJCA) with IRS Section 7874 that effectively end naked inversions by US corporations to Caribbean tax havens.Tax Justice Network

The Tax Justice Network (TJN) is a British advocacy group consisting of a coalition of researchers and activists with a shared concern about tax avoidance, tax competition, and tax havens.

Activity

Research

The TJN has reported on the OECD ...

introduced the Financial Secrecy Index

The Financial Secrecy Index (FSI) is the report published by the advocacy organization Tax Justice Network (TJN) which ranks countries by ''financial secrecy indicators'', weighted by the economic flows of each country.

It looks at how wealt ...

("FSI") and the term "secrecy jurisdiction",Medtronic

Medtronic plc is an American-Irish medical device company. The company's legal and executive headquarters are in Republic of Ireland, Ireland, while its operational headquarters are in Minneapolis, Minneapolis, Minnesota. Medtronic rebased to I ...

completes the largest tax inversion in history in a US$48 billion merger with Covidien plc in Ireland, while Apple Inc.

Apple Inc. is an American multinational corporation and technology company headquartered in Cupertino, California, in Silicon Valley. It is best known for its consumer electronics, software, and services. Founded in 1976 as Apple Comput ...

complete the largest hybrid-tax inversion in history moving US$300 billion of intellectual property

Intellectual property (IP) is a category of property that includes intangible creations of the human intellect. There are many types of intellectual property, and some countries recognize more than others. The best-known types are patents, co ...

to Ireland (called leprechaun economics); by 2016, the US Treasury tighten the inversion rules, causing Pfizer to abort their US$160 billion merger with Allergan plc.University of Amsterdam

The University of Amsterdam (abbreviated as UvA, ) is a public university, public research university located in Amsterdam, Netherlands. Established in 1632 by municipal authorities, it is the fourth-oldest academic institution in the Netherlan ...

's CORPNET group using a purely quantitive approach, splits the understanding of OFCs into Conduit OFCs and Sink OFCs. CORPNET's lists of the top five Conduit OFCs and top five Sink OFCs, matched 9 of the top 10 havens in Hines' 2010 list, only differing in the United Kingdom, which only transformed their tax code in 2009ŌĆō12.EU Commission

The European Commission (EC) is the primary executive arm of the European Union (EU). It operates as a cabinet government, with a number of members of the Commission ( directorial system, informally known as "commissioners") corresponding t ...

produces its first formal list of tax havens with 17 countries on its 2017 blacklist and 47 on its 2017 greylist;Gabriel Zucman

Gabriel Zucman (born 30 October 1986) is a French economist who is currently an associate professor of public policy and economics at the University of California, BerkeleyŌĆśs Goldman School of Public Policy, Chaired Professor at the Paris Sch ...

(''et alia'') estimates ''aggregate'' corporate "profit shifting" (i.e. BEPS) is shielding over US$250 billion per year from taxes.European Parliament

The European Parliament (EP) is one of the two legislative bodies of the European Union and one of its seven institutions. Together with the Council of the European Union (known as the Council and informally as the Council of Ministers), it ...

votes to accept a report by 505 votes in favour to 63 against, identifying five "EU tax havens" that should be included on the EU Commission

The European Commission (EC) is the primary executive arm of the European Union (EU). It operates as a cabinet government, with a number of members of the Commission ( directorial system, informally known as "commissioners") corresponding t ...

list of tax havens.

Definitions

Context

There is no established consensus regarding a specific definition of what constitutes a tax haven. This is the conclusion from non-governmental organisations

A non-governmental organization (NGO) is an independent, typically nonprofit organization that operates outside government control, though it may get a significant percentage of its funding from government or corporate sources. NGOs often focus ...

, such as the Tax Justice Network

The Tax Justice Network (TJN) is a British advocacy group consisting of a coalition of researchers and activists with a shared concern about tax avoidance, tax competition, and tax havens.

Activity

Research

The TJN has reported on the OECD ...

in 2018,Government Accountability Office

The United States Government Accountability Office (GAO) is an independent, nonpartisan government agency within the legislative branch that provides auditing, evaluative, and investigative services for the United States Congress. It is the s ...

,

Academic non-quantitative (1994ŌĆō2016)

One of the first ,Dhammika Dharmapala

Dhammika Dharmapala (born 1969/1970) is an economist who is the Paul H. and Theo Leffman Professor of Law at the University of Chicago Law School. He is known for his research into corporate tax avoidance, corporate use of tax havens, and the cor ...

.

OECDŌĆōIMF (1998ŌĆō2018)

In April 1998, the OECD produced a definition of a tax haven, as meeting "three of four" criteria. It was produced as part of their "Harmful Tax Competition: An Emerging Global Issue" initiative. By 2000, when the OECD published their first list of tax havens,OECD

The Organisation for Economic Co-operation and Development (OECD; , OCDE) is an international organization, intergovernmental organization with 38 member countries, founded in 1961 to stimulate economic progress and international trade, wor ...

has never listed any of its 35 members as tax havens, Ireland, Luxembourg, the Netherlands, and Switzerland are sometimes defined as "OECD tax havens".

In 2017, only Trinidad & Tobago met the 1998 OECD definition; that definition thus fell into disrepute.Financial Stability Forum

The Financial Stability Forum (FSF) was a group consisting of major national financial authorities such as finance ministries, central bankers, and international financial bodies. It was first convened in April 1999 in Washington. At the 2009 G20 ...

(or FSF) defined the related concept of an offshore financial centre (or OFC), which the IMF adopted in June 2000, producing a list of 46 OFCs.

Academic quantitative (2010ŌĆō2018)

In October 2010, Hines published a list of 52 tax havens, which he had scaled quantitatively by analysing corporate investment flows.University of Amsterdam

The University of Amsterdam (abbreviated as UvA, ) is a public university, public research university located in Amsterdam, Netherlands. Established in 1632 by municipal authorities, it is the fourth-oldest academic institution in the Netherlan ...

's CORPNET group ignored any definition of a tax haven and focused on a purely quantitive approach, analysing 98 million global corporate connections on the Orbis database. CORPNET's lists of top five Conduit OFCs, and top five Sink OFCs, matched 9 of the top 10 havens in Hines' 2010 list, only differing in the United Kingdom, which only transformed their tax code in 2009ŌĆō12.Conduit and Sink OFCs

Conduit OFC and sink OFC is an empirical quantitative method of classifying corporate tax havens, offshore financial centres (OFCs) and tax havens.

Traditional methods for identifying tax havens analyse tax and legal structures for base eros ...

study split the understanding of a tax haven into two classifications:Gabriel Zucman

Gabriel Zucman (born 30 October 1986) is a French economist who is currently an associate professor of public policy and economics at the University of California, BerkeleyŌĆśs Goldman School of Public Policy, Chaired Professor at the Paris Sch ...

(''et alia'') published research that also ignored any definition of a tax haven, but estimated the corporate "profit shifting" (i.e. BEPS), and "enhanced corporate profitability" that Hines and Dharmapala had noted.Cayman Islands

The Cayman Islands () is a self-governing British Overseas Territories, British Overseas Territory, and the largest by population. The territory comprises the three islands of Grand Cayman, Cayman Brac and Little Cayman, which are located so ...

, as Google, Facebook and Apple do not appear on Orbis.

Related definitions

In October 2009, the Tax Justice Network

The Tax Justice Network (TJN) is a British advocacy group consisting of a coalition of researchers and activists with a shared concern about tax avoidance, tax competition, and tax havens.

Activity

Research

The TJN has reported on the OECD ...

introduced the Financial Secrecy Index

The Financial Secrecy Index (FSI) is the report published by the advocacy organization Tax Justice Network (TJN) which ranks countries by ''financial secrecy indicators'', weighted by the economic flows of each country.

It looks at how wealt ...

("FSI") and the term "secrecy jurisdiction",

Groupings

While tax havens are diverse and varied, tax academics sometimes recognise three major "groupings" of tax havens when discussing the history of their development:

European-related tax havens

As discussed in , the first recognized tax haven hub was the Zurich-Zug-Liechtenstein triangle created in the mid-1920s, later joined by Luxembourg in 1929.

British EmpireŌĆōrelated tax havens

Many tax havens are former or current dependencies of the United Kingdom and still use the same core legal structures.Crown Dependencies

The Crown Dependencies are three dependent territory, offshore island territories in the British Islands that are self-governing possessions of the The Crown, British Crown: the Bailiwick of Guernsey and the Jersey, Bailiwick of Jersey, both lo ...

(Guernsey, Isle of Man and Jersey), and the six Overseas Territories (Anguilla, Bermuda, British Virgin Islands, Cayman Islands, Gibraltar, Turks and Caicos Islands), "to identify the opportunities and challenges as offshore financial centres", for the HM Treasury

His Majesty's Treasury (HM Treasury or HMT), and informally referred to as the Treasury, is the Government of the United KingdomŌĆÖs economic and finance ministry. The Treasury is responsible for public spending, financial services policy, Tax ...

.

Emerging market-related tax havens

As discussed in , most of these tax havens date from the late 1960s and effectively copied the structures and services of the above groups.

Lists

Types of lists

Three main types of tax haven lists have been produced to date:

Top 10 tax havens

The post-2010 rise in quantitative techniques of identifying tax havens has resulted in a more stable list of the largest tax havens. Dharmapala

A ''dharmap─üla'' is a type of wrathful god in Buddhism. The name means "''dharma'' protector" in Sanskrit, and the ''dharmap─ülas'' are also known as the Defenders of the Justice (Dharma), or the Guardians of the Law. There are two kinds of ...

notes that as corporate BEPS flows dominate tax haven activity, these are mostly corporate tax havens.Gabriel Zucman

Gabriel Zucman (born 30 October 1986) is a French economist who is currently an associate professor of public policy and economics at the University of California, BerkeleyŌĆśs Goldman School of Public Policy, Chaired Professor at the Paris Sch ...

's June 2018 study also appear in the top ten lists of the two other quantitative studies since 2010. Four of the top five Conduit OFCs are represented; however, the UK only transformed its tax code in 2009ŌĆō2012.Apple

An apple is a round, edible fruit produced by an apple tree (''Malus'' spp.). Fruit trees of the orchard or domestic apple (''Malus domestica''), the most widely grown in the genus, are agriculture, cultivated worldwide. The tree originated ...

, Google

Google LLC (, ) is an American multinational corporation and technology company focusing on online advertising, search engine technology, cloud computing, computer software, quantum computing, e-commerce, consumer electronics, and artificial ...

and Facebook

Facebook is a social media and social networking service owned by the American technology conglomerate Meta Platforms, Meta. Created in 2004 by Mark Zuckerberg with four other Harvard College students and roommates, Eduardo Saverin, Andre ...

. In Q1 2015, Apple completed the largest BEPS action in history, when it shifted US$300 billion of IP to Ireland, which Nobel-prize economist Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American New Keynesian economics, New Keynesian economist who is the Distinguished Professor of Economics at the CUNY Graduate Center, Graduate Center of the City University of New York. He ...

called "leprechaun economics

Leprechaun economics () was a term coined by economist Paul Krugman to describe the 26.3 per cent rise in Irish 2015 Gross domestic product, GDP, later revised to 34.4 per cent, in a 12 July 2016 publication by the Central Statistics Office ( ...

". In September 2018, using TCJA repatriation tax data, the NBER listed the ''key tax havens'' as: "Ireland, Luxembourg, Netherlands, Switzerland, Singapore, Bermuda and heCaribbean havens".

(ŌĆĀ) Also appears as one of 5 Conduit OFCs (Ireland, Singapore, Switzerland, the Netherlands, and the United Kingdom), in CORPNET's 2017 research; or

(ŌĆĪ) Also appears as a Top 5 Sink OFC (British Virgin Islands, Luxembourg, Hong Kong, Jersey, Bermuda), in CORPNET's 2017 research.

(Δ) Identified on the first, and largest, OECD 2000 list of 35 tax havens (the OECD list only contained Trinidad & Tobago by 2017).tax inversion

A tax inversion or corporate tax inversion is a form of tax avoidance where a corporation restructures so that the current parent is replaced by a foreign parent, and the original parent company becomes a subsidiary of the foreign parent, thus mov ...

since 1982 (see here

Here may refer to:

Music

* ''Here'' (Adrian Belew album), 1994

* ''Here'' (Alicia Keys album), 2016

* ''Here'' (Cal Tjader album), 1979

* ''Here'' (Edward Sharpe album), 2012

* ''Here'' (Idina Menzel album), 2004

* ''Here'' (Merzbow album), ...

).

Top 20 tax havens

The longest list from ''Non-governmental, Quantitative'' research on tax havens is the University of Amsterdam CORPNET July 2017 Conduit and Sink OFCs

Conduit OFC and sink OFC is an empirical quantitative method of classifying corporate tax havens, offshore financial centres (OFCs) and tax havens.

Traditional methods for identifying tax havens analyse tax and legal structures for base eros ...

study, at 29 (5 Conduit OFCs and 25 Sink OFCs). The following are the 20 largest (5 Conduit OFCs and 15 Sink OFCs), which reconcile with other main lists as follows:

(*) Appears in as a in all three quantitative lists, Hines 2010, ITEP 2017 and Zucman 2018 (above); all nine such s are listed below.

(ŌÖŻ) Appears on the James Hines 2010 list of 52 tax havens; 17 of the 20 locations below, are on the James Hines 2010 list.

(Δ) Identified on the largest OECD 2000 list of 35 tax havens (the OECD list only contained Trinidad & Tobago by 2017); only four locations below were ever on an OECD list.

(ŌåĢ) Identified on the European Union's first 2017 list of 17 tax havens;Ireland

Ireland (, ; ; Ulster Scots dialect, Ulster-Scots: ) is an island in the North Atlantic Ocean, in Northwestern Europe. Geopolitically, the island is divided between the Republic of Ireland (officially Names of the Irish state, named Irelan ...

ŌĆō a major corporate tax haven, and ranked by some tax academics as the largest;Singapore

Singapore, officially the Republic of Singapore, is an island country and city-state in Southeast Asia. The country's territory comprises one main island, 63 satellite islands and islets, and one outlying islet. It is about one degree ...

ŌĆō the major corporate tax haven for Asia (APAC headquarters for most US technology firms), and key conduit to core Asian Sink OFCs, Hong Kong and Taiwan.Netherlands

, Terminology of the Low Countries, informally Holland, is a country in Northwestern Europe, with Caribbean Netherlands, overseas territories in the Caribbean. It is the largest of the four constituent countries of the Kingdom of the Nether ...

ŌĆō a major corporate tax haven,United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotlan ...

ŌĆō rising corporate tax haven after restructuring tax code in 2009ŌĆō12; 17 of the 24 Sink OFCs are current or former dependencies of the UK (see Sink OFC table).Switzerland

Switzerland, officially the Swiss Confederation, is a landlocked country located in west-central Europe. It is bordered by Italy to the south, France to the west, Germany to the north, and Austria and Liechtenstein to the east. Switzerland ...

ŌĆō both a major traditional tax haven (or Sink OFC), and a major corporate tax haven (or Conduit OFC), and strongly linked to major Sink OFC, Jersey.

* *ŌÖŻLuxembourg

Luxembourg, officially the Grand Duchy of Luxembourg, is a landlocked country in Western Europe. It is bordered by Belgium to the west and north, Germany to the east, and France on the south. Its capital and most populous city, Luxembour ...

ŌĆō one of the largest Sink OFCs in the world (a terminus for many corporate tax havens, especially Ireland and the Netherlands).

* *ŌÖŻHong Kong

Hong Kong)., Legally Hong Kong, China in international treaties and organizations. is a special administrative region of China. With 7.5 million residents in a territory, Hong Kong is the fourth most densely populated region in the wor ...

ŌĆō the "Luxembourg of Asia", and almost as large a Sink OFC as Luxembourg; tied to APAC's largest corporate tax haven, Singapore.

Sovereign (including de facto) states that feature mainly as traditional tax havens (but have non-zero tax rates):

* Taiwan

Taiwan, officially the Republic of China (ROC), is a country in East Asia. The main geography of Taiwan, island of Taiwan, also known as ''Formosa'', lies between the East China Sea, East and South China Seas in the northwestern Pacific Ocea ...

ŌĆō major traditional tax haven for APAC, and described by the Tax Justice Network

The Tax Justice Network (TJN) is a British advocacy group consisting of a coalition of researchers and activists with a shared concern about tax avoidance, tax competition, and tax havens.

Activity

Research

The TJN has reported on the OECD ...

as the "Switzerland of Asia".Malta

Malta, officially the Republic of Malta, is an island country in Southern Europe located in the Mediterranean Sea, between Sicily and North Africa. It consists of an archipelago south of Italy, east of Tunisia, and north of Libya. The two ...

ŌĆō an emerging tax haven inside the EU, which has been a target of wider media scrutiny.

Sovereign or sub-national states that are very traditional tax havens (i.e. explicit 0% rate of tax) include (fuller list in table opposite):

*ŌÖŻ╬öJersey

Jersey ( ; ), officially the Bailiwick of Jersey, is an autonomous and self-governing island territory of the British Islands. Although as a British Crown Dependency it is not a sovereign state, it has its own distinguishing civil and gov ...

(United Kingdom dependency),Isle of Man

The Isle of Man ( , also ), or Mann ( ), is a self-governing British Crown Dependency in the Irish Sea, between Great Britain and Ireland. As head of state, Charles III holds the title Lord of Mann and is represented by a Lieutenant Govern ...

'' (United Kingdom dependency), the "failing tax haven", not in the CORPNET study (discussed here

Here may refer to:

Music

* ''Here'' (Adrian Belew album), 1994

* ''Here'' (Alicia Keys album), 2016

* ''Here'' (Cal Tjader album), 1979

* ''Here'' (Edward Sharpe album), 2012

* ''Here'' (Idina Menzel album), 2004

* ''Here'' (Merzbow album), ...

), but included for completeness.)

*''Current British Overseas Territories

The British Overseas Territories (BOTs) or alternatively referred to as the United Kingdom Overseas Territories (UKOTs) are the fourteen dependent territory, territories with a constitutional and historical link with the United Kingdom that, ...

'', see table opposite, where 17 of the 24 Sink OFCs are current, or past, U.K. dependencies:

** *ŌÖŻ╬öBritish Virgin Islands

The British Virgin Islands (BVI), officially the Virgin Islands, are a British Overseas Territories, British Overseas Territory in the Caribbean, to the east of Puerto Rico and the United States Virgin Islands, US Virgin Islands and north-west ...

, the largest Sink OFC in the world and regularly appears alongside the Caymans and Bermuda (the Caribbean "triad") as a group.

** *ŌÖŻBermuda

Bermuda is a British Overseas Territories, British Overseas Territory in the Atlantic Ocean, North Atlantic Ocean. The closest land outside the territory is in the American state of North Carolina, about to the west-northwest.

Bermuda is an ...

, does feature as a U.S. corporate tax haven; only 2nd to Ireland as a destination for U.S. tax inversions.Cayman Islands

The Cayman Islands () is a self-governing British Overseas Territories, British Overseas Territory, and the largest by population. The territory comprises the three islands of Grand Cayman, Cayman Brac and Little Cayman, which are located so ...

, also features as a major U.S. corporate tax haven; 6th most popular destination for U.S. corporate tax inversions.Gibraltar

Gibraltar ( , ) is a British Overseas Territories, British Overseas Territory and British overseas cities, city located at the southern tip of the Iberian Peninsula, on the Bay of Gibraltar, near the exit of the Mediterranean Sea into the A ...

ŌĆō like the Isle of Man, has declined due to concerns, even by the U.K., over its practices.

* ŌÖŻMauritius

Mauritius, officially the Republic of Mauritius, is an island country in the Indian Ocean, about off the southeastern coast of East Africa, east of Madagascar. It includes the main island (also called Mauritius), as well as Rodrigues, Ag ...

ŌĆō has become a major tax haven for both Asian (especially India) and African economies, and now ranking 8th overall.

* Cura├¦ao

Cura├¦ao, officially the Country of Cura├¦ao, is a constituent island country within the Kingdom of the Netherlands, located in the southern Caribbean Sea (specifically the Dutch Caribbean region), about north of Venezuela.

Cura├¦ao includ ...

ŌĆō the Dutch dependency ranked 8th on Oxfam's tax haven list, and the 12th largest Sink OFC, and recently made the EU's greylist.

* ŌÖŻ╬öLiechtenstein

Liechtenstein (, ; ; ), officially the Principality of Liechtenstein ( ), is a Landlocked country#Doubly landlocked, doubly landlocked Swiss Standard German, German-speaking microstate in the Central European Alps, between Austria in the east ...

ŌĆō long-established very traditional European tax haven and just outside of the top 10 global Sink OFCs.

* ŌÖŻ╬öBahamas

The Bahamas, officially the Commonwealth of The Bahamas, is an archipelagic and island country within the Lucayan Archipelago of the Atlantic Ocean. It contains 97 per cent of the archipelago's land area and 88 per cent of its population. ...

ŌĆō acts as both a traditional tax haven (ranked 12th Sink OFC), and ranks 8th on the ITEP profits list (figure 4, page 16)Samoa

Samoa, officially the Independent State of Samoa and known until 1997 as Western Samoa, is an island country in Polynesia, part of Oceania, in the South Pacific Ocean. It consists of two main islands (Savai'i and Upolu), two smaller, inhabited ...

ŌĆō a traditional tax haven (ranked 14th Sink OFC), used to have one of the highest ''secrecy scores'' on the FSI, since reduced moderately.

Historic broad lists of tax havens

PostŌĆō2010 research on tax havens is focused on quantitative analysis (which can be ranked), and tends to ignore very small tax havens where data is limited as the haven is used for individual tax avoidance rather than corporate tax avoidance. The last credible broad unranked list of global tax havens is the James Hines 2010 list of 52 tax havens. It is shown below but expanded to 55 to include havens identified in the July 2017 Conduit and Sink OFCs

Conduit OFC and sink OFC is an empirical quantitative method of classifying corporate tax havens, offshore financial centres (OFCs) and tax havens.

Traditional methods for identifying tax havens analyse tax and legal structures for base eros ...

study that were not considered havens in 2010, namely the United Kingdom, Taiwan, and Cura├¦ao. The James Hines 2010 list contains 34 of the original 35 OECD tax havens;

(ŌĆĪ) Identified as one of the largest 24 Sinks

A sink (also known as ''basin'' in the UK) is a bowl-shaped plumbing fixture for washing hands, dishwashing, and other purposes. Sinks have a tap (faucet) that supplies hot and cold water and may include a spray feature to be used for faste ...

by CORPNET in 2017; the above list has 23 of the 24 (Guyana missing).

(ŌåĢ) Identified on the European Union's first 2017 list of 17 tax havens; the above list contains 8 of the 17.

(Δ) Identified on the first, and the largest, OECD 2000 list of 35 tax havens (the OECD list only contained Trinidad & Tobago by 2017); the above list contains 34 of the 35 (U.S. Virgin Islands missing).

Unusual cases

U.S. dedicated entities:

* Delaware

Delaware ( ) is a U.S. state, state in the Mid-Atlantic (United States), Mid-Atlantic and South Atlantic states, South Atlantic regions of the United States. It borders Maryland to its south and west, Pennsylvania to its north, New Jersey ...

(United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 ...

), a unique "onshore" specialised haven with strong secrecy laws and a liberal incorporation regime; however Federal and State tax apply (see ).

* Puerto Rico

; abbreviated PR), officially the Commonwealth of Puerto Rico, is a Government of Puerto Rico, self-governing Caribbean Geography of Puerto Rico, archipelago and island organized as an Territories of the United States, unincorporated territo ...

(United States), almost a corporate tax haven "concession" by the U.S., but which the Tax Cuts and Jobs Act of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs ...

mostly removed.

Major sovereign States that feature on financial secrecy lists (e.g. the Financial Secrecy Index

The Financial Secrecy Index (FSI) is the report published by the advocacy organization Tax Justice Network (TJN) which ranks countries by ''financial secrecy indicators'', weighted by the economic flows of each country.

It looks at how wealt ...

), but not on corporate tax haven or traditional tax haven lists, are:

* United States ŌĆō noted for secrecy, per the Financial Secrecy Index (see United States as a tax haven

In 2010, the United States implemented the Foreign Account Tax Compliance Act; the law required financial firms around the world to report accounts held by US citizens to the Internal Revenue Service.

The US on the other hand refused the Com ...

); makes a "controversial" appearance on some lists.Germany

Germany, officially the Federal Republic of Germany, is a country in Central Europe. It lies between the Baltic Sea and the North Sea to the north and the Alps to the south. Its sixteen States of Germany, constituent states have a total popu ...

ŌĆō similar to the U.S., Germany can be included on lists for its tax secrecy, per the Financial Secrecy Index.

Neither the U.S. nor Germany have appeared on any tax haven lists by the main academic leaders in tax haven research, namely James R. Hines Jr., Dhammika Dharmapala

Dhammika Dharmapala (born 1969/1970) is an economist who is the Paul H. and Theo Leffman Professor of Law at the University of Chicago Law School. He is known for his research into corporate tax avoidance, corporate use of tax havens, and the cor ...

, or Gabriel Zucman

Gabriel Zucman (born 30 October 1986) is a French economist who is currently an associate professor of public policy and economics at the University of California, BerkeleyŌĆśs Goldman School of Public Policy, Chaired Professor at the Paris Sch ...

. There are no known cases of foreign firms executing tax inversion

A tax inversion or corporate tax inversion is a form of tax avoidance where a corporation restructures so that the current parent is replaced by a foreign parent, and the original parent company becomes a subsidiary of the foreign parent, thus mov ...

s to the U.S. or Germany for tax purposes, a basic characteristic of a corporate tax haven.

Former tax havens

* Beirut

Beirut ( ; ) is the Capital city, capital and largest city of Lebanon. , Greater Beirut has a population of 2.5 million, just under half of Lebanon's population, which makes it the List of largest cities in the Levant region by populatio ...

, Lebanon

Lebanon, officially the Republic of Lebanon, is a country in the Levant region of West Asia. Situated at the crossroads of the Mediterranean Basin and the Arabian Peninsula, it is bordered by Syria to the north and east, Israel to the south ...

formerly had a reputation as the only tax haven in the Middle East

The Middle East (term originally coined in English language) is a geopolitical region encompassing the Arabian Peninsula, the Levant, Turkey, Egypt, Iran, and Iraq.

The term came into widespread usage by the United Kingdom and western Eur ...

. However, this changed after the Intra Bank crash of 1966, and the subsequent political and military deterioration of Lebanon dissuaded foreign use of the country as a tax haven.

* Liberia

Liberia, officially the Republic of Liberia, is a country on the West African coast. It is bordered by Sierra Leone to LiberiaŌĆōSierra Leone border, its northwest, Guinea to GuineaŌĆōLiberia border, its north, Ivory Coast to Ivory CoastŌĆōLib ...

had a prosperous ship registration industry. The series of bloody civil wars

A civil war is a war between organized groups within the same state (or country). The aim of one side may be to take control of the country or a region, to achieve independence for a region, or to change government policies.James Fearon"Iraq' ...

in the 1990s and early 2000s severely damaged confidence in the country. The fact that the ship registration business still continues is partly a testament to its early success, and partly a testament to moving the national shipping registry to New York, United States.

* The Tangier International Zone

The Tangier International Zone (; ; ) was a international zone centered on the city of Tangier, Morocco, which existed from 1925 until its reintegration into independent Morocco in 1956, with interruption during the Spanish occupation of Tang ...

had a short existence as a tax haven in the period between the end of effective control by the Spanish in 1945 until it was formally reunited with Morocco

Morocco, officially the Kingdom of Morocco, is a country in the Maghreb region of North Africa. It has coastlines on the Mediterranean Sea to the north and the Atlantic Ocean to the west, and has land borders with Algeria to AlgeriaŌĆōMorocc ...

in 1956.

* Some Pacific islands were tax havens but were curtailed by OECD demands for regulation and transparency in the late 1990s, on the threat of blacklisting. Vanuatu

Vanuatu ( or ; ), officially the Republic of Vanuatu (; ), is an island country in Melanesia located in the South Pacific Ocean. The archipelago, which is of volcanic origin, is east of northern Australia, northeast of New Caledonia, east o ...

's Financial Services commissioner said in May 2008 that his country would reform laws and cease being a tax haven. "We've been associated with this stigma for a long time and we now aim to get away from being a tax haven."

Scale

Overview

Estimating the financial scale of tax havens is complicated by their inherent lack of transparency.

Estimating the financial scale of tax havens is complicated by their inherent lack of transparency.[ Even jurisdictions that comply with OECD transparency requirements such as Ireland, Luxembourg, and the Netherlands, provide alternate secrecy tools (e.g. Trusts, QIAIFs and ]ULL

Ull or ULL may refer to: Organisations

* SK Ull, a Norwegian Nordic skiing club

* Non-Party List (), a short-lived political party in Liechtenstein

* Ullensaker/Kisa IL, a Norwegian sports club

* University of La Laguna, Canary Islands, Spain

* Un ...

s) that may be used for the secrecy of UBOs.

''Price of Offshore: Revisited'' (2012ŌĆō2014)

A notable study on the financial effect was ''Price of Offshore: Revisited'' in 2012ŌĆō2014, by former McKinsey & Company

McKinsey & Company (informally McKinsey or McK) is an American multinational strategy and management consulting firm that offers professional services to corporations, governments, and other organizations. Founded in 1926 by James O. McKinse ...

chief economist James S. Henry.Tax Justice Network

The Tax Justice Network (TJN) is a British advocacy group consisting of a coalition of researchers and activists with a shared concern about tax avoidance, tax competition, and tax havens.

Activity

Research

The TJN has reported on the OECD ...

(TJN), and as part of his analysis, chronicled the history of past financial estimates by various organisations.[

Henry used mainly global banking data from various regulatory sources to estimate that:]

''The Hidden Wealth of Nations'' (2015)

In 2015, French tax economist Gabriel Zucman published '' The Hidden Wealth of Nations'' which used global national accounts data to calculate the quantum of net foreign asset positions of rich countries which are unreported because they are located in tax havens. Zucman estimated that circa 8ŌĆō10% of the global financial wealth of households, or over US$7.6 trillion, was held in tax havens.[

Zucman followed up his 2015 book with several co-authored papers that focused on corporate use of tax havens, titled "The Missing Profits of Nations" (2016ŌĆō2018),][

A 2022 study by Zucman and co-authors estimated that 36% of the profits of multinational firms are shifted to tax havens.]

OECD/IMF reports (since 2007)

In 2007, the OECD estimated that capital held offshore amounted to between US$5 to 7 trillion, making up approximately 6ŌĆō8% of total global investments under management.[

In 2018, the IMF's quarterly journal '']Finance & Development

''Finance & Development'' is a quarterly journal published by the International Monetary Fund (the IMF).

The journal publishes analysis on issues related to the financial system, monetary policy, economic development, poverty reduction, and ot ...

'' published joint research between the IMF and tax academics titled, "Piercing the Veil", that estimated circa US$12 trillion in global corporate investment worldwide was "just phantom corporate investment" structured to avoid corporate taxation, and was concentrated in eight major locations.foreign direct investment

A foreign direct investment (FDI) is an ownership stake in a company, made by a foreign investor, company, or government from another country. More specifically, it describes a controlling ownership an asset in one country by an entity based i ...

(FDI) was "phantom", and that "Empty corporate shells in tax havens undermine tax collection in advanced, emerging market, and developing economies".

Incentives

Prosperity

In several research papers, James R. Hines Jr. showed that tax havens were typically small but well-governed nations and that being a tax haven had brought significant prosperity.

GDP-per-capita

Tax havens have high GDP-per-capita rankings, as their "headline" economic statistics are artificially inflated by the BEPS flows that add to the haven's GDP, but are not taxable in the haven.modified gross national income

Modified gross national income (also Modified GNI or GNI*) is a metric used by the Central Statistics Office (Ireland) to measure the Irish economy rather than Gross national income, GNI or GDP. GNI* is GNI minus the depreciation on Intellectual ...

, or GNI*.

The artificial inflation of GDP can attract underpriced foreign capital (who use the "headline" Debt-to-GDP metric of the haven), thus producing phases of stronger economic growth. ''Notes:''

''Notes:''

Acceptance

In 2018, noted tax haven economist, Gabriel Zucman

Gabriel Zucman (born 30 October 1986) is a French economist who is currently an associate professor of public policy and economics at the University of California, BerkeleyŌĆśs Goldman School of Public Policy, Chaired Professor at the Paris Sch ...

, showed that most corporate tax disputes are between high-tax jurisdictions, and not between high-tax and low-tax jurisdictions. Zucman (et alia) research showed that disputes with major havens such as Ireland, Luxembourg and the Netherlands, are actually quite rare.

Benefits

Promoters of growth

A controversial area of research into tax havens is the suggestion that tax havens actually promote global economic growth by solving perceived issues in the tax regimes of higher-taxed nations (e.g. the above discussion on the U.S. "worldwide" tax system). Important academic leaders in tax haven research, such as Hines, Dharmapala,foreign direct investment

A foreign direct investment (FDI) is an ownership stake in a company, made by a foreign investor, company, or government from another country. More specifically, it describes a controlling ownership an asset in one country by an entity based i ...

("FDI") that came from tax havens into higher-tax countries, had really originated from the higher-tax country,

U.S. tax receipts

A finding of the 1994 Hines-Rice paper, re-affirmed by others,check-the-box For United States income tax purposes, a business entity may elect to be treated either as a corporation or as other than a corporation. This entity classification election is made by filing IRS tax forms, Internal Revenue Service Form]8832 Absent f ...

" rules, and U.S. hostility to OECD attempts in curbing Ireland's BEPS tools,Council on Foreign Relations

The Council on Foreign Relations (CFR) is an American think tank focused on Foreign policy of the United States, U.S. foreign policy and international relations. Founded in 1921, it is an independent and nonpartisan 501(c)(3) nonprofit organi ...

, realised the scale of U.S. corporate use of tax havens:

''Tax justice'' groups interpreted Hines' research as the U.S. engaging in tax competition with higher-tax nations (i.e. the U.S. exchequer earning excess taxes at the expense of others). The 2017 TCJA seems to support this view with the U.S. exchequer being able to levy a 15.5% repatriation tax on over $1 trillion of untaxed offshore profits built up by U.S. multinationals with BEPS tools from non-U.S. revenues. Had these U.S. multinationals paid taxes on these non-U.S. profits in the countries in which they were earned, there would have been little further liability to U.S. taxation. Research by Zucman and Wright (2018) estimated that most of the TCJA repatriation benefit went to the shareholders of U.S. multinationals, and not the U.S. exchequer.Council of Economic Advisors

The Council of Economic Advisers (CEA) is a United States agency within the Executive Office of the President established in 1946, which advises the president of the United States on economic policy. The CEA provides much of the empirical resea ...

("CEA") in drafting the TCJA legislation in 2017, and advocating for moving to a hybrid "territorial" tax system framework.

Concepts

There are a number of notable concepts in relation to how individuals and corporates engage with tax havens:[''Tolley's Offshore Service'' (2006), ]

Captured state

Some authors on tax havens describe them as "captured states" by their offshore finance industry, suggesting the legal, taxation and other requirements of the professional service firms operating from the tax haven are given higher priority to any conflicting State needs.Amazon Inc

Amazon.com, Inc., doing business as Amazon, is an American Multinational corporation, multinational technology company engaged in e-commerce, cloud computing, online advertising, digital streaming, and artificial intelligence. Founded in 1994 ...

's Project Goldcrest tax structure, which showed how closely the State of Luxembourg worked with Amazon for over two years to help it avoid global taxes.

Preferential tax ruling

Preferential tax rulings (PTR) can be used by a jurisdiction for benign reasons, for example, tax incentives to encourage urban renewal. However, PTRs can also be used to provide aspects of tax regimes normally found in traditional tax havens.

Tax inversion

Corporations can move their legal headquarters from a higher-tax home jurisdiction to a tax haven by executing a tax inversion

A tax inversion or corporate tax inversion is a form of tax avoidance where a corporation restructures so that the current parent is replaced by a foreign parent, and the original parent company becomes a subsidiary of the foreign parent, thus mov ...

. A " naked tax inversion" is where the corporate had little prior business activities in the new location. The first tax inversion was the "naked inversion" of McDermott International

McDermott International, Ltd provides engineering and construction services to the energy industry. Operating in over 54 countries, McDermott has more than 30,000 employees, as well as a fleet of specialty marine construction vessels and fabri ...

to Panama in 1983.American Jobs Creation Act of 2004

The American Jobs Creation Act of 2004 () was a federal tax act that repealed the export tax incentive (ETI), which had been declared illegal by the World Trade Organization several times and sparked retaliatory tariffs by the European Union. I ...

.

Base erosion and profit shifting

Even when a corporation executes a tax inversion to a tax haven, it also needs to ''shift'' (or earnings strip) its untaxed profits to the new tax haven.Bermuda Black Hole

Bermuda black hole refers to base erosion and profit shifting (BEPS) tax avoidance schemes in which untaxed global profits end up in Bermuda, which is considered a tax haven. The term was most associated with US technology multinationals such as ...

) from 2004 to 2017.intellectual property

Intellectual property (IP) is a category of property that includes intangible creations of the human intellect. There are many types of intellectual property, and some countries recognize more than others. The best-known types are patents, co ...

(IP) accounting to ''shift'' profits between jurisdictions. The concept of a corporation charging its costs from one jurisdiction against its profits in another jurisdiction (i.e. transfer pricing

Transfer pricing refers to the rules and methods for pricing transactions within and between enterprises under common ownership or control. Because of the potential for cross-border controlled transactions to distort taxable income, tax authorit ...

) is well understood and accepted. However, IP enables a corporation to "revalue" its costs dramatically. For example, a major piece of software might have cost US$1 billion to develop in salaries and overheads. IP accounting enables the legal ownership of the software to be relocated to a tax haven where it can be revalued to being worth US$100 billion, which becomes the new price at which it is charged out against global profits. This creates a ''shifting'' of all global profits back to the tax haven. IP has been described as "the leading corporate tax avoidance vehicle".

Corporate tax haven

Traditional OFCs, such as Cayman, BVI, Guernsey or Jersey are clear about their corporate tax neutrality. Because of this, they tend not to sign full bilateral tax treaties

A tax treaty, also called double tax agreement (DTA) or double tax avoidance agreement (DTAA), is an agreement between two countries to avoid or mitigate double taxation. Such treaties may cover a range of taxes including income taxes, inheritance ...

with other higher-tax jurisdictions. Instead, the receipts from investment structures in those jurisdictions are subject to full withholding tax set by the relevant onshore jurisdiction. The British Overseas Territories and Crown Dependencies all provide full tax transparency and automatic tax reporting to onshore tax authorities via CRS, FACTA.

Other tax havens, for example in Europe or Asia, maintain higher non-zero "headline" rates of corporate taxation, but instead provide complex and confidential BEPS tools and PTRs that bring the "effective" corporate tax rate closer to zero; they all feature prominently in the leading jurisdictions for IP law (see graphic). These "corporate tax havens" (or Conduit OFCs), further increase respectability by requiring the corporate using their BEPS tools/PTRs to maintain a "substantial presence" in the haven; this is called an employment tax, and can cost the corporate circa 2ŌĆō3% of revenues. However, these initiatives enable the corporate tax haven to maintain large networks of full bilateral tax treaties, that allow corporates based in the haven to ''shift'' global untaxed profits back to the haven (and on to Sink OFCs, as shown above). These "corporate tax havens" strongly deny any association with being a tax haven and maintain high levels of compliance and transparency, with many being OECD-whitelisted (and are OECD or EU members). Many of the are "corporate tax havens".

Conduits and Sinks

In 2017, the University of Amsterdam

The University of Amsterdam (abbreviated as UvA, ) is a public university, public research university located in Amsterdam, Netherlands. Established in 1632 by municipal authorities, it is the fourth-oldest academic institution in the Netherlan ...

's CORPNET research group published the results of their multi-year big data

Big data primarily refers to data sets that are too large or complex to be dealt with by traditional data processing, data-processing application software, software. Data with many entries (rows) offer greater statistical power, while data with ...

analysis of over 98 million global corporate connections. CORPNET ignored any prior definition of a tax haven or any legal or tax structuring concepts, to instead follow a purely quantitative approach. CORPNET's results split the understanding of tax havens into Sink OFCs, which are traditional tax havens to which corporates route untaxed funds, and Conduit OFCs, which are the jurisdictions that create the OECD-compliant tax structures that enable the untaxed funds to be routed from the higher-tax jurisdictions to the Sink OFCs. Despite following a purely quantitative approach, CORPNET's top 5 Conduit OFCs and top 5 Sink OFCs closely match the other academic . CORPNET's Conduit OFCs contained several major jurisdictions considered OECD and/or EU tax havens, including the Netherlands, the United Kingdom, Switzerland, and Ireland.

Tax-free wrapper

As well as corporate structures, tax havens also provide tax-free (or "tax neutral") legal wrappers for holding assets, also known as special purpose vehicles (SPVs) or special purpose companies (SPCs).Section 110 SPV

An Irish Section 110 special purpose vehicle (SPV) or section 110 company is an Irish tax resident company, which qualifies under ''Section 110'' of the '' Irish Taxes Consolidation Act 1997'' (TCA) for a special tax regime that enables the S ...

is a major wrapper in the global securitization market.bankruptcy remote

A bankruptcy remote company is a company within a corporate group whose bankruptcy has as little economic impact as possible on other entities within the group. A bankruptcy remote company is often a single-purpose entity, and frequently deploye ...

ness, which would not be appropriate in larger financial centres

A financial centre (financial center in American English) or financial hub is a location with a significant concentration of commerce in financial services.

The commercial activity that takes place in a financial centre may include banking, ...

, as it could damage the local tax base, but are needed by banks in securitizations. The Cayman Islands SPC is a structure used by asset managers as it can accommodate asset classes such as intellectual property ("IP") assets, cryptocurrency assets, and carbon credit assets; competitor products include the Irish QIAIF and Luxembourg's SICAV

A SICAV is a collective investment scheme common in Western Europe, especially Luxembourg, Switzerland, Italy, Spain, Belgium, Malta, France, and the Czech Republic. SICAV is an acronym in French for ''soci├®t├® d'investissement ├Ā capital varia ...

.

Data leaks

Some businesses in tax havens have been subject to the illegal obtaining and either public or non-public disclosures of client account data, the most notable being:

Liechtenstein tax affair (2008)

In 2008, the German Federal Intelligence Service

The Federal Intelligence Service (, ; BND) is the foreign intelligence agency of Germany, directly subordinate to the Chancellor's Office. The BND headquarters is located in central Berlin. The BND has 300 locations in Germany and foreign cou ...

paid Ōé¼4.2 million to Heinrich Kieber, a former IT data archivist of LGT Treuhand, a Liechtenstein bank, for a list of 1,250 customer account details of the bank. Investigations and arrests followed relating to charges of illegal tax evasion. The German authorities shared the data with US IRS

The Internal Revenue Service (IRS) is the revenue service for the Federal government of the United States, United States federal government, which is responsible for collecting Taxation in the United States, U.S. federal taxes and administerin ...

, and the British HMRC

His Majesty's Revenue and Customs (commonly HM Revenue and Customs, or HMRC, and formerly Her Majesty's Revenue and Customs) is a Departments of the United Kingdom Government, department of the UK government responsible for the tax collectio ...

paid GBP┬Ż100,000 for the same data. The authorities in several other European countries, Australia and Canada also received the data. Liechtenstein's authorities strongly protested the case and issued an arrest order against the man suspected of having leaked the data.

British Virgin Islands offshore leaks (2013)

In April 2013, the International Consortium of Investigative Journalists

The International Consortium of Investigative Journalists, Inc. (ICIJ), is an independent global network of 280 investigative journalists and over 140 media organizations spanning more than 100 countries. It is based in Washington, D.C., with ...

(ICIJ) released a searchable 260-gigabyte database of 2.5 million tax haven client files anonymously leaked to the ICIJ and analyzed by 112 journalists in 58 countries. The majority of clients came from mainland China, Hong Kong, Taiwan, the Russian Federation, and former Soviet republics; with the British Virgin Islands identified as the most important tax haven for Chinese clients, and Cyprus an important tax haven location for Russian clients. Various prominent names were contained in the leaks including Fran├¦ois Hollande

Fran├¦ois G├®rard Georges Nicolas Hollande (; born 12 August 1954) is a French politician who served as President of France from 2012 to 2017. Before his presidency, he was First Secretary of the Socialist Party (France), First Secretary of th ...

's campaign manager, Jean-Jacques Augier

Jean-Jacques Augier (born 23 October 1953) is a French publisher and businessman. He previously worked as an inspector of finances, and was treasurer for the 2012 presidential election campaign of previous French president Francois Hollande. Hol ...

; Mongolia's finance minister, Bayartsogt Sangajav; the president of Azerbaijan; the wife of Russia's Deputy Prime Minister; and Canadian politician Anthony Merchant

Evatt Francis Anthony "Tony" Merchant, (born 1944) is a Canadian lawyer, businessman, and former politician. His law firm Merchant Law Group LLP, which he founded in 1986, is best known for representing former students of Indian residential s ...

.

Luxembourg leaks (2014)

In November 2014, the International Consortium of Investigative Journalists (ICIJ) released 28,000 documents totalling 4.4 gigabytes of confidential information about Luxembourg's confidential private tax rulings given to PricewaterhouseCoopers from 2002 to 2010 to the benefit of its clients in Luxembourg. This ICIJ investigation disclosed 548 tax rulings for over 340 multinational companies based in Luxembourg. The LuxLeaks' disclosures attracted international attention and comment about corporate tax avoidance schemes in Luxembourg and elsewhere. This scandal contributed to the implementation of measures aiming at reducing tax dumping and regulating tax avoidance schemes beneficial to multinational companies.

Swiss leaks (2015)

In February 2015, French newspaper , was given over 3.3 gigabytes of confidential client data relating to a tax evasion scheme allegedly operated with the knowledge and encouragement of the British multinational bank HSBC

HSBC Holdings plc ( zh, t_hk=µ╗ÖĶ▒É; initialism from its founding member The Hongkong and Shanghai Banking Corporation) is a British universal bank and financial services group headquartered in London, England, with historical and business li ...

via its Swiss subsidiary, HSBC Private Bank (Suisse). The source was French computer analyst Herv├® Falciani

Herv├® Daniel Marcel Falciani (; born 9 January 1972) is a French-Italian systems engineer and whistleblower who is credited with "the biggest banking leak in history." In 2008, Falciani began collaborating with numerous European nations by prov ...

who provided data on accounts held by over 100,000 clients and 20,000 offshore companies with HSBC in Geneva; the disclosure has been called "the biggest leak in Swiss banking history". Le Monde called upon 154 journalists affiliated with 47 different media outlets to process the data, including ''The Guardian

''The Guardian'' is a British daily newspaper. It was founded in Manchester in 1821 as ''The Manchester Guardian'' and changed its name in 1959, followed by a move to London. Along with its sister paper, ''The Guardian Weekly'', ''The Guardi ...

'', ''S├╝ddeutsche Zeitung

The ''S├╝ddeutsche Zeitung'' (; ), published in Munich, Bavaria, is one of the largest and most influential daily newspapers in Germany. The tone of ''SZ'' is mainly described as centre-left, liberal, social-liberal, progressive-liberal, and ...

'', and the ICIJ.

Panama papers (2015)

In 2015, 11.5 million documents totalling 2.6 terabytes, detailing financial and attorney-client information for more than 214,488 offshore entities, some dating back to the 1970s, that were taken from the Panamanian law firm Mossack Fonseca, were anomalously leaked to German journalist

In 2015, 11.5 million documents totalling 2.6 terabytes, detailing financial and attorney-client information for more than 214,488 offshore entities, some dating back to the 1970s, that were taken from the Panamanian law firm Mossack Fonseca, were anomalously leaked to German journalist Bastian Obermayer

Bastian Obermayer (born 10 December 1977) is a Pulitzer Prize-winning German investigative journalist with the Munich-based newspaper ''S├╝ddeutsche Zeitung'' (SZ) and the reporter who received the Panama Papers from an anonymous source as well ...

in ''S├╝ddeutsche Zeitung

The ''S├╝ddeutsche Zeitung'' (; ), published in Munich, Bavaria, is one of the largest and most influential daily newspapers in Germany. The tone of ''SZ'' is mainly described as centre-left, liberal, social-liberal, progressive-liberal, and ...

'' (SZ). Given the unprecedented scale of the data, SZ worked with the ICIJ, as well as journalists from 107 media organizations in 80 countries who analyzed the documents. After more than a year of analysis, the first news stories were published on 3 April 2016. The documents named prominent public figures from around the globe including British Prime Minister David Cameron

David William Donald Cameron, Baron Cameron of Chipping Norton (born 9 October 1966) is a British politician who served as Prime Minister of the United Kingdom from 2010 to 2016. Until 2015, he led the first coalition government in the UK s ...

and the Icelandic Prime Minister Sigmundur Dav├Ł├░ Gunnlaugsson.

Paradise papers (2017)

In 2017, 13.4 million documents totalling 1.4 terabytes, detailing both personal and major corporate client activities of the offshore magic circle law firm Appleby, covering 19 tax havens, were leaked to the German reporters Frederik Obermaier and Bastian Obermayer

Bastian Obermayer (born 10 December 1977) is a Pulitzer Prize-winning German investigative journalist with the Munich-based newspaper ''S├╝ddeutsche Zeitung'' (SZ) and the reporter who received the Panama Papers from an anonymous source as well ...

in ''S├╝ddeutsche Zeitung

The ''S├╝ddeutsche Zeitung'' (; ), published in Munich, Bavaria, is one of the largest and most influential daily newspapers in Germany. The tone of ''SZ'' is mainly described as centre-left, liberal, social-liberal, progressive-liberal, and ...

'' (SZ). As with the Panama Papers in 2015, SZ worked with the ICIJ and over 100 media organizations to process the documents. They contain the names of more than 120,000 people and companies including Apple, AIG, Prince Charles, Queen Elizabeth II, the President of Colombia Juan Manuel Santos, and then-U.S. Secretary of Commerce Wilbur Ross. At 1.4 terabytes in size, this is second only to the Panama Papers of 2016 as the biggest data leak in history.

Pandora Papers (2021)

In October 2021, 11.9 million leaked documents with 2.9 terabytes of data were leaked by the International Consortium of Investigative Journalists

The International Consortium of Investigative Journalists, Inc. (ICIJ), is an independent global network of 280 investigative journalists and over 140 media organizations spanning more than 100 countries. It is based in Washington, D.C., with ...

(ICIJ). The leak exposed the secret offshore accounts of 35 world leaders, including current and former presidents, prime ministers, and heads of state as well as more than 100 billionaires, celebrities, and business leaders.

In a report dated 15 June 2023, certain chilling admissions were made by the Parliament of the European Union regarding the conduct and publicity surrounding the Pandora Papers data breach: